ConocoPhillips concerned about Orinoco work

ConocoPhillips Chief Executive Officer James Mulva said he is concerned about his company’s heavy-oil production operations in Venezuela’s Orinoco region.

His comment came in answer to questions from reporters on Mar. 1 during a Rice University Baker Institute conference on national oil companies.

Mulva was asked about Venezuelan President Hugo Chavez’s recent comments that he has decreed that state-owned Petroleos de Venezuela SA take majority control of Orinoco projects by May 1.

Such a move could have “commercial and operating implications for heavy oil,” Mulva said, noting that international oil companies have made massive investments there.

“It’s important for us to start our discussions with the ministry and PDVSA,” Mulva said, adding that it was “premature” to speculate on the possible outcome. “Obviously, there have been significant changes in Venezuela over the last several years.” Since last year, the Venezuelan government has been negotiating with international consortia operating in the Orinoco area, seeking a PDVSA majority stake in each project (OGJ, Jan. 15, 2007, p. 41).

Joint ventures of PDVSA with ExxonMobil Corp., Chevron Corp., ConocoPhillips, Total SA, BP PLC, and Statoil ASA produce about 600,000 b/d of tar-like Orinoco crude. PDVSA currently holds an average 40% stake in these ventures.

Except for Mulva’s comments, the international oil companies have declined to comment until they have further details.

Saudis plan $95 billion capacity upgrades to 2015

Saudi Arabia plans to invest $95 billion to develop its oil and natural gas industry over the coming 4-8 years, according to the Kingdom’s advisor to the oil minister.

“Saudi Arabia plans to invest $70 billion to increase its oil and gas production capacity until 2015 and invest $25 billion to increase its refining capacity before 2011,” said Majid Al Moneef, advisor to Saudi Oil Minister Ali al-Naimi, in a speech at the Jeddah Economic Forum. Al Moneef also confirmed previously announced plans to increase the country’s upstream output capacity to 12.5 million b/d by 2009 from the current 11.3 million b/d output level, as well as to step up downstream refining capacity by some 50% to 6 million b/d.

Al Moneef said he expected developing nations, especially those in Asia, to spur 85% of new demand for oil over the next 25 years. He said, “We will see increasing oil roles coming from OPEC and Middle Eastern countries.”

Indonesia to boost gas output to offset deficit

Indonesia expects a natural gas production shortage of some 300 MMscf for 2007 and must increase production to meet its projected demand of 8.7 bcf, said Energy and Mineral Resources Minister Purnomo Yusgiantoro during a meeting with members of the country’s House of Parliament.

However, he said the country has no plans to terminate existing natural gas export contracts

Luluk Sumiarso, director general for oil and gas at the Ministry of Energy and Mineral Resources said Indonesia has sufficient reserves of gas to meet domestic needs as well as export contracts but he did not explain how the country would service the projected shortfall.

Luluk spoke in reference to forecasts of Indonesia’s long-term gas supply and needs, a “gas balance” drawn up by the government to help determine its future export policy. According to Purnomo, the national gas balance for 2007 shows a supply of 8.4 bcf, and demand of 8.7 bcf, creating the deficit.

Last year Indonesia produced a total of 8.217 bcf, of which about 54% was exported, with the remaining 46% sold on the domestic market.

But a shortage of gas due to declining output in 2006 prevented the government from fully meeting its export commitments to overseas buyers, while this year the government has already cut LNG exports by 19% to Japan, South Korea, and Taiwan.

It will not export gas to neighboring Malaysia and Singapore beyond current contracts, because of its need to meet rising domestic demand (OGJ Online, Mar. 1, 2007).

During the meeting in parliament, the government announced a number of moves to deal with the problem, including incentives to boost production from existing fields and accelerate the development of new onshore and offshore fields.

Purnomo, who provided no details of the proposed incentives, said there is no other way forward for the country except to increase production of natural gas in the near future.

The government has set a goal increasing gas output by 30% by 2009.

