Numerous oil and gas downstream construction projects are on the horizon, particularly heavy-oil processing facilities and transmission pipelines, according to Oil & Gas Journal's Worldwide Construction Survey.

Operators reported major investments for oil sands upgraders in Canada, heavy oil upgraders in Venezuela, and heavy, high-sulfur crude oil hydroprocessing units in the US.

Click here to view the Worldwide Construction Update

Likewise, there are notable pipeline projects planned worldwide even as many projects were completed in 2004 and dropped off the OGJ list..

Click here to view the Pipeline Study

The OGJ survey covers refining, petrochemical, gas processing, gas-to-liquids, sulfur, and pipeline projects. Subscribers can access the full survey at www.ogjonline.com (see box).

Mergers and acquisitions

Several mergers and acquisitions of engineering and construction companies have taken place recently.

AMEC PLC reported its acquisition of Paragon Engineering Services Inc. of Houston for $38 million cash in January. The newly merged company, AMEC Paragon Inc., will have expanded access to markets in South America, the Middle East, Alaska, West Africa, and China.

Also in January, Black & Veatch Pritchard acquired R. J. Rudden Associates and Lukens Energy Group, thereby increasing the engineering company’s market share in the oil, gas, and water industries.

Det Norsk Veritas (DNV), an asset risk-management company, recently announced three key acquisitions to expand its coverage in the energy sector. First, DNV purchased Cortest Columbus Technologies, a research and engineering company whose main focus is onshore oil and gas pipelines. Secondly, DNV acquired Jardine & Associates, which specializes in oil, gas, chemical, power, and rail industries. Finally, DNV acquired Primalux Suite of Asset Management Systems, developed by Primalux Technology Co. Ltd. The company’s software package is a dual-language system, supporting English and Chinese, and is the first such system available in China.

Worley Group Ltd. acquired Houston-based Parsons E&C Corp. for $245 million. The combined company is now known as WorleyParsons Ltd.

Refining

In the refining sector, Venezuela leads the industry in announcing plans for greenfield refineries, even as the government positions itself to sell out of the US-based Citgo Petroleum Corp. refineries.

Petróleos de Venezuela SA (PDVSA) plans three deep-conversion refineries close to the Orinoco oil belt: a 50,000 b/d plant in Barinas, a 400,000 b/d plant in Cabruta, and a 50,000 b/d plant in Caripito. When completed in 2010, the new refineries will add 15% to PDVSA’s refining capacity.

Additionally, PDVSA is in discussions with Brazilian state refining company Petroleo Brasileiro SA to build a $2.5 billion, 150,000- 250,000 b/d refinery in Pernambuco, Brazil.

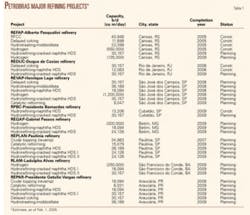

For now, Petrobras plans to invest a record $8.9 billion in upgrades for its eight Brazilian refineries. Table 1 details a list of current projects.

In Canada, BA Energy Inc. awarded the front-end engineering and design (FEED) contract for the grassroots Heartland Upgrader project in Fort Saskatchewan, Alta., to Jacobs Engineering Group Inc. The 226,000 b/d upgrader will be built in three phases, the first of which is to come online in 2007. The upgrader will process western Canadian oil sands into light and medium semisour crude blends.

Other heavy-oil upgrading projects in the area include facility newbuilds or expansions by Canadian National Resources Ltd.’s Horizon project, Husky Energy Inc.’s Lloydminster upgrader, Northwest Capital Inc.’s project, Northwest Inc.’s project, Nexen Inc. and Opti Canada Inc.’s project, Royal Dutch/Shell Group’s Scotford upgrader, Suncor Energy Products Inc.’s upgrader, Synenco Energy Inc.’s Northern Lights project, and UTS Energy Corp. and Petro-Canada’s Fort Hills’ project

In Angola, Technip (60%) and Sonagol (40%) plan to build a $2 billion, 200,000-b/d refinery in Lobito. KBR will provide major contracting services; the expected completion is 2007.

In Viet Nam, construction on Petrovietnam’s grassroots refinery in Dzung Quat is well under way. Technip was awarded the FEED contract last year, and UOP LLC, Axen Group PLC, and Institut Français du Pétrole have been chosen to provide various technologies and licenses for the 130,000 b/d refinery. Process units currently under design or construction include a reformer, hydrotreater, residual fluid catalytic cracking unit, and an isomerization unit.

In Taiwan, Formosa Plastics Corp. announced its plan to build a 600,000-b/d refinery in Yunlin Co. near the Mailiao Petrochemical Zone. The prime contractor for the $3.72 billion project is Formosa Heavy Industries Corp.

