At mid-2006, the crowded picture of North American LNG import capacity was beginning to clear.

From the dozens of terminal proposals for Canada, the US, and Mexico as recently as 18 months ago, a few projects have moved ahead, others appear poised to proceed, while others are stymied by local opposition, a lack of committed supply or capital, or both.

The US is currently served by five LNG import terminals. Four are conventional land-based terminals (three on the East Coast); the fifth sits 116 miles off Louisiana and is served by new-generation combined LNG shipment and regasification tankers.

This first of two articles sorts terminal proposals for eastern North America among the few projects that have advanced or are about to and the rest. The conclusion next week covers terminal projects on the US and Mexican gulf and Pacific coasts.

The reviews here and next week make no attempt to touch on each North American LNG terminal proposal. They cover expansions at existing terminals, proposals that have advanced to receive regulatory approvals, and all that were under construction on Aug. 1 or about to start.

Expansion has taken place or is under way at the three land-based terminals in the Lower 48 states that can expand, while owners of the fourth have advanced an offshore project to increase supplies to its markets. Construction is under way at three new US terminals, all on the Gulf Coast (see the concluding article next week).

In Canada, one terminal on the East Coast has cleared ground; on Mexico’s Gulf Coast, a small LNG terminal could start operations later this year or, more likely, in 2007.

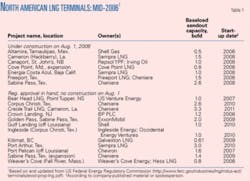

Table 1 presents a quick look at North American LNG terminal projects under construction or having received regulatory approvals and awaiting construction.

EIA outlook: prices, imports

The US Energy Information Administration, part of the Energy Department, has projected that this year’s warm winter weather will push total US natural gas consumption to 1.7% below 2005 levels (www.eia.doe.gov). Consumption will then increase by 4.2% in 2007, partly on the contribution of natural-gas-intensive industries as they continue to recover from effects of the 2005 hurricanes.

In 2005, said EIA’s report, domestic dry natural gas production declined by 2.7%, largely from hurricane damage to Gulf of Mexico infrastructure. Such production will increase by 0.6% this year and by 1.1% next year. Total LNG net imports will increase to 760 bcf this year from 630 bcf in 2005 and to 1 tcf in 2007.

EIA estimated working natural gas in storage on June 30 at 2.6 tcf, 425 bcf above a year ago and 591 bcf above the previous 5-year average. It cites warm winter weather and the large difference by which prices for future delivery contracts for the 2006-07 winter months exceeded spot prices as responsible for much of the high storage level.

Spot Henry Hub (La.) natural gas prices, which averaged $8.86/Mcf in 2005, will remain below $7/Mcf through autumn. Assuming the absence of extreme weather for the rest of the year, the annual average Henry Hub spot price will decline to about $7.61/Mcf for 2006.

The respite will be short-lived, said EIA, as “concerns for potential future supply tightness and continuing pressure from high oil market prices” could push spot natural gas prices to more than $9/Mcf by December 2006 and January 2007. Next year, the Henry Hub price will average $8.13/Mcf.

Currently high prices for natural gas will accelerate construction of new LNG terminals and result in a large increase in total US LNG receiving capacity by 2015. High natural gas prices will also increase support for construction of an Alaska natural gas pipeline that (presumably) begins operations in 2015 and to stimulate production of unconventional natural gas.

EIA sees total sendout capacity of US LNG receiving terminals increasing rapidly, to 4.9 tcf in 2015 from 1.4 tcf in 2004. By 2015, net LNG imports will likely hit 3.1 tcf. Construction of new LNG terminals will slow after 2015. With terminal capacity of 5.8 tcf in 2030, US net LNG imports total 4.4 tcf.

Net US natural gas exports to Mexico will fall through 2011, as new LNG terminals are built in Mexico. After 2011 US exports to Mexico increase, to 560 bcf in 2030.

