Market Movement

Energy prices register sharp rise and fall

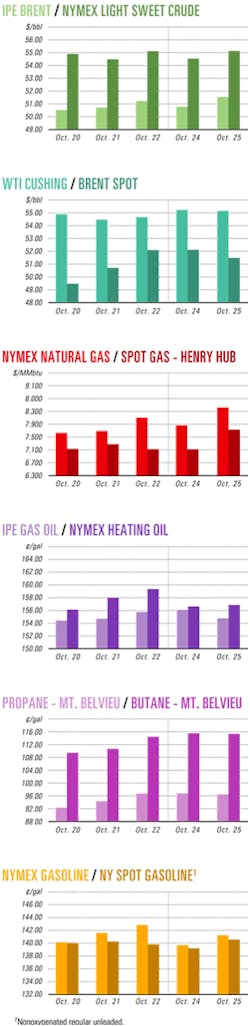

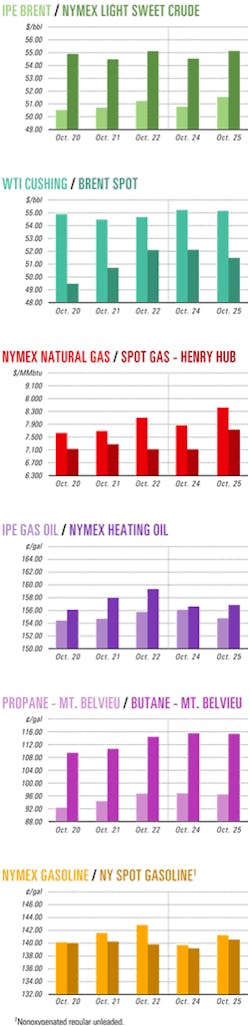

After a surprise jump in energy prices, with natural gas soaring to a 20-month high Oct. 26 on the New York Mercantile Exchange, the market plummeted the following day as the US Energy Information Administration reported a larger-than-expected 4 million bbl increase in US commercial inventories of crude to 283.4 million bbl in the week ended Oct. 22.

Traders shrugged off a sharp drop in US distillate inventories in the same period, down by 2.4 million bbl to 116.6 million bbl. It was the sixth consecutive week that stocks of distillates, including heating oil, had fallen. Just days before the Nov. 1 start of the winter heating season, EIA reported US distillates were "below the lower end of the average range for this time of year." US gasoline stocks rose 1.3 million bbl to 201.2 million bbl.

The December contract for benchmark US sweet, light crudes jumped by 63¢ to $55.17/bbl Oct. 26 on NYMEX, then fell to $52.46/bbl in the following session. The November natural gas contract expired at $7.63/Mcf on Oct. 27 after having climbed by 51.2¢ to $8.40/Mcf in the previous session.

The back-to-back sharp swings in energy prices prompted some analysts to conclude that currently high prices are unsustainable and subject to wide fluctuations without a firm backing of market fundamentals.

Heating oil 'friction'

However, Paul Horsnell, Barclays Capital Inc., London, said, "The US heating oil market has become the point of greatest friction among the profusion of constraints, shortages, and choke points that now characterize the global oil market. The latest [EIA] data show no letting up in the constriction of the US distillate market, with inventories continuing to plunge far earlier than they should under the normal season pattern. The remarkable feature of the data is that it shows absolutely no progress at all in terms of the system moving towards any equilibrium."

Horsnell noted, "The relative price movement between gasoline and heating oil over the last 3 weeks has been more than $5/bbl in favor of heating oil. In all, the market has provided a massive incentive for refineries to maximize distillate yields and minimize gasoline yields. However, that has not been the result. Gasoline production has climbed back towards its level prior to Hurricane Ivan. Heating oil output, by contrast, is still languishing."

US refinery operations remained some 6% below prehurricane levels, he said. "While there are a few lags still to work through, the US refinery system does seem to be having difficulties in optimizing, given the general lack of flexibility accompanied by the shifts in the crude slate and in the availability of units," said Horsnell.

GOM disruptions continue

More than a month after Hurricane Ivan made landfall in Alabama on Sept. 16, there were 332,072 b/d of crude and 1.3 bcfd of natural gas production in the gulf still shut in as of Oct. 27 because of damage from that storm, said US Minerals Management Service officials in New Orleans. Lost offshore production during Sept. 11-Oct. 27 totaled 25.5 million bbl of oil and 104.5 bcf of natural gas, MMS said.

