Market Movement

Cold weather drives up energy prices

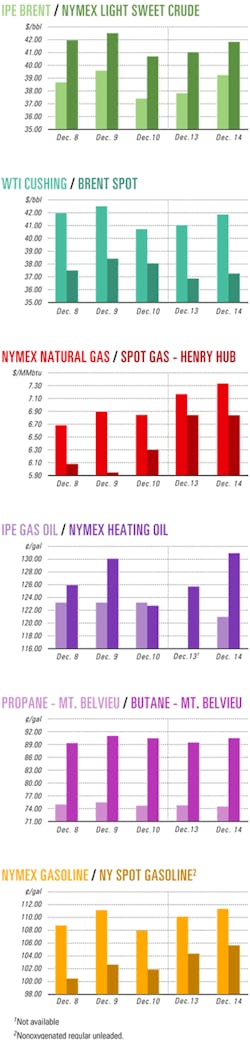

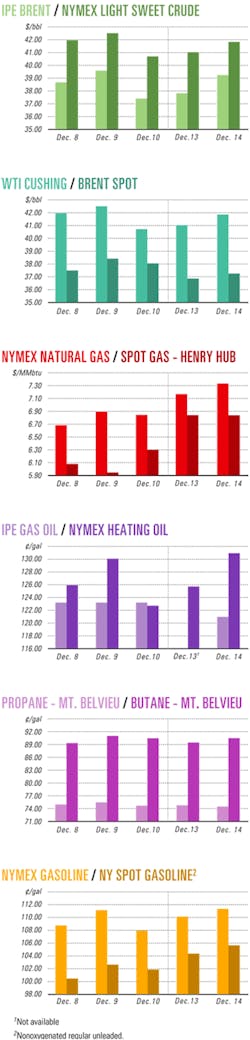

The first cold weather of the US winter blew into the Midwest and Northeast on Dec. 13-14, pushing up prices for heating oil in the world's biggest market for that commodity and pulling up other energy prices with it.

Indications that lower-than-normal temperatures might linger longer than was first expected helped establish heating oil as a market leader, said analysts. But some traders awaited the Dec. 15 release of weekly inventories of US crude and petroleum products to set the tone of trading for the rest of that week.

The US Energy Information Administration reported then that commercial crude inventories dipped by 100,000 bbl to 293.8 million bbl during the week ended Dec. 10, while distillate fuels remained flat at 119.3 million bbl, just below the lower end of the average range for this time of year. However, US gasoline stocks increased by 1.5 million bbl to 209.6 million bbl.

Strong US demand

That latest data "relates to a week when [weather] was distinctly mild," prior to the movement of cold air from Canada into the northern US, said Paul Horsnell, Barclays Capital Inc., London. "Despite that, the implied demand for distillate remained very strong at 4.242 million b/d, the strongest reading seen for 6 weeks, and the 11th straight week above 4 million b/d," he said. "Gasoline demand weighed in at 9.268 million b/d, the highest for 14 weeks."

Horsnell noted, "With the peak holiday season yet to come, US gasoline demand for December-to-date is already running up by 2.5% [vs. a year ago], the strongest growth seen since April."

He said, "With the impact of the recent fall in retail prices not yet fully absorbed into the numbers, it is difficult to get bearish on gasoline demand at this point."

Imports decline

Crude imports fell by 498,000 b/d to nearly 10.4 million b/d during the week ended Dec. 10. In that same period, input into US refineries decreased by 52,000 b/d to 15.7 million b/d. Production of heating oil remained relatively flat, while production of diesel fuel decreased slightly. Gasoline production, however, rose to average nearly 9 million b/d during the same period.

"Crude oil imports fell by [nearly] 500,000 b/d while refinery runs were flat, and one does wonder whether the changes in product slates are being caused more by variations in the quality of crude input than they are by conscious optimization decisions," observed Horsnell.

"We believe the system still looks highly nonoptimized. Should distillate strength fall away, then it will take a while for the rest of the complex to assume price leadership. However, should distillates continue the way they have been doing, then prices will move higher."

OPEC takes action

Ministers of the Organization of Petroleum Exporting Countries voted at their Dec. 10 meeting to reduce production by 1 million b/d effective Jan. 1, while retaining their present total production quota of 27 million b/d for the 10 members except Iraq. The 10 members affected by the quota are estimated to be overproducing that level by 1.1-1.7 million b/d. With Iraq included, current OPEC production is estimated at 29.5-30 million b/d.

"It now appears that OPEC intends to defend West Texas Intermediate prices in the $40/bbl range," said analysts in the Houston office of Raymond James & Associates Inc. They cited three reasons for OPEC's action:

There has been virtually no evidence of oil demand destruction at $40/bbl-plus oil.

