Senator proposes extension on 1998, 1999 leases

US Sen. Pete V. Domenici (R-NM) reported plans to propose 3-year extensions of federal Gulf of Mexico deepwater leases issued in 1998 and 1999 without price thresholds if the leaseholders agree to new terms including such a provision.

During a Senate Interior Appropriations Subcommittee hearing on Mar. 20, Domenici, who is chief minority member of the Energy and Natural Resources Committee, said he is open to other ideas to bring leaseholders to the negotiating table, but added that offering an extension in exchange for price thresholds deserves a closer look.

Noting that the omission of price thresholds in the original leases could cost the federal government as much as $10 billion, Domenici said, “I recognize that this will not entirely solve the problem and make the Treasury 100% whole, but the bottom line is that this was a major mistake by [the administration of former President Bill Clinton] that has already cost the government nearly $1 billion. As I have said, I am open to other solutions that would withstand legal challenges, but we must act soon.”

US House members have proposed either prohibiting holders of deepwater leases without price thresholds from participating in future federal lease sales if they are unwilling to voluntarily renegotiate terms, or requiring them to pay “resource conservation fees” to make up royalties which would be suspended under the original leases.

The US Minerals Management Service has tried to get holders of such leases to voluntarily renegotiate terms. Six have signed new agreements already, C. Stephen Allred, assistant Interior secretary for lands and minerals management, told the Senate Energy and Natural Resources Committee on Jan. 18.

At the Senate appropriations subcommittee hearing, US Sec. of Interior Dirk A. Kempthorne said he would work with Domenici and other senators to reach a solution. He also pledged that President George W. Bush’s administration would not omit price thresholds from oil and gas leases.

North, South Korea make energy pact

South Korea will provide North Korea the energy equivalent of as much as 50,000 tonnes of fuel oil in exchange for taking initial denuclearization steps under the so-called Six-Party Framework Agreement, which involves North and South Korea, the US, China, Japan, and Russia.

Junichi Ihara, deputy director-general of the Japanese Foreign Ministry’s Asian and Oceania Affairs Bureau, told reporters that the decision was reached Mar. 15 in Beijing at the meeting of the Six-Party Talks’ working group on economic and energy assistance to North Korea.

According to Joon Yung-woo, South Korea’s chief nuclear negotiator, the task of the working group is to determine detailed plans and specific means of providing economic, energy, and humanitarian assistance to the North as agreed in the Feb. 13 agreement.

He was referring to the nuclear deal signed in Beijing, under which North Korea-in exchange for heavy fuel oil or equivalent aid-agreed to shut down and seal its nuclear reactors.

One of the main priorities of the working group is to decide how the countries will sequence the provision of energy aid to the north with the communist nation’s shutdown of its nuclear facilities. South Korean officials, speaking anonymously, said the actions would have to take place “simultaneously.”

European gas execs reject market consolidation

Gas executives at European energy companies do not want further consolidation within Europe’s energy markets according to a survey carried out by Deloitte at the FLAME gas conference in Amsterdam Mar. 14.

Only 6% of delegates surveyed believed Europe’s competitive strength in global energy markets would be improved through further consolidation. Respondents would prefer to enhance Europe’s competitive position by harmonizing standards for cross-border trading (44%), followed by ownership unbundling of networks (30%), and the creation of a European regulator (20%).

Neither are delegates optimistic that all gas customers across Europe can choose their supplier by the July 2007 deadline given by the European Commission-83% of respondents said the deadline will not be met.

“Many executives across the industry are comfortable with the prospect of working in a more-competitive market environment,” said Deloitte oil and gas leader Peter Newman. “They seem more persuaded by the arguments of the EU Commission in favor of greater liberalization, as the best way to achieve diversification and new investment, than of those of some of the national policy makers who continue to emphasize the role of ‘national champions.’ It is quite possible that the EU’s strong new focus on energy emissions and efficiency may divert its attention away from the further liberalization and regulation measures that form part of a single European energy market.”

ODAC: UK was net oil importer in 2006

The UK became a net importer of oil for most of 2006, according to the Oil Depletion Analysis Centre (ODAC) in Aberdeen. “It is time for the UK government to let go of the idea that the UK will be a net oil exporter until 2010 and accept we are now dependent on imports,” ODAC said.

