Market Movement

US enters winter season with record gas storage

The US Energy Information Administration recently reported "a 'true' physical injection" of 41 bcf of natural gas into underground storage in the week ended Nov. 5, raising US storage to a record 3.3 tcf.

The latest injection figure included the reclassification of 7 bcf of "working gas" into the "base gas" category, said analysts at Banc of America Securities LLC, New York. It compares with injections of 44 bcf the previous week and 32 bcf during the same period a year ago.

Until natural gas prices declined in early November, the market "appeared to be paying little attention to historical storage norms as a measure of adequacy in meeting gas requirements for the winter ahead," said Stephen A. Smith, founder and president of Stephen Smith Energy Associates, Natchez, Miss. (see related article, p. 37).

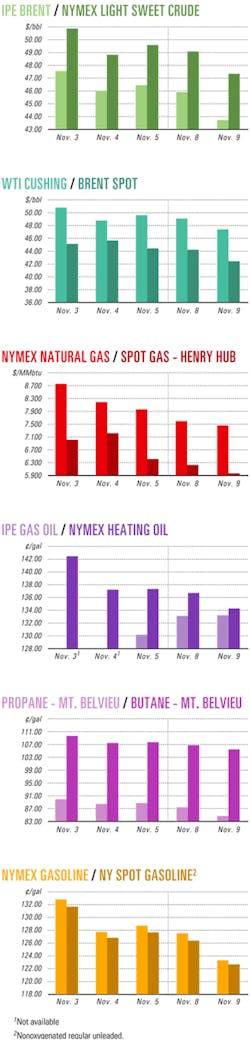

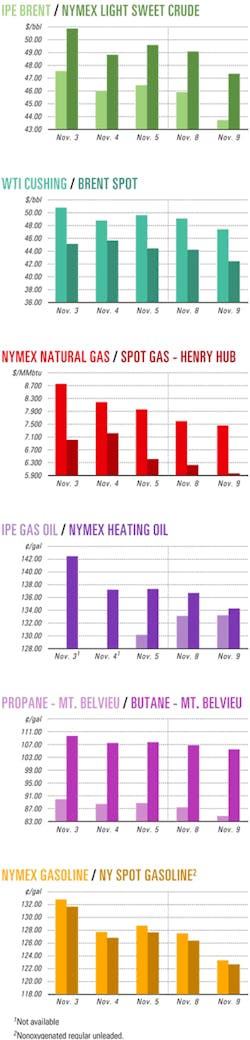

Gas futures price falls

The price of the near-month natural gas contract on the New York Mercantile Exchange has recently tumbled to $7.47/Mcf on Nov. 9 from $8.73/Mcf on Oct. 29. That downward correction "appeared overdue," said Smith in a Nov. 8 report.

With the market's earlier nervousness about natural gas supplies at the start of the heating season Nov. 1, Smith said, "Hurricane Ivan provided the perfect catalyst for the fall price surge. But the effects of Ivan have now largely come and gone...and 113 bcf of lost Ivan production have been more than offset by mild fall weather—in fact, the storage surplus is now 36 bcf higher than when Ivan arrived [in the Gulf of Mexico in mid-September]."

The US Minerals Management Service reported gulf gas production amounting to 692.36 MMcfd was still shut in Nov. 10 as a result of damage from Hurricane Ivan. Cumulative gas production lost to that storm totaled 116.9 bcf Sept. 11-Nov. 10, or 2.6% of annual gas production from the gulf.

"While there is some legitimacy to the recent nervousness about the adequacy of historical storage norms to provide an adequate cushion for winter, we simply believe that this new nervousness (as manifested by $8-9[/Mcf] futures) has been overdone," Smith said.

US gas production declines

In a separate report Nov. 8, analysts in the Houston office of Raymond James & Associates Inc., St. Petersburg, Fla., said they expect US gas production to continue declining "for the next several quarters." For the last several years, they said, US gas production has been "heading down despite a huge increase in drilling activity."

