Brazil moves to lower reliance on Bolivian gas

To reduce dependence, on Bolivian natural gas, Brazil’s Petroleo Brasileiro SA (Petrobras) is accelerating plans to enhance domestic production (OGJ, Jan. 23, 2006, p. 32). It has presented a plan to the National Energy Council for authorization to increase gas output in its southeast region to 40 million cu m/day by yearend 2008 from 15.8 million cu m/day.

Petrobras plans to develop two new oil and gas fields in the southeastern state of Espirito Santo and increase gas production in Marlim field in the Campos basin off Rio de Janeiro and in Merluza field in the Santos basin.

The clash between Brazil and Bolivia over energy is worsening, with Bolivia’s Hydrocarbons Minister Andrés Soliz Rada declaring that negotiations are paralyzed.

Jorge Alvarado, president of Bolivia’s state-owned Yacimientos Petroliferos Fiscales Bolivianos (YPFB), on May 30 accused Petrobras of sabotaging Bolivia’s diesel supply, and the country threatened sanctions against Petrobras.

Soliz Rada said Bolivia would push to raise the price of gas sold to Brazil to $7.50/MMbtu from $3.80/MMbtu. On average, Brazil has been importing 25 million cu m/day of gas, about half of its consumption.

On May 1 Bolivia nationalized international upstream oil and gas interests, including those of Petrobras the largest foreign investor in the country’s oil and gas industry, and refused to compensate the companies (OGJ, May 8, 2006, Newsletter). Bolivia later demanded that retail outlets and refineries also be turned over to YPFB (OGJ Online, May 23 and 30, 2006). Petrobras owns two refineries in Bolivia and 25% of its retail outlets.

Brazilian Gas Transport Co. responded by canceling bidding for contracts to expand the 3,150-km Bolivia-Brazil pipeline (OGJ, June 5, 2006 Newsletter). The line represents a major section of the proposed 10,000 km Southern Gas Pipeline proposed by Venezuelan President Hugo Chávez to link South America from Venezuela to Argentina, with about two thirds of it crossing Brazil.

Brazilian Foreign Relations Minister Celso Amorim said the pipeline would not be feasible without Petrobras’s participation.

Japanese-Russian talks advance on ESPO oil line

Talks between Japan and Russia are said to be progressing over a proposal to have Japanese firms join Russian development of an East Siberian oil field in connection with the project to lay the 4,188-km East Siberia Pacific Ocean ESPO crude oil pipeline.

Reports say the two sides have not yet agreed on which specific Siberian oil field they will develop but that Japan Oil, Gas & Metals National Corp., an independent administrative agency in oil development in eastern Siberia is being considered as a participant, while private sector firms such as Sumitomo Corp. and Inpex Corp. also have indicated a desire to invest.

The two governments are talking to prepare for a deal that was expected to be concluded by Japanese Prime Minister Junichiro Koizumi and Russian President Vladimir Putin when they met this month on the sidelines of the Group of Eight summit in St. Petersburg.

Russia has long said it may be possible to export as much as 80 million tonnes/year of oil through the fully extended pipeline, but that meeting such a target will depend on output from fields in eastern Siberia which have yet to be developed.

The Japanese side hopes that an agreement with Russia on development of the fields, in which the oil produced will be exported to Japan, will speed the early construction of the eastern half of the projected ESPO line so that the Siberian oil can be shipped to Japan.

Due to such commercial considerations, Russia has not decided when, if ever, to start construction of the eastern half of the line, although it started building the western half on Apr. 28 under a plan to complete the portion in 2008.

The western half will start from Taishet near Lake Baikal and will extend to Skovorodino near the Russian-Chinese border, the midpoint of the entire pipeline route. From there, Russia plans to export oil to China via railroad or a branch line of the pipeline.

French plan would push biofuels, energy savings

French Finance, Economy, and Industry Minister Thierry Breton in late May announced a “very ambitious biofuels development plan” along with an elaborate energy-savings program in which all gas, heating oil, and electricity suppliers and “all the players within the automobile world” must participate under threat of financial penalties.

