Market Movement

Oil futures prices reach new high

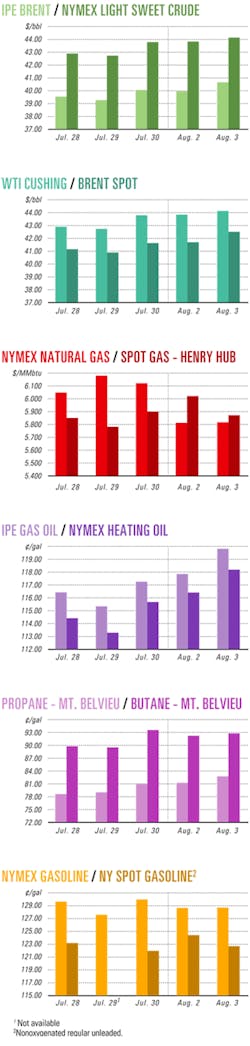

Crude oil futures prices last week reached above the $44/bbl mark on the New York Mercantile Exchange, setting another record.

The September contract closed Aug. 3 at $44.15/bbl, the highest level since that commodity began trading on NYMEX in 1983.

In the next day of trading, however, oil futures prices then reversed their record-breaking rise on NYMEX, falling by $1.32 at closing.

The price escalation to new record levels began July 28 as the September contract touched an intraday high of $43.05/bbl before closing at a record $42.90/bbl, up $1.06 for the day on NYMEX, amid fears of a possible shutdown of production by OAO Yukos, Russia's largest oil company. On that date, Russian bailiffs ordered Yukos to stop sales from certain production units as part of a court-ordered freeze on assets. Prices declined in the next session, after Yukos reported the Russian Ministry of Justice had lifted the ban imposed on the company's Yuganskneftegas, Tomskneft, and Samara- neftegas units.The price escalation continued Aug. 2 following a weekend warning by US Homeland Security Sec. Tom Ridge that terrorists could be targeting key US sites with car bombs.

OPEC voices concern

With crude reaching record-high prices, some analysts and traders called into question whether the Organization of Petroleum Exporting Countries could maintain control over price levels. Analysts also warned that very high oil prices could threaten global economic growth.

Rising demand, tension in the Middle East, continued fighting in Iraq, and an imbalance in seasonable product supplies are combining to push prices to new highs, traders said. An announcement made Aug. 4 by Purnomo Yusgiantoro, OPEC conference president and Indonesian minister of energy and mineral resources, stated that OPEC is growing concerned about the current high prices of crude as well as gasoline and was still capable of boosting production by as much as 1.5 million b/d to help ease lofty prices.

Price band change

Yusgiantoro added that OPEC ministers at a Sept. 15 meeting in Vienna would discuss measures to check the rise in international oil prices.

He said it's possible for OPEC to lower crude prices, but the success of its efforts hinges upon supply and demand factors. "Minister Naimi has said Saudi Arabia can increase production but they cannot do it immediately," Yusgiantoro said, referring to Saudi oil minister Ali al-Naimi.

Rafael Ramirez, Venezuela's oil minister, said he would move to lift OPEC's price band at the group's upcoming September meeting in Vienna. Market prices have exceeded OPEC's current price band of $22-28/bbl (for an OPEC basket of crudes) since Dec. 2, 2003. The band agreement calls for the group to adjust production by increments of 500,000 b/d for each dollar that prices fall outside that band for 20 consecutive trading days.

Ramirez did not say what the new price band should be. However, it was recently suggested by one Venezuelan official that the band should be readjusted to $28-35/bbl. The average price for OPEC's basket of seven benchmark crudes stood at $39.29/bbl on Aug. 4. So far this year, OPEC's basket price has averaged $33.08/bbl.

Iraqi pipeline damaged

Contributing to price skittishness last week was another pipeline attack in Iraq. Iraq's Northern Oil Co. said Aug. 3 that another attack had damaged a northern pipeline just as it was about to resume shipping crude from the Kirkuk oil fields to Ceyhan, Turkey, following repairs of damage caused by an earlier attack. No details of the latest attack were immediately available.

