OGJ Newsletter

Gazprom may buy half of Shell’s Sakhalin-2 stake

Royal Dutch Shell PLC, under stepped-up pressure from the Russian government, is close to making a deal that would allow Russia’s OAO Gazprom a stake in the Sakhalin-2 oil and natural gas project.

Dmitry Medvedev, who serves as chairman of Gazprom chairman as well as Russia’s deputy prime minister, Dec. 12 said talks with Shell were going quickly and that the Russian side hoped to reach a deal soon.

Reports suggested that Shell’s share in the project would drop from 55% to 25%, while its Japanese partners Mitsui (25%) and Mitsubishi (20%) would each sell 10% of their shares to Gazprom. However, it was expected that Shell would remain as operator of the project since Gazprom has never before run an LNG project.

Medvedev did not confirm those reports, saying only, “as far as the size of the stake is concerned, it is important but not critically important.” He told a press conference in Moscow, “We are looking at all options ranging from cash to an exchange of assets.” The announcement of a deal coincided with further threats by the Russian government to undertake legal action against the Shell-led project for alleged violations of the country’s environmental laws.

Oleg Mitvol, deputy head of natural resources watchdog Rosprirodnadzor, Dec. 12 claimed that damages inflicted by the operator of the Sakhalin-2 hydrocarbons project are estimated at $10 billion, according to preliminary calculations.

Mitvol said the agency would come up with a more-precise figure by the end of next summer, but that the estimated amount included damage to the environment, lost revenue, and compensation for lawyers that Rosprirodnadzor would hire for litigation.

He said Rosprirodnadzor plans to start court proceedings in March over violations at the Sakhalin-2 project, and that it would file Sakhalin-2 suits in several court jurisdictions, including in Russia and in the Stockholm Arbitration Court.

The announcements followed earlier pressure from the Russian government which last week withdrew key environmental permits from Shell and its Japanese partners. As a result of the withdrawn permits, construction on the project has effectively come to a halt (OGJ Online, Dec. 7, 2006). Japan’s Economy, Trade and Industry Minister Akira Amari Dec. 12 underscored the urgency of reaching an agreement, urging the operators of the Sakhalin-2 project to abide by a plan to supply LNG to Japan beginning in 2008.

“It is important that the resource is properly delivered to the final user,” such as Japanese electric power and gas companies, Amari told a news conference in Tokyo.

Kazakhstan to decide on mineral rights

Kazakhstan’s Energy and Natural Resource Minister Baktykozha Izmukhambetov said the Kazakh government will decide by Dec. 30 whether to seek oil and natural gas rights in that country now held by Canada’s Nations Energy Co.

Commenting on the pending sale of Nations Energy and its Kazakh assets to China’s state-owned Citic Group, Izmukhambetov said, “In principle, we have the right to bid for any offer, for any deal, or stake that is being sold.”

Izmukhambetov said the Kazakh government has 45 days to reach a decision according to the law on subsurface operations and that the deadline for it to decide on the Citic-Nations deal expires on Dec 30. “By Dec. 30 we should reach a decision,” he said.

At the end of October, Nations Energy said Citic would acquire its assets in Kazakhstan in December under an agreement that includes its interests in Karazhanbas field, where Nations produces 50,000 b/d of oil equivalent and has an estimated 340 million bbl in reserves. In early December, however, the government of Kazakhstan was reportedly planning to block the Citic-Nations agreement in order to acquire the Karazhanbas development for itself (OGJ Online, Dec. 11, 2006).