“Oil is henceforth a rare and costly product,” Breton said, saying the plan will “prepare France for the post-oil period.”

A law will make it compulsory for anyone distributing motor oil in France to be “totally transparent and provide permanent information on prices.”

Breton had called a June 7 meeting of oil, automobile construction, and agricultural players to examine the plan under which “consumers must be free to choose” their motor fuel in service stations by 2010. He means E85 biofuel-an 85% ethanol-15% fossil fuel mix-alongside the usual fossil fuel.

The government on June 1 tested seven Ford “flexfuel” vehicles in one of France’s agricultural regions that produce ethanol-adaptable crops.

Jean-Louis Shilansky, delegate general of the oil industry trade group Union des Industries Pétrolières, described France’s plan to accelerate the use of biofuels in transport as “an important project, which merits examination.” But he viewed it with caution because it will involve service stations’ offering both fossil motor fuels and biofuel on an equal basis by 2010.

Even with oil hovering at $70/bbl, a liter of biofuel is 30% more costly than a liter of gasoline, and “(biofuel) would need to be massively detaxed,” Schilansky said. He told OGJ that the government first needs to study all the plan’s “logistics, economic, and fiscal aspects.”

For example, he wondered whether the compulsory nonstop information on service station fuel prices might pose compliance and competition problems for small service stations.

Moreover, the choice of an ethanol-based biofuel in a country where most vehicles run on diesel will further destabilize France’s refining industry, which already must import diesel and export surplus gasoline.

In addition, the new system would require a new generation of automobiles. The president of PSA Peugeot-Citroën said gasoline currently contains only 2% biofuels, and existing cars can tolerate only 10% without modification.

Storm-water permit exemption takes effect

An exemption for oil and gas producers from a federal storm-water permit requirement took effect June 12, the US Environmental Protection Agency said.

The exemption, mandated by the Energy Policy Act of 2005, means that uncontaminated storm water discharged from exploration and production activities does not require a National Pollutant Discharge Elimination System permit.

Producers still will be encouraged to use best management practices for field construction to minimize erosion and control sediment during storms, EPA said. States also retain the right to regulate these activities under other laws and authorities.

“EPA’s final action on clarifying this matter is important because the industry will be regulated the same whether it’s constructing or operating a well,” said Lee O. Fuller, vice-president for government relations at the Independent Petroleum Association of America.

He said the revisions prevent a potential loss of 1.3-2.9 billion bbl of crude oil and 15-45 tcf of natural gas, as estimated by the Department of Energy.

“The industry will continue to manage storm water in an environmentally effective way,” he said.

Industry ScoreboardLarge oil discovery reported in N. Iraq

DNO ASA, Oslo, said its Tawke-1 exploration well in the northern Kurdish region of Iraq discovered 100 million bbl of recoverable oil in a single zone using a 30% recovery factor.

The unspecified shallow discovery zone flowed 5,000 b/d of good quality oil, a rate restricted by test equipment.

Of six intervals tested, two were found to contain formation water (OGJ Online, Mar. 24, 2006). Two deep and two shallow intervals tested oil, but reserve estimates were not made for the other three. Only one of the shallower zones achieved a commercial flow rate. Production is to start in the first quarter of 2007.

The other indicated oil-bearing intervals are assumed to have been damaged by drilling fluid and have cement behind casing that restricted oil flow. Several repair attempts failed to improve the flow rates, and two other potential oil-bearing intervals in the shallower section were not tested.

The company recovered good quality oil from all of the oil-bearing intervals tested.

DNO plans to drill Tawke-1A, a twin well 20 m away, through the shallower reservoir intervals penetrated at Tawke-1. Then it will drill Tawke-2, a 2-km west step-out.

Acquisition of 204 sq km of 3D seismic in the Tawke area began in May, and a second rig is to start drilling in July.

Kerr-McGee tests oil in Bohai Bay wildcat

Kerr-Mc-Gee Corp., operator of Block 04/36 in Bohai Bay, China, has made a “possible discovery” with its CFD 22-2-1 well, reported Stone Energy Corp., Lafayette, La.