(Editor’s note: To make finding a project of interest easier in the following review and the discussion next week, the first mention of a relevant company or project name appears in italics.)

Three terminals on the US East Coast receive LNG for the Northeast and Mid-Atlantic states. Others are proposed to serve Florida markets.

New England and south

Suez LNG NA subsidiary Distrigas of Massachusetts LLC owns and operates the LNG import and regasification terminal on the Mystic River in Everett, Mass., an industrial suburb of Boston. Currently, Distrigas meets about 20%/year of New England’s gas demand.

The company says that between start-up in 1971 and 2003, the terminal received about half of all LNG imported into the US and that it is the nation’s longest-serving LNG terminal.

Two LNG storage tanks at the terminal have a combined capacity of 3.4 bcf of gas equivalent; rated vaporization capacity is about 1 bcfd, with a sustainable daily throughput capacity of about 715 MMcfd.

Distrigas delivers regasified LNG via interconnections with Algonquin Gas Transmission LLC and Tennessee Gas Pipeline Co. and the local gas distribution system of Boston Gas Co.

Other customers in the region purchase LNG from Distrigas and store the liquid in more than 40 LNG satellite facilities around the region; this LNG can satisfy an additional 15% of New England’s peak gas demand, says the company. Distrigas supplies this LNG through four truck-loading bays that have a maximum liquid sendout capacity of more than 100 MMcfd.

Significant expansion at Everett is impossible because the terminal is bordered on its three land sides by industrial neighbors and a river. Therefore, Distrigas parent SUEZ LNG has proposed an offshore LNG terminal about 22 miles northeast of Boston and in 250 ft of water 10 miles off the coast (Fig. ). The Neptune offshore project will feed another 400 MMcfd on average and about 700 MMcfd peak-day delivery into New England markets.

The terminal will consist of a buoy system to which LNG carriers will moor and discharge LNG regasified by vaporization equipment aboard ship. The natural gas will be transported via a subsea pipeline into the existing Algonquin 30-in. HubLine pipeline, which will deliver gas ashore.

Estimated cost for the Neptune project, including purpose-built LNG regasification vessels, buoy system, and connection to HubLine, is about $900 million, says Suez subsidiary Neptune LNG LLC. In October 2005, it applied for a deepwater port license from the US Coast Guard and the US Maritime Administration.

Construction would take about 36 months, says the company’s application, and would start up in late 2009.

A competing proposal has also been submitted to US regulatory agencies by Excelerate Energy LLC, Houston.

The Northeast Gateway Energy Bridge deepwater port would sit in Massachusetts Bay, about 13 miles southeast of Gloucester, Mass., in 270-290 ft of federal waters. The technology will be based on the newest US LNG terminal, Excelerate’s Gulf Gateway Energy Bridge, off Louisiana. That terminal started operations in April 2005.

Plans call for the terminal to move regasified LNG in a new 16.4 mile, 24-in. pipeline lateral to be built, owned, and operated by Algonquin into its HubLine, allowing Northeast Gateway to deliver on average 400 MMcfd with peak sendout of 800 MMcfd.

Excelerate says Northeast Gateway will consist of two subsea submerged turret loading buoys, two flexible risers, two subsea manifolds, and two subsea flowlines to connect to Algonquin’s pipeline lateral.

Each STL buoy will connect to its own subsea manifold using the flexible riser assembly. The subsea manifold will then be tied into the subsea flowline, subsequently connecting to Algonquin’s pipeline lateral.

An Excelerate spokesperson told OGJ the company expected state and US Coast Guard approvals in the next 6-8 months and to have the offshore equipment ready to receive gas by December 2007.

While neither Neptune LNG nor Northeast Gateway had received regulatory approval by third-quarter 2006, another terminal proposed for the Northeast US received FERC approval more than 1 year ago, although local forces were working hard to circumvent that approval and stop the terminal’s construction.

