OGJ Newsletter

General Interest—Quick Takes

Proposed bill would let US states override moratoriums

US Sens. Lamar Alexander (R-Tenn.) and Tim Johnson (D-SD) have introduced legislation that would give governors the power to override federal drilling bans and approve exploration and production off their states.

In an Apr. 6 news release explaining the bill, Alexander said it was time to "aggressively revamp" US natural gas policy.

The 250-page bill targets reducing US petroleum demand by 1.75 million b/d by 2015. Alexander said the US needs aggressive production, conservation, and use of alternative fuels and aggressive research and development and LNG imports.

The bill authorizes the US Department of the Interior to issue gas-only leases for offshore drilling. It also instructs DOI officials to draw the state boundary between Alabama and Florida regarding the area included in Gulf of Mexico Lease Sale 181 and to lease portions off Alabama that do not conflict with military training or operations. The bill sets Dec. 31, 2007, as the deadline for amending the leasing program.

"A moratorium on gas, or oil and gas, leasing on the Outer Continental Shelf shall be effective with respect to the area off the coast of a state only if the governor of the state consents to the moratorium," the bill said. The drilling moratoriums for the East and West coasts have existed since 1982.

The bill calls for a streamlined permitting process for LNG receiving terminals, giving the US Federal Energy Regulatory Commission "exclusive authority" for siting and regulating the terminals.

It clarifies the permitting process for pipelines and gas storage facilities and requires that FERC grant or deny a terminal or pipeline application within 1 year of the application's filing.

At the same time the bill recognizes the authority of state governments under the Coastal Zone Management Act and other acts.

"Nothing in this section grants the commission any right of eminent domain with respect to the siting, construction, expansion, or operation of a natural gas import or export facility," the bill said.

In addition the bill calls for a 4-year consumer education program aimed at reducing energy demand and would establish higher appliance and equipment standards for natural gas efficiency.

The bill calls for construction of six coal gasification plants by 2013 and requires streamlined permitting for coal gasification facilities.

In addition, it outlines tax incentives for investment in solar power, the use of hydrogen for fuel cell vehicles, gas hydrates, biofuels, and biomass.

FERC Chairman Pat Wood to step down, return to Texas

US Federal Energy Regulatory Commission Chairman Pat Wood III told his staff on Apr. 7 that he will leave FERC when his term expires June 30, saying he wants to return his family to Texas.

"My career as a public servant has been guided by a firm belief that well-structured competitive markets are better than top-down regulation in delivering customer benefits and service and technological innovation," Wood said.

A Republican ally of President George W. Bush, Wood assumed his position at FERC in 2001, succeeding Curtis Hebert, who resigned to become an executive vice-president of Entergy Corp., New Orleans (OGJ Online, Aug. 15, 2001).

Wood is Bush's longest-serving appointee, having been named to the Texas Public Service Commission in 1995 when Bush was Texas governor.

APPEA chief seeks action on Australian energy policy

The chairman of the Australian Petroleum Production and Exploration Association (APPEA), Reg Nelson, used his keynote speech at the association's annual conference in Perth to urge government to agree on strategic priorities for the Australian petroleum industry and implement appropriate policies.

Nelson said that negative perceptions within the general community about the petroleum industry are compromising growth in the country's national wealth. This must change, and quickly, he said.

Nelson said the negative perceptions make it difficult to create a climate within governments that is responsive to the need for policy change, even though governments of both major political persuasions agree that development of Australia's petroleum resources is a national priority.

Australia's import bill for energy could reach $25 billion (Aus.)/year within the coming decade, primarily for increased petroleum imports, he said.

APPEA strategic priorities for the industry include upgrading the national focus on exploration, broadening it to encompass both oil and gas, and targeting gas development for domestic and international markets.

Nelson said changes to the Petroleum Resource Rent Tax are vital, with changing the general project cost uplift factor one of the urgent priorities. Other tax measures also are required to stimulate different parts of exploration activity.

A more level fiscal playing field also must be established between fuel types, such as coal and natural gas, he said.

Mark Nolan, chairman and managing director of ExxonMobil Corp.'s Australian operations, pointed out that natural gas produces 70% less carbon emissions than coal and called on government to introduce tax concessions for gas used in power generation.