Underwater mudslides triggered by Ivan "created some major pipeline problems that we expect will persevere into next year," said Horsnell. "Within weeks, the continuing problems in the gulf are either going to reassert severe downward pressure on US crude oil inventories, or they will force the US to import crude at record levels." However, finding foreign light crudes to replace benchmark US light crudes will, he said, "prove impossible." US crude imports increased by 220,000 b/d to 10.3 million b/d in the week ended Oct. 22.

Meanwhile, Purnomo Yusgiantoro, the Organization of Petroleum Exporting Countries' conference president, said Oct. 27 that he asked US officials to release crude from the Strategic Petroleum Reserve "to help cool down [energy] prices." However, administration spokesman Trent Duffy said there were no discussions within the White House on whether or not to release SPR crude. Duffy reiterated that President George W. Bush previously said he would not use SPR to manipulate oil prices. Releasing crude from emergency storage just days before the presidential election, he said, could be viewed as playing politics with oil prices.

Pat Wood, chairman of the US Federal Energy Regulatory Commission, recently said the commission is keeping close tabs on natural gas prices as the winter heating season gets under way to determine whether any manipulation is involved in the current price spikes.

"You better believe we're looking at it. But if it's a legitimate supply and demand response, then that's the way it works," he told reporters.

Industry Scoreboard

null

null

Industry Trends

GAS-TO-LIQUIDS (GTL) fuel has a role to play in the long-term transition to renewable fuels, a Shell International Gas Ltd. executive said in comments about results of a GTL fuel trial in California.

"This fuel is increasingly seen as the most cost-effective alternative fuel for reducing emissions in transport," Jack Jacometti, Shell International Gas vice-president of GTL global development, told OGJ in a telephone interview from his London office.

The trial involved six trucks with conventional diesel engines that deliver bottled water in Los Angeles. The results show that GTL fuel reduced all regulated emissions, with nitrogen oxide (NOx) emissions down by 16% and particulate emissions (PM) down by 23%.

The trial involved a standard set of simulated driving conditions that emissions-testing researchers call a New York City Bus drive cycle. It achieved the basic emissions reductions without a particulate filter. Use of a catalyzed diesel particulate filter reduced NOx emissions by 20% and PM by 97%.

Jacometti said that GTL fuel can help prompt the development of advanced engines. He believes the oil industry, vehicle manufacturing industry, and governments need to cooperate in this development.

GTL fuel for the California trial came from Shell's 14,500 b/d plant at Bintulu, Malaysia, which uses the Shell Middle Distillate Synthesis process.

Shell GTL fuel has cut emissions and improved performance of passenger cars in trials in Germany and of heavy-duty trucks tested in Japan and California.

Recently, a Shell GTL fuel blend was launched in a bus trial in Shanghai, China, with the Shanghai Pudong Bus Transportation Co. Ltd. Blends of GTL fuel currently are being sold at Shell retail stations in Germany, the Netherlands, Thailand, and Greece.

TANKER CHARTER RATES have soared, some to their highest levels for a continual 6-month period in more than 30 years, because of strong oil consumption, said SSY Consultancy & Research Ltd., London.

During the first half of 2004, the very large crude carrier spot rate for Persian Gulf-Japan trades averaged $69,700/day in time-charter equivalent terms, compared with $52,750/day for the same period a year ago.

Chinese oil imports are a major influence, SSY said. "With most of that country's crude imports being sourced from the Middle East and West Africa, this added to long-haul tanker employment, to the particular benefit of larger vessel sizes," SSY said.

Tanker demand also was higher in Atlantic markets this year than last year because of booming exports from the former Soviet Union and greater cargo supplies coming from North Africa, SSY said.

Freight market strength has continued in the third quarter. Charter rates remain high despite increased newbuild tanker deliveries and a marked slowing in tanker scrapping activity, SSY said.

This has meant faster net world oil tanker fleet growth during the first half of 2004, compared with the first half of 2003, SSY said.

Government Developments

THE US SUPREME COURT agreed to hear part of ExxonMobil Corp.'s appeal of a verdict against the major concerning a class-action lawsuit that involves as many as 10,000 current and former service station dealers.

If all the dealers were to recover damages via a 2001 verdict from a US District Court in Miami, the total could exceed $1.3 billion. The case involves service stations in 34 states and the District of Columbia during 1983-1994.

On Oct. 12, the Supreme Court agreed to review the question of whether the trial court had jurisdiction over individual class member claims of less than $50,000 when the case was filed in 1991, said Eugene Stearns, an attorney for the dealers.

No immediate comment was available from ExxonMobil.

