Iran becoming mega petchem producer, natural gas consumer

Iran’s government is moving away from an oil-export based economy by increasing the priority of its gas resources development, including the expansion of its petrochemical industry. Access to large quantities of ethane recoverable from natural gas reserves guarantees low-cost ethylene production and sustainability. Iran is therefore currently constructing massive new petrochemical production capacity that is approximately the combined current ethylene capacity of Japan, Korea, Taiwan, and China.

The petrochemical industry is one of the most capital-intensive industries in Iran. Feedstock is supplied from the by-products of oil and gas exploitation, including NGL and condensate, as well as refined products such as naphtha, natural gas, and ethane.

The first and also one of the biggest petrochemical plants in Iran-Shiraz-began operations in 1959, followed by the Kharg petrochemical complex located on Kharg Island, which was established in 1966 with a capacity of 1,000 tonnes/year (tpy).

Before Iran’s revolution in 1979, some plants such as the Razi and Bandar Imam petrochemical complex came into operation as well. After the Iran-Iraq war, petrochemical production accelerated. Iran currently produces approximately 24 million tpy of petrochemical products.

Rise in petchem production

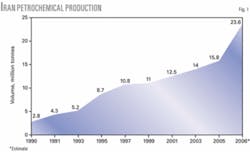

Production and investment in Iran’s petrochemical industry have grown significantly in recent years. In 1995, petrochemical production was 8.7 million tonnes. The total volume of petrochemicals produced at National Iranian Petrochemical Co. (NIPC) increased at an average of 6%/year during 1995-2005 and reached 15.8 million tonnes in 2005.

The production from all petrochemical complexes will be 23.6 million tonnes in 2006.

Fig. 1 shows total petrochemical production for 1990-2006.

The average growth rate of total petrochemical production for 1990-2006 is 14.3%/year. The largest increase in production occurred during 1993-95 with an average growth of 30%/year due to the start-up of the second phases of the Arak and Bandar Imam petrochemical plants. During 1998-99, production growth was the lowest because the Shiraz and Razi refineries were being revamped; this left the second and third-largest petrochemical complexes with little feedstock.

With the commencement of the South Pars gas field development in 2001, NIPC started planning for large gas-based petrochemical plants, many of which came online in 2003-06. Some of these include new petrochemical companies such as Amir Kabir Petrochemical Co., Bu Ali Sina Petrochemical Co., Fan Avaran Petrochemical Co., Bisotoon Petrochemical Co., and Khuzestan Petrochemical Co. Production growth during this period was about 30%/year.

Demand, export growth

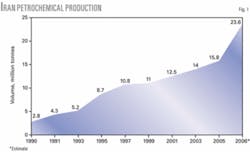

In terms of domestic demand for petrochemical products, growth during 1990-2006 averaged 10.5%/year and 5.3%/year during 1996-2006.

Fig. 2 shows domestic petrochemical demand for 1990-2006. This is rather moderate compared with the overall growth of the petrochemical sector, leaving substantial volumes for exports.

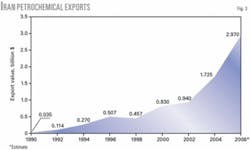

As previously mentioned, the Iranian government’s policy is to move away from crude oil exports to the export of non-crude and especially petrochemical products. The policies have been drafted to achieve these objectives by encouraging the private sector to export products; expanding the marketing efforts beyond Iran; improving product quality, packaging, and after sales services; and supporting local export establishments.

In 2006, about 78% of total annual production was exported (Fig. 3), which brought in revenue of about $3 billion; a substantial increase from $35 million in 1990. Although the export values pale in comparison with crude sales, which were about $50 billion in 2006, it is still a substantial contribution, being the second-largest revenue generating sector in Iran.

Massive plans, investments

Iran has abundantly inexpensive energy resources. Feed gas, which is currently sold domestically at 20¢/MMbtu, became the main feedstock for petrochemical units. This sector has huge export potential, with investments in the petrochemical industry in Iran growing exponentially.

