OGJ Newsletter

General Interest - Quick Takes

Firms ordered to jointly operate Cepu Block

Indonesian President Susilo Bambang Yudhoyono has ordered state oil company PT Pertamina to jointly operate the Cepu Block with ExxonMobil Corp. on a rotating basis, according to Pertamina Pres. Widya Purnama.

Purnama said Pertamina will operate the block, which lies in east-central Java, for the first 5 years, ExxonMobil will operate the block for the next 5 years, and the cycle would repeat for the 30-year contract term.

In September, Pertamina and ExxonMobil signed a contract establishing joint ownership of Cepu Block (OGJ Online, Sept. 20, 2005). Last month, the Indonesian government had said it would intervene in talks between the US major and the state oil firm if the two sides could not reach agreement over operation of the block by the end of this month (OGJ Online, Nov. 29, 2005).

Purnama said the state oil firm has set aside $120 million to start drilling on the block and would submit its plan of development for approval by Indonesia’s upstream oil and gas regulatory body BP Migas early in January 2006.

Interests in the Cepu Block are Pertamina and ExxonMobil, 45% each, and a company to be established by the local administrations, 10%. The block is expected to start producing oil in 2008 with output of 160,000-180,000 b/d.

Firms relinquish Indonesian contract areas

ConocoPhillips and Amerada Hess Corp. will relinquish to the Indonesian government contract areas not considered commercially feasible.

Amerada Hess will return the Tanjung Aru Block in the Makasaar Strait, and ConocoPhillips will do the same for the Nila Block in the Kutei basin off Kalimantan.

Zainal Achmad, an official of BP Migas, said the companies failed to find commercial quantities of crude oil or natural gas.

ConocoPhillips last year said Menur-1, its third and final commitment well, was plugged and abandoned as a dry hole. It said it was pursuing full relinquishment of the Nila production-sharing contract (PSC) before the end of the exploration term in May.

Indonesia awarded a PSC for Nila Block to Conoco Nila Ltd. and Inpex Natuna Ltd. in 2001. The award was part of an exploration and production tender made earlier that year (OGJ Online, Dec. 13, 2001).

Earlier in 2001, Indonesia awarded Amerada Hess and Petronas the Tanjung Aru Block (OGJ Online, Sept. 19, 2001).

Gazprom to begin trading gas in France

OAO Gazprom of Russia reported that it had obtained authorization to trade natural gas on France’s liberalized gas market starting in early 2006.

Gazprom stated it is targeting 10% of the French market, which is now opened to 73% of France’s gas end-users. In July 2007, the market will be fully opened. Gazprom will target sales to large industrial and regional customers.

In comparison, Total SA is targeting only industrial and commercial clients but not private ones. The French firm, which currently holds 10% of the market, aims to capture 15% in the medium term.

The only stipulation for Gazprom’s client base is that it cannot take clients directly from Gaz de France. GDF currently holds 80% of France’s gas market. ✦

Exploration & Development - Quick Takes

BHP Billiton to develop field off Australia

BHP Billiton Ltd. and equal joint venture partner Woodside Energy Ltd. have approved the $600 million development of Stybarrow oil field in the WA-255-P(2) permit 65 km off Western Australia (see map, OGJ, Aug. 4, 2003, Newsletter).

Lying in 825 m of water in the Exmouth subbasin, Stybarrow will be the deepest oil field development in Australia, says BHP Billiton, the operator.

The company will use Atwood Oceanics Inc.’s Atwood Eagle semisubmersible to drill and complete five subsea production wells to be tied back to a newbuild, double-hull floating production, storage, and offloading vessel.

It has a 10-year service agreement with a MODEC joint venture for the FPSO, which will be able to process 80,000 b/d of liquids and store 900,000 bbl.

Development drilling is expected to begin in mid-2006 and take 9 months. Production is to start in first quarter 2008.

Stybarrow, discovered in 2003, and the oil rim of nearby Eskdale field have total estimated reserves of 60-90 million bbl of oil.

BHP Billiton and Woodside have drilled nine wells in the Stybarrow-Eskdale area.

The Stybarrow 1 discovery encountered a gross oil column 23 m thick with 18.6 m of net pay in the Macedon sandstone. BHP drilled it in February 2003 and followed with the Eskdale 1 in March, Skiddaw 1 and 2 in May, and Stybarrow 2 in June.

Between April and July 2004, the firm drilled the Stybarrow 3 and 4 appraisal wells and the Eskdale 2 and Knott 1 exploratory wells.

