OGJ Newsletter

General Interest - Quick Takes

Contract dispute halts Marib operations in Yemen

Yemen Exploration & Production Co. (YEPC), a venture of Hunt Oil Co., ExxonMobil Corp., and South Korea’s SK Corp., said operations in oil fields in Yemen’s Marib region have come to a halt after the alleged violation of a contract by the Yemeni government.

YEPC filed for arbitration with the International Chamber of Commerce in Paris, claiming the government expropriated Block 18 (the Marib Al-Jawf Block) on Nov. 15.

The joint venture has produced oil from the block for about 20 years under a production-sharing agreement passed into law in Yemen in 1982. A 5-year extension of the agreement, signed on Jan. 4, 2004, took effect Nov. 15.

According to a statement by Hunt Oil, the government “has taken numerous actions to prevent YEPC from exercising its duties as operator of Block 18.” It called the action “without precedent in Yemen” and said the government has attempted to replace YEPC with government-owned Safer Exploration & Production Operations Co.

Operations associated with the Marib PSA include a central production unit able to handle as much as 400,000 b/d of oil, a 10,000 b/d refinery, a 263-mile pipeline with capacity of 225,000 b/d, and four gas processing plants with capacities exceeding 1.6 bcfd.

Hunt Oil holds a 38.5% stake in the venture; ExxonMobil has 38%, and SK holds 15.7%. The remainder is held by the Yemeni government.

FERC temporarily waives gulf cost requirements

The US Federal Energy Regulatory Commission temporarily waived some construction cost requirements so natural gas infrastructure damaged by Hurricanes Katrina and Rita can be rebuilt more quickly.

“Twenty percent of the US natural gas supply comes from the offshore Gulf of Mexico, and much of that production remains shut in because of infrastructure damage. That is contributing to high natural gas prices,” FERC Chairman Joseph T. Kelliher said Nov. 17.

Specifically, the commission increased the cost caps for projects that may be constructed under the automatic authorization provisions of Part 157, Subpart F blanket certificate regulations from $8 million to $16 million, and under the prior notice provisions from $22 million to $50 million.

The increased limits will apply to projects providing increased or alternative access to natural gas supplies, it said. The regulations implement provisions of the Natural Gas Act.

FERC also temporarily expanded the definition of “eligible facilities” that can be constructed under the blanket certificates to include main line facilities; extensions of a main line; facilities, including compression and looping, that alter the capacity of a main line; and temporary compression that raises the capacity of a main line.

The cost limit waivers will apply to the newly eligible facilities as long as the facilities will provide increased or alternative access to gas supply, it indicated. Previously, construction under the blanket certificate regulations was limited to facilities necessary to provide service within existing levels covered by FERC certificates.

The temporary waivers and expanded eligibility standards will apply only to projects constructed and placed in service by Oct. 31, 2006, FERC said.

Ruling favors California OCS plaintiffs

The US Court of Federal Claims has ruled that the US government must return more than $1.1 billion in lease bonuses to 12 holders of 36 federal oil and gas leases off California.

The court granted a plaintiffs’ motion for summary judgment on liability and partial summary judgment on damages in a breach of contract lawsuit, Amber Resources Co. et al. vs. United States. It said the government’s imposition of new requirements on the leases created a significant obstacle to oil and gas development and breached agreements made when it sold the leases.

Amber Resources, a subsidiary of Delta Petroleum Corp., Denver, is one of 12 plaintiffs.

Delta Petroleum said the court still must address plaintiffs’ claims about four other leases and about hundreds of millions of dollars spent in successful efforts to find oil and gas in the disputed lease area.

The final ruling will be subject to appeal. No payments will be made until all appeals have been waived or exhausted, Delta Petroleum said.

DOE reopens comment period on SPR expansion

The US Department of Energy has reopened the public comment period on expanding the Strategic Petroleum Reserve and extended it through Dec. 19. The agency also scheduled a public meeting on the subject for Dec. 7 in Port Gibson, Miss.

DOE took the actions after Mississippi Gov. Haley Barbour asked Energy Sec. Samuel W. Bodman on Oct. 27 to include a new site at the Bruinsburg salt dome in the analysis of proposed sites and environmental impacts.