The Supreme Court will analyze whether the 11th Circuit Court of Appeals correctly sided with the majority of circuits in finding that the smaller claims could be brought in federal court, Stearns said. The high court is expected to hear arguments early next year.

Stearns said the Supreme Court's decision to limit review to the question of jurisdiction means that most of the class members' claims can be processed and paid.

Dealers claim that the major—then Exxon Corp.—overcharged station owners for the wholesale price of motor fuel for 11 years and fraudulently concealed the overcharges.

The claims deadline is Dec. 1, Stearns said, adding that attorneys for the service station dealers expect claims payments in spring 2005.

US PRESIDENT GEORGE W. BUSH signed a bill that extends the fuel-ethanol tax credit and creates a tax credit for biodiesel fuel.

The incentives, which will take effect Jan. 1, 2005, and remain in effect for 2 years, are part of the American Jobs Creation Act of 2004.

Sens. Chuck Grassley (R-Iowa) and Blanche Lincoln (D-Ark.), Rep. Kenny Hulshof (R-Mo.), and others supported the tax incentives, which received backing from the National Biodiesel Board, American Soybean Association, and US Department of Agriculture.

The incentives, they claim, are expected to increase biodiesel demand to at least 124 million gal/year from 30 million gal in fiscal year 2004, based on a DOA study.

NORWAY'S ENERGY OFFICIALS recommend that the government's 2005 budget include an allocation of 222.3 million kroner for petroleum research and development, compared with the 2004 allocation of 137.5 million kroner.

Minister of Petroleum and Energy Thorhild Widvey said, "We work actively to contribute to increase the petroleum production on the Norwegian Continental Shelf, through stimulating higher exploration activity and increased oil recovery. A commitment to research and development within the petroleum sector is a vital element."

Statoil ASA applauded the proposed funding increase, calling it a step in the right direction.

Ingve Theodorsen, Statoil vice-president for research and technology, said that Statoil commits about 1 billion kroner/year to research and development.

Quick Takes

ITALY'S ENI SPA and Libya's National Oil Co. have inaugurated a trans-Mediterranean pipeline central to the Western Libya Gas Project (WLGP) (OGJ, Dec. 20, 1999, p. 39). The 520-km, 32-in. pipeline, called Greenstream, connects Mellitah, Libya, with Gala, Sicily, extending under water as deep as 1,127 m. The 7 billion euro WLGP will move gas and condensate from Wafa field in the desert near the Algerian border and Bahr Essalam field 110 km offshore to a new processing plant at Mellitah. The Bahr Essalam platform is called Sabratha. At full capacity, Wafa will be able to produce 4 billion cu m/year of gas. Two 530-km pipelines, with diameters of 16 in. and 32 in., extend from the field to Mellitah. Bahr Essalam will be able to produce as much as 6 billion cu m/year. The subsea pipelines serving it have diameters of 10 in. and 36 in. Libya will use 2 billion cu m/year of WLGP gas, and the balance will move to Italy. • Indonesia's state-owned gas company Perusahaan Gas Negara plans to build a 493-km natural gas pipeline from Duri field in Riau Province to cities in North Sumatra by July 2007, some 5 months ahead of schedule, reported OPEC News Agency. PGN will buy 120 MMcfd of gas from Kondur Petroleum SA and transport 100 MMcfd to Asahan Power Corp.'s 600-Mw power plant in North Sumatra. The pipeline initially will transport 80 MMcfd, increasing to 120 MMcfd over 20 years. The $300 million Duri-Dumai-Medan transmission line also will transport gas from other fields along its route through South Sumatra, Riau, Jambi, and North Sumatra provinces. • Pemex Exploration & Production has awarded a $77 million contract to Global Offshore Mexico S de RL de CV, Carlyss, La., to install four 50-km pipelines as part of the Lobina project in Mexico's Bay of Campeche. The contractor will install the pipelines—two 16-in., a 12-in., and a 6-in.—in 2005. Global Offshore Chairman and CEO William J. Doré said the Sea Constructor pipelay-bury barge, based in Carlyss and working in the Gulf of Mexico, will join the Ciudad del Carmen-based Shawnee pipelay-derrick barge for this project.

