OGJ Newsletter

General Interest—Quick Takes

Europe sees growing diesel-gasoline imbalance

The imbalance between growing diesel oil consumption and falling gasoline demand in Europe, which especially affects France, will increase under European Union fuels specifications, said Jean-Paul Vettier, president of Total SA's refining division.

Tax differentials favoring diesel automobiles helped increase diesel consumption in France by 3.4%/year since 1996 and reduced gasoline use by 3.1%/year, with a 5% drop registered in 2004.

"For political reasons, there is little chance that taxation will change," said Vettier. Automobile manufacturers have cut their production of gasoline engines. Gasoline accounts for 25% of total fuels consumption in France.

Refiners currently export 20% of their surplus gasoline and import 40% of the middle distillates required to bridge the diesel gap. The imports come mainly from Russia, along with some supplies from Algeria. Vettier questioned whether Russia will be able to maintain its exports. EU specifications require that the sulfur content in motor fuels drop to 10 ppm by 2009.

Total is building a 500 million euro hydrocracker at its Normandy refinery, due on stream in mid-2006, to produce 1.3 million tonnes/year of diesel and lower the sulfur content. The group also has hydrocrackers at Leuna in Germany and Flessingen in Holland.

"But how many hydrocrackers can a company afford to build?" Vettier said. "We have invested 100 million to ¤500 million to bring our other refineries in France and Europe to standards, but throughout Europe, only 10-15% of refineries can afford such investments, especially if they are not well located and competitive."

French refiners had hoped that an EU directive requiring fuels to contain 2% biofuels by 2005 and 5.75% by 2010 would reestablish a balance between diesel and gasoline. But the French government required ethanol in gasoline, which is expected to maintain that imbalance.

Oil industry trade group Union Française des Industries Pétrolières said five refiners plan investment of ¤2 billion for refinery upgrades during 2005-09. The five are Total, BP PLC, Royal Dutch/Shell Group, Italy's Eni SPA unit Agip SPA, and a unit of ExxonMobil Corp.

Norway to sell more Statoil shares to provate investors

Norway's Ministry of Petroleum and Energy plans to offer 17.5 million shares of Statoil ASA to private investors in Norway and Europe during July, reducing the Norwegian government's stake to 71% from 76%. The government earlier offered 100 million shares to institutional investors in Norway and abroad. Private investors will be able to buy Statoil shares for the same price, $16.67/share, government officials said Feb. 18.

Minister of Petroleum and Energy Thorhild Widvey said, "The current market environment allows us to further reduce the government's holding in StatoilU. Increasing liquidity is important to ensure that Statoil can be fairly valued in line with its international peers."

Norway began Statoil's partial privatization nearly 4 years ago under a mandate from Parliament (OGJ Online, Apr. 26, 2001).

SEC to hold discussion for Sarbanes-Oxley feedback

The US Securities and Exchange Commission will hold a roundtable discussion Apr. 13 in Washington, DC, on implementation of Sect. 404 of the Sarbanes-Oxley Act of 2002.

The federal securities regulator also solicited written comments from registrants, auditing firms, and others who are implementing the new internal-control requirements as they prepare annual financial reports to SEC. Submissions are due before Apr. 1.

The commission emphasized that it is seeking comments about implementing the internal financial control procedures and not feedback about a specific set of inquiries. It plans to make submissions part of the public record and intends to post them, as submitted, on its web site.

Comments may be submitted electronically by using the SEC's internet submission form at www.sec.gov/news/press.shtml, or by e-mail at [email protected] (with File Number 4-497 as the subject line).

Paper submissions should be sent, in triplicate, to Jonathan G. Katz, secretary, SEC, 450 5th St., NW, Washington, DC, 20549-0609.

Venezuela, Brazil form alliance, woo Cuba

Venezuelan President Hugo Chávez and Brazilian President Luiz Inacio Lula da Silva agreed Feb. 21 to create a "strategic alliance" between the two countries that included 20 accords, including cooperation in oil and gas production, refining, petrochemicals, energy, avoidance of double taxation, and the sales of Brazilian jet fighters to Venezuela.

