General Interest - Quick Takes

Lawsuit blames energy firms for storm damage

Five Louisiana residents filed a class-action lawsuit against 10 major producer and pipeline companies, claiming damage inflicted by those firms on the coastal marshes in southern Louisiana was a cause of “all, or almost all, of the loss of life and destruction of property that resulted from Hurricane Katrina.”

The suit does not specify any amount of damage. However, other sources have estimated that federal government costs related to the hurricane could exceed $200 billion.

Companies named in the lawsuit filed Sept. 13 in the US Court for the Eastern District of Louisiana are ExxonMobil Corp., BP Corp. North America Inc., Chevron Corp., Shell Oil Co., Colombia Gulf Transmission Co., Koch Pipeline Co. LP, Gulf South Pipeline Co. LP, Shell Pipeline Co. LP, Tennessee Gas Pipeline Co., and Transcontinental Gas Pipeline Co.

Plaintiffs in the suit were identified as George Barasich of St. Bernard Parish; Benny J. Borden, Jefferson Parish; and Courtney Foxworth, Darin Tircuit, and Ralph H. Long Jr., all of Orleans Parish. As OGJ went to press last week, plaintiffs or their attorneys could not be reached for additional identification or comment. However, a George Barasich of St. Bernard Parish was listed in 2004 as a member of the board of directors for the Louisiana Shrimp Association.

The suit said the companies dredged canals in the coastal marshlands of Louisiana that they are still using and that “have eroded over the course of time and continue to erode.” It claims the “continuing failure” of the defendants to maintain those canals caused “damage to the stability and ecological function of the marsh property, which provided protection to inland communities from hurricanes.”

It further charges, “Over 1 million acres of marsh property has already been destroyed and millions more essentially destroyed as a result of defendants’ negligence in oil, gas, and pipeline operations throughout southeast Louisiana, thus depriving metropolitan areas such as the City of New Orleans from its natural protection against hurricane winds and storm surges.”

The suit acknowledges that “other causes may have contributed to the loss of marsh property.” But it claims that the energy companies’ canals “are a, if not the, substantial cause of marshland loss” and resulting storm damage.

“But for the negligent actions of defendants in failing to properly mange their canals, marsh property would have existed at the time Hurricane Katrina arrived at the Louisiana coast,” it said. If undamaged marshlands had existed, the plaintiffs claim, “Hurricane Katrina’s winds and storm surge would have been greatly diminished by the marsh property, thus averting all, or almost all, of the loss of life and destruction of property that resulted.”

A representative of Shell Oil told OGJ that company attorneys had received a copy of the suit and are in the process of reviewing it. Phone calls made last week to some of the other companies were unsuccessful.

Dingell seeks DOE’s help on refining capacity options

The House Energy and Commerce Committee’s chief minority member has requested help from the US Department of Energy in addressing the domestic refining situation.

Rep. John D. Dingell (D-Mich.) noted that at the committee’s Sept. 14 hearing on recovering from the effects of Hurricane Katrina several witnesses discussed the importance of expanding US refining capacity.

“According to statistics gathered by the Energy Information Administration, some 30 refineries have closed in the United States since 1995, representing over 900,000 b/d of refining capacity,” Dingell said in a Sept. 15 letter to Energy Sec. Samuel W. Bodman.

He then asked Bodman if refiners have tried to bring any of these facilities back online and if DOE had analyzed whether any of these plants are ready to be restarted. On specific closed refineries, Dingell said he is interested in:

• The last date on which the refinery yielded petroleum products and its throughput capacity at that time.

• Whether substantial equipment and infrastructure remain that would allow production of gasoline and other products to resume within a reasonable time.

• Whether appropriate transportation facilities, including necessary pipeline hookups, remain in place.

“If the owners have provided to you estimates of the time and capital expenditures required to reopen the facility, we would appreciate them as well,” Dingell wrote the energy secretary.

He also noted that US President George W. Bush proposed a policy of siting new refineries on closed military bases on Apr. 27. “What efforts has the department undertaken to promote this policy? How many closed military bases has the department determined may be suitable locations to site a new refinery? How many inquiries have been made by the refining industry to the department (or any other federal agency) expressing an interest in siting a new refinery on a closed military base?” Dingell asked.