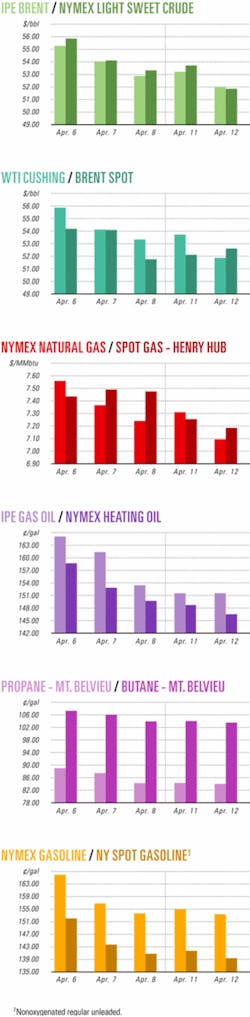

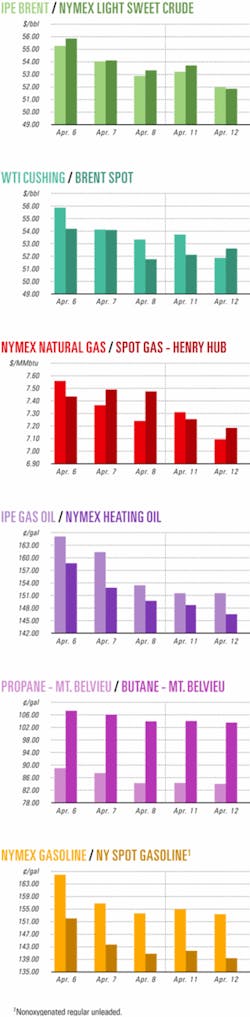

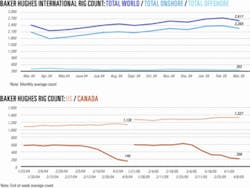

Industry Scoreboard

null

ChevronTexaco, WAERA form research alliance

ChevronTexaco Australia Pty. Ltd. and the Western Australian Energy Research Alliance (WAERA), both of Perth, have formed a multimillion-dollar strategic research alliance in Australia. The new entity—the Western Australian Alliance for Advanced Energy Solutions—will undertake petroleum industry research, technology development, and education and training projects, reported ChevronTexaco Corp.

ChevronTexaco said it would invest as much as $5 million (Aus.)/year to develop research projects through the alliance, which will coordinate research and development and use the research activities of WAERA's three research institutions: the University of Western Australia, Curtin University of Technology, and the Australian government's research and development agency CSIRO (the Commonwealth Scientific Industry and Research Organization).

ChevronTexaco Australia Managing Director Jay Johnson said projects initially would focus on oil and gas exploration and development; hydrocarbon processing; industry-related health, safety, and environmental issues; and education and training initiatives.

Future research could support the development of emerging technologies, such as those associated with the hydrogen economy, he added.

Exploration & Development—Quick Takes

Woodside pushes Pluto, Browse basin work

Woodside Energy Ltd. has given high priority to development of its recent Pluto gas discovery in the Carnarvon basin off Western Australia and to the older Browse basin discoveries Scott Reef, Brecknock, and Brewster fields further offshore to the northwest.

CEO Don Voelte told the Australian Petroleum Production and Exploration Association (APPEA) conference Apr. 11 in Perth that he hopes the projects will be on stream or well into development within 5-6 years.

Woodside holds 100% of Pluto, where preliminary estimates suggest gas reserves exceeding 2.2 tcf. The field is 60 km from the Goodwyn field platform and 90 km from the North Rankin platform on the North West Shelf.

Voelte said the development could be tied into these production facilities for transmission to the coast or treated as a separate project. Another possibility is a joint development with the large, nearby Wheatstone gas-condensate discovery, wholly owned by ChevronTexaco Corp.

Browse basin field reserves top 20 tcf of gas and 300 million bbl of condensate. Although the water is only 50-350 m deep, the bar to development in this province has been the 380 km distance from shore and a lack of markets.

Gas marketing probes, begun in 2004, resulted in interest from China, the US, South Korea, and Japan. The aim is to secure agreements as soon as possible, with deliveries by 2010-11.

Three wells and a 3D seismic survey to clarify field outlines are planned for Browse basin fields starting later this year. Gas sales would be contingent on appraisal program results.

