OGJ Newsletter

Venezuela energy minister resigns

Venezuela Energy Minister Rafael Ramirez resigned after President Hugo Chavez requested the resignation of all his cabinet ministers.

Chavez told reporters in Venezuela that the ministers will stay in their posts until replacements are approved.

Ramirez has been minister since 2002 and was appointed president of state oil company Petroleos de Venezuela SA in November 2004. He did not resign as PDVSA president, PDVSA told Business News Americas. PDVSA officials confirmed that Ramirez had resigned as minister.

N. Sea decommissioning to cost $42 billion

Companies operating in the North Sea are expected to spend $42 billion on decommissioning infrastructure, said Wood Mackenzie Ltd., Edinburgh.

About 48% of decommissioning costs will be spent in Norway and 40% in the UK, WoodMac said.

North Sea operators say the UK government needs to clarify the regulation, tax, and decommissioning liability rules that will help them close deals faster on transferring ownership rights over their acreage. The UK Offshore Operators’ Association and the Independent Oil & Gas Association have been lobbying the government to make progress on this issue, said WoodMac.

The companies are concerned about changes to the UK tax regime that could affect the levels of tax relief they can claim against decommissioning costs. “However, the UK industry would welcome change to current liability and financial security requirements,” the analyst added.

WoodMac anticipates the majority of future decommissioning expenditure to be in 2015-31 with a spending plateau of about $1.5 billion/year. However, operators are expected to have some success in extending the life of existing fields beyond current plans.

To date 40 fields have been abandoned-23 in the UK, 11 in Norway, and 6 in the Netherlands-and an additional 66 fields are being decommissioned or await abandonment.

Countries sign energy efficiency accord

The US, China, India, Japan, and South Korea agreed on Dec. 15 to work together to boost energy efficiency, to diversify their energy sources, and to guard against emergencies in the face of rising oil prices.

In a joint statement, energy ministers from the countries said they face a common challenge to obtain “sufficient, reliable, and environmentally responsible supplies of energy with reasonable prices.”

The statement said in recent years global oil price fluctuations and increases have hurt the world economy, especially developing countries.

The ministers said the collective efforts of their countries, which consume about 47% of the world’s energy, are of great significance for the stability of the international market for oil and other sources of energy, as well as for enhancing global energy security.

Total to cut gas flaring in half by 2012

Total SA plans to cut its gas flaring by 50% at its operated facilities in the Gulf of Guinea and other places by 2012 to reduce climate change and promote energy efficiency and sustainability.

Total said it reduced gas flaring by 40% during 1998-2005 at its operated facilities despite boosting gas production levels. Associated gas flaring accounted for 23% of its greenhouse gas emissions in 2005.

“We will look at reinjecting gas back into oil fields,” a spokesman said. Total also wants to send gas to the proposed 5 million tonne/year Angola LNG project, operated by Chevron Corp. Total plans to use otherwise flared gas for electric power generation in Nigeria and is keen to produce methanol, he added.

Total is a member of the World Bank’s Global Gas Flaring Reduction partnership. Established in August 2002 by the World Bank, the public-private partnership facilitates and supports national efforts to use currently flared gas. Partners include governments of oil-producing countries, state-owned companies, and major international oil companies.

In 2000, Total set a “zero flaring” policy for its projects.

New Zealand to meet IEA inventory target

New Zealand Energy Minister David Parker announced that, effective Jan. 1, New Zealand would meet its International Energy Agency obligation to hold oil stocks representing 90 days of net oil imports.

New Zealand’s oil stocks have dipped to volumes as low as 60 days of net oil imports as a result of increasing demand and declining domestic oil production, he said. In May, criticized New Zealand’s inventory levels.

The government has arranged contracts that provide options for New Zealand to buy petroleum and diesel in case of an IEA-declared emergency. The contracts cover petroleum and diesel stored in Australia, the Netherlands, and the UK from BP PLC, Royal Dutch Shell PLC, and Total SA.

The New Zealand government signed bilateral arrangements with the governments of Australia, the UK, and the Netherlands to enable the stocks to count toward New Zealand’s IEA obligations.