He added that if DOE or any other federal agency does not have information on the suitability of using closed military bases as sites for new refineries, he would appreciate DOE’s conducting an analysis and transmitting it to the committee. Noting that Rep. Joe Barton (R-Tex.) wants to move expeditiously, Dingell asked Bodman for a response by Sept. 30.

“We expect further committee action on this matter and note that we have not yet heard from several important stakeholders, including state and local officials,” the Michigan Democrat said. “As the committee continues to investigate what, if any, policy changes need to be made in order to avoid future disruptions in retail gasoline supply, I would appreciate the department’s assistance in gathering information that may be relevant to our deliberations.”

Norsk Hydro to acquire Spinnaker Exploration

Norsk Hydro ASA plans to acquire Spinnaker Exploration Co., Houston, in a $2.56 billion transaction geared to boost Norsk Hydro’s presence in the Gulf of Mexico and raise its overall international production.

Hydro agreed to pay $65.50/share for Spinnaker Exploration for a total of $2.45 billion and to assume $110 million in debt. Upon the transaction’s completion, Hydro expects to achieve 40%/year worldwide production growth during 2005-08.

The boards of both companies have approved the deal, which is expected to close in the fourth quarter. The acquisition remains subject to approval by Spinnaker’s shareholders and US regulators.

Hydro Pres. and Chief Executive Officer Eivind Reiten said, “We believe that the deepwater potential in the Gulf of Mexico is considerable.” He said Hydro will integrate its deepwater expertise with Spinnaker’s assets.

Spinnaker’s production is expected to reach 50,000 boe/d by 2008 compared with its current production of 23,000 boe/d. The independent reports 62 million boe of proved reserves.

The takeover will bring Hydro holdings in numerous gulf blocks, including 25% interest in Front Runner oil field. Spinnaker also produces oil and gas on the gulf shelf. ✦

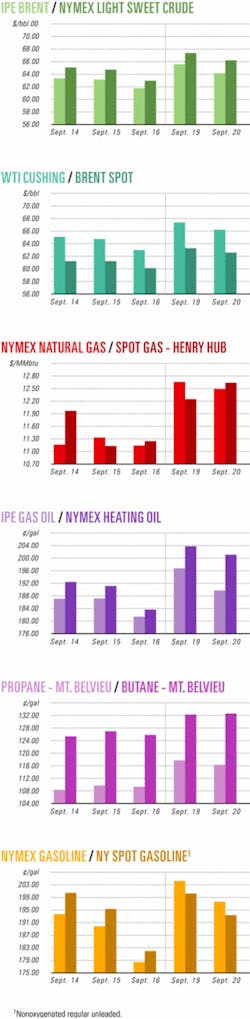

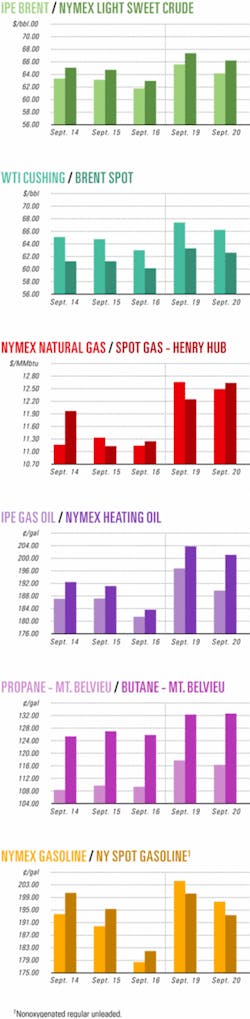

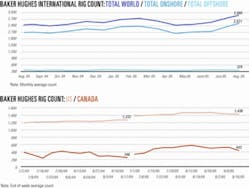

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Chevron, Gazprom win blocks off Venezuela

The Venezuelan Ministry of Energy and Mines has awarded licenses to local units of Chevron Corp. and OAO Gazprom for offshore exploration. The tracts are three of seven licenses offered in Venezuela’s Stage A Rafael Urdaneta natural gas bid round in August (OGJ Online, Apr. 29, 2005).

