With nearly 450 offshore fields developed to date, offshore Europe is the world’s largest offshore oil and gas producing province and is responsible for some 24% of the global offshore total.

Despite being mature with oil production having reached its peak in 2000, the province’s prospects again seem bright as $70 oil drives a surge of applicants for new licenses.

More than 90 billion bbl of oil and gas equivalent have been produced in the North Sea to date, with estimated remaining reserves at 70 billion bbl and a possible 40 billion bbl yet to be found.

A different future

Each year, Europe’s summer offshore show alternates between the competing regional oil capitals of Aberdeen, Scotland, and Stavanger, Norway. It is Stavanger’s turn in 2006.

The UK and Norwegian economies have benefited greatly from the past 30 years of production.

While in the 1970s the breakneck development of offshore oil dragged the UK back from the brink of economic catastrophe, Norway, with its small population (4.6 million compared with UK’s 60.4 million) was able to adopt a more managed approach, leaving oil in the ground and since 1990 investing part of the tax take from production for future generations. At present, this Norwegian Petroleum Fund totals $225 billion, or nearly $50,000 for every man, woman, and child in the country.

As a result of different economic needs, each of offshore Europe’s oil and gas provinces has been developed differently, and this results in a very different future.

The mature UK sector has little potential for major new fields, and accordingly government efforts are focused on attracting players to develop the myriad of remaining small prospects. Norway, meanwhile, is still bringing on production some world class gas fields and is exploring in the arctic waters of the Barents Sea on its border with Russia.

Elsewhere, in Denmark and the Netherlands, the focus is also on small prospects. In the case of Ireland there is again interest in what the deep Atlantic margin might offer.

High acreage interest

Previous years had seen a fall in the number of oil companies seeking a position in the North Sea, aggravated by changes to the tax regime in the UK and relatively low oil prices during much of 2001.

Now $70+ oil has caused a surge of interest by oil and gas companies in the many remaining North Sea prospects and indeed in areas out into the Atlantic.

The UK’s 24th offshore Oil & Gas Licensing Round closed on June 16, 2006, and attracted a record 147 applications by 121 companies for new UK oil and gas exploration and production licenses in 255 blocks.

The “Promote” license, designed specifically to encourage newer and smaller firms to enter the sector, is offered at one-tenth the cost of a traditional license for the first 2 years. This is to encourage smaller companies with good ideas to apply for acreage and work up prospects to either sell or bring in other investors. The concept was again very successful and attracted 62 applications.

On Mar. 31, 2006, the Norwegian Minister of Petroleum & Energy awarded new production licenses in the 19th round on the Norwegian shelf. Seventeen companies were given the opportunity to participate in 13 new production licenses covering 33 blocks or parts of blocks. The Barents Sea was the main focus of the round.

Can contractors deliver?

The present shortage of supply of everything from drilling rigs to experienced personnel to operate them has resulted in an unprecedented spiral of cost increases as operators compete for limited resources.

In its May 2006 London strategy presentation to analysts, Shell management noted that since 2002 equipment prices have increased by 20-50%, pipe by 41-65%, construction labor by 25-80%, and world rig rates by 140-430%.

In a recent front-page article in the London Financial Times, industry watcher Jason Nunn claimed that the new rigs on order worldwide would require some 7,000 in crews. And this is in an environment in which many companies are delighted to be able to hire 7 people.

In short, the prospects are there, and oil and gas companies want to get into the field, but will resource shortages be the rain that stops play?

Offshore Europe output

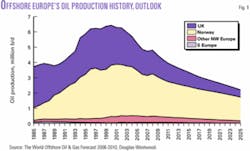

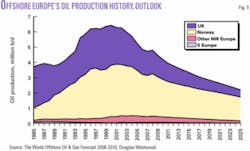

The bulk of oil and gas production originates off Norway and the UK even though the North Sea overlies the continental shelves of five countries (Norway, the UK, the Netherlands, Germany, and Denmark).

The Norwegian and Barents seas also cover a large area of the shelf and continental slope of Norway, while the UK has additional production from the Irish Sea and the Atlantic shelf west of Shetlands.