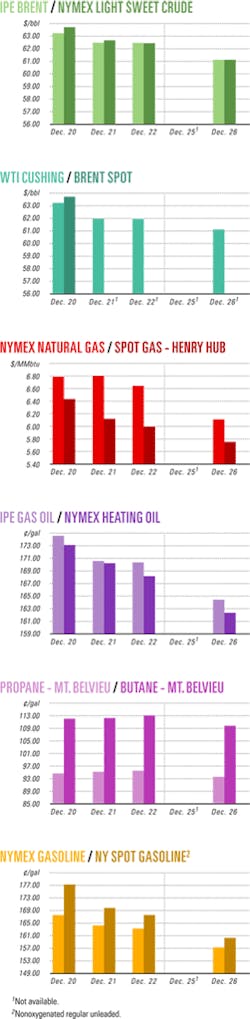

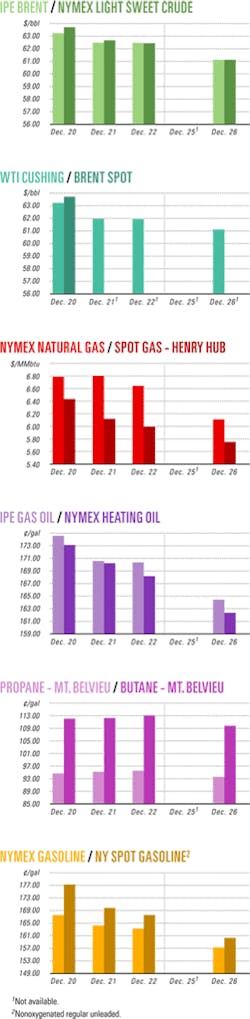

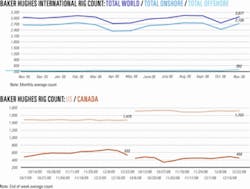

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesShell, Plains E&P make GOM oil find

Shell Offshore Inc. has made an oil discovery on its Friesian prospect on Green Canyon Block 599 in 3,800 ft of water in the Gulf of Mexico, about 200 miles south of New Orleans.

The discovery well was drilled to 29,414 ft TD and encountered more than 120 ft of net oil pay. The well is prepared for completion and temporarily abandoned.

Shell, operator, and Plains Exploration & Production Co. each own a 50% interest in the project.

Leases issued for five oil shale projects

The US Department of the Interior has issued research, development, and demonstration (RD&D) leases for five oil shale projects in Colorado’s Piceance basin, the US Bureau of Land Management said Dec. 15.

C. Stephen Allred, assistant Interior secretary for land and minerals management, signed the RD&D leases for projects proposed by Chevron USA Inc., EGL Resources Inc., and Shell Frontier Oil & Gas Inc.

The leases grant rights to develop oil shale resources on tracts up to 160 acres for a 10-year initial term, with an extension option of up to 5 years with proof that diligent production levels have been pursued.

The leases also contain a preferential right to convert the RD&D acreage, plus as much as 4,960 acres of adjacent land, to a 20-year commercial lease once commercial production levels are achieved and all requirements are met, it added.

The tracts were identified in proposals submitted by the companies in June 2005. The leases contain project-specific requirements for permitting, monitoring, and environmental mitigation.

Target shales are in the Eocene Green River formation, which lies under parts of Colorado, Utah, and Wyoming, and according to BLM might hold 800 billion bbl of recoverable shale oil. More than 70% of the formation lies under federal land.

Husky finds gas, oil in Jeanne d’Arc basin

Husky Energy Inc., St. John’s, Newf., and Norsk Hydro Canada Oil & Gas have made a hydrocarbon discovery during delineation drilling in the Jeanne d’Arc basin, off Newfoundland and Labrador.

The West Bonne Bay F-12 well was drilled in significant discovery license (SDL) 1040, about 320 km southeast of St. John’s, and near the Terra Nova oil field. Under a farm-in agreement with Norsk Hydro, operator of SDL 1040, Husky drilled the well using the Rowan Cos. Inc. Gorilla VI jack up rig.

The F-12 well was drilled to TD 4,666 m. A sidetrack well F-12Z was drilled to further delineate the structure and to gather additional reservoir information. In both wells hydrocarbons were encountered in the Upper Hibernia formation. Further analysis of core, fluid samples, and wire line log data is continuing to estimate the resources in this pool.

Husky served as operator for the drilling program and holds a 27.78% interest in the West Bonne Bay well. Norsk Hydro is operator of the SDL and holds a 72.22% working interest.

Indonesia awards PSCs to 18 companies

Indonesia has awarded production-sharing contracts to 18 companies in an effort to boost the country’s dwindling oil production. The government wants to increase oil production to 1.3 million b/d by 2009 from the current 1.04 million b/d.

Indonesia invited companies to bid on 41 oil and gas blocks onshore and offshore Sumatra, Kalimantan, Sulawesi, and Java.

