General Interest - Quick Takes

Occidental shipping Libyan oil to US again

Occidental Petroleum Corp. has lifted its first Libyan crude oil for shipment to the US since leaving its operations in Libya’s prolific Sirte basin in 1986 because of US economic sanctions.

Those sanctions were in place for nearly 20 years. This is the first shipment of a US company’s equity share of Libyan crude oil to the US, Occidental said.

The cargo of 900,000 bbl of 36o gravity crude marks a milestone, Oxy Chairman, Pres., and Chief Executive Officer Ray R. Irani said.

“Above all, it reflects the ongoing improvement in US-Libya relations,” he said. Occidental negotiated an agreement with Libya’s National Oil Corp., effective July 1, to resume operations under the “standstill agreement” that preserved Oxy’s claims to the licensed properties (OGJ, Aug. 8, 2005, p. 30).

Current estimates indicate that Occidental’s net Libyan production will reach 22,000 b/d by yearend, an increase from earlier estimates of 12,000-15,000 b/d.

Occidental has assets in Libya’s Intisar-103 and Epsa fields and interests in 13 exploration blocks. The holdings encompass 130,000 sq km, making Occidental the largest net working interest holder of oil and gas acreage in Libya.

NEB examines growing Canadian oil production

Canadian oil activity is picking up in response to higher oil prices, although the oil-related activity has been overshadowed by gas drilling in Western Canada, the National Energy Board (NEB) said in a recent report.

In its Short-term Outlook for Canadian Crude Oil to 2006, NEB noted growing oil production volumes stemming from oil sands and reserves off Newfoundland and Labrador, including development of Hibernia, Terra Nova, and White Rose fields.

Overall, conventional production from the Western Canada Sedimentary Basin, both light and heavy, is in decline. Canada last year produced 2.5 million b/d of crude oil, of which 2.2 million b/d came from the WCSB.

Meanwhile, production gains from off the East Coast and the oil sands are offsetting WCSB’s decline, NEB said.

“In 2005, total production is projected to be about 3% below 2004 levels primarily due to operational problems experienced at all three integrated oil sands mining and upgrading plants,” the NEB report said. “By yearend 2006, however, total Canadian production is projected to increase substantially to 2.9 million b/d as mined bitumen, in situ bitumen, and East Coast offshore production expand.”

Canada consumed 977,000 b/d of Canadian crude oil and imported 950,000 b/d during 2004, and it exported 1.6 million b/d of crude oil to the US. Overall, Canada was a net exporter of 630,000 b/d.

Issues facing the oil industry include insufficient supply of diluent to transport heavy crude oil to market, lack of heavy crude pipeline capacity out of the WCSB, price volatility, and lack of coking capacity for the growing supply of crude from oil sands, the NEB report said.

Timor-Leste sets up petroleum fund

The Timor-Leste government has established a petroleum fund for long-term management of its hydrocarbon reserves with a starting balance of $250,000.

Prime Minister Mari Alkatiri said the fund, modeled after a Norwegian program, is estimated to grow to more than $5 billion by 2025. All revenue from the country’s petroleum resources will flow into it. ✦

Exploration & Development - Quick Takes

GDF gets contract to explore off Egypt

Egyptian Natural Gas Holding Co. let a production-sharing contract to Gaz de France for a 100% stake in the 1,364 sq km West El Burullus exploration block in the Mediterranean Sea off Alexandria.

The first well is scheduled for drilling early next year. GDF told OGJ that it probably will seek partners for the project.

GDF already held a 20% interest in Egyptian block North West Damietta. The PSC allows it to become an operator in Egypt for the first time.

S. Korea assessing N. Korean development

South Korea’s government is seeking to jointly develop North Korean oil and natural gas resources and is currently evaluating their commercial potential.

The Ministry of Commerce, Industry, and Energy told lawmakers at a parliamentary audit session on Sept. 22 that small amounts of crude oil have been found in North Korea’s continental shelf in the West Sea.

The ministry said Korea National Oil Corp. procured data on possible oil fields from a Japanese firm that conducted preliminary exploration in the area, but further drilling is needed to determine if the deposits have commercial value.