The initial comment period closed a day later. ✦

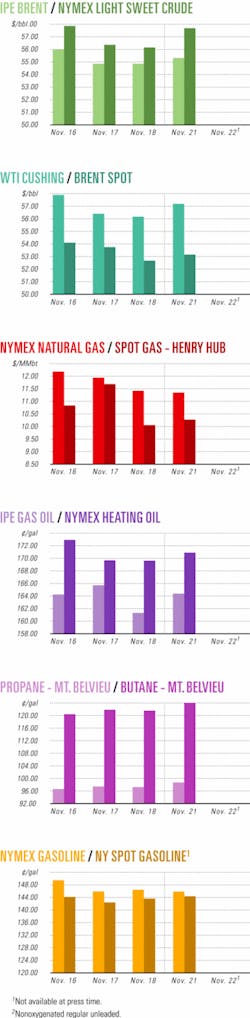

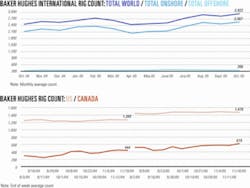

Industry Scoreboard

null

null

Exploration & Development - Quick Takes

Venezuela awards five gas E&P licenses

null

Venezuela, in the second round of bidding in its vast Rafael Urdaneta natural gas project, has awarded exploration licenses to four foreign firms and a domestic company, Energy Minister Rafael Ramirez said Nov. 15.

The licenses cover three of five blocks offered in the Gulf of Venezuela off the western state of Falcon. The Rafael Urdaneta region, 29 blocks in a 30,000 sq km offshore area, is estimated to hold a combined 728 billion cu m of gas.

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) and Japan’s Teikoku Oil Co. were selected to explore the Moruy II block for $19.5 million.

Italy’s Eni SPA and Spain’s Repsol YPF SA won exploration rights for the Cardon IV block for $34.3 million.

Venezuelan firm Vinccler Oil & Gas-the first domestic company to win a gas block in Venezuela, the minister said-will explore the Castillete-Northeast block for $7.38 million.

Two other blocks, Urumaco III, in a second offering, and Cardon III, were not awarded.

Exploration terms on the awarded blocks are 30 years.

Ramirez, who also is president of the state-owned oil company Petroleos de Venezuela SA, said there will be no more bidding on gas licenses this year.

On Sept. 8, in Phase I, Chevron Corp. and Russia’s OAO Gazprom were awarded three licenses for a total of $46 million (OGJ Online, Sept. 20, 2005).

The government plans to resume bidding on eastern blocks in 2006.

Eni reports gas shows in well off Brazil

null

Italy’s Eni told the National Petroleum Agency of Brazil that its 1-ENI-4A-RJS wildcat, drilled to 5,900 m TD in 387 m of water on Santos basin Block BM-S-4 off Brazil, encountered gas shows.

Pride International Inc.’s Pride Rio de Janeiro semisubmersible drilled the well, targeting Tertiary and Cretaceous turbidite structures, in the western part of the block.

Petrobras’s Mexilhao deep gas field lies 36 km southwest of the drillsite.

An Eni well drilled in 2003 on the southeastern part of the block encountered 14° gravity oil in its upper section. That well was plugged and abandoned.

Mexilhao development talks in final stage

Petrobras is in the final stages of negotiations with Repsol YPF for development of giant Mexilhao gas-condensate field on Block BS-400 in the Santos basin off Brazil.

A Petrobras official told OGJ that the two companies have a confidentiality agreement and are not disclosing their plans until a definitive development program can be announced.

Petrobras discovered Mexilhao field in 2003 with its 1-SPS-35 exploratory well, drilled by the Alaskan Star semisubmersible in 1,591 ft of water (OGJ Online, May 12, 2003). It is estimated to contain 2.54 tcf of natural gas.

Francisco Nepomuceno, Petrobras’s exploration and production manager, said the field will cost about $1.9 billion to develop. At last report, the company planned to bring the field into production with a fixed production platform capable of handling 529.7 MMcfd of gas. It has said the field is expected to commence operations in mid-2008.

Nepomuceno also said plans call for construction of a gas processing facility in northern Sao Paulo state at Caraguatatuba at a cost of about $300 million, to which gas would flow through a subsea pipeline from the production platform. In addition, he said that the company intends to bring into production 635.7 MMcfd of gas from adjacent Block BS-500, which lies in deeper waters of the Santos basin and would require two or three production platforms.

Nepomuceno said Petrobras believes the Santos basin contains about 14.8 tcf of natural gas and plans to carry out exploratory drilling on at least 74 of the blocks.

Petrobras pushes Mexico for gulf E&P permits

Petrobras said it has agreed to share its US Gulf of Mexico deepwater exploration and production expertise with Petroleos Mexicanos (Pemex) if Mexico will change its laws to permit foreign companies to operate in its sector of the gulf.

Petrobras Pres. Jose Sergio Gabrielli de Azevedo said Petrobras is open to joint activity with Pemex on expanding US Gulf of Mexico projects but would not do so without a reciprocal arrangement with Petrobras in the Mexican sector, which would require a change in Mexico’s constitution to permit foreign companies to operate there.