In December 2003, Weaver’s Cove Energy LLC applied to FERC to develop a site near Fall River, Mass., as an LNG import terminal. On July 15, 2005, the commission granted a certificate for constructing the terminal. Weaver’s Cove is owned by Hess LNG LLC, a joint venture made up equally of shipping consultancy Poten & Partners, New York, and Amerada Hess Corp., Houston.

On a 73-acre site of a former petroleum import terminal, the LNG terminal would consist of a ship-unloading jetty capable of receiving LNG tankers up to 145,000 cu m (Fig. ). Also to be constructed is a single 200,000 cu m, full-containment LNG storage tank (4.3 bcf of gas equivalent) in support of baseload sendout capacity of 400 MMcfd and peak sendout capacity of 800 MMcfd. There would also be LNG truck-loading facilities, similar to those at Everett.

Dredging of the Taunton River channel leading to the site would take place along with expansion and deepening of the site’s turning basin. The Taunton River in Massachusetts flows into Mt. Hope Bay in Rhode Island, which flows eventually into Rhode Island Sound, which connects to the Atlantic Ocean-the importance of this will be clear shortly.

Finally, construction will install two pipeline connections between the LNG receiving terminal and the existing Algonquin Transmission system.

But the $250-million project has been stymied by local opposition.

A year ago, Massachusetts lawmakers in the US Congress slipped language into a transportation bill subsequently signed into law that would prevent demolition of a bridge now blocking LNG tankers from reaching the site of the proposed terminal.

Later in August 2005, the US Navy asked FERC to reverse its approval, citing the passage of LNG tankers through its Narragansett Bay testing area for torpedoes. US rules for protecting LNG tankers in navigable waterways would disrupt testing, said the Navy.

And last month, Rhode Island-which encompasses waterways through which LNG carriers bound for and from the proposed Weaver’s Cove terminal must pass-enacted a law prohibiting LNG tankers from coming within hundreds of yards of multiple obstacles and hazards including “people, docks, waterfront facilities, hunting grounds or anywhere workers are welding” (FERC, July 14, 2006).

A spokesperson for Weaver’s Cove told OGJ the project would “forge ahead” and stated the company’s belief that the law will be overturned on appeal because it represents a state’s intrusion into an area of federal jurisdiction, specifically the regulation of interstate commerce.

He also said Weaver’s Cove engineers have gone back to the drawing boards over the bridge problem and recalculated the size of tankers that can still make the trip to the terminal and pass under the obstructing bridge.

That approach, however, may well be defeated, based on comments in late July by Massachusetts Gov. Mitt Romney that the proposed Fall River project is “ill advised,” even though he acknowledged the state’s need for LNG. And the state’s senate will vote soon on legislation to bar certain types of ships from passage under bridges, regardless of size.

Finally on the US East Coast, in a decision announced in June 2006, the FERC approved construction of the Crown Landing LNG project in Logan Township, NJ (OGJ Online, June 21, 2006).

Situated next to National Energy Power Co. LLC’s pulverized coal-fired Logan generating station, the planned terminal will:

- Be able to store up to 450,000 cu m of LNG (9.2 bcf equivalent of natural gas) in three 150,000 cu m, full-containment LNG storage tanks.

- Have a baseload sendout capacity of 1.2 bcfd and peak-day capacity of 1.4 bcfd, with seven closed-loop shell-and-tube heat exchanger vaporizers (including one spare).

- Reduce the heating value of the vaporized LNG, if necessary to meet requirements of receiving pipeline systems, with a nitrogen production and injection system.

Crown Landing anticipates beginning commercial service by fourth-quarter 2008. Its immediate future, however, is clouded by a US Supreme Court case filed by New Jersey against Delaware, in which New Jersey claims exclusive state jurisdiction over projects originating from the New Jersey side of the Delaware River and extending beyond the low tide mark into Delaware state waters.

This includes the unloading pier associated with the Crown Landing project.