Data published by the UK Department for Trade and Industry showed that the UK imported oil during every month in 2006 except for June. DTI forecasts that the UK will export oil for a few months during 2007 and see a decline in domestic oil production. From 2008, the International Energy Agency and the US Energy Information Administration expect the UK to be a net oil importer.

In May 2006 the UK imported its highest net volume over that year of 1.357 million tonnes of oil compared with 100,000 tonnes of oil in March, which was the lowest volume. In June the UK exported 298,000 tonnes.

A spokeswoman for the UK Offshore Operators’ Association said the difference in oil imports and indigenous production in 2006 was small. “Last year’s dip can be attributed to lower-than-expected North Sea production, owing in part to delays in new fields coming on stream, reservoir performance, and maintenance programs. Global constraints on resources, including equipment and personnel, also had an impact on activity levels in the UK.”

Crude oil production in the UK in 2006 was an estimated 1.6 million b/d, while consumption was an estimated 1.7 million b/d.

“Based on the most recent information given to us by our members, we believe it now likely that the UK will become a net importer of oil from 2009 onwards. However, indigenous production could still provide 90% of the UK’s oil needs in 2010,” the UKOOA spokeswoman said.

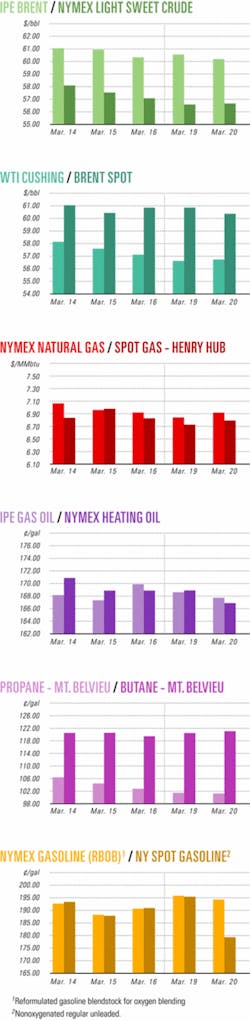

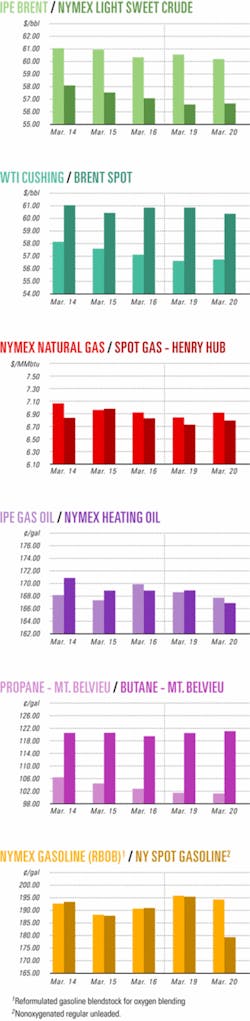

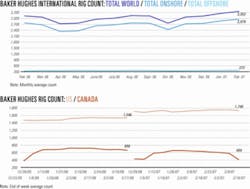

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesCNOOC makes oil, gas discovery in Bohai Bay

CNOOC Ltd. found oil and gas with a discovery well drilled in the Yellow River Mouth Sag of Bohai Bay. The well, Bozhong (BZ) 28-2E-1, was drilled south of Structure BZ 28-2E between BZ 28-1 and BZ 28-2S oil fields.

The well penetrated oil pay zones with 35 m total thickness and gas sections of 35 m. The well was drilled to 2,575 m total depth in 20 m of water.

On test, the well flowed an average 1,600 b/d of oil through 7.14-mm and 14.29-mm chokes, and 10 MMcfd of gas through a 15.08-mm choke.

Since 2006, CNOOC has made four discoveries in the Yellow River Mouth Sag, the company said.

Statoil finds gas, condensate on Biotitt prospect

Statoil ASA has proved gas and condensate on the Biotitt prospect in the Norwegian North Sea, 20 km northeast of the Sleipner field.

Seadrill Ltd.’s ultralarge West Epsilon jack up drilled the well to a TD of 2,360 m, targeting Cretaceous rock, with gas and condensate being proved in the Heimdal formation of Tertiary age.