Voelte said Woodside wants to accelerate development, with offshore platforms and a pipeline to shore-based LNG facilities to be built at Broome on Western Australia's northwest coast. The plant potentially would comprise two LNG trains with 6-7million tonnes/year of total capacity.

Woodside has an aggregate of about 50% interest in the region, which covers four separate permits, while ChevronTexaco and BP PLC have about 16.75% each.

Smaller interests of 8.375% each belong to Royal Dutch/Shell Group and BHP Billiton Ltd.

Total gets approval to develop Forvie

Total SA has received development approval from the UK Department of Trade and Industry to develop Forvie North gas and condensate field on North Sea Block 3/15, about 440 km northeast of Aberdeen.

Forvie North is 100% owned and operated by Total. It will be developed as a satellite to nearby Alwyn North.

Production is expected in late 2005. At plateau, the field will produce 18.6 million boe/d.

A new high-pressure gas-condensate pipeline link will be built from Forvie to Alwyn North. The Forvie subsea system has expansion capacity to allow the tie-in of additional wells.

Myanmar gas find could impact pipeline talks

A new gas discovery on Block A-1 off Myanmar could impact trilateral negotiations over a pipeline proposed for the region, if the find proves commercial.

The Shwe Phyu discovery off the country's Western Rakhine coast is the second field to be found on Block A-1, although officials from the concession operator, South Korea's Daewoo International Corp., said they were uncertain of the size of the latter discovery. The company said Mar. 30 that testing was still under way.

As much as 6 tcf of gas has been discovered in nearby Shwe field on Block A-1, and Indian Oil Minister Mani Shanka Aiyar said Mar. 10 that plans call for the drilling of eight more wells on the block. India, with two companies in the A-1 consortium, plans to buy the gas from Myanmar.

To transport the gas, a $1 billion pipeline running through Myanmar, Bangladesh, and India is under negotiation (OGJ Online, Jan. 18, 2005).

The pipeline would carry Block A-1 gas and gas expected from Block A-3 off Myanmar, to India's West Bengal state through Bangladesh.

The three countries prepared a memorandum on the pipeline in February, but Bangladesh decided not to host a meeting on Apr. 20-21 for its signing, saying Bangladesh's three conditions put to India have not been met.

Dhaka wants Delhi to provide transit facilities to import hydroelectricity from Nepal and Bhutan, give scope for Bangladesh to trade with the two countries, and reduce the trade imbalance between Bangladesh and India.

Indian officials are said to be considering other ways of transporting the natural gas from Myanmar if the talks break down.

According to official estimates, Myanmar had a total of 87 tcf in gas reserves and produced 9.9 billion cu m of gas in fiscal 2003-04.

Daewoo International holds 60% interest in Block A-1; South Korea Gas Corp. holds 10%, ONGC Videsh Ltd. of India 20%, and Gas Authority of India Ltd. 10%.

DSME lets topside work to KBR

Daewoo Shipbuilding & Marine Engineering Co. Ltd. (DSME) let a subcontract to KBR, Houston, to provide engineering design and procurement services for the topsides of a floating production, storage, and offloading vessel for ChevronTexaco's Agbami field off Nigeria. The FPSO will have 13 topside modules, which contain the main process and utility systems.

ChevronTexaco's Nigerian subsidiary, Star Deep Water Petroleum Ltd., awarded DSME the engineering, procurement, construction, and integration contract to construct the moorings, hull, and topsides, plus the commissioning of the vessel (OGJ Online, Feb. 25, 2005). DSME will build the vessel at its fabrication yard in Okpo, South Korea.

The Agbami FPSO will be moored in about 4,700 ft of water 220 miles southeast of Lagos. Development will require at least 40 subsea wells.

The vessel, which will have a storage capacity of 2.2 million bbl of oil, will produce 250,000 b/d of oil, 450 MMcfd of gas, and 450,000 b/d of injected water. About 415 MMcfd of gas will be reinjected.

Star Deep expects oil production to begin by first quarter 2008.

Other partners in the project are ChevronTexaco affiliate Texaco Nigeria Outer Shelf Inc., Petroleo Brasileiro Nigeria Ltd., Statoil Nigeria Ltd., Famfa Oil Ltd., and Nigerian National Petroleum Corp.

Drilling & Production—Quick Takes

Statoil to extend Huldra production life

In a 600 million-kroner project to improve Huldra gas field recovery and extend field life by 5 years, Statoil ASA has awarded a 320 million-kroner turnkey contract to Vetco Aibel to prepare a module and platform for a compressor to be installed on the North Sea platform. Dresser Rand will supply the compressor, and Saipem UK will transport and install the module.