Brazilian-Venezuelan trade increased to $1.6 billion in 2004 from $880 million in 2003 and is expected to rise to $3 billion in 2005.

José Eduardo Dutra, president of Brazil's state-run Petroleo Brasileiro SA (Petrobras), said, "One of the agreements includes the construction of a lubricants factory in Cuba through a joint venture between Petrobras, Petroleos de Venezuela [SA], and Cuba's state-owned oil company Cupet [Cubapetroleo SA].

"The factory would require investments of $20 million and would produce lubricants in Havana for domestic consumption and for exporting to neighboring Caribbean countries."

Petrobras and PDVSA each want a one-third stake to build the plant. With changes to requirements that Cuba hold at least 50% of any partnership forged with international companies, Dutra believes the deal is viable.

Brazilian analysts view this project as more than just the relatively small investment in a lubricants factory. It represents both presidents' continuing efforts to remove Cuba from political isolation created by the decades-old US embargo.

Petrobras also is evaluating oil exploration and production in the deepwater Cuban sector of the Gulf of Mexico.

Chávez said, "Today we have reached the point of no return in the path towards integration. We have the continent's largest oil and gas reserves."

He added that Venezuela would rather strike deals with other South American countries than with the US.

The Brazilian president said, "Solutions to South America's problems are within our continent and not in the north or overseas."

The alliance involves E&P cooperation between PDVSA and Petrobras for projects in Venezuela and the creation of a regional financing system within the framework of Brazil's National Economic Development and Social Bank, which has committed to financing as much as $235 million for infrastructure projects in Venezuela.

After 3 years of negotiation, Petrobras and PDVSA have agreed to jointly build a 150,000-250,000 b/d refinery in Pernambuco state in northeastern Brazil. PDVSA selected Brazilian executive Gil- berto Prado, who conducted the negotiations, as a minority partner in the project, said PDVSA sources.

Construction on the $2.5-3 billion project should begin in 6-8 months (OGJ Online, Feb. 7, 2005).

Brazil's giant private petrochemical group Braskem also will include Venezuela in its international expansion strategy, a Braskem source told OGJ. The company signed a memorandum of understanding with PDVSA's petrochemical arm Pequiven to evaluate possible new business.

Tunisia Tyrrhenian basin due seismic surveys

Tunisia's state-owned L'Enterprise Tunisienne d'Activites Petrolieres (ETAP) let a contract to PGS Geophysical AS, Lysaker, Norway, to acquire exclusive 2D and 3D seismic data in the Tyrrhenian basin, off northern Tunisia.

The shallow-water area, covering 25,000 sq km, is crossed by a fold thrust belt linking the North African Atlas and the Sicily Appennine, which contains giant Val D'Agri, Luna, Vega, and Gagliano fields in Italy.

The area will be the subject of oil and gas license offers in the fourth quarter.

Tunisia is attracting new entrants with the recent 2000 hydrocarbon law, favorable fiscal regulations, flexible licensing procedures, and a renewed emphasis on negotiating most terms.

The country also is providing opportunities for international direct investment due to its proximity to developed countries and its close ties with the European Union.

