Differing market quality specs challenge LNG producers

Differing market quality specs challenge LNG producersThe emergence of a more fluid LNG market and growing demand for lean LNG (low calorific value), especially in the US and UK, are forcing LNG producers to address new gas quality issues.

This article reviews the gas specification constraints in importing countries and compares them to countries that produce LNG. This highlights the discrepancy between gas quality in Asia, UK, and US, as well as the mismatch between currently produced LNG and new lean-gas markets.

This article also presents a case study that provides a basis for global economic optimization along the entire LNG chain, including shipping costs.

Background

In the past, most liquefaction plants were designed to serve clearly identified markets in long-term supply contracts. These contracts also specified the particular LNG quality parameters that the plant had to meet.

The emergence of a more fluid LNG market and more LNG projects, particularly in the Atlantic Basin, means that LNG producers now reroute more cargoes and envision multiple destinations for LNG from a single plant.

In addition, the reawakening of the North American LNG market, along with the emergence of new markets such as the UK, is imposing new constraints on the quality of gas for distribution in those regions.

Some large LNG producers are clearly targeting these markets, which means that they will soon start to unload significant quantities of LNG produced from rich gas into receiving terminals connected to low-calorific-value gas pipeline networks.

Producers now face the dilemma of whether to produce a new lean LNG in addition to rich LNG intended for Asian markets, which implies additional investment, or to produce LNG of only one quality.

The terminal operator must determine whether to invest in nitrogen injection or LPG extraction units to be able to receive LNG cargoes from many different suppliers. The solution depends on the particular situation of each company.

Gas specifications, importing countries

In general, quality specifications for LNG unloaded at import terminals reflect the constraints that the natural gas transport and distribution networks impose further downstream.

These specifications vary a great deal in different countries, and in different networks in countries where there are several different companies operating distribution networks. Official regulations or the distribution network operators set these specifications.

These regulations and the values they specify:

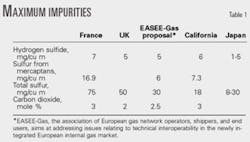

- Ensure that the distributed gas is noncorrosive and nontoxic. This sets the upper limits for H2S, total sulfur, CO2, and Hg.

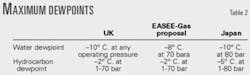

- Guard against formation of liquids or hydrates in the networks via maximum values for water and hydrocarbon dew points.

- Allow interchangeability of the distributed gases via limits on the range for parameters affecting combustion such as the content of inert gases, calorific value, Wobbe Index, soot index, incomplete combustion factor, yellow tip index, etc.

Tables 1 and 2 show the values usually encountered for the first two categories of specifications. All LNG cargoes easily comply with these specifications because the liquefaction process itself requires stringent purification of the feed gas.

This article focuses on the third group of parameters related to gas combustion and interchangeability. There are major discrepancies between the characteristics of some LNG currently produced and the specifications for certain natural gas networks, particularly in the US and UK.

The most common parameter is gross calorific value, also known as the high heating value. All networks specify a minimum and maximum for GCV.

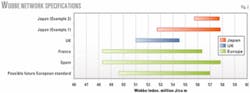

The Wobbe Index, which is the GCV divided by the square root of the relative density, is a more reliable indicator of the combustion properties of a given gas. This index is frequently used as a parameter, particularly in the UK, for which the upper limit constitutes a major constraint on the import of rich gases.

Other limits for main gas components are a minimum amount of methane, and maximum amounts of ethane, propane, butane, pentanes and heavier, and inert gases, particularly nitrogen, oxygen, and carbon dioxide.

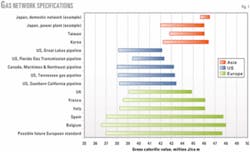

For GCV, existing natural gas networks consist of three major groups:

- Asia (Japan, Korea, Taiwan), where the distributed gas is rich, with a GCV greater than 43 million Joules/cu m (1,090 btu/scf).

- UK and US, where distributed gas is lean, with a GCV usually less than 42 million Joules/cu m (1,065 btu/scf).

