CO2 injection gains momentum

Oil & Gas Journal’s exclusive biennial enhanced oil recovery (EOR) survey, p. 45, shows that the industry continues to increase the number of carbon-dioxide-injection EOR projects, while steam injection is producing less oil in California and more in the heavy oil and bitumen regions of Western Canada.

EOR methods provide a way to improve recovery factors in many of the world’s known oil reservoirs. While these projects typically have higher operating costs than conventional production, they do not have the exploration costs and risks associated with finding new hydrocarbon accumulations.

EOR projects usually are long-lived. As a result, companies tend to use long-term price forecasts to justify initiating them, and therefore the EOR survey tends to reflect the industry’s economic perceptions from several years ago.

Other factors that may suppress the initiation of new projects include high natural gas prices that increase the cost of generating steam and contracts that tie the purchase of CO2 for enhancing oil recovery to the price of oil.

Another problem is a limited source for CO2. For instance, even the Permian basin of West Texas and New Mexico requires major new investments in the CO2 source fields and the pipeline infrastructure to deliver additional CO2 to the basin, according to various sources

The interest in CO2 sequestration because of a fear of global warming may in the future make additional CO2 sources available (OGJ, Mar. 20, 2006, p. 18). Already, the industry has announced several potential power-generation-to-CO2 for EOR projects, but the final decision on initiating them has yet to be made.

Proposed projects that obtain CO2 from new power-generating plants and inject it into oil fields include two projects that involve BP PLC. One project would inject CO2 into the North Sea Miller oil field, while the other would supply CO2 to oil fields in California.

Statoil ASA and Royal Dutch Shell PLC have proposed another project. This would obtain CO2 from proposed power and methanol plants in Norway and inject it offshore in the Draugen and Heidrun oil fields.

The companies indicate that CO2 injection in these fields may start in 2009-11.

Survey description

OGJ published its first EOR survey May 3, 1971, and the survey has been a regular biennial OGJ feature since 1974.

Tables A through E (pp. 45-57) lists projects in the 2006 EOR survey.

Listed are those that involve injecting fluids into a reservoir other than water or methane to improve or enhance oil recovery. Operators use the injectants during the initial production stage, after primary depletion or secondary production, which also is known as tertiary recovery.

The most common injectants include:

• Steam in heavy oil fields at shallow depths.

• Air for in situ combustion projects.

• Carbon-dioxide floods in lighter oil fields.

• Hydrocarbon miscible gas in lighter oil fields.

• Chemicals and polymer in lighter oil fields.

Acid gas, a concentrated stream of hydrogen sulfide and carbon dioxide, is a new type of injectant seeing its first applications for EOR. Apache Canada Ltd. has started a pilot in the Zama field in northwestern Alberta and now estimates that the injection is adding 1,000 bo/d to production.

Chevron Corp.’s 2005 annual report says that sour-gas injection will also be part of the second-generation project in the Tengiz field in Kazakhstan. It estimates that this expansion will increase production to between 430,000 and 500,000 b/d by late 2006 from the current 298,000 bo/d, depending on the effects of sour-gas injection.

Chevron’s report describes sour-gas injection as taking a portion of the rich, sour gas separated from crude oil production and reinjecting it into the Tengiz and Korolev reservoirs. It expects the injection to have two key effects:

1. Reduce the requirement for sour-gas processing capacity, thereby increasing liquid production and decreasing the sulfur and gas generated.

2. Increase production efficiency and recovery by maintaining higher reservoir pressure because of the gas reinjection.

It lists the primary uncertainties as compressor performance associated with injecting high-pressure sour gas and subsurface response to injection.

US projects

OGJ’s survey shows that EOR contributed 649,000 b/d to US oil production (Tables 1 and 2), which is a 14,100 bo/d decrease from the previous 2004 survey (OGJ, Apr. 12, 2004, p. 45). The survey covers 153 active projects, which is an increase of 10 projects compared with the 2004 survey.

Oil production from mature thermal heavy-oil projects in California is the main reason for the lower production. Production from these projects peaked in 1986 at 480,000 bo/d and has declined to the current 286,000 bo/d.

Chevron Corp.-operated Kern River field remains the largest single EOR project in the US, producing about 86,000 b/d, but this is a sizable decrease from the 100,000 b/d listed in the 2004 survey. In California, Chevron’s thermal EOR projects produce 159,000 b/d.

Aera Energy LLC, a venture of ExxonMobil Corp. and Shell Inc., has the second most thermal EOR production, producing 107,000 bo/d from 16 projects, but this also is a decrease from the 141,000 bo/d listed in the 2004 survey.

Oil production from combustion production is on the increase in North and South Dakota as well as in Montana. Encore Acquisition Co. has three new projects and Continental Resources Inc. has added two more to its previously listed six.

Production from these fields and from the Bellevue combustion project in Louisiana is now 13,260 bo/d, compared with the 1,901 bo/d listed in the previous survey. The largest producer is Continental Resources’ Ceder Hill North Unit in Bowman Co., ND. The company says the unit produces 8,100 bo/d.

In the US, the number of CO2 miscible injection projects for enhancing oil recovery has increased (Table 1). The survey lists 80 ongoing projects compared with the 70 in the 2004 survey. Enhanced oil recovered from these projects also has increased to 234,000 b/d from the 206,000 b/d shown in the previous survey.

Units of Occidental Petroleum Corp. continue to add CO2 projects, either through acquisitions or new project startups. Oxy operates 27 projects compared with 18 listed in the 2004 survey.