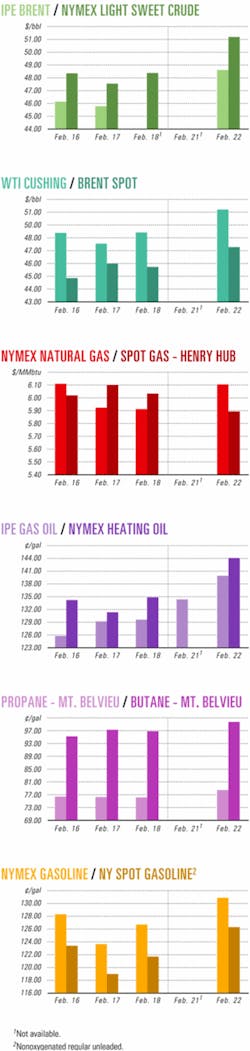

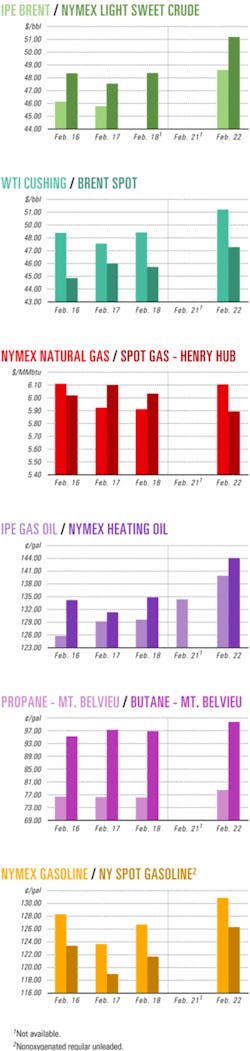

Industry Scoreboard

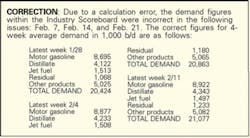

null

null

Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

Exploration & Development—Quick Takes

Well off Trinidad and Tobago scores gas

ChevronTexaco Corp. and 50:50 partner British Gas PLC confirmed that their Manatee 1 exploration well currently under test on Block 6d off Trinidad and Tobago has encountered "significant amounts of natural gas." ChevronTexaco operates the well, its first off Trinidad and Tobago.

Manatee 1, drilled in 299 ft of water, lies just northwest of ChevronTexaco's Loran field discoveries off Venezuela, with which it is on trend, and appears to extend the six shallow gas sands in Loran field into Trinidad and Tobago territory. (OGJ Online, Jan. 4, 2005). Manatee 1 encountered six gas-containing sand intervals for a total gross thickness of 899 ft.

ChevronTexaco recently drilled three exploration wells—Loran 2X, 3X, and 4X—across the border on Venezuela's Plataforma Deltana Block 2.

Manatee 1 results will help Trinidad and Tobago and Venezuela evaluate the resource and negotiate cross-border unitization (OGJ Online, Aug. 17, 2004).

The recent discoveries also advance the Trinidad and Tobago government toward its goal of building a fifth and possibly sixth LNG liquefaction train.

Forest makes gas finds in Alaska, Rockies

Forest Oil Corp., Denver, reported two successful exploration wells in the Cook Inlet area of Alaska, where it has more than 1.1 million net undeveloped acres.

Its wholly owned West Foreland 2 well, drilled upstructure from the West Foreland 1, tested 15 MMcfd of gas equivalent from two zones.

The Three Mile Creek Unit 1 well, in which Forest holds a 30% interest, tested at an initial rate of 2 MMcfd of gas equivalent from shallow Beluga intervals. Further testing is scheduled for spring if weather conditions enable a rig to maneuver in Cook Inlet.

Also, Forest made a gas discovery in the Green River basin of Utah. Hickory 4-20 on the south plunge of the Moxa arch reached 13,400 ft TD and encountered 22 ft of high-quality pay and excellent gas shows, Forest said.

Forest operates the well with a 58% working interest and has more than 8,000 gross acres in the prospect area. The play was internally generated and supported by proprietary 3D seismic. Additional follow-up opportunities exist and will be pursued after the well is tested and completed.

Eni makes oil discovery in deepwater gulf

Eni SPA reported an oil discovery on Green Canyon Block 298 in deep water, 260 km south of New Orleans in the Gulf of Mexico. The Allegheny South exploration well was drilled to 4,870 m TD in 1,000 m of water.

Eni's Agip Petroleum Co. is the current operator of Allegheny field and Allegheny South, holding 100% working interest in the block. Eni estimated reserves at 20 million boe but gave no details on production test results.

The positive well results and the well's proximity to Allegheny field, which produces from a monocolumn or "mini" tension leg platform, will make production start-up possible this year, the major said.

Newfield makes discoveries in UK, Gulf of Mexico

Newfield Exploration Co., Houston, discovered oil and gas in the UK North Sea and on several prospects in the Gulf of Mexico.

