OGJ Newsletter

Hostages released from Nigerian Shell facility

Most hostages taken Oct. 10 from a Royal Dutch Shell PLC facility in southern Nigeria have been released, authorities said Oct. 11, adding that a further 8 workers are due to be set free later in the day.

Around 60 oil workers were seized when attackers wielding automatic rifles occupied the Shell facility at Oproma in Bayelsa state after overrunning the nearby navy base. The attackers initially demanded that Shell tackle erosion problems, in addition to supplying electrical light and water to the community.

Hafiz Ringim, the police commissioner for Bayelsa state, said an agreement had been reached between the government and militant leaders following discussions on Oct 10. He did not detail the conditions that had been agreed.

News of the release came as senior security officials in Nigeria said they were laying down strategies to limit the impact of militant attacks in the oil-producing delta. The officials met after militants claimed to have killed 30 members of the armed forces in gun battles with government gunboats and attack helicopters in the creeks of the eastern Niger Delta last week.

MMS publishes guidelines for coastal state aid

The US Minerals Management Service has published guidelines under which six states can receive financial help under the Coastal Impact Assistance Program.

The program, which was authorized under Section 384 of the 2005 Energy Policy Act, authorizes the US Secretary of the Interior, as delegated to MMS, to distribute $250 million/year to Alabama, Alaska, California, Louisiana, Mississippi, and Texas from fiscal 2007 through 2010.

All CIAP funds will be distributed through grants, MMS said.

The states must use all funding received under CIAP for coastal programs and activities, including implementation of a federally approved marine, coastal, or comprehensive conservation management plan; mitigation of impacts from Outer Continental Shelf activities through funding of onshore infrastructure projects and public service needs; and wetlands protection or restoration.

Each state has to submit a coastal impact assistance plan by July 1, 2008, to receive funding from the program, MMS said. They also have to submit individual grant applications as required and governed by the DOI’s grant regulations.

Chevron, Petronas resolve Chad tax dispute

Chevron Corp. and Malaysia’s state-owned Petronas have resolved a dispute with the government of Chad over the payment of taxes.

In a memorandum signed Oct. 6, Finance Minister Abbas Mahamat Tolli and Chevron’s Africa Director Frederick Neilson, representing the two companies, agreed to pay $289 million in taxes.

In August, Chad President Idriss Deby accused Chevron and Petronas of failing to pay taxes and ordered the two companies to leave the country (OGJ Online, Aug. 28, 2006).

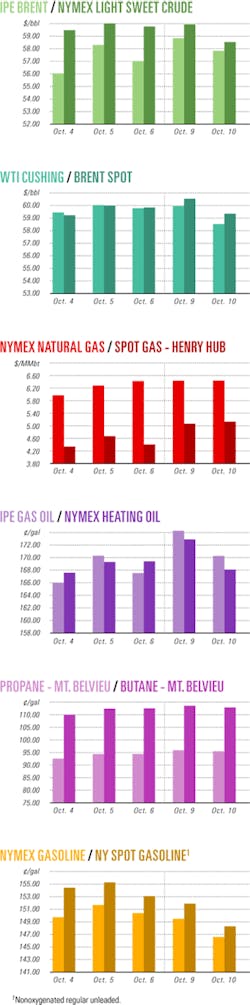

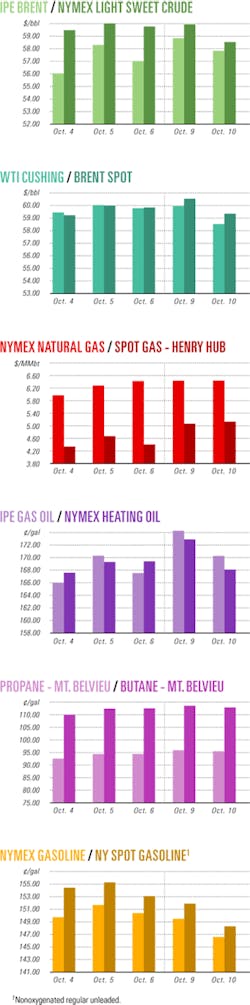

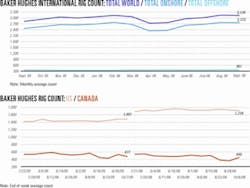

Industry Scoreboardnull

Scoreboard

Due to the holiday in the US, data for this week’s industry Scoreboard are not available.

null

Exploration & Development - Quick TakesPetrobras group encouraged by oil find off Brazil

A group led by Brazil’s Petroleo Brasileiro SA (Petrobras) agreed to accelerate its exploration program based on results from a light oil discovery on Block BM-S-11 in a frontier section of the Santos basin 150 km off Rio de Janeiro, said partner BG Group PLC.

