General Interest - Quick Takes

MMS seeks comment on next 5-year OCS plan

The US Minerals Management Service is seeking initial public comment on development of its next 5-year Outer Continental Shelf leasing plan for the Gulf of Mexico.

Emphasizing that development for now would be confined to the plan for 2007 through 2012 and not necessarily extended to additional areas of the OCS itself, MMS said it also is seeking public comment on other economic and environmental issues in federal waters.

MMS noted that presidential withdrawals or congressional moratoriums have placed more than 85% of the OCS off the Lower 48 states off limits to energy development.

The administration of President George W. Bush supports existing moratoriums in deference to states wanting to determine activities off their coasts, it added. But MMS also acknowledged that the 2005 energy legislation that Bush signed into law calls for a comprehensive inventory of oil and gas resources on the OCS.

As it drafts its proposal, MMS said it would seek comment on potential resources on all OCS areas while recognizing “that many of these areas are subject to existing moratoria and will not be fully analyzed for potential leasing.”

MMS said it also is asking for public comment on whether existing withdrawals or moratoriums should be modified or expanded and whether the Department of the Interior should work with Congress to develop gas-only leases.

Comments are due by Oct. 11.

China responds to Guangdong price jump

The Chinese government has taken “urgent measures” to correct problems of oil product supply in Guangdong Province, an official of the National Development and Reform Commission (NDRC) told state media.

Since late July, product prices at some retail stations in the southern province have risen by more than 8% and exceeded limits set by NDRC.

China Petroleum & Chemical Corp. and China National Petroleum Corp. have delivered 80,000-90,000 tonnes/day of product to Guangdong since Aug. 16.

The NDRC official attributed the product crunch to natural disasters and the rise in worldwide oil prices.

Ecuador provinces to share oil tax revenue

International oil companies operating in Ecuador have agreed to give governments of oil-rich provinces such as Orellana and Sucumbios, where protests have disrupted production, 16% of the 25% in income tax they pay to the central government, according to Ecuador’s Interior Minister Mauricio Gandara.

The companies still might take legal action against the protesters.

Energy Minister Ivan Rodriguez called damage to production equipment “worse than a war” and estimated economic losses of $400 million to the impoverished South American nation by yearend (OGJ Online, Aug. 23, 2005).

Ecuador has asked for a grace period of 6 months for repayment of crude oil Venezuela will supply to make up for lost production, said Economy Minister Magdalena Barreiro.

Barreiro said Ecuador was to repay with crude oil once its own production returned to normal. The exchange will be complicated by variation in crude quality, she said.

Venezuela has agreed to supply 660,000 bbl of crude oil as well as diesel fuel.

State-owned Petroecuador had to suspend its oil exports due to a protest in two oil-rich provinces in the Amazon. The energy ministry said production has returned to 85% of normal output.

Center to study subsurface CO2 storage

The Scottish Center for Carbon Storage Research (SCCSR) has been established in Edinburgh to conduct a 4-year investigation into the storage of carbon dioxide in underground reservoirs such as deep saline aquifers, oil and gas reservoirs, and deep coal seams.

Worldwide, about 25 gigatonnes (Gt)/year of CO2 enters the atmosphere, according to the International Energy Agency. About 400-10,000 Gt of CO2 could be locked away in deep saline aquifers, 920 Gt in oil reservoirs, and 40 Gt in coal structures, IEA estimates.

The Scottish Higher Education Council, Heriot-Watt University, and the University of Edinburgh have provided £1,399,815 toward the project.

SCCSR will examine the use and development of seismic, geochemical, and other techniques to monitor behavior of stored gas and to ensure that the storage structure provides an effective, long-term seal.

The center’s partner laboratories will investigate application of CO2 injection, long used for onshore enhanced oil recovery, in offshore regimes such as the North Sea.

