OGJ Newsletter

General Interest - Quick Takes

Energy bill lacks MTBE lawsuit protection

Despite last-minute attempts at a tradeoff, the compromise energy bill that emerged from a House-Senate conference committee last week lacked product-defect liability protection for makers of methyl tertiary butyl ether (see story, p. 25).

Key oil industry groups refused to support a House Republican proposal to set up an $11.4 billion fund for water-system rehabilitation in exchange for the limited litigation immunity. Refiners face a wave of lawsuits over MTBE detected in water supplies.

Reps. Joe Barton (R-Tex.), the conference chair, and Charles Bass (R-NH) proposed the fund, about one-third of which would have come from the oil industry.The House bill offered the liability protection; the Senate bill did not.

The American Petroleum Institute, National Petrochemical and Refiners Association, Society of Independent Gasoline Marketers of America, and National Association of Convenience Stores refused to support the Barton-Bass proposal, which aimed at making liability protection palatable to opponents.

API earlier had released a study estimating the unfunded costs of MTBE cleanup at less than $1.5 billion. Most such costs, the study said, would be paid by responsible parties, a federal trust fund for remediating leaks from underground storage tanks, state clean-up funds, and private insurance (OGJ, July 11, 2005, Newsletter).

Refiners add MTBE to gasoline to meet oxygen requirements set by the Clean Air Act Amendments of 1990.

MMS issues rule on floating platforms

The US Minerals Management Service issued a final rule July 19 that streamlines permitting for floating platforms and incorporates industry standards for floating production systems into MMS regulations.

Previously, MMS regulations did not specifically address floating production facilities separately from fixed platforms. The change reflects the acceleration of deepwater exploration and development and the producing industry’s increasing reliance on floating platforms, MMS said (see story, p. 27).

Canada extends NGV fleet pilot program

The Canadian government extended a program that promotes the use of natural gas in vehicles to increase benefits to commercial fleet owners.

Natural Resources Canada administers the Natural Gas for Vehicles Market Transformation Pilot Project, under which fleet owners may receive up to $3,000 toward the installation of an advanced NGV conversion system.

Under the original pilot project, applicants received an incentive toward the capital cost of buying or leasing a new NGV with a warranty from a vehicle manufacturer. That incentive program continues.

R. John Efford, Natural Resources Canada minister, said on July 27 that the pilot program enables the government to demonstrate its commitment to addressing climate change. Funding for the pilot project comes from a $9.9 million Natural Gas for Vehicles measure announced in the 2003 federal budget.

Petrobras China sign oil export contract

State-owned Petroleo Brasileiro SA (Petrobras) has signed a contract to sell 12 million bbl of oil to China’s Sinochem International Oil Co. Estimated value of the deal is $600 million.

Petrobras called it the first Brazilian contract for exporting oil to China, which earlier bought Brazilian oil only on the spot market.

Petrobras will supply heavy crude from offshore Marlim field.

Brazil, which produces 1.7 million b/d of crude, is a net oil importer but has a surplus of Campos basin heavy crude for export. ✦

null

null

null

Exploration & Development - Quick Takes

BP adds discovery on deepwater Angolan block

BP has made its seventh oil discovery on ultradeepwater Block 31, 165 km off Angola.

The Juno-1 well, drilled to 3,200 m TD in 1,601 m of water in the southwestern part of the block, tested 2,676 b/d of oil through a 28/64 in. choke. It is 60 km southeast of the planned Northeast Development Area encompassing the Plutao, Saturno, Marte, and Venus discoveries.

The GlobalSantaFe Corp. Jack Ryan drillship drilled Juno-1 10 km northwest of the Palas and 22 km south of the Ceres discoveries (OGJ, Apr. 11, 2005, Newsletter).

BP, operator of the block, is studying development concepts for discoveries in the southeastern part of the block.

BP has a 26.67% interest in the block. Partners are Esso Exploration & Production Angola (Block 31) 25%, Sonangol EP 20%, Statoil Angola AS 13.33%, Marathon Petroleum Angola Block 31 Ltd. 10%, and Total SA’s TEPA (Block 31) Ltd. 5%.

