Construction plans surge on prospects for gas use

War in the Middle East last year didn't roil world energy markets, and major countries' economies at yearend 2003 were clearly recovering from more than 3 years of slump. These elements, together with continued strong demand for natural gas worldwide and especially in the US, helped push plans for oil and natural gas pipeline construction well ahead of what they were a year ago (OGJ, Feb. 3, 2003, p. 62).

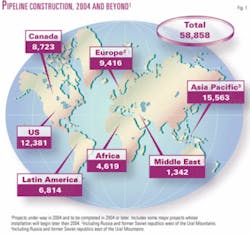

As 2004 began, operators had announced plans to build nearly 60,000 miles of crude oil, product, and natural gas pipeline beginning this year and extending for the next decade (Fig. 1). The great majority of these plans —more than 40,000 miles—is for natural gas pipelines.

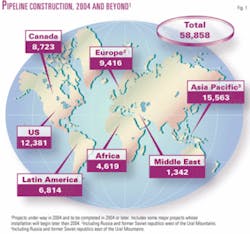

For the short term, operators plan to install more than 13,250 miles in 2004 alone (Table 1), with natural gas construction again taking up the lion's share—more than 8,700 miles—of the plans.

EIA outlook

Nowhere was the change a year makes more apparent than in the yearend 2003 US Energy Information Administration outlook for energy through 2025.

EIA noted that natural gas prices substantially above normal for nearly 4 years had forced a "reevaluation of expectations about future trends in natural gas markets, the economics of exploration and production, and the size of the natural gas resource."

The agency's revised outlook projected "greater [US] dependence on more costly alternative supplies of natural gas, such as imports of [LNG], with expansion of existing terminals and development of new facilities, and remote resources from Alaska and from the Mackenzie Delta in Canada, with completion of the Alaska Natural Gas Transportation System and the Mackenzie Delta pipeline."

OGJ's numbers for 2004 and beyond already reflect the Mackenzie Delta pipeline, plans for which are making steady progress, while efforts towards a line down Alaska from the North Slope appear to have stalled. OGJ's numbers also reflect the likelihood of considerable ancillary natural gas pipeline construction in the Lower 48 to accommodate anticipated volumes of vaporized LNG from expanded and new terminals on the US Gulf Coast and the peninsula of Baja California.

The historically high natural gas prices in recent years, however, have also somewhat skewed market demand back in favor of coal, primarily for electricity-generating capacity, says EIA, and could put question marks over some natural gas pipeline projects that only a year ago appeared to be on track to construction.

EIA noted that with a higher long-term forecast for natural gas prices, the competitive position of coal will likely improve. Cumulative additions "of natural-gas-fired generating capacity between 2003 and 2025 are lower" in the latest forecast than they were at yearend 2002, and "more additions of coal and renewable generating capacity are projected."

Behind EIA's projections are its assumptions about the US economy as measured by gross domestic product, which it believes will grow at 3%/year from 2002 to 2025.

World oil demand will increase to 118 million b/d in 2025 from 78 million b/d in 2002. Demand for petroleum will be slower over the period in the US and Western Europe and particularly in China, India, and other developing nations in the Middle East, Africa, and South and Central America than projected a year ago by the agency.

OPEC oil production, says the agency, will reach 54 million b/d in 2025. Non-OPEC oil production will increase to 63.9 million b/d over 2002-25.

Production by developed nations (US, Canada, Mexico, Western Europe, and Australia) will remain nearly level at 24.2 million b/d in 2025. EIA believes that increased nonconventional oil production, predominantly from oil sands in Canada, will "more than offset" a decline in conventional production in these nations.

Most of the projected increase in non-OPEC oil production, says EIA, will be in Russia, the Caspian Basin, non-OPEC Africa, and South and Central America (in particular, Brazil).

Russian oil production will continue its recovery from the lows of the 1990s and reach 10.9 million b/d in 2025, 43% above 2002 levels, says the agency. Production from the Caspian Basin will exceed 6 million b/d by 2025, compared with 1.7 million b/d in 2002.

In 2025, projected production from South and Central America will reach 7.8 million b/d, up from 4.3 million b/d in 2002, with much of the increase—900,000 b/d—from nonconventional oil production in Venezuela. Non-OPEC African production will grow to 6.7 million b/d in 2025 from 3.1 million b/d in 2002.

