Growing global demand seen changing natural gas trade

With global demand for natural gas likely to grow by 2.2%/year during the next 2 decades, gas trade faces major changes, says Ron Billings, vice-president of LNG for ExxonMobil Gas & Power Marketing Co. Speaking Apr. 13 at the Australian Petroleum Production and Exploration Association’s annual conference in Perth, Billings said natural gas would become the preferred fuel for electric power generation. He predicted that natural gas consumption will increase from the current level of 280 bcfd to about 500 bcfd, or one quarter of total world energy demand by 2030.

Billings said localized gas production will be important, but the major growth will come with LNG developments, where technological developments and economies of scale will lower the costs of production and delivery. This will extend the economic reach of remote supplies.

He said average growth of LNG over the next 25 years is likely to be as much as 7%/year. Markets will have far more liquidity than at present, and there will be a greater degree of price parity between Atlantic and Pacific Basin supplies.

Billings predicted that the Atlantic Basin will be the largest LNG market by 2020, with demand reaching some 250 million tonnes/year by that time. He added that the US in particular would become a target for LNG suppliers where previously it had been isolated from major LNG trade.

He said there will be much less reliance on long-term contracts as supplies and suppliers become more flexible. The overall globalization of world gas markets means that suppliers will be able to move gas on a short-term basis, and the price risk of LNG developments will no longer depend on the credit of single buyers.

Large US potential seen for carbon dioxide, enhanced oil recovery

The latest technology for enhanced oil recovery by injection of carbon dioxide holds the potential to recover 43 billion bbl of oil “stranded” in six mature US producing regions, says a study conducted for the US Department of Energy.

DOE’s Office of Fossil Energy calls the volume, estimated in the study by Advanced Resources International, “technically recoverable potential.”

It identifies as “state-of-the-art CO2 EOR technologies” horizontal wells, 4D seismic to track injectant flow, automated field monitoring systems, and injecting larger volumes of CO2 than were used in earlier EOR projects.

The study says state-of-the-art CO2 injection might recover 5.2 billion bbl of 22 billion bbl of oil unrecoverable by conventional production methods in California. The stranded oil is in 88 large reservoirs amenable to CO2 injection.

CO2 injection might recover 6 billion bbl of 18 billion bbl stranded in parts of the Texas and Louisiana Gulf Coast basins and the Mississippi Salt basin. The technically recoverable estimate reaches 10.1 billion bbl when results are extrapolated to all Gulf Coast basins.

Off Louisiana, CO2 EOR might extend field lives and recover an additional 5.9 billion bbl from 99 large reservoirs in shallow water, the study says.

Oklahoma might yield an additional 5 billion bbl of oil from 63 large reservoirs identified as amenable to CO2 injection. The number could reach 9 billion bbl with extrapolation to all reservoirs in the state.

Alaska holds 43 billion bbl of stranded oil, of which 12.4 billion might be recoverable with CO2 injection.

And Illinois, with 2 billion bbl stranded in 46 reservoirs, might yield 700 million bbl with CO2 injection. The study identified 533 large reservoirs in the six areas that “screen favorably for CO2 EOR.”

null

null

null

State companies, partners dominate China’s retail market

Sinopec Corp. and PetroChina, along with their joint ventures involving several international oil majors, will dominate China’s retail gasoline market well into the future, predicts Lijuan Wang in an April FACTS Inc. report. Sinopec is a publicly listed subsidiary of state-owned China Petrochemical Corp. PetroChina is a publicly listed subsidiary of China National Petroleum Corp.

Before China opened its retail oil market to international investment last Dec. 11 as part of its commitment to becoming a member of the World Trade Organization, Sinopec and PetroChina began to acquire and consolidate local gasoline stations owned by smaller private companies, Wang said.

After this large consolidation, the government ruled that only the two state firms could build service stations. In the late 1990s, China had about 100,000 stations.

Since early 2004, BP PLC, Royal Dutch/Shell Group, and ExxonMobil Corp., have been welcomed in joint ventures with the Chinese companies. Later in 2004, Saudi Aramco and France’s Total AS also established joint ventures in China’s retail fuel business.

