OGJ Newsletter

General Interest - Quick Takes

PDVSA takes over oil fields

Venezuela’s Ministry of Energy and Mines has voided operating service agreements with Total SA for Jusepin oil field and Eni SPA for Dacion oil field and made Petroleos de Venezuela SA operator.

Energy Minister Rafael Ramirez said the companies failed to meet a government requirement for conversion of their contracts into a joint venture with PDVSA as majority owner.

“We are waiting for a resolution with these operators after they exhausted the possibility of entering into the mixed companies,” Ramirez said.

Jusepin field produces 30,000 b/d of oil and was operated by Total with a 55% interest in a partnership with BP PLC, which held the remaining interest. Eni’s Dacion field has an output of about 60,000 b/d of oil.

Total said it is considering alternatives in how to react to the takeover, while Eni said it intends to seek reparations and possible legal action, since it believes PDVSA has violated its contractual agreement.

Most companies operating in Venezuela have agreed to the migration of their contracts into PDVSA majority-held operations. According to Ramirez, 17 companies, including majors Chevron Corp. and Repsol YPF SA agreed to the contract changes that gave PDVSA a minimum of 60% ownership of the operations.

Separately, Statoil ASA said it reached a settlement transferring its 27% interest in LL652 oil field in Lake Maracaibo to PDVSA. No terms were disclosed.

Statoil continues as operator of Block 4 of Plataforma Deltana and has an interest in the Orinoco Belt heavy crude Sincor project. It and Total are presently negotiating with the ministry over alleged back taxes imposed on the project.

AGA: US gas reserves highest since 1984

US natural gas reserves at the end of 2005 were at their highest level since 1984, the American Gas Association reported Mar. 31.

Gas reserves grew to more than 197 tcf from 193 tcf at the end of 2004, AGA said. The annual analysis is based on figures reported by the 30 largest US reserves holders, which account for about half of the US total.

Production growth hasn’t followed the increase in reserves, noted Chris McGill, AGA’s managing director of policy analysis.

“In 2005, over 27,000 gas wells were completed in the United States, which is the highest level of completions on record,” he said. “However, most of these wells were drilled onshore in shale, tight sands, and coal seams, which are low-yield and slow-yield resources,” McGill said.

AGA said operators produced 18.3 tcf of gas in the US last year, down slightly from 2004, largely due to hurricanes in the Gulf of Mexico.

At the same time, drilling and revisions to earlier estimates added as much as 35.7 tcf to reserves, allowing total domestic reserves to grow for a 7th consecutive year.

AGA expects production capacity to remain at 18-19 tcf/year for the foreseeable future unless policies change to increase producer access to US resources.

Energy market citations hit 18 EU states

Following a Feb. 21 warning, the European Commission issued formal notices Apr. 4 citing 18 European Union member states for failure to officially and effectively implement its directives on opening gas and electricity markets or, in the case of Spain, failure to apply them properly.

The letters-a “start of firm action” to remedy identified weaknesses in European markets-were sent to Austria, Belgium, the Czech Republic, Germany, Estonia, Spain, Finland, France, Greece, Ireland, Italy, Lithuania, Latvia, Poland, Sweden, Slovakia, and the UK. The commission is still investigating Hungary and Portugal.

The notifications warned that if a member state could provide no assurance that it intends to amend its energy laws, the commission would involve the European Court of Justice. It is doing so with Spain and Luxembourg, which have not yet submitted the directives to their legislative bodies.

Completion of internal gas and electricity markets is one of six priorities in the commission’s strategy, adopted last March, for “sustainable, competitive, and secure energy.”

Energy Commissioner Andris Piebalgs stressed that the directives must be implemented quickly and in full, “not only in form but also in substance.” The strategy, he said, will not be possible without open, competitive energy markets to enable EU companies to compete Europe-wide.

In addition, differences in the ways EU members are opening their markets will hamper development of a genuinely competitive market.

The commission focused on points that guarantee competition, such as the extent to which markets are opened; the real possibility of changing suppliers; the emergence of new market entrants with nondiscriminatory access guaranteed by strong, independent regulators; and the guarantee of consumer protection.

Iraqi officials confirm reduced oil exports

Iraqi oil officials have confirmed reduced exports of crude oil, largely due to attacks on northern facilities, but are taking steps to ensure continued exports via the country’s southern terminals.