Total US petroleum demand will grow at 1.6%/year, to 28.3 million b/d in 2025 from 19.6 million b/d in 2002

Total US demand for natural gas, says the agency, will increase by 1.4%/year over 2002-25 with gas consumption increasing to 31.4 tcf in 2025 from 22.8 tcf in 2002, primarily because of increasing use for electricity generation and industrial applications, which together account for almost 70% of the total projected growth in natural gas demand from 2002 to 2025.

Bases, costs

This year only (Table 1), operators plan to build more than 13,250 miles of oil and gas pipeline worldwide at a cost of more than $19 billion. For 2003 only, companies had planned more than 12,500 miles at a cost of more than $15 billion.

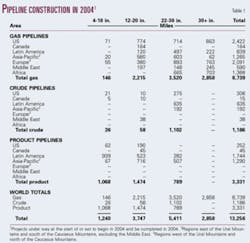

For projects completed after 2004 (Table 2), companies plan to lay more than 45,500 miles of line and spend more than $62.7 billion. When these companies looked beyond 2003 last year, they anticipated spending $31 billion to lay nearly 26,000 miles of line.

- Projections for 2004 pipeline mileage reflect only projects likely to be completed by yearend 2004, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage in 2004 and beyond include construction that might begin in 2004 and be completed in 2005 or later.

Also included are some long-term projects judged as probable, even if they will not break ground until after 2005.

Cost estimates are based on US average costs-per-mile for onshore and offshore gas pipeline construction as found in Table 4 of OGJ's most recent Pipeline Economics Report (OGJ, Sept. 8, 2003, p. 60).

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

*Total onshore construction (12,216 miles) for 2004 only will cost more than $15.5 billion:

—$1.4 billion for 4-10 in.

—$4.3 billion for 12-12 in.

—$6.2 billion for 22-30 in.

—$3.6 billion for 32 in. and larger.

*Total offshore construction (1,040 miles) for 2004 only will cost slightly more than $3.3 billion:

—$395 million for 4-10 in.

—$1.2 billion for 12-20 in.

—$1.7 billion for 22-30 in.

*Total onshore construction (43,453 miles) for beyond 2004 will cost more than $56 billion:

—$1.3 billion for 4-10 in.

—$7.5 billion for 12-20 in.

—$16.3 billion for 22-30 in.

—$31 billion for 32 in. and larger

*Total offshore construction (2,149 miles) for beyond 2004 will cost nearly $6.8 billion:

—$365.1 million for 4-10 in.

—$1.9 billion for 12-20 in.

—$4.5 billion for 22-30 in.

The action

What follows reviews many of the world's current and future pipeline projects in some of the more active regions. It is impossible in this space to cover all projects and all parts of the world; these have been selected to indicate scope and magnitude.

US events

The close of 2003 brought news of one of the largest and most important midstream mergers of recent years.

In December, Enterprise Products Partners LP and El Paso Energy Corp.'s GulfTerra Energy Partners LP, both of Houston, agreed to form what the companies called the nation's "second largest publicly traded energy partnership" with an "enterprise" value of about $13 billion. The general partner of the combined partnership will be jointly owned by affiliates of privately held Enterprise Products Co. and El Paso Corp., each with a 50% interest.

The combined partnership will retain the name Enterprise Products Partners LP and serve the largest producing regions in the US, including the Gulf of Mexico, Rocky Mountains, San Juan basin, Permian basin, South Texas, East Texas, Midcontinent, Louisiana Gulf Coast and, through connections with third-party pipelines, the Western Canadian Sedimentary Basin.

Assets of the combined partnership will include more than 30,000 miles of pipelines, consisting of more than 17,000 miles of gas pipelines, 13,000 miles of NGL pipelines, and 340 miles of large-capacity crude oil pipelines in the Gulf of Mexico.

The combined partnership's other assets include ownership interests in 164 million bbl of NGL storage and 23 bcf of natural gas storage, six offshore Gulf of Mexico hub platforms, and import and export terminals on the Houston Ship Channel.

The partnership will also own interests in 19 fractionation plants with capacity of about 650,000 b/d and 24 natural gas processing plants with capacity of 6 bcfd.

The merger must be approved by unitholders of both Enterprise and GulfTerra along with regulators. The companies expected the merger to be completed during second half 2004.

Concurrent with the closing of the merger, Enterprise will acquire nine natural gas processing plants from El Paso for $150 million in cash. These plants, in South Texas, have historically been part of GulfTerra's Texas intrastate gas pipeline and NGL fractionation and pipeline systems.

