General Interest - Quick Takes

Senate committee OKs Sale 181 bill; fight looms

The US Senate Energy and Natural Resources Committee approved a bill to begin oil and gas leasing in the eastern Gulf of Mexico’s Sale 181 area.

The bill, S. 2253, would order Interior Sec. Gale A. Norton to begin the leasing process within 1 year of its enactment. It passed the committee by a 16-5 vote, with one member, Sen. Mary L. Landrieu (D-La.), voting “present.”

The Outer Continental Shelf area was scheduled to be opened for drilling in 2001 before President George W. Bush removed it from consideration.

“This is the most important piece of legislation we have taken up since passing the energy bill last year,” Chairman Pete V. Domenici (R-NM) said following the vote. The committee’s chief minority member, Jeff Bingman (D-NM), and members James M. Talent (R-Mo.) and Byron L. Dorgan (D-ND) are cosponsors.

Dorgan said the bill could help reduce gas prices in North Dakota, which is one of the nation’s heaviest users per capita. Increased domestic production also would reduce US dependence on foreign oil sources, he observed.

But Florida’s senators pledged to fight the bill when it reaches the Senate floor. Their main objection was to a provision that would establish a 100-mile buffer between any leases and the state’s coast.

“Florida needs and demands better protection. A 100-mile buffer is not enough,” declared Republican Mel Martinez, who serves on the committee.

He said Floridians want permanent protection for the state’s coastal areas, which S. 2253 does not address. Martinez and Florida’s other senator, Democrat Bill Nelson, have introduced a bill that would open part of the Sale 181 region but push leasing at least a further 50 miles farther out to sea.

Nelson said that after the vote he told Senate Minority Leader Harry Reid (D-Nev.) he intends to filibuster the bill.

Nelson also said Interior Sec. Norton excluded Floridians from upcoming public hearings on what he said was a plan to open a further 2 million acres in the Gulf of Mexico for oil and gas leasing.

The US Minerals Management Service has proposed redrawing state boundaries in the gulf as part of its draft 5-year OCS proposals for 2007-12. Nelson said this will effectively give Louisiana and Alabama, which he termed “oil-friendly,” control over waters formerly under Florida’s jurisdiction.

The plan includes a provision to issue oil and gas leases within the Sale 181 area. Like S. 2253, it would establish a 100-mile buffer from Florida’s coast. It also would ban or place restrictions on leasing in offshore areas used by the Department of Defense for military training.

Landrieu said she would try to amend S. 2253 to give coastal states a share of royalties generated in the sale area.

The bill’s passage through the Senate committee drew praise from several trade associations. National Petrochemical & Refiners Association Pres. Bob Slaughter called it “a limited and sensible approach to offshore leasing that will increase domestic supplies of oil and gas for the benefit of all the nation’s consumers.”

American Chemistry Council Pres. Jack N. Gerard said, “Today’s bipartisan action sends a signal to the market that ‘help is on the way’ in bringing supplies of natural gas to meet our nation’s growing energy needs.”

Domenici to seek ANWR measure in budget bill

Senate Energy and Natural Resources Committee Chairman Pete V. Domenici (R-NM) confirmed he will press to include Arctic National Wildlife Refuge leasing in this year’s budget resolution.

The disclosure came as he complimented Interior Sec. Gale A. Norton for her department’s support Mar. 2 of environmentally responsible development of oil and gas resources along ANWR’s coastal plain. Norton appeared before the committee to discuss the department’s proposed fiscal 2007 budget.

Domenici also praised Norton for the department’s effort to begin an oil shale leasing program and urged her to move quickly to get streamlined permitting fully operating in the Rocky Mountains.

“We want you to move quickly to get those permits out the door,” he declared, noting that Congress authorized about $20 million/year for the pilot programs at the Bureau of Land Management.

That’s where the money will stay, Domenici pledged. “The repeal of those provisions won’t take place up here,” he said.

He also noted that the Interior Department is expected to issue eight 160-acre leases for six oil shale projects in Colorado and two in Utah before June. Some companies competing for the leases have said extracting oil from oil shale would cost $40-80/bbl, he said.

“I am pleased to see that you requested funding for that program. I think there ought to be more that we can do to spur development of this resource,” Domenici said.

Daukoru: OPEC sees spare capacity market overlooks

The Organization of Petroleum Exporting Countries sees 2 million b/d of spare production capacity that the market does not seem to recognize, OPEC Pres. Edmund M. Daukoru said Mar. 3 in Washington, DC.