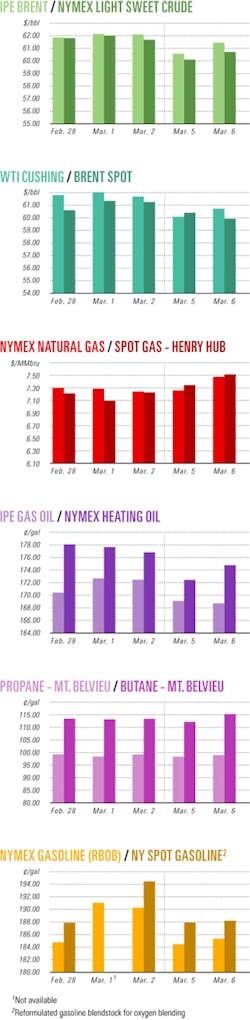

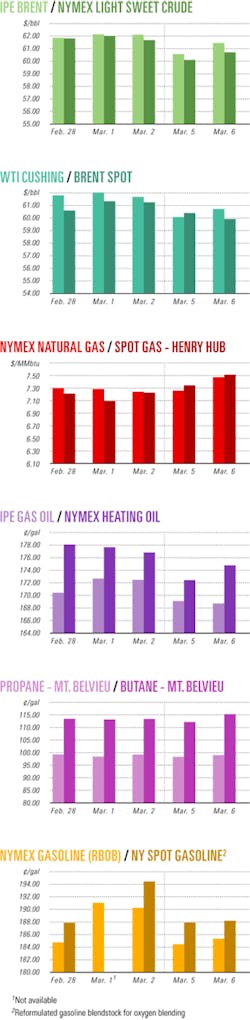

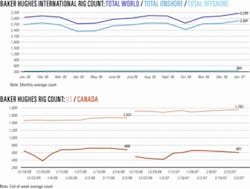

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesJapan discovers large methane hydrate deposit

Japan’s Ministry of Economy, Trade, and Industry reported a methane hydrate discovery of some 1.1 trillion cu m of estimated gas in place in a section of the Nankai Trough about 50 km off eastern Japan.

The figure includes recoverable and unrecoverable gas in natural methane hydrate in the area, the METI statement said. State-run Japan Oil, Gas & Metals Corp. (JOGM) assessed the 5,000-sq-km area as part of a project to draw gas from the hydrate.

As a result of the find, METI said it will broaden the scope of its exploratory efforts in Japan’s coastal seabeds, which are thought to hold substantial deposits of methane hydrate that as yet cannot be produced economically.

Last October METI announced new efforts in Canada to develop technologies associated with the development of methane hydrate. Starting in December, METI and JOGM planned to conduct methane production tests in northwestern Canada with the Canadian government.

Following the drilling of an exploratory well in Canada’s Arctic Circle on Feb. 23, JOGM said Feb. 27 it will start test-production of gas from methane hydrate in the permafrost area this month.

Depending on the outcome, Japan expects to start trial exploitation of methane hydrate deposits from the Pacific Ocean floor in 2009 with the hope of beginning commercial output from 2017.

The US, Canada, and Germany are all studying ways to use methane hydrate. In February, BP Exploration (Alaska) Inc. successfully drilled a research well on the Alaska North Slope in partnership with the US Department of Energy and the US Geological Survey to collect samples and gather knowledge about the potential gas source.

Drilling crews and research team members collected about 430 ft of core samples, which will be distributed to US-based gas hydrate researchers.

Caracas, Trinidad reach border fields accord

Trinidad and Tobago has approved a framework agreement for the unitization of hydrocarbon reserves in offshore fields bordering the Caribbean twin-island nation and Venezuela. It is the first such cross-border initiative in the Americas and one of only eight worldwide.

After 4 years of negotiations, there has been agreement at the technical level for the exploitation of reserves in the offshore Plataforma Deltana area, said Trinidad and Tobago Minister of Energy Lenny Saith.

Saith said the first field to be jointly produced would be Loran-Manatee, which contains 10 tcf of gas. It has been agreed that in Loran-Manatee, Venezuela owns 7.3 tcf, while 2.7 tcf is on the Trinidad side of the border.

Chevron Corp. is the operator of Loran, while it partners with BG Group in Manatee field.

The treaty focuses on general provisions, exploitation of cross-border hydrocarbon resources, and establishment of a committee for implementing the treaty, the applicable law, and final provisions.

The treaty provides for determination and allocation of the reserves volumes, the way in which costs and benefits from the unitization will be distributed, and the construction, operation, and use of installations related to the project.

The agreement also provides for construction of a cross-border pipeline.

Each state will continue to exercise civil, administrative, and criminal jurisdiction over the various areas that fall within the treaty.

Parties will settle disputes by negotiation through the respective steering teams and a ministerial committee from each country, e.g., the ministerial teams will decide what the states will do with the gas reserves.