A survey of 46 of the largest publicly traded US gas producers followed by Raymond James analysts showed a 3.3% production decline in the third quarter compared with the same period a year ago. That followed a production drop of 3.8% in the second quarter.

"We see no significant near-term catalysts to alter the declining gas supply picture," said Raymond James analysts. "Despite a 46% increase in the gas rig count over the past 24 months, gas supply continues to fall. That means price rationing remains the only viable option to bring the gas market into equilibrium."

They said, "With the 12-month futures strip staying above $5/Mcf in all of 2004 and setting an all-time intraday high of $8.31/Mcf last month, we believe commodity market pricing reflects the tight supply environment—even if the equity markets (and most energy analysts) have yet to fully awaken to this reality."

Even more importantly, said analysts, "The majors and gas utilities continue to show the biggest decline in gas production, coming in this quarter at down 9% vs. last year and down 3.8% sequentially." Although the majors and gas utilities represent a large proportion of US gas supply, the group's drilling activity has been "essentially flat since the start of 2003," analysts said. "This indicates that further production declines lie ahead for this group."

It also illustrates "an even more astonishing reality: the independents are driving nearly all of the drilling activity increases, with little production response to show for it," said analysts. "Specifically, the independents have been responsible for putting an additional 45 gas rigs to work (a 15% increase) since September 2003, and yet their corresponding production grew only 1.8% year-over-year and 0.5% on a sequential basis."

The analysts concluded, "Even though these results seem mediocre compared to the independents' massive level of investment, it is important to note that at current gas prices, these companies are making excellent returns on almost every prospect they drill. As a group, however, they have not been able to 'move the needle' on US gas supply."

Industry Scoreboard

null

2

null

GAS-TO-LIQUIDS technology provides "the ideal fuel to fill the widening wedge between rising world oil demand and falling legacy production," said Bernard J. Picchi, senior managing director of Foresight Research Solutions Inc., New York.

GTL unit capital costs have come down, while oil and gas prices have spiraled in the last 2 years, he noted.

Picchi called GTL "the most promising current alternative to conventional oil production and refining. We liken GTL's current situation to that of LNG in the early 1970s: an exotic hydrocarbon processing technology not taken too seriously then. It won't take 30 years for GTL to achieve the prominence that LNG enjoys today."

Many new fuels and energy technologies, including GTL, will be required to fill a growing gap between escalating world oil demand and falling oil production, he said.

"GTL project economics are healthy even if GTL products—mostly distillates like zero-sulfur diesel fuel—were priced off $25/bbl crude oil," on the New York Mercantile Exchange, Picchi said.

Within 18 months, GTL projects with output capacities totaling about 800,000 b/d have been announced. In July, ExxonMobil Corp. announced plans to spend $7 billion on a 166,000 b/d integrated GTL facility in Qatar (OGJ Online, July 14, 2004). Other GTL players include Sasol Ltd., Shell International Gas Ltd., and ChevronTexaco Corp.

"It is the first inning of GTL's commercial life," Picchi said. "Many more facilities are likely to be built. GTL, now a distant cloud on the horizon, is likely to come into sharp focus quickly. This may not be a welcome sight for oil refiners."

GTL plants, which convert natural gas to finished oil products including diesel and naphtha, are poised to produce an abundant supply of fuel products in the next decade, he said.

"Unlike traditional refineries, GTL plants lock in their raw material costs—natural gas—for decades at prices 90-95% below the current market value of crude oil," Picchi said. "No oil refinery could compete against such a cost advantage. Further, once the high capital cost of building a GTL unit has been sunk, the facility will operate at the highest possible utilization rate under almost all oil price scenarios because GTL cash operating costs are expected to be low—about $10/bbl, we estimate."

FRANCE is making satisfactory progress in opening its gas market, French Energy Regulatory Commission Pres. Jean Syrota said.

"The criteria was to check that competition was working smoothly. Indeed, no incident was brought to our attention," Syrota said.

