Analogs, work commitments drive drilling in Atlantic Canada

Operators are drilling on and offshore the eastern Canadian provinces, moving forward with most project plans and work commitments but letting others slide.

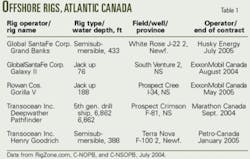

According to Nickle's Rig Locator for July 26, there were three land rigs and five offshore rigs in eastern Canada, with an overall rig utilization rate of 55% in the region. The rigs working off Newfoundland and Nova Scotia have contracts set to expire beginning this month (Table 1).

For the week ending July 23, 476 rigs were active in Canada out of a rig fleet of 713 (67% utilization). There have been 13,222 well licenses issued in Canada through July 9 and 10,440 completions. According to Nickle's Daily Oil Bulletin, operators in Canada have taken more than 5.5 times as many licenses for natural gas than for oil.

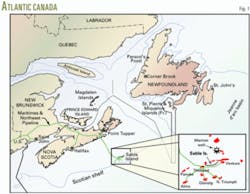

Basins of the Maritime Provinces in eastern Canada are underlain by Carboniferous and Permian sedimentary strata with conventional natural gas and coalbed methane potential (Fig. 1). The Carboniferous Central Maritimes basin is about 150,000 sq km and includes the Magdalen basin and the Bradelle platform (northeast New Brunswick shelf). According to EnerNorth Industries Inc., source rock studies suggest that early Carboniferous rocks are oil prone and Upper Carboniferous rocks are gas prone.

Atlantic Canada investment

In early July, the Halifax-based Atlantic Provinces Economic Council released the 2004 edition of the major projects inventory, identifying 272 major projects in development in Atlantic Canada, concentrated in Newfoundland and Nova Scotia (40% each).1

The projects involve investments of $47.3 billion (Can.), an increase of 4% from 2003. Project activity in 2004 is up 23% for New Brunswick and 14% for Newfoundland and Labrador. But the report suggests that a "significant weakness is looming." APEC says a "major new discovery is needed soon to revive momentum in the East Coast offshore and to sustain investment activity in the second half of this decade."

At the Offshore Technology Conference in May this year, the Canadian government announced a 5-year incentive for offshore drilling, suspending duties on foreign-flagged offshore rigs. Newfoundland Minister of Natural Resources John Efford said the decision "will contribute to the Canadian economy, particularly inUAtlantic Canada."

According to APEC, energy exports from Atlantic Canada increased threefold to $7.6 billion (Can.) in 2002 from 1999. Regional energy exports in 2003 increased to $7.9 billion (Can.), representing nearly 13% of Canada's total energy exports of $61.7 billion (Can.) last year.

In May 2004, ExxonMobil Canada Properties Ltd. announced that it would provide $1 million (Can.) over the next 5 years to Halifax-based Petroleum Research Atlantic Canada for research and development. PRAC also received a $1.2 million grant from the Atlantic Canada Opportunities Agency.

PRAC is a nonprofit, public-private partnership formed in 1999, partly with a $1.25 million (Can.) grant from ExxonMobil. Partners in the Sable project have spent more than $20 million (Can.) in Nova Scotia R&D in addition to sponsoring PRAC.

Newfoundland onshore

Oil and gas exploratory drilling is predominantly in four rift basins in West Newfoundland. Cabot Martin of Deer Lake Oil & Gas Inc. believes that the West Newfoundland basins lie on trend with the St. Lawrence, Appalachian, and Michigan basins, within the Cambro-Ordovician carbonate platform. A common attribute of all these basins is hydrothermal dolomitization, which can enhance reservoir porosity and permeability.

A particularly strong analogue is the Deep Trenton/Black River gas play in western New York in which Talisman Energy Inc.'s wholly owned subsidiary, Fortuna Energy Inc., has invested $354 million since November 2002.

Numerous surface seeps and historical production prompted Canadian junior exploration companies to drill at Parsons Pond (OGJ, May 17, 2004 p. 43). Drilling began in the 19th century, and many shallow wells later fed a small refinery that operated on the north shore of Parsons Pond, 1920-25.2

Companies have also drilled in the 1,000-sq mile Deer Lake basin (Fig. 2). Five of seven wells drilled in the basin in the last century have had oil or gas shows or both. In 1917, the Mills-1 well suffered a gas blowout, and there was another blowout in 1956, at the Claybar-1 well. Drilled with better safety systems in 2000, the Western Adventure-1 well produced 100 Mcfd with condensate during drillstem tests.