Although the agreement will have indefinite life, either party may terminate it.

Saith said no decision has been made as to where Manatee gas will go, but Trinidad and Tobago and Venezuela will exploit the reserves “as partners” and make whatever decisions were in the best interest of each country.

It is expected that the treaty will be signed in Caracas later this month when Venezuela’s President Hugo Chavez is scheduled to hold energy talks with Trinidad and Tobago Prime Minister Patrick Manning.

Drilling & Production - Quick TakesCoal project may tip oil sands energy balance

Sherritt International Corp., Toronto, has floated a development plan for a $1.2 billion clean coal gasification project in south-central Alberta that would produce syngas, hydrogen, carbon dioxide, and elemental sulfur.

One of as many as four coal gasification units could start up in late 2011 on flat agricultural land about 50 miles southeast of Edmonton, just south of Beaverhill Lake. Feasibility of a second unit would be investigated once the first unit is operating at design capacity. Sherritt noted, “The development of Alberta’s vast oil sands resource has resulted in increased demands for natural gas to produce steam for bitumen recovery and as a source of hydrogen for bitumen upgrading.” Use of natural gas is costly and unsustainable, the company said.

Coal carefully reacted with oxygen and steam produces a syngas mix of hydrogen, carbon monoxide, and CO2. This mix, with more steam, converts CO to hydrogen and CO2. Then acid gas is applied to remove the CO2 and other impurities such as hydrogen sulfide. Output is 320 MMcfd of syngas, further refined into 270 MMscfd of pipeline-grade hydrogen, and as much as 12,500 tonnes/day of high-quality CO2.

The Dodds-Roundhill coal gasification project would be Canada’s first commercial coal gasification application. Sherritt and the Ontario Teachers’ Pension Plan are 50-50 partners in the developer, Carbon Development Partnership. CDP owns or has the rights to 12 billion tonnes of economically minable coal in Alberta, British Columbia, and Saskatchewan.

The initial project would involve a single coal gasification unit on 640 acres and a 312 sq km surface mine with 320 million tonnes of subbituminous coal, enough to support two gasifiers for 40 years. Average overburden depth is 15 m.

Shell starts Changbei field gas production

Commercial gas production has begun at Changbei gas field in China, said Royal Dutch Shell PLC, the field’s operator, on Mar. 1. The field is expected to plateau at 3 billion cu m/year in 2008 and deliver gas to Beijing, Tianjin, Shandong, and Hebei.

Shell will use long multilateral horizontal wells to achieve this production level because Changbei is a difficult reservoir.

PetroChina and Shell are jointly developing the field under a production-sharing contract, with Shell currently being the field development operator. The field is on the edge of the Maowusu desert in the Ordos basin of Shaanxi Province and Inner Mongolia Autonomous Region and is the largest onshore upstream cooperative development Shell has had in China.

Changbei development includes the construction of the central processing facilities, interfield pipelines, and a drilling program that is expected to involve about 50 horizontal and multilateral wells over 10 years.

Gas delivery starts from Indonesia’s Suban field

ConocoPhillips, operator of Suban gas field on the Corridor Block production-sharing contract (PSC) area in South Sumatera, has achieved first gas delivery via a gas processing plant recently completed as part of the Indonesian field’s second-phase development.

The development also includes a series of planned development wells, the first of which, the Suban-10 well, was drilled, completed, and is producing at a constrained rate of 150 MMscfd.

ConocoPhillips, under a 17-year gas sales agreement, will supply 2.2 tcf of gross gas to Perusahaan Gas Negara via the South Sumatera-West Java pipeline. Gas sales deliveries from the field are expected to start later this year.

Interest holders in Suban field are ConocoPhillips 54%, Talisman Energy Inc. 36%, and PT Pertamina 10%.

Kearl oil sands project gets conditional nod

Imperial Oil Ltd. has received conditional approval from the Alberta Energy and Utilities Board and the Canadian government for the development of the Kearl oil sands project in the Kearl Lake area of the Athabasca region.

The approval comes after a joint federal and provincial review of the proposed oil sands mining project, which is similar in design to existing Fort McMurray-region oil sands mines that use large-scale shovels, trucks, crushers, and oil sands hydrotransport technology.

The Kearl mining project will be developed in stages. Plans call for an initial mine train with production capacity of about 100,000 b/d, and possible subsequent expansions to about 300,000 b/d. The mine plan does not include any on-site bitumen upgrading. Any future upgrading capacity to support the project would be submitted in separate applications.