Mid-Atlantic

On the Chesapeake Bay in Cove Point, Md., south of Baltimore, lies Dominion Cove Point LNG LP’s LNG terminal, largest of the US LNG import terminals. Its sendout capacity is about 1 bcfd with supporting storage capacity of 7.8 bcf. Supplies to the terminal are from Trinidad, Nigeria, Norway, and Algeria.

In the 1970s, the former Consolidated Natural Gas Co., parent of what is now Dominion Transmission, joined with the Columbia Gas System to build Cove Point. Shipments arrived between 1978 and 1980 when increased natural gas production in the US reduced the need for the more expensive LNG imports. The terminal was mothballed.

In 1988, Consolidated sold its interest in the terminal and the associated pipeline to Columbia Gas, which in 1995, reopened the facility for storage and peak-shaving operations. Columbia used the facility to liquefy, store, and distribute domestic natural gas for use in the growing Mid-Atlantic region.

In 2000, Williams bought Cove Point and subsequently sold it in 2002 for $217 million.

In June 2006, FERC granted Cove Point’s request to expand the terminal to 1.8 bcfd sendout capacity from its current 1 bcfd. Storage capacity will also increase to about 14.5 bcf from 7.8 bcf.

The expansion will add two storage tanks to five existing ones and add two electric generator units to the existing three units.

Construction will get under way in fourth-quarter 2006 with start-up set for fourth-quarter 2008.

Looking further south: In December 2005, Southern LNG Inc., Birmingham, Ala., subsidiary of Southern Natural Gas Co., an El Paso Co., announced Phase 3 expansion at the Elba Island LNG terminal near Savannah, Ga., and construction of a related Elba Express Pipeline in Georgia. The line will consist of about 105 miles of 42-in. pipeline and 86 miles of 36-in.

Initial in-service date is to be mid-2010; total expected capital cost for both projects is about $850 million.

Phase 3 follows a $157 million expansion (Phase 2) that started up in February of this year. It added 3.3 bcf of storage capacity and 540 MMcfd of peak sendout capacity, bringing totals to 7.3 bcf of storage and more than 1.2 bcfd of sendout capacity.

This Phase 2 added docking facilities to accommodate two LNG vessels simultaneously in a new slip.

Southern LNG plans to complete Phase 3 in two steps with the total project estimated to cost about $350 million.

Step 1 will add a 200,000-cu m storage tank. Completion is planned by mid-2010 and will add about 4.2 bcf of LNG storage capacity to the terminal. Maximum sendout capacity will be 405 MMcfd. This step will also include modifying the north and south docks to accommodate new larger vessels and facilitate simultaneous unloading of two ships.

Step 2 will add another 200,000-cu m LNG storage tank, adding another 4.2 bcf storage capacity to the terminal in 2012, and increase sendout by 495 MMcfd.

BG LNG Services holds the original capacity under long-term contract. Shell NA LNG LLC, subsidiary of Royal/Dutch Shell, holds the expansion capacity.

Shell NA LNG and BG LNG Services LLC, a wholly owned subsidiary of BG Group PLC, have long-term agreements for the incremental storage and sendout capacity of Elba Island’s Phase 3 expansion and for the transportation capacity on the Elba Express pipeline. El Paso plans to submit applications to FERC for the two projects this quarter of 2006.

Shell intends to use its capacity primarily to import LNG from Qatar through its Qatargas IV project, said press announcements late last year. BG, sole importer of LNG at Elba Island at the time, said it would continue to buy LNG from existing and future supply sources in the Atlantic Basin, including Trinidad, Egypt, and Equatorial Guinea.

And off Florida: Rounding out this look at US East Coast projects, competing plans to base LNG terminals in the Bahamas and send regasified LNG through subsea pipelines into Florida markets evolved by the end of 2004 into one.

Three proposals, involving Calypso LNG, a subsidiary of Suez Energy NA; Ocean Express, a unit of AES Ocean LNG Ltd.; and units of El Paso Corp., agreed to merge their projects. El Paso was concerned only with the pipelines in US waters to bring regasified LNG from a single LNG terminal in the Bahamas. The other two entities have been negotiating with Bahamian authorities on a site for the terminal.

