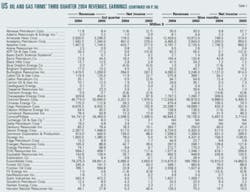

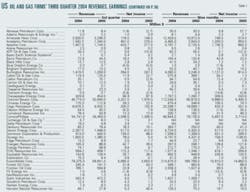

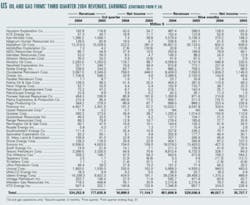

Strong commodity prices propelled third-quarter earnings for most operators and service companies in the US and Canada, many of which reported that they are using increased cash flows to reduce debt, increase stock dividends, and buy back shares.

Collectively, the 93 oil and gas producers in this sample of firms posted a 52% increase in earnings for the third quarter. But nearly one fourth of these companies reported net income down from a year earlier. The large earnings of the integrated operators, including ChevronTexaco Corp., skewed the group's combined results, as most of the independent oil and gas producers reported modest earnings gains.

Meanwhile, a sample of US-based service and supply companies combined to more than triple their third-quarter earnings from a year earlier, as their revenues nearly doubled. Also, a group of Canadian firms posted improved earnings from the same 2003 quarter, although their combined results did not improve as dramatically as those of their US counterparts (see article, p. 40).

Integrated firms

ChevronTexaco reported net income of $3.2 billion for the third quarter, compared with $2 billion in last year's same quarter. The 2004 amount included special-item gains of $486 million related to the sale of nonstrategic assets. And for the first 9 months of 2004, net income was $9.9 billion, compared with $5.5 billion in the same 2003 period.

Jacques Rousseau of Friedman, Bilings, Ramsey & Co. (FBR) commented that ChevronTexaco's quarterly earnings were below expectations, due primarily to weak US refining and marketing results, which were $96 million vs. $517 million in the second quarter. The decline reflected lower refining and marketing margins, environmental remediation charges, and reduced refinery throughput as a result of the shutdown of the Pascagoula, Miss., refinery late in the third quarter due to Hurricane Ivan.

"Upstream production volumes declined 6% from a year earlier, with about two thirds of this decline due to asset sales," Rousseau said. "Management indicated that the shut-in output from Hurricane Ivan should average 50-60 million boe/d in the fourth quarter, with an expected earnings opportunity loss of $100 million, plus $50 million in damage repairs."

ChevronTexaco Chairman and CEO Dave O'Reilly said the company has used cash flow to strengthen its balance sheet and increase dividends. It also has bought back common shares worth nearly $1.4 billion since April, including $750 million in the third quarter.

In the first 9 months of this year, O'Reilly said, the company reduced its debt by $700 million and contributed nearly $1.2 billion to its US employee pension plans, including $600 million in the third quarter. At the end of September, the company's debt ratio was 22%, down from 26% at the end of 2003.

ExxonMobil Corp. reported a $2 billion gain in third-quarter net income to a record $5.7 billion. Capital and exploration expenditures of $3.6 billion were down $204 million from a year earlier.

"During the quarter, the corporation acquired 65 million shares at a gross cost of $3 billion to offset the dilution associated with benefit plans and to reduce common stock outstanding," ExxonMobil Chairman Lee R. Raymond said.

Independent producers

Most of the independent oil and gas producers in the sample of firms posted earnings gains during the third quarter as a result of increased output and prices.

Berry Petroleum Co. reported a 133% increase in earnings from the same 2003 period due to increased production and higher oil and gas prices.

Magnum Hunter Resources Inc. recorded a 184% jump in earnings for the same reasons, in addition to an improved hedge position that boosted the company's net margins. Gary C. Evans, president and CEO, said the company continues to reduce its overall indebtedness with free cash flow and to pay off high-cost debt whenever possible, such as the early redemption of $105 million in 9.6% senior notes called during the third quarter.

Kerr-McGee Corp. reported record production for the third quarter, but the company's earnings slumped due to special items, including a $79.6 million write-down related to its Savannah titanium dioxide pigment plant, higher environmental charges of $19.7 million, and higher nonhedge commodity and other derivative losses of $24.1 million.

Kerr-McGee's third-quarter production increased 33% from a year earlier. Higher volumes were primarily due to the early start of oil production in Bohai Bay, China, gas production from the company's new Red Hawk deepwater Gulf of Mexico hub, and a full quarter of production from the Westport Resources acquisition.

