OGJ Newsletter

Analysts see robust future for oil sands

The outlook for Canadian oil sands growth continues to improve, although the next 2 years could prove critical as oil companies face the risks of increasing cost overruns and project delays, said Friedman, Billings, Ramsey & Co. Inc.

In a Sept. 29 research note update on oil sands, an FBR analyst said increasing project proposals also increase the risk profile for the Canadian oil sands because of an already tight labor market.

“We believe that the risks of cost overruns and project delays will be increasing over the next 2 years, with the greatest risk being borne by those who have yet to firm up their cost estimates and to order key critical equipment,” said Amir Arif, FBR senior vice-president.

He estimates 25-30% cost inflation from 2004 levels for new projects that will be firmed up in 2007 with risk of an additional 10-20% cost overruns related to labor, steel, and line pipe costs, along with infrastructure and logistic issues.

Noting that the number of oil sands projects planned in Alberta have been steadily climbing, FBR estimates the cumulative capital to be spent in the oil sands, based on announced projects, amounts to more than $125 billion (Can.) This is a 140% increase from FBR’s 2003 estimate of $52 billion.

The increase is a result of both new projects being announced and additional cost pressures on previous cost estimates, Arif said.

Sakhalin-2 project faces more authorization woes

Part of the pipeline built for the Sakhalin-2 project may have been built without proper government authorization, according to Oleg Mitvol, deputy head of the Russian Federal Service for the Regulation of the Use of Natural Resources (Rosprirodnadzor).

Mitvol said the pipeline segment in question was built near the village of Sovetskoye and passes through the Zubrovyy nature reserve. He believes that segment was constructed after “unauthorized rerouting.”

He said, “This is a crime punishable by law. We will examine the situation and transfer all the evidence to the prosecutor’s office.”

Meanwhile, starting Oct. 2 Rosprirodnadzor began taking aerial photographs of the complete pipeline, which was built as part of the Sakhalin-2 project. The photographic results will be compared to the relevant documents on file to establish whether there are discrepancies between existing work and work authorized.

Rosprirodnadzor inspectors flew over a 200-km section of the pipeline route by helicopter on Sept. 29. The survey revealed areas prone to mud slides due to pipeline construction, Mitvol said.

He also noted the presence of incorrectly constructed crossings over rivers. “There are problems over many crossings, which mean that most often these rivers have been made unsuitable for spawning,” Mitvol said.

Mitvol said at least 3 months would be needed to draw up a full picture of the state of Aniva Bay after construction work has been carried out there for the Sakhalin-2 project.

Concerns aired over Brazil lease round exclusions

Some international oil company executives have voiced concerns about Brazil’s National Petroleum Agency (ANP) excluding the Campos basin and parts of the Santos basin from the country’s Nov. 28 licensing round.

Excluding these areas from the 8th licensing round makes it “less attractive,” Alvaro Teixeira, executive secretary of the Brazilian Petroleum & Gas Institute, told OGJ.

Most of the field development activity undertaken by international firms is concentrated in the Campos basin, which produces 80% of Brazil’s output of 1.8 million b/d of oil.

“Is the exclusion of these basins a sign that there will be changes concerning policies for future licensing rounds?” Teixeira posed. “Brazil’s Mines and Energy Minister Silas Rondeau reaffirmed that the rounds will continue as normal and that the 9th Round will probably be announced right after the 8th round. We will see,” he said.

The IBP executive said: “In the short term, there will be a reduction in the rhythm of annual investments in exploration. In the medium and long terms, there will be a postponement in investments to develop potential commercial discoveries of exploration work that was also postponed. The end result will be a reduction in the pace and or maintenance of the present rate of oil production in the next 6-7 years.” IBP is a 50-year-old, nonprofit, private organization with 220 associates including most of the multinationals operating in Brazil.

ANP placed 284 blocks on offer in the upcoming 8th Round (OGJ Online, Sept. 12, 2006). The blocks being offered are in seven sedimentary basins and are considerably less in number than ANP’s previous announcement of 1,153 blocks in 18 basins.

ANP justified excluding the Campos basin by saying, “A wide selection of acreage is to be put up for auction, including areas considered to have great potential for both oil and gas, new frontier blocks, and blocks in mature areas.”