Stone is participating in the drilling of two exploratory wells on separate concessions in exchange for options to earn interests in the areas, which cover a total of 1 million acres.

It said the CFD 22-2-1 well, drilled to TD 9,065 ft, encountered potential oil pay in two intervals. A drillstem test of one zone flowed oil at an average rate of 700 b/d. The operator cut sidewall cores.

Stone said appraisal drilling is planned.

The second exploratory well in which it will participate is expected to be spudded by yearend.

Statoil has two Tampen area oil strikes

Statoil ASA, operator of Production License 050, reported two oil discoveries in the Tampen area of the North Sea.

Exploration well 34/10-49 and a sidetrack probed five targets-Epidot, Alun, Spinell, Sølvkåpe, and Apollo-in Cretaceous and Jurassic sandstones.

The deepest borehole, 34/10-49 S and B, bottomed in Early Cretaceous rocks 5,480 m beneath the seabed.

The 34/10-49 A sidetrack extended for 3,312 m and made the discoveries in Middle Jurassic Epidot and Alun sands.

Lars Christian Bacher, senior vice-president for the Tampen cluster, estimated combined reserves at 15 million bbl of oil equivalent.

Statoil said the discoveries could be tied back to Gullfaks field 5 km to the northeast.

The 34/10-49 well will be plugged. Diamond Offshore’s Ocean Vanguard semisubmersible, which drilled the well, will move to the Norwegian Sea to drill Statoil’s Valkyrie prospect.

Statoil has a 61% interest in PL 050. Petoro AS has 30%, and Norsk Hydro Produksjun AS has 9%.

Firms look to tap Philippine Calauit oil

Vital Resources Corp., Calgary, plans to acquire 100% of private Bentley International Oil Ltd.’s interest in a May 26 farmout agreement with NorAsian Energy Ltd. of the Philippines that covers service contracts 50, 51, and 55 in the Northwest Palawan-Mindoro basin.

NorAsian and Vital plan to develop the Calauit oil discovery using three horizontal wells. That development “will provide the oil production revenue to advance the additional world-class drilling targets that have been identified on this 3.7 million acre land position,” said Vital.

The agreement gives Vital the right to individually earn a 30% net working interest in each service contract.

Calauit-1B, an early 1991 discovery on 425,000-acre SC 50, is calculated to have 8.91 million bbl recoverable, or 16.3% of oil in place. The well, in 292 ft of water 100 miles north of Palawan Island, flowed 3,200 b/d of 32.6° gravity oil from a late Oligocene limestone. TD is 7,282 ft.

Calauit was to have been the subject of an extended production test in 1997 (OGJ, Feb. 10, 1997, p. 64).

Vital plans to reenter Calauit-1B in late 2006 or early 2007 and drill a 500-m lateral at the top of the 154-m thick oil column. The first lateral is likely to produce 10,000-15,000 b/d. At 2.1 miles south-southeast is South Calauit-1, which flowed 3,286 b/d in early 1992.

The plan for 1.1 million acre SC 51 in the East Visayas basin calls for seismic in mid-2006 and drilling in 2007. The block has the undeveloped Villaba-1 discovery with a 19-m gas column on the Leyte Block and a number of seismic prospects on the Cebu Straits Block.

The plan for 2.2 million acre SC 55 in the Southwest Palawan basin is for seismic in mid-2006 and drilling in 2008. Several large geologic structures including reefs and turbidite sands have been identified.

Spartan enters PSA with Belize

Spartan Petroleum Corp., Houston, has entered a production-sharing agreement (PSA) with the government of Belize covering 250,000 acres in the northern portion of the country.

Spartan said it will start geophysical work soon.

The PSA is one of five awarded since 2005 by the country, which recently had its first commercial oil discovery (OGJ, Mar. 6, 2006, Newsletter).

Drilling & Production - Quick TakesBPZ Energy to drill three wells off Peru

BPZ Energy Inc., Houston, plans in late July to spud the first of three wells on Block Z-1 in Corvina gas field off northwestern Peru as part of a gas-to-power project.