Up 18% from the 2003 period, Kerr-McGee's daily oil production averaged 166,400 b/d in the quarter. Natural gas sales averaged a record 1.051 bcfd, up 50% from the 2003 third quarter. Including hedging effects, the company's third quarter realized commodity prices averaged $29.24/bbl for oil, up from $25.76/bbl a year earlier, and $5.14/Mcf for gas, a 22% gain from a year ago.

Refining, chemicals

Frontier Oil Corp. announced net income of $23.8 million for the third quarter. This compares to net income of $3.8 million for the third quarter of last year.

The stronger 2004 third quarter results are attributable to improvements in the diesel crack spread, continued strength of the gasoline crack spread, and wide crude oil differentials. Frontier's diesel crack spread improved to an average of $8.10/bbl in the third quarter from $4.75/bbl a year earlier. The gasoline crack spread averaged $8.88/bbl in the third quarter of 2004 vs. $9.70/bbl in the same 2003 period.

Giant Industries Inc. reported that third quarter earnings declined to $6 million from $7.5 million a year ago, while revenues gained 36% year-on-year. The company's earnings were hurt by the shutdown of portions of its Yorktown, Va., refinery through all of September for upgrades. Additionally, earnings declined because of lower fuel and merchandise margins in the company's retail operations.

FBR's Rousseau noted that the export tax bill, passed in October by the US Congress and signed by the president, will benefit small refiners such as Frontier and Giant. The bill contains a provision to assist small refiners in upgrading their facilities to produce low-sulfur diesel fuel. The benefits are in the form of increased cash flow from an acceleration of the deduction of capital expenditures for tax purposes and higher earnings due to a per-gallon tax credit for low-sulfur diesel production.

ConocoPhillips Co.'s chemicals segment, which includes the company's 50% interest in Chevron Phillips Chemical Co. LLC, posted income from continuing operations of $81 million, compared with $7 million in the third quarter of 2003.

The year-over-year increase reflects improved margins and volumes in olefins and polyolefins, as well as improved margins in the aromatics and styrenics business line, the company reported. These same factors boosted ConocoPhillips's chemicals segment income from continuing operations to $166 million during the first 9 months of this year, compared with a loss of $4 million for the same period a year ago.

Occidental Petroleum Corp. announced chemical segment earnings were $137 million for the third quarter, a 125% increase from a year earlier. The improvement was mostly due to higher sales prices and margins in chlorine, ethylene dichloride, polyvinyl chloride, and vinyl chloride monomer, partially offset by higher ethylene and energy costs. Chemical earnings of $272 million for the first 9 months were almost double those of 2003.

Service, supply firms

OGJ's sample of service and supply companies collectively posted a 238% gain in third quarter 2004 earnings from a year earlier.

The group's revenues nearly doubled in the same period. For the first 9 months of this year, net income for the sample of firms increased 76% on 18% higher revenues. But a variety of factors lowered earnings for some of the companies.

BJ Services Co. reported the highest quarterly revenue in its history during the recent third quarter. Revenue improved to $694.5 million from $588.6 million in the same 2003 period. This resulted in an earnings boost to $85.6 million from $60.4 million a year earlier. The company said that the year-over-year improvement was primarily due to favorable margins in the US pressure pumping market.

Schlumberger Ltd. reported earnings of $318.2 million for the third quarter. This compares to a loss of $55.3 million for the same 2003 quarter. Despite the improved performance and the strength of the company's WesternGeco operations, Geoff Kieburtz of Smith Barney said that results missed analysts' expectations.

The oil field service company's earnings fell below expectations for several reasons, including Hurricane Ivan; drilling slowdowns by Petroleos Mexicanos, Petroleos de Venezuela SA, and OAO Yukos; and the oil workers strike in Norway. Each of these factors, Kieburtz said, "has potential near-term future implications as well." Losses on two drilling projects also lowered earnings, raising questions with longer-term implications, the analyst added.

Schlumberger Chairman and CEO Andrew Gould said pricing in North America showed improvement during the third quarter, and overall activity trends remained positive, particularly in the Eastern Hemisphere.

Parker Drilling Co. announced revenues of $87.9 million and a net loss of $22.1 million for the third quarter. Results suffered from a lack of activity in the international offshore segment, which for the third quarter more than offset improved utilization and dayrates in the US drilling market and increased rental tool activity. Also contributing to the loss were nonroutine costs totaling $10.3 million, the company reported.