Stybarrow 3, in 792 m of water about 2 km northeast of Stybarrow 1, encountered a gross oil column of 6.5 m. The Stybarrow 4 sidetrack cut a 16 m gross oil column.

Eskdale 2, in 830 m of water, encountered a gross oil column 13 m thick and a gross gas column of 24 m. Knott 1, drilled in June 2004, was plugged and abandoned.

CNOOC makes oil strike in Bohai Bay

CNOOC Ltd. has made an oil discovery on the Jinxian (JX) 1-1 structure in Liaodong Bay in the northeastern part of Bohai Bay.

The JX1-1-2D wildcat, spudded in August and drilled to 3,143 m TD in 29 m of water, encountered 31.5 m of pay.

On drillstem tests of various intervals, the well flowed 1,000 b/d of oil and more than 730 Mcfd of gas through 7.94-mm and 11.91-mm chokes.

CNOOC, which holds 100% interest, said the pay zones are not productive elsewhere in the area.

McMoRan tests gulf shelf gas-condensate wells

McMoRan Exploration Co., New Orleans independent temporarily based in Baton Rouge since the 2005 hurricanes, hopes to start production in early 2006 from its latest deep shelf gas-condensate discovery in the Gulf of Mexico.

The Long Point discovery well flowed 41 MMcfd of gas and 860 b/d of condensate with 10,200 psi flowing tubing pressure through a 29⁄64-in. choke. It is in 8 ft of water on Louisiana State Lease 18090 and close to production facilities.

McMoRan also production-tested the King Kong-2 development well in 12 ft of water on Vermilion Blocks 16/17 at 8 MMcfd and 24 b/d through a 16⁄64-in. choke. TD is 13,680 ft.

The company plans to start production shortly from King Kong-1 and was to spud King Kong-3 in late November.

Pakistani gas field due more development

BHP Billiton will increase gas plant capacity by 50% to a total of 450 MMcfd in the second phase of development of Zamzama gas field in Pakistan.

Approval of the new development phase came with signing of agreements among Zamzama Joint Venture Partnership, the Pakistani government, and Sui Southern Gas Co. Ltd. (SSGC).

The 2.3 tcf field on the Dadu license in Sindh Province, 200 km north of Karachi, currently supplies an average of 270 MMcfd of gas to SSGC and Sui Northern Gas Pipelines Ltd.

Second-phase development will raise Zamzama condensate production to 3,000 b/d.

BHP Billiton is laying a 40-km pipeline to carry condensate from Zamzama field to the Karachi-Multan crude oil pipeline. Condensate production now moves by truck.

MMS issues notice for OCS Sale 198

The US Minerals Management Service has issued a proposed notice for Central Gulf of Mexico Outer Continental Shelf Lease Sale 198 scheduled Mar. 15, 2006.

Sale 198 offers 4,000 blocks covering 21 million acres 3-210 miles off Louisiana, Mississippi, and Alabama in 4-3,400 m of water. MMS estimates the proposed lease sale could result in the production of 276-654 million bbl of oil and 1.59-3.3 tcf of natural gas.

The proposed sale includes provisions for deepwater royalty relief lease terms specified in the Energy Policy Act of 2005 and initially implemented with the August Western Gulf of Mexico Sale 196.

It also includes shallow-water, deep-gas royalty relief for leases in less than 400 m of water. Previous sale relief was less than 200 m. In addition, this sale will provide an increase in the royalty suspension volume to 35 bcf from 25 bcf for successful wells drilled 20,000 ft TVD subsurface or deeper.

This will be the first central gulf sale with higher rental rates that were implemented in the last western gulf sale (OGJ, Online, Mar. 29, 2005). The rates are $6.25/acre for blocks in less than 200 m and $9.50/acre for blocks in 200 m or deeper water.

A new stipulation limits use of the seabed and water column in Mississippi Canyon Block 118 because of a federally funded University of Mississippi study of gas hydrates. ✦