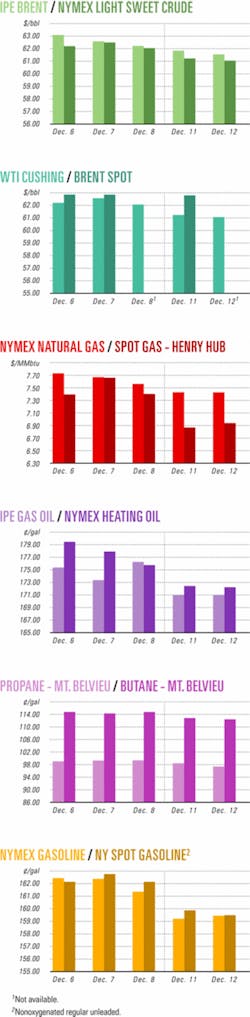

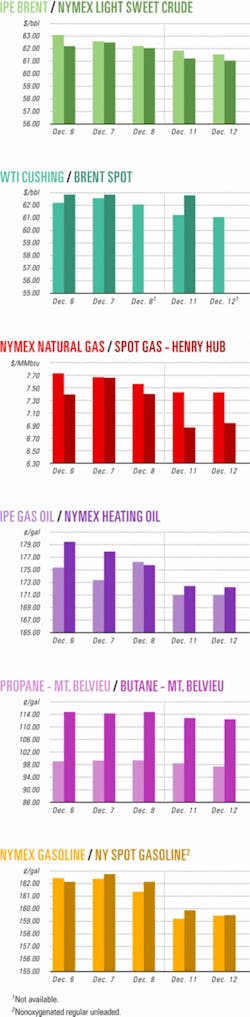

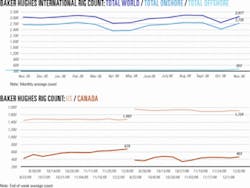

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesSakhalin-2 water-use licenses suspended

Russia’s Ministry of Natural Resources has suspended 12 water-use licenses for the Sakhalin-2 oil and gas project after discovering what it called major violations of environmental law (OGJ, Nov. 6, 2006, Newsletter). Natural Resources Minister Yuriy Trutnev said a comprehensive inspection of the project showed that “in the course of implementing the Sakhalin-2 project major violations of Russian environmental law have been committed.”

As a result of the inspection, Trutnev’s ministry said it has suspended 12 licenses for water use granted to Starstroi, a Russian-Italian joint venture building natural gas and oil export pipelines as a subcontractor of the Sakhalin Energy consortium.

The ministry said Russia’s environmental watchdog, Rosprirodnadzor, had uncovered violations of water law requirements by the company during the laying of pipelines in the Piltun-Astokhskoye and Lunskoye regions.

It gave the company 2 months to remove the designated violations; otherwise, it will annul the licenses, which are mandatory for any construction affecting rivers and other water resources.

Royal Dutch Shell owns a 55% stake in Sakhalin Energy, Mitsui 25%, and Mitsubishi 20%.

ONGC Videsh to bid for Sakhalin-3 stake

India wants to obtain a stake in the Sakhalin-3 project in its strategy to invest heavily in Russian oil and gas work, said R.S. Butola, managing director of ONGC Videsh Ltd. (OVL).

OVL, the overseas subsidiary of state-owned Oil & Natural Gas Corp., initiated discussions with OAO Rosneft and OAO Gazprom for compiling a joint bid to buy into Sakhalin-3.

Butola’s comments came during a formal function to receive the first consignment of crude from Russia’s Sakhalin-1 project, in which OVL holds 20% interest. Russian oil tanker MK Viktortitov, an OVL charter, delivered 92,055 tonnes (672,000 bbl) of Sokol crude. A second shipment is expected by Dec. 31.

ExxonMobil Corp. holds 30% interest in Sakhalin-1, Japan’s Sakhalin Oil & Gas Development Co. holds 30%, and Rosneft and OVL each hold 20%.

Anadarko makes gulf find at Mission Deep

Anadarko Petroleum Corp. has made an oil discovery at its Mission Deep prospect on Green Canyon Block 955 in the Gulf of Mexico. The discovery well found more than 250 ft of net oil pay in the primary middle Miocene objective.

The well, in 7,300 ft of water, was drilled to TD 25,000 ft. Future plans include deepening the well to a secondary lower Tertiary objective and drilling a sidetrack well to further delineate the extent of the reservoir, the company said.

The discovery at Mission Deep is the company’s ninth out of 12 tests so far this year in the deepwater gulf. Anadarko is one of the top three leaseholders in the deepwater gulf with an inventory of about 150 prospects and leads, representing an estimated 13-18 billion bbl of gross, unrisked resource potential, the company said. Anadarko said it plans to drill 10-15 exploration tests over the next 2 years to evaluate this potential within its position in the Miocene and emerging lower Tertiary plays.

Anadarko, Mission Deep operator, holds a 50% working interest; Devon Energy Corp. has a 50% working interest.

ConocoPhillips, Santos test new Timor Sea well

A joint venture of ConocoPhillips and Santos Ltd. has confirmed the presence of natural gas in another field in the eastern Timor Sea during its aggressive search for reserves to feed a second LNG train at its Darwin liquefaction plant.

The JV recorded a strong flow from the Barossa-1 well. It is on an old Royal Dutch Shell discovery, Lyndoch, on Permit NT/P69 about 295 km northeast of Darwin and near the maritime boundary with Indonesia.