Even as they were giving their reports, Al-Arabiya TV of Dubai on Mar. 30 reported that new explosions had targeted pipelines carrying crude oil from northern fields to the country’s main refining center at Baiji.

Oil Minister Hashem al-Hashemi said the country cannot export oil via the northern pipeline system because of extensive damage from saboteurs. He said a manifold had been destroyed and will take 8-12 months to repair.

Production from the northern fields, averaging around 250,000 b/d in March, has been shut in.

Overall, Iraq’s exports have dropped to their lowest level since 2003 at 1.1 million b/d in December and January due to the sabotage in the north along with bad weather and logistics problems in the south.

But Hashemi said Iraq’s production of crude oil is stable at 1.9-2.1 million b/d. He said March exports via the country’s two main Persian Gulf terminals would reach 1.5 million b/d.

Meanwhile, to help ease the logistics problems and boost exports, another official said Iraq has hired two tugboats to escort oil tankers in and out of its southern oil terminals and plans to purchase as many as five new tugs.

Shamkhi Faraj, head of oil marketing and economic affairs in the oil minister’s office, said the two rented tugs are at work at the Basra and Khor al-Amaya terminals.

However, Faraj said Iraq can’t export more than 1.6 million b/d from the south for a variety of reasons, including a lack of investment in southern oil fields, which are producing around 1.75 million b/d. ✦

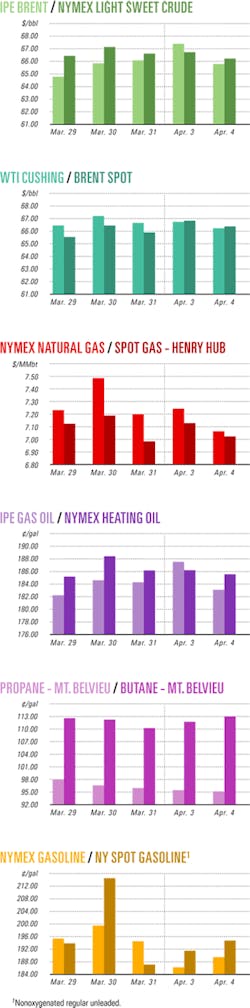

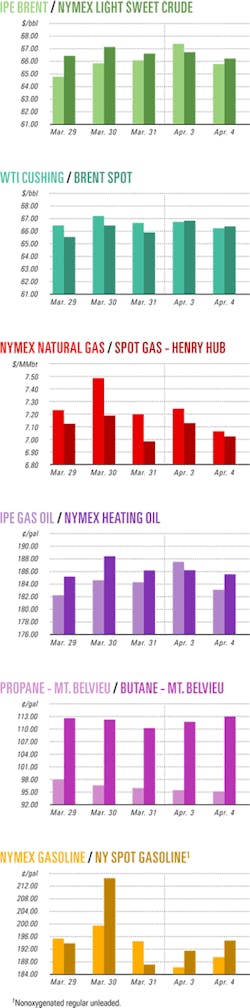

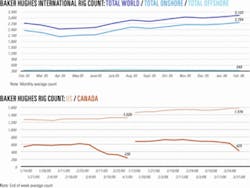

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Chevron group suspends Hebron development

Chevron Canada Ltd. and partners have agreed to suspend negotiations with the government of Newfoundland and Labrador on development of offshore Hebron oil field.

“Significant and fundamental gaps remain on fiscal terms and benefits that would enable the project to proceed in a viable manner,” said Chevron Canada Pres. Alex Archila.

The partners previously deferred development of the field, which lies 350 km off Newfoundland and Labrador, citing complex and demanding reservoir characteristics (OGJ Online, Feb. 13, 2002).

“Hebron poses a number of challenges due to the high degree of technical complexity associated with recovering heavy oil in a harsh marine environment,” Archila said.

Field activities might revive if a definitive agreement is reached with the provincial government, Chevron said.

Hebron partners are Chevron Canada, operator, 28%; ExxonMobil Canada Properties 37.9%; Petro-Canada 23.9%; and Norsk Hydro Canada Oil & Gas Inc. 10.2%.

Large structures seen in Taoudeni basin

A first-time comprehensive review of existing exploration data on the Taoudeni basin in Mali and Mauritania showed large to regional scale structures, said Baraka Petroleum Ltd., Perth.

The company is discussing farmouts with interested parties.