“OPEC will discuss extensively how much prices reflect true supply and how much they reflect speculation,” when its members meet Mar. 8 in Vienna, he said.

Daukoru was wrapping up a 3-day visit to Washington, where he met with US government officials, oil company representatives, and potential investors in oil projects.

He called for greater cooperation and dialog between producing and consuming nations.

“It’s the short-term micromanagement that leads to volatility. More reliable information is needed. We have it for supply. We don’t have it for demand,” he said at a luncheon sponsored by the US Energy Association.

Daukoru said more downstream oil capacity needs to be developed. He noted that some of the integrated oil companies that once absorbed downstream shocks with more-profitable upstream operations have sold refining and marketing holdings to independent companies less able to absorb the jolts.

Daukoru suggested that some downstream consolidation may be necessary to create independent refiner-marketers capable of increasing capacity.

Noting that current oil prices are still lower in real terms than those of the early 1980s, he said OPEC tries to stabilize the market but has little influence over downstream bottlenecks, intense speculation, geopolitical events, and natural disasters.

“The market is well-supplied with crude oil today, and gasoline inventories are at 5-year highs,” he said. “There is no reason consumers can’t receive oil on a steady, reliable basis well into this century.

“But it will require substantial planning and major investments.” ✦

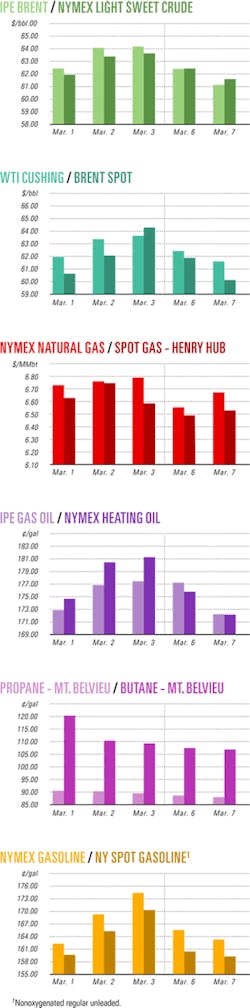

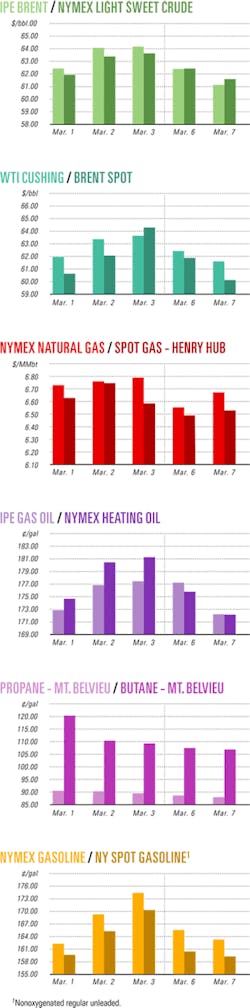

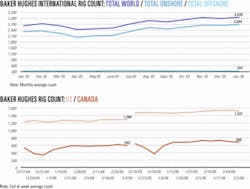

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Chevron acquires Athabasca heavy oil leases

Chevron Corp. has acquired five heavy oil leases with potential for in situ development in Alberta’s Athabasca region.

The leases, covering about 75,000 acres, are 24 miles southwest of the Athabasca Oil Sands Project (AOSP). Chevron Canada Ltd. holds a 20% interest in AOSP, which includes the Muskeg River Mine and Scotford Upgrader. Shell Canada Ltd., operator, and Western oil Sands LP hold the other AOSP interests.

Chevron said development of 7.5 billion bbl of oil in place under the new leases might involve steam-assisted gravity drainage.

Petrobras to start Manati development drilling

State-owned Petroleo Brasileiro SA (Petrobras) plans to start development drilling soon in Manati gas field in the Camamu-Almada basin off southern Bahia, Brazil.

Petrobras expects the field to produce 6 million cu m/day of gas at peak. It is waiting on an environmental license.

The campaign will use two rigs to drill seven shallow-water development wells and an exploratory well in shallow water on the BCAM-40 block. Each well should take about 60 days to drill.

DNO tests Masila basin oil in Yemen

DNO ASA, Oslo, has tested oil in the Godah-1 sidetrack on Block 32 in the Masila basin in Yemen.

