Oil and gas capital spending to rise in US, fall in Canada

Capital spending for oil and gas activities in the US will rise this year but at a slower rate than last year. In 2006, upstream spending surged as a result of increased activity and high costs as oil prices held firm.

Meanwhile, total capital spending in Canada will decline this year, but spending for oil sands development there will continue to climb.

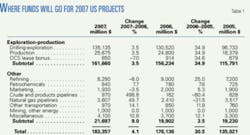

Total capital expenditures for upstream and downstream oil and gas projects in the US during 2007 will be $183 billion, up from $176 billion last year. In 2005 spending totaled $135 billion.

In Canada, total capital spending will dip to $50 billion from $53 billion last year and $45 billion 2 years ago.

Upstream spending outside the US and Canada will also increase, but indications are that such expenditures will grow much more slowly than they did a year ago. Oil and gas activity in Asia remains heavy, with a wealth of upstream and downstream projects under way and planned.

OGJ’s 2007 upstream spending forecast is based on estimates of drilling activity and costs, as well as what companies report for their upcoming budgets and past capital expenditures. Annual changes to downstream spending are determined by the capital budget plans reported by refiners, petrochemical plants, pipeline operators, and others, in addition to individual project announcements.

All amounts reported are in US dollars unless otherwise indicated.

US upstream spending

Upstream oil and gas expenditures in the US this year will climb nearly 4%. Total spending for exploration, drilling, and production activity will total almost $162 billion, OGJ forecasts.

The basis of this estimate is OGJ’s drilling forecast, which projected that the total number of well completions in the US will be 47,003 this year (OGJ, Jan. 15, 2007, p. 31).

Outlays for drilling and exploration in the US this year will be $135.1 billion, compared with $130.5 billion last year and $96.7 billion in 2005.

Included in that total are geological and geophysical expenditures, which this year will amount to $12.6 billion.

Capital outlays for production also will climb 3.5% this year to $25.7 billion.

Companies collectively will spend less on bonus payments related to Outer Continental Shelf lease sales this year. OGJ forecasts that such payments will total $850 million, down from $914 million last year.

The US Minerals Management Service has scheduled three lease sales for 2007. One each is scheduled for tracts in the Western Gulf of Mexico, the Central Gulf of Mexico, and the Beaufort Sea.

During 2006, the MMS held two lease sales. The first one, for acreage in the Central Gulf of Mexico, resulted in $582 million in bonus payments. The other sale, for the Western Gulf of Mexico, produced $332 million in bonus payments.

The 2007 capital budgets of large integrated oil and gas companies based in the US show that much of these firms’ upstream spending will occur outside the US. At the same time, most US-based independent producers will devote the majority of their expenditures to projects in the US.

Chevron Corp. has budgeted $19.6 billion for capital and exploratory expenditures during 2007, with $14.6 billion earmarked for upstream spending. The majority of this is likely to be spent on projects outside the US. During 2006, Chevron spent 68% of its upstream capital outlays on projects outside the US.

ExxonMobil Corp., which has announced a 2007 budget of $16 billion for worldwide upstream capital expenditures, last year spent just 15% of such outlays in the US.

In contrast, Marathon Oil Corp. announced that it has allocated the majority of its exploration and production (E&P) spending to projects in the US. With total upstream spending set at $2.23 billion this year, Marathon will spend 60% on US projects.

Meanwhile, large independent producer Anadarko Petroleum Corp. has budgeted $4 billion to this year’s capital program and plans to spend 25% of it in the deepwater Gulf of Mexico and 28% in the Rocky Mountain area. The company plans to spend up to 16% of its budget outside the US.

Processing expenditures

OGJ forecasts that capital spending in the US in all other oil and gas categories will grow 9% from last year. These categories include refining, petrochemicals, pipelines, LNG, corporate, and others.

Refining expenditures will decline following an upsurge during 2006. OGJ projects that capital spending at US refineries this year will decline to $8.3 billion from 2006 spending of $9 billion.

Last year, capital improvements at refineries to meet clean-fuels requirements caused a 25% surge in outlays. This year spending will shift toward expanding capacity at existing refineries. There still are no advanced plans to build a new refinery in the US.

Holly Corp. will expand the crude capacity at its Navajo refinery in New Mexico and at its Woods Cross refinery in Utah with revamps to existing units and new equipment.

And Marathon will increase the crude processing capacity at its Garyville, La., refinery by 180,000 b/d in a project expected to cost $3.2 billion.

Valero Energy Corp. has estimated its capital budget for 2007 at $3.5 billion, down from $3.73 billion last year. In 2005, the refiner’s capital spending totaled $2.6 billion. This year’s declines are due to a $775 million drop in clean-fuels and other regulatory outlays as its strategic and sustaining expenditures climb 25% from a year ago.

Other US outlays

Pipeline expenditures in the US will grow following last year’s big decline. OGJ forecasts that spending for US natural gas lines will climb 50%. Meanwhile, outlays for crude and product lines will total $970 million, up from $162 million last year.

Plans call for a total of 2,050 miles of gas pipelines to be completed this year, mostly larger than 30 in. in diameter (OGJ, Feb. 19, 2007, p. 48). These projects are expected to cost $3.6 billion. In addition, plans call for the construction of 813 miles of crude and product lines in the US this year. The majority of these lines will be 12-20 in. in diameter.

Capital expenditures at petrochemical plants will total $840 million this year, up nearly 8%. In 2006, petrochemical spending in the US moved up at about the same rate, but the big growth area for petrochemicals is Asia, especially China.