The Seohanman region east of Nampo saw production of 450 b/d of crude oil in 1985, while 70 b/d were produced at the Ahnju basin area to the north.

Natural gas also has been found in the East Sea near Wonsan, another area attracting interest.

Japan boosts surveillance in E. China Sea

Japan plans to step up surveillance of its disputed maritime border region in the East China Sea to prevent China from developing natural gas fields in the area.

The Japan Maritime Self-Defense Force will add flights of patrol aircraft in the area in cooperation with the Japan Coast Guard and the Ministry of Economy and Industry.

China reportedly has completed development of three gas fields near the border along with offshore facilities in Tianwaitian field near the border region.

Japan claims that the subsea resources China is developing extend across the maritime border into Japanese territory.

The countries, which were to have held another round of talks in Tokyo on the issue beginning Sept. 30, have been holding talks on the issue since May.

China has proposed joint development of the fields, but only for the portion that falls on Japan’s side of the border. Japan has asked that the Chinese side be included.

Meanwhile, if China does not compromise, the Japanese government is considering test drilling at a site on its side of the border near Chunxiao gas field.

In August, the Japanese government issued a new protest to China over Chunxiao field, saying Beijing had the means to start producing from the disputed area (OGJ Online, Aug. 15, 2005).

Hardman cuts oil, gas pay in Tevet appraisal

Australia’s Hardman Resources Ltd. said its Tevet-2 appraisal well off Mauritania cut “gas and oil-bearing sands” similar in thickness to those at its Tevet-1 discovery well (OGJ, Dec. 6, 2004, p. 42).

With the well drilled to 2,785 m, Hardman has run wireline logs, sampled fluid, and measured downhole pressures in the Miocene appraisal objective. Preliminary evaluation of wireline and drilling data indicates a gross gas interval of about 1.5 m above a gross oil interval of about 37 m.

The Tevet-2 well is 2.5 km south of the discovery well in 466 m of water. With a planned TD of 3,965 m, it also will test a deeper Cretaceous target.

Hardman has a 21.6% stake in the field. Australia’s Woodside Petroleum Ltd. holds 53.8%, BG Group 11.6%, Premier Oil 9.2%, and Roc Oil Co. Ltd. 3.7%.

Statoil’s Tulipan wildcat finds gas

Statoil ASA has discovered a small gas deposit in early Tertiary sandstones at 2,600 m in its Tulipan prospect in Production License 251 in the Norwegian Sea.

The 6302/6-1 wildcat is in 1,260 m of water 130 km west of Norsk Hydro ASA’s Ormen Lange gas development (OGJ Online, June 2, 2005). It was drilled to 2,950 m TD beneath the seabed in late Cretaceous rocks by Ocean Rig’s Eirik Raude semisubmersible.

Field operator Statoil is completing an extensive logging program, which will form the basis for further analysis.

Statoil has a 90% interest in Tulipan, and Norske Shell has 10%. BG Norge is acquiring 20% of Statoil’s share, subject to government approval.

The Eirik Raude will move to the Barents Sea to drill on Eni’s Goliat discovery before spudding an exploration well on Statoil’s Uranus prospect.

Sonoran Energy to explore Azraq Block

Sonoran Energy Inc., London, has finalized the terms of a production-sharing agreement (PSA) with Jordan’s state Natural Resources Authority for the exploration and development of the 11,250 sq km Azraq Block east of Amman.

The PSA, yet to be ratified by the Jordanian parliament, is the first to be signed by the country in 8 years.

Sonoran will assume operation of the existing producing wells in Hamza oil field, which lies in the eastern part of the block bordering Saudi Arabia and contains the northern extension of Azraq-Sirhan Graben, which is mature for oil generation (OGJ Online, Dec. 10, 2004).

Sonoran’s mapping of reprocessed 2D seismic data has revealed additional structures and potential new plays on the block.