ANP considers 35 offshore areas as high potential blocks, 153 offshore blocks as new frontier basins, 47 onshore blocks as new frontier basins (with little geological data), and 49 blocks in onshore mature basins.

CAPP: Don’t upset Canada’s investment climate

Speaking at the International Pipeline Conference & Exposition in Calgary, Kathy Sendall, Petro-Canada senior vice-president, North American natural gas, and chair of the Canadian Association of Petroleum Producers, implored the Canadian government to not “do anything stupid” regarding terms of investment in projects in the country.

Sendall said Canada’s transparent and stable investment climate acted as a balance to the relatively high production costs in the region and that any adjustments to terms of investments should only be undertaken with the utmost caution, lest this balance be upset.

Sendall also said continued progress needs to be made to keep Canada’s regulatory process untangled, making particular note of the manifold jurisdictions currently required to weigh in on any pipeline project before actual work can begin.

Even so, Sendall cited the combination of Canada’s resource base, innovative technology, competitive global position, and environmental stewardship as key factors that will allow the country to succeed as it sets a course toward becoming an “energy superpower.” She also said “pipeliners should be salivating” at the prospect of bringing Canada’s hydrocarbon resources to market.

US House panel approves pipeline safety bill

The US House Energy and Commerce Committee passed a bill Sept. 27 reauthorizing federal oil and gas pipeline safety programs. It now has to be reconciled with a similar measure passed June 19 by the Transportation and Infrastructure Committee before there can be a final vote on the House floor.

Passage of the latest House pipeline bill by voice vote came hours before Senate Commerce, Science, and Transportation Committee leaders introduced their own pipeline safety bill.

Committee Chairman Ted Stevens (R-Ark.) and chief minority member Daniel K. Inouye (D-Hi.) sponsored the measure to reauthorize the federal Pipeline Safety Act for 4 years starting in 2007, with Trent Lott (R-Miss.) and Frank R. Lautenberg (D-NJ) as cosponsors. Other provisions include a 50% increase in the number of federal pipeline inspectors to 135 from 90 at a cost of $6 million over 4 years, application of Department of Transportation standards to all low-stress pipelines, and new civil enforcement authority against excavators and pipeline operators responsible for third-party damage.

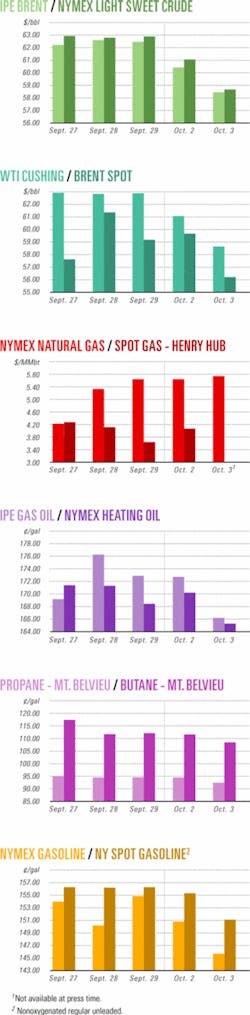

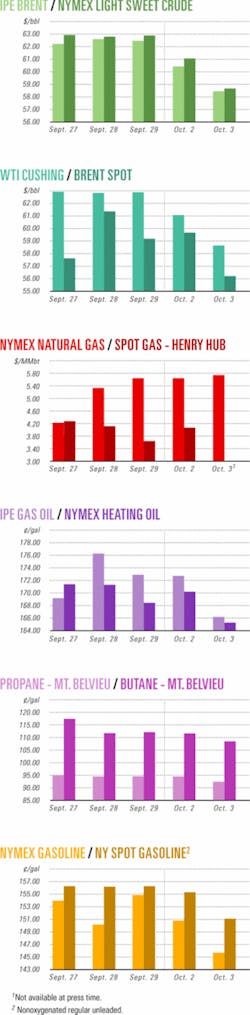

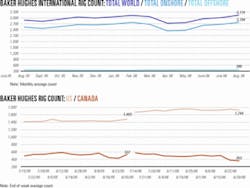

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesMariner makes Gulf of Mexico discovery

Mariner Energy Inc., Houston, said it has made a material discovery with its 5ST1 well on High Island Block 116 in the Gulf of Mexico.