In other merger action, Southern Union Co., Wilkes Barre, Pa., earlier last year acquired Panhandle Eastern Pipe Line Co., Houston, and subsidiaries from CMS Energy Corp. The acquired assets include Panhandle Eastern Pipe Line, Trunkline Gas, Sea Robin Pipeline, Trunkline LNG, and Southwest Gas Storage.

CMS Energy received about $584 million in cash and 3 million shares of Southern Union common stock worth about $49 million, said the company. Southern Union acquired $1.16 billion of debt at Panhandle along with the pipeline assets.

Southern Union, an LDC, serves 1 million customers through operating divisions in Missouri, Pennsylvania, Rhode Island, and Massachusetts. The company also owns and operates electric generating facilities in Pennsylvania.

US gas projects

Florida Gas Transmission Co. in November 2003 placed into service its Phase VI expansion, providing 121 MMcfd of incremental firm gas-transportation service, equivalent to electric service to about 150,000 homes and businesses in Florida, said the company.

The $100-million Phase VI expansion consists of about 33 miles of pipeline and 18,600 hp of compression, much of which will be completed by spring of this year.

With the expansion, said the company, Florida Gas' system has more than 2.1 bcfd of capacity available for "electric generation, local distribution, and industrial customers" throughout Florida.

The Phase VI expansion was supported by long-term firm natural gas transportation contracts with Orlando Utility Commission, Reliant Energy Services Inc., the City of Leesburg, Fla., and South Florida Natural Gas Co.

Florida Gas had already completed the second stage of its Phase V expansion, adding about 64 miles of pipeline and increasing compression by about 103,000 hp at new or existing compressor stations to provide 298 MMcfd of additional capacity.

With both Phases V and VI complete, according to the company, Florida Gas makes available about 550 MMcfd of new capacity to Florida, increasing total capacity to more than 2.2 bcfd.

The company is wholly owned by Citrus Corp. and operates a 4,900-mile interstate gas transmission system between South Texas and South Florida. Citrus Corp. is owned jointly by Enron Corp. and El Paso Corp., both of Houston.

Also last year, Algonquin Gas Transmission Co., Boston, a unit of Duke Energy Corp., Houston, made progress on its 29 mile, 30-in. HubLine project in Massachusetts Bay.

Horizon Offshore Inc.'s subsidiary Horizon Offshore Contractors Inc. secured a contract late last year that involves a diving support phase to inspect and clear obstructions along an existing pipeline route and backfill predetermined sections of the pipeline. Horizon also mobilized jetting equipment to assist in the construction project.

Also in the East in October 2003, Eastern Shore Natural Gas Co., a unit of Chesapeake Utilities Corp., received approval from the US Federal Energy Regulatory Commission for an $8.5 million expansion of its natural gas pipeline.

The project consists of constructing and operating mainline looping, upgrading a measuring and regulating station, and constructing and operating a new pressure-control station.

The project will add peak capacity of more than 15 MMcfd to the pipeline's existing peak capacity of more than 110 MMcfd.

The company said that the incremental capacity will "serve residential and commercial customer growth in Delaware, Maryland and Pennsylvania." Since 1998, Eastern Shore has invested nearly $30 million to increase system capacity by 93%, said the company.

Construction is taking place over 3 years. Phases I and II are in Chester County, Pa., and Phase III is in New Castle County, Del.

Also in the Northeast, Dominion of Richmond, Va., obtained FERC approval for two new natural gas transmission projects—the Mid-Atlantic Expansion Project and the Cove Point East Project—to provide additional supplies to the Mid-Atlantic region.

The Mid-Atlantic project will serve markets in Virginia and the Washington, DC, areas with 223 MMcfd of incremental pipeline capacity and 5.6 billion cu ft of additional storage capacity.

Facilities will include:

- 5,000 hp of new compression in Wetzel County, W.Va.

- An upgrade of the existing turbines at Dominion's Crayne Station in Waynesburg, Pa.

- Expansion and upgrades at Chambersburg Station in Chambersburg, Pa.

- 7,800-hp additional compression at Leesburg Station in Leesburg, Va.

- 6,000 hp of new compression in Fauquier County, Va.

The project will cost about $78 million and targets service for November 2004.