Statoil will investigate whether it will produce the find using the Sleipner platform. Statoil said it would carry out an evaluation and analysis of the gathered data to determine the find’s resource potential and that a joint development with the 16/7-2 find south of Biotitt could be an option.

West Epsilon will drill the Ermintrude prospect on Block 15/6 in production license 303, 10 km north of Sleipner field.

The licensees in exploration license 339, awarded in 2004, are Statoil with a 70% share and ExxonMobil Corp. with 30%.

Statoil to shoot seismic survey in Libya

Statoil plans to shoot a 2,000 km, 2D seismic survey in the Kufra license in the southeastern part of Libya for the first time in the country under its work program for the two licenses it was awarded last year.

Statoil shares its Kufra 171 license on a 50-50 basis with BG Group, and they plan to drill two exploration wells once they have finished processing the seismic data. The license spans 10,000 sq km in the desert.

Statoil also plans to shoot a 3,000 km, 2D seismic survey for its Cyrenaica 94 license in April. It has full ownership of the license and will drill one exploration well. The license lies in the north of Libya, near the Egyptian border.

Statoil said the desert areas are little-explored in relation to petroleum resources. A few wells have been drilled in the area, but that was in the 1960s and 70s.

During the second half of 2008, Statoil will drill the first exploration well in Libya.

MMS issues final notice for Lease Sale 202

The US Minerals Management Service issued a final notice for OCS Lease Sale 202, covering 8.7 million acres off Alaska’s northern coast in the Beaufort Sea. The sale will be held Apr. 18 in Anchorage, MMS said.

The sale area extends from the Canadian border on the east to the Barrow area on the west, but excludes offshore areas near Barrow and Kaktovik, which the Inupiat Natives use for bowhead whale subsistence hunts.

Any offshore oil and gas activity in the entire sale area will have to be coordinated with the Inupiat whalers during their subsistence hunt, MMS Regional Director John Goll noted in Anchorage. Stipulations for this sale were developed after consultations with several interested parties and groups, he added.

The sale’s lease terms are the same as those used for MMS’s last Beaufort Sea leasing, Sale 195, held in March 2005.

MMS estimates that the Beaufort Sea could contain about 7 billion bbl of oil and 32 tcf of gas on a mean conventionally recoverable basis.

GeoPark redeveloping Chile’s Fell gas block

GeoPark Holdings Ltd. is reestablishing gas production at the Fell Block in Chile’s Tierra del Fuego region and plans to sign a long-term gas supply contract to supply the nearby Methanex Corp. methanol plant at Punta Arenas.

The two companies signed a memorandum of understanding under which GeoPark would supply gas for 10 years starting in May. The agreement provides incentives for volume growth up to 100 MMcfd of gas and includes provisions for the financing of development operations and the potential joint acquisition of new hydrocarbon blocks in Chile.

GeoPark began operating the Fell Block in September 2005 and began producing from the block in May 2006 from Molino, Ovejero, and Nika fields. It reactivated the first well in Santiago Norte field in December 2006 at 3.2 MMcfd and 50 b/d of condensate and recently completed an $8 million 3D seismic program on the Fell Block.

Gas is piped to Methanex, and Chile’s state ENAP buys the condensate.

Drilling & Production - Quick TakesGas production starts from Bibiyana field

Chevron Corp. has brought on production from Bibiyana gas field on Block 12 in the Habiganj district of northeast Bangladesh.

The field is expected to initially produce 200 MMcfd of gas and peak at 500 MMcfd by 2010. At that time, Bibiyana would be the largest producing gas field in the country.

The field development project includes 12 development wells, a gas plant, a gas pipeline, and a condensate pipeline. The gas plant’s full capacity of 600 MMcfd is scheduled to be reached later this year.

Due to the 2005 Chevron and Unocal Corp. merger, Chevron has a gas sales agreement with state-owned Petrobangla. Under that contract minimum volumes of 200 MMcfd will increase to 400 MMcfd at the end of 2008 (OGJ, Dec. 6, 2004, p. 44).

Chevron holds a 98% interest in the field.

Maersk expands Al Shaheen work off Qatar

Maersk Oil Qatar AS has let an engineering, procurement, installation, and construction contract to National Petroleum Construction Co. (NPCC) of Abu Dhabi for platforms in Al Shaheen oil and gas field off Qatar.