SCCSR will use research data from the Institute of Petroleum Engineering at Heriot-Watt, work with the School of Geological Sciences at University of Edinburgh, and interact with the British Geological Survey at Keyworth, the joint research institute Edinburgh Collaborative in Subsurface Science and Engineering, and other international groups. ✦

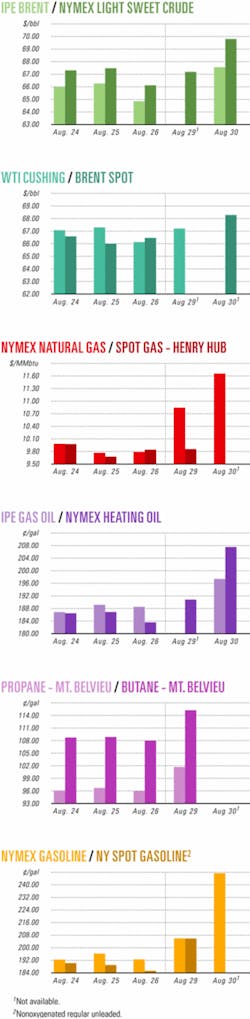

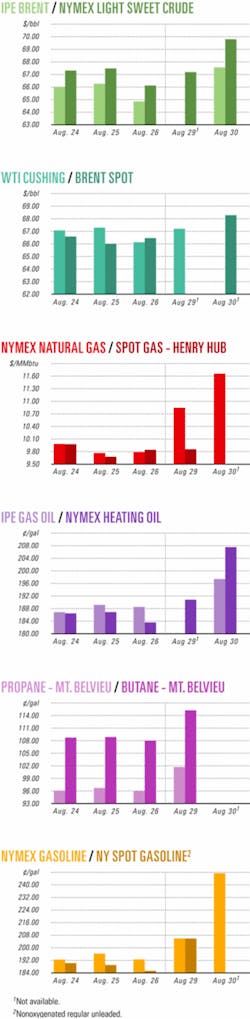

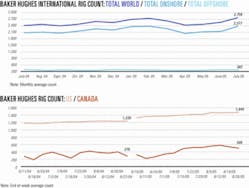

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Anadarko, Chevron to drill deepwater gulf wells

Anadarko Petroleum Corp. and Chevron Corp. have signed an agreement to jointly participate in drilling four deepwater Gulf of Mexico prospects. Chevron will operate all four wells.

Under the agreement, Anadarko will pay a disproportionate share of the drilling costs to earn a 20-25% working interest in two appraisal wells and two exploration wells slated for completion by midyear 2006. Anadarko also will gain rights in 29 deepwater gulf blocks.

Anadarko reported that the accord would bolster its position in the gulf’s Miocene Foldbelt trend, which is “a key growth area” for the company and an area where it already has three discoveries under development.

The appraisal wells to be drilled are Tonga, on Green Canyon Block 727, and Sturgis, on Atwater Valley Block 138.

The two planned exploration wells to be drilled are Turtle Lake, on Grand Canyon Block 847, and Caterpillar, on Mississippi Canyon Block 782, which is near Chevron’s Blind Faith discovery.

Chevron, which will use drilling rigs that are already under contract, expects to spud Caterpillar within the next 2 months.

Statoil, ExxonMobil form Gulf of Mexico pact

Statoil ASA and ExxonMobil Corp. have entered a Gulf of Mexico exploration agreement and plan to drill, with partners, one or more exploratory wells in the Alaminos Canyon area.

Separately, the companies are jointly evaluating acreage in the Walker Ridge area, on trend with the Jack and St. Malo discoveries in which Statoil holds equity interests (OGJ Online, Apr. 28, 2005).

Timor-Leste launches first offshore bid round

Mari Altakiri, prime minister of Timor-Leste, announced the country’s first oil exploration bidding round for the Timor Sea.

Altakiri said the round would be competitive and transparent in an accountable process, with details available early this month. Areas to be offered are in undisputed territory outside the contentious Joint Development Zone held with Australia in the central Timor Sea.

The move follows the parliamentary approval in July of a new legal and fiscal regime for development of oil and gas resources both on and offshore. A comprehensive 6,600 km, 2-D seismic survey was acquired earlier this year by a consortium of Petro-China Co. Ltd. and Norway’s Global Geo Services AS. These data and other geological information will be available to potential bidders.

The prime minister and other officials Sept. 2 began an international tour to highlight the petroleum potential of the region in Singapore, and will move on to London, Calgary, and Houston.

There has been only one well drilled off Timor-Leste-the Mola-1 wildcat drilled in 1975 to TD of 3,077 m in shallow waters off the south coast. Woodside Burmah Oil NL, forerunner of Woodside Petroleum Ltd of Perth, and Timor Oil Ltd., Sydney, drilled that well, which encountered natural gas shows in Pliocene sediments. However, annexation of East Timor by Indonesia a few months later voided the permits, and no further work was done.