The well, drilled to a TD of 1,841 m downdip of the original location, encountered a full oil column and flowed at a rate of 1,839 b/d gross with no water and a GOR of 2,412 scf/bbl.

The original Godah-1 exploration well, which confirmed the presence of oil and gas in the Cretaceous Qishn reservoir, was drilled on a separate structure 14 km east of Tasour field, primarily to target the Qishn S1A sandstone.

DNO and partners have agreed to drill the Godah-2 appraisal well farther downflank of the Godah-1 sidetrack to evaluate the areal extent of the oil accumulation and possibly prove the oil-water contact. Production from the Godah structure can be tied back to Tasour production facilities for processing and transport.

Cabot to put Alberta gas strike on stream

Cabot Petroleum Canada Corp. plans early production from a gas discovery at its Hinton prospect in northwestern Alberta, reported parent company Cabot Oil & Gas Corp., Houston.

The Cabot Hinton 11-16-51-16W5M, drilled to 10,690 ft, encountered three productive zones with 118 ft of combined net pay in a new pool. Cabot has completed one zone in a 106 ft pay section and is preparing the well for production.

The zone flowed naturally but was fracture-stimulated and tested at a rate of 7.3 MMcfd on a restricted choke at 7,061 psi flowing tubing pressure. Cabot has a 75% working interest in the well and in one offsetting section, along with a 60% working interest in 10 additional sections on this play, which covers 7,680 gross acres. Cabot Chairman Dan O. Dinges said the well would start production at up to 12 MMcfd. He said production would exceed 20 MMcfd when pipeline upgrades are complete.

Cabot is in discussions to expand takeaway capacity in the area to more than 50 MMcfd of gas by yearend. Two offset development locations are planned for later this year, with further drilling possible in 2007, depending on success.

Norway clears Tyrihans for development

Norway’s Storting (parliament) on Feb. 16 approved Statoil ASA’s plan for development and operation of Tyrihans oil and gas field in the Norwegian Sea.

Development includes Tyrihans South, an oil field with a gas cap, and Tyrihans North, a gas and condensate discovery with a thin oil zone. Reserves are put at 182 million bbl of oil and condensate, and 34.8 billion cu m of rich gas.

Statoil plans to install five seabed templates to be tied back, via two 45-km pipelines, to the Kristin platform, which it also operates. The development involves four subsea production and gas injection structures and a template for seawater injection (OGJ Online, Feb. 3, 2006).

Tyrihans is due on stream in July 2009 when spare capacity will be available in Kristin’s topside facilities.

Tyrihans gas will be sent through the Åsgard Transport System to the treatment complex at Kårstø, north of Stavanger, while condensate and crude production will be combined with Kristin output and piped through an existing pipeline to the Åsgard C storage vessel for export by shuttle tanker.

The Tyrihans partners will spend 14.5 billion kroner developing Tyrihans, said to be one of the biggest projects on the Norwegian continental shelf in coming years. ✦

Drilling & Production - Quick Takes

Statoil confirms cause of platform gas leak

Statoil ASA has confirmed that the cause of a Jan. 19 gas leak on the Visund platform in the North Sea was a design fault on a knock-out drum.

The company’s investigation proved that a metal plate on the flare tank’s outlet to the knock-out drum collapsed, damaging the flare piping. A portion of the deformed plate came loose and created a hole about 50 cm in diameter in the pipe.

As a precaution, Statoil has changed similar knock-out drum systems on the Kvitebjørn and Heidrun platforms (OGJ Online, Feb. 13, 2006).

Repairs are under way at the Visund platform, after which production of roughly 35,000 b/d of oil and about 5 million cu m of export gas will resume.

Deal signed for platform rig off Malaysia

ExxonMobil Corp. has signed a 3-year contract extension valued at about $65 million with SapuraCrest Petroleum Bhd. unit Petcon (Malaysia) Sdn. Bhd. for a tender-assisted platform rig off Malaysia.

The extension provides for use of the T-9 rig, now drilling in Tapis C field, on ExxonMobil platforms off Terengganu.

ExxonMobil let the original contract to SapuraCrest in April 2001 for use of the T-2 tender-assisted platform rig off Malaysia.

ATP well starts gas flow in Dutch North Sea

ATP Oil & Gas Corp. has begun production from its L06d-S1 well in 115 ft of water in the Dutch North Sea.

The well logged 88 ft of net pay in the Jurassic Terschelling sandstone 26 ft updip of the original L06d-2 well. It is expected to produce initially at 15-20 MMcfd net to ATP.