Canada independent to explore Caspian block

Valkyries Petroleum Corp., Vancouver, BC, acquired a 70% interest in the 494,000 acre Lagansky exploration block in the Russian sector of the Caspian Sea, began acquiring 424 km of 2D seismic in mid-July, and expects first drilling in second quarter 2006.

The block lies between Valkyries-operated Caspian oil and gas field onshore in Kalmykia and giant Yuri Korchagin oil field and Rakushechnoye gas-condensate field in the Russian Caspian. OAO Lukoil is appraising the two offshore fields.

Lagansky reservoirs are expected to be primarily Aptian sandstones and Upper Jurassic carbonates that are productive on trend.

Valkyries paid $28.5 million to acquire its interest in Lagansky from Mintley Kalmykia Ltd., which purchased the Russian company that held the license since August 2004. Valkyries will fund 100% of the exploration program.

The minimum work program for the 5-year primary term calls for the acquisition of 1,400 km of 2D seismic data, 500 sq km of 3D seismic, and the drilling of 4 exploration wells. The standard Russian fiscal terms include a 24% corporate income tax, a petroleum revenue tax, and a duty on exports that is related to domestic and export crude prices.

A $12.5 million bonus will be due to Mintley Kalmykia in the event of a commercial discovery and a further $10 million bonus will be due upon the award of a development license for any resulting discovery.

UBS subsidiary Ferrier Lullin private bank will provide a 9-month, $50 million bridge loan that will be guaranteed by Lorito Holdings Ltd., an investment company wholly owned by a trust whose settler is Adolf H. Lundin.

Group to explore two blocks in Yemen

Oil Search Ltd., Sydney, and partners Voyager Energy Ltd. and Adelphi Energy Ltd., both of Perth, and Kuwaiti company Kufpec (Aden) Ltd. have been awarded Blocks 7 and 74 in Yemen’s 2005 international bid round.

Block 7 is in the eastern part of the oil-producing Shabwah basin where 120,000 b/d of oil is being produced, mostly from Blocks 18 and 20.

Work commitments for Block 7 over the first 3-year exploration period include reprocessing existing seismic data, acquiring 250 km of new 2D seismic data, and drilling four wells.

Block 74 lies in the Masila basin to the south, where 250,000 b/d of oil is being produced, mostly from Block 14.

The first 3 years of exploration includes reprocessing existing seismic data, acquiring 250 km of 2D seismic data, and drilling three exploration wells.

In addition, Oil Search is awaiting final ratification of a production-sharing agreement in Block 3 awarded to Oil Search and Petoil Petroleum & Petroleum Products International Exploration & Production Inc. In Block 3, the exploration period is 30 months, during which time the partners must acquire 300 km of new 2D seismic data and drill one well.

Canadian Superior wins E&P rights off Trinidad

Trinidad and Tobago and Canadian Superior Energy Inc., Calgary, have signed a production-sharing contract for Block 5(c) in the Columbus basin 90 km off the east coast ofTrinidad (OGJ, May 17, 2004, Newsletter).

Block 5(c), named Intrepid by Canadian Superior, covers 80,041 gross acres. The company plans to begin a multiwell drilling program in the fourth quarter.

JV gives Anadarko access to Indonesian PSCs

Anadarko Petroleum Corp. and Medco Energi International, Indonesia’s largest independent exploration and production company, have formed a joint venture through which Anadarko can greatly increase its exploration acreage in Indonesia.

Under the JV agreement, Anadarko subsidiaries gained access to 13 production-sharing contracts (PSCs) covering 7.8 million acres onshore and off Sumatra, Kalimantan, Sulawesi, Java, and Papua.

Anadarko will fund a 3-year, $80 million exploration work program and earn up to 40% interest in each PSC where a successful exploration well is drilled at Anadarko’s cost and a plan of development is approved.

In December 2004, the Indonesian government awarded Anadarko the exploration and production rights to the North East Madura III Block, where the company is preparing to drill two wells.

Petrobras charters second Golfinho FPSO

Brazil’s state-owned Petróleo Brasileiro SA (Petrobras) plans to charter a floating, production, storage, and offloading platform (FPSO) for Module II development of Golfinho oil field in Espírito Santo basin off Brazil.