The Mid-Atlantic expansion project also includes leasing capacity on Texas Eastern Transmission LP's pipeline in southern Pennsylvania. Texas Eastern has received FERC approval to install 35 miles of new pipe and upgrade its compressor station in Fayette County, Pa.

Cove Point East is a 445-MMcfd expansion of the 87-mile Dominion Cove Point pipeline in Virginia and Maryland.

Two new compressor stations with a total of 19,340 hp will be added in Loudoun and Fairfax counties at an estimated $43.5 million. The expansion, said the company, will allow it to send natural gas both east and west on the pipeline, thus "making it a key component in bringing needed supplies to the Mid-Atlantic region, both through its LNG facility at Cove Point and other pipelines that converge in the suburban Virginia area."

In service is planned in 2005.

All new capacity on both the Mid-Atlantic Expansion and Cove Point East projects is fully subscribed.

This follows suspension earlier last year by Dominion unit Greenbrier Pipeline Co. LLC of field work while project parent Dominion reviewed whether to shift budgeted funds for pipeline development into expansions now under way at Dominion's Cove Point LNG terminal in southern Maryland.

Greenbrier Pipeline is a proposed 280-mile interstate pipeline from West Virginia to North Carolina.

Pipeline activity in the Lower 48 over the next year and more will receive a boost from construction of some of the several LNG terminals proposed or planned. One area often mentioned is Baja California, in Mexico.

Late last year, Sempra Energy International, San Diego, and PG&E Gas Transmission Northwest, Portland, Ore., reported they had received strong shipper interest in expansion of the North Baja pipeline system in Mexico and the southwestern US.

An open season that concluded on Sept. 15 resulted in the North Baja operators getting bids from seven LNG regasification terminal developers or suppliers totaling 5.5 bcfd of natural gas.

The open season covered three existing pipelines and targeted the LNG terminals being developed in northwestern Baja California.

The open season allowed shippers to submit indications of interest for new interconnections to serve other markets. The pipeline operators received nine indications of interest for new interconnections to the markets of Sonora, Mexico; Yuma and Phoenix, Ariz.; and Topock and Blythe, Calif., totaling 900 MMcfd.

Targeted in service for the expansions is April 2007.

The open season was conducted by North Baja Pipeline LLC, a subsidiary of PG&E Gas Transmission Northwest Corp. and by Gasoducto Bajanorte S. de RL de CV, and Transportadora de Gas Natural de Baja California S. de RL de CV, both subsidiaries of Sempra Energy International.

The 220-mile North Baja pipeline system went into service in September 2002 and was developed simultaneously by Sempra Energy International, which owns Gasoducto Bajanorte, the 140-mile Mexican leg of the pipeline, and PG&E Gas Transmission Northwest, which owns North Baja Pipeline LLC, the 80-mile US segment.

The combined North Baja pipeline system begins at an interconnection with the El Paso Corp.'s natural gas pipeline near Ehrenberg, Ariz., crosses Southern California and northern Baja California, and ends at an interconnection with Transportadora de Gas Natural near Tijuana, Mexico.

The combined North Baja pipeline system can move about 500 MMcfd and serve markets in Southern California, Arizona, and northern Baja California.

Offshore Gulf of Mexico, ChevronTexaco Corp.'s Chandeleur Pipe Line Co. held an open season in September 2003 for firm pipeline transportation to delivery points near Coden, Ala. Chandeleur was to have acquired existing facilities of the Mobile area gathering system from Chevron Natural Gas Pipe Line and integrated them into Chandeleur's system.

MAGS consists of a 12-in. line from a connection with Chandeleur's Mobile 861 lateral to interconnections with Transco's Station 82, Gulf South Pipeline Co.'s Mobile Bay lateral, and Florida Gas' Zone 3 markets. MAGS had been operated as a gathering system but was to be operated as part of Chandeleur's FERC-regulated transmission system upon approval by FERC and acquisition by Chandeleur.

The Chandeleur pipeline system extends from offshore Louisiana Main Pass Block 41 to onshore Mississippi at Pascagoula. Chandeleur's pipeline system had delivery interconnects with Gulf South, Destin Pipeline, and the ChevronTexaco refinery near Pascagoula, and with Texas Eastern Transmission Corp. in the offshore.

Chandeleur said acquiring MAGS will result in the availability of firm transportation to the Alabama delivery points of about 75 MMcfd available early this year, after any necessary approvals are received and MAGS is integrated into the Chandeleur pipeline system.