The main test, on a high quality reservoir interval, flowed gas at 30 MMcfd through a 56/64-in. choke accompanied by condensate at 7-9 bbl/MMcf of gas. The flow rates were constrained by limitations of the rig equipment.

An earlier test of a lesser-quality reservoir flowed at 0.8 MMcfd of gas through a 1-in. choke.

Barossa-1 is the third well on the structure following Shell’s Lyndoch-1, drilled in 1973, and Lyndoch-2, drilled in 1998. Shell abandoned the prospect as uneconomic at the time.

The reservoir lies about 4,250 m subsea in 233 m of water.

The one drawback, in common with other finds in this eastern Timor Sea region, is the relatively high levels of carbon dioxide-in Barossa’s case 16%.

The JV’s earlier Caldita discovery immediately to the south in an adjoining permit has similar CO2 content, as does Santos’ Evans Shoal field to the southwest.

Nevertheless, the Barossa-1 result is encouraging. It builds on the group’s resources in this region and may result in a development that links all the fields in this general area via a trunk line to Darwin.

Japanese company Inpex Corp. also has a major discovery in Abadi field in Indonesian waters near the Australian offshore border. Because of its isolation from Indonesian infrastructure, Inpex is considering a development option to send Adabi gas via pipeline to Darwin. Like ConocoPhillips and Santos, Inpex holds an interest in the Darwin LNG plant.

Barossa-1 will now be plugged and abandoned and the rig moved south to drill a Caldita-2 appraisal.

ConocoPhillips has 60% of Barossa and Caldita while Santos holds 40%.

BHP to drill Ruby appraisal off Trinidad

A month after reporting an oil discovery with the Ruby-1 well on Block 3(a) off the northeast coast of Trinidad and Tobago, BHP Billiton and its partners are preparing to drill an appraisal well (OGJ, Dec. 11, 2006, Newsletter).

BHP Billiton confirmed it will spud the Ruby-2 well soon and finish drilling in 5-7 weeks. Ruby-2 is being drilled in 200 ft of water on Block 3(a) by Nabors Offshore’s Nabors 657 jack up rig.

Block 3(a) is operated by BHP Billiton, which has a 25.5% interest. Partners are Talisman (Trinidad Block 3a) Ltd., and Anadarko Petroleum Corp., each with 25.5% interest; Petrotrin, 15%; and Total SA, 8.5%.

Engineering approved for Kipper gas field

A group comprising ExxonMobil Corp., BHP Billiton, and Santos Ltd. has agreed to begin engineering and design on the Kipper gas field development in the offshore Gippsland basin of southeast Victoria.

The field, operated by ExxonMobil’s Australian subsidiary, is in 100 m of water about 45 km off the coast. It holds about 620 bcf of gas and 30 million bbl of condensate. Discovered in 1986, it is the largest undeveloped gas field in the region.

The intention is to bring Kipper gas and condensate ashore for treatment in the ExxonMobil-BHP Bass Strait production facilities at Longford in Victoria. Entry into the system would be via the West Tuna platform. Kipper straddles the boundary between two permits, so the field has been unitized for development. ExxonMobil and BHP each has 32.5%, while Santos, which bought Woodside’s interest in May, has 35%.

ExxonMobil says a final investment decision is expected in 2007. Production could then begin by the end of the decade.

Gas flow up at Greater Natural Buttes, Utah

The giant Greater Natural Buttes area in the Uinta basin reached a milestone in September, averaging a gross 225 MMcfd of gas, said operator Anadarko Petroleum Corp.

Anadarko has more than 1,400 wells and owns and operates a 700-mile gathering system in the basin. The 2006 program called for the drilling of 270 wells, and 4,900 drillsites are in inventory.

The company, which holds 237,000 net acres in the heart of the field, is exploiting tight gas formations with 12 rigs, including 8 operated rigs. Anadarko has drilled 3 pilot wells on 20-acre spacing to evaluate recovery potential in the field’s more developed areas drilled on 40-acre units.

A slick-water completion pilot program begun in the first quarter of 2006 has grown to 61 wells and resulted in an average frac cost reduction of $100,000/well with no material effect on well performance, the company said.

Eight Trinidad and Tobago blocks draw bids

Nine companies entered bids for 8 of the 11 onshore and nearshore blocks offered by the government of Trinidad and Tobago.

The bid round was completed after more than a year’s delay caused by the introduction of a new production-sharing contract.

Many large oil and gas companies did not bid for the small nearshore and onshore blocks but are expected to bid in the Atlantic Deep bid round, which concluded Dec. 15.

