DRILLING MARKET FOCUS: Rig rates rise; fleets active in Venezuela

High demand for rigs may drive operators to defer planned drilling programs until rigs come available or can be mobilized from other areas.

Mobilization fees for offshore rigs can add substantially to well costs and carry the risk of damage or loss during transport. The demand continues to keep the shipyards busy with newbuild contracts and upgrades as retired rigs are activated.

The market for semisubmersibles is currently the softest; ODS-Petrodata forecasts increasing demand through the year as well as continued idle capacity. Fleets continue to change hands as drilling contractors realign their markets.

Rig counts, North America

There was a substantial year-over-year increase in the number of rigs working in both Canada and the US in May, after several weeks of slightly declining rig counts in the US.

The Baker Hughes Inc. rotary rig counts for the week ending June 3 showed an overall 21% increase in North America, up 15.8% in the US and 46.5% in Canada from 2004. There were 375 rigs working in Canada, including 3 in the Canadian Atlantic: the GSF Galaxy II jack up (ExxonMobil Corp.); GSF Grand Banks semisubmersible (Husky Oil Operations Ltd.); and Transocean Inc.’s Henry Goodrich semisub (PetroCanada Corp.).

The Kullu drilling barge owned by Seatankers Management Co. Ltd. remains cold-stacked in the Canadian Arctic, according to Rigzone.

There were 1,353 rigs working in the US the week of June 3, according to BHI. This included 98 rigs working offshore (94 in the Gulf of Mexico, 4 off California); 24 working inland waters; and 1,231 working on land.

Texas led the nation, with 611 rigs, up 117 from a year earlier. Louisiana had 187 rigs working, up 18 from a year earlier, and Oklahoma had 154 rigs working, down 14 from a year earlier.

New Mexico had 77 rigs working, a 17% gain from a year earlier, due in part to gas drilling in the San Juan basin and partly to oil drilling in the Permian basin, says OGJ Exploration Editor Alan Petzet. Colorado also showed a substantial 37% increase to 70 rigs up from 51 rigs, due to increased drilling in the Piceance basin in northwestern Colorado and the Niobrara gas play in the Denver-Julesburg basin.

According to ODS-Petrodata, utilization of the mobile Gulf of Mexico fleet was 84% in the week ending May 20, 2005, with 131 rigs of the 156-rig fleet under contract. The fleet has dropped in size by 8 rigs (5%) from a year earlier and has dropped by 42 rigs (21%) from 5 years earlier.

The shrinking fleet caused the utilization rate to increase from only 71% a year earlier and from 81%, 5 years earlier.

Rig counts, Europe

In the week ending May 20, ODS-Petrodata noted that utilization of the mobile offshore drilling fleet in Europe and the Mediterranean was about 93%, up from about 80% a year earlier and about 84%, 5 years earlier. The fleet currently includes 99 drilling units, up 5 rigs from a year ago, but down 5 rigs from 5 years ago.

According to the BHI international rig count, there were 27 land rigs operating in Europe in May 2005, no change from a year earlier. There were 45 rigs working offshore Europe in May, up from 41 in April, and up from 44 in May 2004.

World rig counts

The BHI count showed a yearly increase of 295 rotary rigs operating worldwide to 2,485 in May 2005, up 70 from April. Latin America had 330 rigs working, compared with 245 in the Middle East, 226 in Asia-Pacific, and 46 in Africa. The largest annual increase was in Asia-Pacific, up 13.6% from May 2004. Drilling activity increased 12.6% in Latin America, and almost 9% in Africa, year-over-year.

As of Mar. 2, according to ODS-Petrodata, there were 294 platform rigs deployed worldwide, including 109 off Europe and in the Mediterranean (98% utilization) and 65 in the Gulf of Mexico (43% utilization). The worldwide fleet utilization rate for platform rigs was 77%.

US day rates

Market rates for mobile offshore drilling units capable of working in midwater depths (to 2,500 ft) and for semisubmersibles have increased dramatically in the Gulf of Mexico since the beginning of the year.

