OGJ Newsletter

Regulator says fundamentals lifting energy prices

High energy prices stem from supply-demand fundamentals rather than attempts by any type of traders to manipulate prices, US Commodities Futures Trading Commissioner Sharon Brown-Hruska said.

Some politicians have suggested speculative traders and hedge funds might be responsible for high oil and natural gas prices.

“We haven’t uncovered any systematic problems with regard to manipulation or with speculative traders to exercise market power,” Brown-Hruska told reporters Jan. 26 during the annual Energy Trading & Marketing Conference at the University of Houston.

The Commodities Futures Trading Commission (CFTC) regulates US commodities markets and maintains surveillance of the markets, she said, adding that the agency reviews any dramatic price swings.

“We don’t have any formal investigation” of speculative funds, Brown-Hruska said.

In the wake of the Enron Corp. collapse and investigations into energy trading practices, CFTC filed 32 enforcement cases with individual traders and energy companies, imposing $300 million in civil penalties. A few cases have yet to be resolved, she said.

“These entities know now that you can’t mess up when it comes to keeping the books straight,” she said, expressing confidence with the integrity of current energy markets and traders as well as with price-reporting practices.

“Regulators and the industry can work together without resorting to heavy-handed prescriptive regulations,” Brown-Hruska said. “I don’t think that mandates for greater transparency will bring down the market prices.”

Venezuela limits deductions on gas production

Venezuela has increased pressure on international oil companies (IOCs) after moving private production contracts to government control and making claims for back taxes through tax authority Seniat (OGJ Online, Jan. 9, 2006).

The latest blow is a resolution passed Jan. 9 that limits deductible expenses on natural gas production to 15% of the wellhead price. This contradicts terms of previous license agreements and leaves various IOCs-notably Statoil ASA and Chevron Corp.-facing new costs. State oil firm Petroleos de Venezuela SA said the change would encourage firms to reduce spending.

The extra expense from this resolution will be relatively minor. However, it is another signal to foreign operators that the government of Hugo Chavez is determined to squeeze them financially.

Late last year Energy Minister Rafael Ramirez outlined an income tax increase to 50% from 34% on four heavy-oil projects in Venezuela’s Orinoco River basin, potentially affecting operations of ExxonMobil Corp., Chevron, ConocoPhillips, BP PLC, Total SA, and Statoil.

Bolivia names energy minister

Bolivian President Evo Morales named Andris Soliz Rada energy minister, replacing Mauricio Medinacelli. Soliz is an attorney who has written numerous books and articles about oil and natural gas.

Soliz told reporters in Bolivia that his first priority is to strengthen state oil company Yacimientos Petroliferos Fiscales Bolivianos. Previously, Soliz served on the transition committee for the Morales administration.

Morales won election in December after a campaign that raised fears about nationalization of the oil and gas industry. He was inaugurated Jan. 22 and named a cabinet on Jan. 23 (OGJ Online, Jan. 23, 2006).

India appoints new oil minister

India’s new Minister of Petroleum and Natural Gas Shri Murli Deora took office Jan. 30, vowing to secure energy supplies to ensure India’s growing fuel needs.

Deora was appointed to the job Jan. 29. Previously, Mani Shankar Aiyar held the post.

Upon questioning from reporters in New Delhi, Deora declined to outline specific plans, saying, “It is premature for me at this moment to comment on details.”

India, Saudi Arabia sign energy pact

India and Saudi Arabia signed a strategic energy partnership, the Delhi Declaration, to work cooperatively in the upstream and downstream sectors, the government said in a Jan. 27 joint statement.

The signing was announced near the end of Saudi Arabia King Abdullah bin Abdulaziz al-Saud’s recent visit to India. Previously, Saudi Arabia signed a similar accord with China regarding oil, gas, and minerals (OGJ Online, Jan. 24, 2006).

The India-Saudi strategic energy partnership envisions increased volumes of crude oil supplies from Saudi to India via long-term contracts that would be renewed automatically. Currently, India imports 25 million tonnes/year of Saudi crude oil.

The declaration also is expected to promote Saudi investments in refining, marketing, and storage in India, as well as India-Saudi ventures in gas-based fertilizer plants in Saudi Arabia.

EU, France seek integrated energy policy

The European Union is seeking an integrated, efficient energy policy that would improve its ability to manage growing dependence on non-EU energy supplies.