Petrobras awarded a $600 million contract to Saipem SPA for a 9-year period with a 3-year extension option. The development program calls for Golfinho field’s Moldule II to come on stream during the first half of 2007.

Golfinho field’s Module I is being developed with the Capixaba FPSO through a $560 million contract signed in November 2004 with Single Buoy Moorings Inc. A floating platform is being converted in Singapore; the FPSO is expected to arrive at Golfinho field by June 30, 2006. First production from Golfinho field is scheduled for 2006.

Each FPSO will have a production capacity of 100,000 b/d and will be able to store 1.6 million bbl. Petrobras is investing $6 billion in Espírito Santo state through 2010 (OGJ Online, Oct. 1, 2004).

Cairn, partners receive five blocks in India

Cairn Energy PLC and partners received authorization from the Indian government to explore five blocks under the fifth licensing round.

The government expects the contracts to be signed by early October, enabling the companies to start exploration next year (OGJ Online, June 2, 2005).

Four of the blocks are onshore and include two new areas in Rajasthan. The onshore blocks are:

x2022; RJ-ONN-2003/1 Western Rajasthan, Rajasthan basin. Italy’s Eni SPA will be the operator with a 34% interest. Cairn will have 30% interest, and India’s state-owned Oil & Natural Gas Corp. will have 36% interest.

• VN-ONN-2003/1 Eastern Rajasthan, Vindhyan basin. Cairn will be the operator with 49% interest, and ONGC will have 51% interest.

• KG-ONN-2003/1 Andhra-Pradesh, Krishna-Godavari basin. Cairn will be the operator with 49% interest, and ONGC will have 51% interest.

• GV-ONN-2003/1 Uttar Pradesh, Ganga Valley basin. Cairn will be the operator with 49% interest, and ONGC will have 51% interest.

The offshore block is GS-OSN-2003/1 in the Saurashtra basin. ONGC will be the operator with 51% interest, and Cairn will have 49% interest ✦

Drilling & Production - Quick Takes

Devon plans 800 wells on Iron River leases

Devon Energy Corp., Oklahoma City, plans to drill more than 800 wells during the next 4 years on Iron River leases it has acquired from ExxonMobil Canada Energy in western Canada. About 70 locations are ready to drill.

“We can generally drill year-round in the Lloydminster area, and we plan to have four or five rigs running at Iron River in the third quarter of 2005,” said Stephen J. Hadden, Devon’s senior vice-president, exploration and production.

Drilling on the largely undeveloped properties is expected to add 700,000 boe to Devon’s 2005 production, and the independent expects to boost its area production from less than 3,000 b/d of oil to 30,000 b/d by 2010.

The newly acquired leases-208 net sections of heavy oil leases and 51 net sections of conventional oil and gas leases, 120 miles northeast of Edmonton, Alta.-encompass 165,000 net acres in which Devon now holds an average 96% working interest. Devon purchased the properties for about $200 million (US).

Iron River is adjacent to Devon’s Manatokan field, which produces 7,000 b/d of oil from about 300 wells. Devon said it believes Manatokan to be “a direct analogy to Iron River in geology, reservoir characteristics, oil quality, and operations.”

Underbalanced, horizontal well tests gas

Initial test results are reported to be “strongly positive” for the first underbalanced, horizontal gas well in the Sacramento basin of northern California. The well, McCormack 9, is on the west flank of Rio Vista field.

Field operator and majority interest holder Output Exploration LLC (Opex), Stafford, Tex., and partner Royale Energy Inc., San Diego, tested the well at a stabilized rate of 2.5-3 MMcfd of natural gas, reported Royale Energy. Opex declined a request for test data.

“We are waiting on hookup before releasing any production information,” said Opex Chief Executive Robert Brook.

Combined underbalanced and horizontal drilling technologies, used successfully in other producing regions, had not been applied in the Sacramento basin.

Royale Energy said it previously had drilled three successful vertical wells on the McCormack property following a 3D seismic survey, prior to Opex’s obtaining an interest in the field.

Royal Energy is analyzing the results of McCormack 9 to determine whether to use this technology on the remaining 26,600 net acres the company has under contract in California.

