OGJ Newsletter

General Interest - Quick Takes

Both US houses of Congress pass energy bill

Both houses of Congress have approved the omnibus energy bill reported July 26 by a House-Senate conference (See story, p.28).

The House approved the measure by a vote of 275-156 on July 28. The Senate approved it the next day by a vote of 74-26.

Measures sought by the oil and gas industry but excluded from the bill include approval of leasing of the Arctic National Wildlife Refuge coastal plain and protection against product-defect litigation for makers of the gasoline additive methyl tertiary butyl ether.

The bill does not ban MTBE, as had been proposed, and it repeals the requirement that oxygen be added to reformulated gasoline.

It requires that 7.5 billion gal/year of ethanol from grain or cellulose be added to gasoline by 2012.

Other provisions affecting the oil and gas industry include:

• Permission to move MTBE claims to federal courts.

• The ability of refiners to charge to expense 50% of the cost of refinery equipment through 2011.

• Consolidation within the Federal Energy Regulatory Commission of permitting authority for LNG terminals.

• An inventory of oil and gas resources on the Outer Continental Shelf.

• Royalty relief to keep oil and gas production on stream when commodity prices fall below low thresholds.

• Royalty incentives to encourage development of ultradeep offshore gas wells.

• Improved coordination of federal agencies that issue drilling permits.

US, Asia-Pacific group seeks clean energy

The US and five countries from the Asia-Pacific region have formed what US President George W. Bush described as “a partnership on clean development, energy security, and climate change.”

Bush disclosed the effort July 27, saying it would “allow our nations to develop and accelerate deployment of cleaner, more efficient energy technologies to meet national pollution reduction, energy security, and climate change concerns in ways that reduce poverty and promote economic development.”

Because the partnership includes two key industrialized countries, the US and Australia, that haven’t ratified the Kyoto Protocol on Climate Change, some observers interpreted formation of the group as an alternative to Kyoto.

“Despite some diplomatic language about the agreement not replacing the Kyoto Protocol, this new approach to managing greenhouse gas emissions by some of the world’s largest energy-consuming nations clearly rejects Kyoto’s inflexible, economically destructive approach,” said Myron Ebell, the Competitive Enterprise Institute’s director of global warming policy.

Other partners to the new agreement are China and India, which are exempt from the Kyoto Protocol, and Japan and South Korea, which have ratified it (See Editorial, p.19).

A White House fact sheet said the partnership would focus on “voluntary practical measures” to create investment opportunities, build local capacity, and “remove barriers to the introduction of clean, more-efficient technologies.”

Chinese ministry cites crude import needs

China’s demand for crude oil will outstrip domestic supply by some 130 million tonnes in 2005.

China’s Ministry of Commerce predicted that the country’s crude oil output would increase by 3% this year to 180 million tonnes but that demand would rise by 6% to 310 million tonnes.

Imports will have to fill demand not met by domestic production.

The ministry said demand for refined oil will rise by 5% to more than 230 million tonnes.

Within that total, the demand for gasoline will increase by 4% to more than 54 million tonnes, while diesel oil will rise 6.5% to 110 million tonnes, and fuel oil will increase by 5% to 54 million tonnes.

Pakistan plans three thermal power stations

The National Electric Power Regulatory Authority of Pakistan has received 35 bids from 7 local and 13 international companies to build three electric power stations fueled by natural gas, oil, or both in Lahore, Uch, and Faisalabad, Pakistan. The stations would generate about 1,300 Mw of electricity at an estimated investment of $1 billion. Bidders are from the US, UK, China, Japan, Malaysia, UAE, Turkey, and Pakistan.

The first project, a 400-450 Mw Uch-II power station in Sindh Province, will be built at Kashmore near the Pakistan Water & Power Development Authority’s (Wapda) Guddu power station. Oil & Gas Development Co. Ltd. will supply the plant with low-btu gas for 25 years from Uch gas field. National Transmission & Dispatch Co. will purchase the power.

The second project, a 450 Mw power project at Faisalabad near a Wapda power station, will use pipeline quality gas and oil. Sui Northern Gas Pipeline Ltd. (SNGPL) will supply the gas, while Faisalabad Electric Supply Co. will purchase the power.