Since July 1, about 70% of the market, based on volume, has opened to competition, including industrial and professional clients. In 2007, all of the market is to be open.

The next stages in the liberalization process, Syrota said, will be the unbundling of transportation and distribution networks as well as the establishment of independent managers for each sector.

Government Developments

RUSSIA has ratified the Kyoto Protocol on climate change. Russian President Vladimir Putin's signature clears the path for the United Nations environmental pact to be implemented next year.

"We do not expect Kyoto to have any material effect on oil and gas companies, regardless of where they are based or where they operate," said John Tysseland, Houston analyst with Raymond James & Associates Inc., St. Petersburg, Fla.

The US and Australia have rejected the protocol, which is intended to reduce greenhouse gas emissions. Countries covered by the treaty's provisions include Canada, Japan, Russia, and those of the European Union.

The 1997 pact is to take effect 90 days after Russian notifies the UN of its ratification. The next round of global climate talks is slated for December in Buenos Aires.

ARGENTINA is creating an energy company. President Nestor Kirchner on Nov. 2 signed a law authorizing Energia Argentina SA (Enarsa). The Argentine government will own 53%, and the provinces will own 12%.The remaining shares will be traded on the Buenos Aires Stock Exchange.

Enarsa was formed in part to help increase Argentina's electricity-generating capacity. In April, the government acknowledged a natural gas shortage and problems generating enough electricity to meet forecast demand.

The company will be involved with exploration and production, transportation, and marketing of oil, gas, and electricity. It will seek alliances with Latin American oil companies to explore and develop concessions off Argentina.

Meanwhile, Chinese President Hu Jintao is to visit Buenos Aires Nov. 15-16 to discuss trade relations between the two nations, including possible oil exploration and transportation partnerships. Hu's Argentine visit is part of a Latin America tour.

Representatives from China Petrochemical Corp., China National Petroleum Corp., and China National Offshore Oil Co. have expressed interest in meeting with Argentine energy representatives.

Also in Argentina, the provinces of Tierra Del Fuego and La Pampa are working with lawmakers to create their own oil companies. A national decree enables each province to award exploration permits and production concessions and to oversee other oil and gas operations in its jurisdiction.

ALGERIA says state oil and gas company Sonatrach and state electricity and gas company Sonelgaz are not included in the planned privatization of Algerian corporations.

Earlier this month, Algerian Prime Minister Ahmed Ouyahia announced in Algiers that 1,200 public companies would be proposed for privatization. The list excluded strategic enterprises, including Sonatrach and Sonelgaz, OPEC News Agency reported.

The privatization of Algeria's state-owned industries is moving ahead as the nation negotiates to join the World Trade Organization.

Algerian officials have said they are opening state-controlled industries to reduce the country's dependence on the oil sector and to help slash unemployment.

Quick Takes

TRINIDAD AND TOBAGO has reached an agreement to supply LNG to Jamaica under a special pricing arrangement, said Jamaica Prime Minister P.J. Patterson. The decision followed a year of negotiations between the two Caribbean nations over the price Jamaica would pay for the LNG (OGJ Online, Aug. 12, 2004). Jamaica can now establish a 1.1 million tonne LNG receiving terminal and convert major industries from oil to natural gas usage. These will include bauxite plants, the country's electric power company, the national bus service, and several large manufacturers. Trinidad and Tobago said plans were under way for a fifth LNG train, with a minimum capacity of 800 MMcfd, to enable the deliveries to Jamaica because LNG from the three existing LNG trains and from Train 4 is already committed to US and Spanish markets under long-term contracts. Government sources told OGJ the fifth train likely would include Venezuelan gas, with an interest for Petroleos de Venezuela SA. Patterson said Jamaica is optimistic that it also can find oil and natural gas off its own southern coast and in a few onshore areas. In January Jamaica will begin accepting bids for as many as 22 exploration blocks in the Walton basin, which consultants say could hold as much as 2.8 billion bbl of oil. BP Shipping has awarded a classification contract to Lloyd's Register Group, London, for four 155,000 cu m Technigaz Mk III membrane-type LNG carriers at the Hyundai Heavy Industries shipyard in South Korea. The fourth ship, Lloyds said, will be built at Hyundai's Samho yard. The contract also includes options for four additional ships. The vessels will have dual fuel, diesel-electric propulsion—the first LNG ships with this type of propulsion to be built in South Korea. Most LNG carriers worldwide use steam turbines. The ships will trade in the Atlantic Basin, primarily serving Trinidad and Tobago's Atlantic LNG project, the UK, the US, and Spain.