The $126.7 million project entails drilling three initial wells, recompleting a shut-in gas well, and constructing a 10-mile pipeline to transport gas to a planned 160 Mw gas-fired power plant.

BPZ has secured a 2-year rig contract from Petrex SA, a South American subsidiary of Saipem SPA (OGJ Online, Dec. 29, 2005).

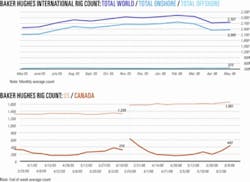

US drilling continues slow climb

US drilling activity continued its slow growth with 1,661 rotary rigs working the week ended June 9, 4 more than the previous week and up from 1,339 during the same period last year, said Baker Hughes Inc.

The bulk of the increase was in land operations, up by 9 rigs to 1,539 working. Activity in inland waters gained 1 rig to 25 drilling. Offshore drilling declined by 6 rigs to 97 in US waters, including the decrease of 4 to 92 in the Gulf of Mexico.

Texas accounted for most of the increase, up by 7 rigs to 749 working. Wyoming increased by 4 rigs to 100, while Louisiana had gain of 1 rig to 199. Oklahoma and Alaska were unchanged, with respective rig counts of 182 and 9. California’s rig count dropped by 5 to 29, while New Mexico lost 4 to 95. Colorado was down 2 rigs to 90.

Canada’s weekly rig count jumped by 150 to 443, up from 319 a year ago.

Processing - Quick TakesSabic, citing costs, stops cracker project

Saudi Basic Industries Corp. Europe has halted a cracker project in the Netherlands, citing “too high” investment costs and financial risks.

Sabic was in the engineering stage of a large expansion at its ethylene plant in Geleen (OGJ, Apr. 24, 2006, p. 20).

“The main cause for the high investment costs is the current overstrained market situation in the global contracting and construction market due to the many investments projects in the oil, gas, and energy market worldwide,” said Sabic Europe Chief Executive Frans Noteborn.

Syncrude’s Mildred Lake plant due FGD unit

Syncrude Canada Ltd. has let a $40 million contract to Washington Group International Inc. to perform detailed engineering and procurement services for an emissions reduction project at its synthetic crude oil production site in Mildred Lake, Alta.

Washington Group will retrofit a flue gas desulfurization (FGD) system into the operation of the two existing fluid cokers. This work is separate from the FGD unit that was recently shut down due to residents’ complaints of odorous emissions believed to be associated with the start up of the unit. Those repairs could take 1-2 months (OGJ Online, June 2, 2006).

Contract let for Sarroch sulfur units

Saras SPA has let a contract to a unit of Foster Wheeler Ltd. for a gasoline desulfurization unit and related facilities at its 300,000 b/cd Sarroch refinery in Sardinia, Italy.

Foster Wheeler will handle engineering and procurement for a 180 cu-m/hr hydrodesulfurization unit designed to reduce the sulfur content of a gasoline blending component to 7 ppm by weight while minimizing octane loss. The contract also covers two independent tail gas treatment units, each with 36 tonnes/hr capacity, designed to achieve minimum overall sulfur recovery of 99.9%.

The contract also includes an option for construction supervision services by Foster Wheeler Italiana SPA.

Plant to make biodiesel from crude palm oil

Mission Biotechnologies Sdn. Bhd., a subsidiary of Mission Biofuels Ltd., Perth, Australia, said it will use crude palm oil as primary feedstock at a biodiesel and glycerine purification refinery under development at Kuantan Port in Pahang, Malaysia.

It has secured access to the feedstock at a low cost relative to European producers. And it has secured a 5-year agreement with a European trading house for the sale of as much as 250,000 tonnes/year of biodiesel.

The refinery, scheduled to be commissioned in 60 weeks, is expected to produce 100,000 tonnes/year of biodiesel.

Petrobras to produce soy oil, diesel mix

Brazil’s Petroleo Brasileiro SA (Petrobras) said it would introduce a pioneering low-sulfur diesel production technology involving vegetable oils at two refineries by 2008.

