E&P activity, refining drive third-quarter earnings

Although most companies in a sample of US-based oil and gas firms posted moderate third-quarter 2006 profits or losses, big earnings gains by a handful of large operators propelled the group toward an increase in net income as compared with third-quarter earnings a year earlier.

Downstream results, led by strong refining and marketing margins, drove profits for refiners and integrated companies. Product demand, especially that for transportation fuels, was strong during the quarter as well as in the first 9 months of this year, pushing refining throughputs higher. Refinery utilization in the US held above 93% during the third quarter, according to the American Petroleum Institute.

On average oil prices in the recent quarter were higher year-on-year, but natural gas prices declined. The average price at the wellhead for oil during the third quarter of 2006 was up 14% from a year earlier to $65.07/bbl. The spot price for gas at Henry Hub averaged $6.314/MMbtu in the recent quarter vs. $9.531/MMbtu a year earlier.

A sample of service and supply companies reported a spike in earnings for the quarter and for the first half of this year, as nearly all of them recorded improved earnings from a year earlier. These firms continued to experience high demand for oil-field services and equipment and strong day rates during 2006.

A sample group of Canadian firms posted a jump in earnings for the quarter, while their combined net income for the first 9 months of this year more than doubled from the comparable 2005 period.

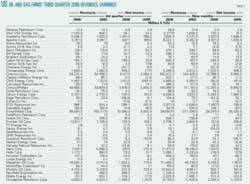

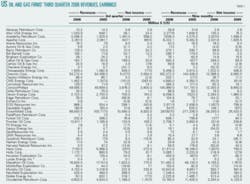

US-based operators

The group of oil and gas producers and refiners based in the US recorded a combined 20% jump in net income for the recent quarter, and for the first 9 months of this year, their earnings climbed 30% from the prior year (Table 1). Leading these gains were large increases in the earnings of Anadarko Petroleum Corp., Chevron Corp., Marathon Oil Corp., and Valero Energy Corp. Meanwhile, 14 of the 74 companies in this group posted a net loss for the third quarter.

For Anadarko, the 144% quarterly earnings gain to $1.46 billion was partially due to the inclusion of the results of Kerr-McGee Corp. and Western Gas Resources, beginning on their respective Aug. 10 and Aug. 23 acquisition dates.

Downstream earnings drove Chevron’s 40% earnings increase for the third quarter. The company reported that its downstream earnings increased nearly $900 million to $1.4 billion on improved product margins and refinery utilization. Meanwhile, upstream profits of $3.5 billion were up 5% on greater production volumes and higher oil prices.

Solid refining and marketing margins also were key to the Marathon and Valero earnings increases.

Marathon’s downstream segment income was $1 billion in the third quarter of 2006, compared to $473 million in the third quarter of 2005. The main driver behind this increase was the company’s refining and wholesale marketing gross margin, which averaged 32.7¢/gal in the recent quarter vs. 17.7¢/gal a year earlier.

Valero’s Chief Executive Officer Bill Klesse said, “We had the highest third-quarter earnings in the company’s history despite the drop in gasoline margins that began in early August. Throughout the third quarter, though, distillate margins and sour crude oil discounts were very favorable.”

Klesse said, “Gulf Coast conventional gasoline margins averaged $12/bbl for the quarter, and (US) Gulf Coast off-road diesel margins averaged around $9/bbl throughout the quarter. More importantly, Gulf Coast on-road diesel margins averaged almost $17/bbl.”

Klesse added, “We continue to believe that the combination of slower- than-anticipated growth in global refining capacity, cleaner fuel specifications, and continued demand growth should keep the supply and demand balance for refined products tight.”

One of the firms in the sample that posted a net loss for the quarter is McMoRan Exploration Co. Increased exploration expenses and greater depreciation and amortization outweighed higher revenues from increased production volumes and higher oil price realizations for the company, resulting in a loss of $18.6 million for the third quarter vs. earnings of $7.1 million in the comparable year-earlier period.

Service, supply companies

OGJ’s sample of service and supply firms (Table 2) outperformed the US operators and Canadian companies for the third quarter. For the period the service and suppliers collectively posted a 77% year-on-year surge in earnings.

Offshore drilling contractor GlobalSantaFe Corp. reported net income for the third quarter was up 97% from a year earlier. For the first 9 months of 2006, the company reported its net income grew 132% year-on-year.

“Reflecting the continued strength of international offshore drilling markets, our contract drilling segment improved significantly on a strong second quarter performance with record revenues and operating income in the third quarter,” said GlobalSantaFe Pres. and Chief Executive Officer Jon Marshall. “These positive results were diminished by an unusually large loss on one turnkey well in the US Gulf of Mexico and by timing of oil sales in the North Sea.”

GlobalSantaFe attributes its earnings improvement to higher contract drilling revenues from increased day rates and continued high fleet utilization. But higher labor, insurance, repair and maintenance, and other operating expenses compared with the same 2005 period partially offset those gains, the company said.

In the third quarter of 2006, average revenues per day from contract drilling increased to $130,500/rig, up 60% from the third quarter of 2005. The company reported average fleet utilization at 97% in the third quarter of 2006, compared with 98% in the same period of 2005.

Canadian firms

A sample of 16 companies based in Canada recorded a 53% gain in combined earnings for the third quarter vs. the same quarter in 2005 (Table 3). For the first 9 months of this year, their net income climbed 105% year-on-year.

Despite the group’s overall gain, the third-quarter results of six of its members declined from the third quarter of last year. One of these is Nexen Inc.

Earlier this year, a court of arbitration concluded that Nexen breached an obligation with respect to Block 51 in Yemen. Nexen announced that while the amount of damages is not yet determined, the company reduced its net income by $93 million to reflect its estimate of this liability. For the recent quarter, Nexen reported net income of $193 million (Can.), down from $615 million (Can.) a year earlier.

Canadian Natural Resources Ltd. (CNRL) reported the largest earnings increase among the firms in this group. Up 639% from a year earlier, CNRL’s net income in the third quarter included a pretax gain of $754 million for the unrealized risk management activities relating to oil and gas hedges, the company said.

CNRL’s gas production increased 1% from the third quarter of 2005 despite reduced gas drilling activity in the second and third quarters of this year. The company’s third quarter 2006 crude oil production volumes declined 4% from a year earlier due to scheduled maintenance turnarounds in the North Sea and sand screen issues on four production wells at Baobab, offshore West Africa, CNRL said.