US liquids expansions

On the crude oil side, Seminole Group LP, Tulsa, announced plans late last year to build a 280 mile, 20 in., 200,000-b/d crude oil pipeline from Longview, Tex., to Cushing, Okla.

The $150-million Liberty Crude Oil Pipeline will create a transportation corridor with access to multiple offshore Gulf of Mexico oil discoveries including Royal Dutch/Shell Group's Mars discovery, Seminole said.

Seminole awarded Liberty's engineering contract to Denver-based Trigon-Sheehan LLC; the project targets completion for yearend 2005.

It will provide lower Petroleum Administration of Defense District II (PADD II) refiners increased access to a continuous and reliable supply of deepwater and Gulf Coast crudes, said Seminole said.

The company said that production from the deepwater field will increase steadily through 2006, peaking at 1.9 million b/d of oil, according to a May report released by the US Minerals Management Service.

In another oil project, Enbridge Energy Partners LP, Houston, announced in October plans to develop a new crude oil pipeline from its existing terminal at Superior, Wis., south to the Wood River hub in southern Illinois.

The new line, which will be subject to support by crude oil shippers and to regulatory approvals, will form part of the Lakehead Pipeline System owned by the partnership.

The 630-mile line (either 24 or 30 in.) will have initial capacity of 250,000 b/d and cost $550-650 million.

It will interconnect with the Spearhead Pipeline Project, being developed by Enbridge Inc., which will permit shippers on the line to access any one of the market hubs at Chicago, Wood River, or Cushing, said the company. The line will be in service in 2007, allowing sufficient time for shipper and public consultation, detailed route determination, environmental reviews and regulatory approvals.

The new pipeline will provide increased capacity on the Lakehead system to accommodate growing production from the Alberta oil sands, said the company.

The new line and Enbridge's Spearhead Pipeline, the company also said, are both part of a broader company strategy to "provide improved access to growing Canadian crude oil supplies for US refiners in the Midwest, Midcontinent, and potentially as far as the [US] Gulf Coast."

The most ambitious Gulf of Mexico oil and gas pipeline plans are part of BP PLC's Mardi Gras system to develop the company's four deepwater fields: Thunder Horse, Holstein, Mad Dog, and Atlantis. BP will operate the systems through wholly owned subsidiary Mardi Gras Transportation Inc. (OGJ, May 5, 2003, p. 84).

In 2001, the company set forth plans for the related Okeanos and Cleopatra gas gathering systems in covering the same four fields and the NaKika field development. Okeanos is now in operation, having come on line in November with NaKika start-up. Okeanos carries gas from NaKika to Main Pass 260 where it connects to the BP-operated Destin line into Pascagoula, Miss.

The Cleopatra gas gathering system has also been completed and awaits startup of the Mad Dog, Holstein, and Atlantis fields.

The oil lines are the third major component of BP's planned Mardi Gras Transportation system in the deepwater gulf. January 2004 saw completion of the first oil line, the 120-mile Caesar pipeline, connecting Holstein, Mad Dog, and Atlantis with Ship Shoal Block 332.

It consists of a 28-in. mainline, with 24-in. laterals to the three fields. With initial capacity of 450,000 b/d, it will be the largest so far installed in water deeper than 5,000 ft in the gulf, according to BP.

Caesar Oil Pipeline Co. LLC will own the line, a subsidiary of BP 56%, BHP Billiton Ltd. 25%, Equilon Pipeline Co. LLC 15%, and Unocal Corp. 4%.

In December of last year, installation of the onshore Endymion oil pipeline began. Last month, dredging operations were underway at three locations along the route, with pipe welding taking place in the second week of the month.

In late 2002, Valero Energy Corp. joined El Paso Energy Partners LP as an equal partner in the $450-million Cameron Highway Oil Pipeline project. Announced a year ago, the pipeline will cover 380 miles to deliver as much as 500,000 b/d from the Mississippi Canyon area and the western gulf to refineries at Port Arthur and Texas City.

The pipeline will be one of the largest crude oil delivery systems in the gulf, according to El Paso, handling oil movement for the three major deepwater discoveries that make up its initial anchor fields as well as other deepwater oil discoveries.

In the first leg of the system, El Paso is building a 30-in. OD pipeline to El Paso's Ship Shoal 332 platform and extend it to the High Island area. From High Island, the system will proceed with two 24-in. pipelines, one extending north to Port Arthur and another to Texas City.