- Continental Europe, where the acceptable GCV range is quite wide—about 39-46 million Joules/cu m (990-1,160 btu/scf).

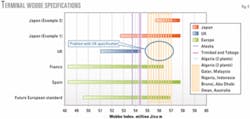

Figs. 1 and 2 show several examples of current GCV and Wobbe Index specifications for pipeline networks. There is a discrepancy between the acceptable GCV ranges for Asia and the US. This is also true for the Wobbe Index in Japan and the UK. This is the main challenge for LNG producers wishing to sell to the Asian, US, and UK markets at the same time.

Conversely, because continental European countries have a wide range of specifications, LNG quality is not an issue there.

Past trends, future developments

In general, countries that originally installed gas transport networks to distribute indigenous gas adopted specifications corresponding to the characteristics of that local gas. Only later did they have to handle imported gas via pipeline or as LNG.

Butane and propane are often extracted from produced gas and then marketed as LPG, for example, in the US, Mexico, and India. In some cases, ethane is also removed for use as petrochemical feedstock (especially the US Gulf Coast).

In other cases, the local gas is naturally lean, or high in nitrogen or CO2, and full removal of these impurities is too costly. Many countries with this situation have domestic appliances designed for lean gas.

Japan, Korea, and Taiwan based their natural gas infrastructure on imported LNG from the beginning. They set specifications at the top of the GCV range to match the gas characteristics from traditional suppliers in the Middle East and Southeast Asia. In this case, injecting LPG at the import terminal can adjust for any quality differences in the LNG.

In continental Europe, two distinct distribution networks were developed, one for lean gas from the large Groningen field in the Netherlands and the other for high-GCV gas produced locally or imported from Algeria, Russia, or Norway.

Because there was a wide range of gas quality from different sources, European countries quickly adopted broad specification ranges for GCV and Wobbe Index to allow the cross-border trade that was necessary for importing countries. This also meant that the standards applicable to domestic appliances had to be adapted.

Europe still has a lean-gas network, but its geographical coverage has been considerably reduced (Netherlands, Belgium, northern France). This network does not handle imported LNG.

In many countries, the specifications for GCV and Wobbe Index are therefore mainly for ensuring the safety of domestic gas appliances. Any significant change in gas quality would force domestic customers to install new burners or buy new appliances.

Environmental concerns can also lead to limits on the calorific value. In California, the California Air Resources Board for Compressed Natural Gas has set maximum levels for C2H6 (6%) and C3+ (3%), which limits the GCV to about 43 million Joules/cu m.

There will be no rapid changes in gas specifications, therefore, even though there are many regulatory moves occurring, in Europe and the US particularly, to harmonize and broaden the acceptable value ranges, especially the Wobbe Index.

For the gas networks that do not serve residential customers but only industrial users and power plants, therefore, there could be rapid changes in network specifications. A combined-cycle power plant, for example, can adjust to burn different quality gases if the Wobbe Index does not vary more than 5%.

The C3+ content specified for the Mexican network was until recently a low value; it was impossible to import any LNG from the Atlantic Basin. This specification is now complemented with a maximum value for the hydrocarbon dewpoint, set at –7° C. at network operating pressure, which effectively prevents the formation of liquids. This change, however, is not related to the safety of gas combustion in residential appliances.

Existing liquefaction plants

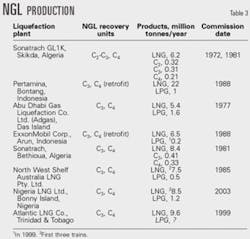

There are currently 17 liquefaction plants operating worldwide. Only two of them have light feed gas: Conoco- Phillips, Kenai, Ala., and Atlantic LNG Co., Trinidad and Tobago. The others feed gas with a fairly high ethane, butane, and propane content, but only eight of them are equipped with NGL stripping units.

Table 3 shows the production details from these plants.