The well, drilled to a TMD of 14,683 ft, encountered about 540 ft of net vertical pay in 13 sands. Completion operations are under way, and initial production is expected later in the fourth quarter.

Mariner estimates that the well’s proved and probable gas reserves could be about 40-60 bcf. The company holds 100% working interest and a 72% net revenue interest in the well.

HI Block 116 is part of the asset base Mariner acquired from Forest Oil Corp. in March.

Total-led group tests Yemeni oil well

A group led by Total SA reported the KHA 1-16 oil well in Yemen’s East Shabwa Development Area on Block 10 produced more than 8,400 b/d when tested through a 70/64-in. choke, said participant Soco International PLC, London.

Test results extend Khairir oil field to the east beyond current 3D seismic survey data, Soco said. The well was drilled on the eastern-most 3D seismic parameter as part of a continuing appraisal and development of the field’s basement reservoir.

KHA 1-16 spudded June 5 and reached a MD of 3,298 m. The group will evaluate the well results to decide the best way to access the extension, Soco said.

Block 10 participants are operator Total and Soco’s Comeco Petroleum Inc., each with 28.57% under a production-sharing agreement with Yemen. Other joint venture partners are Occidental Yemen Ltd. 28.57% and Kuwait Foreign Petroleum Exploration Co. 14.29%.

Aramco lets two Khurais development contracts

Saudi Aramco has signed two contracts for the development of its 1.2 million b/d Khurais Increment Program. The Khurais crude contract went to Italy’s Snamprogetti SPA and the Khurais gas contract was let to a consortium of Hyundai Engineering & Construction Co. Ltd. and Foster Wheeler Energy Ltd.

The Khurais program covers three oil fields: Khurais, Abu Jifan, and Mazlij. The Khurais gas facility will process sour associated gas produced from the three fields into an NGL product and a dry, single-phase sour shipping gas. The plant will process a total of 563 MMscfd of sour associated gas and 70,000 b/d of condensate.

The program is the largest crude increment undertaken in Aramco’s history, the company said, and one of the largest industrial projects being executed in the world today. The program is slated for completion by mid-2009.

Snamprogetti’s contract calls for construction of four identical crude processing and gas compression trains, along with the construction of inlet and outlet facilities to receive wet and sour crude through upstream trunklines.

The Hyundai-Foster Wheeler contract includes construction of two gas conditioning trains, crude and NGL storage facilities, product shipping facilities, and flares.

All related support facilities, such as roads, ponds, buildings, electrical systems, and process control systems, are also to be provided under these contracts.

Max Petroleum completes second Kazakh well

Max Petroleum PLC, London, has completed and begun production from the ZMA-2X well, the second of five wells planned on the Zhana Makat A structure on the E Block in the Pre-Caspian basin of Kazakhstan.

ZMA-2X, drilled downdip from the ZMA-1X discovery well to further delineate the field, encountered an oil column about 18 m thick, exceeding the company’s initial expectations for the well.

As with the discovery well, the ZMA-2X production will be increased gradually to ensure minimal reservoir damage.

Max plans to announce the production volumes when the initial well testing is complete.

The operator also has begun drilling its ZMA-4X well, to be followed shortly by the ZMA-3X and ZMA-5X. These three additional wells are further updip on the Zhana Makat A structure, where the company believes the oil column thickness may exceed that seen in the flank areas drilled by the first two wells.

The discovery well is producing about 225 b/d of oil, an increase of 45 b/d from its initial rate in mid-September. Max is continuing to evaluate the well and optimize its production.

The initial drilling program on Zhana Makat A is scheduled for completion in mid-November, and Max will then have the structure’s reserves independently certified before yearend.

Max said it intends to drill up to 30 shallow wells, 6 intermediates, and 3 deep wells by the end of 2007.

Drilling & Production - Quick TakesHull, topsides completed for Independence Hub

Atlantia Offshore Ltd., Houston, has completed integration of the hull and topsides of its deep-draft semisubmersible for the Independence Hub platform on Mississippi Canyon Block 920 in the Gulf of Mexico.

The operation was completed Sept. 20 at the Kiewit Offshore Services facility in Ingleside, Tex. Kiewits’s heavy lifting device was used to set the 8,400-ton deck onto the 10,000-ton hull.