ChevronTexaco Latin America Upstream won the Cardon III exploration block off western Venezuela with a bid of $5.6 million. The block lies in a region containing natural gas potential on trend north of the prolific Maracaibo producing region.

Gazprom unit Zarubezhneftegaz received the Urumaco I and Urumaco II blocks, bidding $15.2 million and $24.8 million respectively for these properties, according to BN Americas.

The two majors are committed to investments of $98 million during the first 4 years.

Two blocks, Moruy III and La Vela Sur, received no bids, and the interest shown in Urumaco III was considered insufficient.

The round, which attracted 27 bidders from 16 countries, was the first stage of a project to develop nonassociated gas. The 30,000 sq km prospect area northeast of Falcon state consists of 29 blocks, 18 of which are offshore in the Gulf of Venezuela and 11 in eastern Falcon state. These will be tendered in stages.

Stage B tenders were requested in mid-September for five more blocks, with bids to be received Nov. 9 and awarded Dec. 1. These are Urumaco III, Moruy II, Castillete Noreste II, Cardon II, and Cardon IV.

Licenses will be for a term of 30 years, and Petroleos de Venezuela SA will secure a 35% interest once commercial viability is established.

CanWest to drill Alberta oil sands prospect

CanWest Petroleum Corp., Calgary, plans to drill 12 exploratory holes this winter on the Eagle Nest Prospect in the Athabasca oil sands of Alberta.

CanWest recently bought the 23,040-acre prospect, 70 miles west of its Firebag East Oil Sands Project, for $727,187 cash. It owns the prospect through subsidiary Township Petroleum Corp.

The drilling, estimated to cost $2 million, will attempt to confirm an estimate by the Alberta Energy Utilities Board’s Crude Bitumen Resource Atlas of May 1996 that the prospect has 3.4 billion bbl of bitumen in place.

EnCana reports oil discovery off Brazil

EnCana Corp. has reported an oil discovery on Block BM-C-7 in the Campos basin, about 75 km off Brazil.

During a 3-day production test, the EnCanBrasil 3-ENC-3-RJS, drilled in 101 m of water, flowed at equipment-limited rates as high as 1,800 b/d of 14˚ gravity oil. The well cut 34 m of net pay.

Pride International Inc.’s Pride South Atlantic semisubmersible drilled the well, which has a projected TD of 2,317 m, according to Brazil’s National Petroleum Agency. The block covers 649 sq km and was acquired during the second licensing round in 2000.

EnCana is operator with a 50% interest. Kerr-McGee do Brasil Ltda. holds 50%.

A declaration of commerciality is due in 2007, but EnCana said it might make the determination by yearend.

An EnCana official called reservoir quality in the discovery well “outstanding.”

It was the company’s third well on the block. A fourth well is planned to delineate the field, dubbed Chinook.

On the same block last year, well 1-ENC-1-RJS, in 100 m of water, reached 2,402 m TD and encountered about 57 m of net oil pay in the Cretaceous Carapebus formation.

Pertamina, ExxonMobil clarify Cepu stakes

Indonesia’s state oil and gas company Pertamina and ExxonMobil Corp. signed a contract establishing joint ownership in Cepu oil field of east-central Java. The contract clarified each company’s stake in the Cepu Block (OGJ, Sept. 12, 2005, Newsletter).

Under the agreement, Peramina and ExxonMobil subsidiaries each hold a 45% interest, with the regional government holding 10% interest.

ExxonMobil Southeast Asia-Pacific Vice-Pres. Stephen Greenlee said the agreement outlines a 30-year production pact to develop the block, which contains 600 million bbl of reserves. A joint operating agreement must be finalized before work can start.

The Cepu Block is expected to boost Indonesia’s crude oil production by 150,000-200,000 b/d. ExxonMobil faced a large dilution of its interest 2 years ago in the block, where the company made two significant oil discoveries in 2001 (OGJ Online, Oct. 4, 2002). ✦

Drilling & Production - Quick Takes

Contract let for monohull production vessel

Sevan Marine has let a contract to a unit of John Wood Group PLC for the operation and management of the Sevan Stabilized Platform (SSP) Piranema, a floating production, storage, and offloading vessel. The FPSO will be operated for Petroleo Brasileiro SA (Petrobras) in Piranema oil field off northeastern Brazil. The 5-year, extendable contract is valued at $7 million/year.Wood Group Engineering & Production Facilities will oversee the vessel’s management and execution, including onshore technical, logistical, and supply chain support, as well as oversee SSP Piranema’s operational efficiency and performance.