“We are willing to discuss information-sharing for our US assets, but only if we are able to also explore and produce on the Mexican side,” Gabrielli said.

Last month, Petrobras and Pemex announced they would be cooperating on a number of strategic fronts, among them deepwater production.

Pemex hopes to invest about $1.4 billion before 2010 to raise its 3.4 million b/d output by 100,000 b/d.

Calvalley completes Hiswah-7 well in Yemen

Calvalley Petroleum Inc., operator of Malik Block 9 in Yemen, reported the completion of its fifth horizontal development well in the Sayun-Masila basin in Hiswah oil field in Yemen.

Hiswah-7, the longest horizontal well drilled by Calvalley in Yemen, with a horizontal section of 576 m, was completed in 17 days.

The well is 250 m west of the Hiswah-6 horizontal well, which tested at up to 3,700 b/d of 35° gravity oil. Hiswah-7 was drilled parallel to Hiswah-6, the field’s most productive well yet, Calvalley said (OGJ Online, June 23, 2005).

Like Hiswah-6, Hiswah-7 also encountered the Cretaceous Saar formation. It was drilled to 1,900 m and intersected the top of the Saar-Naifa reservoir at 1,106 m. It has 615.5 m in the pay zone. The well penetrated oil-saturated, porous, high-energy carbonate grainstones over most of its length. Hiswah-7, along with the other four Hiswah horizontal wells, will be brought on stream after production facilities are in place. The drilling rig will move shortly to begin another horizontal development well at Hiswah.

Vintage tests Upper Lam B oil in Yemen

Vintage Petroleum Inc., Tulsa, has tested 43° gravity oil from the subsalt Jurassic Upper Lam B formation in An Nagyah oil field in Yemen.

An Nagyah-18, drilled to 6,628 ft TD, was completed in 2,559 ft of gross oil-bearing Lam B section (OGJ, Oct. 17. 2005, Newsletter). The interval tested at a stabilized rate of 1,300 b/d of oil with less than 1% water cut and 838 Mcfd of natural gas at 220 psi tubing pressure through a 48⁄64-in. choke.

The Lam B reservoir is 140 ft below the currently producing Lam A formation. The An Nagyah-18 is the first commercial well in Lam B. Drilling of additional Lam B wells may be necessary to further develop the reservoir.

With testing completed at An Nagyah-18, the sixth horizontal well in the field, the drilling rig will move 14 miles northwest to drill the 6,560 ft Hatat-1 exploration well to test a potentially fractured, granitic basement play.

Block S-1 currently produces 11,300 gross b/d of oil and should exceed 12,000 gross b/d by yearend. ✦

Drilling & Production - Quick Takes

Chevron to sell more Gorgon LNG to Japan

Chevron Australia Pty. Ltd. and Japanese power company Chubu Electric Co. Inc. have signed a heads of agreement for the sale of 1.5 million tonnes/year of LNG from the Gorgon project over a period of 25 years, beginning in 2010.

Australian Trade Minister Mark Vaile valued Chevron’s agreement to supply LNG to Chubu at $10 billion (Aus.).

Chevron’s announcement did not disclose the terms of the deal, but the firm said the two parties are also discussing the potential transfer of an equity interest in the Gorgon project (OGJ, Oct. 17, 2005, p. 34).

Chevron Australia’s general manager of the Greater Gorgon Area, Colin Beckett, said the firm has agreements in place that will provide for the export of more than 65 million tonnes of Australian LNG over 25 years from Chevron’s share of the Gorgon project.

The agreement with Chubu follows one struck by Chevron in October to sell 1.2 million tonnes/year of LNG to Tokyo Gas Co. from the Gorgon development, and it takes the project closer to committing all of its 12.9 tcf of natural gas reserves.

Chevron Australia has a 50% operating interest in the Gorgon project. Australian subsidiaries of Royal Dutch Shell PLC and ExxonMobil Corp. hold 25% each.

Flow starts at Basker oil field off Australia

Anzon Australia Ltd. reported the start of production from Basker oil field in the Gippsland basin, 75 km off Victoria (see map, OGJ, Oct. 24, 2005, p. 50).

The Basker-2 well flowed from the upper of two intervals in which it was completed at initial rates of 9,500 b/d of oil and 10 MMscfd of solution gas with no water. The well, in 155 m of water in Bass Strait, is a subsea completion linked by a 1.9 km flowline to the Crystal Ocean floating production, storage, and offloading vessel, the first FPSO in the Gippsland basin. The inlet choke pressure on the FPSO was 1,400 psig.