Statoil expects the project to be completed in late 2006 or early 2007, extending production to 2011 at the field, where reservoir pressure has been falling and output declining.

The Huldra platform, which came on stream in November 2001, is remotely operated from Veslefrikk B.

Group eyes heavy-oil reservoir simulation

ChevronTexaco Corp., Total SA, and Schlumberger Ltd. have formed a joint initiative to research and develop heavy oil thermal reservoir simulation technology.

The initiative seeks to enhance economic performance of development and production in heavy oil regions, Schlumberger said.

The 2-year collaborative project will involve next-generation reservoir simulation technology being developed by Intersect, a joint research project by ChevronTexaco and Schlumberger, to develop reservoir optimization software.

Processing—Quick Takes

BP refinery explosion probe continues

Investigations continue into the causes of a Mar. 23 explosion and fire in an isomerization unit at BP America Inc.'s Texas City, Tex., refinery that killed 15 contractors and injured more than 100 other persons (OGJ Online, Mar. 23, 2005).

Preliminary data point to the ignition of excess vapors from a blowdown drum's vent stack—possibly by a vehicle parked too close to the unit. Many of the victims killed were attending a meeting in a contractor's office trailer located within 150 ft of the isomerization unit, which was being restarted after a maintenance turnaround.

A spokesman from the US Chemical Safety and Hazard Investigation Board (CSB), which is investigating the accident, said, "In this case we know that there was a catastrophic release of hydrocarbons from a vent stack." He also said that the trailers have been "considered a major issue since day one."

BP said the investigation is far from complete.

"The explosion and fire at the isomerization unit was a result of a very complex process upset that BP America is still striving to understand," the company said in an Apr. 10 statement outlining progress of its own internal investigation.

The BP PLC unit said it has turned over to CSB and the US Occupational Safety and Health Administration more than 8,500 pages of information related to the accident, including maintenance records, engineering documents, computerized plant control data, and eyewitness accounts of the incident.

BP said it "has thoroughly inspected the isomerization unit to verify positions of key valves and other visible indicators." It said it will obtain fluid samples and complete further inspections of the unit "in order to actively manage safety concerns related to benzene, asbestos, and other potential hazards."

BP said it is building process data and information gleaned from the investigation site to model the accident and the subsequent explosion, a process expected to take several weeks.

In the interim, the company has taken measures to reinforce safety at the refinery, which has remained in operation. BP said it has completed a comprehensive review of every process unit's safety protection system and has immediately addressed any issues it identified or has shut down work until those issues can be resolved.

By Apr. 8, BP had moved all personnel more than 500 ft from any blowdown stack or flare. It also is removing any temporary trailers that may be within these areas.

BP said it is "also improving internal emergency communication planning, and beginning a review of all safety emergency systems, including blowdown drums and flares."

PDVSA plans three Orinoco refineries

Venezuela's state oil firm Petroleos de Venezuela SA (PDVSA) announced plans to build three refineries that would boost its worldwide refining capacity by 600,000 b/d to 3.9 million b/d by 2010, according to media reports.

PDVSA said the refineries would be sited near the Orinoco heavy oil belt—at Caripito, Barinas, and Cabruta. It also announced plans to upgrade its El Palito and Puerto La Cruz refineries, said a report in Business News Americas.

The new refineries are scheduled to start operations in 2010, said Energy and Oil Minister and PDVSA Pres. Rafael Ramírez. He said the company was "still conceptualizing" the cost, BNA reported.

PDVSA officials previously have estimated the cost at about $3 billion for special equipment required for a refinery to process Venezuela's heavy, sour crude oil.

PDVSA will invest $1.1 billion in its 126,900 b/d El Palito refinery and $1.2 billion at the 195,000 b/d Puerto La Cruz refinery to improve efficiency and safety and increase output, Ramírez told potential oil and gas investors in Los Taques, Falcón state.

Venezuela President Hugo Chávez recently has said that PDVSA would sell some of its refineries in the US or Europe to help finance domestic projects (OGJ Online, Feb. 7, 2005).