Kuparuk River output tops 2 billion bbl

ConocoPhillips reported Kuparuk River oil field on Alaska’s North Slope produced its 2 billionth bbl of oil July 20. Kuparuk, the US’s second largest producing oil field, has been in operation since 1981.

Production from the Greater Kuparuk River Area, including the nearby fields of Tarn, Tabasco, West Sak, and Meltwater, is about 185,000 b/d of oil gross.

ConocoPhillips is developing a large, shallow, heavy oil accumulation from West Sak field that overlies much of the Kuparuk River field. Plans calls for the $500 million heavy oil development program to include two Kuparuk River drillsites.

ConocoPhillips Alaska operates the Greater Kuparuk River Area and owns a 55% interest. Partners are BP Exploration Alaska Inc., Unocal Corp., and ExxonMobil Corp. The owners have invested about $7 billion.

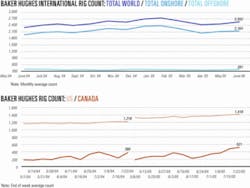

Canada-US drilling activity continues surge

Rotary rig activity in Canada and the US continued to surge this week with the addition of 34 active rigs, reported Baker Hughes Inc. July 22. Canada showed the greatest increase, with a net gain of 28 active units, for a total of 521 working. The US gained 6 units to 1,410.

The rig total for the two countries is 335 more than in the same week last year.

In the US, 5 of the newly active units were in the Gulf of Mexico, bringing the gulf’s total to 100 rigs working. Rigs in inland waters declined by 1 to 24. Onshore gains of 8 rigs in Louisiana, 4 in California, and 1 each in Wyoming and Colorado were partly offset by declines of 3 each in Oklahoma and Texas, and 2 each in Alaska and New Mexico.

Phu Horm gas deliveries to begin in 2006

A four-company consortium led by Amerada Hess (Thailand) Ltd. has signed an accord to sell natural gas from the onshore Phu Horm gas field in northeastern Thailand to Thailand’s PTT Exploration & Production PLC (PTT). Phu Horm is on Block E5N in Udon Thani province.

Initial deliveries of 79 MMcfd of gas will begin during April-November, 2006. In a subsequent stage, deliveries will increase to as much as 108 MMcfd, depending on the gas depletion rate from Nam Phong field just north of Phu Horm in Khon Kaen province.

Nam Phong, operated by ExxonMobil Corp., was the country’s first onshore gas field and is close to the end of its production life. Phu Horm gas will replace the Nam Phong gas supply to Egat PLC’s power plant 40 km from Phu Horm (OGJ Online, June 9, 2003). The initial estimate of Phu Horm’s gas reserves is 550 bcf plus condensate capable of yielding 500 b/d of production.

The Phu Horm consortium consists of Amerada Hess (operator) 35%, Apico LLC 35%, PTT 20%, and ExxonMobil Exploration & Production Khorat Inc. 10%. ✦

Processing - Quick Takes

Dow Freeport cracker remains shut down

Dow Chemical Co., which shut down its Light Hydrocarbon 7 ethylene cracker at Freeport, Tex., June 26 because of equipment failure, said the unit was still down July 26.

During the month-long shutdown, Dow has been repairing the cracker and said it hopes to restore production to preincident levels “as quickly as possible.”

The unit has a nameplate capacity of 590,000 tonnes/year (OGJ, Mar. 28, 2005, p. 59).

Petrofac to build gas plant in northern Oman

Oman’s Ministry of Oil & Gas has awarded a $200 million engineering, procurement, and construction contract to Petrofac UK Ltd., Woking, UK, for construction of a 20 MMscf separation plant at Kauther gas field in northern Oman.

Petrofac Engineering & Construction, Sharjah, will perform the services over 2 years and operate the single-train plant for a year.

Petroleum Development Oman (PDO) operates the Al Dakhlia region field (OGJ Online, (OGJ Online, Jan. 28, 2002).

Conditioned gas from the plant will flow into the domestic gas system. Condensate will be transported to the Saih Rawl central processing plant.