Paulo Roberto Costa, Petrobras downstream director, told a press conference that the H-Bio technology will combine diesel fractions from distillation, cracking, and delayed coking with soy oil and hydrogen as raw materials to produce high-quality diesel with mineral fuel qualities.

“We’ll be planting diesel from now on,” Costa said. “It’s a very positive marriage between agriculture and oil.”

Brazil is already a pioneer in mass use of sugar cane-based ethanol as a vehicle fuel.

Costa said the new diesel plan would run parallel with regular biodiesel output programs and traditional petroleum diesel production. Brazil will blend 2% biodiesel with normal diesel starting in 2008.

Petrobras has tested the process at its 145,000-b/d refinery in Minas Gerais state, using a blend of as high as 18% of soy oil with mineral raw materials and hydrogen in the hydrotreatment unit.

“Economically, the test was very positive, showing a very interesting price composition. Basically, it was cheaper (than the normal process),” Costa said.

Petrobras plans to use 10% soy oil in the two refineries where the technology will be installed next year and in 2008. The program should be expanded to five refineries in the following few years.

Transportation - Quick TakesKazakhstan to join BTC pipeline

Kazakh President Nursultan Nazarbayev said his country will become part of the Baku-Tbilisi-Ceyhan oil pipeline this month after it signs a formal agreement with Azerbaijan.

The document is expected to be signed on June 17. Kazakhstan had support from US President George W. Bush, who sent a letter to Azerbaijan’s President Ilham Aliyev.

In April, Baku-Tblisi-Ceyhan Pipeline Co. representatives talked with numerous oil producers in Kazakhstan about securing crude oil for transmission (OGJ Online, Apr. 21, 2006).

The first tanker with 700,000 bbl of crude oil from the pipeline left the Turkish port of Ceyhan on June 6.

South Caucasus Gas Pipeline starts line-fill

BP PLC has begun line-fill of the South Caucasus Gas Pipeline, which will transport gas from Shah Deniz field in the Caspian Sea off Azerbaijan to Erzurum in Turkey.

Azerbaijan’s Industry and Energy Minister Natik Aliyev told reporters that construction of the SCGP is in its last stage as planned and that the line has been subjected to hydraulic testing.

Aliyev said Shah Deniz gas would reach the Georgian-Turkish border by the end of September.

The 690 km pipeline runs from Shah Deniz gas field through Baku and the Georgian capital of Tbilisi to Erzurum, Turkey, alongside the Baku-Tbilisi-Ceyhan crude oil pipeline, also near completion (see map, June 27, 2005, p. 61).

Iran books two more tankers to store crude

National Iranian Tanker Co. chartered two more very large crude carriers to store crude oil from Soroush and Nowruz fields in the Persian Gulf.

Iran already has seven VLCCs under contract for use as storage because of difficulties selling heavy, sour crude.

Norwegian shipbrokers confirmed contracts for the 313,679-dwt Stena Vision and the 302,493-dwt Edinburgh for up to 120 days.

The bookings raise NITC’s floating storage capacity to 18.4 million bbl.

Keystone project gas-line conversion sought

TransCanada Corp. has filed an application with the National Energy Board (NEB) for conversion of a portion of the company’s natural gas pipeline to crude oil transportation.

The conversion is part of the proposed 1,830-mile Keystone Pipeline project, expected to transport 435,000 b/d of heavy crude from Hardisty, Alta., to Wood River and Paktoa, Ill. Capacity would be expandable to 590,000 b/d with additional pump stations (OGJ Online, Aug. 9, 2005).

The application involves the Canadian portion of the $2.1 billion project, which calls for the construction of 230 miles of pipeline and conversion of 530 miles of TransCanada’s Canadian Mainline gas pipeline.

The US portion of the project includes 1,070 miles of pipeline construction.

TransCanada earlier said it had secured firm, long-term shipper commitments for transportation of 340,000 b/d of oil for an average of 18 years. It said shippers also have expressed strong interest in a proposed south extension of the Keystone pipeline to Cushing, Okla. A binding open season will be held later this year for the Cushing extension, which would add 291 miles of pipeline in Nebraska, Kansas, and Oklahoma at an estimated cost of $445 million.