The Tupi well, in 2,126 m of water, flowed 4,900 b/d of 30° gravity crude and 4.3 MMscfd of gas from a deep presalt reservoir through a 5/8-in. choke. Tupi involves a large structure that requires appraisal drilling and evaluation.

Petrobras, operator, has a 65% stake in the frontier block. BG Group holds 25% interest, and Petrogal 10% interest.

Tullow, Hardman to explore Ugandan Block 2

The Ugandan government, Hardman Resources Ltd., and Tullow Oil PLC have agreed under a new memorandum of understanding to progress the appraisal and development activities for Block 2 on the Ugandan side of the Albertine Graben.

The companies want to realize the full potential of existing discoveries and “provide time for the continuing active exploration of the remainder of the block.”

The partners plan to spud the Nzizi-1 well, an updip appraisal well to the southwest of the Mputa oil discovery, by early November.

They will also carry out further 3D and 2D seismic surveys to better define the volumes of the existing discoveries, develop infill locations, and explore the northern area of the block to identify drilling prospects in 2007-08. The partners are currently evaluating the most effective way to drill offshore prospects in Lake by the end of 2007.

The partners and the government are keen to start early production with the discoveries already made. If their investigations prove to be technically and commercially feasible, the petroleum development could use the oil discovered to fuel a potential 50-Mw local electric power station and supply a small refinery. This would be significant for Uganda, which has no oil production.

Simon Potter, Hardman chief executive officer and managing director, said, “Confidence in the existing resource base and the market potential allows us to consider an early production scheme.

Hardman has a 50% interest in Block 2 via its subsidiary Hardman Petroleum Africa Pty. Ltd., which is operator. Tullow holds the remaining 50%.

Aramco to start work on Manifa oil field

Saudi Aramco will start development of offshore Manifa oil and gas field in first quarter 2007 with a production target of 900,000 b/d of Arab Heavy crude.

It expects to let a lump-sum, turnkey contract by yearend for construction of a causeway to shallow-water parts of the field. The causeway will have a 21-km main artery and branches totaling 20 km to 27 drilling islands.

In addition to the causeway, the project will include a central processing facility; a primary gas-oil separation plant; utility and water supply plants; a water-injection facility with capacity of 1.74 million b/d; offshore platforms including jackets, platforms, and electric submersible pumps; offshore crude and water-injection trunklines, flowlines, and electrical cables; pipelines to the Khursaniyah gas plant and Ras Tanura and Juaymah oil terminals; and an upgrade at Khursaniyah to handle 120 MMscfd of Manifa gas.

The completion target is mid-2011. Aramco has received bids for the front-end engineering and design of onshore parts of the project and hopes to let the contract by the end of October. It plans to award offshore lump-sum bid packages early in 2007.

Heritage prepares to test Kingfisher well in Uganda

Heritage Oil Corp., London, has temporarily suspended drilling at its Kingfisher-1 exploration well on Block 3A in Uganda in preparation for a testing program.

The production test, expected to begin in about 30 days, is scheduled to take about 3 weeks.

Heritage plans to test as many as four intervals in the well. The intervals have a total net pay of 37 m in a stacked sand and shale sequence typical of the Albert Graben basin.

Kingfisher-1 has been drilled to 2,125 m, and wireline logs and formation pressure testing and sampling have shown encouraging indications of hydrocarbons, Heritage said.

The well encountered hydrocarbons in a section above the primary objective, and drilling to the primary objective is scheduled to resume after this initial testing has been completed.

It could take an additional 60 days to reach the target depth of 3,000-4,000 m.

Kingfisher-1 is the first of a possible two-well initial drilling program on Block 3A, for which Heritage is the operator with a 50% interest; Tullow Oil PLC owns the remaining interest (OGJ Online, July 21, 2006).

Firms start exploration south of Mobile Bay

Private Corpus Christi, Tex., independent Royal Exploration Co. and Petsec Energy Ltd., Lafayette, are starting a two or three-well program for gas in Gulf of Mexico federal waters south of Mobile Bay.

The duo plans wells on Mobile Blocks 950 and 951 off the Mississippi-Alabama state line and Block 873 southeast of North Central Gulf gas field, which is near the mouth of the bay.

The wells, the first to be drilled on the portfolio of 33 leases acquired in August 2006, can be drilled in 12-15 days/well and, if successful, hooked up in within 4 months from completion of the drilling program, Petsec Energy said.