Satyavan Reymond, Baraka’s chief operating officer, said the desktop review of reprocessed seismic, magnetic, and well data “confirmed the expected stratigraphy and favorable structural style, as well as delineating the extent of the Ordovician and Infra-Cambrian play fairways in Baraka’s 260,000 sq km gross acreage holding in the Taoudeni basin.”

Ordovician and Infra-Cambrian formations are producing 1.23 million b/d of oil and 445,000 b/d of condensate in the nearby and related Ahnet and Illizi basins in Algeria, Reymond noted.

“Within the Taoudeni, the seismically observed structures are large to regional scale anticlinal features and large monoclines with widths typically in excess of 10 km, which are expected to extend laterally over large areas and possibly have closure over several hundred square kilometers,” he added.

Baraka identified 40 oil and gas leads along the defined structural trends. The company noted that Taoudeni is practically unexplored, with four wells and 12,500 line-km of seismic in an area more than twice the size of Texas (see maps, OGJ, May 23, 2005, p. 39).

A $3.7 million regional airborne gravity and magnetic survey of Baraka’s five Mali blocks is 20% complete and is to be finished by September.

Swift to acquire stake in Alaskan acreage

Swift Energy Co. has entered into an agreement with Aurora Gas LLC to acquire a 37.5% working interest in onshore acreage in the Cook Inlet basin of Alaska (OGJ, Dec. 9, 2002, p. 18).

Swift will acquire half of Aurora’s working interest in seven areas covering 54,500 acres.

The companies soon will spud the Endeavour 1 exploratory commitment well, in which Swift has a 50% working interest, with Aurora as operator.

At least six other prospects have been targeted on the acreage in two main plays: the Hemlock-Tyonek oil play and the Beluga-Sterling gas play.

Uzbekistan, South Korea sign E&D agreement

On a state visit to Uzbekistan, South Korean President Roh Moo-hyun signed an agreement with Uzbek President Islam Karimov allowing for joint exploration and development of oil and gas fields in the central Asian country.

Under a memorandum of understanding signed among South Korea’s National Oil Corp. (KNOC), Korea Gas Corp. (Kogas), and Uzbekisan’s state-run Uzbeknefgaz, the South Korean firms have the exclusive right to explore and develop two oil fields and two gas fields.

KNOC will carry out preliminary exploration for 6 months in Chust-Pap and Namangen-Terachi in the eastern part of the country with Uzbeknefgaz, while Kogas will cooperate in developing Surgil and Uzunkui gas fields.

Eni block off Brazil due new seismic survey

Eni SPA has let a contract to Petroleum Geo-Services ASA for a 1,500 sq km marine 3D seismic survey on a Santos basin block on which it has drilled three wells.

The survey of BM-S-4 Block will begin by June and take 45-50 days to complete. PGS shot a seismic survey over the block in 2000.

Last year, Eni reported that its 1-ENI-4A-RJS wildcat, drilled to 5,900 m TD in 387 m of water on the block, had gas shows. A well it drilled on the block in 2003 encountered oil but was plugged and abandoned (OGJ, Nov. 28, 2005, Newsletter).

Encore, ExxonMobil to develop West Texas fields

Encore Acquisition Co., Fort Worth, and ExxonMobil Corp. have agreed to further develop seven natural gas fields in West Texas jointly.

Initially, Encore will drill 24 wells in the fields, serving as operator until their completion, after which ExxonMobil will become operator. Encore will assume a 30% working interest in these and future wells in the fields.

The agreement covers formations in Brown Bassett field in Terrell County; Parks, Pegasus, and Wilshire fields in Midland and Upton counties; and Block 16, Coyanosa, and Waha fields in Ward, Pecos, and Reeves counties. The JV will target formations in the Barnett, Devonian, Ellenberger, Mississippian, Montoya, Silurian, Strawn, and Wolfcamp horizons.

Encore, which intends to invest $17 million in 22 wells this year, plans to have four rigs operating in West Texas by yearend. The company said it would propose and drill wells as long as it is engaged in continuous drilling operations.

CNOOC wildcat finds oil in Bohai Bay

CNOOC Ltd. made an oil discovery on Structure BZ28-2S in the Yellow River Mouth Sag of central northern Bohai Bay off China. CNOOC drilled the well to 2,125 m TD in 22 m of water.

The BZ 28-2S-1 well penetrated 85 m of oil pay and 8 m of gas pay. Two drillstem tests conducted over two intervals yielded a combined 1,900 b/d of oil and 2 MMcfd of gas through 7.94-mm and 12.7-mm chokes.