Oil firms show high interest in Thai bidding round

Nine groups of international oil firms have applied for 11 petroleum exploration blocks in Thailand’s latest bidding round.

The number of bids submitted to the energy ministry reflects early enthusiasm by oil exploration companies for the country’s potential reserves, as the invitation offering 82 blocks was announced only recently (OGJ Online, Aug. 17, 2005).

The nine consortiums placed bids for five onshore and six offshore blocks in the Gulf of Thailand. A Thai Energy Ministry official said it would take 3-4 months to evaluate and award the contracts to the first group of successful bidders.

Interested firms have until the end of June 2006 to submit applications to the ministry as part of the current 19th round. Bids may be submitted on the 15th of every month.

S. Korean group gets two blocks off Nigeria

A South Korean consortium plans to sign a production-sharing agreement this month covering the OPL 321 and OPL 323 areas off Nigeria.

South Korea’s Ministry of Commerce, Industry, and Energy said the consortium, led by state-owned Korea National Oil Corp., will hold 65% interest. The remainder will be shared by India’s Oil & Natural Gas Corp. Ltd. and a Nigerian oil company. ✦

Drilling & Production - Quick Takes

Husky nearing start of White Rose field oil output

Husky Energy Inc., Calgary, plans to start production in the fourth quarter from White Rose oil field in the Grand Banks region off Newfoundland and Labrador.

Husky, operator of the $2.35 billion White Rose project, anticipates peak production of 100,000 b/d of oil from the field, which it estimates has probable reserves of 200-250 million bbl (OGJ Online, Aug. 12, 2004). Husky holds 72.5% interest in the field, and Petro-Canada, 27.5%.

Topsides for the SeaRose floating production, storage and offloading vessel have been completed, and once the vessel completes its sea trials, it will proceed to the field, which lies in the northeastern Jeanne d’ Arc basin 50 km from Hibernia and Terra Nova oil fields and 350 km southeast of St. John’s, Newf.

The SeaRose FPSO has a peak production capacity of 100,000 b/d of oil.

Petrobras to finish deep Santos basin well

Brazil’s Petroleo Brasileiro SA (Petrobras) said it soon will conclude the drilling of a deep well in the central-north section of Block BM-S-10 in the Santos basin off Brazil.

Transocean Inc.’s Deepwater Expedition drillship is drilling the 1-RJS-617D well, recently below 6,800 m.

Drilling of the well, in 2,038 m of water, began in December 2004. Petrobras estimates the cost at more than $50 million.

Tullow reports first gas from Munro field

Tullow Oil PLC has begun natural gas production from Munro field in the southern UK North Sea.

Production began Aug. 22 at an initial average rate of 55 MMscfd, 6 weeks ahead of the development schedule and 16 months after the field was discovered.

Munro, Tullow’s second UK development in 2005, produces from one well through a minimum-facilities platform and a 5 km pipeline that connects to Tullow facilities in the Caster Murdoch System area.

Production from Munro field, in which Tullow has a 15% interest, is expected to peak at 80 MMscfd of gas.

Chevron lets contract for Tahiti flowlines

Chevron USA Inc. has let a contract to a J. Ray McDermott SA subsidiary for installation of infield flowlines, associated pipeline connections, and steel catenary risers (SCRs) for the Tahiti development in the Green Canyon area of the Gulf of Mexico.

The Tahiti development includes a truss spar on Block 641 in 4,000 ft of water, production drilling facilities on Blocks 596 and 640, and a discovery well on Block 640 that Chevron said could produce as much as 30,000 b/d of oil (OGJ Online, Oct. 20, 2004).

McDermott will install two 6-in. and four 9-in. flowlines with associated pipeline end terminations (PLETs), a PLET assembly near the drill center manifold, including static flowline segments and in-line buoyancy, which will transition into an SCR terminating at the Tahiti spar. Derrick Barge 50 will perform the work in 2007.

Mumbai High North field output recovering

India’s state-owned Oil & Natural Gas Corp. has restored 60% of the production at Mumbai High North (MHN) oil and gas field and hopes to reach “near-normal” production by second quarter 2006, ONGC Chairman Subir Raha said.

The MHN processing platform and a multipurpose support vessel were destroyed in a July 27 fire that erupted when the support vessel hit the platform in the Arabian Sea, killing 11 workers (OGJ, Aug. 8, 2005, Newsletter).