Across the world, offshore oil and gas production is growing. However, beyond the present euphoria it is well to remember that the only significant region where offshore production has fallen is Western Europe, driven by a lack of major new oil and gas prospects in the North Sea. Six years after the offshore oil production peak, the gas peak is still some years away.

Current UK gas declines are being compensated for by increases in Norwegian gas, which should extend the region’s present 9 million boe/d production plateau out through 2010, but then we expect to see long-term production decline (Figs. 1 and 2).

null

null

Norway’s fields

Two new fields, Enoch and Blane, are expected to start producing off Norway in 2006 after two others, Kristin and Urd, started up in 2005.

Although 2005 was a record-breaking year for gas production, oil production dropped more than forecast by the Norwegian Petroleum Directorate, largely as the result of lost production on Snorre, delayed start-up of Kristin, and delayed drilling plans at a number of fields.

For 2006, oil production will be even lower, although there will be smaller declines up to 2010 as new fields come on.

Oil production is expected to continue to decline from the 2001 peak as a result of markedly reduced output from the giant fields. Although the Norwegian Sea, and to a lesser extent the Barents Sea, has some excellent prospects and natural gas liquids output is increasing, these will be unable to reverse overall decline.

It is forecast that Norway will be producing around 2.8 million b/d by 2010, down from nearly 3 million b/d in 2005.

Conversely, gas production continues to rise. The country is forecast to be producing 114 billion cu m/year by 2010, up from around 83 billion cu m/year in 2005. The increase will come from the Norwegian Sea, primarily the Ormen Lange project, and from the Barents Sea.

Norwegian firms can expect to take what they have learned from Snohvit, Western Europe’s first LNG export plant, and pursue a variety of opportunities elsewhere, including involvement in the Russian Shtokman development, where Statoil and Hydro are believed to be keen to participate with operator Gazprom.

Norwegian fields under development include:

Alvheim. Many awards have already been made for the project, which is to develop Kneler, Boa, and Kameleon fields. The Marathon-led project is to be developed using an FPSO converted from the Odin multipurpose shuttle tanker (MST). Conversion work for the topsides will be undertaken by Vetco Aibel and the hull upgrading by Keppel. APL has been awarded the turret contract and Technip the subsea installation. The development will consist of five subsea drill centers and associated flow lines. In addition, nearby Vilje (formerly Klegg) will be developed as a subsea tieback 19 km southwest, boosting oil and gas production. Alvheim’s reserves total 180 million boe, with production expected to begin during 2007.

Brage. This field is a showcase for Hydro, demonstrating it can operate tail-end production as efficiently as its smaller rivals. Original end of life for the field was 2005, but with improved recovery schemes and debottlenecking measures it is hoped that this can be pushed back to 2010. At the end of 2005, Norwegian company Altinex bought a 12.26% stake in the field from Italy’s Eni for $64 million. Altinex plans to ramp up output to 5,000 b/d by 2008.

Ekofisk. A number of platforms are producing, and the complex has been undergoing a “growth” project since 2001, including planned new living quarters for the 2/4H and 2/4Q platforms due for installation in 2009. Two groups are competing for a FEED contract for the 570-person capacity accommodation platform. This is at the same time as parts of the first phase of the field’s infrastructure are decommissioned.

An investment of $1 billion is likely for Eldfisk field to lift more oil from its Alpha and Bravo reservoirs, with two wellhead platforms, including one with integrated living quarters, possible for 2009-10.

Ormen Lange. This giant deepwater field was discovered in 1997. There will be no surface installations; instead, two 120-km, 30-in. pipelines will transport the unprocessed wellstream from the field to the Nyhamna Terminal. From there gas will be shipped via a 660-km, 42-in. pipeline to the Sleipner Riser Platform and then via a 540-km, 44-in. pipeline to Easington, UK. Construction of the pipes was completed in March 2006, having resulted in the world’s largest subsea pipeline. First production is scheduled for October 2007. The planned gas export volume to England is about 20% of Norway’s gas exports and 20% of UK gas demand. The field has also attracted interest from the National Geographic television channel, which has recently been shooting at the field for inclusion in a series about the world’s most incredible construction projects.