The first plant to extract LPG and ethane to market them separately from LNG was Sonatrach's Skikda, Algeria, plant commissioned in 1972. The produced ethane feeds a neighboring petrochemicals plant. Since then, no other plant has been equipped with an ethane extraction unit.

Since it was commissioned in 1977, the Abu Dhabi Gas Liquefaction Co. Ltd. (Adgas) plant, Das Island, has removed and exported LPG in parallel with LNG. The richness of the plant's feed gas, which mainly consists of associated gas, made this absolutely necessary.

It was also the richness of the associated gas used as feed gas to Nigeria LNG Ltd.'s Bonny Island plant that led the operator to add LPG recovery and export facilities, starting with the third train.

The LPG extraction facilities at the North West Shelf Australia LNG Pty. Ltd. plant have operated since the gas production plant started up. ExxonMobil Corp.'s Arun and Pertamina's Bontang plants in Indonesia, which were not designed to export LPG, added extraction, storage, and export LPG facilities during a debottlenecking project. These modifications significantly increased gas throughput at both plants at constant LNG production.

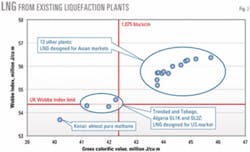

Fig. 3 shows that most plants that initially intended to supply Asian markets produce rich LNG with a GCV about 44-45 million Joules/cu m (1,110-1,140 btu/scf). Other than Kenai, which is a special case, only the Atlantic LNG plant and two of Algeria's plants produce lean LNG with a GCV less than 1,075 btu/scf, suitable for the US market. Some of these LNG cargoes also comply with the UK Wobbe Index limitation.

Quality adjustments

In many cases, quality specifications for LNG unloaded at import terminals are less stringent than the specifications for the distribution networks further downstream. This is because import terminal operators can adjust gas quality by:

- Injecting LPG if the gas is too lean.

- Injecting inert gases or removing NGL if the gas is too rich.

Streaming and blending, either in the terminal itself or further downstream in the transmission networks.

These different measures are complementary; the terminal operator should optimize them on a case-by-case basis. When the operator also controls the transmission network, other import terminals, and underground storage facilities, the opportunity for optimization is even broader.

This means that the LNG supplier must comply with the terminal operator's quality specifications, not those set by importing-country regulations or the company operating the distribution network. LPG injection is technically fairly simple and is widely used in Japan. The process is costly, but the energy content of the LPG injected is valorized at natural gas prices.

Nitrogen is usually the inert gas used in injection operations. If required occasionally, it is delivered in liquid form via tanker truck; if required continuously, it is produced in an air-separation unit attached to the terminal.

This technique is not often used currently due to the high costs involved, but one should still consider it when more economical blending solutions do not give the terminal operator required flexibility.

Air injection is also a technical, but seldom used, option. It is used for minor adjustments of GCV so that the gas also complies with minimum free-O2 content specifications, which are 0.01-0.2%.

NGL extraction generally treats a portion of the LNG; the resultant leaner gas is blended with the rest of the LNG as it leaves the terminal. Extraction units already exist, but the new rich LNG imports to the US have led engineering companies to develop and market many new processes that are either more efficient or more economical.

Economics determine if NGL extraction is preferable to nitrogen injection; the selling price of the NGL produced is a major factor. Valorization of butane and propane, for which there is a market in all countries, poses no problems.

Ethane is more difficult to valorize unless there is a local market and transport and storage facilities (US Gulf Coast). If there are no commercial outlets for ethane, it can be used as fuel gas, either in submerged combustion vaporizers or for cogeneration.

NGL extraction, like LPG injection, requires more safety precautions for the handling and storage of the NGL; this can lead to difficulties in siting the units in plants with limited space. It can also mean that the safety and environment permits are more difficult to obtain.

Streaming requires piping all or part of the gas directly to those industrial users that can use gas that does not meet the quality specifications for public consumption. Also, streaming requires that the remaining off-specification LNG can be blended, upstream from all other customers, with a reliable supply of gas from other sources that is within the limits of the grid specifications.