Sonoran intends to begin an aggressive evaluation program focusing on both exploration and the potential for boosting production from existing wells and facilities. The program will entail acquiring 3D seismic data, drilling two exploration wells, and conducting a number of technical studies. ✦

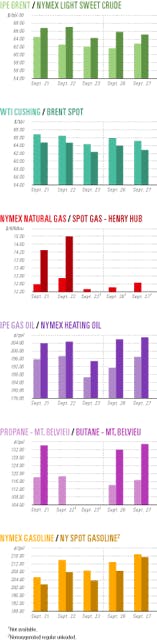

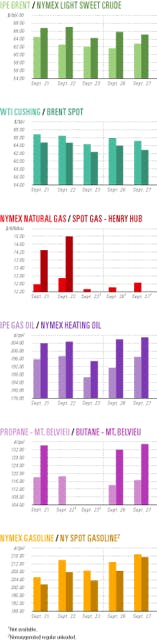

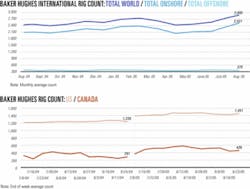

Industry Scoreboard

null

null

null

null

Drilling & Production - Quick Takes

On-site Gulf of Suez FPSO repair completed

Zaafarana Oil Co. maintained oil production from Zaafarana field in the Gulf of Suez off Egypt during a recent on-station repair to the field’s 120,000 dwt Al Zaafarana floating production, storage, and offloading vessel (OGJ Online, Nov. 15, 2001).

Intelligent Engineering Ltd. of the UK and partner-licensee Keppel Shipyard, a wholly owned subsidiary of Keppel Offshore & Marine Ltd., Singapore, completed the repair of a cargo storage unit aboard the vessel in early September. Conducting repairs on site enabled FPSO owner-operator Prosafe Production Inc. to avoid field shutdown and FPSO relocation for yard-based repairs.

The repair involved reinstating 191 sq m of the lower strakes of two longitudinal bulkheads in a 36-year-old oil cargo tank that had corroded below Det Norske Veritas’s offshore standards allowance.

Repair work schedules were complex due to frequent offloading from the Al Zaafarana, which has the capacity to process about 30,000 b/d of heavy crude, said Denis Welch, director of the “SPS overlay” technology used in the repair.

Chevron lets contract for Tahiti spar

Chevron Corp. has let a contract to France’s Technip for the engineering, procurement, and construction of the spar hull and mooring systems for deepwater Tahiti field in the Gulf of Mexico (OGJ, Sept. 5, 2005, Newsletter). Chevron also has awarded Technip a contract for fabrication of the topsides modules.

Tahiti field lies on Green Canyon Blocks 596, 597, 640, and 641 in 4,200 ft of water about 190 miles southwest of New Orleans.

The Tahiti facility will have the capacity to produce 125,000 b/d of oil and 70 MMscfd of gas and treat 120,000 b/d of produced water. The topsides will include a 9,950-ton production module, a 6,500-ton utility module, and a 2,500-ton module support frame.

The Technip-designed deepwater spar hull will be 170 m long and 39 m in diameter and have a steel weight of 24,000 tonnes.

Technip will conduct detailed hull and moorings design, procurement, and fabrication at its yard in Pori, Finland. The fabrication of the topsides by Gulf Marine Fabricators, at the group’s yard near Corpus Christi, Tex., is scheduled to begin in the fourth quarter.

Delivery of the spar hull to the Gulf of Mexico and fabrication of the topsides are scheduled for completion in mid-2007.

Chevron is the operator of the Tahiti project with a 58% working interest. Tahiti partners are Statoil ASA 25% and Shell Exploration & Production Co. 17%.

Victoria Petroleum tests Ventura well

Victoria Petroleum NL, Perth, began flowing its Ventura-1 oil discovery at 165 b/d in the South Australian Eromanga basin.

The well, in permit PEL 115, was put on pump in an extended production test. The initial flow rate is expected to increase as the company optimizes pumping parameters from the Mesozoic-age basal Murta and Namur reservoirs.

Ventura is 4.5 km west of Victoria’s other recent discovery, Mirage-1, which is currently flowing at a natural rate of 180 b/d but also will be put on pump this month.

Victoria plans to drill three more wells in Mirage field by the end of this year, following interpretation of a 3D seismic survey now being run over the area. Success in these three wells could bring Mirage production up to 1,000 b/d and the total from the block to around 1,200 b/d.