Earlier, Iraqi Oil Minister Thamer al-Ghadhban reported it would take Iraq 4 years to increase its oil production to 4 million b/d. "We have now a production capacity of 2.8 million b/d; we need to spend a lot of moneyUand a time span of 4 years from now in order to produce 4 million b/d," he was quoted as saying in Iraq's state-run Al-Sabah newspaper. Iraq currently is producing 2.6 million b/d of crude and exporting 1.7 million b/d through its southern terminals, which are running at capacity (OGJ Online, Aug. 2, 2004).

Stocks mixed

Contributing to oil supply uncertainty was a mixed report on US stocks.

The US Energy Information Administration reported Aug. 4 that US crude oil inventories fell by 1.9 million bbl to 298.6 million bbl during the week ended July 30 from the previous week. At this level, EIA said, US crude stocks are in the bottom half of the average range for this time of year.

Gasoline inventories, meanwhile, rose by 2.4 million bbl, near the upper end of the average range for that period.

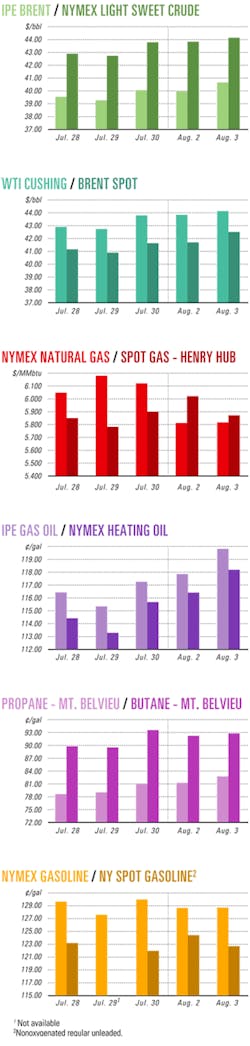

Industry Scoreboard

null

null

null

Industry Trends

CANADIAN OIL SANDS production could fill an anticipated gap left from declining production in Saudi Arabia's Ghawar field and mature oil regions, said St. Petersburg, Fla.-based Raymond James & Associates Ltd.

In a research note last month, RJA analyst John Mawdsley said that Canadian oil sands production eventually could grow to 4 million b/d and maintain that rate for more than 100 years.

"Canada's stable political environment and Alberta's attractive fiscal regime provide a profitable investment arena. As the world's other giant oil fields decline, we believe that an investment in the oil sands is going to produce impressive long-term returns," he said.

Ghawar, the world's largest oil field, has been on stream since 1951. Mawdsley said Ghawar's production gradually will decline.

"We estimated that by the end of 2004, 57 billion bbl of oil will have been produced from Ghawar field [and] production peaked in 1981 at 5.7 million b/d (subsequently restrained for market reasons). It again reached over 5 million b/d in the 1990s and has since declined to recent levels of 4.5 million b/d. At these rates, Ghawar generates almost 6% of the world's oil production each and every day," Mawdsley said.

Estimates of Ghawar's remaining reserves vary. The US Energy Information Administration estimates 50-70 billion bbl, and state oil company Saudi Aramco estimates 125 billion bbl.

"Another important point to make here is the current water cut, which is believed to be anywhere from 20% to 55%. It is estimated that the field's oil production is declining by about 8%/year, and, assuming this rate, oil production next year will drop by 360,000 b/d," he said.

ULTRACLEAN DIESEL FUEL is gaining acceptance.

O2Diesel Corp., Newark, Del., said that its proprietary ethanol-diesel blend has been certified as an acceptable clean fuel by Nevada and California state government officials.

O2Diesel claims its fuel reduces vehicle emissions of ozone-forming nitrogen oxides.

Last month, O2Diesel said that its technology will be used to supply 10,000-20,000 tonnes to Al-Obayya Corp., a company owned by Prince Turki Bin Abdullah Bin Abdul Aziz al-Saud, a member of the Saudi royal family.

Al-Obayya plans to distribute and market O2Diesel's fuel throughout the Middle East.

In the US, the Nevada Division of Environmental Protection (NDEP) officially included O2Diesel on its list of alternative fuels that state, county, and municipal fleets of 10 or more vehicles can use instead of conventional gasoline or diesel.