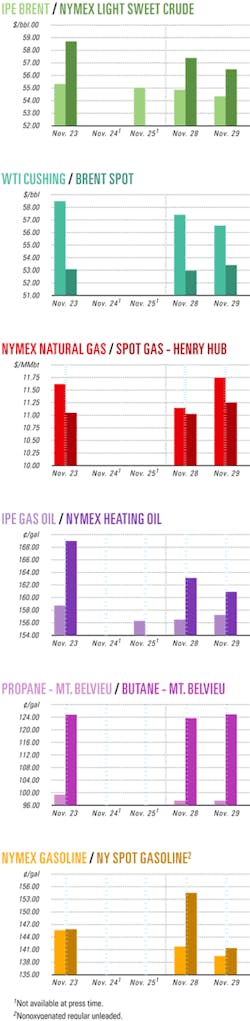

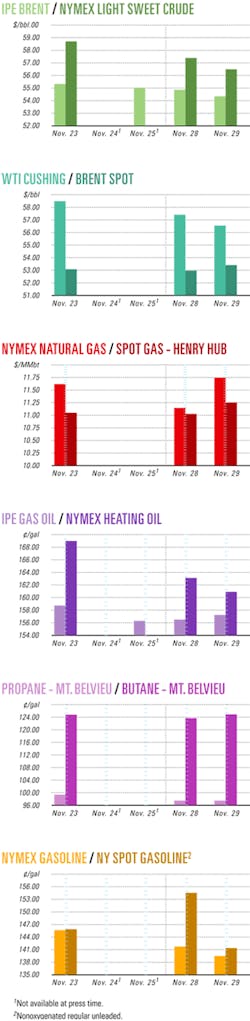

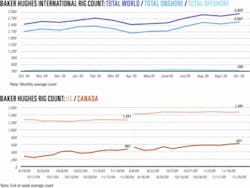

Industry Scoreboard

null

null

Drilling & Production - Quick Takes

Statoil ASA is conducting an inquiry into the cause of an oil discharge Nov. 23 observed near the Transocean Arctic semisubmersible, which is drilling in Statoil-operated Norne field satellites in the Norwegian Sea.

Statoil said the discharge might have resulted during a facilities shutdown for modifications to the Norne production ship, which will accommodate production from the Svale and Stær satellites. Satellite development involves drilling eight wells that will be tied back to the production ship (OGJ Online, July 15, 2004).

The Norne production vessel will not resume production after completion of the modifications until the cause is found for the spill.

The discharge, estimated at 280 bbl of oil, is dissolving and poses little threat to the Norwegian coastline, Statoil said.

Urd boosts oil production from Norne area

Statoil ASA has begun oil production from Urd field in the Norne area of the Norwegian Sea.

The 3.6 billion kroner Urd development consists of the Staer and Svale satellites. The well stream from the two satellites flows through a single, electrically heated pipeline to the Norne production ship for processing and loading into shuttle tankers with other oil from Norne. Statoil is expected to ramp up production to 70,000 b/d.

Staer is 5 km north of the main field and has been developed with a single seabed template tied back to the Norne production ship. Svale lies 10 km north of Norne and is being produced through two subsea templates, also tied back to the vessel.

A total of five oil production wells and three water-injection wells will be drilled in Urd. Statoil plans to use gas lift for the production wells. Gas from the Norne ship will be injected into the wells to reduce well stream density and increase production.

The wells are equipped with technology that can isolate reservoir zones to optimize output, Statoil said.

Urd contains estimated reserves of 70 million bbl of oil and a small amount of gas, which will be exported with Norne gas output via a tie-in to the Aasgard Transport Pipeline and processed at Karsto north of Stavanger.

Statoil has a 50% interest in the development. Its partners are Petoro AS 25%, Norsk Hydro AS 13.5%, and Eni SPA 11.5%.

Padulla field due on stream by yearend

In a fast-track development, Stuart Petroleum Ltd., Adelaide, plans to begin production before yearend from its wholly owned Padulla oil field in the South Australian Cooper basin.

It will bring the discovery well, Padulla-1, on stream via an extended production test.

The field, in permit PEL113 about 20 km southwest of producing Worrior oil field, contains an estimated 1 million bbl of oil reserves.

Padulla development will involve the drilling of at least four more wells plus an additional appraisal well.

Ivanhoe cites Dagang field production lag

Peak production will be considerably less than originally anticipated at the start of the Dagang oil field project in China, said Ivanhoe Energy Inc., Vancouver, BC.

Ivanhoe is operator with 60% working interest in two blocks divided into six areas that total 22,400 acres at Dagang in the Bohai Bay basin 200 km southeast of Beijing.

Recent wells drilled in the northern areas “experienced reservoir quality, thickness, and productivity that were below our expectations,” the company said.

After the quarter that ended June 30, the company revised downward its internal estimate of proved reserves and said its 2005 yearend independent reserves report will confirm the revisions or revise the figures further.

In early November, Ivanhoe said its production for the quarter ended Sept. 30 was 39% higher than that for the quarter ended June 30.