The North Sea find is on its 100%-held Grove prospect on License Area 49/10a in the Southern Gas basin. The well was drilled to 11,400 ft TD and encountered 120 ft of net gas pay in the Permian Leman and Carboniferous Barren Measures sands. It flowed 25 MMcfd of gas and 330 b/d of condensate, constrained by limited equipment capacity. The well, drilled to appraise a 1971 undeveloped discovery, lies in the six-block Cleaver Bank North section of the 100,000-acre license area. It holds reserves of 75-100 bcf of gas equivalent. Newfield plans to install production equipment and start production late in 2006.

Newfield made its first deepwater Gulf of Mexico discovery as an operator on its 50%-held Wrigley prospect on Mississippi Canyon Block 506. Well 1, in 3,670 ft of water, encountered 90 ft of high-quality, gross dry gas pay. A sidetrack, drilled 250 ft updip, found 44 ft of similar quality gross gas pay. The reserves are 55-85 bcf of gas equivalent. Newfield will tie back the well to existing infrastructure and expects first production in mid-2006.

At its La Femme prospect on Mississippi Canyon Block 427, Newfield drilled a gas well in about 5,800 ft of water. Tests from Well 1 logged about 90 ft of gross hydrocarbon pay. A second well is planned for midyear to determine field size and commerciality. Newfield is the operator of the prospect, with a 50% working interest.

Nexen makes deepwater discovery off Louisiana

Nexen Inc., Calgary, made a deepwater discovery off Louisiana in the Gulf of Mexico in the Anduin prospect on Mississippi Canyon Block 755. The well, in 2,365 ft of water, cut 48 ft of gross oil pay. A sidetrack is planned updip to define reserve size and development options. Nexen is operator of the block in a 50:50 partnership with Newfield.

Tests prove oil on Gabon Koula prospect

Shell Gabon SA and coventurer Pan-Ocean Energy Corp. Ltd. Helier, Jersey, UK, completed a 6-day well test on its recently drilled AWOKOU-1 ST3 appraisal well on the Awoun permit in Gabon, West Africa.

Oil flowed on test at 4,000 b/d at 640 psia through a 46/64-in. choke and had a gas:oil ratio of 400 scf/bbl. The well produced no water and encountered 31° gravity oil with properties similar to the oil in nearby fields. The flow rate was constrained due to capacity limitations of surface facilities.

The test results follow the coventurers' earlier light oil discovery on the Koula prospect (OGJ Online, Sept. 8, 2004).

Shell, the operator, and PanOcean currently are determining the feasibility of a development program and plan to appraise the Damier discovery—also on the Awoun permit—during the first half.

El Paso has deep gas find off Louisiana

El Paso Production Co. has discovered gas in the deep shelf of the Gulf of Mexico.

Well 1, drilled to 22,824 ft TMD on West Cameron Block 75, about15 miles off Louisiana in 35 ft of water, logged more than 40 ft of net gas pay in the Lower Miocene.

El Paso Production Holding Co. operates the well and holds a 36% working interest. The first 25 bcf of gas equivalent produced from the reservoir qualifies for royalty relief from the US Minerals Management Service.

El Paso plans to start testing the well in March and expects to have a reserves estimate by yearend. After well tests, El Paso will drill a second deep shelf prospect in an offsetting block, West Cameron 62, and then resume development on West Cameron 75.

Production from West Cameron 75 is expected in the fourth quarter after facilities are installed.

Statoil to start Volve production

Statoil submitted to the Norwegian Ministry of Petroleum and Energy a plan for development and operation of the Volve discovery on Production License 046 in the North Sea.

Volve, expected on stream early in 2007, has reserves of 70 million bbl of oil and 1.5 billion cu m of gas. Production is expected to peak at 50,000 b/d and to last 4-5 years.

Associated gas from Volve will be piped to Statoil's Sleipner A platform for processing and export.

Statoil plans to produce the field from the Mærsk Inspirer jack up and use the Navion Saga tanker for storage. It plans to drill three production wells, three water injection wells, and two water production wells.

Statoil has a 49.6% share in the licenses. ExxonMobil Corp. has 30.4%, and Total SA and Norsk Hydro ASA hold 10% each.