"As a matter of policy, this decision is the first official recognition of O2Diesel as a fuel that can make a significant improvement in air quality while helping Nevada and the nation reduce its reliance on petroleum," O2Diesel said.

Last year, the California Air Resources Board deemed O2Diesel as an official alternative diesel fuel formulation there.

Meanwhile in Nevada, O2Diesel is demonstrating its ethanol-diesel blended fuel in cooperation with the US Air Force in Las Vegas and the Nevada Air National Guard in Reno.

Government Developments

US PRESIDENT GEORGE W. BUSH named a new chair to the Federal Trade Commission, sidestepping the typical Senate approval process after Congress left for a month-long recess.

Republican Deborah Majoras, a former US Department of Justice antitrust official, was one of 20 individuals given a "recess" appointment. Another FTC commissioner, Democrat Jon Leibowitz, also was installed in his post in late July without the usual Senate approval.

Some Senate Democrats opposed Majoras's nomination for several months, saying they were not satisfied that she will investigate monopolistic practices by fuel marketers (OGJ Online, July 4, 2004).

Sen. Ron Wyden (D-Ore.), who led the effort to stall FTC nomination, released a statement July 30, calling the White House's latest action "undemocratic."

"The anticonsumer record of the [FTC] on oil company mergers and other issues that are significant factors in raising gasoline prices at the pump is a sorry one, and there is no evidence that Ms. Majoras will change this course.

"I hope I am wrong, and that this undemocratic process for naming a new chair won't result in consumers being hammered with high [gasoline] prices again and again," Wyden said.

He has called for hearings into the conclusions of a recent Government Accountability Office report that found oil mergers approved by FTC had increased gasoline prices by as much as 7¢/gal. Wyden also questioned what Majoras—as FTC chair—would do to protect consumers from the effects of possible oil mergers that FTC might consider in the future.

A number of consumer advocacy groups, including the Consumer Federation of America, Consumers' Union, the US Public Interest Research Group, and Common Cause last May also sent letters to the Senate Commerce Committee opposing Majoras's nomination.

Since that time, FTC has taken actions against Royal Dutch/Shell Group and Unocal Corp.

The Shell probe will focus on agency concerns that the company's decision to shut down its 70,000 b/d, Bakersfield, Calif., refinery might be illegal. Subpoenas have been issued, although senior FTC officials last month declined to say when or to whom the documents were sent. Agency officials also declined to say when they expect the staff to finish the investigation.

In other action, the agency said it reinstated charges that Unocal violated antitrust laws by defrauding the California Air Resources Board as it mulled new reformulated gasoline specifications (OGJ Online, July 8, 2004).

VENEZUELA AND ARGENTINA are moving toward a more cooperative working relationship in petroleum shipping.

Petróleos de Venezuela's subsidiary PDV Marina has signed a memorandum of understanding with Argentine shipyard Astilleros Río Santiago for the repairs to oil tankers in PDVSA's fleet.

PDVSA Pres. Alí Rodríguez Araque said that the agreement would help complement the shipbuilding industries of both countries.

The agreement will begin in September 2005, when the tanker Luisa Cáceres de Arismendi will be sent to Argentina for maintenance work.

"It is expected that sometime in the future Argentine shipyards could build tankers for the PDV Marina fleet," Rodríguez noted.