Additional hookup and commissioning activities are expected to continue over the next several weeks.

The Hub will then be towed to another location to be moored in about 8,000 ft of water. Once installed, the Atlantia DeepDraft semisubmersible will connect to a 24-in. export gas line, and will have the capacity to connect to 16 infield flowlines and 12 umbilicals from an initial 10 ultradeepwater fields. Total designed throughput of the process facility will be 1 bcfd of gas.

Independence Hub is owned 80% by Enterprise Products Partners LP and 20% by Helix Energy Solutions Group Inc. Anadarko Petroleum Corp. will operate the hub on behalf of Atwater Valley Producers Group, which is comprised of Anadarko, Dominion Exploration & Production, Hydro Gulf of Mexico LLC, Devon Energy Corp., and Energy Resources Technology.

Stone resumes Amberjack platform production

Stone Energy Corp., Lafayette, La., has resumed production from its Amberjack platform on Mississippi Canyon Block 109 in the Gulf of Mexico. The platform had been shut down due to damages caused by Hurricane Katrina in 2005.

Stone repaired and rerouted a severed oil pipeline and expects production of 50-60 MMcfd of net gas equivalent during the fourth quarter. This brings Stone’s overall fourth-quarter production to 250 MMcfd of gas equivalent.

Stone said limited oil production from the Amberjack platform was initially restored in early September via barging.

Stone is the operator on MC Block 109 and holds a 100% interest since this summer (OGJ, July 17, 2006, p. 30). It also owns a 24.8% interest in Block 108.

Mariner resumes Gulf of Mexico production

Mariner Energy Inc., Houston, has restarted production at Ochre and Pluto gas fields in the deepwater Gulf of Mexico.

Ochre field, on Mississippi Canyon Block 66, has resumed production of 10.5 MMcfd of gas equivalent (gross). The field was shut-in due to damages caused by Hurricane Ivan in 2004.

On MC Block 718, Mariner has brought Pluto production on stream. The field is expected to flow at 40-50 MMcfd of gas equivalent (gross). The field was originally shut-in for the drilling and completion of a new well, but start-up was delayed due to Hurricane Katrina last year.

Mariner holds a majority interest in and is operator of these two fields.

The company estimates that most of its remaining 2005 hurricane-related production shutins will restart in the fourth quarter.

Processing - Quick TakesHuntsman lets contract for Port Arthur repairs

Huntsman Corp., Salt Lake City, let a $60 million engineering, procurement, and construction contract to Shaw Group Inc., Baton Rouge, La., for repairs to Huntsman’s olefins manufacturing plant in Port Arthur, Tex. The facility, damaged by fire in April, has production capacity of 1.4 billion lb/year of ethylene and 800 million lb/year of propylene.

The total cost of the cleanup, engineering, and rebuild is estimated at $110 million. The project is slated for completion in second quarter 2007.

Huntsman said it also will accelerate some maintenance work at the facility that was scheduled for a 2010 turnaround and inspection. Performing the work now will make the plant run more efficiently, the company said.

The maintenance work will not extend the time required to repair and restart the facility.

Coker contract awarded for Tatarstan refinery

CJSC Nizhnekamsk Refinery has let a contract to Foster Wheeler Ltd. subsidiary Foster Wheeler USA Corp. to design a process package involving its proprietary delayed coking technology.

The coker will be part of an integrated refining and petrochemical grassroots complex to be constructed at Nizhnekamsk in Tatarstan, Russia.

The contract’s terms were not disclosed. Foster Wheeler also has the front-end engineering design contract for the integrated complex (OGJ, Sept. 25, 2006, Newsletter).

In the coking contract, Foster Wheeler will provide its thermal conversion process to upgrade heavy residue feed and process it into transport fuels.

Sabic, ExxonMobil settle technology dispute

Saudi Basic Industries Corp. (Sabic) said it has reached a full and final settlement of its disputes with ExxonMobil Corp. concerning technology and a patent that can be used in the production of polyethylene.

Under terms of the settlement, Sabic and its affiliates will have the right to use the technology without royalties and will equally share in any third-party royalties from the past or future licensing of the technology by ExxonMobil.