Inpex agrees to cut Azadegan field ownership

Japan’s Inpex Corp. has agreed to reduce to 10% its concession in Iran’s Azadegan oil field from the current 75%, with the outstanding 65% stake to be transferred to National Iranian Oil Co.

With the agreement, Japan will likely avoid withdrawing from the development project altogether. But the Japanese government will suspend planned financial assistance to the development project.

As a result, Iran, which is cash-strapped and has little technological expertise, is thought likely to attempt to transfer most of its concession to a third party.

NIOC Managing Director Gholamhosein Nozari has already suggested that Iran could transfer the 65% share to other companies, either Iranian or foreign. France’s Total SA is considered one possibility, along with other unnamed Russian and Chinese firms.

Due to the threat of United Nations economic sanctions, however, it is uncertain whether NIOC will be able to find a new participating company among any international firms for the project.

Inpex, owned 29.35% by the Japanese government, signed a contract with NIOC in February 2004 to develop Azadegan. But development work for the field was delayed by the possibility of UN sanctions being imposed on Iran due to its nuclear program.

Also Inpex reportedly is requesting from NIOC a proportionate reimbursement of the substantial advance fee it paid for the development rights.

Azadegan, in southwestern Iran, was one of Iran’s biggest oil finds when announced in 1999, with oil in place of 26 billion bbl and reserves pegged at 6 billion bbl.

The field is eventually expected to produce 260,000 b/d of crude oil, equivalent to 6% of Japan’s total crude imports.

Drilling & Production - Quick TakesHeerema to remove North West Hutton platform

BP PLC has let a contract to Heerema Marine Contractors for the main decommissioning work on its North West Hutton integrated drilling, production processing, and accommodation platform 130 km northeast of the Shetland Islands in the UK North Sea. The platform sits in 140 m of water.

The field, discovered by Amoco Corp. in 1975, produced 125 million bbl of oil between 1983 and January 2003.

Heerema’s contract covers offshore removal and onshore recycling and disposal. A heavy-lift vessel will remove the 20,000-tonne topsides and the 17,000-tonne steel jacket down to the tops of the footings (OGJ, June 20, 2005, p. 51). The units will be moved to the Able yard on Teesside for recycling and disposal.

About 97% of the material recovered will be recycled, according to BP. After this work is finished, Heerema and subcontractors will decommission the pipeline, clear debris, and inspect the platform site.

Detailed engineering for removal will begin immediately. Offshore removal is expected to begin in 2008 and to be completed by the end of 2009. A BP spokesman declined to tell OGJ the value of the contract.

BP said the contract “represents the largest remaining element of the total North West Hutton decommissioning project.” BP has completed well abandonment and topsides cleanup.

According to BP, no company has tried to dismantle a steel jacket structure of this weight and in this water depth, meaning that new cutting tools are required to carry out the operation.

North West Hutton field is operated by BP (25.8%) on behalf of CIECO Exploration & Production (UK) Ltd. (25.8%), Enterprise Oil UK Ltd. (28.4%), and Mobil North Sea Ltd. (20%).

Hess lets contract for Songa drillship off Libya

Hess Corp. has let a contract to Songa Offshore for the Songa Saturn drillship.

This contract is for the drilling of one well off Libya in fourth quarter 2007. The contract will start after the Songa Saturn completes a contract with Noble Energy Inc. in Equatorial Guinea.

The revenue totals $17 million. The Songa Saturn is available for additional work in the Mediterranean at the completion of the Hess contact.

ADCO to boost oil output from three fields

Abu Dhabi Co. for Onshore Oil Operations (ADCO) let a front-end engineering and design contract to Foster Wheeler International Corp. to boost production from three mature oil fields.

The project involves the Sahil, Asab, and Shah (SAS) oil fields. The value of the contract was not disclosed. ADCO plans to increase total production from the fields to more than 1.8 million b/d by 2010. Current production figures were not immediately available. ADCO is part of the Abu Dhabi National Oil Co. group of companies.

In addition to boosting production, the SAS field development is intended to enhance the environmental aspects of the fields and to provide facilities to enhance operation of the fields until 2040.

The contract is scheduled for completion in mid-2007. The project’s commissioning is slated for 2010.

SAS fields are 180 km south of Abu Dhabi City. Production began in 1974 at Asab and was followed by Sahil and Shah.

Santos begins Maleo field production off Java

Santos Ltd., Adelaide, has begun natural gas production from Maleo field off eastern Java under a $550 million deal with Indonesia’s state-owned PT Perusahaan Gas Negara (PGN).

Santos has agreed to sell 243 bcf of gas to PGN for 8-12 years.

The new gas supply is expected to reduce east Java’s diesel fuel consumption by 6.75 million kl.