Stranded gas off Peru to be developed

BPZ Energy Inc., Houston, signed a third agreement to sell natural gas from currently idle gas and condensate fields off Peru to electric power generating concerns in Ecuador and Peru.

The three-phase project will require construction of a total of 140 miles of pipeline, refurbishment of existing production facilities in Corvina and Piedra Redonda fields on Block Z-1, in which it holds 100% interest, and the drilling of additional wells (OGJ Online, Jan. 5, 2005).

First phase gas sales, to be delivered in first half 2006 through a proposed 10-mile pipeline from Corvina field, will support BPZ's integrated electric power project at Caleta Cruz, Peru (see map, OGJ, Jan. 24, 2005, p. 38).

Under a recent Phase II sales agreement, BPZ would sell a peak 27 MMcfd of gas to Ecuadorian state-owned Electroguayas SA to feed a 96-Mw turbine being built at Arenillas, Ecuador, 8 miles east of the Peru border and 40 miles northeast of Corvina field. A 40-mile pipeline is planned.

In the third phase, BPZ would construct a line to deliver gas another 90 miles further north from Arenillas to Guayaquil, Ecuador.

Lukoil exits Zykh-Govsany project

OAO Lukoil subsidiary Lukoil Overseas Holding Ltd. exited the Zykh-Govsany field-rehabilitation project in Azerbaijan with the approval of its 50:50 partner State Oil Co. of the Azerbaijan Republic.

Lukoil said in a news release that the "main reason for the decision is the incompatibility of the project's economics with the benchmarks established in the company for the rate of return. This is due to the significant costs of environmental rehabilitation of the contract area and the high degree of depletion of reserves."

There are 15 wells operating in the fields, which produced about 250 tonnes/day of oil in 2001.

Drilling & Production—Quick Takes

US rig count near 19-year high

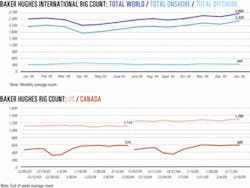

US drilling activity continued to climb, up by 15 units to 1,295 rotary rigs at work the week ended Feb. 18, Baker Hughes Inc. reported. That is up from 1,114 during the same period a year ago and the highest weekly rig count since late February 1986 when the count was at 1,308 and falling.

Land operations accounted for most of the week's increase, up by 10 units to 1,160 working.

Drilling in inland waters increased by 3 units to 28 rotary rigs working. Offshore drilling increased by 2 to 100 in the Gulf of Mexico and 107 for the US as a whole.

Canada's rig count was unchanged at 589 active that week, up from 574 a year ago.

Caspian well gets long expandable liner

Enventure Global Technology used its solid expandable tubular technology to install a 3,068-ft, 133/8 x 16–in. open-hole liner (OHL) in an ExxonMobil Corp. well in the Caspian Sea off Azerbaijan.

It claimed a length record for the system and called it the Caspian's first solid expandable.

Enventure said ExxonMobil included the OHL system in its original casing design to avoid borehole tapering, as formations to be penetrated demanded more casing strings than conventional pipe allowed.

Caspian Sea wells frequently encounter high formation pressures, multiple pressure regressions, and narrow margins between formation pressure and fracture gradient.

Processing—Quick Takes

Obaiyed gas plant upgrade moves ahead

Badr Petroleum Co. (Bapetco), jointly owned by Egyptian General Petroleum Corp. and Shell Egypt NV, let contract to KBR Production Services for engineering and support services for three projects related to the 300 MMscfd Obaiyed gas plant in Egypt.

Under the multimillion-pound, 2-year contract, Qasr gas field this year will be tied in to the Obaiyed plant, which will be upgraded to boost capacity to 420 MMscfd of sales gas. KBR also will implement a precompression scheme to sustain Obaiyed production.

Four refiners to get MMS royalty oil

The US Minerals Management Service has let contracts to small refiners Paramount Petroleum Corp., Paramount, Calif.; Gary-Williams Energy Corp., Denver; US Oil & Refining Co., Tacoma, Wash.; and Placid Refining Co. LLC, Port Allen, La. to purchase crude oil produced in federal waters of the Gulf of Mexico and Pacific Ocean. Under the MMS Small Refiners Program, the agency sells royalty oil from offshore leases to qualified small refiners. Delivery of 50,000 b/d as outlined in the 6-month contracts is scheduled to begin Apr. 1.