KINDER MORGAN ENERGY PARTNERS LP (KMP), Houston, reported that a third-party contractor struck its San Jose 10-in. products pipeline Nov. 9 in Walnut Creek, Calif., causing a gasoline release and fire. The accident caused unspecified injuries. KMP evacuated the area, shut down the pipeline, and notified regulatory agencies. The San Jose line is part of KMP's 3,850-mile Pacific products system in California and neighboring states.

SHELL HYDROGEN US has opened a combined hydrogen and gasoline station in Washington, DC— the first such station in North America. The station offers both compressed and liquid hydrogen. It's part of a Shell-General Motors Corp. partnership to develop hydrogen vehicles on a commercial scale. The station will serve as the fueling station for six GM fuel cell minivans being driven around Washington. Shell Hydrogen, established in 1999 as a global business of the Royal Dutch/Shell Group, has fuel cell demonstration projects in Japan, the US, and Europe. Cathay Merchant Group Inc., an affiliate of MFC Bancorp Ltd., Hong Kong is developing its first wind energy project in China. The Twin Dragon Wind Farm is planned as a 160 Mw project in Hebei Province, a site chosen by Cathay for its "world-class wind resources" in a large gap facing the Inner Mongolia Autonomous Region. The first phase of development will have capacity of 100 Mw (50-70 wind turbines) at an expected cost of $125 million. The projected annual output from this phase is 400,000 Mw-hr, and Cathay expects the project also will be eligible to sell emission credits for the reduction of 300,000 tons/year of carbon dioxide. PPM Energy, the Portland, Ore.-based subsidiary of Scottish Power, is investing $200 million in the construction of two wind farms in the northwestern and north-central US. The fully permitted 75 Mw Klondike II wind project in Sherman County, Ore., and 100 Mw Trimont wind project in southwestern Minnesota are expected to be operational in 2005. PPM also has a 200 Mw wind development in late-stage development. PPM signed a 15-year power supply agreement with the Great River Energy cooperative for all output from Trimont. Negotiations are also under way for a long-term sales agreement for Klondike II's electricity.

REPSOL YPF sa has selected a partnership of KBR and ExxonMobil Corp.'s research and engineering arm, EMRE, to perform basic engineering design for upgrading FCC units at its La Plata, Argentina, refinery and its Lujan de Cuyo refinery in Mendoza, Argentina. The alliance also will apply licensed, advanced reaction system technology for Repsol YPF's FCC units at the two refineries. KBR, Houston, is the engineering and construction arm of Halliburton Co. The revamping of both refineries will include "Automax-2" feed nozzles and short contact time riser termination. In addition, Repsol YPF will add a catalyst cooler, new regenerator cyclones, and regenerator debottlenecking at the La Plata refinery.