El Paso expects to start up the line later this year and will be operator. El Paso has shipper agreements with producers BP, BHP Billiton, and Unocal for oil production from the Holstein, Mad Dog, and Atlantis Deepwater Trend discoveries.

Two large segments will comprise the third system, not slated to come on stream before 2005. It will serve the Thunder Horse field in the Mississippi Canyon portion of the gulf. Dubbed the Proteus Oil Pipeline, the 28-in. deepwater portion of the system will cover 70 miles from the Thunder Horse platform to a booster station platform to be installed on South Pass Block 89.

From there, Proteus will connect to the Endymion oil pipeline, a 90 mile, 30-in. system extending to Clovelly, La., where it will connect with Louisiana Offshore Oil Port storage and offloading facilities. The two lines, Proteus and Endymion, will initially be able to move 420,000 b/d.

In product action, Colonial Pipeline Co., Atlanta, which annually leads all US petroleum product pipelines in throughput, completed construction of a new, larger pipeline into East Tennessee to move more gasoline and other liquid fuels. The 43 miles of new pipe comprise the second phase of a multiphase expansion in Tennessee.

Colonial's East Tennessee Expansion Phase I uprated pumps and motors to increase flow. The 43-mile Phase 2 construction of new 16-in. from Ooltewah (northern Hamilton County) to northern McMinn County, Tenn., was completed in December and will begin operation early this year. Capacity will increase to 125,000 b/d, up from 100,000 b/d.

Proposed Phase 3 calls for construction of 24 miles of 16 in. from Loudon County into Knoxville and is set for construction within the next 5 years. Upon completion of the entire project, Colonial's capacity to Knoxville will reach 180,000 b/d.

China surges

Overstating the impact of China on oil and gas pipeline construction activity in Asia is probably impossible.

EIA data for the first three quarters of 2003 showed China poised to surpass Japan as the second largest petroleum market after the US. Demand along the eastern provinces of the huge country is driving both oil and natural gas pipeline projects and plans.

Asian media late last year reported the remarks of Liu Lei, general manager of the PetroChina Co. Ltd. pipeline company, who cited rapid economic development, pressure of environmental protection, and the need to improve energy infrastructure as forces behind the increasing demand for natural gas.

Gas consumption in China may well rise 7.5%/year by 2020 with volumes reaching 55 billion cu m next year and 100 billion cu m in 2010. China's current gas consumption makes up only 2.5% of its total energy mix, compared with the more than 23% in the rest of the world and even the 10% for the rest of Asia.

Lei reported that China's gas pipeline network, by 2002, barely exceeded 8,600 miles and could deliver slightly more than 1.1 tcf/year. The US gas system in 2002, by contrast, consisted of more than 190,000 miles of federally regulated natural gas pipelines that moved more than 32.2 tcf (OGJ, Sept. 8, 2003, p. 60). Uncounted in the US figures are dedicated intrastate pipelines, easily as much as 100,000 miles or more of transportation capacity.

As evidence of the push in China, last year saw construction begin and partially complete one of the largest pipeline project in Asia in many years, the 2,370 mile, 40-in. West-East natural gas pipeline (see three-part series: OGJ, Mar. 17, 2003, p. 68; May 26, 2003, p. 54; and July 21, 2003, p. 58).

Project construction covered two phases. The first consisted of about 1,152 miles of 40-in. line pipe and accesses existing natural gas production from Changqing oilfield near Jingbian in Shanxi Province to flow to Shanghai. The second phase consisted of about 1,218 miles of 40-in. line pipe to connect natural gas production in the Tarim basin near Lunnan in Xinjiang Autonomous Region to the western end of the mainline completed in Phase 1 in Jingbian. Completion of this phase will be by yearend 2004.

When fully operational this year, the line will supply 12 billion cu m/year to China's most populous city of Shanghai and other east China areas.

In September 2003, PetroChina Co. Ltd. began building a 446 mile, 28-in. Zhongxian-Wuhan mainline natural gas pipeline through 16 administrative regions in Chongqing and Hubei.

The line will have a capacity of 3 billion cu m/year. It will move Sichuan basin gas to Wuhan from Zhongxian, with three laterals: a 130-mile Jingzhou-Xiangfan line; a 212-mile Qianjiang-Xiangtan line; and a 48-mile Wuhan-Huangshi line. Total length of the system will reach 837 miles (OGJ Online, Sept. 2, 2003).