The primary target has been sandstones of the North Brook and Howley formations. Core recovered from the Western Adventure-1 well at 675 m had 6-13% porosity and 8-10 md permeability (OGJ, Dec. 24, 2001, p. 36).

Secondary targets include fractured, porous Cambro-Ordovician carbonates, including the Petite Jardin formation. Cores recovered from 4,025 ft showed vuggy macro-porosity from hydrothermal dolomitization.

Vulcan Minerals Inc. has drilled three wells and holds 250,000 acres in the Flat Bay area. Vulcan President Patrick Laracy said this is a "pivotal year" for the company, which tested 34º API oil from conglomeratic sandstone in the shallow Flat Bay-1 well earlier this year. Vulcan perforated and fracture-stimulated a zone at 195 m in March and installed West Newfoundland's first pump jack in July (Fig. 3). Laracy plans to bring a single rotary rig to the province to drill two more wells at Flat Bay this year.

Newfoundland offshore

About 600 people attended the Newfoundland Offshore Industries Association conference in St. John's in June to hear presentations byt Petro-Canada, Husky Energy Inc., Norsk-Hydro, Chevron Canada Resources Ltd., ExxonMobil Canada Ltd., and others.

Husky Oil Ltd. is drilling in the White Rose field with Global SantaFe Corp.'s Grand Banks semisubmersible, under contract through June 2005 at $107,000/day. Husky drilled 10 wells during October 2003-April 2004.

Petro-Canada spudded the F-100 2 well on June 13, 2004, using the Henry Goodrich semisubmersible, to 4,527 m TD.

Terra Nova reserves were recently downgraded 13%, primarily based on the Far East region of the field. The Canada-Newfoundland Offshore Petroleum Board estimates now stand at 354 million bbl for the field. Terra Nova currently produces about 150,000 bo/d.

The giant Hibernia field was discovered in 1979 by Chevron and now produces more than 220,000 bo/d of light crude.

The Hebron/Ben Nevis fields are still awaiting development of the heavy oil. The Hebron discovery well was drilled in January 1981 and the Ben Nevis well in 1982.

The Hibernia oil field was discovered by Chevron in 1979. ExxonMobil Canada and partners recently set several records drilling the B-16 36 (OPA1) well at Hibernia (OGJ, July 26, 2004, p. 51). The well was drilled beyond 30,000 ft MD into the A Block, in water 265 ft deep and was completed Nov. 17, 2003.

CNOPB released an estimate of the undiscovered hydrocarbon resources in the Flemish Pass basin in May. It calculated 50% probability of 1.7 billion bbl, with field sizes ranging from 44 million bbl to 528 million bbl.

New licenses

Operators bid $673 million (Can.) in the Orphan basin lease sale in late 2003. Chevron Canada (50%) and partners ExxonMobil Canada (25%), and Imperial Oil Ltd. (25%) received eight deepwater leases located about 400 km northeast of Bonavista, with water depths reaching 4,000 m.

Chevron project manager Mark Macleod said the company plans to acquire seismic in the Orphan basin this year and drill in 2006 at the earliest.

In May, three operators were issued eight licenses in the Laurentian sub-basin south of Newfoundland. ConocoPhillips Canada (operator, 70%) and Murphy Oil Corp. won seven blocks and Imperial Resources Ventures has one.

Bob Spring, ConocoPhillips' vice-president of Canadian exploration, said the company would start a reconnaissance seismic program, and drilling might start in about 4 years. The company is most interested in parts of the blocks in 1,000-2,500 m water, which might require a deepwater drillship, with well costs around $75 million (Can.). "Even for us, that's a big bite," he said.

In addition, ExxonMobil Canada Properties and Conoco Canada Resources Ltd. have 1,610 sq km under license until April 2006, in France's exclusive economic zone surrounding the Saint-Pierre and Miquelon islands. The companies have already drilled one dry hole (Bandol-1 wildcat) and now have an additional work commitment for 8 million euros (OGJ, June 7, 2004, p. 41).

A modified mining rig was used to drill the Western Adventure-1 well in the Deer Lake basin, western Newfoundland, July 2000 (Fig. 2, photo by Frank Ryan, courtesy of Deer Lake Oil & Gas Inc.).

Prince Edward Island

A handful of companies hold exploration permits covering 800,000 acres in the province of Prince Edward Island—Calgary's Rally Energy Corp. (eight permits, 708,053 acres), Toronto-based PetroWorth Resources Inc. (264,000 acres in Magdalen basin), Halifax-based Corridor Resource Inc., and Calgary's BP Canada Energy Co.