Dramatically higher transportations costs over the past several months mean lower realized oil prices for OPEC producers, especially Saudi Arabia.

Continued declines in the US dollar vis-à-vis the euro have further weakened OPEC's purchasing power.

OPEC's action is "a strong signal" that "ministers are happy with [current] prices and do not want to see any further significant and sustained moves downwards," said Horsnell. "By scheduling another meeting in January, ministers have in effect signaled that they will cut quotas were prices to fall lower than they are now and that they might cut in any case, depending on the view they take of the potential path of global supply-demand balances."

Meanwhile, he said, "The outlook for next year is highly dependent on the extent to which Russian export growth slows, the situation in Iraq and whether Iraqi output will be a [year-over-year] positive or negative in the balances, the scale of Chinese demand growth, and the severity of the Northern Hemisphere winter in the key areas of winter oil heating demand."

Industry Scoreboard

null

null

null

Industry Trends

THE ROCKY MOUNTAIN natural gas market could experience a price slump by fall 2005 because a medium-term surplus is developing, said market research consultant Bentek Energy LLC, Golden, Colo.

Bentek reached that conclusion in a multiclient study entitled "Catch The Wave—Risks and Rewards in the Expanding Rocky Mountain Gas Market."

Porter Bennett, Bentek president, said, "We were quite surprised by study findings that Rockies gas prices could be much lower by this time next year, perhaps down into the low $3/MMbtu range."

He referred to a spot Rocky Mountain price not tied to any particular hub.

"We expected that the new pipeline capacity out of the Rockies providing increased access to Midwest markets would improve the market for western gas production. Instead, any improvement in market access has been overshadowed by dramatic increases in competitive supplies from new production in West Texas and Oklahoma," Bennett said.

He acknowledged the study contradicts forecasts by other analysts who suggest US production is declining.

Bentek statistics indicate stable US production with Rocky Mountain states increasing gas production by more than 5%/year since 1995. During that period, Paradox basin production was up more than 16%/year, Unita-Piceance basin production increased 20%/year, and Powder River basin production was up 73%/year.

The consultant's long-term base scenario forecast is for US gas supply to average 2.9%/year growth during 2005-10. Increases in Rockies and Midcontinent production are expected to account for virtually all of that growth.

Citing gas price increases since 2000, the study said, "With these high prices, it was only a matter of time before producers responded.

"That response happened much more quickly than expected. Producers throughout the US reacted to the higher prices by dramatically increasing drilling activity."

But, the magnitude of increased drilling activity only became evident in recent production volumes, the study said. During the first quarter, production levels in 19 of the 32 major US basins were up compared with the first quarter of 2003.

Rockies gas production rose 4% during the period with similar increases on track for the remainder of 2004. The more mature Midcontinent basins including Anadarko, Arkoma, Arkla, East Texas, and Fort Worth also demonstrated growth.

"Although much of this increased production seems to be from infill drilling and other enhanced recovery techniques and thus may not be sustainable over the long run, the short-run impact in 2005 and 2006 will be formidable," the study said.

The increased production and slow demand growth due to a sluggish economic recovery set the stage for a gas surplus. Bentek's model of US and Canadian supply and demand predicts a gas surplus of almost 1.9 bcfd by late 2005.

Government Developments

US PRESIDENT GEORGE W. BUSH nominated Samuel W. Bodman, US Treasury deputy secretary, to succeed Sec. of Energy Spencer Abraham, who had earlier announced his resignation (OGJ Online, Nov. 15, 2004).

The former chairman of chemical manufacturer Cabot Corp., Bodman joined the US Department of Commerce as deputy secretary in February 2003. He became Treasury deputy secretary in February.

Industry trade associations welcomed the nomination, noting Bodman's business experience.

The American Petroleum Institute said Bodman's "experience in the world of finance should serve him well in working with an industry that requires enormous investments and strategic planning."

American Chemistry Council Pres. and CEO Tom Reilly said: "The President picked the right man for the jobUBodman is a chemical engineer, knows the energy industry, and has a wealth of experience in finance and manufacturing."

The nomination also won praise from John J. Castellani, president of the Business Roundtable, a Washington group working with the US Departmentn of Energy to promote a voluntary program for companies toward reducing greenhouse gas emissions.

"Bodman's extensive experience as a leader in the business arena, combined with his scientific background, make him an excellent fit," Castellani said.

US STATE AND FEDERAL officials continue to debate LNG regulatory and other legal issues.