PetroChina has said the Sichuan basin has total reserves exceeding 7 trillion cu m and proven reserves of 680 billion cu m.

The mainline and the Xiangfan and Huangshi lines will be operating by yearend 2004, supplying commercial natural gas to users along the pipeline, mainly for petrochemical, power generation, building materials, metallurgy, and urban fuel projects. The Xiangtan line will start up by mid-2005, supplying gas to users in Changsha and cities along the line.

Late in last year, feasibility studies on a natural gas pipeline from Russia's Irkusk Kyvokta gas field to China and on to South Korea were completed, according to China National Petroleum Corp. (CNPC), Russia Petroleum Co. Ltd. of Russia, and Kogas Co. of South Korea.

Total line length will be 2,700 miles: 1,206 miles in Russia; 886 miles in China from Manzhouli to Shenyang; another 403 miles from Shenyang to Beijing; and 206 miles from Shenyang to Dalian and on 333 miles from Dalian across the Yellow Sea to Pyongtaek in South Korea.

Several other issues, including commercial operations by enterprises and policies, remain to be addressed, said the companies.

On the oil side last year, plans moved ahead to build at least one, and possibly two, pipelines from Russian oil fields in Siberia to Daqing, a city in Heilongjiang Province in northeast China, or to the Russian Sea of Japan port of Nahodka.

China is pushing for and Russia's OAO Yukos seems inclined to support the shorter, less expensive line to China over the longer, more expensive—to build and to maintain—line to the export terminal. Japan, which covets Russian oil as a way of reducing its dependence—to the tune of more than 85%—on Middle East oil, wants the latter project and has been energetic in efforts to induce the Russians in its favor.

Late last year, Japanese Foreign Minister Yoriko Kawaguchi reiterated Japan's preference in a meeting with Russian Prime Minister Mikhail Kasyanov, about this and other trade topics.

Kawaguchi told Kasyanov that adopting Japan's proposal would help Russia develop natural resources in eastern Siberia and strengthen its relations with countries in the Asia-Pacific region.

Japan, urging Russia to build the pipeline linking Angarsk and Nahodka, has said it would provide loans to Russia if it accepted the Japanese proposal. The cost of the longer, 2,460-mile line would run to $5 billion, by some media estimates.

The shorter, 1,512-mile crude oil line—preferred by China—would run from near Angarsk in eastern Siberia to Daqing in northeast China. Under preliminary plans, the line would carry as much as 400,000 b/d initially, rising to nearly 600,000 b/d by 2010, and could cost as much as $2 billion.

Early last year, construction was envisioned by yearend or early 2004, but the arrest late in the year of Yukos' CEO Mikhail Khodorkovsky has thrown any such optimistic scenarios into great doubt, along with many other plans. Still, the general thrust of the project appears on track, if not on schedule; an oil line seems certain between the two countries.

Rail, an expensive and dangerous method of moving oil, now transports nearly 4 million tonnes of oil, and Russia has committed to expand those shipments by 25% this year, proof of its desire to cement its supply role and of China's commitment to reduce its dependence on Middle East oil.

European plans

Contracts were let last year in one of the most technologically difficult projects under way anywhere in the world.

Norsk Hydro ASA is development operator for Ormen Lange field, which lies in the Norwegian Sea 140 km west of Kristiansund, Norway, in nearly 3,600 ft of water. The field will require subsea gas export pipelines on the Norwegian continental shelf consisting of a two-part pipeline of about 745 miles to an onshore processing plant at Aukra, then to the Sleipner installation in the North Sea, and on to the natural gas terminal at Easington-Dimlington, UK. The total system has been dubbed "Britpipe."

Norsk Hydro in early 2003 awarded Aker Kværner, Lysaker, Norway, a 950-million kroner contract for frontend engineering design, engineering, procurement, and construction management assistance of the project's onshore Nyhamna processing plant near Aukra, in Møre og Romsdal County, Norway.

In November, Norsk Hydro awarded to Stolt Offshore SA a contract worth up to $280 million, including options, to install part of the Ormen Lange pipeline in the North Sea. Under the contract, Stolt Offshore will initially install 335 miles of 44-in. OD with an option in 2006 for the installation of 225 miles of 42 in., according to Stolt.

Developer Norsk Hydro holds a 17.956% interest in the field and Norske Shell 17.2%. Other shareholders are Petoro AS 36%, Statoil ASA 10.774%, Esso Norge AS 7.182%, and BP PLC 10.888%.