Quick Takes

NIGERIA LNG LTD. (NLNG) has approved the addition of a sixth train at its LNG liquefaction plant at Finima on Bonny Island, Nigeria. The additional train will boost production capacity to 22 million tonnes/year of LNG and 5 million tonnes/year of NGL. Train 6 is scheduled to start up in fourth quarter 2007. NLNG is a Nigerian joint venture of Nigerian National Petroleum Corp. 49%, Shell Gas BV 25.6%, Total LNG Nigeria Ltd. 15%, and ENI International (NA) NV 10.4%. Subsidiaries of Shell, Total, and ENI will supply equity gas to the plant to feed Train 6. Barbados-based Shell Western LNG will purchase 3 million tonnes/year of Train 6 LNG, primarily for markets in Mexico and the US, and Total Gas & Power Ltd. will buy 1 million tonnes/year for proposed LNG receiving terminals on the Iberian Peninsula and in North America. The long-term contracts together represent about 35% of NLNG's total output. The balance will be sold to Italy, France, Spain, Portugal, and Turkey (OGJ Online, May 14, 2004). Trains 4 and 5 have reached an advanced stage of construction and are expected to start up next year. Engineering, procurement, and construction contracts for Train 6 will be awarded to the TSKJ consortium—Technip-Coflexip Group of France, Italy's Snamprogetti SPA, Houston-based KBR, and JGC Corp., Yokohama—and the tankage and jetty works contract to Entrepose Contracting. To transport the LNG, NLNG signed charter hire agreements with Bergesen DY ASA of Norway for three ships plus an option for one other and with Nippon Yusen Kabushiki Kaisha for two ships. Daewoo Shipbuilding & Marine Engineering Co. Ltd. and Samsung Heavy Industries Co. Ltd. will build them in South Korea.

Fluxys SA, Brussels, has awarded a lump sum turnkey contract to ENI SPA unit Saipem SPA for the extension of Belgium's Zeebrugge LNG receiving terminal. The terminal's capacity will be expanded to 9 billion cu m (bcm)/year of natural gas from its current capacity of 4.5 bcm/year. The work includes the engineering, procurement, and construction of the overall terminal facilities, including a 140,000 cu m LNG storage tank and regasification facilities. Expansion of the terminal is scheduled for completion by yearend 2007.

HYUNDAI OILBANK CO. LTD. (HDO) awarded a contract to Foster Wheeler Ltd. for project management of a $200 million clean-fuels upgrade project at HDO's Daesan refinery 130 km southwest of Seoul. New plant facilities will include a third 25,000 b/d gas oil hydrotreating unit, a 20,000 b/d motor gasoline hydrodesulfurization unit, and a 40 MMscfd hydrogen manufacturing unit. The project also will include revamping a 35,000 b/d gas oil hydrotreating unit and utilities work. The investment will reduce the gasoline's sulfur content to 30 ppm from 200 ppm and sulfur in the gas oil from the new gas oil hydrotreating unit to 10 ppm in compliance with environmental legislation to take effect Jan. 1, 2006.

FIRST CALGARY PETROLEUMS LTD. (FCP) and Algeria's state oil company Sonatrach, reported test results of the ZCH-1 exploration well on Block 406a, Rhourde Yacoub, in Algeria's Berkine basin. The well, drilled to 3,864 m TD, encountered multiple gas and light oil reservoirs. Initial production flowed on test 8,545 b/d of liquids—6,376 b/d of light oil and 2,169 b/d of condensate—and 56.2 MMcfd of natural gas from several zones at various wellhead flowing pressures, FCP said. FCP holds 49% interest in the block, and Sonatrach 51%.

Statoil ASA has assumed 75% interest and operatorship of the Hassi Mouina gas block in Algeria, with Sonatrach retaining 25%. Hassi Mouina lies near In Salah gas fields in central Algeria. In Salah went on stream this summer (OGJ Online, July 7, 2004). The block covers an area of 22,993 sq km of the Timimoun basin. Sonatrach had drilled one well on the block, discovering gas, which Statoil now will develop. Pakistan Petroleum Ltd. (PPL) plans to begin drilling the Pasni X-2 well targeting gas on Pasni Block 2462-1 in the Arabian Sea off Pakistan by yearend, said PPL's Managing Director Syed Munsif Raza. Previous operator Ocean Energy Inc., Houston, had suspended drilling on the blocks for security reasons, Munsif Raza said, whereupon PPL assumed Ocean Energy's 85% share and operatorship. PPL now holds a 95% share. Pakistani holding company Government Holding (Pvt.) Ltd. has a 5% share. PPL plans to invest about $15 million in the venture. PPL produces 720-750 MMcfd of gas from Sui field, and if it continues at that rate, those reserves would last for less than 10-12 years, Munsif Raza said. Sonatrach awarded an exploration block to a partnership formed by Spanish companies Repsol YPF SA and Gas Natural SDG. The block, in the western Berkine basin in eastern Algeria, covers 4,831 sq km. The companies are discussing the possibility of jointly developing a new grassroots LNG project in Algeria involving gas from Gassi Touil field.