US Rep. Barney Frank, D-Mass., is coordinating an effort with congressional delegates from coastal areas to support state governments arguing that the US Federal Energy Regulatory Commission lacks final jurisdiction on LNG terminal siting permits.

Frank said a bipartisan group plans to file a friend-of-the-court brief in a petition for review that the California Public Utilities Commission (CPUC) filed with the US Court of Appeals for the District of Columbia about a proposed Long Beach, Calif., LNG terminal (OGJ Online, July 16, 2004).

Previously, Congress approved spending legislation with a provision declaring that FERC has the final decision in permitting LNG facilities.

"The provision, added to the explanatory report accompanying the omnibus bill with no advance notice or opportunity to review it, is not binding because it wasn't part of the actual bill," Frank said. "I believe it is very clear that this provision has no legal effect.

"On the other hand, it is always possible that an individual judge could decide that the provision should be taken into account in making a ruling on the California LNG site, with that ruling then being applied to other cases in the future."

CPUC has a jurisdictional dispute with FERC over plans by Sound Energy Solutions (SES), a wholly owned subsidiary of Japan's Mitsubishi Corp., to build and operate an LNG terminal at the Port of Long Beach (OGJ Online, July 13, 2004).

CPUC said that the SES needs a state permit under California law and that FERC has no jurisdiction because the proposed facility would only send natural gas intrastate within California.

In March, FERC ruled that it has jurisdiction over the SES facility.

Quick Takes

AUSTRALIA'S FIRST SHIPMENT of LNG to China will leave the North West Shelf Project's (NWSP) Burrup Peninsula liquefaction plant in Western Australia in mid-2006. The North West Shelf Gas Joint Venture participants signed a $25 billion (Aus.) LNG sales and purchase contract (SPC) with Guandong Dapeng LNG Co. of China. The contract is for the supply of as much as 3.3 million tonnes/year of LNG over 25 years to the Guandong receiving terminal under construction in China, the country's first such plant. As part of the deal CNOOC Gas & Power, China's national energy company, will acquire 5.3% interest in the gas reserves in the NWSP, which is operated by Woodside Petroleum Ltd. of Perth. Shipping arrangements will be through a joint venture of Chinese and Australian companies.

Earlier this year NWSP brought on stream its second offshore gas pipeline and its fourth LNG train at the Burrup Peninsula facility to bring its total production capability to 11.7 million tonnes/year of LNG. This will enable it to serve the new Chinese contract as well as its existing contracts with buyers in Japan. A fifth LNG train, capable of producing a further 4.2 million tonnes/year, is under consideration with a final investment decision expected by mid-2005. The six equal NWSP partners are BHP Billiton Petroleum Pty. Ltd., BP Developments Australia Pty. Ltd., ChevronTexaco Australia Pty. Ltd., Japan Australia LNG (MiMi) Pty. Ltd., Shell Development (Australia) Pty. Ltd., and Woodside. Dominion, Richmond, Va., has completed the recommissioning and expansion of the Dominion Cove Point LNG import terminal in Maryland, begun in 2003, and has proposed another expansion. The company placed into service a 135,000 cu m capacity LNG storage tank at the terminal, bringing the total number of tanks at the site to five. The new tank holds the equivalent of 2.8 bcf of natural gas, increasing on-site storage to the equivalent of 7.8 bcf of gas. Dominion's proposal for an additional expansion, scheduled to be in service in 2008, would increase output capacity to 1.8 bcfd from 1 bcfd and storage capacity to 14.6 bcf (OGJ Online, June 14, 2004). Facilities would include two additional storage tanks, additional vaporization and electrical equipment, and pipelines. The terminal will flow the additional gas through 47 miles of looped pipeline in Maryland and 88 miles of pipeline to be laid in Pennsylvania along with two compressor stations at Leidy, Pa. Construction on the 3-year project will begin as soon as regulatory approvals are received, Dominion said.

CROSSTEX ENERGY LP, Dallas, has entered into throughput agreements with Fort Worth basin producers that support construction of a 110-mile, 24-in. pipeline to deliver natural gas from the Barnett shale area in North-Central Texas to major pipelines serving Texas, the Midwest, and the Eastern US. Initial throughput capacity will be 200 MMcfd of gas. Crosstex expects more commitments to follow, at which time it will consider expanding the line. The $80 million pipeline will extend from the Justin area north of Fort Worth to interconnections with Natural Gas Pipeline of America and Houston Pipeline Co. mainlines in Lamar County, Tex. A feasibility study is to be completed by Jan. 15, 2005, and Crosstex expects pipeline construction to be completed by January 2006.