At a meeting of 25 EU finance ministers in Brussels Jan. 24, Austrian Energy Minister Martin Bartenstein said he would focus on energy during his country’s 6-month presidency of the EU. Next spring the energy ministers will meet to pursue a “sure, sustainable, and competitive energy policy.”

French Economic and Finance Minister Thierry Breton presented a memorandum promoting energy conservation, long-term investment visibility and planning, and improved communication with the EU’s energy suppliers. The memorandum encourages the EU to seek international partnerships in exploration, production, and refining.

The proposal, based on France’s long-term energy planning, offers help to any nation that wishes to initiate or resume nuclear power generation and sets out guidelines finding balance among safety, concern for environmental impact, and corporate competitiveness.

Among other measures, it encourages EU nations to replace petrochemicals with “green chemicals” and to continue development of hydrogen, fuel cell, and carbon dioxide sequestration technology.

Pakistan agrees in principle on incentives

Pakistan has agreed in principle to offer an incentive package for oil and gas investment through its Petroleum Policy 2006, to be unveiled in June, according to IHS Energy, which is preparing the policy under contract.

Pakistan currently uses a petroleum policy from 2001 with which oil and gas companies long have been dissatisfied because of a cap on local gas prices.

Companies have asked the government to provide guarantees and tax exemptions to accelerate gas production. The government plans to increase gas production to meet the energy needs of its growing economy.

New York, EPA settle underground tank suit

New York City and the US Environmental Protection Agency reached an agreement under which the city will pay $1.3 million and bring substandard underground storage tank systems into compliance with federal law to settle a civil suit.

The city also agreed to undertake an additional environmental project to make it better able to identify releases from the tanks in which it stores petroleum and other substances. It also pledged to upgrade or close tanks that do not comply with the federal Resource Conservation and Recovery Act.

The city owns at least 1,600 underground storage tanks in at least 400 locations throughout its metropolitan area, including all five boroughs, according to EPA.

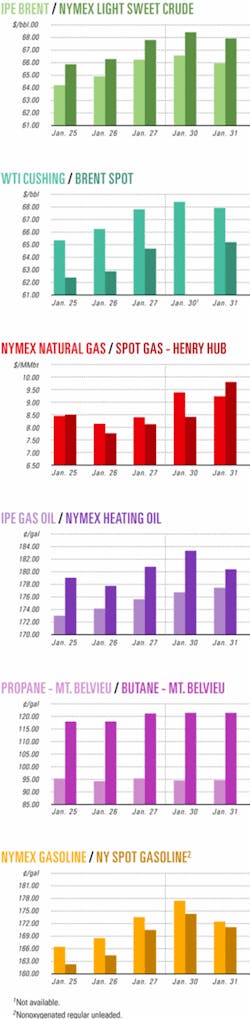

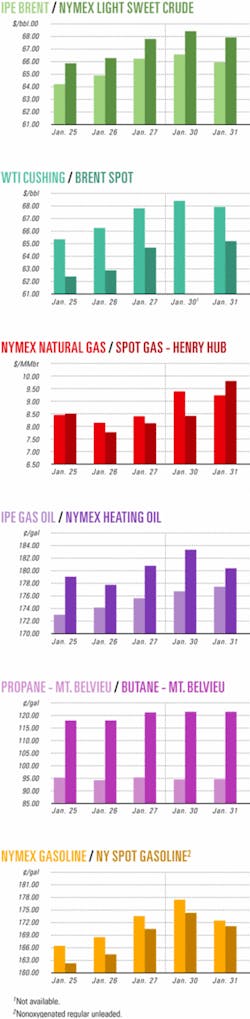

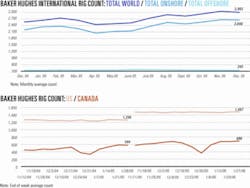

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesShell group has oil, gas strike off Malaysia

Shell Malaysia said its joint venture with Petronas and ConocoPhillips has made its fourth discovery with the Pisagan-1A exploration well on deepwater Block G off northwest Sabah, Malaysia.

Shell said the Pisagan-1A exploration well, drilled to 1,465 m, encountered oil and gas.

Since 2003, the group has made three other oil and gas discoveries off Sabah: Ubah-2 in 2005, Malikai-1 in 2004, and Gumusut-1 in 2004 (OGJ Online, Oct. 10, 2005).

The partners in Block G are operator Shell Malaysia 35%, ConocoPhillips (East Malaysia) 35%, and Petronas 30%.

