Canadian operators are focusing their drilling for natural gas and boosting oil production from tar sands, in lieu of pursuing conventional oil plays.

Operators are taking greater risks in drilling for gas rather than for oil. In western Canada, 26% of gas wells drilled during the first 7 months of 2004, compared with 16% of oil wells, were classified as "exploratory."

Drilling permits for natural gas reached 11,455 by the end of July, 18% ahead of the same period in 2003. Gas well completions reached 8,379, 34% higher than 2003. The gas permit count may reach 19,000 by the end of the year.

null

In contrast, oil well drilling permits in western Canada were down 14% from last year; only 3,060 permits had been filed by the end of July 2004.

Switching attention

Speaking at a North American natural gas strategies conference earlier this year, Paul Ziff, CEO of Ziff Energy Group, pointed out that drilling "has tripled during the last 5 years in Canada without much of an increase" in production. This can be attributed to smaller discoveries, shrinking reservoirs, and lower productivity (OGJ, May 3, 2004, p. 38). As a result, Ziff sees operators switching their western Canadian investments toward nonconventional oil and tar sand resources.

Canadian oil production is expected to reach 3.6 million bo/d by 2015, up nearly 40% from 2.6 million bo/d currently produced, according to the 2004 Canadian Crude Oil Production and Supply Forecast released by the Canadian Association of Petroleum Producers (CAPP) on July 15, 2004.

The majority of the production increase is expected to come from Alberta's oil sands, more than offsetting declines in conventional oil production. By 2015, according to the CAPP forecast, 3 of every 4 bbl "of oil produced in Canada will come from oil sands." Companies are expected to invest about $30 billion (Can.) in the next decade in oil sands projects.

According to Brent R. Heinz, analyst at Calgary-based Sayer Securities Ltd., OPTI Canada Inc. raised $1.05 billion (Can.) earlier this year to finance its Long Lake oil sands project in northern Alberta.

Operator activities

Canada's top operators in 2004 (through July) include EnCana Corp.; EOG Resources Canada Inc.; Husky Energy Inc.; and Apache Canada Ltd. The busiest summer drillers as of Aug. 30 include EnCana (33 rigs), Husky Energy (24 rigs), Talisman Energy Inc. (22 rigs), Burlington Resources (18 rigs), and Devon Canada Corp (16 rigs).

Calgary's Husky Energy and Trident Exploration Corp. extended their joint development agreement for coalbed methane (CBM) production in south central Alberta. The 2-year, $40 million extension will include drilling 120 wells about 75 miles northeast of Calgary (OGJ, Aug. 9, 2004, p. 8).

In May, ChevronTexaco Corp. announced that its North America Exploration and Production Co. sold 13 producing fields across Manitoba, Alberta, British Columbia, and Northwest Territories to Acclaim Energy Trust and Enerplus Resources Fund for $800 million. ChevronTexaco will remain active in other Canadian projects, chiefly the Athabasca oil sands project, Mackenzie Delta gas project, Canadian east coast exploration, and other development and production activities.

Western Canada

According to Nickle's Rig Locator, for the week of Aug. 30, there were 708 rigs in western Canada, with 384 operating and 324 down (54% utilization).

In June, the Canadian Association of Oilwell Drilling Contractors (CAODC) forecast that 20,412 wells would be drilled in western Canada in 2004 (British Columbia, Alberta, Manitoba, Saskatchewan, and Northwest Territories). Through the end of July, 11,570 wells had already been drilled.

The CAODC also forecast a 30-rig increase in the Canadian fleet during 2004; growing to 715 rigs in third quarter and 720 rigs in fourth-quarter 2004, with an average of 420 active rigs out of 705 rigs (projected average) available through 2004 (60% utilization).

Historically, the average utilization over the past 3 years has been 63% in 2003 (422 used of 670 available), 50% in 2002 (315/630), and 63% in 2001 (397/630). The fleet usually reaches peak utilization in February each year.

In February 2004, peak utilization was 93%, up from 91% a year earlier, and up from 75% in February 2002 (Fig. 1). During first-quarter 2004, an average of 580 rigs were working, out of a fleet totaling 690 rigs, resulting in 84% rig fleet utilization.

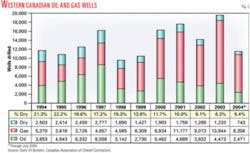

The drilling success rate continues to improve in western Canada. For the first 7 months of 2004, about 6.4% of all wells drilled were dry holes, nearly equal to the 6.3% dry hole rate in 2003 (Fig. 2).

Calgary-based Blizzard Energy Inc. is an emerging junior oil and gas exploration and production company focused on natural gas drilling and production in the Western Canadian sedimentary basin. The company completed a 34-well winter drilling program in the Sousa shallow gas field (100% ownership) in first-quarter 2004, spending $14 million (Can.) to drill, complete, and tie-in the Lower Cretaceous Bluesky formation wells in northwest Alberta.

Independent assessment firm Gilbert Laustsen Jung Associates Ltd., confirmed 53.2 bcf proved plus probable natural gas reserves at Sousa as of July 1, 2004. Blizzard claims an additional 8.3 bcf in possible reserves, for total field reserves of 61.3 bcf, which they are currently producing at about 9 MMcfd. The company plans a $42 million (Can.), 100-well development-drilling program at Sousa in first-quarter 2005, projected to raise production to 18 MMcfd by the end of second-quarter 2005.