The Basker-Manta-Gummy Joint Venture developed the field. Interests are Anzon, operator, 62.5%, and Beach Petroleum Ltd., 37.5%.

Habanero reports heavy oil pilot in Alberta

Habanero Resources Inc., Vancouver, BC, reported plans for a steam-assisted gravity drainage pilot project in the Peace River oil sands region of Alberta after agreeing to acquire an equity interest in a private company that controls 10,000 acres in the area.

The private company will file an application to the Alberta Energy and Utilities Board for the pilot plant during first quarter of next year, Habanero said.

According to Habanero, the company in which it has acquired the interest plans to drill two additional wells and shoot a 3D seismic survey to reassess the size and extent of its reserves and administer the pilot project. Habanero “may have the option to participate in the development and exploitation of the prospect in the future.”

According to a report completed by DeGolyer & MacNaughton of Calgary on Sept. 1, the acreage holds possible and probable reserves of 111.3 million bbl of oil. There is likely a supply of condensate in the area for treating and blending the heavy oil for pipeline sales. ✦

Processing - Quick Takes

Syntroleum inks three MOUs for GTL plants

Syntroleum Corp., Tulsa, recently signed memoranda of understanding that it says could lead to construction of three gas-to-liquids (GTL) plants using its proprietary Fischer-Tropsch technology:

• Syntroleum and Papua New Guinea’s Ministry of Planning and Development will examine development of a 50,000 b/d GTL plant near the capital city Port Moresby as part of an industrial complex dedicated to gas-based industries. The plant would share a natural gas pipeline and infrastructure facilities with other possible gas conversion participants, including ammonia, methanol, and power plant developers.

Syntroleum has held discussions with several Papua New Guinea gas reserve holders regarding gas supplies. Papua New Guinea’s proved and probable natural gas reserves are estimated at more than 15 tcf. About 6 tcf currently are dedicated to a planned pipeline linking the country to Australia.

• Syntroleum and service company PT Elnusa, a subsidiary of Indonesia’s state-owned company Pertamina, will establish a joint study to identify suitable existing gas reserves for development of a GTL facility in Indonesia. The companies are looking at numerous properties within Indonesia as potential sites for a plant, Syntroleum said.

• Ivanhoe Energy (Middle East) Inc., a Syntroleum licensee, and Egyptian Natural Gas Holding Co. (EGAS) will prepare a joint study to determine the economical feasibility of constructing and operating a GTL plant in Egypt. A site has not yet been determined.

EGAS would commit as much as 4.2 tcf of natural gas, or about 600 MMcfd, for a 20-year period if the study proves the project viable, Ivanhoe reported.

Coke drum to be replaced at S. Texas refinery

Flint Hills Resources LP has let a contract to Foster Wheeler USA Corp. for detailed engineering and procurement for a replacement coke drum in a delayed coker at the 300,000 b/d West Plant Refining Complex at Corpus Christi, Tex. The terms of the contract were not disclosed.

Foster Wheeler was involved in the earlier conceptual study, process design, and front-end engineering phases of the coke drum replacement project.

Wood River refinery to get S Zorb unit

ConocoPhillips plans to install its S Zorb sulfur removal technology (SRT) at its 306,000 b/d Wood River, Ill., refinery.

ConocoPhillips will convert a kerosine hydrotreater into an S Zorb SRT unit for gasoline streams. The 32,000 b/d unit is to be completed in early 2007.

S Zorb SRT units also are planned at Pasadena Refining System Inc.’s 117,000 b/d Pasadena, Tex., refinery and Sinopec Beijing Yanshan Co.’s 162,000 b/cd Yanshan refinery. These units will be the first to be built outside of ConocoPhillips’s refining system.

ConocoPhillips has two S Zorb units in operation-one each in its refineries in Borger, Tex., and Ferndale, Wash.-and a third under construction at its Lake Charles refinery in Westlake, La.

Contract let for Thai aromatics project

Aromatics (Thailand) Public Co. Ltd. has let a contract to Foster Wheeler Ltd.’s Thailand subsidiary for project management of a project called Reformer and Aromatics Complex II planned at Map Ta Phut, Thailand.

The terms of the contract were not disclosed.

Foster Wheeler will coordinate the engineering, procurement, construction, and commissioning phases of the project, which is scheduled for completion in 2008.

The new facilities will produce 565,000 tonnes/year (tpy) of paraxylene, 301,000 tpy of benzene, and 60,000 tpy of toluene.