The third project, a 350-400 Mw power project at Chichoki Malian near Lahore, also will use pipeline quality gas and oil as fuel. SNGPL will supply the gas, while Lahore Electric Supply Co. will purchase the power. ✦

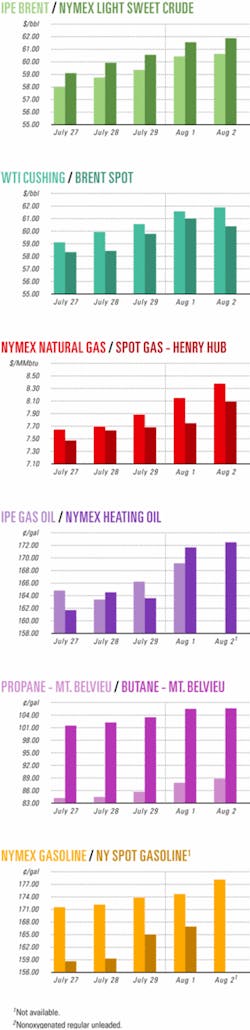

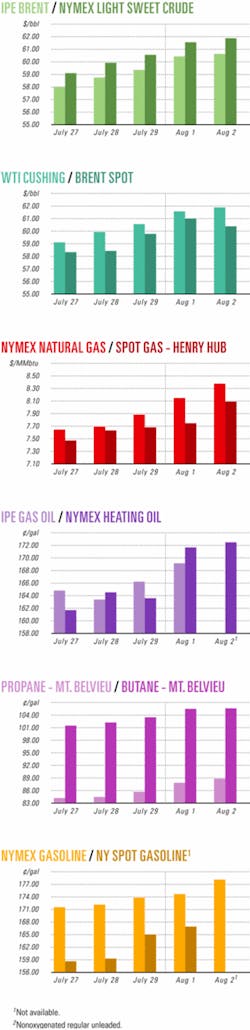

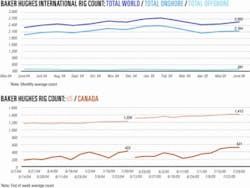

Industry Scoreboard

null

null

null

Exploration & Development - Quick Takes

Shell reports two discoveries off Nigeria

Shell Nigeria Ultra Deep Ltd. and Shell Nigeria Exploration Properties Alpha Ltd. reported two deepwater discoveries in a frontier area off Nigeria.

Further appraisal is planned for the discoveries, in oil prospecting license (OPL) 322 and OPL 245.

In OPL 322, the Transocean Deepwater Pathfinder drillship drilled Bobo-1X to 5,173 m TD in 2,479 m of water. The well cut more than 140 m of hydrocarbon-bearing sands. Shell Nigeria Exploration holds a 40% share in OPL 322.

The same drillship in February drilled Etan-1X in OPL 245 to 4,574 m TD in 1,720 m of water. The well logged 120 m of hydrocarbon-bearing sands. OPL 245 is 100% held by Shell Nigeria Ultra Deep.

Total extends Usan oil field off Nigeria

Total SA’s Nigerian operating subsidiary Elf Petroleum Nigeria Ltd. (EPNL), which operates deepwater OPL 222 off southeastern Nigeria, has extended Usan oil field to the east.

Usan field lies 110 km off southeastern Nigeria in 800 m of water. The field was discovered in 2002. A western Usan extension was confirmed in 2004 with the drilling of the Usan 5 and Usan 6 (OGJ Online, Jan. 7, 2005).

The eastern extension was confirmed by drilling Usan 7 and Usan 8, Total said Aug. 1. Usan production is planned by 2010.

EPNL holds a production-sharing contract from Nigerian National Petroleum Corp for OPL 222. It holds a 20% interest and is operator. Chevron Petroleum Nigeria Ltd. holds 30%, Esso Exploration & Production Nigeria (Offshore East) Ltd. 30%, and Nexen Petroleum Nigeria Ltd. 20%.

UK North Sea step-out indicates hydrocarbons

Dana Petroleum PLC said an exploration well on Block 23/16b indicated hydrocarbons in the central North Sea block next to Barbara gas and condensate field.

Dana and its partners discovered Barbara field in 2002 with exploration well 23/16c-8. The latest well, 23/16b-10, was stepped out 1.5 km to the east of the Barbara discovery and drilled to 9,400 ft subsea.

Logs are being evaluated, Dana said. Preliminary analysis indicates that the well encountered a considerably thicker Paleocene Forties sandstone reservoir than the discovery well.