Of the 11 blocks on offer there were no bids for the Herrera shallow and deep horizon blocks as well as NCMA 3 (OGJ Online, Mar. 24, 2006).

Among companies bidding for blocks were Australia’s Hardman Oil & Gas Pty. Ltd. and the Indian partnership of Oil & Natural Gas Corp. and Mittal.

Drilling & Production - Quick TakesPetrobras gets OK for FPSO in Gulf of Mexico

Petroleo Brasileiro SA (Petrobras) has received approval from the US Minerals Management Service for the conceptual subsea development plan of Cascade and Chinook oil fields in the Gulf of Mexico.

This is the first time the agency approved a plan that includes the deployment of a floating, production, storage, and offloading vessel in the gulf.

Oil production from the project is scheduled to start in 2009, since field operator Petrobras intends to use its new technologies to allow a fast-tracked development approach.

Petrobras proposes to use six technologies, which are new to the US gulf, including a disconnectable turret buoy allowing the FPSO to move offsite during hurricanes and severe weather, crude transportation via shuttle tanker, free-standing hybrid risers, subsea electric submersible pumps, torpedo pile vertical-loaded anchors, and polyester mooring systems.

The development plan consists of the installation and operation of a FPSO in about 8,200 ft of water. It provides for at least two subsea wells in Cascade and one subsea well in Chinook, each drilled to about 27,000 ft and to be tied back to the FPSO. Based on reservoir performance, the development plan could be expanded to include additional wells on each unit.

More detailed engineering studies will now be carried out, including the preparation of the Deepwater Operations Plan which will include all technical details demonstrating that these technologies will meet or exceed the current requirements for operations in the gulf.

Petrobras holds 50% and 66.67% interests respectively in the Cascade and Chinook units. Devon Energy Corp. owns the remaining 50% of Cascade unit and Total E&P USA Inc. owns 33.33% of Chinook unit.

E&P firms compete to drill wells in UKCS

Oil and gas exploration and production firms operating in the UK Continental Shelf (UKCS) are planning to drill about 180 wells in 2006-08, according to a report published by UK based North Sea consultancy Hannon Westwood. Around $2 billion/year of investment will be required to boost production from the mature province.

Companies will compete intensely for drilling rigs, the consultancy added, noting that there is a rig utilization rate of 93-100% of Europe’s 72-rig offshore fleet. There are 143 companies with UKCS interests, many of which are small independent North Sea companies and listed on the Alternative Investment Market in London. The wells are expected to add 500 million boe/year of reserves.

A key problem for small companies is accessing finance for their drilling operations, but this has been particularly exacerbated recently because of the growth of small companies looking for oil and gas in the UKCS, delegates told OGJ at the Prospects Fair in London. The event, organized by the UK government’s Department for Trade and Industry, and the Petroleum Exploration Society of Great Britain, which brings small companies together to seek partners in developing their prospects.

“With more opportunity than available funds over the next few years, we can expect a wave of mergers or acquisitions among those 80 companies who have exploration licenses but do not have North Sea production,” said Charles Westwood, Hannon Westwood founding partner. “Perhaps 30 of these 80 new-start companies will survive in the long run.”

The strong competition for exploration opportunities has been demonstrated by the record number of applications for acreage under the UK’s 24th licensing round. The results have not yet been announced although they are meant to be reported in the fall. About 141 companies have applied for licenses. DTI said the results have been delayed because it is carrying out additional environmental checks against the applications to comply with the European Union’s Habitat Directive.

The report added that the ownership of licenses and acreage has dramatically changed also: “We have gone from a license system where acreage could be held with little effective challenge for up to 40 years, to a system where a three year lull in activity will now place the property on the ramps for either third-party investment or relinquishment.”

The UKCS has entered into a dynamic period “when value is no longer measured simply by traditional production, but is also much more a function of exploration acreage and secured drilling activity”, the report concluded.

Fort Hills files plan for heavy oil upgrader

Petro-Canada Oil Sands Inc., on behalf of Fort Hills Energy LP, filed an application with the Alberta Energy and Utilities Board for the construction and operation of a heavy oil upgrader in Sturgeon County, about 40 km northeast of Edmonton (OGJ, Feb. 13, 2006, Newsletter).

The upgrader is expected eventually to process as much as 340,000 b/d of bitumen from the Fort Hills mine and other production sources into as much as 280,000 b/d of synthetic crude oil. The Fort Hills mine, which obtained regulatory approval in 2002 for as much as 190,000 b/d of bitumen production, is about 90 km north of Fort McMurray, Alta. Production is planned to start in 2011.