Victoria is operator with a 40% interest. Other interest holders are Impress Ventures Ltd., Perth (27.5%), Roma Petroleum NL, Brisbane (20%), and Entek Energy Ltd., Perth (12.5%).

Suncor completes upgrader repairs

Suncor Energy Inc., Calgary, has restarted its 225,000 b/d oil sands upgrader that was damaged by fire in January.

The repaired upgrading facility’s current crude oil production is 200,000 b/d.

Upgraded product volumes are expected to ramp up as Suncor operations returns to full production capacity.

Suncor will soon commission its next expansion project, which is expected to increase oil sands production capacity to 260,000 b/d.

Restart operations suspended at El Bibane

Workover operations to restart production from El Bibane field off Tunisia have been unsuccessful, said Candax Energy Inc., Toronto. Operations are being suspended and equipment demobilized.

El Bibane 3 was temporarily shut in for essential maintenance and repair of the wellhead. Attempts to restart production have been made using nitrogen lift, but due to the high water-cut in the well, natural flow could not be sustained when the nitrogen lift was terminated.

Candax had planned a full field development program to optimize production and recovery of the El Bibane reserves. The program will now include reinstating production from El Bibane 3. The plan involves drilling another development well and installing permanent gas lift capability in both wells. The program is expected to start late in the fourth quarter and to complete in first quarter 2006. ✦

Processing - Quick Takes

Strike halts output of Total refinery in France

Total SA said operations at its Gonfreville l’Orcher refinery, the largest in France, came to a halt on Sept. 26 as a workers’ strike over pay moved into its seventh day.

Total said production would halt at the few units still operating at the 343,000 b/d refinery, which accounts for 17% of France’s refining capacity. Altogether, Total controls 56% of the country’s refining capacity, which came to 1.95 million b/d in 2004.On Sept. 21, Total said the refinery was progressively reducing its output to minimum levels for safety reasons following a strike by employees. The CGT labor union said the strike began on Sept. 20 among employees in the shipping department and involved a wage issue.

The current strike follows one in mid-May, which hit five of Total’s six refineries in France (OGJ Online, May 20, 2005).

On Sept. 7, the union said production at the Gonfreville refinery had been halted by a strike when the entire early shift at the plant downed tools in response to the company’s disciplinary action against four members of staff at the La Mede refinery.

CGT said the strike also affected other refineries, a point confirmed by a Total spokeswoman who said strikes at five of Total’s six refineries in France started on Sept. 6-7 and were leading to reduced output.

The refineries included Provence at Marseille, Feyzin at Lyon, Grandpuits near Melun in the Paris region, Normandie at Le Havre, and Donges near Saint-Nazaire in Western France.

The spokeswoman could not say how much of Total’s production had been cut but said it was “not yet near” the 15-20% output minimum capacity below which the plants would have to close for safety reasons.

The CGT strike was prompted after action was taken on Aug. 7 against four employees implicated in a fuel leak at the Provence plant. One of the workers was suspended without pay for 10 days, while the other three were reportedly transferred to different positions.

Trinidad and Tobago approves small GTL plant

Trinidad and Tobago has approved construction of a $100 million gas-to-liquids (GTL) plant expected to start producing high-quality diesel fuel by first quarter 2007.

According to Eric Williams, the Caribbean island nation’s energy minister, state-owned Petrotrin will hold a 33% stake in the plant, to be built at Pointe-a-Pierre, in southern Trinidad. Petrotrin’s partner will be World GTL, New York, which will hold the remaining two-thirds stake.

World GTL, founded in 2000, is run by former executives of ARCO and Royal Dutch Shell PLC. Its chairman, Gordon Barrows, is chairman of Barrows Co., a petroleum information company.

World GTL will approach capital markets to fund 70% of the $100 million cost of the plant.

Small in comparison with similar projects elsewhere, the plant will require 18.4 MMcfd of gas and produce 2,250 b/d of diesel.

The GTL plant is being built with parts from mothballed methanol plants and can be expanded if needed.

Gas for the plant will be supplied by Petrotrin, with more gas to be purchased from Trinidad’s National Gas Co. ✦

Transportation - Quick Takes

Commitments sought for Sabine Pass gas line

Kinder Morgan Energy Partners LP has started a binding open season for a proposed 137-mile interstate gas pipeline from the 2.6 bcfd Cheniere Energy Inc. Sabine Pass LNG terminal under construction in Cameron Parish, La., to pipeline interconnections in Evangeline Parish, La. (OGJ, Aug. 18, 2005, Newsletter).

