SPECIAL REPORT: US diesel use rising in ultralow-sulfur era

While US demand for ultralow-sulfur diesel (ULSD) is expected to escalate, no industry or government organization has solid data on how much of the fuel will be available or needed.

And no one seems concerned. Unlike in the period prior to the 2006 deadlines for refiners to reduce highway diesel sulfur to 15 ppm from 500 ppm, government and industry officials interviewed for this report said they are confident the market will function smoothly while meeting new deadlines in 2007 and beyond. Refiners approached last year’s changes confident that they could meet demand for ULSD but worried about logistics they couldn’t control, especially the possibility of downstream contamination (OGJ, May 22, 2006, p. 18). Any such problems have been minor.

Since Oct. 15, most of the diesel fuel sold at retail outlets in the US and Canada has been ULSD-more than the 80% of US diesel production mandated by the US Environmental Protection Agency. The first diesel engines specifically designed for the ultralow-sulfur fuel are in 2007 model vehicles now in car and truck showrooms. The 2007-model diesel trucks also will reduce particle emissions by 90% and significantly lower emissions of nitrogen oxide (NOx). But no one has a dependable estimate of how many of those new diesel vehicles will be produced, much less sold, in this or other years.

Meanwhile, EPA is mandating by June a 500 ppm sulfur cap on all off-road diesel, with a 2010 deadline for all highway and some off-road diesel to be at the 15 ppm ULSD level. In June 2010, the sulfur cap is to be lowered to 15 ppm for all nonroad diesel other than locomotive and marine, but small refiners are exempted from that rule. In June 2012, the ULSD requirement will apply to locomotive and marine diesel, and by June 2014 the ULSD cap will extend to small refiners that make nonroad diesel.

Supply outlook

The only data on ULSD production available through the US Department of Energy’s Energy Information Administration show refinery and blender net production totaled 1.9 million b/d last June; 2.2 million b/d in July; 2.4 million b/d, August; 2.6 million b/d, September; 2.5 million b/d, October; and 2.6 million b/d, November. Imports tallied at 97,000 b/d in June; 202,000 b/d in July; 182,000 b/d in August; 263,000 b/d in September; 137,000 b/d in October; and 143,000 b/d in November.

But after allowing for adjustments and stock change, the total ultralow-sulfur distillate fuel supplied amounted to 1.3 million b/d in June; 1.8 million b/d in July; 2.3 million b/d in August; 2.4 million b/d, September; 2.6 million b/d, October; and 2.7 million b/d as of November. No later or more detailed data were available, EIA officials said.

US inventories of ULSD totaled 57.3 million bbl in the week ended Feb. 23, the latest period available at deadline, down from 58 million bbl the previous week but up from 1.7 million bbl during the same period a year ago, before the mandate took effect. Low-sulfur diesel (LSD) stocks amounted to 22.3 million bbl on Feb. 23, down from 23.6 million bbl the previous week and 79.5 million bbl during the same period in 2006. EIA officials told OGJ that data on distillate fuel exports come from the Bureau of Census. “Currently, Census does not break out ULSD from LSD. Normally exports of diesel are small, and ULSD exports would be expected to be even smaller. This means that the product supplied (which is a surrogate for demand) for ULSD potentially is slightly overstated,” EIA said.

EIA said refiners likely will see little shift in diesel and gasoline demand in the next decade because of the slow growth in the fleets of vehicles requiring ULSD. Diesel prices no longer provide an incentive to switch over as when they were lower than gasoline prices some years ago. But high fuel prices in general should maintain consumer interest in more fuel-efficient diesel vehicles, EIA officials said.

The US gasoline price on Feb. 26 averaged $2.383/gal at the pumps, up 8.7¢/gal from the prior week and 12.9¢/gal from the same period a year ago. US diesel averaged $2.551/gal at the pump, up 6¢/gal from a week before and 8¢/gal from a year ago. For the month of January, the US retail price of gasoline averaged $2.24/gal. EIA said factors contributing to that price included the price of crude, 54%; refining, 11%; distribution and marketing, 15%; and state and local taxes, 20%. In that same month, the retail price of diesel averaged $2.49/gal. Contributors to that pump price included crude, 49%; refining, 18%; distribution and marketing, 12%; and taxes, 21%, EIA reported.