SYNTROLEUM CORP., Tulsa, and Oil Search Ltd., Sydney, agreed to a joint feasibility study examining costs to build and operate a gas-to-liquids barge in Papua New Guinea using Syntroleum's proprietary GTL synthetic fuels technology. The study is expected to take 3-4 months. The conceptual design includes gas processing to extract NGLs in advance of the GTL section that would produce 20,000 b/d of liquids. Oil Search produces oil and gas in Papua New Guinea.

SHELL EXPLORATION & PRODUCTION CO. has begun production from its two wells in Glider field on the Gulf of Mexico's Green Canyon Block 248. Glider, the first subsea tieback to the Brutus tension leg platform, lies in 3,400 ft of water, about 165 miles south-southwest of New Orleans. Shell is operator with a 75% interest, and Newfield Exploration Co., Houston, holds the balance. The Glider subsea system is tied back to Brutus via 7 miles of 6-in. buried and insulated flowline. The first well began production July 20, and the second well currently is being completed. Reserves are primarily oil with associated gas. Husky Energy Inc. and Trident Exploration Corp., both of Calgary, extended for 2 years a joint venture to produce gas from coal beds in south-central Alberta. The $40 million extension calls for drilling 120 wells between Fenn and Rumsey, Alta., 75 miles northeast of Calgary. The JV produces 6 MMcfd of coalbed methane (CBM) from 32 connected wells. Husky will hold a 50% interest in the production. The agreement covers more than 250 net sections of Husky land upon which Trident will drill at least 40 more wells by yearend 2005 with the option to drill at least 80 wells in 2005. Trident will manage production, and Husky will operate facilities and transportation and processing infrastructure. Husky's lands at Fenn Rumsey contain an estimated 500 bcf of gas in place in coals and interbedded sands. Development entails up to four wells per section. Penn Virginia Corp., Radnor, Pa., said it controls 650,000 acres of prospective horizontal CBM leasehold in the Appalachian basin. With the redesign of drilling patterns Penn Virginia expects to develop 11,000 acres with an associated increase in 2004 drilling capital and production. The acreage is in southern West Virginia, western Virginia, and eastern Kentucky. The company has 24 successes in 25 attempted horizontal CBM wells since 2001. Despite pipeline curtailments this year, production from the horizontal CBM wells rose to 5.2 MMcfed in 2004 from 1.8 MMcfed in the same 2003 period. The company's total Appalachian production in the quarter was 27.3 MMcfed, up 5% from the same quarter of 2003. Pipeline curtailments under interruptible contracts began in May, and Penn Virginia has acquired long-term firm transportation on one system starting in November 2004.

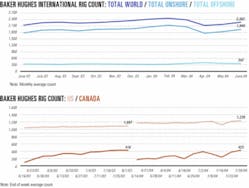

THE NUMBER OF ROTARY RIGS drilling in Canada rose by another 43 to 423 the week ended July 30, continuing its turnaround begun the previous week, reported Baker Hughes Inc. The figure represents 7 more rigs than were working the same time last year. Rigs active in the US increased by a total of 13, with the 17 additional land rigs offset by a drop of 3 rigs in inland waters and 1 offshore. The total, 1,229, is 132 more than were working last year at the same time. In the US, 1,057 rigs were drilling gas-directed wells, 171, oil-targeted wells, and 1 was unspecified. Agip Kazakhstan North Caspian Operating Co. (Agip KCO) has awarded a letter of intent to National-Oilwell Inc., Houston, for the design and construction of a complete drilling facility for Agip KCO's "D" Island project in Kashagan field off Kazakhstan. The project, valued at $150 million, includes two complete harsh-environment onshore drilling rigs and drilling support equipment. The 3,000 hp rigs will be designed to drill on artificial islands in the North Caspian Sea.