The Nyhamna development, due for completion when Ormen Lange field comes on stream in 2007, includes the process plant, utility systems, slug catchers, a tank farm, and power supply and distribution.

The field will need pipeline capacity of at least 60 MMcfd. In addition, there is transport capacity demand in other parts of the system for gas from other fields.

"The total export pipeline system tied into Ormen Lange will be the most significant pipeline project ever in the Norwegian offshore sector," a consortium spokesperson said.

The total Ormen Lange investment, including field development and transportation pipelines, is estimated at 55 billion kroner (2002). The field is the first deepwater development project on the Norwegian Continental Shelf.

"The investment demands large parts of the world's pipeline-laying capacity in 2005 and 2006," says Bengt Lie Hansen, Hydro's head of mid-Norway exploration and development. "Ormen Lange will increase Norwegian gas export[s] by 25%, making Norway the world's next largest gas exporter after Russia," he said.

First production from Ormen Lange is planned for October 2007, with gas production scheduled to last 30-40 years. The field's production is expected to peak at 20 billion std. cu m/year, about 20% of the total anticipated Norwegian gas production in 2010, Norsk Hydro has said.

Estimated gas reserves on Ormen Lange are 375 billion std. cu m of dry gas and 22 million std. cu m of condensate, making it the largest undeveloped gas field on the shelf, according to the operator.

Yet another gas line for service to the UK was to have received additional planning and details at yearend 2003.

Gastransport Services (GtS), part of NV Nederlandse Gasunie, was to have announced in December whether construction of the BBL pipeline would progress.

BBL is a 143-mile line connecting the Netherlands with the UK from Balgzand on the northwestern Dutch coast to Bacton in Norfolk. At Bacton, the BBL will connect to the Transco system via an existing terminal. First gas is scheduled for mid-2006.

Camisea moves ahead

The long-delayed and much-debated Camisea project in Peru took a major step forward late last year when the Inter-American Development Bank authorized $135 million towards completion of the entire $1.6 billion project in Peru's Amazon rainforest (OGJ Online, Sept. 15, 2003).

IDB is contributing $75 million from its own funds and $60 million from a syndicated group of banks. Andean Development Corp. (CAF) also approved $75 million for Argentina's Transportadora de Gas del Peru (TGP) to finance completion the project's pipeline, taking the total credits to $210 million.

TGP is seeking an additional $375 million from international and local markets. Banks may be able to raise a $200-million syndicate, with bond issues as one of the possibilities, although the move is expected to take time.

The credits include $75 million to be repaid over 14 years and $60 million from a syndicated loan formed by companies who signed agreements with the IDB, for repayment over 12 years with interest rates at market value.

The company's website states that Camisea encompasses construction and operation of two pipelines, a 443 mile, 24 to 28 in., 450-MMcfd natural gas line and a 335-mile, 8 to 10 in., 35,000-b/d NGL line. The parallel pipelines will run from the Camisea fields, about 268 miles east to the coast south of Lima, where the NGL pipeline will end at a fractionation plant. From the plant, the gas pipeline will turn north and run along the coastline to the Lima city gate.

Concession agreements specify commercial operation to start no later than August 2004.

The pipeline route selected by TGP starts at the Camisea production site in the Department of Cuzco and traverses the Ayacucho, Huancavelica, lca, and Lima departments. Elevation for the pipelines reaches its highest point of about 15,750 ft above sea level in the Andes Mountains.

Techint, Buenos Aires, is responsible for design and construction of the gas and NGL transportation system. Pipeline construction is underway and has been divided into three segments: rain forest, mountain, and coastal.

Through September 2003, says the website, 112 miles of right-of-way in the rain forest had been cleared and welding and back-filling of 112 miles of 14-in. NGL pipeline had been finished. On the gas line, 112 miles of 32 in. had been strung, welded, and back filled.

In the mountains, 211 miles of right-of-way had been cleared, and welding and back-filling of nearly 186 miles of the 14-in. NGL line had been completed. Along the gas line, welding and back-filling of nearly 187 miles of 24-in. pipe had been completed.

Finally, at the coast, workers had cleared nearly 120 miles of right-of-way, strung 109 miles of pipe, welded nearly 104 miles of pipe, and lowered in and backfilled almost 58 miles of 18-in. gas pipeline.

At the end of August 2003, total progress on the Camisea pipelines was 83% complete.