On June 30, PEI's Minister of Environment and Energy Jamie Ballem issued a call for bids for oil and natural gas exploration rights in four license areas in East Prince and West Queens Counties ranging from 35,609 to 71,326 hectares. Ballem characterized the province as an "underexplored region."

Bids for the 6-year licenses were accepted until July 30.

Only 16 exploratory wells have been drilled on Prince Edward Island, beginning with the Hillsborough-1 well drilled in 1944 by Island Development Co. In 1958, Imperial Oil Ltd. drilled three wells that were later plugged and abandoned.

In 1970-72, Hudson's Bay Oil and Gas Co. Ltd. drilled three Fina wells, all abandoned. Then in 1974, Hudson's Bay drilled the Fina East Point E-49 well offshore northeastern Prince Edward Island, near the maritime border with western Cape Breton, NS. The well tested gas at 5.5 Mcfd from the Westphalian Riversdale sandstone. In 1980, the E-47 offset well was drilled to 2,662 m but had no hydrocarbon shows. The lease area is held by BP Canada.

Sainte Foy, Que.-based Soquip Énergie Inc. drilled two wells in 1975, Hudson's Bay drilled two more in 1980, and Chevron Canada drilled one well in 1983, but all were plugged and abandoned.

In 1997, Corridor Resources drilled and suspended the Green Gables-2 well, and Prince Edward Gas Co. Inc. drilled and abandoned a well.

In 2001, Toronto-based Meteor Creek Resources Inc. drilled and later abandoned a 3,500-m well in eastern PEI (OGJ, Jan. 15, 2001, p. 36).

The Department of Environment and Energy issued the province's first-ever call for bids for oil and gas licenses in 2001, for a parcel between St. Peter's Bay and Cardigan Bay.

Calgary-based Rally Energy Corp. drilled two shallow wells that had gas shows in 2003, both abandoned. The company acquired and processed additional seismic and collected 10,900 km in an airborne gravity and magnetic survey, with plans for additional onshore and possibly offshore exploration.

New Brunswick

According to the New Brunswick Department of Natural Resources and Energy, 39 wells have been drilled in the province since 1997. The Maritimes and Northeast Pipeline (M&NP) that crosses New Brunswick and transports gas from the Sable development off Nova Scotia provides a ready access to market and is expected to result in additional exploration.

In a presentation at the NOIA conference, Halifax-based Corridor Resources Inc. discussed the McCully gas field in southeast New Brunswick. Corridor drilled the discovery well in September 2000 and has now drilled eight wells on the structure. The company used a triple rig owned by Union Drilling Inc. for five wells drilled 2000-01, and a Precision Drilling Corp.'s super single Rig 709 for three wells drilled in 2002. Bridgeville, Pa.-based Union Drilling is a contract land drilling company with 43-45 rigs, formed in 1997 and owned by Morgan Stanley & Co. Inc.

Since April 2003, 2 Mcfd from the first two wells (A-67, P-66) have been transported via 2-km gathering lines to a small gas processing plant which supplies the daily gas demand of the PCS potash mill near Sussex, NB. Under a joint operating agreement, Corridor operates the wells and Potash Corp. of Saskatchewan Inc. operates the surface facilities (gathering lines and processing plant).

The other six wells are shut-in and Corridor intends either to connect production to the M&NP, 45 km north, by Fall 2006 or set up a modular, gas-fired power generation facility.

The Carboniferous Horton group reservoir sands contain 20-40 m net pay interval with up to 10% porosity and 2-md permeability. These over-pressured sands are sensitive to water-based drilling muds and fracture fluids. Corridor Vice-President Paul Hopkins told OGJ that BJ Services of Canada ran fracture jobs ranging from 8 to 37 tonnes, with water and cross-linked gel, plus methanol and CO2. In some cases, the company used regular sand and carbo proppant. Injection pressures ranged from 60 to 90 mPa (about 13,000 psi).

Horton Group sands occur between 1,800 and 3,600 m capped by the Moncton Group and unnamed red beds of the Sussex Group. Corridor Resources estimates 500 bcf to 1 tcf gas in place.

Corridor next plans to process and evaluate a 3D seismic survey shot over the development area, then batch-drill and fracture 10-15 wells north of the PCS mine, on 100-acre well spacing.

Corridor also drilled a separate play southwest of the McCully field, using a double rig from Doubil Inc. in Ontario (Fig. 4).

In addition, Corridor has exploration interests on Anticosti Island, Quebec's Magdalen Islands, and in the Gulf of St. Lawrence. Corridor has a 60% interest and Foothills Minerals Inc. has a 40% interest in the Fatima prospect offshore the Magdalen Islands.