The two Chinese firms and their joint ventures “largely will divide up the Chinese retail oil market,” Wang said. “This development will continue at least until Dec. 11, 2006, when China officially opens its wholesale oil market to foreign investment.”

LNG ‘reemerges’ as Asia-Pacific gas source

Gas demand in the Asia-Pacific region has increased fourfold since 1980, and LNG has reemerged as an important gas supply source in the region due to rapid demand growth in Japan, South Korea, and Taiwan. There also are new markets emerging in India, China, the Philippines, and New Zealand, said Allison Ball of the Australian Bureau of Agricultural and Resource Economics.

Speaking at the Australian Petroleum Production and Exploration Association’s annual conference in Perth, Ball said Asia-Pacific LNG imports are predicted to double by 2015, creating intense competition among existing suppliers to retain their markets. Australian LNG export capacity, for instance, could more than quadruple if proposed projects come to fruition.

Ball said total LNG shipments to Asia-Pacific are expected to reach 119 million tonnes by 2010 and rise to 150-163 million tonnes by 2015.

Japan will remain the largest recipient and one of the most important markets, with South Korea second. But imports to India and China, the fastest growing markets, are predicted to be 11 million tonnes/year and 18 million tonnes/year, respectively, by 2015.

Ball said that by 2010 about three fourths of LNG imports by Asia-Pacific countries will come from existing contracted supplies, leaving 21 million tonnes for which new supplies will have to be procured. By 2015, uncontracted LNG demand will rise to 76-89 million tonnes, which represents 51% of projected demand. Japan will account for nearly one third of uncontracted LNG demand by 2015.

Contracts will become more flexible, Ball said, with long-term contracts giving way to less rigid take-or-pay and destination clauses. There also will be more flexibility in fob pricing, delivery, and timing, she said. ✦

Exploration & Development Quick Takes

Combine tests more gas on Malaysian block

CS Mutiara Petroleum Sdn. Bhd., a 50-50 joint venture of Petronas Carigali Sdn. Bhd. and Shell Exploration & Production Malaysia BV, has reported a fourth gas discovery on Block PM301 off the northeastern Malaysia peninsula.

The venture drilled the Bumi South-1 exploration well to 1,650 m TD in 55 m of water 25 km northwest of Bunga Anggerik gas field. The well encountered multiple gas zones. Further technical evaluation is required to determine the reserves, the company said.

The combine is assessing development options for Bumi South and the three other recent gas discoveries on Block PM301: Bunga Kamelia, Bunga Zetung, and Bunga Anggerik. It plans to continue exploration and appraisal activities on the same block.

CS Mutiara Petroleum, formed in July 2001, also operates Block PM302 off northeastern Peninsular Malaysia.

M’Boundi field extended; exports arranged

Maurel & Prom, Paris, operator of M’Boundi oil and gas field in Congo (Brazzaville), tested its 1001 stepout well in the north-northeast end of the field, which lies on the Kouilou permit 25 km inland from Pointe Indienne on the Atlantic Coast (see map, OGJ, Nov. 8, 2004, p. 36).

Testing the shallowest section of the Vandji reservoir, Well 1001 had an initial flow of 4,000 bo/d, indicating a further extension of the reservoir in that direction.

“Preliminary interpretation of well log data indicates a thickening of this reservoir section in this area, with excellent permeability and porosity,” said partner Burren Energy PLC, London, which holds a 35% interest in the permit. Maurel & Prom holds 54%, and Energy Africa Ltd., Cape Town, 11%.

Maurel & Prom signed a nonbinding memorandum of understanding with Total SA subsidiary TEP Congo, which operates the Djeno terminal, to handle and export crude oil from M’Boundi and Kouakouala fields.

Calvalley tests Hiswah oil pool in Yemen

Calvalley Petroleum Inc., Calgary, tested a horizontal appraisal well that confirms a continuous reservoir over the 7-km-long structure of the Hiswah oil discovery on Block 9 in Yemen.

Calvalley, operator of the block, drilled the Hiswah-4 well to 1,276 m to evaluate the oil-bearing Saar formation and gather reservoir data, including two separate 9-m cores.