ENI SPA UNIT Agip Tunisia BV, operator of the Adam production concession in southern Tunisia, has drilled a successful appraisal well in the Hawa producing area, reported partner Pioneer Natural Resources Co., Dallas. The Hawa-2 well is producing more than 3,000 gross b/d of oil. The Adam, Dalia, and Hawa areas of the onshore Ghadames basin concession are producing more than 13,000 b/d of oil from five wells, Pioneer said (OGJ Online, July 28, 2004). The group expects to drill and complete a third well in the Adam area within 90 days. Adam concession participants are ENI units 35%, Tunisa state oil company L'Enterprise Tunisienne d'Activites Petrolieres 30%, Pioneer 28%, and Paladin Resources PLC 7%. Angola's national oil company Sonangol EP has notified Total SA that the company's offshore development license for Block 3/80, northeast of Total's deepwater Block 17, will not be renewed when it expires at yearend. There might be political undertones to Sonangol's decision because of a dispute between France and Angola over alleged arms trafficking during Angola's civil war by a French national whom Angola is protecting from French courts. Total played down the political aspect, saying the license was "depleting," and it is "not a major exploitation." The company, however, said it wants to discuss the matter with Angolan authorities. Block 3/80 currently produces 10,000 b/d of oil. Total, with 50% interest, is operator in a joint venture with Agip SPA, Sonangol, and two Serbian and Croatian companies.

THE US MINERALS MANAGEMENT SERVICE has scheduled two sales of Outer Continental Shelf leases in the Gulf of Mexico for Mar. 16, 2005, in New Orleans. The sales cover both deep shelf and deepwater areas. Sale 194 in the central gulf encompasses 4,043 blocks covering 21.3 million acres 3-210 miles off Louisiana, Mississippi, and Alabama in 4-3,400 m of water. MMS estimated the sale could result in production of as much as 654 million bbl of oil and 3.3 tcf of natural gas. Sale 197 in the eastern gulf will offer 124 blocks not leased in Sales 181 and 189 (OGJ Online, July 12, 2001 and Dec. 10, 2003). The blocks cover 714,240 acres in areas 100-196 miles offshore in 1,600-3,425 m of water. MMS estimates that 65-85 million bbl of oil and as much as 340 bcf of natural gas are recoverable in this lease area. MMS said it will lease Vermilion Blocks 139 and 140 but set limits on their use because of the approved deepwater LNG port to be built there. Governmental agencies have received six license applications for deepwater LNG ports that could affect future lease sales. MMS revised the price threshold for suspending deepwater royalties to $39/bbl for oil and $6.50/MMbtu for gas and also raised shallow-water, deep-gas royalty suspension provisions. MMS said it will announce in February its decision on whether to change deepwater royalty suspension thresholds to a monthly basis from the current annual basis. Minimum bids for tracts in 400-800 m of water have been raised to $37.50/acre. These and other bidding specifications and requirements may be obtained at http://www.gomr.mms.gov.

The Nigeria-Sao Tome Joint Development Authority (JDA) will offer for bids in December Blocks 2, 3, 4, and 6 in the Gulf of Guinea, OPEC News Agency reported. Alhaji Abubakar Tanko, chairman of JDA's Joint Ministerial Council, said the tender invitation marks the opening of second round licensing and the end of the first round in which JDA offered eight blocks and awarded only one. Rights to Block 1 went to ChevronTexaco 50%, Exxon Mobil 41%, and Dangote Energy Equity Resources of Norway 9%. Deepwater Blocks 5, 8, and 9 will be withheld for technical reasons, Tanko said (see map, OGJ, Sept. 8, 2003, p. 38). Tanko called for JDA to conclude production-sharing contract negotiations regarding Block 1 by yearend.

Luksar Energy, a joint venture of OAO Lukoil Overseas Holding Ltd. and Saudi Aramco, contracted WesternGeco, Houston, to conduct 2D and 3D seismic surveys on Contract Area A in the northern Rub al-Khali desert in Saudi Arabia. WesternGeco will start work Nov. 25 on seismic surveys expected to continue through 2005. Exploration drilling is anticipated for early 2006. The exploration period covers 5 years, during which time Luksar will conduct seismic surveys and drill at least nine exploration wells. Lukoil Overseas obtained a 40-year contract early this year to explore for and produce nonassociated natural gas in Contract Area A. F Lukoil has begun a $6 million drilling program on the North-East Geisum Block in the Gulf of Suez off Egypt. Egyptian Drilling Co. will use its Senusret jack up for the 2-month project. The well will be drilled in 35 m of water to a target depth of 1,820 m. The project is part of a $27.8 million, 4-year exploration program in which Lukoil will drill four wells on the block and adjacent West Geisum Block. The first well on the West Geisum Block will be spudded in February 2005. Lukoil said five oil and gas prospects have been identified on the blocks, which have a combined area of 175 sq km.