The work is part of a development effort that will raise the field’s oil production to 525,000 b/d from 240,000 b/d (OGJ, Aug. 14, 2006, Newsletter).

NPCC will build and install wellhead, process, and flare platforms in the G area of Block B; a process platform and bridge in the E area; and three interconnecting bridges.

It is building jackets, bridges, risers, and pipelines under two EPIC contracts awarded last year.

Maersk holds a 100% interest in Block B, which lies in 52-70 m of water, under a production-sharing agreement with Qatar Petroleum.

Marathon unit orders semi rig for GOM

A subsidiary of Marathon Oil Corp. has signed a letter of intent (LOI) with Noble Drilling Services Inc. for Noble’s new Bingo 9000 Rig 4 semisubmersible hull for drilling in the Gulf of Mexico, Noble said.

The semi, which will be renamed Noble Jim Day, will follow the operational design of the Noble Danny Adkins currently under construction at the Jurong Shipyard in Singapore. Noble Jim Day will be completed as a dynamically positioned (DPS-3) unit designed to operate in 12,000 ft of water, and it will have living accommodations for 200 people.

The rig’s expected delivery date is during fourth quarter 2009.

The LOI is contingent upon execution of a definitive drilling contract that includes an option for Marathon to extend the 2-year primary term to 4 years.

Murphy taps Tanjung for jack up in Malaysia

Murphy Sarawak Oil Co. Ltd. has awarded a $122.7 million contract to Tanjung Offshore Services Sdn. Bhd. subsidiary Tanjung Offshore Bhd. to provide a jack up drilling rig.

The 208 rig is required for Murphy Oil’s 2007-10 development drilling programs in Malaysian waters, Tanjung said. The contract, effective from Nov. 30, is for a firm 3-year period, with an option to extend for a further 2 years.

Processing - Quick TakesWilliams to pay $2.2 million for pollution charges

Williams Refining Co. agreed to pay $2.2 million to settle charges that it violated Clean Air Act provisions at its Memphis refinery, the US Department of Justice and Environmental Protection Agency jointly announced.

The Mar. 14 settlement agreement resolves allegations that the Williams Cos. Inc. subsidiary, which owned and operated the plant from the mid-1980s until its sale to Premcor Refining Group Inc. in March 2003, did not comply with regulations intended to prevent benzene emissions. Valero Energy Corp. acquired Premcor in 2005.

Williams Refining’s settlement also resolves allegations that it did not follow leak detection and repair regulations for the refinery’s equipment as specified in the CAA. Additionally, the agreement resolves assertions that the company did not properly store hazardous waste, as required under the Resource Conservation and Recovery Act, and one violation of the Clean Water Act for an oil pipeline rupture, EPA said.

EPA said it initiated an investigation of the refinery after it became suspicious of Williams Refining’s report of less than 10 Mg of benzene emissions based on the plant’s size. The CAA requires refineries that discharge more than 10 Mg/year to manage their wastewater in compliance with the Benzene National Standards for Hazardous Air Pollutants.

EPA said that the CAA also requires refinery operators to monitor pumps and valves for leaks, and to report any which are discovered. It said that it discovered more violations during an inspection on Nov. 5 and 6, 2002, and as a result of a Feb. 2, 2002, pipeline rupture.

CSB investigates fire at Valero’s McKee refinery

The US Chemical Safety Board is investigating a Feb. 16 propane fire at Valero Energy Corp.’s McKee refinery in Sunray, Tex. The blaze seriously burned three workers and forced the facility to shut down (OGJ Online, Feb. 21, 2007).

CSB investigators began working at the site a few days later, interviewing witnesses and examining the area where the fire began. “The exact mechanical failure that led to the propane release remains to be identified. Further modeling and testing of piping, valves, and flanges will be needed to determine precisely what happened,” lead investigator Jim Lay said on Mar. 9.

He said Valero has cooperated with the investigation and has provided drawings, written procedures, and inspection records in response to CSB’s document requests.

PDVSA to convert refinery for heavy oil

State-owned Petroleos de Venezuela SA (PDVSA) will work with Japan’s JGC Corp. on basic engineering for a deep conversion project at PDVSA’s 200,000 b/d refinery at Puerto la Cruz.