Gas will be supplied at a plateau rate of 110 MMcfd for 5-6 years, then tail down as the field depletes.

The $75 million development comprises a mobile offshore production unit supported by a new six-well wellhead platform connected to a 7.4-km spur line to the existing East Java Gas Pipeline. From there gas is distributed to the Surabya and Gresik gas grid.

The field was discovered in 2002 and contains proved and probable reserves of 240 bcf.

Santos has a 75% interest in the Maleo partnership, and Petronas subsidiary PC Madura holds the remaining 25%.

PTTEP to ramp up Arthit field gas production

Thailand’s PTT Exploration & Production PLC (PTTEP) plans to increase production by as much as 45% from its Arthit gas field in the Gulf of Thailand, in the first 3 years of operation.

To meet rising domestic demand, PTTEP will produce an additional 120-150 MMcfd of gas from Arthit in addition to the earlier scheduled rate of 330 MMcfd.

The production increase is made possible with the help of a floating production, storage, and offloading vessel at the field, 230 km off the southern Thai province of Songkhla.

Following a series of delays caused by technical problems and equipment shortages, PTTEP has rescheduled the Arthit production start-up to first quarter 2008 (OGJ Online, May 4, 2006).

The company said it would discuss terms and conditions for the sales of additional gas supplies with state-owned PTT PLC.

PTTEP has an 80% stake in the field; Chevron Thailand Exploration & Production Ltd. holds 16% interest; and Moeco (Thailand), a Thai unit of Mitsui Oil Exploration Co., holds the remaining 4%.

Processing - Quick TakesEPA, API mark ULSD’s arrival at retailers

The US Environmental Protection Agency marked the arrival of ultralow-sulfur diesel fuel at retail outlets with a ceremony at the Columbus, Ind., headquarters of diesel engine manufacturer Cummins Inc. on Oct. 10.

US refiners began to produce diesel fuel for highway use with a 15 ppm sulfur content on June 1, down from 500 ppm previously, under EPA orders. The federal agency said that the lower sulfur fuel will be used by more than 90% of the nation’s trucks and buses. It estimates that this will cut nitrogen oxide emissions by 2.6 million tons/year and particular matter emissions by 110,000 tons/year.

American Petroleum Institute Pres. Red Cavaney, who also attended the ceremony, noted that while the change is arguably the most complex and costly transition ever experienced in US motor fuels history, its implementation has been smooth so far with no significant problems concerning supplies or vehicle performance.

Most retailers will complete the transition to ULSD by Oct. 15, he added. Only ULSD will be allowed for highway and virtually all off-road vehicles by 2010, and for nonroad, locomotive, and marine diesel engines by 2014.

Flexicoking unit due Elefsis refinery

Hellenic Petroleum SA has selected ExxonMobil Research & Engineering Co.’s flexicoking technology for an upgrade project at its 100,000 b/cd refinery in Elefsis, Greece.

ExxonMobil will supply a 20,000 b/d flexicoking unit, which will convert vacuum residue to lighter products.

Flexicoking integrates fluid bed coking and air gasification to eliminate petroleum coke. It allows refiners to process vacuum resid, atmospheric resid, oil sands bitumen, heavy whole crudes, deasphalter bottoms, or thermal cracked tar to produce higher-value liquid and gas products.

Flexicoking produces a clean low-sulfur fuel gas, which can be used economically in refinery furnaces and boilers, as well as by power plants to minimize nitrogen oxides and sulfur oxides emissions.

Husky taps Axens for Lloydminster upgrader

Husky Energy Corp., Calgary, has selected Axens NA of Princeton, NJ, to supply three technologies for a possible future expansion of Husky’s 82,000 b/sd heavy oil upgrader at Lloydminster.

Axens has studied process configuration optimization to establish a firm technical basis for developing the basic engineering for the upgrader expansion. Such an expansion would increase production to 150,000 b/sd, enabling the unit to process additional heavy oil from operations in the Lloydminster area and the Tucker Oil Sands project at Cold Lake, Alta., 250 km away.

Axens will license a high conversion hydrocracker to convert vacuum gas oil into ultralow-sulfur diesel and additional high-quality distillates for synthetic crude production. A Prime-D unit also has been licensed to upgrade distillates to ULSD.

In addition, Axens will revamp the existing H-Oil hydrocracker to process 100% deasphalted oil. This modification will achieve high conversion to quality distillates for direct blending into the synthetic crude oil pool.

Japanese firms plan pilot GTL plant

Six Japanese firms have announced plans to jointly establish a research entity and build a test plant for the production of gas-to-liquid fuel with an eye toward potential international development.