The well was completed subsea with a 41 km tie-back to a Gaz de France platform.

ATP Oil & Gas (Netherlands) BV, operator, and Energie Beheer Nederland BV each holds a 50% working interest in the well.

Otway basin CO2 sequestration trial advances

Australian Cooperative Research Centre for Greenhouse Gas Technologies (CO2CRC), Canberra, has been awarded two production licenses in the onshore Otway basin of western Victoria in which to conduct its first carbon dioxide sequestration trial.

Subject to environmental approvals, the pilot gas injection, storage, and monitoring program will begin by yearend.

CO2CRC is now 100% owner of licenses PPL11 and PPL13, which cover Buttress CO2 field and nearby depleted Naylor natural gas field.

The program will involve production of CO2 from Buttress at a rate of 3 MMcfd, piping the gas 1.75 km to Naylor, and injecting it into the Cretaceous Waarre reservoir on the flank of the depleted field via a well to be drilled this year.

Injection will continue for about 2 years.

Monitoring has begun in the region to establish baseline data and will continue for the next 4-5 years to gauge the movement of CO2 in the reservoir. A number of monitoring points will be established within a 5 sq km area around the injection point. There will also be monitoring equipment in the old Naylor-1 well.

Buttress reserves exceed 10 bcf, 90% CO2. The minor amounts of methane will be stripped out and used to power the compressors and other equipment.

The Otway Project is believed to be the only one in the world where researchers own the petroleum leases, the CO2 source, and the depleted storage reservoir.

The Victorian government has allocated $4 million (Aus.) to the program. Funding also is coming from petroleum companies and overseas research groups. About 30 researchers will be involved in the project.

Results will be particularly relevant to the proposed Gorgon gas project off Western Australia, which is to inject that field’s 12% CO2 content into reservoirs under Barrow Island when it comes on stream in 2010-11. ✦

Processing - Quick Takes

SRI: China looms as petrochemical competitor

China can become a major competitor in petrochemicals, says SRI Consulting, Houston, in a recent report.

“A recently built, state-of-the-art petrochemical complex in China can be very competitive against Saudi Arabian producers exporting to China, even though the Saudis have unparalleled feedstock cost advantage,” said Ken Zheng, SRI Consulting’s senior consultant.

According to the report, which compares costs of petrochemical plant construction and operation in China versus the US, Japan, and Germany, China’s main competitive advantage is low-cost labor.

China now can build chemical plants with local construction and engineering labor, equipment, machinery, and materials, Zheng said.

“As the cost of local sourcing, especially labor cost, is significantly lower than that in the developed countries, a chemical plant built in China can cost one-third less than the same plant on the US Gulf Coast,” he said.

But plant construction cost can vary greatly in China, depending on location and ownership, limiting the cost benefits of local sourcing.

Based on 2004 cash flow return on investment (CFROI) basis, a Chinese producer with a recently built petrochemical complex using naphtha feedstock would have achieved a CFROI close to those of ethane-based producers in the US but higher than those of naphtha-based producers in Germany and Japan, the report said.

In China, several world-scale integrated petrochemical complexes are planned and are likely to come on stream in the next few years.

Sinopec refinery due two steam generators

China Petroleum & Chemical Corp. (Sinopec) subsidiary Guangzhou Petroleum Co. has awarded a $25 million contract to subsidiaries of Foster Wheeler Ltd.’s Global Power Group for the engineering and supply of two 120 Mw circulating fluidized-bed (CFB) steam generators to its 154,000 b/d Guangzhou City refinery in Guangdong Province, China.

The project is part of a Sinopec refinery expansion program.

Foster Wheeler International Engineering & Consulting (Shanghai) Co. Ltd. will design the coal and coke-fired CFBs that will be manufactured by Foster Wheeler Power Machinery Co. Ltd. at Xinhui, China. The boilers are expected to be operational in 2007.

EPC contract let for Rabigh complex

Rabigh Refining & Petrochemical Co. (PetroRabigh) has let an engineering, procurement, and construction contract to two Foster Wheeler Ltd. subsidiaries for the utilities and offsites at its refining and petrochemical complex under development in Rabigh, Saudi Arabia (OGJ, Aug. 8, 2005, Newsletter).

PetroRabigh is a joint venture of Saudi Aramco and Sumitomo Chemical Co. Ltd.