Contract rates for midwater MODU’s had increased to about $115,000/day in early May from about $80,000/day in early January, according to ODS-Petrodata and Zephirin Group Inc. Rates for MODU’s capable of working in 2,500-5,000 ft water depth had increased to about $125,000/day from $90,000/day, on average, from January. Semisubmersible rates increased to about $156,000/day from $114,000/day.

Premium jack up rates in the Gulf of Mexico increased to about $77,000/day from $58,000/day, and shallow jack up rates increased to about $43,000/day from about $37,000/day, also from the Zephirin report on May 23.

SCORE indices

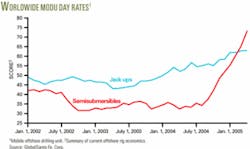

On May 16, international drilling contractor GlobalSantaFe Corp. reported that the company’s worldwide SCORE (summary of current offshore rig economics) for April 2005 was up 5.5% from March. The profitability of day rates for MODUs has been rising steadily for jack up rigs since second-quarter 2003 and more dramatically for semisubmersibles since third-quarter 2004 (Fig. 1).

The SCORE compares the current profitability of MODU day rates with the profitability of rates in 1980-81 (SCORE = 100 = $700 profit/$million invested). The SCORE indicates that day rates for both types of drilling units still lag the industry’s more profitable rates from 25 years ago.

The SCORE for worldwide jack ups was 63.2 in April, up 0.8% from March, up 21.6% from April 2004, and up 103% from 5 years ago.

The SCORE for semisubmersibles was 73.1 in April, up 11.9% from March, up 126% from April 2004, and up 206% from 5 years ago. At this level of growth, semisubmersible day rates should reach parity in profitability with the 1980-81 day rates during fourth-quarter 2005.

Regionally, the day rates for West Africa and the North Sea are increasing at the fastest rates. Between March and April, the SCORE increased 10% in West Africa (to 66), and 9% in the North Sea (to 72.4).

The SCORE for Southeast Asia increased to 60.1 in April, up 4.4% from March, contributing to the 11.7% increase from April 2004. In the Gulf of Mexico, the SCORE increased only 0.8% from March, but the rates are up 77.3% from April 2004.

ODS-Petrodata indices

Offshore drilling rig day rate indices issued by ODS-Petrodata on May 13 confirm that rates are strengthening in most rig markets. ODS bases its rates on rig market rates in 1994 = 100.

For 250-300-ft jack ups in the Gulf of Mexico, the day rate index reported in May was 224, down slightly from April. The small decline is attributed to a lack of new contracts, rather than a weakening of demand as the fleet utilization approaches 90%.

For non-harsh environment jack ups in the North Sea, the day rate index reported in May was 280, up slightly from April. Fleet utilization is at 100% and ODS analysts expect North Sea jack up day rates to continue to rise through the year.

For worldwide semisubmersibles capable of working in water 2,001-5,000 ft deep, the day rate index reported in May was 346, at the highest level since April 1998. Fleet utilization is nearly 100% and rates will continue to increase.

For worldwide floaters, capable of drilling in water 5,001 ft or deeper, the day rate index reported in May was 351, up only slightly from April. Fleet utilization is just under 100% and some contract rates are moving over $300,000/day, with increases expected.

Fleet transactions

Dallas-based ENSCO International Inc. announced in mid-May that it will sell its Venezuelan drilling barge fleet, including six barge rigs in Lake Maracaibo and related assets, to Danish group A.P. Moller-Maersk A/S. ENSCO expects to close the $59 million cash transaction by the end of second-quarter 2005.

The six Venezuelan-flagged barges include the ENSCO II (drilling), ENSCO III (ready-stacked), both built by TDI-Halter LP, part of Halter Marine Group, at different Texas shipyards and were delivered in 1999. ENSCO II and III have National 1320-UE 2,000 hp drawworks, can drill to 25,000 ft, and work in 125-ft water.

The deal also includes four cold-stacked units: ENSCO XI, XII, XIV, and XV. Texas Drydock Inc., predecessor of TDI-Halter, built them in Orange, Tex. and delivered them in 1994. These 2,000-hp rigs can drill to 20,000 ft and work in water as deep as 125 ft.