Gjoa. This field is to be developed via a semisubmersible scheduled for operation in 2010. Aker Kvaerner is currently undertaking a FEED contract for the platform. Statoil will run the project until Gaz de France assumes operation in the production phase. Hydro is looking into tiebacks to the platform from its Camilla, Belinda, and Fram B fields.

Skarv. A $2.75 billion development is to be produced via a newbuild FPSO and will include production from Idun. In 2005, Aker Kvaerner won the FEED work. Plans include 15 or 16 subsea wells to be tied back to the vessel. First production is slated for the end of 2010.

Tyrihans. The oil and gas-condensate field is set to start producing in 2009. The development will consist of five subsea templates and be tied back to Kristin. Production will be transported through a 43-km pipeline. Statoil is the operator with Total, Hydro, Eni, and ExxonMobil all having shares.

Troll. Primarily a gas field, Troll also possesses a large quantity of oil in thin zones under the gas cap west of the main field. Statoil, the operator with a 20.8% interest, has been producing gas from the field since 1996. Troll holds 60% of total gas reserves on the Norwegian shelf. Troll Further Development involves assessing an expansion in gas output from Troll East as well as a start to production from the western area. The gas in Troll West provides the mechanism for oil recovery. Statoil is aiming to make a final choice of concept in 2007.

Statfjord. This is an oil field with associated gas, but the Statoil-led group’s late-life project will convert it to a gas field with associated oil. The project plans to keep the field online until 2020, achieved with a very extensive well program and modifications to the platforms. The associated Tampen Link pipeline is also being laid to accommodate increased gas output.

Frigg. The field produced from 1977 to 2004. In early in 2005, Total received consent for the partial removal and disposal of the field’s facilities, which straddle the UK-Norwegian median line boundary. The $487 million decommissioning project is the biggest removal operation ever on the Norwegian continental shelf and is expected to take until 2012, with all the steel topsides and jackets to be removed and returned to shore and the concrete substructure likely to remain.

Other prospects include the Goliath discovery in the Barents Sea, operated by Eni Norge, and the redevelopment of Yme field by Talisman.

UK fields

Output of oil from offshore UK peaked in 1999 after having reached a previous peak in 1985 prior to the Piper Alpha disaster.

The destruction of Piper seriously disrupted supply as a result of loss of Piper oil, as new safety systems were retrofitted in other fields in subsequent years and as taxation rules were modified.

The old giant fields are all nearing the ends of their lives, and new smaller fields and satellites are unable to fill the gap.

Output of oil from all areas and of natural gas liquids is expected to continue to decline although addition of Clair and Buzzard fields, Callanish/Brodgar, and Tweedsmuir will briefly sustain production levels through to 2007. It is forecast that UK oil production, including NGLs, will continue to decline from a 1999 peak of 2.7 million b/d to around 1.65 million b/d in 2010.

Meanwhile, gas production peaked in 2000 at 115 billion cu m/year. It is forecast to have declined in all areas to around 83 billion cu m/year by 2010.

Major developments under way off the UK include:

Brenda. Oilexco finished its last appraisal well in Block 15/25b in the Outer Moray Firth in late 2004. Production from three horizontal wells will be tieback to Agip’s Balmoral FPSO 8 km away. A fourth well may be added depending on initial performance of the reservoir. The project will cost over $150 million.

Blane and Enoch. These Talisman fields (formerly Paladin’s) lie on the UK-Norway median and have been sanctioned for development by the respective governments, with production slated for late 2006. Blane is to be developed as a subsea tieback to BP’s Ula platform 34 km away in the Norwegian sector, with equipment, consisting of three subsea completions on the UK side, at a cost of $260 million. Enoch is to be developed via a tieback to Brae field, also in the Norwegian sector, at a cost of $125 million. Initial production from both fields is expected to reach 32,000 boe/d.

Broom. The Heather platform is the host facility for Lundin Petroleum-operated Broom, with Subsea 7 providing the subsea hardware. The tieback required major upgrade and modernization of the platform in 2004. Further development wells were completed as part of a phase two development, which started production at the end of 2005.

Buzzard. This is one of the largest fields to be discovered in the North Sea in the past decade. The platform’s topsides were recently installed and are designed to process up to 200,000 b/d of oil and 60 MMcfd of gas. Nexen’s development includes 27 production wells and 16 water injectors, and production is set to start in late 2006, only 5 years after discovery.