Foster Wheeler will perform detailed design, procurement, and management of the construction contractors for the utilities and offsite facilities, including all interconnecting process and utility piping for the complex; flare, water, air, and power systems; instrumentation and control rooms; main electrical distribution substations, firewater systems, blending and metering; and refurbishment and change in duty of existing tankage and roads. The contract value wasn’t disclosed.

The project will upgrade Saudi Aramco’s 400,000 b/cd Rabigh refinery to raise output of transportation fuel and make it the basis of a complex producing a total of 2.4 million tonnes/year of petrochemical solids and liquids, along with large volumes of gasoline and other products.

A new high-olefins fluid catalytic cracker complex will be integrated with a world-scale, ethane-based cracker to produce 1.5 million tonnes/year of ethylene, 900,000 tonnes/year of propylene, 60,000 b/d of gasoline, and other products.

Downstream units will convert all of the olefin production into products such as linear low-density polyethylene, high-density polyethylene, polypropylene, propylene oxide, and monoethylene glycol.

The project is scheduled for completion in 2008. ✦

Transportation - Quick Takes

Spearhead delivers oil sands crude to Cushing

Enbridge Inc. delivered the first crude from oil sands in western Canada to Cushing, Okla., through its Spearhead Pipeline on Mar. 2. The oil entered the Enbridge mainline system at Edmonton, Alta., and traveled 1,565 miles to Chicago before entering the Spearhead Pipeline and traveling 650 miles to Cushing.

Enbridge expects throughput to reach Spearhead’s 125,000 b/d initial capacity rapidly and plans to expand capacity soon to as much as 190,000 b/d through increases in pumping power. Looping the system could add 100,000 b/d later. First deliveries took place at a rate of 80,000 b/d.

Enbridge bought a 90% stake in the Cushing-to-Chicago Pipeline System from BP Pipelines North America Inc. in 2003 with the intent of reversing its flow. Enbridge is studying the possibility of further extending the system to the Gulf Coast.

KMI Illinois gas line project moves forward

Kinder Morgan Inc. (KMI), Houston, has received firm commitment from a lone shipper for the entire 360 MMcfd initial capacity on its proposed Kinder Morgan Illinois Pipeline. It has begun a binding open season ending Mar. 15 to determine support for a capacity increase.

The proposed 28-mile gas pipeline, which would interconnect with major interstate systems, would extend from Beecher, Ill., to the Chicago city limits near Burnham, Ill.

The project will require pipeline construction, a long-term capacity lease from KMI subsidiary Natural Gas Pipeline Co. of America, and Federal Energy Regulatory Commission approval. KMI has scheduled service to begin Nov. 1, 2007.

Terasen plans Trans Mountain expansion

Terasen Pipelines (Trans Mountain) Inc., Calgary, has applied to Canada’s National Energy Board for authorization to build and operate loops and oil pumping facilities that would increase capacity of the 710-mile Trans Mountain Pipeline in Alberta and British Columbia by 40,000 b/d. In 2004, the Trans Mountain system moved 236,100 b/d of oil (see map, OGJ, Aug. 8, 2005, p. 26).

The proposed $400 million TMX-Anchor Loop project includes construction of 7 km of 30-in. pipeline from west of Hinton, Alta., to the Hinton pump station and 151 km of 36-in. pipeline from the station to near Rearguard, BC. Terasen Pipelines also proposes building two electric-drive pump stations: the Wolf pump station in Alberta and the Chappel pump station in British Columbia. Terasen Pipelines is a unit of Kinder Morgan Inc., Houston.

Toho Gas due more LNG from MLNG Tiga

Malaysia LNG Tiga Sdn. Bhd. (MLNG Tiga), a subsidiary of state-owned Petronas, has signed an agreement to sell Toho Gas Co. Ltd. 520,000 tonnes/year of LNG for 20 years beginning in 2007.

The LNG will come from the Petronas LNG complex in Bintulu, Sarawak. Carriers operated by Petronas subsidiary Malaysia International Shipping Corp. Bhd. (MISC). will ship the LNG to Toho’s receiving terminal in Chita, Japan. Toho currently receives a total of more than 500,000 tonnes/year of LNG under contracts with Malaysia LNG Sdn. Bhd. (MLNG) and MLNG Tiga. The Bintulu complex has production capacity of 23 million tonnes/year of LNG from the 3-train, 8.1 million tonne/year MLNG plant; the 3-train, 7.8 million tonne/year MLNG Dua plant; and the 2-train, 6.8 million tonne/year MLNG Tiga plant. ✦