TEXACO NORTH SEA UK CO. and partners reported a significant oil and gas discovery with the Rosebank-Lochnagar well (213/27-1Z) on Block 213/27 in the deepwater Faroe-Shetland Channel off the UK. The well, 126 km off Esha Ness, Shetland, near the UK-Faroes median line, was drilled by the West Navigator drillship in 3,600 ft of water. It encountered two 27-36° gravity oil and gas accumulations in total net pay of 169 ft. Nonassociated gas was encountered in the shallower reservoir. The untested well has been plugged and abandoned at 12,153 ft TD, and further drilling is planned. Operator Texaco North Sea holds a 40% interest, and Statoil (UK) Ltd. holds 30%, OMV (UK) Ltd. 20%, and DONG (UK) Ltd. 10%.

Shell Canada Ltd. discovered natural gas on a previously untested Leduc reef feature 30 km southwest of Rocky Mountain House in central Alberta. The Shell Tay River RicinusW 2-6-37-10-W5 well, drilled to 5,100 m, encountered 140 m of net pay. Test data indicate it will be capable of a restricted flow rate of 30 MMcfd through 31/2-in. tubing. Shell estimates 500-800 bcf of original gas in place, containing 60% methane and 35% hydrogen sulfide. The discovery, near sour-gas processing facilities, is expected to be producing by mid-2005. Shell Canada holds 75% interest in the discovery and Mancal Energy Inc., Calgary, 25%.

Statoil ASA's 34/10-48S wildcat, drilled from the Gullfaks C platform in the North Sea, has discovered oil in the Topas prospect on Production License 120, about 3 km northeast of Gullfaks and 5 km south of Visund oil field. Drilled in 217 m of water, the horizontal well is 7,393 m in total length and has a TD of 2,849 m, terminating in Middle Jurassic rocks. It encountered oil in Middle Jurassic and Upper Triassic sands. Statoil logged the well extensively during the 102-day drilling operation and gathered core and mud samples. Statoil said it might seek approval for Topas pilot production from Gullfaks facilities to assess the discovery's size and commercial value. Statoil operates Licene 20, holding a 30.07% interest. Partners are Norsk Hydro AS 29%, Petoro AS 16.93%, Total SA 11%, and ConocoPhillips 13%. Tullow Oil PLC, Dublin, reported that its Bangora-1 natural gas discovery well on Block 9 at Bangora, Bangladesh, flowed during a production test at a combined rate of 120 MMscfd of gas from its three lowest zones. The well, drilled to 3,636 m, encountered several gas reservoirs at 2,580-3,285 m. The lowermost E sand flowed gas at a top rate of 24.5 MMscfd. The D sand, 87 m thick, was tested in two separate zones: the Lower D at 41.2 MMscfd and the Upper D at 56.0 MMscfd. Gas quality is high, the company said, with 99.13% combustible gases. Operator Tullow will test the shallower gas sands later, and the well will be suspended as a future production well. Tullow will carry out a comprehensive appraisal program of the Bangora find and its earlier Lalmai discovery on the same 40 km anticlinal structure, including additional seismic, drilling, and extended well testing. ChevronTexaco Latin America Upstream's Plataforma Deltana Loran 3X exploration well on Block 2 off Venezuela encountered six gas sands having total gross thickness of 755 ft, parent ChevronTexaco Corp. reported. The well tested more than 55 MMscfd from two intervals. A gas sand previously not encountered on the block flowed 35 MMscfd of that to.The well, drilled in 345 ft of water, reached 9,976 ft TMD. ChevronTexaco, with 60% interest, operates Block 2 in partnership with ConocoPhillips, 40%. Loran 3X is ChevronTexaco's second well on the block, southeast of the Petroleos de Venezuela SA's Loran 1X discovery drilled in 1982. Loran 3X extended to the south the five shallow gas sands already discovered in Loran 1X and ChevronTexaco 2X. The sixth sand discovered in Loran 3X is deeper than the others. The company will drill another exploration well before beginning the next evaluation phase. x& Pioneer Oil & Gas, South Jordan, Utah, responding to a May 2004 discovery by another operator, has acquired a 50% interest in more than 60,000 acres along the hingeline portion of the Rocky Mountain Overthrust Belt in central Utah. The private operator, Wolverine Gas & Oil Co., Grand Rapids, Mich., reportedly is producing several thousand barrels per day of light oil from two wells in 17-23s-1w, Sevier County. The reservoir is identified as the Lower Jurassic Navajo sandstone below 8,000 ft. Wolverine has declined to release information. The discovery, which would be the first sustained hydrocarbon production from the hingeline, is 150 miles south of Pineview oil field in Summit County, Utah, nearest field on the Overthrust Belt. Pioneer, which said Wolverine is drilling a third well, has obtained interests in more than 10 prospects that appear to have oil potential. The hingeline is only lightly explored (OGJ, Nov. 24, 1980, p. 188).