The winning bidders must drill as many as 32 wells over the next 3 years at a total cost of about $235.78 million.

Companies that secured exploration rights in frontier areas will receive 80% of the net oil production, while those operating in nonfrontier areas will receive 65% of net production.

Winners included ConocoPhillips and partner Statoil ASA, which obtained rights to explore for oil and gas on the Kuma Block in western Sulawesi. Also CNOOC and its partner PT Gregori Gas Perkasa won rights for the Batanghari Block in central Sumatra.

PetroLatina to develop Serafin gas project

PetroLatina Energy PLC, formerly Taghmen Energy PLC, has initiated development of the 1991 Serafin gas discovery in Area B of the Tisquirama License in Colombia. Gross reserves are estimated at 4-8 bcf.

The Serafin well is north of PetroLatina’s Los Angeles field and 3.5 km from a main gas pipeline. PetroLatina holds a 50% interest in the project, and PetroSantander Inc. holds 50%.

PetrLatina will reenter and work over the well this month and test results will determine the design of a tie-in to the pipeline. PetrLatina expects commercial gas deliveries to start in second quarter.

Development cost, including pipeline and tie-in, is estimated at $1.36 million.

Recent increases in the price of gas in Colombia to about $3/Mcf will enable the project to pay out in 5 months, PetroLatina said. Local industries will buy the gas.

Texas Petroleum Co. drilled the Serafin well, which encountered a gas-bearing sand in a stratigraphic trap of the Miocene Real Group. Logs indicated 18 ft of pay with porosity of 28% and a water saturation of 27%. The well flowed at rates of up to 16 MMcfd from a 4,582-98-ft zone on extended tests. Reservoir pressure is 1,978 psi, and the gas is over 97% methane.

PetroLatina is using 3D seismic data to identify further prospects.

Drilling & Production - Quick TakesAzeri Shah Deniz field comes on stream

Commercial gas production has begun from Shah Deniz gas-condensate field in the Caspian Sea off Azerbaijan. Consortium partner Total SA said Shah Deniz field’s Stage 1 gas production plateau is expected to be 300 MMcfd.

Shah Deniz covers about 860 sq km about 70 km south of Baku in 50-600 m of water (map, OGJ, June 27, 2005, p. 61). BP PLC is technical operator of the field and an associated onshore terminal, and Statoil ASA is commercial operator, responsible for gas sales, contract administration, and business development (OGJ, May 15, 2006, Newsletter).

In addition to BP and Statoil, which hold 25.5% interest each, Shah Deniz shareholders include State Oil Co. of the Azerbaijan Republic, Total, Naftiran Intertrade Co. Ltd., and LukAgip NV-each holding 10%-and Turkiye Petrolleri Anonim Ortakligi, 9% (OGJ, Mar. 17, 2003, Newsletter).

The field, which has gas reserves pegged at 25-35 tcf, is expected to produce 8.6 billion cu m/year of gas in Stage 1 and 37,000 b/d of condensate, which will be shipped to Ceyhan, Turkey, for processing (OGJ, Aug. 21, 2000, p. 68).

Gas is being exported to Azerbaijan, Georgia, and Turkey via the $1.3 billion, 700 MMcfd South Caucasian Pipeline. The BP-operated line extends 430-miles from Baku to Tbilisi, Georgia, and Erzurum in eastern Turkey, paralleling the Baku-Tbilisi-Ceyhan crude oil pipeline.

Beyond Erzurum, there currently is no place for the remaining gas to go, but Georgia has agreed to place some of the gas in storage until Erzurum can be integrated into the Turkish gas network. Turkish state-owned Petroleum Pipeline Corp. will assume gas transportation at the border, and will build a new pipeline to tie in to the existing Turkish distribution network at Erzurum.

Petrobras starts up P-34 FPSO off Brazil

Petroleo Brasileiro SA (Petrobras) has brought online the P-34 floating production, storage, and offloading vessel, establishing first-phase production of Jubarte field off Espirito Santo, Brazil.

P-34 flow will rise to nominal capacity of 60,000 b/d, including 15,000 b/d of 17° gravity oil from the Jubarte-4 horizontal well and output from three other wells.

Production from the second production well, ESS-110, could start by yearend.

Dalia oil field starts production off Angola

Oil production from Dalia field off Angola started Dec. 15 and will reach 250,000 b/d by next summer, field operator Total SA reported.