However, it had drilled no wells on the northern blocks in the quarter ended Sept. 30, moved to temporarily cease drilling at Dagang before the end of 2005, suspended talks to obtain a loan for field development, and wrote off an $857,000 origination fee.Water injection and a successful frac program will continue, but Dagang was the main factor in the company’s net loss having deepened in the third quarter compared with the second quarter of 2005, the company said.

Ivanhoe said its 2005 capital outlay is expected to fall $36.3 million short of the original $79 million budget, mainly due to the Dagang drilling reduction and plans to farm out a second well at another project in China, Zitong.

Dagang produces 30-35° gravity oil from an estimated 394 million bbl of oil in place at about 10,500 ft on the blocks.

Ivanhoe placed the first well on production in early 2004 and had 41 wells producing or available for production at Sept. 30. Yearend 2004 output was 1,655 b/d from 22 wells. The blocks also have 82 previously drilled wells that Ivanhoe has been reworking. PetroChina Ltd. buys the crude oil.

Ivanhoe in 2003 projected that production from the 30-year, $176 million project would peak at 14,000 b/d based on an oil price of $26/bbl.

Denbury plans CO2 injection in three fields

Denbury Resources Inc., Dallas, plans to operate an enhanced oil recovery program in three oil fields in Mississippi and Alabama, the controlling working interest of which it has agreed to acquire for $250 million.

The properties, all potential carbon dioxide tertiary flood candidates, include Tinsley field 40 miles northwest of Jackson, Miss.; Citronelle field in southwest Alabama; and the smaller South Cypress Creek field near Denbury’s Eucutta field in eastern Mississippi. The acquisition is expected to close in late January.

The three fields, currently producing a total of 2,200 boe/d, have estimated conventional proved reserves of 14.3 million boe, with two-thirds attributable to Citronelle field, Denbury said.

Denbury Chief Executive Officer Gareth Roberts said Tinsley field, with more than 660 million bbl of OOIP, would become Phase III of Denbury’s CO2 program.

The company expects to begin an initial $19 million tertiary development project at Tinsley field in 2006, with more-extensive development planned for 2007. Detailed engineering is under way, and a full development plan should be completed in early 2006, Roberts said. CO2 will flow to Tinsley from the company’s Jackson Dome area through an acquired 8-in. pipeline previously used for natural gas storage.

To transport CO2 to Citronelle field in Alabama, Denbury will add a 60-70-mile extension to its Free State CO2 pipeline under construction between Jackson Dome and Eucutta field. The Citronelle tertiary development timetable has not yet been determined.

South Cypress Creek likely will be developed after the initial development of Tinsley and Citronelle fields as an additional project for Denbury’s Eastern Mississippi Phase II CO2 project. ✦

Processing - Quick Takes

Demand slowdown yields polystyrene surplus

A global oversupply of polystyrene (PS) has resulted from slower-than-anticipated demand growth in China and extensive capacity additions, reported Chemical Market Associates Inc. (CMAI), Houston.

CMAI’s 2006 World Polystyrene-Expandable Polystyrene (EPS) Analysis, covering 2000-10, said that despite China’s recently slowed demand for PS, the country continues to drive demand growth for the chemical. In 2000-03, while global PS consumption decreased, China’s consumption increased by 640,000 tons.

Chinese demand growth in 2004 and 2005 is expected to be lower than in previous years, CMAI said.

Worldwide PS demand has been suppressed by high product and raw material prices, which have encouraged product substitution and increased use of recycled or reprocessed material, especially in China.

But CMAI expects PS prices to ease and demand growth to recover. Because propylene prices likely will remain high, PS will not face strong competition from polypropylene.

PS demand will be lower than forecast if crude oil prices remain at current levels, CMAI said. Since tightness of the benzene market has eased, the crude price remains the main factor in the PS price.

Syntroleum to test GTL process with coal

Syntroleum Corp., Tulsa, plans to test its propriety Fischer-Tropsch catalyst with coal-derived synthesis gas at a coal gasification plant.

The 6-month test, scheduled to start during January, is intended to demonstrate that Syntroleum’s gas-to-liquids process also is applicable to coal-to-liquids processing, the company said.

Flint Hills to invest in Kenai diesel unit

Flint Hills Resources Alaska LLC will contribute $15 million to the construction of a diesel desulfurization unit at Tesoro Corp.’s Kenai, Alas., refinery in exchange for 6,000 b/d of low-sulfur diesel and gasoline.