Blending can also occur in the terminal by mixing LNG from different sources with different characteristics. This requires close management of the different LNG import contracts and assumes that the terminal has significant storage capacity.

This low-cost solution is the first choice whenever it is feasible.

LNG quality, terminal specs

As mentioned, each LNG terminal has its own LNG-quality specifications. Matching them with current LNG characteristics (Figs. 4 and 5) allows operators to highlight the mismatch between most existing LNG cargoes and new "lean gas" markets, as well as the difficulty of producing a "go-anywhere" LNG.

Figs. 4 and 5 highlight two important issues: One terminaling agreement equals one LNG quality specification and the aging of LNG during shipment.

Terminaling agreements

The GCV and Wobbe Index values in Figs. 4 and 5 correspond to one of these cases:

- Specifications published in the terminal operators' tariffs.

- Network specifications in countries or regions where there is no LNG import terminal.

- Examples from existing contracts, particularly for Japan.

In reality, each LNG-terminaling agreement can involve negotiations that result in slightly different specifications. Terminal operators can use different methods to adjust gas quality and have more opportunities for blending to the network downstream.

These methods may evolve over time with the addition or extension of facilities for NGL extraction or inert gas injection, for example.

A terminal operator's ability to handle an LNG with a borderline quality may vary according to whether it is a spot cargo or a long-term contract involving regular cargo deliveries.

The GCV and the Wobbe Index are not the only important parameters. The gas composition affects other important parameters regarding gas interchangeability, such as the sooting index, incomplete combustion factor, yellow tip index, etc.

The operator's willingness to accept "off-spec" LNG may vary in different terminals due to various factors, including technical constraints, safety issues (risk of roll-over), and commercial issues.

Each contract is an individual case.

LNG aging

When LNG is shipped in tankers, its composition changes because some of it evaporates due to heat entering through the insulation.

More volatile components such as nitrogen and methane evaporate faster than the heavier components. Evaporation therefore increases the gas GCV. If an LNG is rich in heavy components with a low nitrogen content, the GCV will increase even more.

This aging process must be accounted for when determining whether the LNG is likely to meet terminal specifications, especially if a long journey is involved. During transport between the Middle East and US, for example, the GCV can increase about 0.2-0.3 million Joules/cu m.

NGL extraction

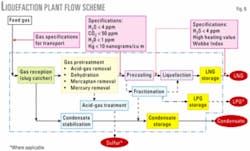

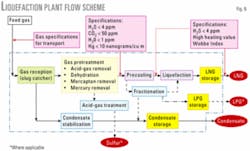

Fig. 6 shows the overall scheme and main functions of a liquefaction plant.

Operators achieve the GCV and Wobbe Index specifications by adjusting:

- The quantities of ethane, propane, and butane left in the LNG. The pentanes and heavier components are always extracted from the LNG because their crystallization can cause blockages in the cryogenic exchangers.

- The quantity of nitrogen, if necessary, using an end-flash or nitrogen-removal unit.

LNG producers are considering the production of lean LNG, which involves almost total extraction of the NGL, due to new demand from the US market and the emergence of new markets, such as the UK. Depending on the initial feed-gas composition, LNG producers may have to extract almost all the propane and butane, and even some of the ethane.

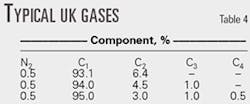

Table 4 shows theoretical gas compositions that would satisfy UK market specifications. Even in the absence of C3+, the gas must not contain more than about 6% ethane.

The classic liquefaction scheme, which contains a scrub column with reflux, does not allow extremely high propane extraction; recovery of ethane is also limited. There are solutions based on techniques used in the gas processing industry, however, that enable LNG producers to remove almost all the C2+. The decision of which process to use depends on technical criteria and economic considerations.

NGL extraction units with storage and export facilities will have an impact in four main areas:

- Increased plant capital expenditures due to the additional equipment required (recovery and treatment units, storage and loading facilities, related utilities).

- Increased amounts of feed gas required.