Fluor Corp. announced a FEED award from Kuwait National Petroleum Co. for the 450,000 b/d refinery in Shuaiba. Recent reports estimate the total cost for the refinery at $3.3 billion. Expected completion is early 2009.

Iraq’s oil minister announced plans to start construction of a 250,000-300,000 b/d refinery in either the northern city of Mosul or the southern port of Basra sometime during the next 3 years. Iraq is looking for financing from foreign investors. Despite having some of the largest oil reserves in the world, Iraq imports about half of its needed gasoline, heating oil, and other refined products due to the disrepair of its refineries.

India’s state-owned Oil & Natural Gas Corp.’s engineering arm received a build, operate, and transfer contract from Sudanese authorities to construct a 100,000 b/d refinery at Port Sudan, Sudan. The $1.2 billion complex will be completed in late 2008.

In Texas, Crown Central Petroleum Corp. sold its Pasadena refinery to Pasadena Refining System Inc. PRSI plans to install ConocoPhillips’s S Zorb sulfur-removal technology there. Projected start-up for the first such unit to be built outside the ConocoPhillips refining system is late 2006.

Petrochemical

ABB Lummus Global reported several petrochemical projects for the next few years. ABB is providing ethylene-engineering services for PKN Orlen SA in Poland, Petroquímica SA in Mexico, and Fujian Petrochemical Co. Ltd. in China. ABB also reported progress with various petrochemical projects in South Korea, Oman, Russia, and Saudi Arabia.

Also vying for market share in Saudi Arabia is Aker Kvaerner ASA’s John Brown SA Ltd. and Saudi Davy Co. Ltd. The two companies combined to form AK Gulf, which plans to increase engineering and construction contracts, mostly for polyethylene, polypropylene, ethylene oxide/ethylene glycol, and acetic acid. AK is currently at work on a 75,000 tonne/year (tpy) butanediol project under construction at Al Jubail for start-up later this year.

Haldor Topsoe AS has licensed 16 of the ammonia projects listed in this report, including projects in India, Pakistan, Ukraine, China, Oman, and Saudi Arabia. Most projects are in the engineering or construction phase, and the combined capacity for these projects is more than 5.4 million tpy. Worldwide, there will be more than 8.1 million tpy of ammonia capacity added by 2007.

Haldor Topsoe is also involved in urea, formaldehyde, and methanol projects in Russia, India, Nigeria, Saudi Arabia, and China.

Iran’s national oil company reported that it would add 8.5 million tpy of ethylene capacity by 2008. Technip, Intecsa Uhde Industrial SA, Nargan Engineers & Constructors, and Linde AG received contracts for various segments of the projects. Worldwide, there will be more than 26 million tpy of ethylene capacity added by 2011.

Gas processing

LNG projects dominate gas processing construction.

The OGJ survey reveals 33 liquefaction projects worldwide, totaling 87 million tpy of new capacity to come on stream by 2010. The survey also lists 55 regasification terminals planned worldwide, which would add about 42.1 bcfd of sendout capacity, not considering variations in gas composition. It is unlikely, however, that all projects listed will be built due to the competing nature of some locations, lack of funding, local civilian safety objections, or permitting problems.

For example, BP PLC’s proposed Crown Landing terminal on the Delaware River dropped from the report. Delaware authorities stated that the pier would violate local zoning laws. BP plans to apply to FERC for the Bay Crossing terminal on Pelican Island, Tex., near Galveston. If completed, the terminal would have 1.2 bcfd of sendout capacity with a targeted in-service date in 2010.

Of major interest to the US, Atlantic LNG reported that its Train 4 in Trinidad and Tobago is more than 70% complete and should be commissioned by yearend 2005, well ahead of schedule. ALNG’s three trains account for 77% of all LNG imported by the US, and the fourth train will add 5.2 million tpy of capacity to the facility.

Bechtel is a key contractor for the ALNG project and also reported involvement with the Egyptian LNG Trains 1 and 2 in Idku, the Darwin LNG Train 1 in Wickham Point, Australia, the EG LNG Train 1 at Bioko Island, Equatorial Guinea, and the terminal at Sabine Pass, Cameron Parish, La. Bechtel recently won the FEED contract for the Brass LNG facility in Nigeria.

In Japan, Chiyoda Corp. reported work on several storage facility projects. Due to be completed this year are the four-storage tank LPG complexes for Japan Oil, Gas, & Metals National Corp. (JOGMEC) at Fukushima, Nagasaki, and Kamisu, Iberagi. Both complexes will add 200,000 tonnes of storage to the aboveground systems.

Chiyoda also reported construction on a storage cavern for JOGMEC that, when completed in December 2008, will be capable of holding 300,000 tonnes of propane and 150,000 tonnes of butane.

Chiyoda also reported involvement with the LNG receiving terminal for Mizushima LNG Co. Ltd. in Mizushima, Okayama. The 500,000 tpy plant is under construction and due for completion in March 2006.