Fatima would test early Permian-late Carboniferous sands flanking the Cap-aux-Meules salt dome, underlain by Westphalian coal measures. The companies have proposed drilling the offshore wildcat using a land rig on the island of Cap-Aux-Meules.

null

Nova Scotia offshore

Primary exploration areas off Nova Scotia are the Scotian Shelf, including the Sable Island Bank, the deepwater Scotian Slope, and the Laurentian sub-basin.

In May 1999, operators invested $600 million (Can.) for 19 leases off Nova Scotia. In November, companies bid $2 million (Can.) for 2 leases onshore Nova Scotia and Cape Breton Island, and then $61 million (Can.) for 11 offshore leases.

Industry had work commitments to drill 16 wells offshore Nova Scotia before the end of 2006, backing up $1.6 billion (Can.) in lease agreements. But leaseholders allowed 12 exploration licenses to expire on June 30 of this year, representing $280 million (Can.) in work commitments. The five operators (ExxonMobil, Shell Canada, Kerr-McGee Offshore Canada Ltd., Imperial Oil Resources, and Richland Minerals Inc.) are required to pay the Canadian government 25% of the promised work expenditures less any credits earned.

Ten more licenses are set to expire at the end of 2004. EnCana Corp. has five, Richland Minerals has three, and Kerr-McGee Offshore has two, representing $56.2 million (Can.) in work commitments.

On Apr. 30, BEPCo Canada Co. proposed an exploratory drilling program on the Scotian shelf in Exploration License 2407, filed with the Canada–Nova Scotia Offshore Petroleum Board.3 The scoping document was open for comments until June 18. The company wants to drill one to three deepwater wells in 2005-07, followed by three appraisal wells in 2008-09. The first well location is in 1,450-m waters, several hundred km southwest of Sable Island.

There were three wells being drilled off Nova Scotia in July (Table 1).

On June 18, Marathon Oil Canada spud the Crimson F-81 well in 2,091 m (6,862 ft) water using with Transocean's Deepwater Pathfinder drillship under a 110-day contract at $157,300/day. The projected TD is 6,524 m and the well had reached 5,229 m as of July 22. Marathon is operator (30%), with partners EnCana Corp. (26%), Norsk Hydro Oil & Gas Canada (25%), and Murphy Oil Corp. (19%).

The Crimson well is about 220 miles east of Halifax and about 5 miles southeast of Marathon's Annapolis-24 well, drilled in 2002. The Annapolis well was the first deepwater well drilled off Nova Scotia, and Crimson is the sixth.

Another exploration well, the Cree I-34, was drilled between Alma and Thebaud platforms, southwest of Sable Island. ExxonMobil Canada spudded the well on May 17, using the Rowan Gorilla V jack up, in water 57 m deep. The total projected depth is 3,962 m, and the well had reached 3,775 as of July 22.

ExxonMobil spud the South Venture-2 development well in 23 m water on June 8, using GlobalSantaFe's harsh environment Galaxy II jack up (Fig. 5). The projected total MD is 5,267 m (5,093 m TVD).

null

Downside

Fewer than 200 wells have been drilled offshore Nova Scotia and much of the shelf and slope is untested. The harsh environment, high costs, and unusually slow bureaucratic response to paperwork have probably contributed to the limited drilling activity.

There were 10 wildcats in 2002-03, and 3 high-profile wells in the last year have had disappointing results.

Imperial Oil Resources Ventures Ltd. and Talisman Energy Inc. drilled the Balvenie B-79 deepwater exploration well to 15,600 ft, about 300 km southeast of Halifax. Imperial abandoned the well because it did not encounter significant hydrocarbons.

Canadian Superior Energy Inc. and El Paso Oil & Gas Canada Inc. drilled the shallow water Mariner I-85 well with Rowan Companies' super Gorilla V jack up. The company abandoned it after El Paso refused to proceed with well testing (OGJ, May 17, 2004, p. 43).

EnCana Corp. (55%), Shell Canada (30%), and Ocean Rig ASA (15%) drilled the Weymouth A-45 well in 5,200 ft water using the Eirik Raude semisubmersible, 60 km west of the Annapolis discovery. The well reached 6,520 m (21,400 ft) after 185 days of drilling. The company abandoned the well in May, after spending an undisclosed sum, widely estimated as more than $100 million (Can.).

Sable Island

According to the Nova Scotia Petroleum Directorate, Lake Ainslie Oil & Salt Co. drilled the first hydrocarbon well onshore in 1869. Nearly a century later, in 1967, Mobil Oil Corp. drilled the first well offshore Nova Scotia. In 1971, Mobil made Canada's first offshore oil discovery at Sable Island.