KERR-MCGEE CORP. has reported its eighth Bohai Bay oil discovery off China—the CFD 14-5-1 well on Block 09/18. The well, in 75 ft of water, was drilled to 13,970 ft TD and encountered 85 ft of net oil pay. It flowed 26° gravity crude from the Eocene Shahejie sand. Kerr-McGee, which expects to spud the first appraisal well before yearend, holds 100% foreign interest in Block 09/18. Upon governmental approval of development plans, China National Offshore Oil Corp. will have the right to back in for a 51% interest. Kerr-McGee operates four exploration licenses in western Bohai Bay, with two fields producing 30,000 b/d of oil from 15 wells. • Stone Energy Corp., Lafayette, La., has entered into a series of exploration agreements with Kerr-McGee Oil & Gas Corp. covering interests in 30 Kerr-McGee leases in the Gulf of Mexico. Stone will commit $50 million to acquire 16.67-50% working interests, while Kerr-McGee will remain operator, retaining 50-75% working interests. The agreements cover deepwater and deep shelf prospects, including the Essex prospect on Mississippi Canyon Blocks 23, 24, and 25, the Kung Pao prospect on Garden Banks Block 171, and the Fawkes prospect on Garden Banks Block 303. The Kung Pao and Fawkes prospects, to be spudded in the fourth quarter, are potential satellite tiebacks to the Baldpate facility on Garden Banks Block 260. The companies will share interests in six exploratory wells through 2005 and within the next 2 years will work together in deepwater prospects on Garden Banks and Green Canyon and in deep shelf leases on Grand Isle, Ship Shoal, South Timbalier, Vermilion, and South Marsh Island. • Vintage Petroleum Inc., Tulsa, reported that its An Nagyah 11 well in An Nagyah field on Block S-1 in central Yemen has produced oil from the subsalt Upper Lam formation. The field's first horizontal well was drilled to 4,574 ft TMD, equivalent to 3,452 ft of TVD. Electric log analysis indicated a gross oil-bearing interval of 587 ft in the well. An Nagyah 11 was completed over a 538 ft interval at 3,816-4,354 ft MD. The interval flowed on test at a stable 3,100 b/d of 43° gravity oil and 1.7 MMcfd of natural gas through a 56/64-in. choke with 365 psi tubing pressure. Operator Vintage holds a 75% interest in the field, and TransGlobe Energy, Calgary, 25%.

KAZAKHSTAN plans to invest $3.88 billion in its oil refining, gas processing, and petrochemical businesses during 2004-07 as part of an accelerated development program to bring processing capacity in line with oil and gas production by 2010. Existing refineries and gas processing plants will be modernized, and a gas processing plant will be built at Aksai by 2007. Other work will include a new petrochemical complex near Kashagan oil field, plastics manufacturing plants in Aktau and Atyrau, and a plant at Jem to process gas from Zhanajol and Kenkyak oil and gas fields.

PEMEX PETROQUIMICA has proposed the construction of a world-scale chemicals and plastics complex on Mexico's Gulf Coast and has named three companies to conduct a feasibility study of the venture, known as Project Phoenix. The partners—Mexican companies Grupo Idesa Petroquimica and Indelpro SA de CV (a joint venture of Grupo Industrial Alfa 51% and Himont 49%), along with Nova Chemicals Corp., Pittsburgh—will ascertain whether the project can produce a globally competitive complex, initially comprising two world-class ethylene and polyethylene plants. Two locations are being considered: Altamira in Tamaulipas state and Coatzacoalcos in Veracruz state. The partners will target start-up in 2009 or 2010 if the project proves feasible.