Hiswah-4 intersected 60 m of gross 35° gravity oil and 20 m of gross gas pay over an 80-m gross interval, with 16% porosity. Cores cut from the Saar oil column show good oil staining within microfractured, high-energy carbonate grainstones comparable to the Hiswah-3 reservoir.

Production tests, conducted over the open hole with an electric submersible pump, established flow rates of up to 1,200 b/d of oil and 400 Mcfd of gas. Following a pump failure, oil flowed at 1,098 b/d without artificial lift before kill fluid was injected.

Upon resumption of testing with new equipment, the well flowed at a reduced sustained flow rate of 380 b/d of oil and 600 Mcfd of gas and no water.

Preliminary evaluation indicates that the reduced flow rate may be due to wellbore damage at the time the kill fluid was injected and the downhole equipment removed.

Hiswah-4 is the second of several horizontal appraisal wells planned for the Hiswah oil pool. The rig is being moved to the Hiswah-5 well, 700 m northwest of Hiswah-4.

Corridor well to test large gas accumulation

Corridor Resources Inc., Halifax, said it spudded the C-67 well in western McCully gas field in New Brunswick, which is estimated to contain more than 1 tcf of gas in place in the Hiram Brook member of the Albert formation in the Mississippian Horton Group.

Projected TD is 2,325 m to the base of the Hiram Brook.

The new drilling is part of an effort to connect the field to the Maritimes & Northeast Pipeline to New England after proving more reserves. McCully’s two producing wells have averaged more than 1 MMcfd of gas for 2 years.

Sibneft wins license in Western Siberia

Russia’s OAO Sibneft has won development rights for the Salymskiy-5 Block in the Khanty-Mansiisk Autonomous District of Western Siberia.

The company will pay $730,000 for the block, which has an estimated 19.6 million tonnes of recoverable oil.

Sibneft recently won the rights to develop the Salymskiy-2 and Salymskiy-3 Blocks and plans to continue to expand its operations in the area (OGJ Online, Mar. 31, 2005). ✦

Production - Quick Takes

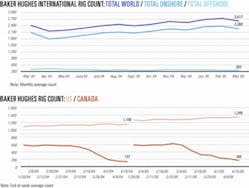

US drilling rebounds to new high

US drilling activity rebounded the week ended Apr. 15 to a new 19-year high with 1,348 rotary rigs working, 21 more than the previous week and up from 1,150 during the same time last year.

Land operations accounted for the bulk of that gain, up by 21 rigs to 1,224 drilling. Offshore drilling increased by 1 rig to 96 rigs working, including 92 in the Gulf of Mexico. However, drilling in inland waters slipped by 1 rig to 28.

Canada’s drilling activity continued to fall with the seasonal thaw, down by 48 rotary rigs to 160 active the week ended Apr. 15, but up from 137 during the same period in 2004.

Lexington, Newfield complete Oklahoma well

Lexington Resources Inc. and Newfield Exploration Mid-Continent Inc. have completed the Newfield POE 1-29 gas well in Hughes County, Okla.

The well, drilled to 8,600 ft, initially flowed at a rate of 500 Mcfd of gas and is currently producing from the Woodford formation. It is tied in to a gas supply pipeline. Alternative zones for possible commingled production and additional fracs are being assessed. Lexington has a 25% working interest in the well.

Statoil spuds Barents Sea wildcat

Ocean Rig’s Eirik Raude semisubmersible has spudded a wildcat for Statoil ASA on the Guovca prospect in the Barents Sea.

The work on Guovca is expected to be completed within 20-30 days, after which the rig will move to the Norwegian Sea to drill a well in Statoil’s Tulipan prospect on Block 6302/6.

The rig is scheduled to return to the Barents Sea in the autumn to drill the Uranus wildcat for Statoil. ✦

Processing - Quick Takes

China plant to use GE coal technology

Wilson (Nanjing) Chemical Co. Ltd. signed a licensing agreement with GE Energy, a division of General Electric Co., Atlanta, for the use of GE’s technology in a new plant to be built in Nanjing Chemical Industrial Park on the Yangtze River.