Dana is drilling the 23/16b-10 well under a farmout from Shell UK Ltd. and Esso Exploration & Production UK Ltd. In return for drilling, Dana will receive operatorship and 50% interest in the Barbara extension area within Block 23/16b.

Barbara field is within tieback distance of both the Everest and ETAP production and export infrastructure systems (OGJ Online, July 27, 2004).

Santos group logs gas find off Victoria

A group led by Santos Ltd. has logged its third gas discovery in VIC/P44 in the Otway basin offVictoria.

Henry-1, located 8.5 km northwest of Casino gas field, cut 21 m of net gas pay in a 30 m gross section in Cretaceous Waarre sandstone, the primary objective and the Casino pay zone. Santos cut a 27.8 m core in the reservoir with 100% recovery.TD is 2,032 m MD.

The gas at Henry is good quality and has composition similar to that of Casino, Santos said. Casino, a 2002 discovery set to begin production in early 2006, is 250 km southwest of Melbourne in 70 m of water.

Besides the Casino discovery, the Martha-1 well found gas in 2004, and its commercial potential is under review.

VIC/P44 interest holders are Santos, operator, 50%; a unit of Australian Worldwide Exploration Ltd., Sydney, 25%; and Mitsui & Co.’s Mittwell Energy Resources Pty. Ltd. 25%.

Shell gets 84 leases in Beaufort Sea

The US Minerals Management Service awarded 84 leases in the Beaufort Sea off Alaska to Shell Offshore Inc., which bid on the leases in Outer Continental Shelf Lease Sale 195 last March.

Shell plans to make additional investments in Alaska, officials said. The company opened an office in Anchorage to help support its new Alaska business, and company officials are meeting with other stakeholders regarding the Beaufort Sea leases. ✦

Drilling & Production - Quick Takes

India’s Mumbai High platform lost in collision, fire

A support vessel collided with Oil & Gas Natural Gas Corp.’s Mumbai High North processing platform in the Arabian Sea July 27, resulting in a fire that destroyed both the support vessel and the platform and killed at least 11 workers. As many as 352 persons were rescued from the platform by July 28, and 12 were still missing.

The destruction of the platform resulted in the loss of 110,000 b/d of crude production, said India’s Petroleum and Natural Gas Minister Mani Shankar Aiyar, who estimated that 70% of the output could be restored in 4 weeks.

The accident happened when ONGC’s multipurpose support vessel, Samudra Suraksha, under the Shipping Corp. of India operation, lost control during a medical evacuation, drifted, and hit the platform (see map, OGJ, Mar. 14, 2005, p. 50). The 180,000 b/d-capacity processing platform and a helicopter positioned on it were totally lost in less than 2 hr, authorities said.

The platform, 100 miles off Mumbai, processed part of the crude oil and associated gas produced from the Mumbai High area, which includes Mumbai High, Panna, Mukta, and Bassein fields (OGJ, Jan. 11, 1982, p. 39).

ONGC has set up a panel of former ONGC executives, directors, and oil industry experts to investigate the cause of the accident.

Apache starts flow from Mohave-1H strike

Apache Corp.’s Mohave-1H discovery in the Carnarvon basin offWestern Australia is on stream, producing 10,690 b/d of oil.

Production is from a 398-ft horizontal interval in Lower Cretaceous Flag sandstone.

Mohave field is 4.5 miles southeast of Apache’s Varanus Island production hub in 26 ft of water.

Mohave-1H encountered an oil column of 42 net ft and was sidetracked horizontally for completion. It’s the only well required for development of the field.

The field is part of the Harriet joint venture, which Apache operates with a 68.5% interest. Its partners are Kufpec Australia Pty. Ltd., 19.3%, and Tap Oil Ltd., 12.2%.

Petrobras signs letters for Modec floaters

Brazil’s state-owned Petroleo Brasileiro SA (Petrobras) signed letters of intent with Modec Inc., Houston, to supply a floating production, storage, and offloading platform (FPSO) and a floating storage, and offloading vessel (FSO) in the offshore Campos basin.

Modec will operate the FPSO in Espadarte Sul field and the FSO will receive stabilized crude oil from Marlim Sul, Roncador, and Marlim Leste fields. Both vessels are expected to be in place by yearend 2006.