The vessel will be the first implementation worldwide of Sevan Marine’s SSP cylindrical monohull design, Wood Group said. SSP Piranema’s design includes 30,000 b/d of oil process plant capacity, a gas injection plant with 3.6 million cu m/day of compression capacity, and 300,000 bbl of oil storage capacity. Piranema also can accommodate as many as 21 risers.

During the design and construction phase, the Wood Group unit will provide a number of support services, including operations and process engineering, and participate in hazardous-operations reviews.

The SSP Piranema will require 60 full-time personnel for day-to-day operations and maintenance, 95% of whom will be Brazilian.

Compass Energy buys production semi

Compass Energy Group, an offshore engineering firm based in Singapore, purchased on speculation the semisubmersible production unit Petrobras XXIV to use for fast-track field development and offshore accommodation projects.

The 88-m long production unit was renamed the Molly Brown and is due to arrive in Singapore in mid-November. It was built as a drilling rig by Marathon Le Tourneau in Brownsville, Tex., and named Penrod 72.

In 1987, Placid Oil Co. converted it for use in Green Canyon Block 29 as the Gulf of Mexico’s first floating production facility, moored in more than 500 m of water.

The Molly Brown has heated process facilities for up to 60,000 b/d, a gas export system, total power output of 8,000 kw, and accommodation for 94, upgradeable to 200. It does not require any major changes to the hull structure or the marine systems to continue serving as a floating production unit.

Chinguetti development ahead of schedule

Development of Chinguetti oil field off Mauritania, where the government recently changed in a bloodless coup, is ahead of schedule but will cost slightly more than earlier estimated, reports operator Woodside Petroleum (Pty.) Ltd.

Woodside expects production to start next February instead of March and costs to total $705 million instead of $625 million (OGJ, Aug. 15, 2005, p. 27). Chinguetti field, 90 km west of Nouakchott, holds an estimated 100 million bbl of oil.

Woodside, which holds a 47.38% interest, set aside $45 million for unplanned contingencies. It said most of the increased cost estimate relates to drilling. The field’s complex geology has required extra time for sidetracks, and there are additional costs for preparation of subsea flowlines for installation.

Other partners in the production-sharing contract are Hardman Resources Ltd. 19%, BG Group 10.2%, Premier Oil PLC 8.1%, Roc Oil Co. Ltd. 3.3%, and the Mauritanian government 12%.

Wood Group to operate compression platform

A joint venture in Mexico let a contract to a subsidiary of John Wood Group to provide operations and maintenance services for the Akal GC compression platform in the Bay of Campeche through October 2006.

Compania de Servicios de Compresion de Campeche, a joint venture of Duke Energy International LLC and Marubeni Corp., owns the platform, which separates liquids and compresses 250 MMscfd of gas for Pemex Exploration & Production.

Wood Group Engineering & Production Facilities SA will have operational responsibility for the platform, including offshore operations and maintenance and onshore technical support, logistics, and supply chain activities. ✦

Processing - Quick Takes

PetroChina lets ethylene contract to Linde

PetroChina Co. Ltd. let a $140 million contract to Linde AG of Wiesbaden, Germany, to provide technology and key components to build what will become China’s largest ethylene plant.

Linde will be responsible for a megacracker with capacity of 1 million tonnes/year of ethylene and 500,000 tonnes/year of propylene. The operating company, PetroChina Dushanzi Petrochemical Co., intends to start production in second half 2008.

The contract is part of a $3.29 billion expansion of a refinery and petrochemical complex in Dushanzi in Northwest China’s Xinjiang province. The expansion will increase the complex’s refining capacity to 10 million tonnes/year from 6 million tonnes/year and its ethylene capacity to 1.2 million tonnes/year from 220,000 tonnes/year (OGJ Online, Feb. 23, 2005).

The project will raise PetroChina’s refining capacity by about 10% and its ethylene capacity by about 55% over last year’s levels.