The plant, slated to start operation in 2007, will convert coal into carbon monoxide and hydrogen, which then will be used to produce products. The project calls for three 450 cu ft gasification units, of which one will be a spare.

The GE contract also includes the preparation of a gasification process design package, technical services, and equipment to implement the gasification technology. China Tianchen Chemical Engineering Corp. of Tianjin, China, is the project engineer.

Ethylene cracker planned in Ras Laffan

Qatar Petroleum, Chevron Phillips Chemical Co. LLC, Qatar Petrochemical Co. Ltd. (Qapco), and Total Petrochemicals have signed a letter of intent with Technip France to provide engineering, procurement, and construction services for a 1.3 million tonne/year ethylene cracker in Ras Laffan, Qatar.

The cracker will provide ethylene feedstock via pipeline to derivative units planned in Mesaieed, Qatar. The venture will be owned by Qapco and Total Petrochemicals through their Qatofin joint venture and by Qatar Petroleum and Chevron Phillips through their Q-Chem II joint venture.

The ethylene cracker and the Q-Chem II project, which will include a 350,000 tonne/year polyethylene plant and a 350,000 tonne/year normal alpha olefins plant adjacent to the existing Q-Chem complex, are slated for operation in late 2008.

The polyethylene and alpha olefins plant will use proprietary ChevronPhillips technology. Also, Qatofin is building a 450,000 tonne/year linear low-density polyethylene unit, which will begin service in 2008 in Mesaieed alongside existing Qapco low-density polyethylene units. ✦

Transportation - Quick Takes

TAP progresses as Pakistan weighs options

Turkmenistan, Afghanistan, and Pakistan have signed a protocol supporting the long-delayed, multibillion-dollar Turkmenistan-Afghanistan-Pakistan (TAP) gas pipeline, said Pakistan’s Minister for Petroleum and Natural Resources Amanullah Khan Jadoon. At a briefing Apr. 13 following a 2-day trilateral steering committee meeting in Karachi, Jadoon also reiterated that the Asian Development Bank has deemed the 1,600-km pipeline project “viable and feasible” (OGJ Online, Jan. 21, 2005).

Meeting participants Turkmenistan Oil Minister Amangeldi Pudakov and Afghan Minister for Mines and Industry Mir Muhammad Siddique also were present at the briefing.

The Afghan minister said his country would take all precautions to protect the proposed pipeline.

The ministers said the design and route of the $3.3 billion pipeline have yet to be finalized.

Pakistan also is considering three other options to meet its future energy needs: LNG imports and pipelines from Iran and Qatar. Jadoon said a decision would be made in Pakistan’s best interests regardless of US pressure not to import gas from Iran. Jadoon said a preliminary report found that Turkmenistan has enough gas reserves to meet Pakistan’s requirement of 3 bcfd for 30 years.

Pertamina seeks spot market LNG

Indonesia’s state oil and gas firm PT Pertamina is negotiating spot market purchases of 125,000 tonnes of LNG from “a Middle East country” to meet commitments to buyers in Japan, Taiwan, and South Korea-the country’s three largest customers.

Pertamina riled buyers Jan. 18 when it said it would delay their LNG shipments , claiming they were seeking fewer LNG shipments this year. (OGJ Online, Jan. 26, 2005). Representatives from the three countries, however, rejected Pertamina’s request for a grace period and demanded the contracted supplies.

Japanese LNG importers said Indonesia was sending a bad signal to investors that would hurt the country’s business competitiveness.

The delay, which Pertamina blamed on a slight decline in gas output and a need to reallocate gas to fertilizer producers, was expected to cut export commitments from PT Badak LNG in Bontang to 335 shipments and to cut 45 shipments from the Arun plant in Aceh. If buyers continue to refuse rescheduling, the remainder of the shipments this year will probably be supplied from Bontang field in East Kalimantan, according to Kardaya Warnika, vice-chairman of BP Migas, Indonesia’s oil and gas implementing body.

Cheniere seeks Creole Trail firm capacity

Cheniere Creole Trail Pipeline Co., a unit of Cheniere Energy Inc., Houston, has initiated an open season for firm capacity on its planned 3.3 bcfd Cheniere Creole Trail natural gas pipeline in southern Louisiana. The binding open season will end on June 1.