Dalia field, which lies on deepwater Block 17, 135 km offshore in 1,200-1,500 m of water, holds 1 billion bbl of recoverable oil (map, OGJ, Feb. 14, 2005, p. 24). Oil is being produced from 37 wells, all of which are tied in to 9 manifolds. The field also has 3 gas-injection and 31 water-injection wells.

Subsea installations include 40 km of insulated flowlines linked to 8 flexible risers specifically manufactured for the project. The risers take fluids to a floating production, storage, and offloading vessel, which can store 2 million bbl of oil.

According to Total, Dalia is the largest deepwater development to be brought on stream in 2006 and among the largest projects of its kind in the world.

Total holds 40% interest in Block 17. Partners are Esso Exploration Angola (Block 17) Ltd. 20%, BP Exploration (Angola) Ltd. 16.67%; Statoil Angola Block 17 AS 13.33%, and Norsk Hydro Dezassete AS 10%.

Firms clash over Yacheng gas supply outlook

CLP Holdings Ltd., Hong Kong, rejecting claims by natural gas suppliers, China National Offshore Oil Corp., BP PLC, and Kuwait Foreign Petroleum Exploration Co. (Kufpec), that Yacheng gas field off Hainan Island has sufficient reserves to supply Hong Kong through 2036, decided to build an $8 billion (HK) LNG terminal on the Soko Islands southwest of Lantau after an independent assessment in 2002 concluded that the field’s reserves would be insufficient to meet increased demand for gas in Hong Kong.

Demand growth for gas on Hainan Island, rising by 23%/year, is expected to create a shortfall during 2006-10 because supplies are forecast to increase by only 18%/year.

CNOOC, however, said it plans to invest $80 million on drilling 3-4 production wells after 2009, lifting the total number to as many as 15 and expanding the exploration area to 322 sq km.

CNOOC owns a 51% stake in Yacheng, while BP and Kufpec share the remaining 45%. Yacheng reserves are pegged at more than 100 billion cu m.

CLP consumes 2.5 billion cu m/year of gas, or 83% of Yacheng’s annual output.

Processing - Quick TakesIreland refinery producing renewable diesel

ConocoPhillips has begun commercial production of renewable diesel from soybean oil and other vegetable oils at its 71,000 b/d Whitegate refinery in Cork, Ireland.

Whitegate is producing 1,000 b/d of renewable diesel using its existing equipment. Unlike biodiesel, the renewable diesel is blended and transported with petroleum-based diesel. ConocoPhillips said renewable diesel involves different processing methods than biodiesel. Renewable diesel also is different chemically from biodiesel. Use of the renewable diesel will help reduce carbon emissions, ConocoPhillips said.

Chevron starts up FCC unit at Pascagoula

Chevron USA Inc. has brought online a fluid catalytic cracking (FCC) unit at its 325,000 b/cd refinery in Pascagoula, Miss.

The FCC unit, completed this month during a 75-day project shutdown, will increase the refinery’s capacity to manufacture gasoline by about 10% to 5.5 million gal/day (OGJ, Nov. 20, 2006, Newsletter).

Chevron Executive Vice-Pres. of Global Downstream Mike Wirth said, “In the last 2 years, Chevron has increased its gasoline manufacturing capacity in the United States by 6%, or 1 million gal/day.”

Dubai condensate refinery upgrade advances

GE Oil & Gas will supply eight compressors and a steam turbine power generation set for an upgrade of Emirates National Oil Co.’s 120,000 b/d condensate refinery at Jebel Ali, Dubai.

Foster Wheeler Energy Ltd. is the engineering, procurement, and construction contractor for the addition of a 36,000 b/sd crude catalytic reformer and a 70,000 b/sd LPG-naphtha hydrotreater.

The project will convert the existing naphtha product to low-sulfur petrochemical naphtha, add a 102 RON reformate stream, and enable the refinery to operate at full capacity on sour condensate. Other new products are LPG, butane, and sulfur.

The generator to be supplied under the GE contract will use steam from the refinery. The compressors-five centrifugal and three reciprocating, all driven by electric motors-are for the new hydrotreater and reformer.

The project is scheduled for completion by yearend 2007.

Transportation - Quick TakesPlains confirms offshore oil pipeline leak

Plains All American Pipeline LP said a crude oil leak was detected Dec. 24 on its High Island Pipeline System off Texas City, Tex., 30 miles south of Galveston in the Gulf of Mexico. No injuries were reported.

Earlier that day, Plains said the pipeline had experienced a pressure loss and was shut down. The cause of the incident is being investigated.

The company said it is working with federal and state officials to minimize the consequences of the incident.