SWIFT ENERGY CO., Houston, said its 2005 capital budget likely will include $15-20 million for further development of Bay de Chene and Cote Blanche Island fields in South Louisiana begining in the second half of the year. Swift plans to acquire 100% interest in the fields, for a combined $27.3 million, from Enervest Management Partners Ltd., Houston, and another party. About $50 million is required to fully develop the two fields, which contain proved reserves of 5.6 million bbl of oil and 9.8 bcf of gas, Swift said. Production is less than 1,000 boe/d net to the interests being acquired. Cote Blanche Island field in St. Mary Parish produces oil and gas from Miocene sands at less than 11,500 ft to more than 18,500 ft on 4,215 gross acres. Bay de Chene field, in Lafourche and Jefferson parishes produces oil and gas from Miocene sands at 1,500-13,000 ft on 14,000 gross acres. Swift is acquiring existing 3D seismic data over Bay de Chene field and plans to merge it with 600 sq miles of 3D data that is part of its previously announced Barataria Bay and Lake Washington merged data set.

HOLLY CORP. subsidiary Holly Refining & Marketing Co., Dallas, has awarded a $23 million services contract to Benham Cos. LLC for the engineering, procurement, and construction of a diesel hydrotreater unit at Holly's Woods Cross, Utah, refinery north of Salt Lake City. Following installation of the unit, the refinery will be able to produce 10,000 b/d of ultralow-sulfur diesel and jet fuel by June 2006.

BHP BILLITON LTD., Melbourne, will begin commissioning onshore facilities to treat production from Minerva gas and condensate field during the next 2 weeks—11 years after discovery of the field off Australia. Full field production is expected early in 2005. The separation plant is designed to handle 139.5 MMcfd of gas and 600 b/d of liquids. The field is in the Otway basin, 10 km off Port Campbell, Victoria. BHP estimates proved and probable reserves at 300 bcf of gas and 1.24 million bbl of condensate. Production from two subsea wells in 60 m of water will flow ashore via an underwater pipeline and subsurface shore crossing. Dry gas will enter the South Australia electric power generation market via the recently completed, 630 km Seagas pipeline from the Port Campbell area to Adelaide. BHP holds a 90% interest in the $170 million Minerva project, and Adelaide-based Santos Ltd. holds 10%. x& Three flow stations operated by subsidiaries of Royal Dutch/Shell Group and ChevronTexaco in southeastern Rivers State, Nigeria, remained shut down in mid-December, restricting delivery of more than 100,000 b/d of crude oil, said Shell spokesman Andy Corrigan. However, exports have not been affected to date. Oil movement from Shell's Ekulama One and Ekulama Two flow stations in the Ekulama swamp and the ChevronTexaco-operated Robert-Kiri Island flow station has been restricted since Dec. 6, when about 200 Nigerian youths from the Kula community converged on the stations in the Niger Delta, stopping operations and preventing at least 107 oil workers from leaving the facilities. Rivers State government officials are talking with the local residents. Nigeria's media said the villagers' action was an effort to win compensation for exploration on their land, to secure jobs from the oil companies, and to have the companies conduct remediation for an alleged oil spill in the area. In April, seven people, were killed in an attack in the region as they inspected oil facilities damaged last year during local uprisings. x& Statoil said it hopes to resume production of 205,000 b/d of oil from Snorre A and its Vigdis satellite by yearend. The fields have been shut in since Nov. 28, following discovery of a gas well leak (OGJ Online, Dec. 2, 2004). Statoil has isolated the gas-bearing formation from which the Snorre A platform well was leaking and has is preparing to pull remaining casing and set and test plugs in the well. Inspection work is continuing on the subsea template to verify its technical condition.

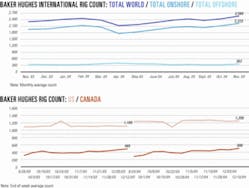

US DRILLING ACTIVITY rebounded slightly with 1,250 rotary rigs working the week ended Dec. 10, five more than the previous week and up from 1,109 a year ago, Baker Hughes Inc. reported. Offshore operations accounted for the bulk of that gain, up by 3 units to 101 in the Gulf of Mexico and 108 in US waters as a whole. Land drilling increased by 1 rotary rig to 1,122. Activity in inland waters also increased by 1 rig, to 20. Canada's rig count jumped by 41 units to 500 rotary rigs drilling, compared with 485 at the same time last year.