The FPSO, a converted very large crude carrier, will be able to process 100,000 b/d of oil, compress 87 MMcfd of gas, inject 113,000 b/d of water, and store 1.6 million bbl of oil. Modec will lease and operate the FPSO for 8 years with an additional four 1-year option periods.

The FSO will be able to receive up to 630,000 b/d of oil and store 2.2 million bbl of oil, Modec said. Petrobras is working to improve the flow of crude oil from its offshore platforms in these fields (OGJ Online, Mar. 8, 2005). ✦

Azeri topsides sail into Caspian Sea

Compression, water injection, and power (CWP) topsides for the Azerbaijan International Oil Co. (AIOC) consortium’s CWP platform in Central Azeri oil field off Azerbaijan sets sail for the field after 18 months under construction. The AMEC-Tekfen-Azfen group built the topsides at Bibi-Heybat near Baku.

The unmanned platform will provide support to three oil production platforms, part of the Azeri-Chirag-Gunashli development operated by BP PLC on behalf of AIOC in the Azerbaijan sector of the Caspian Sea (OGJ, Oct. 18, 2004, p. 39).

The CWP platform will be connected by a bridge link to the Central Azeri drilling and quarters platform and will provide electrical power via subsea power cables to the two production platforms in West and East Azeri.

The 143-m high, 12-pile Central Azeri jacket was installed in February 2004 in 120 m of water.

Processing - Quick Takes

RIL to double capacity of Jamnagar refinery

Reliance Industries Ltd. (RIL), Mumbai, plans to nearly double the capacity of its Jamnagar refinery in India-already one of the world’s largest-as part of a $9.7 billion program to expand petrochemical, refining, exploration, and production operations over the next 4-5 years.

RIL, India’s biggest private-sector refiner, has earmarked $5.7 billion for the Jamnagar expansion, which will raise crude capacity to 1.2 million b/d from 660,000 b/d.At present, the world’s largest refinery is Petroleos de Venezuela SA’s 940,000 b/d Paraguana Refining Center in Cardon, Venezuela (OGJ, Dec. 20, 2004, p. 46).

The Jamnagar facility is the only refinery in India capable of producing Euro III class fuel. It can accommodate any class of crude from any region in the world, said company officials.

RIL also will add a polypropylene plant at the Jamnagar complex, boosting capacity by 280,000 tonnes/year to 1.43 million tonnes/year.

The spending program also includes an exploration and development program that RIL characterized as one of the world’s most aggressive, and it plans to add 2,000 retail fuel outlets to the 540 it now operates in India by 2006.

In addition, company officials said RIL will continue to seek petrochemical acquisitions.

Explosion hits BP Texas City refinery unit

An explosion and fire disrupted the resid hydrotreating unit at BP PLC’s 446,500 b/cd Texas City, Tex., refinery, where a Mar. 23 explosion and fire destroyed an isomerization unit during start-up operations, killing 15 workers and injuring 170 others (OGJ, May 23, 2005, p. 37).

There were no injuries in the July 28 incident. BP reported the fire extinguished about 2:30 a.m. July 29, about 8.5 hr after the explosion.

The company said there were no harmful emissions but issued a shelter-in-place advisory to area residents while the fire burned. Cause of the mishap was unknown.

Aramco, Sumitomo to build Rabigh complex

Sumitomo Chemical Co. of Japan and Saudi Aramco have signed an agreement finalizing a 50-50 joint venture to build a $4.3 billion refining and petrochemical complex at Rabigh, Saudi Arabia.

The JV, Rabigh Refining & Petrochemical Co., plans to convert a 400,000 b/d Aramco topping refinery at Rabigh into an integrated refinery and petrochemical complex capable of producing 1.3 million tonnes/year of ethylene, 900,000 tonnes/year of propylene, and 80,000 b/d of gasoline (OGJ Online, May 11, 2004). ✦

Transportation - Quick Takes

Well off Australia a boost for LNG train

Success of Woodside Petroleum Ltd.’s Pluto-2 appraisal well on the North West Shelf off Western Australia could lead to the construction of a sixth LNG train on the Burrup Peninsula, the company said.

Pluto-2, thought to define the southernmost limits of the Pluto accumulation, penetrated a gross natural gas column of 63 m. The well is 8.5 km south of the Pluto-1 discovery in Woodside’s 100% owned Carnarvon basin permit WA-350-P. Woodside estimates the field has about 3 tcf of natural gas and said it would make a decision before yearend about further Pluto appraisals.