The absence of good data on true supplies of and demand for ULSD is “one of the key issues all of us are painfully aware of in trying to understand” that market,” said Allen Schaeffer, executive director of the Diesel Technology Forum. He blames reduced reporting by EIA “because of budgetary restraints.”

Schaeffer said, “Diesel demand in the US is directly related to the economy. When the economy is growing consistently, as it has in the last couple of years, that creates a demand for moving goods. That means locomotives, ships, trucks-the primary sources of diesel fuel consumption.” Meanwhile, increased demand for crude around the world and especially in China, India, and the US influences prices, refiners’ strategy, and other factors. “And there’s no relief in sight for that,” Schaeffer said.

“The DOE data are pretty good and shows in 2006, for example, that the road diesel demand increase was 4.2% year-on-year, even though the total heating oil and diesel demand increase was little more than 1%,” said Jeff D. Morris, a former Fina executive who is president and chief executive of Alon USA Energy Inc. Alon Israel Oil Co. Ltd. bought the US downstream assets of TotalFinaElf SA in 2000. “The diesel demand growth rate over the last 3 years has been double that of gasoline. It has been 3.5-4% for 3-4 years in a row now, very strong, whereas gasoline has been around 2%,” Morris said.

Markets need “more diesel and less gasoline” in virtually every area of the world, said Aaron F. Brady, associate director of global oil for Cambridge Energy Research Associates, at that group’s annual Houston energy conference in February. He expects rapid growth in commercial demand for diesel and jet fuel over the next 25 years, with refiners having to squeeze light and middle products from heavier crudes. Asia will be the greatest growth area for oil demand by 2030, primarily in transportation fuels, Brady said.

Refineries and infrastructure

Refineries are relatively flexible and can move the manufacture of gasoline or diesel “up and down about 10%,” Morris said. So if US diesel demand increased by 10%, displacing an equal amount of gasoline demand, “The existing refineries can handle that. Beyond that, we would have to do some retooling, but the technology exists to do that. And it’s a lot cheaper retooling than building ethanol plants all over the country.”

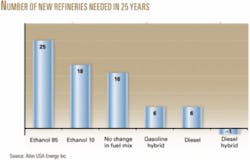

He said, “Today we’re importing 15% of the gasoline used in this country. If gasoline demand grows by 1%/year for the next 25 years, the US would need to build 16 new 200,000 b/d refineries over that period just to maintain the present level of gasoline production and imports. Assume that 2% of US motorists convert to E-85 vehicles; the US then would have to build 25 refineries, including ethanol plants.” But if instead 2% of US motorists bought advanced diesel cars, only six new refineries would be needed, Morris said. And if a diesel hybrid vehicle were developed and marketed at the same annual rate, he said, no new refineries would be necessary. “I don’t understand why this is not talked about more and why more incentives are not being provided,” he said.

At the recent CERA energy conference, Gary Heminger, executive vice-president of Marathon Oil Co., projected that the industry will need to build “a couple of world class refineries each year” to keep up with global demand for fuel. The average number of motor vehicles in Asia is expected to grow to 47 per 1,000 persons by 2020 from 18 per 1,000 in 1997. Neither development of alternate fuels nor increased refining capacity will do much to reduce US gasoline imports in the short term, he said. However, he said, the world will need all new forms of energy “that can stand on sound investment.” For the present, Heminger said, ULSD inventories “look decent.”

In the US, concentration of the diesel-distribution infrastructure varies. A US map supplied through the Diesel Technology Forum by Air Improvement Resource Inc. shows county by county the density of retail diesel service station and truck stop locations per 100 sq miles. According to that data, 498 US counties have 5-75-or more-retail diesel locations per 100 sq miles. But 1,115 counties were indicated to have less than one location per 100 sq miles. Many of those areas with the fewest stations were in large and sparsely populated counties encompassing long stretches of interstate highways in West Texas, New Mexico, Arizona, Utah, Nevada, Nebraska, South Dakota, North Dakota, Wyoming, Montana, and Idaho.

The largest group of counties in any of the 11 density levels indicated on the map had 792 with one or two locations per 100 sq miles; the second largest group was 738 counties with two to five locations per 100 sq miles. Virtually all of the density divisions had similarly overlapping numbers. The largest evident concentration of diesel outlets was essentially east of the Mississippi River.