As of mid-2006, however, prospects for the terminal appeared poor.

Suez Energy NA, therefore, seeming to despair of persuading Bahamian authorities to allow an LNG terminal in the Bahamas, announced last spring plans to replicate its Neptune offshore LNG regasification scheme (discussed above) to waters off Florida.

Subsidiary Calypso LNG LLC will pursue development of a deepwater port, a submerged buoy system off the southeastern coast of Florida that would serve as an offshore LNG delivery point for LNG regasification tankers, mirroring the scheme proposed for Massachusetts Bay.

On Mar. 1, 2006, the company filed a Deepwater Port License Application with the Coast Guard for permitting, operation, and security in federal waters. Calypso Deepwater Port would lie about 10 miles off Port Everglades and consist of a marine offloading buoy and anchoring system that will reside, when idle, 150 ft below the water’s surface. It will connect to a subsea pipeline operated by Suez Energy NA subsidiary Calypso US Pipeline LLC, which will move gas to Florida markets.

Maritimes

Complementing the terminals on the US East Coast, especially Distrigas’ Everett, Mass., terminal, may be one or more terminals in the Canadian Maritime provinces. These terminals expect to supply markets in eastern Canada as well as the Northeast US.

Canaport LNG, a partnership of Repsol YPF SA and Irving Oil Ltd., announced in May plans to begin construction of its LNG regasification terminal near Saint John, NB.

As much as 850 MMcfd of gas will flow from Canaport through New Brunswick via the proposed 145-km, 30-in. Brunswick Pipeline to a connection with the Maritimes & Northeast Pipeline system at the US border near Baileyville, Me.

Construction is scheduled to begin in 2007 and be completed by late 2008.

The site is an existing deepwater marine terminal, Irving Canaport, in operation since 1970. Baseload sendout will be 1 bcfd; peak-day 1.2 bcfd with expansion capability up to 2 bcfd.

The site will have three 160,000 cu m, full-containment LNG storage tanks and a 350-m offloading jetty with mooring capable of accommodating LNG carriers up to 200,000 cu m. Plans call for closed-loop vaporization.

In May 2006, Canaport LNG announced that it had awarded onshore and offshore engineering, procurement, and construction (EPC) contracts. And Repsol YPF completed its agreements to transport natural gas from the Canaport LNG terminal to markets in Canada and the Northeast US via the Brunswick pipeline and an expansion of the Maritimes & Northeast Pipeline system in the US. Site preparation, blasting, and leveling construction work were completed earlier this spring at the terminal’s site.

Due east of the Canaport site, on Cape Breton Island on the Strait of Canso in Nova Scotia, another Maritimes LNG terminal has been proposed and recently received a boost with a change in ownership.

The Bear Head LNG project was initiated in 2002 by Access Northeast Energy, Calgary, and purchased by Anadarko Petroleum Corp., Houston, in 2004. In October 2004, the new owner began clearing the 180-acre site to begin construction, once supplies were secured, with plans to open for business in 2007.

Supply, however, was never secured, and earlier this summer the company announced it had sold Bear Head LNG Corp. to US Venture Energy, a privately held equity investment firm. The sales agreement sends $125 million to Anadarko and gives it an 18-month option to secure up to 350 MMcfd of the terminal’s capacity at “competitive rates,” according to Anadarko.

If and when it is built, Bear Head would have two 180,000-cu m tanks, in its first phase of construction, and initial sendout capacity of 1 bcfd. A second phase of construction (no timetable announced) would increase sendout capacity to 1.5 bcfd and add another 180,000-cu m tank. A 180-m marine jetty could handle LNG tankers up to 250,000 cu m, a size envisioned but not yet produced.

Sentiment in the immediate region was that this sale would revive the nearly dormant project.