SABIC signs polyolefins complex letter

Saudi Arabia Basic Industries Corp. (SABIC), Riyadh, has signed letters of intent to award two engineering, procurement, and construction (EPC) contracts for plants to be constructed at its proposed Yansab petrochemical complex at Yanbu Industrial City in Saudi Arabia.

A new SABIC affiliate, Yansab, will operate the complex. When completed, SABIC said, the Yansab complex will be the largest petrochemical complex of its kind in the world, with capacities exceeding 4 million tonnes/year of various petrochemicals.

A joint venture of Aker Kvaerner and China Petrochemical Corp. (Sinopec) will perform EPC work for a world-scale polyolefins complex that will have polypropylene and linear low-density polyethylene units with a combined capacity of 800,000 tonnes/year (tpy).

Yansab also plans to produce 1.3 million tpy of ethylene; 400,000 tpy of propylene; 500,000 tpy of high-density polyethylene; 700,000 tpy of monoethylene glycol; and 250,000 tpy of benzene, xylene, and toluene.

Toyo Engineering Co. of Japan will perform EPC work for a 700,000-tonne/year ethylene glycol (EG) plant at the complex.

Toyo also is building an ethylene oxide and EG plant with an output of 630,000 tonnes/year for SABIC at Jubail. That plant is scheduled for completion in second quarter 2006.

Lukoil’s Stavrolen plans polypropylene plant

Stavrolen, a unit of Lukoil-Neftekhim, plans to build a 120,000-tonne/year polypropylene plant at Budennovsk, Russia. The plant is scheduled for completion in 2006.

Stavrolen will use Union Carbide Chemicals & Plastics Technology Corp.’s Unipol polypropylene technology.

Total project investment is estimated at more than $70 million.

UOP starts up CCR Platforming unit in China

UOP LLC, Des Plaines, Ill., has commissioned a CCR Platforming unit at Zhanjiang Refinery, Zhanjiang, Guangdong, China. The Zhanjiang project is the first of 10 continuous catalytic reforming projects UOP will perform in China, with capacities of 15,000-55,000 b/d. ✦

Transportation - Quick Takes

Pemex, Valero units to lay products pipeline

Valero LP, San Antonio, has signed agreements with Pemex-Gas y Petroquimica Basica and PMI Trading Ltd. (PMI) to construct more than 114 mi of products pipeline in Mexico and Texas and to ship products on the line for 10 years.

Valero expects to commission the $54 million pipeline system in mid-2006. It will have a capacity of 32,000 b/d.

An 8-in. pipeline segment will extend for 13 miles in Mexico from a point near Reynosa, where Pemex operates a 400 MMcfd gas processing plant, to the international border between Arguelles and Penitas, Tex., and 33 miles from there to Valero’s products terminal at Edinburg, Tex. A 10-in. segment will extend the line 68 miles farther to Valero’s Harlingen, Tex., terminal and on to a terminal at Brownsville.

Valero will operate the US segment, which will also connect to its Valley products pipeline system from Corpus Christi to Brownsville.

Holly group plans Wyoming-Utah oil pipeline

Holly Corp., its refining subsidiary Holly Energy Partners LLC, both of Dallas; and Enbridge Inc., Toronto, plan to lay a crude oil pipeline from the terminus of Enbridge’s Frontier Pipeline at Evanston, Wyo., to Holly’s 25,000 b/d Woods Cross refinery near Salt Lake City, Utah.

Willbros Engineers SLC was chosen for pipeline route selection and design. Permit work is under way, and construction is expected to start in second quarter 2006.

The pipeline is being constructed to reduce refiners’ crude oil supply constraints, especially for heavy Canadian crude oil.

NEB leads investigation of pipeline leak

Canada’s National Energy Board is leading an investigation of a July 15 crude oil leak from a Terasen Inc. pipeline near Abbotsford, BC.

NEB said an undetermined amount of oil had leaked from the facility into Marshall and Kilgaard creeks. The pipeline is shut down for repair. Crews have installed berms and weirs to contain the spill.

A 300-m stretch of creek downstream of the facility has been affected, NEB said.

Water sampling conducted to date does not indicate the presence of hydrocarbons outside the spill containment area. ✦