However, Morris said there is “more than sufficient infrastructure” for supplying diesel to a larger US market. “Assume half of the motorists are driving diesel engines all of a sudden; the conversion per station is simple. All it takes basically is a change in the [size and color of the pump] nozzle. It’s a relatively small fix, whereas if you want to put E-85 at a station, you have to put a new tank and completely segregated system in the ground at a cost of $30,000 per site,” he said. “Diesel has a big advantage in infrastructure in that it can go through [existing] pipelines.” Of course, ULSD can’t afford to pick up much sulfur contamination during the distribution process, or it will be sent back to the refiner for reprocessing.

“In the past, the diesel pump used to be kind of on the ‘back 40’ of a service station, off to the side because the trucks that fueled up there were too tall to fit under the station’s canopy and needed extra space to turn,” Schaeffer said. But now companies “like Shell and Chevron and BP” are integrating a diesel pump right alongside the gasoline on the pump islands. “That suggests to us that refiners and marketers believe diesel fuel is going mainstream and that they need to treat it as a mainstream fuel. There’s no reason I should stand out in the rain while filling my diesel car,” said Schaeffer.

US vehicle fleet

The number of diesel-fueled cars and light trucks sold in the US has “grown consistently in the last 10 years and is up 80% in the last 6 years,” said Schaeffer. Predictions that as much as 15% of the light vehicles on US roads could be diesel-powered by 2015 “could create additional demand in fairly tight supply,” he said.

The best way to meet the goals set by President George W. Bush to reduce greenhouse emissions and gasoline consumption by 20% over the next 10 years is with advanced diesel engines, said Morris. “What I’d really like to see introduced in the US is a diesel-hybrid vehicle-a diesel engine, but not the ‘plug-in’ rechargeable electric car,” he said.

“I think the only thing standing in our way [to a larger US diesel market] is Detroit, which has chosen so far to offer fewer diesel engines rather than more,” Morris said. “The Europeans are beginning to expand their diesel fleet slowly; they see the potential in the market.” He sees “a limited amount of marketing” primarily by foreign-based automobile companies to sell diesel vehicles to US motorists.

“I’ve heard Detroit executives say they don’t bring the diesels to the US because the public has the perception that diesel engines are slow, loud, and smoky,” Morris said. “I interpret it to mean they’re unwilling to put marketing effort into it.”

Loren K. Beard, senior manager of environmental and energy planning at Daimler Chrysler Corp., told the CERA conference he sees “a big, big role for diesel” by 2015 when it is expected to fuel 15% of the light cars on the road, in addition to commercial trucking. The result, he said, will be a major shift in transportation fuels with more diesel replacing gasoline.

DOE calculates US demand for petroleum will increase 25% in the next 25 years because of jumps in both population growth and vehicle miles traveled. However, Beard said demand could be reduced 30% through greater use of E-85 and a 20-80 blend of biodiesel. Even if the changeover to E-85 were perfect, it would take 10-20 years to turn over the existing fleet of motor vehicles to where most could run on that fuel, he said.

Morris suspects the driving public will not pay more for a fuel like ethanol that delivers 25% less fuel efficiency. He also doesn’t believe ethanol production capacity will go to the 15 billion gal/year level some analysts predict from the 8 billion gal/year projected for next year while sustaining a 54¢/gal tariff on ethanol imports.

Biodiesel

Biodiesel blends are mixtures of petroleum-based diesel fuels and fuels produced from soybean oil, waste cooking grease, or other organic matter. These fuels may contain biodiesel in concentrations 2-100% by volume.

Because biodiesel is a more efficient fuel than ethanol, Morris said, there should be a bigger government push for biodiesel. “There would be more of a push for biodiesel if there were more diesel engines,” he said.

The National Biodiesel Board said US biodiesel production increased from “very little 10 years ago” to 75 million gal in 2005 and 225 million gal in 2006, with production tripling in each of the last 2 years. Most of that fuel was produced from soybean oil at 35 major facilities and sold by 1,400 distributors and 450 retail stations. Blends of 20% biodiesel with 80% petroleum diesel (B20) can generally be used in unmodified diesel engines, provided the blend meets accepted American Society for Testing and Materials fuel-quality standards. Some industry representatives say biodiesel can be used as an additive to improve the lubricity of ULSD, which is negatively affected by the removal of sulfur.