Earlier this year, CNOOC Ltd.’s wildcat Bozhong (BZ) 29-4-2, spudded in Bohai Bay, cut 34.5 m of gas pay and 13 m of oil pay, the company reported. BZ29-4-2, drilled to 3,070 m TD, tested 760 b/d of oil through a 7.94-mm choke (OGJ, Mar. 27, 2006, Newsletter). ✦

Drilling & Production - Quick Takes

Total starts up Glenelg field off the UK

Total SA has started production from Glenelg gas and condensate field in 100 m of water in the UK North Sea, 240 km east of Aberdeen.

Production is from a highly deviated well drilled a total length of 7,300 m from the Elgin platform into a high-temperature, high-pressure reservoir 5,600 below sea level (OGJ, Aug. 22, 2005, p. 45).

Total said the well has potential to produce 30,000 boe/d of gas and condensate.

Production from Glenelg is processed at Elgin-Franklin facilities and will extend the fields’ gas production plateau of 550 MMcfd.

Total, operator, holds a 49.47% interest in Glenelg. Other interests are E.ON Ruhrgas 18.57%, BG International 14.7%, Gaz de France 9.26%, and Eni SPA 8%.

Kerr-McGee starts Constitution field output

Kerr-McGee Corp. has started production from its 100%-owned Constitution oil and gas field in 5,000 ft of water on Green Canyon Blocks 679 and 680 in the Gulf of Mexico.

Flow began Mar. 27 from the first of six planned dry-tree wells processed through the Constitution truss spar on Green Canyon 680. Output from the initial well is 15,000 b/d of oil and 12 MMcfd of gas.

Kerr-McGee expects to reach peak production of 40,000 b/d and 75 MMcfd from all six dry-tree wells by yearend.

The Constitution truss spar was expanded during fabrication to handle additional production from nearby Ticonderoga oil and gas field, which was discovered after Constitution was sanctioned. The spar has processing capacity of 70,000 b/d of oil and 200 MMcfd of gas.

Ticonderoga, brought on line in February from two subsea wells, currently is producing at peak rates of 22,000 b/d of oil and 19 MMcfd of gas. Kerr-McGee operates the field with a 50% interest. Noble Energy Inc. owns the remaining 50%.

Production starts in Sonoran workover program

Sonoran Energy Inc. has begun production of more than 100 b/d of oil equivalent from three of four wells in the first phase of a workover program in Louisiana.

The wells are in Vernon and Rapides parishes. First-phase work included replacing mechanical parts, such as gauges, gaskets, and flowlines; pumping liquid nitrogen downhole; acidizing wellbores; and cleaning production tubulars.

Sonoran also has started the second phase of the workover program, focusing on three wells with the most potential to increase production.

Initial wireline survey results of the second-phase wells indicate that problems may not be as severe as initially suspected. This should simplify repairs needed to restart production.

Sonoran is finishing an additional work program to reactivate the remaining first-phase well and to improve performance from the producing wells in order to boost output to the 200 boe/d it expected to achieve in this phase. ✦

Processing - Quick Takes

Yorktown refinery due S Zorb SRT unit

Giant Industries Inc., Scottsdale, Ariz., has selected ConocoPhillips technology for a 30,000 b/d sulfur removal unit for its 58,900 b/cd Yorktown refinery in York County, Va.

The S Zorb SRT unit will desulfurize gasoline blendstocks. The unit’s design will allow for a flexibility of feedstocks from a variety of refinery sources, including light coker naphtha.

The project, which will be managed by D-CoK LLC, a subsidiary of Triten Corp., Houston, is slated for start-up in 2007.

CEPSA picks UOP for refinery expansion

Spanish integrated CEPSA Group (Compañía Española de Petróleos SA) has let a contract to UOP LLC for eight process units for the expansion and upgrade of its 100,000 b/cd La Rábida refinery in Huelva, Spain.

The project will increase output of middle distillates. CEPSA said capacity utilization at the Huelva refinery is currently about 98%.

UOP will employ proprietary hydrocracking and sulfur removal technologies, including two Merox process units: a Unionfining unit and a Unicracking unit.

The new complex will include a 90,000 b/sd crude distillation unit, a 25,000 b/sd vacuum distillation unit, a 32,000 b/sd gas concentration unit, a 4,200 b/sd LPG Merox unit, a 27,000 b/sd naphtha Merox unit, a 31,500 b/sd distillate Unionfining unit, a 41,200 b/sd atmospheric and vacuum gas oils Unicracking unit, and an amine regeneration and sour water stripper units.