To accumulate the huge amounts of capital needed for developing the industry, promoting petrochemical export, and transferring modern technology in this field, the Ministry of Petroleum and NIPC introduced measures to package long-term investments more attractively for international companies. To encourage domestic and foreign investors in the petrochemical industry, Iran has provided tax holidays for its petrochemical zones.

Currently, NIPC has appointed domestic and foreign lenders to lead the financing of petrochemical projects. Joint ventures have also been formed to develop the industry; there are currently four foreign joint ventures in Iran’s petrochemical projects, namely the Olefin No. 9 (NIPC 50%, Sasol 50%), low-density polyethylene unit (NIPC 45%, Pooshineh Baft Co. 25%, and Sabic Euro Petrochemical Co. 30%), isocyanates (NIPC 40%, Chematur Engineering of Sweden 30%, Petroleum Industries Investment Co 20%, Hansa Chemie of Germany 10%), and polyvinyl chloride Hamedan (NIPC 33% , Industrie Generali of Italy 10%, others 57%).

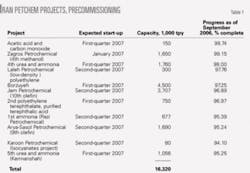

Current investment in Iran’s petrochemical industry will bring online during 2007-10 about 27 million tonnes of new capacity for the production of ethylene, propylene, methanol, benzene, ammonia, and urea. More than half (16 million tonnes) of the new capacity will be completed by second-quarter 2007, bringing yet another wave of production and exports (Table 1).

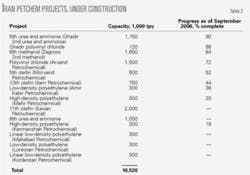

Projects amounting to approximately 10.5 million tonnes, currently being constructed by NIPC and several domestic and international companies will be completed during 2007-10 (Table 2).

West Ethylene Pipeline

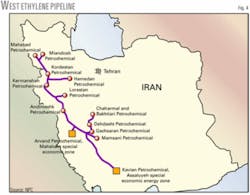

A 2,163-km pipeline currently under construction will run from Assaluyeh in the south of Iran to northwest Iran (Fig. 4). The pipeline will transport ethylene to meet the feed requirements of the new ethylene derivative petrochemical complexes in the cities of Gachsaran, Khoramabad, Kermanshah, Sanandaj, and Mahabad.

Construction of the pipeline began in 2003 and is currently 40% complete (targeted for completion in 2009-10). The initial plan for the West Ethylene Pipeline was to transport 1.5 million tonnes for 1,500 km to feed five planned petrochemical complexes. The Iranian Parliament, however, instructed the Petroleum Ministry to build five more complexes in the cities of Andimeshk, Dehdasht, Hamedan, Kermanshah, and Miyandoab as a means to boost production in the less-developed parts of the country. The pipeline’s length, therefore, was extended to 2,163 km and capacity increased to 2.8 million tonnes.

Olefin plants in Assaluyeh and the Bandar Imam special economic petrochemical zone in Mahshahr City will supply ethylene, the feedstock for petrochemical complexes in the Western provinces.

Bakhtar Petrochemical Co. which is currently constructing the pipeline is a private joint stock holding company whose shareholders include:

- NIPC 30%.

- Petroleum Ministry Pension Fund 20%.

- Arak Petrochemical Co. 10%.

- Esfahan Petrochemical Co. 5%.

- Bank Melli Investment Co. 5%.

- Social Security Organization Investment Co. 5%.

- National Pension Funds Investment Co. 5%.

- Ghadir Investment Co. 5%.

- Petrochemical Industries Investment Co. 5%.

- Modabber Investment Co. 5%.

- Iran Industrial Development Investment Co. 2.5%.

- Rena Investment Co. 2.5%.

Pars petrochemical port

Iran is currently building the Pars petrochemical port to cope with increasing production and exports. This project consists of 15 jetties; seven for solid products and eight for liquid products.