Mazeikiai lets hydrotreater contract

AB Mazeikiu Nafta has let a $43 million contract to Foster Wheeler Iberia SA for detailed engineering, materials procurement, and construction of an FCC gasoline-selective hydrotreater at its 263,420 b/cd Mazeikiai refinery in northwestern Lithuania—the only refinery in the Baltic States.

The new facility comprises two units: a 32,000 b/sd sulfur hydrogenation unit and a 22,000 b/sd hydrodesulfurization unit. The project will help the refinery meet European Union specifications taking effect in 2009 for gasoline sulfur content.

Mechanical completion is slated for fourth quarter 2006.

Venezuela, Jamaica study collaboration

Venezuela and Jamaica signed a letter of intent to study working together in refining, marketing, and distribution in Jamaica.

The agreement allows the nations to assess the potential of upgrading and expanding the 36,000 b/d Petrojam refinery in Kingston. It also includes a technical, economic, and trade feasibility study on the probable participation of Petroleos de Venezuela SA in Petcom Ltd., a subsidiary of Petroleum Corp. of Jamaica, to expand PDVSA's retail station network on the Caribbean island, as well as on other nations in the area.

Transportation—Quick Takes

Enbridge eyes 'synbit' line to BC coast

Enbridge Inc., Calgary, has proposed a 750-mile pipeline to transport "synbit"—raw bitumen diluted with synthetic crude oil—from northern Alberta to Canada's west coast for shipment by tanker to Asia and the US West Coast.

Enbridge envisions the $2.5 billion Gateway Pipeline to be a 30-in. system that could deliver 400,000 b/d from Edmonton, the western terminus of the company's existing pipeline, to either Kitimat or Prince Rupert, BC. A port capable of handling supertankers would be needed on the BC coast. Construction could start in 2008, and the line could be operating in 2009-10, Enbridge said.

Iraqi gas project to end Misan flaring

Gulfsands Petroleum PLC, Houston, has signed a memorandum of understanding with the Iraq Oil Ministry covering the Misan natural gas project in southern Iraq.

The project will entail gathering, processing, and transmitting associated natural gas from oil production in the region to end flaring. Gulfsands said Misan has the potential to produce 46,600 b/d of NGL and 338 MMcfd of dry, sweet natural gas.

Gulfsands, in cooperation with the Oil Ministry, has completed a feasibility study and expects to conduct further technical work and commercial discussions with the Ministry by the end of June.

The project will involve the engineering, design, procurement, construction, and operation of a gas gathering system, a natural gas liquids plant, and transmission pipelines. It will be completed in two phases, with Phase I to last 3 years and Phase II, 2 years.

Skarv gas likely to flow to Kårstø

Gassco AS, operator of Norway's gas transport systems, said gas volumes from the Halten-Nordland area of the Norwegian Sea are insufficient to warrant laying a pipeline from that area to the Tampen area. A more likely scheme for exporting Skarv field gas would be via the existing Åsgard Transport System (ÅTS) to the Kårstø processing complex north of Stavanger if ÅTS is upgraded and the processing facilities debottlenecked, Gassco said. Deliveries could begin in 2010 under this scenario.

Gassco said it would facilitate further work on this plan if the licensees—Statoil ASA, which holds 50%, Enterprise Oil Norge AS 40%, and Norsk Hydro Produksjon AS 10%—sanction field development. "Should gas volumes corresponding to a medium-sized gas-fired power station be required at Tjeldbergodden in mid-Norway, we can also allocate output from Skarv through existing pipelines to that location as well as to Kårstø without noteworthy investment," said Thor Otto Lohne, Gassco's vice-president for commercial development. He added that Gassco's studies provide the Skarv licensees with a good basis for deciding whether to develop the field.

The Norwegian Petroleum Directorate expects 30-35 exploration wells to be drilled on the country's continental shelf in 2005, many in the Norwegian Sea.

null