Cheniere hopes to apply soon to the US Federal Energy Regulatory Commission for a permit to construct and operate the Creole Trail LNG terminal on the Calcasieu Ship Channel in Cameron Parish, La., and for the pipeline system to deliver gas from the terminal and from the Sabine Pass LNG terminal, currently under construction.

The pipeline infrastructure would consist of two mainlines: a 118-mile transmission line from the proposed Creole Trail LNG terminal through seven parishes to a terminus near Rayne, La., and a 47-mile, 42-in. pipeline from the Sabine Pass LNG terminal to a point south of Sulphur, La. There it would become part of the dual 42-in. system extending to the terminus near Rayne. The system would connect with as many as 15 interstate and intrastate pipelines having transportation capacity totaling more than 12 bcfd.

Total Creole Trail LNG terminal and pipeline system cost is estimated at $900 million. The pipeline system is targeted to be in service by yearend 2008, when the Sabine Pass terminal is slated for completion (OGJ Online, Apr. 12, 2005).

The Creole Trail LNG terminal, planned to be in service in 2009, would have facilities capable of regasifying 3.3 bcfd of LNG and would contain two unloading docks to handle vessels carrying as much as 250,000 cu m of LNG. Four 160,000 cu m storage tanks will have a total LNG storage equivalent of 13.5 bcf of gas.

Sempra tests interest in Cameron pipeline

Sempra Pipelines & Storage has launched an open season to solicit market interest in capacity on its proposed Cameron Interstate Pipeline project in Louisiana.

Sempra plans to build the 35-mile pipeline to connect its planned Cameron LNG receiving terminal with interstate systems.

FERC has approved the pipeline design. The certificate authorizes deliveries of 1.5 bcfd of natural gas, although the approved design is capable of delivering 1.8 bcfd. Depending on results of the open season, the project permit may be modified to accommodate more capacity. The Cameron Interstate Pipeline is expected to be operational in mid-2008, the planned in-service date of the Cameron LNG terminal. Sempra is accepting nonbinding requests for service until May 2.

Enbridge, PetroChina to cooperate on oil line

Enbridge Inc., Calgary, and PetroChina Co. Ltd. agreed to cooperate on development of a proposed $2.5 billion (Can.) crude oil pipeline to transport 400,000 b/d of Alberta oil sands production to Canada’s West Coast, where it would be shipped by tanker to China, elsewhere in Asia, and California.

The memorandum of understanding said Enbridge and PetroChina will develop crude supply initiatives with a target of 200,000 b/d. Enbridge has separate initiatives to obtain commitments from other potential shippers for the rest of the pipeline capacity.

A regulatory application for the 1,160-km line would have to be made in 2006 to achieve a 2009-10 service date, Enbridge said. Enbridge has completed preliminary design work for the proposed Gateway Pipeline and is studying Kitimat and Prince Rupert as British Columbia ports where the pipeline might end.

Kazakhs discuss involvement in BTC pipeline

A delegation of Kazakhstan’s national oil and gas company Kaz-MunayGaz has arrived in Baku for talks on transporting Kazakh crude oil through the Baku-Tbilisi-Ceyhan (BTC) oil pipeline.

The BTC pipeline is being developed by an international consortium of 11 partners, known as the Baku-Tbilisi-Ceyhan Pipeline Co. (BTC Co). In discussions at the State Oil Company of the Azerbaijani Republic [SOCAR], representatives of KazMunayGaz and BTC Co. were to discuss a draft agreement between the two sides for Kazakhstan’s involvement in the pipeline.

The BTC pipeline, currently configured to carry 1 million b/d of Azeri crude, will require expansion to accommodate an additional 1 million b/d of Kazakh crude, according to SOCAR Pres. Natiq Aliyev. He said Kazakhstan plans to ship some 500,000 b/d of oil via the Aktau-Baku route in 2010 and will subsequently double that figure.

A 700-km pipeline in Kazakhstan and maritime terminals in Azerbaijan and Kazakhstan are to be built, Aliyev said. ✦