-Jeff Morris, CEO of Alon USA Energy Inc.

“Biofuels are typically being blended or loaded at the jobber’s rack and are not part of a fundamental pipeline distribution system,” said Schaeffer with Diesel Technology Forum. “At this stage, we view biodiesel as a niche fuel in certain markets where it makes sense. But to grow into something more, there is a serious issue now of quality. The National Biodiesel Board, which is the body that represents most of the producers of biodiesel fuel, recently did a survey that found over 50% of the samples it measured around the country did not meet their own quality specs. That is a serious issue for consumers that will buy a $50,000 diesel car and have the expectation that if they’re pumping a 5% blend of biodiesel in there that it’s the right purity and mixed in well and doesn’t attract water. At this point, we can’t guarantee that nationwide. This is going to be a big issue for that industry to grow and be a renewable fuel.”

The National Biodiesel Board said it issued a “winter warning” to motorists about biodiesel quality. Meanwhile, it has certified under its BQ-9000 voluntary quality control program 6 biodiesel marketers and 17 producers who account for 40% of the biodiesel production capacity in the US. The board has asked state and federal government agencies to adopt and enforce fuel quality standards for biodiesel.

“There’s nothing wrong with biodiesel blended to specifications by reputable firms,” Morris said, “but you don’t want to buy fuel from a guy blending vegetable oil in a barrel in his garage. There’s plenty of high-quality biodiesel out there that meet the specifications.” He said Alon USA is considering building a biodiesel plant at its Big Springs, Tex., refinery.

So far there is also limited experience with how biodiesel reacts with ULSD. “One concern that vehicle manufacturers have at this point is that starting in 2007 diesel vehicles will have particulate filters that are very sensitive to ash formation. All of the oils in the engines are being reformulated to a very low ash content. Biodiesel does introduce ash into the system where lots of people are working to take it out,” said Schaeffer.

Urea needed

The ULSD rule issued by EPA in 2000 not only required that refiners drastically reduce the sulfur content of diesel but also imposed emission controls on heavy-duty diesel engines to slash the output of NOx, particulate matter (PM), and hydrocarbons (HC). Those standards require stricter control of PM (0.01 g/bhp-hr), NOx (0.20 g/bhp-hr), and HC (0.14 g/bhp-hr) emissions and apply to diesel-powered vehicles with gross vehicle weight of 14,000 lb or more. The PM standard applies to all on-road heavy and medium-duty diesel engines. The NOx and HC standards are being phased in at 50% of new vehicle sales in 2007-09. By 2010, all new on-road vehicles will be required to meet the NOx and HC standards.

For 2007-09, however, diesel engine manufacturers have the option to design and produce engines to meet an average of 2004 and 2007 NOx and HC emission standards (1.1 g/bhp-hr) by using less-stringent emission control systems. Application of new emission control technology will provide a 3% or greater increase in efficiency, government officials said.

Urea is used as an active ingredient for some selective catalytic reduction (SCR) systems to reduce NOx emissions. It was the first organic compound to be artificially synthesized from inorganic materials.

One product is AdBlue, the European trade name of AUS32, a 32.5% solution of urea in demineralized water used as an operating fluid in diesel-powered freight trucks to clean up emissions. Not a fuel additive, AUS32 is stored in a separate tank and is sprayed in the hot exhaust gases in a specific catalytic converter. The oxides of nitrogen formed at combustion are converted into elementary nitrogen and water. AUS32 allows diesel-powered freight trucks to meet the Euro IV emission standard introduced in 2005 by the European Union, as well as the new EURO V emission standard proposed for 2008. With many EURO V and SCR trucks on European roads, retail gasoline stations are being built to supply AdBlue.

Correct materials must be used in construction of both the storage and dispensing facilities to keep SCR systems free from contamination, manufacturers said. Otherwise, ions can be passed from dispensing materials into the porous head on the SCR, making it ineffective and reducing the catalytic unit’s life expectancy from more than 500,000 km to less than 200,000 km.

However, there is no infrastructure for distribution of urea in the US. Yet another issue is that the solution freezes in extremely cold weather. EPA is concerned with compliance issues because truck drivers may cut costs by not refilling urea tanks. Engine manufacturers are working with EPA to develop control systems to address these issues.