“We have reached a production of 213,200 b/d of crude oil and gas sales of 8.5 million standard cu m/day (MMscmd) exactly a month from the pre-July 26 level of 265,000 b/d and 10.2 MMscmd of gas,” Raha said Aug. 27.

Immediately after the accident, field output fell to 145,000 b/d of oil and 6.1 MMscmd of gas, ONGC statistics show.

“We expect to recoup another 5-10% of production by December this year,” Raha said, adding that the company has invited bids for the installation of a floating production, storage, and offloading vessel. “If we are able to get [the FPSO] going within the next 6 months, we would expect to achieve near-normal production of 270,000 b/d of oil by March next year.”

ONGC estimates that it might need to invest $138 million to rebuild the MHN processing platform and related assets.

That estimate excludes compensation from insurance companies. While the underwriters continue assessing the loss claims, company sources have estimated that insurance will pay $195 million for the MHN processing platform and $65 million for ONGC’s support vessel Samudra Suraksha, under the Shipping Corp. of India operation.

Meanwhile, ONGC is redirecting crude oil produced by numerous platforms in MHN to Mumbai High South facilities and to onshore facilities.

The MHN processing platform, 100 miles off Mumbai, processed part of the crude oil and associated gas produced from the Mumbai High area, which includes Mumbai High, Panna, Mukta, and Bassein fields (OGJ, Jan. 11, 1982, p. 39). ✦

Processing - Quick Takes

BP to issue refinery investigation report

BP PLC said it would issue a final incident investigation report late this month identifying the underlying causes of the Mar. 23 explosion at the company’s Texas City, Tex., refinery, which killed 15 persons (OGJ, May 23, 2005, p. 37).

BP earlier this month agreed to follow a recommendation by the US Chemical Safety and Hazard Investigation Board (CSB) to appoint an independent panel to review the safety management systems and corporate safety culture of BP Products North America Inc., the unit responsible for the company’s five US refineries. The panel, headed by an external chairperson and including outside safety experts and BP staff representatives, will make the findings public, BP said.

The explosion, which BP called “the worst tragedy in the recent history of BP,” was followed this summer by three other explosions or fires at various BP facilities, including one at the same Texas City facility (OGJ Online, July 29, 2005).

CSB also is investigating the incidents, along with the US Occupational Safety and Health Administration, the US Environmental Protection Agency, and the Texas Commission on Environmental Quality.

Baobab oil field off Ivory Coast comes on stream

Canadian Natural Resources Ltd., Calgary, said Baobab oil field on Block CI-40 off the Ivory Coast was brought on stream on Aug. 9 with production of 48,000 b/d.

Production is expected to increase to 65,000 b/d in early 2006, CNR said. The Baobab Ivoirien floating, production, storage, and offloading vessel processes the oil production and has storage capacity of 2 million bbl.

Associated gas production is expected to total 15 MMcfd by yearend. Gas will be transported via pipeline to shore and sold for electric power generation.

CNR has 57.61% interest in Baobab field. Ivory Coast’s state-owned Petroci Holdings has 5% interest, Petroci Overseas Ltd. 10%, and Svenska Petroleum Exploration AB 27.39%.

Porvoo refinery turnaround, upgrades planned

Finland’s Neste Oil Corp. plans to build a production line at its 200,000 b/d Porvoo refinery as part of a diesel project. The line, along with a €500 million euro biodiesel plant currently under construction, will be tied in to the refinery during a 5-week maintenance turnaround that started Aug. 29 (OGJ Online, July 7, 2004). The company will begin shutting down units Aug 22 in preparation for the turnaround.

During the shutdown, Neste Oil will expand the refinery’s enhanced high-viscosity index base oil unit capacity by 30,000 tonnes/year to 250,000 tpy.

The turnaround is part of the Porvoo plant’s normal maintenance and modernization program to enable the refinery to retain high capacity utilization potential over the next 5 years. Safety-related statutory pressure vessel inspections and environmental protection additions also will be carried out. The refinery is expected to be back in normal operation late this month, with the new production line to start up at yearend 2006.

Neste Oil said loss of production during the turnaround will adversely impact its financial performance for the third quarter and for 2005 as a whole. In its second-quarter interim report the company estimated this impact to be €40-60 million on the group’s operating profit.