The project would include 137 miles of large-diameter pipeline with firm capacity of about 2.1 MMbtu/day and 1 mile of pipeline with firm capacity of 1.3 MMbtu/day connecting to the system of Natural Gas Pipeline Co. of America, a Kinder Morgan subsidiary.

Kinder Morgan has obtained conditional agreements from shippers for the 3.4 MMbtu/day of initial project capacity.

The pipeline could be in service as early as first quarter 2009.

ONGC Videsh to ship Sakhalin oil to India

India’s ONGC Videsh Ltd. (OVL) plans to ship 700,000 bbl of crude oil from the Sakhalin-I project off Russia to India every 70 days beginning in April 2006.

The Sakhalin-I consortium partners are reported to have hired five ice class tankers on long-term charter under the crude offtake agreement. The tankers will be ready for delivery by January 2006, and OVL will hire one tanker to transport its output of around 50,000 b/d to India.

Oil from the project’s offshore fields will be piped 226 km across Sakhalin Island and the Tatar Strait to De-Kastri port on the Russian mainland, where an export terminal is under construction.

The field has reserves estimated at more than 2.3 billion bbl of crude oil and 485 billion cu m of natural gas.

The Sakhalin-I partners are Exxon Neftegas Ltd., operator, 30%; Japan’s Sodeco, 30%; Russia’s RN-Astra LLC, 8.5%; Russia’s Sakhalinmorneftegaz-Shelf, 11.5%; and OVL, 20%.

Firms to study Barents Sea LNG transport

Mitsui OSK Lines Ltd. and Itochu Corp. of Japan plan to work with Russia’s Gazprom to develop a plan for transporting LNG to North America from the port of Murmansk on the Barents Sea.

The aim is to operate a fleet of 15 large LNG carriers to ship 15 million tonnes/year of LNG from Russia to North America.

Mitsui OSK Lines and Itochu have developed a tentative plan as the basis for discussions, and the companies will now develop a detailed strategy.

Gas would come from Shtokman gas condensate field in the Barents Sea.

The contract for transporting the LNG could be signed as early as spring 2006, with operations scheduled to begin in 2010.

The 1,400 sq m Shtokman field, discovered in 1988 east of Murmansk, lies north of the Arctic Circle in 350 m of water about 555 km from land.

RasGas II Train 4 to start up Nov. 22

Ras Laffan Liquefied Natural Gas Co. Ltd. II (RasGas II) has commissioned Train 4 and its associated acid gas injection facilities at the Ras Laffan LNG liquefaction plant in Qatar. The train will begin liquefying gas from Qatar’s giant North gas field on Nov. 22.

The 4.7 million-tonne/year train, one of the largest in the world, will provide LNG to RasGas customers in Europe (OGJ Online, Nov. 8, 2002).

Construction is under way on 4.7 million-tonne/year Train 5. By 2011, RasGas ventures, including RasGas II, are expected to supply more than 36 million tonnes/year of LNG to the Asia-Pacific region, Europe, and the US (OGJ Online, July 6, 2004).

RasGas II is a joint venture of Qatar Petroleum Co., 70%, and ExxonMobil RasGas Inc., 30%.

RasGas III lets contracts for LNG trains

RasGas III has let offshore and onshore engineering, procurement, and construction (EPC) contracts for Trains 6 and 7 of the LNG complex at Ras Laffan Industrial City, Qatar.

The onshore EPC contract, awarded to J. Ray McDermott Middle East, covers two 7.8 million-tonne/year liquefaction trains. The Chiyoda Corp. and Technip France Joint Venture received the offshore facilities contract, which involves building and installing two wellhead platforms in Qatar’s North gas field and two offshore gas pipelines.

The project is expected to supply gas principally to the US starting in 2008 or 2009 and extending for more than 25 years.

Qatar Petroleum has a 70% equity interest in the project. ExxonMobil Ras Laffan (III) Ltd. has 30%. ✦