- Added complexity of maritime traffic around the plant. When tanker access to the plant is limited due to a long access channel, heavy traffic, etc., the decision to engage in LPG export should be weighed carefully. The plant operator must consider overall feasibility, especially if the LPG export will not use a dedicated fleet and if the plant operator will not have control of tanker arrival schedules.

- Increased safety constraints related to the handling and storage of LPG.

Valorization of butane and propane poses no problem in an active market offering prices significantly higher than the LNG price. Conversely, there is no international market for ethane, which means that ethane extraction is only feasible if there is a nearby petrochemical plant that can use the ethane as a feedstock.

Global optimization, case study

Any company active in the entire LNG chain, from production and shipping to receiving terminals and gas distribution to the end user, must strive for global optimization of the chain. This should start with a technological-economic comparison of the various options available for adjusting the quality of LNG to target markets.

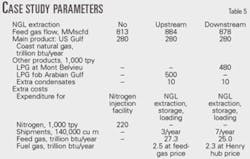

There is no established methodology for this type of study, and this article is not suggesting that any particular solution is better than another. The case study presented here is only one possible approach covering production, shipping, and the receiving terminal. The study parameters are:

- Production of 5.4 million tonnes of LNG in the Persian Gulf intended for the US market

- LNG with a quality that complies with UK specifications to allow for cargo rerouting.

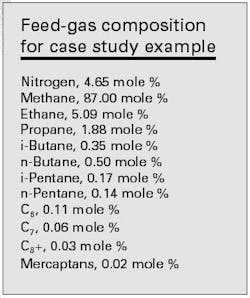

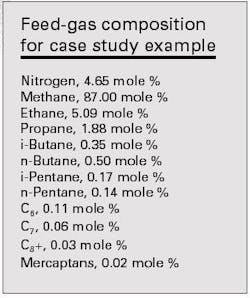

- A feed gas with a composition shown in the accompanying box.

- Two different possible configurations for the liquefaction plant.

In the first configuration, the fraction of LPG that is not used as makeup for the refrigerant cycles is reinjected in LNG. In this configuration, LNG unloaded in US or UK terminals does not meet the required specifications. This assumes that GCV reduction occurs at the regasification terminal.

The second configuration includes LPG extraction units that allow 93% C3 recovery and 100% CH3 recovery with minimal C2 recovery (0.7%).

Shipping from the Persian Gulf to US Gulf Coast in 140,000-cu m tankers; duration 24 days.

- A boil-off rate of 0.15 %/day (methane basis).

The study analyzes the impact of NGL extraction on the marginal parameters, for the same quantity of gas delivered to the US market on an energy basis.

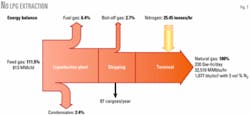

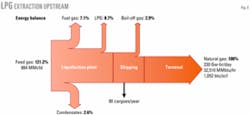

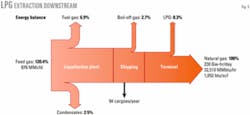

Figs. 7-9 show the energy equation for each of the three scenarios studied. Fig. 7 includes no extraction, but injection of nitrogen at the receiving terminal. Fig. 8 includes extraction at the liquefaction plant and valorization of the LPG at a FOB Persian Gulf price. Fig. 9 includes extraction at the import terminal and valorization of the LPG on the US Gulf Coast market.

The fuel gas in Figs. 7-9 is only the quantity of gas that the end flash supplies, which is sent to the plant's fuel gas system.

In the first case, the LNG ex-terminal has a GCV of 1,077 btu/scf, which complies with the most common US specifications without exceeding the maximum nitrogen content of 3 vol %. In the UK, the maximum nitrogen injection rate is 5 vol %.

In the other two cases, extraction is adjusted to obtain a Wobbe Index of 51.41 million Joules/cu m, which is the maximum allowable in the UK. The calorific value falls to 1,052 btu/scf. Because the ethane does not have to be removed, the only marginal products are butane and propane.

The main advantage of LPG extraction is that gas field production increases 8-9% for the same amount of energy delivered to the end users. It makes no difference whether extraction occurs at the plant or the terminal. The amount of feed gas required varies only 0.7% between the two scenarios.