Nippon Oil hikes China Oil consignment refining

Japan’s Nippon Oil Corp. said it will step up refining activity under a consignment agreement with the PetroChina Co. group, raising output next month by 30% to 40,000 b/d.

Under an agreement with PetroChina affiliate China Oil, Nippon Oil processes crude into fuel oil and diesel at six refineries in Japan for delivery to China.

The firms have cooperated in refining operations since 2004, renewing their contracts each fiscal year.

The first contract reached in July 2004 called for 20,000 b/d, with the figure increased to 30,000 b/d for fiscal 2005.

SK lets contract for FCC unit at Ulsan

SK Corp. has let a contract to Shaw Stone & Webster for the basic design, procurement of critical equipment, and project management for a 60,000 b/sd FCC unit at its 817,000 b/cd refinery in Ulsan, South Korea.

Shaw will integrate 14 process units, define the utility and offsite requirements, and provide overall project management assistance. ✦

Transportation - Quick Takes

Oil shipping rates expected to fall in 2006

Freight rates for oil tankers will decline further in 2006 due to excess shipping capacity, analysts told delegates at Intertanko’s Singapore Tanker Event.

Clarksons Research Services Managing Director Martin Stopford said rates will decline in 2006 as owners spent $20.7 billion on new ships in 2005, marking the third successive year of heavy ordering.

Stopford said supply is set to continue to grow by 6% over the next 3 years, but oil trade is expected to grow by just 1.5 million b/d/year until 2010-about 500,000 b/d less than required to meet the fleet additions.

In 2006 alone, Stopford said, there will be 12.1 million dwt of new ships over the demand balance.

RS Platou Director Erik Anderson made a similar forecast, saying the market is declining given that the peak of fourth quarter 2005 was much lower than the peak of fourth quarter 2004.

Anderson said freight rates would decline in 2006-07 as additional oil production and refining capacity would lead to demand growth of just 2-4%, while fleet growth would be higher at 5-6%.

Simon Yang, deputy director of research and development for Cosco, gave a dissenting view for very large crude carriers, saying the outlook for them is “optimistic” in 2006.

Crosstex Energy completes N. Texas Pipeline

Crosstex Energy LP, Dallas, completed construction on the 24-in. North Texas Pipeline (NTPL) covering more than 140 miles across six Texas counties to gather and transport gas produced from the Barnett shale.

Part of the NTPL system went into service in early February, and the remaining portion began transporting gas Apr. 4. NTPL has initial capacity of 250 MMcfd. With added compression, the capacity could be increased to 375 MMcfd, said Crosstex of the $115 million pipeline project.

Producers in late 2004 indicated an interest in a new pipeline reaching Barnett shale fields because existing carriers offered limited capacity, Crosstex said. It bought rights-of-way across Tarrant, Denton, Collin, Fannin, Delta, and Lamar counties starting in early 2005 and began construction in October 2005.

As drilling spread into Parker County, Crosstex also completed construction on the 35 MMcfd Goforth processing plant and an accompanying NGL pipeline.

Crosstex also is designing a processing plant near Azle, where gas will be gathered, processed, and delivered to NTPL via a new 30-mile 16-in. pipeline. An additional gas liquids pipeline from the Azle plant will connect with the Goforth plant.

Azerbaijan official: BTC due May 27 launch

Azerbaijan’s Minister for Industry and Energy Natiq Aliyev said Mar. 30 that the Baku-Tbilisi-Ceyhan oil pipeline will be launched on May 27, describing reports of a postponement as groundless.

“We are making every effort to wrap up our work,” he told Baku’s Lider TV. He said the formal launch ceremony might take place late in June.

“We are determined to spare no effort in completing the work and launching the pipeline on May 27,” Aliyev said.

He was responding to a report by the Turan news agency that said the date of the pipeline commissioning had been changed. It quoted Turkey’s Ambassador to Azerbaijan, Turan Morali, as saying the first shipment of oil from the Turkish port of Ceyhan would take place at the end of June.

The Turan report said the current stage of testing showed that an official ceremony at Ceyhan might be held toward the end of June.

In February, Aliyev said the first tanker to lift crude from the BTC pipeline would depart the Turkish terminal at Ceyhan in May (OGJ Online, Feb. 16, 2006). ✦