Contract let for Nigerian GTL plant

Chevron Nigeria Ltd. and Nigeria National Petroleum Corp. (NNPC) awarded a $1.7 billion engineering, procurement, and construction contract for a gas-to-liquids plant to be built in Escravos, Nigeria.

The contractor is a joint venture involving Halliburton Co. unit KBR, Italy's ENI subsidiary Snamprogetti SPA, and Japan's JGC Corp. The GTL plant will produce 34,000 b/d of GTL diesel, naphtha, and liquefied petroleum gas for export.

The facility will use Sasol's Slurry Phase Distillate process, which employs Haldor Topsøe's Autothermal reforming, Sasol's Fischer-Tropsch technology, and ChevronTexaco's Isocracking process.

ChevronTexaco Corp. unit Chevron Nigeria owns 75%, and NNPC owns 25% interest.

Coal-to-liquids feasibility study planned

Sasol Synfuels International (Pty.) Ltd. and Chinese partners let contract to Foster Wheeler Energy Ltd. and China Huanqiu Contracting & Engineering Corp. for a first-phase feasibility study of two 80,000 b/d coal-to-liquids projects in the Ningxia Autonomous Region and Shaanxi Province in western China.

The plants would turn coal into products such as diesel, naphtha, and LPG with three principal processes: gasification of coal to synthesis gas, conversion of synthesis gas to liquids, and hydrocracking.

Sasol's low-temperature Fischer-Tropsch technology for the conversion of synthesis gas to liquid fuels is central to the project.

The study is expected to be complete by yearend.

Transportation—Quick Takes

Gulf Gateway offshore port gets first LNG

Excelerate Energy LLC, The Woodlands, Tex., has commissioned its Gulf Gateway Energy Bridge deepwater LNG port and begun commercial operations with its first load of LNG discharged and regasified onboard into almost 3 bcf of natural gas.

The world's first offshore LNG receiving port, it is in the Gulf of Mexico 116 miles off Louisiana in 298 ft of water and is tied into a subsea pipeline that can deliver the gas into the Blue Water and Sea Robin offshore pipeline systems at 50-690 MMcfd. The terminal is capable of delivering 690 MMcfd of gas to downstream markets.

The port consists of a Submerged Turret Loading (STL) system comprised of a submerged turret buoy; chains, lines, and anchors; a flexible riser; and a subsea manifold (OGJ, Apr. 14, 2004, p. 73). The STL floats submerged at 90 ft until retrieved and connected in the moonpool of specially designed LNG carriers called Energy Bridge Regasification Vessels (EBRV). Each EBRV will have a capacity of 138,000 cu m of LNG.

The regasification, using a shell and tube vaporizer—part of a combined open-closed loop system—is accomplished on board the EBRV, and the gas transferred to shore via the pipeline system.

Canada's oil pipelines strained, NEB says

Canada's oil pipeline infrastructure is being strained to the limit, said tht country's National Energy Board in its 2004 annual report.

As a result, plans are being made to expand and to construct new pipelines to accommodate growing oil sands production, it said.

The report further noted that applications for natural gas pipelines to deliver production from new sources continue to be filed despite some spare capacity on existing gas transportation infrastructure.

In October, the board received five applications from Imperial Oil Resources Ventures Ltd. and other applicants for the construction and operation of the Mackenzie Gas Project in northern Canada.

RasGas II delivers LNG to Spain

Ras Laffan LNG Co. Ltd (RasGas II) of Qatar delivered its first LNG cargo to the Port of Cartagena on Apr. 1 for Endesa SA, Spain's largest electric company, under a 20-year agreement.

The gas came from Qatar's North field and was delivered via the Maersk Ras Laffan carrier, which is under charter to RasGas.

RasGas II is a joint venture of Qatar Petroleum 70% and ExxonMobil RasGas Inc. 30%. By 2011, RasGas ventures, including RasGas II, are expected to process and supply more than 36 million tonnes/year of LNG.

Sabine Pass LNG terminal under way

Cheniere Energy Inc., Houston, has begun construction on its Sabine Pass LNG receiving terminal in Cameron Parish, La., (OGJ Online, Dec. 22, 2004). The 2.6 bcfd-equivalent facility will have two docks and three LNG storage tanks with an aggregate LNG storage capacity equivalent to 10.1 bcf of natural gas. Terminal operations are expected to commence in 2008.

Cheniere Energy's wholly owned unit Sabine Pass LNG LP is constructing the facility.