The article on p. 42 discusses the North Hobbs Unit CO2 one of Oxy’s more recent successes.

Another highlight in CO2 EOR is that Anadarko Petroleum Corp. is adding projects in Wyoming after completing a pipeline to transport CO2 to the Salt Creek field and Monell Unit in 2003. The source for the CO2 is ExxonMobil Corp.’s La Barge gas plant in western Wyoming.

Another company initiating new floods is Denbury Resources Inc. It now has seven active floods in Mississippi compared with the two listed in 2004.

One disappointment for CO2 flooding is the miscible CO2 pilot in the Kansas-Lansing formation in Russell Co., Kansas. The US Department of Energy (DOE) partly funded the Hall-Gurney field pilot. The project operator is Murfin Drilling Co. with the University of Kansas Center for Research Inc. as one of the participants.

CO2 injection started in the pilot in December 2003 and to date the project reports that the hoped for oil bank has not arrived at either of the two producing wells. As noted on the survey response, to date about 95% of the CO2 remains in the formation. CO2 injection stopped in June 2005 with 0.19 bcf CO2 injected, after which water injection started in the pilot. The survey response said the poor results are because the reservoir is more heterogeneous and far more complex than anticipated.

Before the pilot, an estimate said that CO2 flooding in the Central Kansas uplift could potentially recover 150 million bbl oil (OGJ, Oct. 11, 1999, p. 38).

To save space, the survey listing no longer includes a section on polymer and chemical floods in the US because only one response was received. Continental Resources indicates its polymer flood in the Cottonwood Creek, Washakie, Wyo., is half finished. The payzone is the Phosphoria limestone at 7,900 ft that has a 10.4% porosity and 16-md permeability. The 40-acre project started in 1999 and produces a 30° oil. Continental did not list the oil production from the project but did note that the project is successful.

Canadian EOR

Some of the first phases of Canada’s many planned steam-assisted gravity drainage (SAGD) projects in the oil sands in Alberta have started.

PetroCanada Corp. started production from its MacKay River SAGD project in 2005 was up to 30,000 bo/d. Suncor Energy Inc. Firebag SAGD has reached 29,000 at yearend 2005, with plans to increase production to about 140,000 b/d by 2010. It estimates that the Firebag project has 9.3 billion bbl of reserves in place.

Encana’s Christina Lake SAGD project may produce between 50,000 and 70,000 b/d from up to 700 horizontal wells by 2009. Also a $350-million expansion of Japan Canada Oil Sands Ltd. (Jacos) SAGD Hangingstone pilot is slated to produce 50,000 bo/d by 2007. Current production is 9,000 bo/d.

Canadian Natural Resources Ltd.’s Primrose and Wolf Lake oil sands project includes both cyclic and SAGD technologies. These projects produce about 45,000 b/d and CNRL has plans to expand production to 120,000 b/d during the next 15-20 years by drilling about 600 new horizontal wells and installing additional facilities.

OPTI Canada Inc. and partner Nexen Inc. are developing the $3.4-billion Long Lake oil sands project that is the first oil sands project to integrate SAGD with an on site upgrader.

The companies estimate that the project contains more than 1 billion bbl of recoverable bitumen. They plan to begin production in 2006 with the upgrader starting up in 2007. The plans include the SAGD wells producing 72,000 b/d that will be upgraded to about 60,000 b/d of synthetic crude.

ConocoPhillips recently started building its $1.4-billion Surmont oilsands project that will start producing in 2006 and is expect to reach production of 27,000 b/d.

The largest steam project remains Imperial Oil Ltd’s. Cold Lake. After a recent expansion, Cold Lake production has increased to 139,000 b/d. Imperial uses a phased development approach to the area that may increase production to 180,000 b/d in the next few years. The company has also started an enhanced cyclic-steam pilot in the field.

Encana’s Weyburn CO2 miscible flood remains the main CO2 flood in Canada, producing more than 6,500 b/d of incremental oil. It buys its CO2 from the Dakota Gasification Synfuels plant, Beulah, N.D., and is recognized as the world’s largest joint implemented project for reducing CO2 emissions.

Apache Canada has started injecting CO2 in the Midale field, also with CO2 purchased from Dakota Gasification plant.

Other countries

The PT Caltex-operated Duri field on Sumatra Island in Indonesia remains the largest single EOR project in the world, producing about 220,000 b/d.

Other countries with active EOR projects include China and Venezuela, although up-to-date statistics for these projects were unavailable at press time.

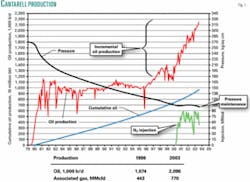

Petróleos Mexicanos has had good success in increasing oil production with immiscible nitrogen injection in the offshore Cantarell field (Fig. 1), where oil production increased to more than 2 million b/d in 2004 from 1 million b/d in 1996. Pemex has said production from the field has started a decline. In a recent presentation, Pemex said that it may start nitrogen injection in the Ku-Maloob-Zapp, Bermudez, and Jujo Tecominoacan fields (OGJ, Jan. 23, 2006, p. 8).

Chevron’s annual report also says that it has initiated a small-scale steamflood pilot in a field that it operates in the Neutral Zone between Kuwait and Saudi Arabia. ✦

About this report...

Every 2 years, Oil & Gas Journal surveys worldwide projects that use various injection technologies to enhance oil recovery. Tables showing the projects surveyed start on p. 45, while the following pages describe events and trends affecting EOR activity levels.