RELIANCE INDUSTRIES LTD. E&P (PETROLEUM), Mumbai, and joint venture partner Niko Resources Ltd., Calgary, plan to invest $3.26 billion for the development, production, and transportation of natural gas from fields on deepwater Block KG-D6 in the Krishna Godavari basin off eastern India. The block, 40-60 km southeast of Kakinada, covers 7,600 sq km in 400-2,700 m of water. Operator Reliance said it likely would develop the field with a semisubmersible platform with batch wells, to be reentered later, and subsea trees connected to several subsea manifolds tied back to an onshore terminal. About one third of the cost will be for infrastructure such as gas pipelines, Reliance said. The first well completions are slated for first half 2006. • Cairn Energy PLC, Edinburgh, received government approval to explore, appraise, and develop several discoveries on 5,000-acre Block RJ-ON-90/1 in Rajasthan, India, near the Pakistan border. The approval secures Cairn a 1,858 sq km development area in the Thar desert that includes the Mangala, N-A, Saraswati, and Raageshwari discoveries and the unappraised GR-F, Kameshwari, and N-R discoveries (see map, OGJ, Feb. 2, 2004, p. 44). Production from Mangala and N-A fields, to begin in fourth quarter 2007, eventually will reach 100,000 b/d. Mangala has an estimated 1 billion bbl OOIP. Cairn expects to submit a Mangala development plan to the government in first half 2005. Cairn is acquiring seismic surveys, and front-end engineering design is under way to determine how best to develop the fields and deliver the crude to buyers, with decisions likely in early 2005. India's state Oil & Natural Gas Corp. has 90 days in which to acquire a 30% interest in the overall development. Ras Laffan LNG Co. Ltd. (II) has awarded J. Ray McDermott Eastern Hemisphere Ltd. a contract to install an additional wellhead platform jacket, WH8, off Qatar for the RasGas Expansion field development. McDermott will provide full engineering, procurement, fabrication, and installation of the 12-slot jacket and associated facilities. Engineering and procurement have begun. The company's Jebel Ali yard in Dubai will fabricate the jacket, which a McDermott installation vessel will install in third quarter 2005. • McDermott Caspian Contractors Inc. (MCCI), a subsidiary of J. Ray McDermott SA, has completed the fabrication, load-out, and sail-away of an integrated deck for the Azerbaijan International Operating Co. Central Azeri platform in the Caspian Sea. The 15,500-tonne deck was fabricated primarily in Azerbaijan as part of the Phase I development of Azeri, Chirag, and deepwater Gunashli fields. MCCI performed onshore fabrication, assembly, hook-up, commissioning, and load-out of the deck as well as offshore hook-up, commissioning, and start-up assistance for the integrated deck. MCCI is fabricating integrated decks and installing subsea pipelines for Phases 1-3. The contractor transported and installed more than 375 km of pipelines in Phase 1 using the Israfil Huseynov pipelay barge. Under a separate contract to BP Shah Deniz Exploration Ltd., MCCI will install subsea pipelines for development of Shah Deniz gas and condensate field off Azerbaijan (OGJ Online, Mar. 10, 2003).

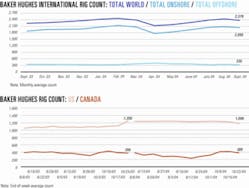

US DRILLING ACTIVITY was up by 25 units to 1,250 rotary rigs working the week ended Oct. 22, the largest count since the week ended Sept. 3, 2001, when 1,252 rigs were making hole, said officials at Baker Hughes Inc. That compares with a count of 1,090 active rigs at this time last year. Land drilling accounted for most of the gain, up by 20 rigs to 1,135 working. Offshore drilling increased by 3 rigs to 90 in the Gulf of Mexico and 95 total in US waters. Inland water activity gained 2 rigs for a total of 20. However, Canada's weekly rig count plunged by 54 units to 356 working rigs, down from 389 a year ago.

SHELL CANADA LTD., Calgary, reported that an October reduction of bitumen output from the Athabasca Oil Sands Project (AOSP) in Alberta will extend into November. The October cutback resulted from scheduled maintenance at the Scotford upgrader in Fort Saskatchewan and planned repairs to settler units at the Muskeg River mine, 75 km north of Fort McMurray. After the upgrader resumed operation, a catalyst pump inside one of two resid hydrocrackers failed. Shell Canada shut down the affected unit and said it expects the associated train to be out of service "for an extended period of time." The other train remains in service. AOSP is a joint venture of Shell 60%, Chevron Canada Ltd. 20%, and Western Oil Sands LP 20%. The project has design capacity of 155,000 b/d of bitumen, although monthly average production has been as high as 182,000 b/d, achieved last August. Shell Canada proposes a series of debottlenecking projects that would raise design capacity to 180,000-200,000 b/d and has further plans to expand capacity to 270,000-290,000 by 2010. • Statoil ASA said repairs to the MSV Regalia multipurpose service vessel will slightly delay its project to increase compressor capacity on the Troll A natural gas platform and will add 10-15 million kroner to the project's cost. Prosafe, Stavanger, owns the vessel, which was found to have leaked 1,000 l. of hydraulic oil. About 120 project personnel were demobilized Oct. 25. Regalia, serving as a floating hotel during the compressor work, was towed to land for repairs, which should take a week. The compressor capacity is being increased to enable more partially processed well-stream gas to be piped from Troll A to the Kollsnes processing plant near Bergen for final processing and transportation to continental Europe through four pipeline systems.

IRVING OIL LTD., St. John, NB, reported that it will apply for a permit to build a 500-700-Mw natural-gas fired electric power plant near its Canaport LNG terminal at the entrance to St. John Harbor. Canaport, in 128 ft of water 4,100 ft offshore, was the first deepwater terminal in the western hemisphere when it started up in 1970. The first LNG shipment is still 3 years away. The plant will provide power to the New Brunswick grid. Privately held Irving said that the LNG project is fueling the prospect of further investment in the energy sector in New Brunswick.