In a statement, PDVSA said the project-to be completed in 2008-involves adding new technology to enable the refinery to process extraheavy oil from the Orinoco tar belt instead of the lighter crude oil it now processes.

PDVSA said the Puerto la Cruz expansion, estimated to cost $1.7 billion, will enable the facility to refine an additional 80,000-90,000 b/d of heavy crude.

The government of Venezuelan President Hugo Chavez has been implementing a program to nationalize the country’s oil industry, including sectors producing the heavy crude to be processed at Puerto la Cruz.

The government warned it will assume control of operations unilaterally if the companies do not cooperate by May 1. “If by the deadline there is no agreement, we will take direct control of all these operations,” said Energy Minister Rafael Ramírez.

On Mar. 12 ExxonMobil said it would participate in a transition committee to oversee the transfer of its control of the Cerro Negro heavy crude facilities in the Orinoco belt. The facilities, which convert tar oil into high-value synthetic crude, are valued at $31 billion.

ExxonMobil and PDVSA each own a 41.7% stake in the venture, with the remaining 16.6% held by BP.

Transportation - Quick TakesQP, ExxonMobil complete RasGas LNG Train 5

Qatar Petroleum and ExxonMobil Corp. announced the completion of RasGas LNG Train 5 in Doha.

Completed in 29 months, Train 5 has a designed capacity of 4.7 million tonnes/year of LNG and will supply gas to northern Europe.

RasGas currently operates five trains in Ras Laffan; Trains 6 and 7 are currently under construction. Those two trains, each with capacity to process 7.8 million tonnes/year of LNG, are expected to start-up in 2008 and 2009, respectively.

RasGas Co. Ltd. is a joint venture of QP and ExxonMobil RasGas Inc.

Kozmino terminal given environmental nod

Russia’s environmental oversight agency Rostekhnadzor said a projected oil terminal at Kozmino, on Russia’s Pacific Coast, will present no threat to its surroundings when constructed.

Head of Rostekhnadzor Konstantin Pulikovsky said plans were ecologically safe for the oil port at Kozmino, selected as the export terminus of the planned 4,300-km East Siberia Pacific Ocean (ESPO) pipeline.

Kozmino will be capable of receiving deepwater tankers and handle crude exports of as much as 80 million tonnes/year-the pipeline’s largest projected throughput.

The pipeline route has already been altered following criticism by Russian President Vladimir Putin and environmental activists. State pipeline monopoly OAO Transneft last year agreed to reroute the pipeline away from Lake Baikal (OGJ Online, May 25, 2006).

Gassco assesses gas pipeline routes to Europe

Norway’s state-owned Gassco AS is evaluating pipeline routes to bring Norwegian North Sea gas to Europe. The company will publish its concept selection in May, a senior Gassco official said Mar. 9. The company will make a final investment decision in December.

Speaking at a press briefing in London, Jan Hauge, Gassco’s executive vice-president for product management, said the three possible landing points for the pipeline are St. Fergus in northeast Scotland, Zeebrugge in Belgium, or Den Helder in the Netherlands. St. Fergus would be the cheapest option as it is the shortest distance.

Gassco wants to take gas from Troll field, but the proposal is proving controversial because Troll partner Norsk Hydro ASA is worried that gas production would reduce pressure needed for recovering oil from the field. Gassco is investigating the design challenges inherent in increasing gas production without having a negative effect on Troll’s oil production. “It will require sophisticated technological work,” Hauge added.

Hydro plans to increase oil production by more than 30% to 2 billion bbl and has developed Troll’s oil resources using more than 110 horizontal wells. Hydro is also assessing whether it is possible to accelerate gas recovery from the eastern part of Troll field while simultaneously preparing for increased oil recovery from the western section.

Hauge declined to give estimates on the capacity of the pipeline or its length, saying information is being assessed and will be published in May. Gassco representatives also said there has been much political interest in the pipeline, particularly from the UK, as security of supply in Europe is a top priority. One of the other issues to determine would be tariff levels in each landing point.

A possible start-up date for operations is 2011, although Hauge stressed that the pipeline could be postponed if conditions are not right.