Blizzard also drilled 12 wells in its Grande Prairie exploration program and plans to spend about $14 million in second-half 2004. By the end of September, the company expects 3-4 MMcfd production from Grande Prairie.

null

Eastern Canada

For the week of Aug. 30, there were three drilling rigs onshore and five rigs offshore eastern Canada, with 75% utilization.

The Greater Corner Brook Board of Trade funded a student internship to establish an online petroleum exploration database for the west coast of Newfoundland. The west coast petroleum exploration website (www.wcpe.ca) went live this month and will be updated biweekly.

It contains drilling data since 1867, as well as an overview of relevant exploration geology, an annotated bibliography concerning sedimentary environments in the Humber Zone, and a series of high-resolution digital images and video (Fig. 3). The project was completed by Memorial University of Newfoundland student Justin Macdonald and supported by several faculty members of Sir Wilfred Grenfell College.

On Aug. 19, Contact Exploration Inc. announced that it would delay until mid-2005 its next onshore well at Parson's Pond, western Newfoundland, hoping to attract additional funding to drill a deeper Ordovician platform play. Contact abandoned the Parson's Pond No. 1 well in April, 140 m short of TD, after encountering a fault zone.

In late August, Contact Exploration announced that it had farmed out two prospects near the Stoney Creek field in eastern New Brunswick to MBA Energy Corp., a subsidiary of MBA Gold Corp. MBA Energy plans to drill at the Dover and Gautreau onshore properties, south of Moncton, NB, and about 25 km southwest of the Maritimes and North Eastern pipeline.

Vulcan Minerals Inc., St. John's, Newf., plans a three-well drilling program, beginning with the Flat Bay No. 2 in mid-September 2004. Vulcan will then drill two wells on the Storm prospect, under farmout agreement with Terralliance Technologies Canada Inc. (TTI) of London, Ont., a subsidiary of Calif.-based Terralliance Technologies Inc., announced in late August. The Storm wells will test a Carboniferous structure covering 18 sq km, about 8 km northeast of Flat Bay.

Husky Energy Inc. (72.5%) and Petro-Canada (27.5%) have drilled four wells, including three water injectors, in the White Rose project, offshore Newfoundland, using the GSF Grand Banks semisubmersible at $107,000/day. The sole production well, White Rose B 07 2, tested more than 9,000 bo/d (capacity of test facilities on rig) in late July.

The well has a horizontal section about 1,200 m long and is estimated to flow 25,000-30,000 bo/d. White Rose field has a probable 200-250 million bbl of oil and is scheduled to come online late 2005 or early 2006, producing through the Sea Rose FPSO.

Offshore Nova Scotia currently has one large offshore project (Sable) with six natural gas fields that will be produced from 28 development wells. The first offshore project, Cohasset Panuke, produced about 44.5 MMboe from 1992 to 1999. Rowan Co.'s Gorilla III jack up was used as the drilling rig and production facility.

Elsewhere on the Nova Scotia shelf, the industry has taken several costly hits as three wells have come up dry this year (OGJ Aug. 9, 2004, p. 44). The Weymouth A-45 well was drilled by Ocean Rig ASA's Eirik Raude semisubmersible but was abandoned in May by operator EnCana Corp. The Mariner I-85 well was drilled with Rowan's Gorilla V jack up but abandoned in late March, costing Halifax-based operator Canadian Superior Energy Inc. and El Paso Oil & Gas Canada Inc. about $35 million. On Aug. 17, Canadian Superior disclosed two proposed locations for another well on the Mariner block.

ExxonMobil Canada Properties announced Aug. 12 that it plugged and abandoned its Cree I-34 well, drilled by Rowan's Gorilla V jack up to 3,945 m. Marathon Oil Canada (30%) and partners EnCana Corp. (26%), Norsk Hydro Oil & Gas Canada (25%), and Murphy Oil Corp. (19%) spud the Crimson F-81 well on June 18 with Transocean's Deepwater Pathfinder drill ship, working in 2,091 m (6,862 ft) water. On Aug. 26, the Canada-Nova Scotia Offshore Petroleum Board reported the well had reached 6,676 m and was being abandonded.

BEPCo Canada Co. has filed with the Canada-Nova Scotia Offshore Petroleum Board to drill three deepwater exploration wells on License 2407, 190 km off Nova Scotia, in 2005-07, funded by the Bass family of Texas.

Still to come

In a July 28 update to its annual fall forecast, the Petroleum Services Association of Canada expects 2004 drilling activity to reach 22,255 wells, surpassing the record set in 2003 by about 450 wells. PSAC's projected count for 2004 includes 15,732 gas wells, 5,030 oil wells, and 1,493 dry or service wells. Gas drilling is the dominant activity, expected to account for 71% of all wells drilled, or 76% of all producing wells.

Alberta will increase to 16,755 wells in 2004, compared with 16,416 in 2003, but may have a slightly smaller percentage of the total due to increased summer drilling activity elsewhere. British Columbian drilling is expected to increase 25% to a record-breaking 1,275 wells, up from 1,024 in 2003. Saskatchewan drilling will decrease about 3%; about 4,025 wells are expected in 2004, compared with 4,157 drilled in 2003.

Roger Soucy, president of PSAC, said first-quarter 2004 was "the busiest first quarter in drilling history" and 15% higher than first-quarter 2003. Despite wet weather depressing drilling in the second quarter, unusually strong summer drilling programs should produce another record-breaking year in Canada.

"More exploration and production companies are continuing their drilling programs throughout the year by targeting areas with summer access," said Soucy.

PSAC will announce its 2005 Canadian drilling activity forecast at its fall conference, Oct. 27-28, in Calgary.