Imperial will review the approved conditions before advancing engineering work to define the project design, execution strategies, and project cost estimate, said Randy Broiles, senior vice-president of resources.

The company previously had reported that the total project investment is estimated at $4.5-6.5 billion (Can.). The project was scheduled to start up by yearend 2010, with possible second and third mine trains starting up in 2012 and 2018, respectively (OGJ Online, July 18, 2005, Newsletter).

Kearl oil sands project is a joint venture of Imperial Oil Resources Ventures Ltd. 70% and ExxonMobil Canada Properties 30%. Imperial is the designated operator of the project.

Processing - Quick TakesCEPSA lets contract for refinery expansion

Cia. Espanola de Petroleos SA (CEPSA) has let a detailed engineering contract to Foster Wheeler Iberia SAU for a major expansion of its 100,000-b/cd La Rabida refinery in Huelva, Spain.

The project will add a 90,000-b/sd crude unit, 30,500-b/sd vacuum distillation unit, and 148-ton/hr gas concentration unit.

The contract value was not disclosed. CEPSA is spending more than $1 billion at the refinery to meet growing demand in Europe for middle distillates.

Foster Wheeler Iberia has completed the front-end engineering design for the planned units (OGJ, Nov. 13, 2006, Newsletter).

Mechanical completion of the new facility is scheduled for fourth-quarter 2009.

Pearl GTL plant foundation stone laid

Qatar’s Crown Prince Shaikh Tamim bin Hamad Al Thani laid the foundation stone Feb. 26 for the Pearl gas-to-liquids (GTL) facility, reportedly the country’s largest energy project.

The complex will have two 70,000 b/d GTL trains and associated facilities. Production from the first train is expected to begin in 2009-10, with start-up of the second train due a year later (OGJ, Aug. 7, 2006, Newsletter).

Pearl GTL, 100% funded by Royal Dutch Shell PLC, is being developed under a development and production-sharing agreement with Qatar; it covers offshore as well as onshore project development and operations.

In a statement, Shell said upstream some 1.6 bcfd of wellhead gas will be produced, transported, and processed to produce 120,000 boe/d of condensate, LPG, and ethane.

Downstream, dry gas will be used as feedstock to produce 140,000 b/d of clean, high-quality GTL fuels and products.

Shell said Pearl GTL is expected to produce 3 billion boe of wellhead gas over the agreement period.

A total of $10 billion in contracts for the project has been awarded, Shell said, including major engineering, procurement, and construction contracts. Construction began in third quarter 2006.

Sinopec, Syntroleum sign technologies deal

China Petroleum & Chemical Corp. (Sinopec) and Syntroleum Corp., Tulsa, have signed a nonbinding memorandum of understanding aimed largely at advancing natural gas-to-liquids and coal-to-liquids technologies.

The MOU aims at cooperation in verifying Syntroleum GTL technologies on an industrial scale, construction of a 17,000 b/d GTL plant and a 100 b/d CTL pilot plant in China as well as joint marketing of Sinopec Syntroleum technology there.

Syntroleum will provide Sinopec with access to its complete set of proprietary GTL technologies, including catalyst technology and Fischer-Tropsch (F-T) technologies related to CTL, for use in China on an exclusive basis during the period of cooperation.

After signing a formal cooperation agreement, Sinopec will provide Syntroleum with $20 million/year over the next 5 years to support the technology’s development.

Sinopec will start feasibility studies for construction of the plants as well as the CTL pilot plant in China, upon completion of the cooperation agreement.

Both plants will be fully capitalized by Sinopec, with technological support from Syntroleum. The two projects will provide the basis for the two parties to jointly market the combined F-T technology capabilities to third parties within China.

A Sinopec spokesman said the company was investing in the technology to complement existing efforts to develop its gas reserves in the long term.

Last December, Syntroleum signed a joint development agreement with Kuwait Foreign Petroleum Exploration Co. for development of a 50,000 b/d GTL plant in Papua New Guinea (OGJ Online, Dec. 22, 2006).

PNOC moves forward on biofuels projects

Philippine National Oil Co. subsidiary PNOC Alternative Fuels Corp. is moving forward with projects related to the production of biofuels from japtropha following approval of its 2007 budget for 1.257 billion pesos ($26 million).