Last year ExxonMobil increased its capital spending for US petrochemicals to $280 million from $243 million in 2005. Also last year, Chevron’s petrochemical capital spending in the US climbed 35% to $146 million.

Huntsman Corp. plans to spend $40 million in the first half of this year on its US base chemicals and polymers business and will require additional outlays to repair its olefins plant in Port Arthur, Tex., which was damaged by a fire in April 2006. The total cost of the clean-up, engineering, and rebuild was estimated at $110 million.

Marketing expenditures in the US this year will decline 3.5%. Marathon and ConocoPhillips have announced plans to reduce these expenditures from a year ago, while Hess will leave such outlays unchanged. Hess plans to expand its retail network and add convenience stores to existing retail gasoline stations.

Miscellaneous expenditures, which include capital expenditures for LNG terminals, will climb this year to $4 billion. Four LNG terminals are currently under construction in the US. The total costs of these projects are reported to range from $400 million to $1 billion each.

Corporate costs and other nonpetroleum activities are also included in the miscellaneous category. OGJ forecasts that the total of these expenditures will increase more than 10% from last year.

Expenditures in Canada

Total oil and gas industry capital expenditures in Canada will decline 6% this year.

E&P spending will be down 10% as rising costs and a shortage of labor and equipment suppress activity. Allocations for spending in most upstream and downstream categories are lower from a year ago, but oil sands spending will continue to increase.

OGJ forecasts that exploration and drilling capital expenditures in Canada this year will be $23.5 billion. This compares to the all-time high of $26.1 billion last year and $21.8 billion spent 2 years ago. Production costs will decline at the same rate, totaling $9.75 billion this year.

In 2005 there were 26,951 well completions in Canada, according to the Canadian Association of Petroleum Producers (CAPP). Of this total, 59% were gas wells.

OGJ’s most recent drilling forecast estimates that well completions in Canada during 2006 totaled 24,185. The forecast called for 22,233 well completions this year.

CAPP’s latest figures also show that in 2005 capital expenditures for oil sands development in Canada totaled $10.4 billion (Can.). That was up 69% from a year earlier. These figures include capital expenditures for in situ developments, mining, and upgraders.

OGJ forecasts that capital spending for oil sands in Canada this year will rise to $12 billion from $11 billion last year.

Downstream capital expenditures in Canada will decline 8% from last year. Refining outlays are the largest component of this group but will be little changed from a year ago. Pipeline spending is the most flexible component in the group.

Canadian refinery outlays will decline 1% to $3.05 billion. Last year, such outlays were a bit lower than during 2005, when projects to meet clean-fuels regulations were gearing up.

One firm that has budgeted more money this year than last for capital spending at its refineries is Petro-Canada. The company has earmarked funds for a conversion of its Edmonton refinery and for engineering a coker at its Montreal refinery.

Pipeline spending in Canada will post the biggest decline of all expenditures this year, as plans call for little construction. OGJ forecasts that outlays for crude and products pipelines this year will be $78 million, down from $510 million last year and $660 million 2 years ago. No capital outlays are expected for gas pipelines in Canada this year.

Petrochemical capital expenditures will grow to $300 million from $270 million last year, mostly due to projects required to meet environmental regulations.

Nova Chemicals, for example, estimates that its 2007 environmental capital spending will be $32 million for pollution abatement and remedial programs. This is up from $8 million last year and $12 million in 2005.

Spending elsewhere

Capital spending outside the US and Canada will grow again this year, spurred by international oil companies and national oil companies ramping up production.

ConocoPhillips announced that its 2007 E&P capital program in Europe, Asia, Africa, and the Middle East will be about $4.9 billion. The company’s projects in the North Sea include continued development of Britannia field in the UK and development of Alvheim and Statfjord fields, as well as ongoing development of existing and new opportunities in Norway’s Ekofisk area.

In the Asia Pacific region, most of the funding will support ConocoPhillips’s continued development of Bohai Bay in China, oil and gas reserves offshore in Block B and onshore South Sumatra in Indonesia, and fields off Malaysia and Vietnam.

ConocoPhillips also said its funding in Africa is primarily for the ongoing development of its Waha concession in Libya and several oil leases in Nigeria. And in the Middle East, the company will focus its spending on the Qatargas III LNG facility in Qatar.

Hess announced that of its $3.5 billion worldwide E&P capital budget this year, it will spend $650 million in Europe, $600 million in Africa, and $960 million in Asia and other areas. Most of the production expenditures will be directed to improve the performance of producing fields.

Investments at the company’s Okume offshore oil development in Equatorial Guinea will primarily be focused on completion of production facilities and the drilling of 18 development wells.

The most recent E&P spending survey from Lehman Bros. indicates that 2007 upstream spending growth outside the US and Canada will slow to 13% from a 28% surge in 2006 (OGJ, Jan. 1, 2007, p. 25).

The survey revealed that companies greatly overspent their 2006 capital budgets, especially on projects outside North America. Lehman reported that 60% of the companies it surveyed spent more than 10% over their original E&P budgets last year.

Meanwhile, downstream activity remains elevated in Asia, Latin America, and the Middle East this year, according to OGJ’s latest Worldwide Construction Update (OGJ, Nov. 20, 2006, p. 20).

The report details numerous refining, petrochemical, and LNG terminal projects under construction this year and planned for the next several years, with a flurry of activity in China, India, Qatar, and Saudi Arabia.