In 1994-95, Mobil and Shell Canada Ltd. formed the Sable offshore energy project. There are now five partners in SOEP: ExxonMobil Canada Properties Ltd. (50.8%), Shell Canada Ltd. (31.3%), Toronto's Imperial Oil Resources Ltd. (9%), Calgary's Pengrowth Corp. (8.4%; purchased in December 2003 from Emera Offshore Inc.), and Calgary-based Mosbacher Operating Ltd. (0.5%).

Tier 1 of the Sable project includes the Thebaud, North Triumph, and Venture gas fields (Fig. 1, inset). Five wells at Thebaud and 2 North Triumph wells were drilled with GlobalSantaFe's Galaxy II jack up; 5 Venture wells with Rowan's Gorilla II jack up.

Beginning Dec. 31, 1999, the Tier 1 fields began delivering gas to the Maritimes & Northeast pipeline system. The M&NP transports gas from the Scotian offshore through Nova Scotia, to New Brunswick and New England.

The Tier 2 fields include Alma, South Venture, and Glenelg. The group has drilled wells at Alma and at South Venture. Shell drilled the first Glenelg well in 2003 and disappointing results caused the company to depreciate the well costs fully in December, as standalone development was deemed uneconomic.

Shell Canada Ltd. completed construction of the Alma platform last year and began production from Alma, the first of the SOEP Tier 2 fields, in late November 2003. The second field, South Venture, should begin production in late 2004.

In its 2003 annual report, Shell Canada President and CEO Linda Z. Cook anticipated that "new production from South Venture and Alma will help to offset declines in SOEP natural gas production capacity in the near-term." Alma field production contributed 25 MMcfd beginning in December (Shell's share).

Shell Canada's 31.3% share of SOEP gas production averaged 135 MMcfd in 2003, down 14.6% from 2002, due to "natural field decline and well performance issues." The partnership performed workovers on the Tier 1 wells in 2003. Shell Canada had a working interest in 15 productive gas wells in Nova Scotia on 109 acres (gross; 34 acres net), as of Dec. 31, 2003. The company's undeveloped offshore interests cover 2,749 acres (gross; 953 acres net).

In February 2004, Pengrowth and Shell Canada issued revised reserves estimates for Sable, down 28% and 41%, respectively. Shell spokeswoman Jan Rowley said the total reserves at the Sable Island venture are now 1.35 tcf, down 62% from the original 3.6 tcf.

Work continues on the Sable compression platform, expected to be online by 2006.

The heavy-duty harsh environment Galaxy II jack up rig arrived as a newbuild from Singapore on Oct. 26, 1998, and is still drilling off Nova Scotia for ExxonMobil Canada (Fig. 5, photo provided by GlobalSantaFe Corp.).

Onshore Nova Scotia

Nova Scotia's deepest onshore well (14,883 ft) was drilled in 8 months, in 1972-73, by Anschutz Canada Ltd. at Wallace Station, Cumberland County.

Since 1999, eight wells have been drilled onshore, and the Nova Scotia Dept. of Energy expects two more to be drilled in 2004, one by Amvest Nova Scotia Inc. in the Wallace area.

There are currently eight onshore exploration agreements and one coal-bed methane agreement covering 1.6 million hectares onshore, and these include $10 million (Can.) in work agreements through 2007. Devon Canada Corp. controls most of the acreage (nearly 1 million hectares).

Future

Operating companies of all sizes have invested in millions of acres across Atlantic Canada. Continued high gas prices and access to ready markets may drive drilling in a wide range of basins and plays. Onshore exploration would benefit from modern rotary rigs dedicated to the region; many wells are currently drilled with less suitable but readily available mining rigs that must be equipped with blowout preventers.

It is unclear whether large operators will maintain their investments and honor pre-existing work commitments on expensive leases expiring soon. Several new contracts will have to be finalized in the next 60-90 days to prevent any of the five offshore rigs from demobilizing.

References

1. Atlantic Provinces Economic Council, "Major Projects Inventory 2004: What's Next on the Drawing Board for Atlantic Canada," in: Atlantic Report, Spring 2004, Vol. 39, No. 1, http://www.apec-econ.ca/ Spring2004ARhighlights.pdf.

2. Henry, J.D. "Oil Fields of the Empire," 1910.

3. BEPCo Canada Co. project description and scoping document, Apr. 30, 2004, http://www.cnsopb.ns.ca/Environment/evironment.html