Firm presses plans for Indonesian gas line

Indonesia’s PT Bakrie & Bros. (B&B) Pres. Bobby Gafur Umar said the company plans to proceed with construction of a 1,115-km pipeline to transport natural gas from East Kalimantan to Central Java despite adverse comments by Indonesian Vice-President Jusuf Kalla about the project’s feasibility.

Kalla earlier said the government might cancel the $1.26 billion project due to a change in domestic gas markets, with Java likely to get fresh supplies from Cepu gas field in Central Java.

Kalla said gas output in Kalimantan is showing signs of depletion.

Umar, however, said the pipeline was in line with the program proposed to upstream regulator BP Migas, which awarded BB the tender to build the project (OGJ, Feb. 20, 2006, Newsletter). Construction has been scheduled to start in early 2007and to complete in 2009.

B&B has a 25-year contract from the government to operate the transmission pipeline, and it has been seeking cooperation with Mitsui of Japan and Daewoo of South Korea to build the line, which will transport 1 bcfd.

PDVSA plans Caribbean-Pacific oil pipeline

Petroleos de Venezuela SA (PDVSA) plans to build a pipeline through Nicaragua to transport oil from the Caribbean to the Pacific, bypassing the Panama Canal.

Officials of the Nicaraguan-Venezuelan oil firm Alba Petroleos de Nicaragua (Albanic), which is managed by Nicaragua’s Sandinista-controlled Association of Nicaraguan Municipalities, confirmed the plans.

Albanic Pres. Jose Pena mentioned PDVSA’s additional interest in building a refinery in Nicaragua to supply Central America with products.

Pena said the plans will be part of an accord to be signed by Venezuelan President Hugo Chavez and Nicaraguan President-elect Daniel Ortega after the latter is sworn in as president Jan. 10.

Albanic Vice-Pres. Dionisio Marenco, mayor of Managua and a Sandinista member, said the Panama Canal is too narrow to allow passage of large tankers. He said the pipeline would be used to boost the export of oil products made in Nicaragua from Venezuelan crude to China and Japan as well as the Pacific Coast of Central America. Nicaragua’s only refinery is Esso Caribbean & Central America’s 20,000 b/d facility in Managua.

In May, Ortega and Chavez signed a cooperation initiative enabling Venezuela to sell oil to Nicaragua on credit.

Venezuela will accept 60% of payment within 90 days of shipment, while the remaining 40% will be paid off over 25 years at 1%, to include a 2-year grace period.

The creation of Albanic is widely seen as a sign of Ortega’s growing political alliance with Chavez. ALBA is the Bolivarian Alternative for the Americas, a Latin American integration initiative started last year by Cuba and Venezuela, which aims to counter US efforts to promote hemispheric free-trade integration.

Fast-track plans outlined for Iranian LNG plant

Perth-based Liquefied Natural Gas Ltd. plans to accelerate development of its 3.45 million tonnes/year Qeshm LNG project in Iran.

The Qeshm Island liquefaction plant, expected to deliver its first LNG shipment in first quarter 2010, is being developed in partnership with Civil Pension Fund Investment Co. Iranian.

The plant will be developed in three phases. The first phase calls for a 1.15 million tonnes/year train in first quarter 2010.

Developers are working with Iranian authorities to select a plant site and finalize an LNG sales agreement.

Gorgon LNG plan clears environmental hurdle

Western Australia has cleared the way for a final investment decision on the Chevron Australia group’s $15 billion (Aus.) Gorgon LNG project off the state’s northwest coast.

However the group must commit an additional $60 million (Aus.) to conserving and monitoring the flatback turtle population, which annually lays eggs on Barrow Island near the plant site, and comply with stringent conditions concerning dredging, quarantine, greenhouse gas reinjection, short-range endemics and subterranean fauna.

The group also will be required to contribute $40 million (Aus.) toward resolving environmental issues in the Pilbara and West Kimberley regions, including rehabilitation of Dirk Hartog Island.

The project needs final environmental approval from the Federal Minister for Environment Ian Campbell before it can proceed.

Chevron and partners ExxonMobil Corp. and Shell Australia will have to weigh the costs of these latest conditions against the economics of the project.

The group has already invested $1 billion in development preliminaries, including $40 million for a carbon dioxide data well on Barrow Island to investigate the feasibility of geosequestering Gorgon’s 12% CO2 content in reservoirs.

Chevron says that an indication of whether the two-train, 10 million tonne/year LNG plant would go ahead could be given in mid-2007.