Contracts set for Vietnam’s first refinery

Major work contracts are in place for construction of a 140,000 b/d refinery in Vietnam-the country’s first-at Dung Quat in the central province of Quang Ngai, state oil firm Petrovietnam reported.

Technip engineering centers in Paris and Kuala Lumpur will carry out the engineering, procurement, and construction contract. Japan’s JGC and Spain’s Tecnicas Reunidas will build the crude oil and product tanks, oil pipelines, and an offshore oil delivery system. Contracts have been signed on all of the project’s bidding packages. Construction will be accelerated to ensure completion of the facility by yearend 2008, Petrovietnam said. ✦

Transportation - Quick Takes

Construction to begin on Russia’s Pacific oil line

Russia will begin construction this fall on the first leg of its planned 4,130-km crude oil pipeline from Taishet in eastern Siberia to the Sea of Japan, Boris Govorin, governor of the Irkutsk Region, told Russia’s Interfax News Agency on Aug 10.

The pipeline will cross seven areas of the Russian Federation: Govorin’s Irkutsk, along with the Chita and Amur regions, the Republic of Buryatia, the Jewish Autonomous Region, and the Khabarovsk and Maritime territories. It will end at an terminal planned near Bukhta Perevoznaya on the Amur Bay, about 100 km west of Nakhodka, the destination in earlier versions of the pipeline proposal.

Earlier, Russian Minister of Industry and Energy Viktor Khristeno said that the first section of the proposed Taishet-Nakhodka pipeline would be laid in 2008 and that two oil companies-Surgutneftegaz and OAO Yukos-would provide the crude (OGJ Online, June 13, 2005).

Govorin stressed, “It is necessary to do the planning work as soon as possible regarding the route of the pipeline because it is extremely important for our region to see this project implemented as soon as possible.”

Russian Prime Minister Mikhail Fradkov signed an instruction on Dec. 31, 2004, authorizing a stage-by-stage implementation of the project to build an oil pipeline with a capacity of as much as 80 million tonnes/year of oil and a railway link.

The first stage envisages construction of the 2,400-km Taishet-Skovorodino section and the export terminal near Bukhta Perevoznaya. Initially, oil will be pumped along the pipeline to Skovorodino and then sent by rail to the export terminal.

The second stage envisages construction of the Skovorodino-Bukhta Perevoznaya pipeline section when sufficient supplies of crude oil come on stream. No date has been set for the start of that construction.

Indonesia plans 1,200 km natural gas line

The Indonesian government plans to build a 1,200 km pipeline from natural gas fields in East Kalimantan to Java at a cost of $1.2 billion. The decision was made in a meeting between Vice-President Jusuf Kalla, Energy and Mineral Resources Minister Purnomo Yusgiantoro, Chief of the Oil and Gas Regulatory Body (BP Migas) Tubagus Haryono, and President Director of State Gas Co. (PGN) WMP Simanjutak.

Haryono said the meeting focused on how to encourage people in Java to switch from fuel oil to gas. To assist that change, he said, the government would build a natural gas receiving terminal in Java, along with a pipeline from fields in Kalimantan.

He said the government soon would issue a tender for special rights to carry gas through a pipeline linking East Kalimantan to Java. He also said BP Migas had undertaken a feasibility study of the gas pipeline, which is scheduled for completion in 2009.

On completion, the pipeline will carry 1 bcfd of gas from the fields operated by Unocal Indonesia and Total SA, Haryono said.

Qatar Gas Transport plans new LNG tankers

Qatar Gas Transport Co. (QGTC) has enlisted international shipbuilders to construct six to eight LNG carriers at a cost of about $230 million each. QGTC expects to lease each vessel to deliver LNG to the UK.

Bids have been issued, winning firms are to be announced next month, and final agreements will be signed in October, QGTC reported. The new LNG carriers will be chartered to Qatargas II, a joint venture of Qatar Petroleum, ExxonMobil Corp., and Total SA.

South Korean shipbuilders Daewoo Shipbuilding & Marine Engineering, Samsung Heavy Industries Co., and Hyundai Heavy Industries Co. will be approached to build the ships, QGTC said.

In mid-August, Ras Laffan Natural Gas Co. awarded five Japanese firms a joint contract to ship LNG from Qatar to the US. The contract is the firm’s first for transport of LNG to North America (OGJ Online, Aug. 15, 2005). ✦