The field lies 15 km from ChevronTexaco Corp.’s Wheatstone gas discovery made last year, which contains an estimated 2 tcf of gas. Together, the discoveries could provide sufficient gas to supply a 4-5 million tonne/year LNG train for 20 years, Woodside said.

Both companies are partners in the North West Shelf gas consortium, which operates prolific North Rankin gas field offshore and the onshore LNG liquefaction plant and terminal.

The fields are more than 100 km from the North Rankin production hub and its pipeline connections to the onshore facilities.

Enbridge gets support for mainline expansion

Enbridge Energy Partners LP, Calgary, said a recently concluded open season indicated strong support from shippers for the addition of 400,000 b/d of crude oil capacity on its mainline system from Hardisty, Alta., to Chicago as early as 2009.

Three phases of the $895 million expansion project are expected to proceed concurrently, which will provide cost savings of $120 million, subject to negotiation of final contract terms and Canadian and US regulatory approvals.

Enbridge Pipelines Inc., Houston, the Enbridge subsidiary that owns the Canadian mainline system, will pay $135 million to expand the Canadian portion of the system. Expansion of the fully integrated US mainline system, Lakehead, will cost $760 million.

The open season also indicated initial support for extension of the Lakehead system from near Chicago to Wood River or Patoka, Ill. Enbridge said it will continue detailed discussions to finalize the project’s design and timing in preparation for a second, binding open season.

In early 2006, the Lakehead system will have access to the pipeline and storage hub at Cushing, Okla., via the Spearhead pipeline.

Sempra to start Cameron LNG construction

Sempra LNG, San Diego, reported plans to begin construction within the next 2 months on its Cameron LNG receiving terminal near Lake Charles, La.

The terminal, slated for completion in late 2008, will have an initial sendout capacity of 1.5 bcfd of natural gas. It is located near Henry Hub about 15 miles south of Lake Charles, La.

Italy’s Eni SPA has agreed to take 600 MMcfd of natural gas-40% of the capacity of the terminal-for 20 years, beginning in 2009, and Sempra said it expects to have the full terminal capacity under contract within a year.

Aker Kvaerner of Norway and Tokyo-based Ishikawajima-Harima Heavy Industries won a contract earlier this year for engineering, procurement, and construction of the terminal (OGJ Online, Jan. 13, 2005).

Russian firm to lay gas line in Algeria

Algeria’s state-owned Sonatrach has let contract to Russia’s OAO Stroitransgaz for construction of a 273-km natural gas pipeline between Souguer and a power plant under construction at Hadjret En Nouss.

Stroitransgaz will build the pipeline within 20 months.

Gaz de France starts receiving Idku LNG

Gaz de France (GDF) took delivery of its first consignment of Egyptian LNG at its Montoir de Bretagne gasification terminal in Brittany.

The company signed a contract in 2002 to purchase for 20 years all output from Egypt’s LNG Idku Train 1 at a rate of 4.8 billion cu m/year. It plans to use the LNG to develop its trading business throughout the Atlantic Basin. The Fos Cavaou terminal on the Mediterranean coastline is to receive this LNG but will not be on stream before 2007.

Meanwhile, GDF signed a contract under which BG Group will buy 36 cargoes of Idku’s LNG at an average rate of two cargoes per month through 2006 in anticipation of Fos Cavaou start-up in 2007. Early completion of the Idku terminal also allowed BG and Malaysia’s Petronas-the two largest shareholders of the Idku consortium-to share six spot cargoes.

Even when Fos Cavaou comes on stream, GDF will not need all of its Idku gas for customers in France. Fos Cavaou will take only one cargo out of two, a spokesman told OGJ. ✦

Correction

An article about the Bureau of Land Management’s cost recovery proposal for onshore oil and gas leases did not accurately state its projected cost impacts on producers, who currently do not pay fees when applying for permits (OGJ, Aug. 1, 2005, p. 27). Under the proposal, first-year fees would be $1,600 for applications for permits to drill (APDs) and geothermal permits to drill (GPDs) and $500 for geophysical exploration permits. Rates would increase by $500 annually until reaching the full fee of $4,000 for an APD, $3,500 for a GPD, and $2,500 for a geophysical exploration permit.