Newfield Exploration Co., Houston, announced that its wildcat well on the Cumbria Prospect in the UK North Sea was a dry hole. The well was drilled on License Area 49/4b in the Southern Gas basin. Newfield was awarded the license in the 21st licensing round and drilled the Cumbria wildcat in August. The company is taking a write-down of $6.7 million ($5 million after tax) in the third quarter. The Cumbria well was drilled for $13.2 million. The joint venture of McMoRan Exploration Co., New Orleans, and Palace Exploration o., New York, reported a discovery with its Deep Tern well on Eugene Island Block 193 in the Gulf of Mexico (OGJ Online, Oct. 19, 2004). Wireline logs confirmed that Deep Tern, drilled to 20,731 TMD, encountered five sands with a total gross interval of 340 ft, including 17 t of new pay below 19,165 ft not previously announced. The well is being prepared for completion in Miocene sands and is expected to be producing by yearend from McMoRan's existing Block 193 facilities, McMoRan said.

Spinnaker Exploration Co., Houston, operator of Eugene Island Block 213, drilled the Minuteman well to 20,432 ft TMD and encountered a laminated sand section at 19,780-20,230 ft, reported partner McMoRan. The well was sidetracked, and wireline logs indicated a gross interval of 60 ft of hydrocarbons "with excellent porosity and permeability" in the upper portion of the sand. The well is being prepared for completion and production by yearend from facilities 7 miles away on Eugene Island Block 215, McMoRan said. The Minuteman well is about 40 miles off Louisiana.

Kerr-McGee Oil & Gas Corp. plans to set casing in and temporarily abandon an apparent discovery well on its Dawson Deep prospect, on Garden Banks Block 625 in the Gulf of Mexico, while it studies development. The Dawson Deep well, which earlier had found more than 100 ft of total vertical thickness of resistivity in a shallow zone, was sidetracked and drilled to 22,790 ft TD. A log-while-drilling tool indicated more than 100 ft of hydrocarbon-bearing sands in the deeper zone—the original objective. Project sanctioning is possible in first quarter 2005, said partner McMoRan. The well is 150 miles off Texas adjacent to the Gunnison spar.

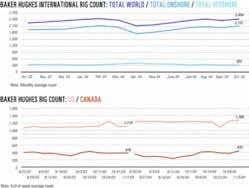

US DRILLING ACTIVITY the week ended Nov. 5 increased by 17 rotary rigs to 1,268 working—the highest level since July 27, 2001, when there were 1,275 rigs drilling, Baker Hughes Inc. reported. That's up from 1,114 active rigs a year ago. Land operations accounted for the bulk of the increase, up by 13 rigs to 1,149 making hole. Offshore drilling increased by 3 units to 91 in the Gulf of Mexico and 96 for the US as a whole. Inland waters added 1 rig for a total of 23. Canada's weekly rig count shot up by 60, to 432 working that week—up from 378 the same time last year.

PRODUCTION FROM DEVILS TOWER oil and gas field on Mississippi Canyon Block 773 in the deepwater Gulf of Mexico has returned to pre-Hurricane Ivan levels, Pioneer Natural Resources Ltd. reported. Dominion Exploration & Production Inc. is operator, with 75% working interest, and Pioneer holds 25%. Three wells on production before the storm hit are again producing 28,000 gross boe/d. A fourth well, near start-up at the time of the storm, is expected to be producing by Nov. 30, Pioneer said. Of the eight development wells drilled, completions of four were delayed when the spar's topsides sustained hurricane damage. Field development could resume by yearend. Pioneer said it also expects production from deepwater Harrier field in the Falcon corridor to resume by yearend.