PNOC-AFC Pres. Peter Anthony Abaya said the company plans to invest in a planned biodiesel refinery, but he did not disclose details.

For feedstock, PNOC-AFC expects to sign a memorandum of understanding this month with Malaysian firm Biogreen Energy Sdn. Bhd. to establish jatropha “meganurseries” on 1,500 hectares to grow about 30 million seedlings within 2 years for commercial plantations and research, Abaya said.

Abaya said other international firms interested in undertaking biodiesel-related projects with PNOC-AFC include South Korea’s Samsung Corp, Sumitomo Corp. and JGC of Japan, National Biofuels of the US, Malaysia’s HDZ, and Brunei National Petroleum Co.

PNOC-AFC has already signed an MOU with Samsung for an 8.2-billion-peso jatropha plantation and refinery project, while Sumitomo has agreed to conduct a feasibility study on the establishment of a biofuels central terminal in Bataan.

Transportation - Quick TakesAlaska governor outlines gas pipeline bill

Alaska Gov. Sarah Palin has introduced legislation intended to induce construction of a multibillion-dollar pipeline that would deliver North Slope natural gas to the Lower 48 states.

On Mar. 2 Palin outlined elements of the proposed Alaska Gasline Inducement Act, or AGIC. The legislation sets aside a previous effort by former Gov. Frank Murkowski. It’s unknown when the legislature will begin public hearings on AGIC. Murkowski had negotiated a draft contract with Alaska North Slope producers ExxonMobil Corp., ConocoPhillips, and BP PLC. The first draft was released in May (OGJ, June 5, 2006, Newsletter).

Despite changes to the draft and special legislative sessions, state lawmakers never approved the proposed plan from Murkowski, who lost a reelection campaign in November.

Palin’s bill initiates an application process open to any project sponsor, meaning that ExxonMobil, ConocoPhillips, and BP must start their negotiations over again. At least 12 companies or groups of companies have expressed an interest in building the pipeline.

Tangguh LNG nears completion, seeks financing

Construction on Indonesia’s Tangguh LNG facility is 70% complete, and startup is expected by fourth quarter 2008, if operator BP Indonesia receives further financing for the project, said Kardaya Warnika, chairman of Indonesia’s upstream oil and gas executive agency BP Migas.

To build the plant BP needs financing of $6.5 billion altogether, he said, of which $3.5 billion consists of loans, with the remainder coming from the company’s own resources.

Warnika said BP Indonesia has secured more than $2 billion in loans and is negotiating with a group of Chinese banks for another $884 million. If BP’s current negotiations are successful, these loans should be disbursed in April.

BP secured loans of $2.616 billion in 2006, including $1.2 billion from the Japan Bank for International Corp., $350 million from the Asian Development Bank, and $1.066 billion from commercial banks, Warnika said.

Meanwhile, according to BP Migas, Indonesia has signed contracts with Fujian-China for 2.6 million tonnes/year of gas over 25 years, SK Power Korea for 550,000 tonnes/year over 20 years, Posco Korea for 550,000 tonnes/year over 20 years, and Sempra Energy for 3.7 million tonnes/year over 20 years.

Nigeria LNG lets FEED for Bonny Island trains

Nigeria LNG (NLNG) has hired Foster Wheeler and Chiyoda Corp. to carry out front-end engineering and design work for the SevenPlus project on Bonny Island, which would add two liquefaction trains, each with a capacity of 8.5 million tonnes/year.

Foster Wheeler and Chiyoda will produce a project specification package that will form the basis for an invitation to bid for an engineering, procurement, and construction contract.

Foster Wheeler said the two trains once finished would be the largest in the world. A spokeswoman for Foster Wheeler declined to say when the trains would go on line, but press reports have said this would be 2012.

NLNG recently signed 20-year sales and purchase agreements with units of BG Group, Eni SPA, Total SA, Royal Dutch Shell PLC, and Occidental Petroleum Corp. for offtakes from SevenPlus.

Eni will take 1.375 million tpy of LNG to sell into the US via a terminal at Cameron, La., where it holds regasification capacity of 4.4 million tpy. Total’s 1.375 million tpy will be sent to its Sabine Pass and Altamira regasification terminals in the US and Mexico.

Shell Western LNG and Oxy, meanwhile, will receive 2 million tpy and 1 million tpy, respectively, but have not revealed the destination for their supplies. BG has bought 2.25 million tpy.