MarkWest Energy to buy Javelina gas plant

MarkWest Energy Partners LP, Denver, agreed to buy the Javelina Co. gas processing and fractionation plant in Corpus Christi, Tex., from El Paso Corp., Kerr McGee Corp., and Valero Energy Corp. for $355 million.

El Paso and Kerr McGee each owns a 40% stake in the plant, while Valero Energy Corp. owns 20%. MarkWest plans to own 100% of the plant subject to regulatory approvals and closing, expected in the fourth quarter.

The gas processing facility gathers, treats, and processes off-gas streams from six refineries in the Corpus Christi area. The Javelina plant processes 125-130 MMcfd of inlet gas, and it has a capacity of 142 MMcfd. ✦

Transportation - Quick Takes

Snøhvit faces delay, increased costs

An underestimation of the scope of the Snøhit natural gas development and LNG project off Norway has led to an 8-month delay in the field’s expected Phase I gas deliveries and increased the project’s costs by $1.1 billion, reported project operator Statoil ASA. The project is the first gas development in the Barents Sea and will be Europe’s first LNG export scheme.

The project originally was slated to begin delivering 4.2 million tonnes/year of LNG in 2006 to Spain and the US, but initial gas is now expected June 1, 2007, with regular deliveries slated for the following December. Statoil said it is seeking alternative sources of supply for these customers until Snøhit production begins.

Statoil Chief Executive Helge Lund said the now-$9 billion project was “not sufficiently mature” when sanctioned in 2001. This led to delays in engineering and to modifications in refrigeration modules, electrical systems, and other elements of the LNG gasification plant on Melkøya Island near Hammerfest in northern Norway (OGJ, Oct. 11, 2004, p. 58).

“Considerably more work remains to be done at Melkøya than was previously estimated,” Lund said, adding that the LNG plant nonetheless remains a profitable venture.

Statoil holds 33.53% of Snøhvit. Other licensees are Petoro AS 30%, Total SA 18.4%, Gaz de France 12%, Amerada Hess Norge AS 3.26%, and RWE DEA Norge AS 2.81%.

Yemen LNG lets contract for Balhaf plant

State-owned Yemen LNG Co. (YLNG) let a contract worth more than $2 billion to Halliburton subsidiary KBR and partners for engineering, procurement, construction, precommissioning, commissioning, start-up, and operational services for Yemen’s first LNG plant.

KBR’s partners are Technip of France and JGC Corp. of Japan.

The plant is to be built at the port of Balhaf near Aden on Yemen’s southern coast. It is to consist of two liquefaction trains with a combined capacity of 6.7 million tonnes/year (OGJ Online, Feb. 16, 2005).

KBR said Train 1 is expected to start operating by yearend 2008. Train 2 is expected to start 5 months later. Gas supplies will come from Marib-Jawf fields on Block 18, operated by Hunt Oil Co.

YLNG has signed three 20-year agreements. Korea Gas Co. will purchase 1.3 million tonnes/year of LNG starting in 2008, with an option to increase its purchases to 2 million tonnes/year. Total Gas of France has signed an agreement to receive 2 million tonnes/year beginning in 2009, and Tractebel of Belgium has signed a contract for 2.5 million tonnes/year.

The shareholders of the YLNG are Total 42.9%, Yemen Gas Co. 23.10%, Hunt Oil 18%, SK Corp. 10%, and Hyundai Corp. 6%.

North European gas pipeline agreement signed

OAO Gazprom, BASF AG, and E.ON AG signed a basic agreement to establish the North European Gas Pipeline Co. as a German-Russian venture for construction of the North European Gas Pipeline (NEGP) through the Baltic Sea.

Under the agreement, Gazprom has 51% majority interest, and BASF and E.ON each have 24.5%.

NEGP will run from Vyborg on Russia’s Baltic coast to the Greifswald region on Germany’s Baltic coast, which is provisionally earmarked for landfall. Preliminary investigations of the seabed structure have been made.

The pipeline will be over 1,200 km long and is to be commissioned in 2010. It initially will be a single pipeline with capacity of 27.5 billion cu m/year. A planned second pipeline would double the capacity. Total investment for the twin pipeline project exceeds €4 billion. ✦