TIDELANDS OIL & GAS CORP. unit Arrecefe Management LLC, San Antonio, is planning two natural gas pipelines at the US-Mexico border: a 30-in. line between Progreso, Tex. and Nuevo Progreso, Mexico, and a 36-in. line west of the Mission, Tex.-Arguelles, Mexico, border. The pipelines will connect with a proposed underground gas storage facility and the oil and gas infrastructure of Mexico's state-owned oil company Petróleos Mexicanos, creating a pipeline network facilitating gas flow to Mexico's commercial, residential, and industrial customers. Tidelands is preparing to file for US Federal Energy Regulatory Commission permits authorizing the pipeline design, construction, and maintenance.

YEMEN has approved Calvalley Petroleum Inc.'s drilling program on Block 9 in Yemen, including two exploration wells and four development wells. Calgary–based Calvalley, operator of Block 9, intends to drill continuously until yearend. The first well, to be drilled to basement, will be followed by an initial exploration well at South Roidhat, a new prospect 5 km southwest of the Al Roidhat 1 discovery well. The rig then will move to the Ras Noor prospect, an independent Qishn structure on the top of the plateau 7 km southeast of Al Roidhat 1.

ConocoPhillips (UK) Ltd. received UK approval to develop the Saturn Unit area in the UK southern North Sea. First natural gas production—75 MMcfd—is expected in fourth quarter 2005, with production ramping up to a maximum 170 MMcfd within a year. The Saturn Unit area, covering Blocks 48/10a and 48/10b on the UK Continental Shelf, lies 37 km north of the Lincolnshire offshore gas gathering system (LOGGS). Initial development will consist of three wells from a six-slot wellhead platform in 25 m of water. A 43 km, 14-in. gas export pipeline will tie the platform back to new reception facilities to be added to LOGGS. Operator ConocoPhillips holds a 42.9% interest; partners are RWE DEA UK Development Ltd., Venture Production (North Sea Developments) Ltd., and ENI UK Ltd.

BP PLC has signed additional contracts worth $80 million with FMC Kongsberg Subsea AS, a unit of FMC Technologies Inc., Houston, to supply subsea systems and related services for the BP-operated Greater Plutonio project on Block 18 off Angola. The contracts, covering installation services and local Angolan supply, will bring to $350 million the total current project value, FMC said. For the entire Greater Plutonio project FMC is expected to include 45 subsea trees and associated structures, manifolds, and production-control systems, as well as connection systems for flowlines and umbilicals. FMC Technologies also will supply technical services related to installation and start-up. Deliveries are scheduled to begin in early 2005. ChevronTexaco Corp.'s Angola-based affiliate

Cabinda Gulf Oil Co. Ltd. awarded a $125 million subsea equipment contract to Houston-based Vetco Gray for the Lobito-Tomboco project on Block 14 off Angola. The 3 year contract calls for 22 subsea horizontal trees, 6 manifolds, and integrated subsea and surface controls systems. The engineering, manufacture, and installation contract also calls for services, spares, and options for additional trees and manifolds. First production from Lobito and Tomboco fields is expected by 2007. The 1,560 sq mile deepwater Block 14 is off the enclave of Cabinda, Angola (OGJ Online, Dec. 27, 2002). West Seno field, which

Unocal Makassar Ltd. operates in the Makassar Strait production-sharing contract area about 118 miles northeast of Balikpapan off Indonesia, currently has 20 wells completed, with gross production averaging 24,000 boe/d in June. By yearend, 26-28 wells are expected to be on line with a gross exit rate of 25,000-35,000 boe/d. Recently opened bids for Phase 2, including tension leg platform fabrication and offshore installations, were deemed unacceptably high. Cost-reduction options are being considered, and construction will extend beyond 2005. Unocal Makassar has a 90% working interest, and Indonesia's state-owned oil and gas company Pertamina Upstream holds the remaining 10%.

BAHRAIN has signed agreements with Belgium-based Tractebel EGI and Kuwait-based Gulf Investment Corp. (GIC) for the country's first independent power project, a natural gas-fired plant. The plant is slated to reach full capacity by May 2007. The Al Ezzel Power Co., jointly owned by Tractebel and GIC, plans to build a $500 million combined-cycle plant near Manama. The plant, which eventually will produce 950 Mw, is to be completed in two phases. The first phase will deliver 470 Mw by Apr. 30, 2006.