Chiyoda is also involved in gas projects in Qatar, Oman, and Russia.

Gas-to-liquids

The number of GTL projects in OGJ’s report dropped from 11 to 8, as Shell confirmed in early April to OGJ that three proposed projects-in Argentina, Australia, and Egypt-have been dropped from their agenda, prompting their removal from OGJ’s list.

Shell’s focus is now on the Pearl GTL project in Qatar, which will bring 140,000 b/d of liquids production capacity on stream by 2010.

ChevronTexaco Corp. is moving ahead with its planned Escravos GTL project in Nigeria. EGTL recently announced that it awarded the engineering, procurement, and construction contract, worth $1.7 billion, to “Team JKS’ consisting of KBR, Snamprogetti SPA, and JGC Corp. EGTL, owned by ChevronTexaco (75%) and Nigerian National Petroleum Corp. (25%), plans to build the 34,000 b/d diesel, naphtha, and LPG plant 60 miles southeast of Lagos.

Sulfur

Fewer projects are on OGJ’s sulfur-recovery construction list than the last iteration due to the completion of several projects. The list dropped to 40 projects worldwide, down from 52.

Of note is the major project by WorleyParsons Corp. and Siirtec Nigi SPA for Eni SPA’s AGIP Petroli near the Kashagan field development in Kazakhstan. Two trains of a modified Claus/BSR sulfur recovery unit will produce 2,800 tonnes/day (tpd) of sulfur. The $29 million facility is scheduled for completion next year.

Also noteworthy are Valero Energy Corp.’s three sulfur-recovery projects. Chicago Bridge & Iron Co. NV (CB&I) is the engineering contractor for the 130 tpd unit at the Ardmore, Okla., refinery, the 165 tpd unit at the Paulsboro, NJ, refinery, and the 130 tpd unit at the Three Rivers, Tex., refinery. All three projects will be completed this year.

CB&I also reported work awarded for Sunoco Inc. at Eagle Point, NJ, and Suncor at Sarnia, Ont.

Pipelines

Fewer projects are on OGJ’s pipeline construction project list than on the last version due to the completion of several. This edition lists 165 projects, down from 194 listed in November of last year.

Many of the current projects are in Brazil (3,332 miles), Canada (4,690 miles), China (5,563 miles), and the US (4,651 miles).

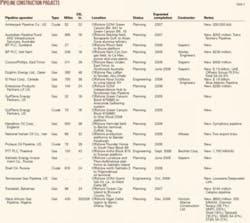

Some of the more notable pipelines will be built offshore. More than 4,000 miles of new offshore pipeline will be laid by 2007 (Table 2).

Although the survey shows many pipeline projects are slated in Canada in the next few years, a recent report by the Canadian Association of Petroleum Producers (CAPP) stated that additional oil pipeline capacity is needed (OGJ, Apr. 4, 2005, p. 60). CAPP said an additional 600,000 b/d would be required in the next decade to support new oil sands project start-ups. This would increase Canada’s pipeline capacity by 50%. Canada’s oil sands production is now more than 1 million b/d and will increase to 3.3 million b/d by 2015, according to the report.

For example, Enbridge Inc. has proposed a 750 mile, 30 in., $2.5 billion pipeline to transport bitumen from northern Alberta to Canada’s west coast for shipment to the US West Coast and Asia.

The anticipated pipeline, to be known as Gateway Pipeline, would move 400,000 b/d from Edmonton to Prince Ruport, BC. Enbridge would like to start construction in 2008 and complete it in 2010.

Also pushing the need for pipeline, particularly in the US, are LNG regasification terminals. For example, a major offshore pipeline will service the Bahamas to Florida LNG transportation system. Another example is the pipeline necessary for Cheniere Energy’s LGN import terminal. A 188-mile transmission pipeline would move gas from Cheniere’s Cameron Parish LNG terminal to pipeline interconnection in Rayne, La.

On the other hand, in Mexico, replacement pipeline is needed to reduce spills caused by the deterioration of mature pipelines.

This year, after Petróleos Mexicanos confirmed its fifth spill in 4 months, Pemex said it needed to invest $9 billion by 2008 to repair or replace its aging 23,000 miles of pipeline. The Mexican Petroleum Institute said that at least half of Mexico’s pipelines is more than 30 years old. ✦

OGJ subscribers can download, free of charge, the 2005 Worldwide Construction Update tables from www.ogjonline.com by clicking on Data & Research, Surveys, and Subscriber Surveys. This link also features the previous editions of this report as well as a collection of other OGJ surveys from previous years. To purchase spreadsheets of the survey data, please email [email protected] or call (800) 752-9764. For further information, please email [email protected], or call Jeannie Stell, OGJ survey editor, (713) 963-6239.