Shell, ONGC sign cooperation agreement

Royal Dutch Shell PLC and Oil & Natural Gas Corp. of India have signed a memorandum of understanding (MOU) covering upstream and downstream projects, mostly in India.

The agreement covers exploration and production of hydrocarbons and distribution of natural gas and oil products. It will also look into refining, petrochemicals, and coal gasification.

While giving Shell greater access to Indian projects, the MOU will allow ONGC more opportunities outside the country. There will be a joint steering committee to manage cooperation and identify other investment opportunities.

The steering committee will look at opportunities for raising production from existing fields and jointly bidding in future exploration rounds.

Downstream, the committee could recommend a long-term oil products supply arrangement and joint operation of terminals and depots.

BG Group acquires stake in block off Nigeria

BG Group has acquired a 45% interest in and become operator of Block 332 off Nigeria in the western Niger Delta under a farmin agreement with Sahara Energy Exploration & Production Ltd.

The agreement comes as BG, along with its partners Sahara and Seven Energy Nigeria Ltd., signed a production-sharing contract on Jan. 19 for Block 332 with Nigerian National Petroleum Corp.

The work program will be carried out in two phases, the first involving the acquisition of 3D seismic data and the drilling of one exploration well.

Block 332 is in 100-1,000 m of water, 100 km southeast of Lagos.

In October 2003, BG LNG Services signed a sales and purchase agreement with Nigeria LNG to acquire 2.5 million tonnes/year of LNG for 20 years for shipment to Lake Charles, La.

CPC acquires exploration rights in Chad

Taiwan’s state-run Chinese Petroleum Corp. (CPC) and Chad have signed an agreement under which CPC will invest $30 million in a 4-year project to explore for oil and gas in Chad.

CPC Deputy General Manager Chiu Chi-hsiung and Chad Oil Minister Mahamat Nasser Hassane signed the agreement in Taipei. CPC obtains exploration rights to 26,250 sq km in the area of the Lake Chad and Doba basins.

PA Resources gets farmouts off Norway

PA Resources Norway AS (PAR) will finance the drilling of up to six exploration wells at a cumulative cost of 285 million kroner through a series of farmouts with DNO ASA subsidiary Det Norske Oljeselskap AS.

PAR obtained interests in eight licenses on the Norwegian continental shelf, said DNO, which secured 340 rig-days that it expects will allow for drilling of six to eight wells in 3 years, starting in the fourth quarter.

The transactions involve the following licenses off Norway:

- PL 001B and PL 242, in which DNO has 35% interest and PAR, 15%.

- PL 028B (DNO 35%, PAR 15%).

- PL 305, PL 305B, and PL 341 (DNO 30%, PAR 10%).

- PL 332 (DNO 20%, PAR 10%).

- PL 334 (DNO 30%, PAR 10%).

Statoil plans 30-40 exploration wells in 2006

Statoil ASA plans to drill 30-40 exploration wells in 2006, of which half will be on the Norwegian continental shelf (NCS), and the other half will be abroad.

Long-term contracts for exploration rigs will allow increased drilling this year compared with last year, said Tim Dodson, senior vice-president for NCS exploration. Due to the increased activity, Statoil has recruited about 100 new employees.

“Finding hydrocarbons on the NCS is becoming more and more demanding,” Dodson said. Success requires “able employees and hard work over a long period.”

Statoil operates licenses in Algeria, Venezuela, and the Faroe Islands and plans to drill in these countries in 2006.

Utah releases thrust belt crude analysis

Analysis of a crude oil sample from the Covenant field discovery well on the Central Utah Thrust Belt or Hingeline shows it to be 40.5° gravity with 0.48% sulfur, said the Utah Geological Survey.

The oil’s pour point is 2.2° F. The analysis by Baseline/DGSI, The Woodlands, Tex., posted on the survey’s web site, also contains viscosity, nitrogen, isotopic, and biomarker data from a sample collected by UGS on Aug. 31, 2004.

Wolverine Oil & Gas Co., a private Grand Rapids, Mich., independent, discovered the thrust belt’s first producing oil field in May 2004. The 17-1 Kings Meadow Ranches, in 17-23s-1w, Sevier County, produced the oil from perforations at 6,215-25 ft in the Jurassic Navajo sandstone (OGJ, Jan. 17, 2005, p. 42).