Currently, the construction status stands at 95% complete with jetty No. 14 in operation, jetty No. 5 near completion, and the rest of the 13 jetties to be completed by yearend 2007. Jetty No. 5 is earmarked for the export of products from Borzuyeh Petrochemical Co.’s aromatic No. 4, while the rest of the jetties will cater to the export of petrochemical products produced in the Pars petrochemical zone.

The port will have an export capacity of 24 million tonnes of liquid products and 6 million tonnes of solid products for a total of 30 million tpy. It can also accommodate tankers and vessels of up to 70,000 deadweight tonnes.

The port currently harbors two ships/month of 44,000-45,000 tonnes of LPG produced from Phases 4 and 5 of the South Pars gas field. Completion of the Pars petrochemical port is scheduled for second-quarter 2007.

Feed-gas requirements

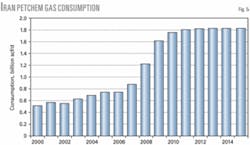

In 2005, petrochemical industry alone consumed around 750 MMscfd (more than 5 million tonnes of LNG equivalent) of fuel and feed gas. Due to massive investment in polyethylene production, there is significant growth potential for gas demand within the country’s petrochemical industry during 2007-10.

The Iranian government has included the petrochemical industry as part of its economic development plan, which is categorized into 5 stages-Plans 1 to 5. The economy is currently in Plan 4.

Plans 4 and 5 include about $24 billion for the petrochemical industry in which much gas-fed capacity will be brought online: 8 million tpy of ethylene, 1.5 million tpy of propylene, 5.1 million tpy of polymers, 14.8 million tpy of methanol, 760,000 tpy of benzene, 5-8 million tpy of ammonia, and 4-7 million tpy of urea. The country is also actively recruiting outside investors, further emphasizing the significance of using energy resources domestically.

Because most of the plants will be gas-based, gas supplies will be diverted away from exports. This further emphasizes our view that Iran will continue to see escalating domestic gas demand and, therefore, less gas available for LNG exports. The demand for natural gas for the Iran petrochemicals should reach 1.8 billion scfd (13 million tonnes of LNG equivalent) by 2015 (Fig. 5).

Many of these projects are based on borrowed capital and in the event that export markets suffer, debt servicing may become an issue.

The philosophy behind the explosive petrochemical projects is to carve a major niche for Iran in the international petrochemical market. Presumably, these projects will force the projects in the consuming countries out of business, due to expensive gas or naphtha. Although this theory may prove correct in the long run, consumer countries may retaliate by imposing tariffs and punitive dumping regulations to protect their own industries. This may prove to be a risky strategy, but one that will transform the global petrochemical industry.

It is highly likely that newer projects will have to buy feed gas at higher prices-about 50¢/MMbtu. Iran watches the Saudi market closely; when Saudi Arabia raised its feed-gas pries to 75¢/MMbtu, Iran planned to do the same.

In addition, with international prices paid for condensate at Borzuyeh, there is pressure to increase domestic gas prices. But the price hikes are being put on hold to encourage industry development.

Meanwhile, although Iran cannot easily increase prices, it will experience continual pressure to do so, especially because the Saudis are trying to raise feed-gas prices for future projects given the shortage of gas. It is, however, understood that even if the Iranians raised the feed-gas price to $1.00-1.30/MMbtu, new projects will be economical, although less attractive, compared with the Saudis who currently charge less at 75¢/MMbtu.

The authors

Alexis Aik ([email protected]) is a consultant for FACTS Global Energy, Singapore, where she heads the information and analysis group. Her focus is on the downstream oil and natural gas/LNG markets East of Suez. She advises on the demand-supply situations for natural gas and LNG markets in addition to leading studies on LNG procurement and pricing East of Suez. Aik holds a Bachelor in business management from the Singapore Management University.

Siamak Adibi is a consultant for FACTS Global Energy. He specializes in the natural gas with a focus on the Middle East and CIS countries. Adibi previously worked for the National Iranian Gas Export Co. He holds an MA in energy economics from the Tehran University.