The engineering, procurement, and construction (EPC) contract for the project has been awarded to a consortium of Korean contractors, and an EPC contract for offsite interconnecting pipelines has been let to a Thai company. ✦

Transportation - Quick Takes

Sovcomflot lets contract for crude tankers

South Korea’s Samsung Heavy Industries Co. has won a $422.5 million contract to build three ice-class crude oil tankers for Russian state-owned shipper Sovcomflot. Delivery is expected by Mar. 1, 2009.

Sovcomflot will use the vessels to transport crude from Varandei port in the Barents Sea for a joint venture set up by OAO Lukoil and ConocoPhillips.

The tankers will ship oil to the port of Murmansk, where it will be transferred to larger vessels for shipments to various markets, including the US.

Osman Sapayev, a deputy director of oil production department at Lukoil, said the Verandei terminal will start shipments in 2007 and will reach 240,000 b/d after 2009.

Sapayev said Varandei may be expanded to 400,000 b/d, and a fourth ice-class tanker may be ordered as the companies boost production in Russia’s Timan-Pechora province.

Fluor to perform RasGas III off-plot work

Fluor Corp. subsidiaries were awarded a contract by Ras Laffan Liquefied Natural Gas Co. Ltd. III to provide initial engineering, procurement, and construction management services for RasGas’ common off-plot projects in Qatar.

The contract’s value is undisclosed. But it authorizes Fluor of Aliso Viejo, Calif., to proceed with a portion of the balance of the project, with an estimated value of more than $1 billion, to be released early next year.

The contract covers common off-plot facilities to support a significant number of new projects in Ras Laffan, including six world-scale LNG trains handling gas from North field. Those facilities include utilities, tankage, and equipment for storage and loading of liquefied petroleum gas and condensates produced from those operations. Initial phase work will be performed in Fluor’s Houston office.

RasGas III will add sixth and seventh LNG trains to production facilities operated by RasGas Co. Ltd. at Ras Laffan Industrial City in the northeastern part of Qatar. Qatar Petroleum has a 70% equity interest in the project.

ExxonMobil Ras Laffan (III) Ltd. has 30% (OGJ Online, Nov. 16, 2005).

Indonesia, Japan agree on LNG contract extension

Indonesia officials and Japanese buyers have agreed on a pricing formula for the proposed extension of an LNG supply contract of 6 million tonnes/year that expires in 2010.

“The Japanese buyers are also interested in extending the contract of another six million [tonnes]/year from Bontang,” said Upstream Oil and Gas Regulatory Agency (BP Migas) Chairman Kardaya Warnika. “We have not made any decisions yet on this request. The gas resources in the area are finite.”

Japan, Indonesia’s largest LNG purchaser, has a contract for 12 million tpy of the fuel from Bontang, East Kalimantan. Buyers in Japan had requested lower prices for the contract extension. “We are asking for a suitable price, considering that oil prices have stayed above $40/bbl,” said Eddy Purwanto, BP Migas deputy of marketing and finance.

In October, Indonesia said it was forced to reduce LNG shipments for 2006 by 10% due to lower production from aging gas fields in East Kalimantan and Nanggroe Aceh Darussalam, where the Arun plant is located (OGJ Online, Oct. 27, 2005).

Buyers in South Korea, Taiwan, and Japan agreed to cut their imports from the Bontang plant by 30 cargoes-equivalent to 1.8 million tonnes of LNG-down from the 370 shipments that had been ordered, BP Migas said Oct. 21.

The agency is also trying to drop nine shipments of 75 cargoes contracted from Arun, which has a declining supply from fields operated by ExxonMobil Oil Indonesia.

Inergy unit to double Stagecoach capacity

Inergy LP subsidiary Central New York Oil & Gas Co. LLC (CNOG) proposed an expansion plan that will add 13 bcf of natural gas storage capacity at the 13.6 bcf Stagecoach facility 150 miles northwest of New York City in Tioga County. It is conducting a nonbinding open season, which will run through Dec. 16 to gauge shipper interest for firm storage.

Phase II of the expansion project is expected to start in third or fourth quarter 2006 with a commercial in-service date slated for second half 2007. CNOG is in the application process for authorization for the expansion from the US Federal Energy Regulatory Commission.

The expansion project will include the “Stagecoach North Lateral,” consisting of 12 miles of storage lateral and interconnect facilities to be connected to the proposed $1.35 billion (Can.) Millennium Pipeline (OGJ Online, Dec. 19, 2001).

The Stagecoach storage facility, which began operations in April 2002, is connected to Tennessee Gas Pipeline Co.’s (TGPL) 300 Line.

Because of its strategic location between TGPL and the Millennium systems, CNOG plans to offer hub services between the two pipelines. ✦