The Covenant trap is an elongate, symmetric, northeast-trending anticline. The Navajo formation is repeated due to a detachment, but only the upper Navajo is productive. It contains a 487-ft oil column, the report noted.

Cumulative production as of Aug. 1, 2005, was 334,391 bbl of oil and 30,201 bbl of water.

Drilling & Production - Quick TakesDeepwater Belize oil field off Angola on stream

Belize oil field on deepwater Block 14 off Angola has gone on stream, reported Cabinda Gulf Oil Co. Ltd., the operator and a subsidiary of Chevron Corp.

The Benguela, Belize, Lobito, and Tomboco fields form the BBLT development, one of Chevron’s biggest projects.

Block 14 lies in the Lower Congo basin in 1,280 ft of water covering 1,560 sq miles. The block is the deepwater extension of the Chevron-operated Cabinda concession, which contains seven commercial discoveries (OGJ, July 25, 2005, p. 43).

BBLT is being developed in two phases. Phase 1, called Benguela Belize, combines an integrated drilling and production platform hub facility supported by a compliant piled tower. Use of the tower marks the first time this technology has been used outside the Gulf of Mexico, Chevron said.

Phase 2, called Lobito Tomboco, will produce via subsea wells tied into the central production hub.

Arrow Energy’s Surat basin CBM field on stream

Arrow Energy NL, Brisbane, has made its first natural gas deliveries from Kogan North coalbed methane field in Queensland’s Surat basin.

Gas is flowing into the Roma-Brisbane pipeline at 2 terajoules/day (1.86 MMcfd) to Arrow’s 50-50 partner, Queensland government-owned explorer and gas utility CS Energy Ltd.

Kogan North Joint Venture will supply 4 petajoules/year (3.72 bcf/year) of gas from the field to CS Energy over a 15-year period. The Kogan North project is the first to flow CBM from the Surat basin. The deliveries come just 12 months after Arrow committed to development of the field.

Commissioning contract let for Tahiti spar

Chevron USA Inc. has let a contract to John Wood Group PLC subsidiary Deepwater Specialists Inc. for commissioning support services for the Tahiti truss spar to be located on Green Canyon Block 640 in 4,000 ft of water 190 miles southwest of New Orleans.

Technip is handling engineering, procurement, and construction (OGJ, Nov. 21, 2005, Newsletter).

The first phase of the Deepwater Specialist contract, covering development of commissioning plans, schedules, and processes, has begun. A second phase will include onshore commissioning of the topsides and dynamic commissioning of all systems offshore.

Mustang Engineering, another Wood Group company, performed the front-end engineering design and is performing detailed design of the Tahiti topsides oil and gas processing facilities.

Processing - Quick TakesGas woes hobbling Aussie ammonium plant

High construction costs, rising natural gas prices, and a failure to acquire enough gas feedstock has caused Melbourne-based petrochemical company Plenex Ltd. to withdraw from a proposed $900 million (Aus.) ammonium plant on the Burrup Peninsula of Western Australia.

Plenex, a wholly owned subsidiary of Plenty River Corp. Ltd., has been trying to establish a plant in the area based on natural gas feedstock from the North West Shelf for 10 years.

The company says the failure to secure gas supplies is a direct result of the rapidly increasing export demand for LNG from the region.

Plenex’s partner, explosives manufacturer Dyno Nobel Ltd. of Sydney, will continue to study the feasibility of the ammonium nitrate plant. However the project is now in doubt and may follow the way of several other attempts to establish petrochemical complexes on the Burrup over the last 10 years.

These include a 1.3 million tonne/year methanol plant proposal for Canadian group Methanex, a $1 billion (Aus.) dimethyl ether project for a Japanese group, and a $770 million (Aus.) methanol plant for GTL Resources.

The exits come despite more than $183 million (Aus.) of Western Australia state government money spent on infrastructure on the peninsula.

The only project to go ahead so far has been a $630 million (Aus.) ammonia plant for the Indian-owned Burrup Fertiliser. This is now nearing completion.

Two other planned projects-both $900 million (Aus.) ammonium nitrate plants, one for Indian company Deepak Fertilisers and the other for Agrium Australia-are also unlikely to go ahead in the near term.

Refinery, chemical complex planned in Taiwan

Kuokuang Petrochemical Technology Corp. (KPTC) plans to spend as much as $12.46 billion to build a refinery and petrochemical complex in Taiwan’s Yunlin County.