Maersk Contractors already owns 23 offshore drilling rigs, including four jack ups under construction at the Keppel FELS’ shipyard in Singapore. The four will be delivered 2007-09. The company also controls about 20 land rigs and an FPSO. Maersk affiliate Egyptian Drilling Co. has 4 jack ups and 2 platform rigs.

The sale does not include the barge rig ENSCO I, which is working in Indonesia under long-term contract to Total SA. The ENSCO I is a Maracaibo-type, over the stern drilling barge, built by TDI-Halter at Port Arthur, Tex., and delivered in 1999. It continues to operate under Venezuelan flag.

According to a company press release, Gulf of Mexico drilling contractor Hercules Drilling Co. LLC, a subsidiary of Hercules Offshore LLC, purchased two jack ups in January. Hercules acquired independent leg cantilever jack up Rig 25J from Parker Drilling Offshore USA LLC, a subsidiary of Parker Drilling Co. A week later, Hercules bought the mat-supported jack up, Odin Victory, which has been renamed Rig 30. With seven jack up rigs, Hercules operates the sixth largest jack up fleet in the Gulf of Mexico, in addition to the second largest lift boat fleet. The company also has a cold-stacked platform rig, Hercules 41.

Another jack up rig is being brought out of retirement. The Blake 505 was retired by Blake Offshore LLC in July 2003, but is being converted back to an active drilling unit, according to Lehman Bros.’ Original Oil Patch Weekly, May 16. Blake Offshore owns and operates eight other jack ups in the Gulf of Mexico, ranging in water depths of 140-250 ft.

Market pilot

On May 2, ODS-Petrodata announced that it had received a contract to develop a pilot market survey system (MSS) for Total SA, ExxonMobil Corp., Royal Dutch/Shell, and ConocoPhillips. The pilot will run until first-quarter 2006 and will include a global selection of contractors and market segments.

Aberdeen’s First Point Assessment Ltd., part of Achilles Group Ltd., and Oslo’s Sagex Petroleum AS will work with ODS-Petrodata to develop new industry standard request-for-information documentation, which will be retrievable from, secure, online storage for participating vendors. Oil and gas companies can use the RFI data to support contracting and procurement.

Latin America, Caribbean

There were more MODU’s working in Venezuela in May than in any other South American country, according to Rigzone. Among the 52 drilling rigs were 45 drilling barges, 2 drilling tenders, 2 jack ups, and 3 semisubmersibles.

There were 33 MODU’s off Brazil and 6 platform rigs being used for workovers in May. There were 9 drillships (including 1 ready stacked); 19 semisubmersibles (including 1 ready stacked); and 5 jack ups (including 1 used for accommodation).

The GSF Constellation II was drilling off Argentina for Total SA, and Chilean state oil company ENAP was drilling with its platform Rig M-10. Odebrecht SA’s Valentin Shashin drillship is ready-stacked in Argentina. Four of Petrex SA’s platform rigs are ready-stacked in Peru.

There were five jack up rigs drilling off Trinidad and Tobago in May. State company Trinmar had two rigs working: Todco’s THE110 and Well services Petroleum Co. Ltd.’s Marine 50. BP PLC had two GlobalSantaFe rigs working: GSF Constellation 1 and GSF Monitor. BHP Billiton Ltd. was using Nabors Offshore Corp.’s Nabors 657.

Colombian drilling

According to William Drennen, ExxonMobil’s vice-president for the Americas, the company will “most likely start” drilling off Colombia in the Caribbean in 2008. ExxonMobil, Brazil’s Petrobras, and Colombia’s state oil company Ecopetrol SA agreed in 2004 to explore the 11-million-acre area (4.4 million hectares) offshore Tayrona block. In 2006, Drennen said that the partners must choose half of the area to develop and return the remainder to Colombia’s National Hydrocarbon Agency (Agencia Nacional de Hidrocarburos). The last well in the Tayrona block was drilled in 1981, according to Ecopetrol.

If the project produces natural gas, ExxonMobil will be the operator and will set up a liquefied natural gas project to export to the US. If the project produces oil, Petrobras will be the operator.

Colombia has recently been offering favorable contract terms to boost investment. Drennen said, “Colombia has become a model for other nations to follow,” according to Dow Jones Commodities News on May 23.