Another advantage of LPG extraction at the plant is that the resultant LNG complies with US and UK specifications. It would be difficult to sell this LNG in Asia; the selling price will suffer due to the need to inject more LPG at the receiving terminal.

Shipping costs are also affected. When LPG is extracted upstream, the resultant LNG is lighter; so it will require more cargoes (90 instead of 87) to deliver the same amount of energy. If LPGs are extracted downstream, they take up space in the vessel's tanks; the number of cargoes required to deliver the same amount of energy increases to 94.

Table 5 sums up the main parameters, which allows an economic comparison among the three scenarios.

A summary economic assessment shows good profitability for the sale of marginal LPG, with a slight advantage in extracting at the plant rather than at the terminal. The assessment starts with a rough estimate of the capital expenditures required for the plant and terminal and takes into account an LPG selling price based on minimum prices during the past few years.

The best solution, however, for producing the LPG in the plant or the terminal is extremely sensitive to:

- Capital expenditures for extraction units, which the site conditions influence strongly.

- Relative prices for LPG in the producing area and importing country.

- Gas composition. If the feed gas is richer than the values in the case study, the ethane should be removed, which will raise the possibility of its valorization.

In this case study, all the LNG is delivered to the same terminal. The case study, therefore, does not factor in the cost of NGL extraction units in several terminals or the possibility of selling the LPG at the natural gas price rather than LPG price in case cargoes are rerouted to other terminals.

Findings

UK-grade LNG (about 1,050 btu/ scf) requires extraction of almost all NGLs; it may be unfeasible to produce this LNG if the feed gas is rich in ethane and if there is no economical way to valorize the product. LNG with this quality would be difficult to sell in Asia, where the market demands rich LNG.

US specifications are less restrictive (about 1,075 btu/scf) and marketing a US-grade LNG in Asia would probably be easier.

Simultaneous production of LNG and LPG (and even ethane in certain cases) at the liquefaction plant achieves better valorization of the produced gas, despite the fact that it requires additional investment and increases site complexity. But simultaneous production is only profitable if the intended markets accept gas with a low calorific value.

Whatever the actual specifications of new lean LNG, its production along with rich LNG for Asian markets imposes extra investment costs and operating complexity related to the liquefaction process, dedicated storage tanks (separate LNG qualities, NGLs), and LPG loading facilities.

Conversely, there is some incentive for import terminal operators to install gas quality adjustment facilities, which give them the competitive advantage of being able to process LNG from many different suppliers. For NGL extraction at the receiving terminal, however, the economic assessment must account for shipping costs.

The medium-term solution is still unclear. New liquefaction plants will either produce two different grades of LNG or there will be widespread addition of gas-quality adjustment facilities in US and UK import terminals.

The authors

Yves Bramoullé ([email protected]) heads the LNG technology department in the gas and power division for Total AS, Paris. In 1978, he joined the Elf Group, where he was a project manager, head of the construction department, and vice-president of development in a gas pipeline transmission subsidiary. In 1999, he joined the natural gas division of Elf-Aquitaine as project manager in charge of LNG receiving terminals. He holds mechanical degrees (1976) from Ecole National Superieure des Arts et Metiers, Paris. Bramoullé is also chairman of the gas transmission and storage commission for the French Gas Association (AFG).

Pascale Morin is head of the advanced technology department in the exploration and production branch of Total AS, Paris. She joined Elf Group in 1983 as a process engineer. She holds engineering degrees (1983) from Ecole Nationale Superieure du petrole and mechanical degrees (1982) from Ecole nationale Superieure des Arts et Metiers, Paris.

Jean-Yves Capelle is an engineer in the gas and power LNG technology department for Total AS, Paris. He is Total's representative in several European working groups on gas quality. After first working in LNG peak-shaving facility construction and start-up, he worked for several years in a Gaz de France research center. He holds mechanical degrees from Ecole nationale Superieure des Arts et Metiers, Paris.