Ettrick. Nexen is going ahead with its development of this oil and gas field using the Aoka Mizu FPSO to be converted by Bluewater. The plan includes drilling three production wells and tying them back to vessel. Production is expected to begin in early 2008. Reserves are 39 million bbl, and tiebacks could extend the estimated production life of 7 years.

Goosander. This oil and gas field is in Block 21/12 some 11 km northwest of Kittiwake field and is being developed as a subsea tieback to the Kittiwake platform. Production is expected to begin later this year.

Nicol. This Oilexco field lies in Block 15/25a of the Central North Sea and has recently won development approval from the UK Department of Trade & Industry. Oilexco intends to develop the field by using a tieback via a horizontal well and the Brenda subsea manifold to the Balmoral FPSO 16 km northeast. The Transocean Sedco 712 semisubmersible will drill the production well, and the first oil flow is expected later in 2006.

Lochnagar/Rosebank. Drilled in more than 1,000 m of water in 2004, Chevron’s discovery comprises Rosebank, a shallow reservoir, and Lochnagar, a deeper one, west of Shetland. The company found nonassociated gas as well as crude oil at Rosebank. A development scheme comprising subsea wells tied back to a floater is likely, if it proves commercial. The development would lay the foundations for infrastructure in the remote area and the reassessment of smaller potential fields. The area may also extend across the border to the Faeroe Islands. Up to 200 days have been suggested for the appraisal program, to have commenced in July 2006, with all wells to be abandoned on completion. The first well is likely to target the North Rosebank formation.

Chestnut. Venture’s field lies in Block 22/2a about 13 km south-southeast of Chevron’s Alba field. Sevan Marine FPSO SSP 300 design will be on the field and is under construction. It will operate in 120 m of water and have the process capacity of 30,000 b/d of oil and 300,000 bbl of storage. It will also contain a 20,000 b/d water injection plant. The unit is due to be delivered in early 2007 and will be moved to a different field once production depletes.

Dumbarton. Dumbarton lies below Donan field. DTI approved Maersk’s plan, which consists of six wells and development drilling started in January 2006. The wells will be tied back to the Global Producer III FPSO currently on Leadon field. The vessel requires upgrading before redeployment.

The big spend-opex stars

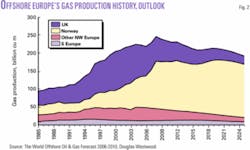

Spending offshore Western Europe declined during 2001-04 to $30 billion from around $33 billion.

A jump in spending occurred in 2005, primarily because of increased drilling and much higher rig costs. This will continue to reach an estimated $40 billion in 2006 before level expenditure is forecast through to 2009 (Fig. 3). Further modest growth is expected in 2010, but primarily due to inflation.

Over the next 5 years, capex is expected to fall by 8% and opex will grow by 20%. The industry tends to focus itself on the more glamorous project-related capex although it is opex that is becoming the real star of the show.

The financial community is beginning to take notice. In May, Kellogg Brown & Root announced that it has completed an agreement to sell its production services group to its Aberdeen-based management. Financing for the purchase was provided by the Bank of Scotland Integrated Finance and commercial due diligence by Douglas-Westwood. KBR received a purchase price of $280 million, and the transaction resulted in a pretax gain to Halliburton of $100 million.

We expect the results of more merger and acquisition activity in the offshore Europe field maintenance and modifications sector to be announced later this year.

Acknowledgments

Thanks to colleagues Georgie MacFarlan, manager of the Douglas-Westwood Offshore Projects Database, and Michael Smith, who manages the Energyfiles database.

The author

John Westwood (admin@ dw-1.com) is the founder of energy analysts Douglas-Westwood of Canterbury, UK. The firm, which acts as consultant to government agencies, oil and gas companies and their contractors, and investment banks, has completed commercial due diligence on M&A and financing deals totaling $3.1 billion in the past 3 years. Westwood spent 12 years in the offshore contracting business in the North Sea, Southeast Asia, South America, and the US. He has since spent 20 years working on business research and analysis.