The six firms-Nippon Oil Corp., Inpex Holdings Inc., Japan Petroleum Exploration Co., Cosmo Oil Co., Nippon Steel Engineering Co., and Chiyoda Corp.-said they would begin by setting up a research organization later this month.

The group also said it hopes to finish construction of a test plant in Japan during fiscal 2008, and will conduct joint research through fiscal 2010.

The test facility, to be built in Niigata Prefecture, is due to produce 500 b/d of synthetic oil.

The consortium plans to conduct tests jointly with Japan Oil, Gas & Metals National Corp., aiming to study the potential for the construction of plants overseas. The group did not say when such construction might begin.

Transportation - Quick TakesEnterprise to lay pipeline for Shenzi oil

Enterprise Products Partners LP has signed definitive agreements with producers to build, own, and operate a pipeline connecting deepwater Shenzi oil and gas field in the Gulf of Mexico with existing systems.

The 83-mile, 20-in. pipeline will be able to carry as much as 230,000 b/d of crude. Shenzi field is in 4,300 ft of water, covering Green Canyon Blocks 609, 610, 653, and 654.

The new pipeline will connect a tension-leg platform under construction at the field with the Cameron Highway Oil Pipeline and Poseidon Oil Pipeline systems at Enterprise’s Ship Shoal 332B junction platform.

The Shenzi TLP will have production capacities of 100,000 b/d of oil and 50 MMcfd of natural gas (OGJ Online, June 14, 2006). Production is to begin by the middle of 2009 from seven wells completed subsea and tied back to the platform. The field eventually will have as many as 15 wells.

Shenzi gas will move through a new lateral to the Cleopatra trunkline and on to Ship Shoal 332.

BHP Billiton Ltd. operates the field and holds a 44% interest. Repsol E&P USA Inc. and Hess Corp. hold 28% interests each.

Gazprom submits plans for Altai gas pipeline

Russia’s OAO Gazprom has submitted to Russia plans for a segment of natural gas pipeline as part of a larger project aimed at transporting Russian gas to China.

The 54-km pipeline section would extend through Altai. An Altai government commission is expected to take 5 days to accept or reject the project.

If accepted, the pipeline route is to be approved by yearend, technical design is to be ready in 2007, and pipelaying would start in 2008.

The Altai line will link western Siberian fields and western China, where it will be connected with the projected 2,800-km West-East Chinese pipeline, through which gas will be supplied to Shanghai.

Under the general project, Russia intends to supply 60-80 billion cu m/year of gas to China through the proposed pipeline, which will be commissioned in 2011.

Electricite de France plans LNG terminal

Electricite de France (EDF), the partially state-owned French utility, plans to boost its gas presence in northwest Europe by building an LNG regasification terminal in northern France, taking capacity at the Gate LNG project in the Netherlands, and increasing its gas pipeline capacity through the Netherlands and Belgium. The plans are significant, considering EDF’s previous focus on electricity within France and Europe.

Over the next 3 years EDF will investigate building and operating a 13.14 million-tonne/year LNG regasification terminal at Dunkirk Port in northern France. If the project proves feasible, EDF will start terminal operations by 2011.

EDF said the terminal’s capacity under the first phase will be 4.38 million tonnes/year; it plans to expand this to 8.76 million tonnes/year in the second phase.

An EDF spokeswoman told OGJ that the terminal’s regasified LNG under the first phase would go to France, the UK, Germany, and Belgium. “The EDF Group is looking to secure supplies for north Europe,” she added.

The Dunkirk Port Authority, which focuses on the North Sea, is France’s third largest third port, handling 6,300 ships a year and annual cargo traffic of more than 53.44 million tons. EDF beat four other candidates to win the LNG tender from the Dunkirk Port Authority.

EDF has also agreed with Gasunie, the Dutch gas transport network operator, to take a 10% capital stake in its Gate LNG regasification terminal in Rotterdam, which will become operational from 2010. Vopak, the Dutch terminal tank operator, will reserve for EDF 2.19 million tonnes/year of regasification capacity at Gate LNG.

Gasunie subsidiary GTS and Belgian transporter Fluxys have also agreed to reserve 3 billion cu m of long-term gas capacity for EDF through the Netherlands and Belgium. “These positions are in addition to the 2 billion cu m transport capacity already acquired by the group on the interconnection between mainland Europe and the United Kingdom,” EDF said.

The company said all of the additional gas supplies were important for its subsidiaries in Great Britain, Germany, and the Benelux countries where EDF and the Dutch company Delta are developing an 870 Mw combined-cycle gas turbine power plant in southwest Netherlands by 2009.