The companies will continue to collaborate on their other ventures in Saudi Arabia.

Hydrocracker due Cartagena refinery

Repsol YPF SA has selected IFP NA subsidiary Axens NA’s technologies for the planned expansion of its 100,000 b/cd Cartagena refinery in Murcia, Spain.

The new refining train will include a 50,000 b/d hydrocracker that will convert a blend of heavy vacuum and heavy coker gas-oils into high-quality, ultralow-sulfur middle distillates for the European market.

Axens is committed also to provide a C5-C6 alkane isomerization unit to boost gasoline pool octane, two hydrodesulfurization units to produce ultralow-sulfur diesel from straight run and light coker gas-oil, and a coker naphtha HDS unit.

The new facilities are scheduled to start up in fourth quarter 2010.

Transportation - Quick TakesGas deliveries to UK begin through new pipeline

Gassco AS on Oct. 1 began gas deliveries from Statoil ASA-operated Sleipner and Troll fields in the Norwegian North Sea to Easington in the UK after opening flow through the 600 km southern leg of the new Langeled pipeline.

This marks the completion of the first stage of the 1,200-km submarine gas pipeline, the cost of which currently is estimated at 17 billion kroner-about 3 billion kroner below budget.

“We will complete all pipelaying on the northern leg this week, which means we’ll manage to finish ahead of the winter season,” said Leif Solberg, Langeled project director.

“The project has progressed on schedule,” he added. “What remains now is subsea connections and testing on the northern leg until next summer.”

The northern leg, due to start up in 2007, lies in 360 m water as far as Sleipner East field (OGJ Online, Sept. 18, 2006, Newsletter). It is designed for an internal pressure of 250 bar, corresponding to water 2,500 m deep, a record for Norway’s gas transport system.

The Langeled system will have a total capacity of 20 billion cu m/year, one fifth of Britain’s annual gas requirements. This supplements the 12 billion cu m/year Vesterled system, which transports gas from the BC Hydro-operated Heimdal platform to St. Fergus in Scotland.

Wesfarmers plans Western Australia LNG terminal

Perth industrial conglomerate Wesfarmers Ltd. plans to build a $138 million (Aus.), 175-tonne/day LNG terminal and regasification plant in Kwinana, south of Perth in Western Australia. The plant will supply natural gas for heavy-duty trucks as well as domestic industrial and electric power generation markets.

The company says that several years of trials involving 70 trucks traveling more than 12 million km around Australia, has shown that LNG is a viable alternative to diesel fuel.

Construction of the Wesfarmers plant is scheduled to begin in November and come on stream in early 2008.

During the first 10 years of plant operation, Santos Ltd. will supply up to 37 petajoules of gas feedstock from its 45% share of production in the John Brookes gas field operated by Apache Energy Australia in the offshore Carnarvon basin. Gas deliveries will be via the Dampier-Bunbury gas trunkline.

ABS issues design approval for CNG carriers

The American Bureau of Shipping has issued full-class design approval for CNG carriers to Sea NG Corp., Calgary. The approval is the first granted to CNG carriers, ABS said.

Sea NG’s proprietary Coselle system uses small-diameter high-strength steel pipe coiled into a carousel to store the high-pressure gas. Each Coselle will comprise about 10 miles of 6-in. pipe used for storing and transporting CNG.

Sea NG is expected to let contracts for construction of three Coselle CNG carriers later this year. These first vessels, which will carry the notation “A1 CNG Carrier,” will be designed to transport gas 200-2,000 miles. They are intended to service projects in the Caribbean or Mediterranean seas.

The vessels will be 120 m long and have the capacity to carry 50 MMscf of gas in 16 Coselles (160 miles of pipe). The 16 Coselles are arranged in four stacks of four high in a fully enclosed and inerted cargo house on the weather deck. The vessels will feature a dual fuel propulsion system with bow thruster and also a proprietary high- and low-pressure manifold system for efficient loading and unloading.

ABS Project Manager Harish Patel said, “This vessel design review and approval was undertaken using a risk-based design approach.”

This included a series of risk assessment studies, including HAZID, HAZOP, gas dispersion, and explosion models, fire, flaring and heat radiation analysis, a jetting study, escape and evacuation studies, and inspectability analysis.