Facilities will include a 300,000 b/d refinery, a naphtha cracker capable of producing 1.2 million tonnes/year of ethylene, an aromatics complex with output of 800,000 tonnes/year of paraxylene, 23 plants for middle and downstream operations, 14 cogeneration plants, and 13 docks.

Construction is expected to begin later this year, with completion scheduled for 2014.

KPTC is a joint venture of several leading Taiwan petrochemical companies. Major stockholders are Chinese Petroleum Corp. 43%, Oriental Union Chemical Corp. and the Chang Chun Group 20% each, and China Man-Made Fiber Corp. 10%. Minority stockholders include Fubon Financial Holding Venture Capital, Ho Tung Holding Corp., and Pan Asia Chemical Corp.

Uzbekneftegaz begins gas plant construction

State-owned Uzbekneftegaz has started construction of a $63.6 million LPG unit at its gas processing subsidiary Shurtanneftegaz in the Kashkadarya region of Uzbekistan.

Shurtanneftegaz, one of three gas processing companies in Uzbekneftegaz, processes 11 billion cu m/year of gas.

After three stages of construction, the plant will produce 175,000 tonnes/year of propane-butane mix by 2010. After the first stage of construction, to be completed by yearend, the unit will reach a capacity of 45,000 tonnes/year.

Uzbekneftegaz plans to implement a number of projects to increase LPG production at the Mubarek gas processing plant and the Shurtan gas production complex.

Transportation - Quick TakesNLNG ships first Train 4 cargo for Total

Total SA reported that its first cargo of LNG from Nigeria LNG (NLNG) Train 4 left Bonny Island Jan. 23 under a 1.15 million tonne/year agreement between Total Gas & Power Ltd. and NLNG for LNG from Trains 4, 5, and 6.

NLNG’s Train 4 started production in fourth-quarter 2005, and Train 5 is being prepared to start up next month. The two trains will increase NLNG’s production capacity by 8 million tonnes/year to more than 17 million tonnes/year. Train 6, currently under construction, will increase the plant capacity by 4 million tonnes/year.

MLNG, Shikoku sign long-term gas-supply contract

Malaysia LNG Sdn. Bhd. (MLNG) signed a confirmation of intent to supply Japan’s Shikoku Electric Power Co. Inc. with 420,000 tonnes/year of LNG for 15 years.

Beginning in 2010, with an option for 5 additional years, the LNG will be supplied to Shikoku from Petronas LNG’s complex in Bintulu, Sarawak. The LNG will be transported to the receiving terminal in Sakaide, Japan. MLNG said the receiving terminal, currently under construction and due for completion in 2010, was owned by Sakaide LNG Co. Inc., a joint venture of Shikoku, Cosmo Oil Co. Ltd., and Shikoku Gas Co. Ltd.

Dolphin operating Al Ain-Fujairah pipeline

Dolphin Energy Ltd. (DEL) of Abu Dhabi has assumed operation and maintenance (O&M) responsibilities for its 182-km, 24-in. natural gas pipeline from Al Ain, Abu Dhabi, to Fujairah, the company’s first initiative under its Dolphin Project (OGJ Online, May 20, 2002).

According to a joint agreement, Emirates General Petroleum Corp. (Emarat) managed O&M for the pipeline from its commissioning in January 2004 until December 2005. When DEL’s main export pipeline from Qatar is completed later this year, DEL will manage it as well.

Created to develop energy projects in countries belonging to the Gulf Cooperation Council, DEL is owned 51% by Mubadala Development Co. on behalf of the Abu Dhabi government and 24.5% each by Total SA and Occidental Petroleum Corp.

The $3.5 billion Dolphin Project will produce and process from Qatar’s North field and transport dry gas by marine pipeline to the UAE, beginning at yearend. An onshore segment currently transports 135 MMcfd of gas from Oman to Union Water & Electricity’s 656 Mw electric power and desalination plant on the UAE East Coast.

The offshore segment will transport gas on a long-term basis from North field to Fujairah in early 2007 and to Oman via a reversal of the onshore segment in 2008. DEL says the pipeline carries the first flow of gas from one CGG member country to another (OGJ Online, Oct. 12, 2004).

DEL began supplying gas to Ras Al Khaimah last year via a tie-in near Qidfa between DEL’s Al Ain-Fujairah pipeline and the existing Emarat gas pipeline network (OGJ Online, May 18, 2005).