The desulfurization unit will have a capacity of 10,000 b/d and cost $45 million. Tesoro plans to add it to the 72,000 b/d Kenai refinery by 2007 (OGJ, June 6, 2005, Newsletter).

Linde to build Saudi air separation plants

Saudi Basic Industrial Corp. (Sabic) subsidiary National Industrial Gas Co. (NIGC) has let a contract worth more than €300 million to Linde AG for two air separation plants in petrochemical complexes at Jubail and Yanbu, Saudi Arabia.

Linde will handle engineering, procurement of equipment and materials as well as construction and commissioning of the facilities, each of which will generate 3,000 tonnes/day of pure oxygen.

NIGC Chairman Ibrahim Al-Shuweir said the plants are part of Sabic’s plan to increase overall petrochemical output to 60 million tonnes/year by 2008 from 43 million tonnes/year in 2004.

The plants are scheduled to start operation in April 2008.

UK firm to build LDPE plant in Pakistan

Trans Polymers Ltd. of the UK plans to construct a low-density polyethylene (LDPE) plant at Karachi with an initial investment of $480 million.

The plant will have an initial production capacity of 310,000 tonnes/year, which will be increased to 360,000 tonnes/year in the third year.

The construction, commissioning, and warranty test of the plant are expected to take 34 months. The project is expected to go into commercial production by fourth quarter 2008. ✦

Transportation - Quick Takes

RasGas II LNG Train 4 starts operation

Ras Laffan Liquefied Natural Gas Co. Ltd. II (RasGas II) reported the start-up of its 4.7 million tonne/year Train 4 LNG facilities at Ras Laffan Industrial City in Qatar. RasGas II is a 70:30 joint venture between Qatar Petroleum and ExxonMobil RasGas Inc.

Train 4 is the first LNG train developed with concurrent acid gas injection facilities to address environmental concerns and reduce sulfur production, RasGas II officials said. Train 4’s LNG production will serve RasGas’s European sales agreements.

The engineering, procurement, and construction (EPC) contract for the onshore components of Train 4 was carried out by a joint venture of Japan’s Chiyoda Corp. and Mitsui & Co., Italy’s Snamprogetti SPA, and Al Mana Trading Co. WLL of Qatar. The contract for the platforms and pipelines packages was executed by J. Ray McDermott Eastern Hemisphere Ltd., Dubai.

Construction of RasGas II’s Train 5 is under way with completion expected in early 2007. Trains 6 and 7 are scheduled for completion and operation in 2008 and 2009, respectively.

The addition of Train 4 will raise output at RasGas’s facility to 16 million tonnes/year of LNG from 11.3 million tonnes/year.

Gazprom, GDF to swap pipeline gas for LNG

Russia’s OAO Gazprom and France’s Gaz de France have signed a deal under which Gazprom will deliver pipeline gas to GDF in exchange for a shipment of LNG, which Gazprom will sell in the US.

Gazprom will receive the LNG from Med LNG & Gas, a joint venture of GDF and Algeria’s Sonatrach.

Shell Western LNG agreed to buy the LNG from Gazprom upon delivery in December at the Cove Point, Md., regasification terminal, which is partly owned by Shell.

CNOOC, partner plan Hainan LNG facility

China National Offshore Oil Corp. (CNOOC) and Hainan Development Holding Co. (HDHC) reported plans to invest $691 million to build an LNG import facility at Hainan.

Phase 1 of the project, due for completion by 2009, will have capacity of 2 million tonnes/year by 2012, rising to 3 million tonnes/year by 2015.

The project is designed to meet Hainan’s gas needs for 25 years. Hainan’s demand for gas stands at 7.3 billion cu m/year, leaving an annual gas shortage of 2.3 bcm.

CNOOC will hold 65% of the facility and HDHC, 35%.

BP gets third double-hull tanker for Alaska

BP Oil Shipping Co. USA said the third of four Alaska-class double-hull crude oil tankers being built by National Steel & Shipbuilding Co., San Diego, was delivered Nov. 22. The fourth ship will be delivered in late 2006.

The Alaskan Navigator, 25% owned by BP, will be operated by Alaska Tanker Co. of Portland, Ore. It will join the Alaskan Frontier and the Alaskan Explorer, which were delivered August 2004 and March 2005, respectively, in delivering crude oil from Alaska to BP’s refineries in Los Angeles and Cherry Point, Wash.

Earlier this year both the Alaskan Frontier and the Alaskan Explorer, each 193,050 dwt, were pulled from service in Alaska when cracks were found on the plating of their rudders (OGJ Online, May 24, 2005). ✦