Fort Hills Energy partners are Petro-Canada, Calgary, 55%; UTS Energy Corp., Calgary, 30%; and mining company Teck Cominco Ltd., Vancouver, BC, 15%. Petro-Canada Oil Sands serves as the project’s contract operator.

Processing - Quick TakesHPCL seeks partners for Vizag plant expansion

State-run refiner Hindustan Petroleum Corp. Ltd. (HPCL) is seeking partners for investments, oil procurement, and product marketing as part of its proposed Visakhapatnam (Vizag) refinery expansion.

HPCL plans to expand the Vizag refinery’s capacity to 16.5 million tonnes/year from 7.5 million tonnes/year. Project consultant Engineers India Ltd. estimates the expansion cost at $2 billion.

Once the proposed expansion is completed, HPCL plans to dismantle an uneconomical plant having a capacity of 1.5 million tonnes/year. The effective net refining capacity of the Vizag plant then would be 15 million tonnes/year.

Ecopetrol plans Barrancabermeja upgrade

State-owned Ecopetrol has let a project management consulting contract to Technip for an upgrade of its 205,000 b/cd refinery in Barrancabermeja, Colombia.

The $50 million contract covers front-end design, detailed engineering, and procurement services for process units, as well as supervision of contractors’ activities for engineering, procurement, and construction.

The project includes a 19,000 b/sd gasoline hydrodesulfurization (HDS) unit and a 57,000 b/sd diesel HDS unit (both based on Axens technology); a 19,000 MMscfd hydrogen production unit; a 55 ton/day sulfur recovery unit, a 110 ton/day tail gas treatment unit; a 500 gpm sour water stripper; and a 30 gpm diesel-gasoline amine regeneration unit.

The project is slated for completion in fourth quarter 2009.

Grupa Lotos lets contract for Gdansk HDS unit

Grupa Lotos SA, Poland’s second largest refiner, let a contract to ABB of Zurich for the engineering, procurement, and construction of a diesel hydrodesulfurization (HDS) unit at its 90,000-b/cd refinery in Gdansk, Poland.

The $130 million award is part of Grupa Lotos’s $1.3 billion residue-upgrade project.

The HDS unit will enable Grupa Lotos to meet European Union requirements that diesel contain less than 10 ppm of sulfur, which will come into force in 2009.

ABB Lummus Global’s business in Wiesbaden, Germany, will handle the work. Project start is planned for early 2009.

The unit will use Chevron-Lummus Global technology. It help Grupa Lotos increase production of ultralow-sulfur diesel to about 2.3 million tonnes/year.

Transportation - Quick TakesCanaport LNG lets contract for St. John terminal

Canaport LNG LP, a partnership of Repsol YPF SA and Irving Oil Ltd., has let a contract to Foster Wheeler Canada Ltd. for project management consultancy services for an LNG regasification terminal with 1 bcfd of gas capacity planned in St. John, NB (OGJ Online, May 18, 2006).

Terms of the award were not disclosed.

Foster Wheeler also will provide technical advisory services during the detailed engineering, procurement, construction, commissioning, and start-up phases of the project. Services will be performed in cooperation with Foster Wheeler USA Corp. in Houston. The Canaport terminal is slated for completion in late 2008.

Pertamina, partners plan LNG plant on Sulawesi

Indonesia’s state-owned PT Pertamina, PT Medco Energi Internasional, and Japan’s Mitsubishi Corp. plan to build a 2 million tonne/year LNG plant at Senoro on the island of Sulawesi. Construction is projected to begin in 2007, with completion targeted for 2009.

Senoro gas field, which has proved reserves of 2.3 tcf of gas, will provide gas to the plant, which will cost some $1 billion, with $600-800 million to be invested by Mitsubishi.

Pertamina Vice-Pres. Iin Arifin Takhyan said Mitsubishi will be an offtaker of LNG from the project, while Medco Pres. Hilmi Panigoro said the Indonesian government already has approved plans to export LNG from the plant to Japan.

In late November, Pertamina and Medco announced they were still in the process of selecting a Japanese partner for the 2 million tonne/year liquefaction plant they planned to build in Senoro (OGJ Online, Nov. 27, 2006).

The decision over Mitsubishi comes within a framework of wider cooperation on energy between Japan and Indonesia signed in November.

The agreement calls for cooperation in ensuring stable supplies of energy and mineral resources, including LNG, from Indonesia to Japan.