Market Movement

Weather triggers record Northeast wholesale price for natural gas

Wholesale prices for natural gas shot up almost 200% to a record $47/Mcf in New York City on Jan. 14—a spike of more than $30/Mcf from Jan. 13—as extremely cold weather moved into the northeastern US.

"The reason is a deliverability issue," explained analysts at Enerfax Daily. "There is plenty of supply around, but no way to get it to the people who need it. There was more demand than pipeline capacity to New York this week."

Winter weather advisories and storm warnings were issued Jan. 15 for much of the US Northeast. Cold weather and strong winds triggered forecasts of dangerous wind chill temperatures as low as –45º F. in eastern Massachusetts.

However, the scramble for natural gas supplies apparently was isolated to New York and therefore was expected to be short-lived. Spot prices for natural gas in most other areas reportedly were slipping as of Jan. 15.

Cold weather also sparked fears of a rapid draw on East Coast inventories of propane late last week. Distributors reported rack prices for propane in that area had spiked in recent weeks but that supplies seemed to be sufficient.

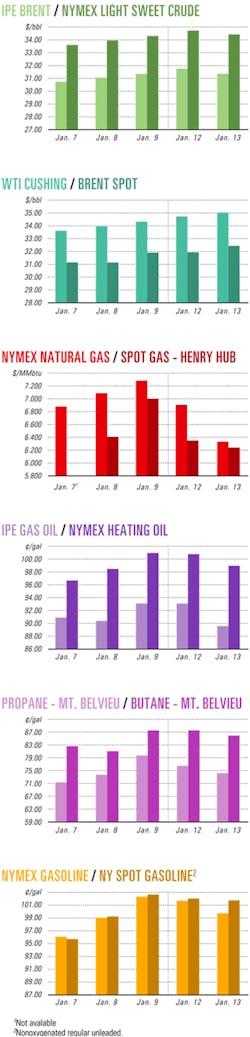

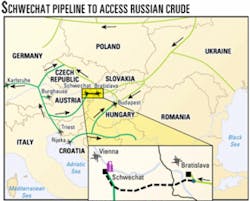

On Jan. 9, the February natural gas contract closed at $7.29/Mcf on the New York Mercantile Exchange, having hit a fresh contract peak and 10 month spot contract high of $7.63/Mcf in overnight trading.

However, that price fell in subsequent sessions as US weather warmed and traders took profits from the earlier rally.

The February natural gas contract plunged by 57.7¢ to $6.33/Mcf on Jan. 13. It inched up to $6.39/Mcf the next day, as traders scrambled to cover open sales position near the end of the NYMEX session and in advance of the latest arctic front. The cash spot market for natural gas remained soft, however.

Early on Jan. 15, the US Energy Information Administration reported 153 bcf of natural gas was withdrawn from US underground storage during the week ended Jan. 9. That was up from 52 bcf the previous week and 136 bcf during the same period in 2003. However, it was less than the consensus amount expected by Wall Street analysts for that week.

US gas storage stood at 2.4 tcf on Jan. 9, representing surpluses of 219 bcf vs. year-ago levels and 184 bcf for the 5 year average.

Oil stocks fall

EIA earlier reported commercial US crude inventories plunged by 5 million bbl to 264 million bbl during the week ended Jan. 9. That was 33.7 million bbl below the 5 year average for this time of year and the lowest level of US oil stocks since the fall of 1975, said EIA officials.

The February contract for benchmark US crude closed Jan. 14 at $34.50/bbl on NYMEX, while on the US spot market, West Texas Intermediate at Cushing, Okla., finished at $34.53/bbl.

"Such thin levels of inventory cover above operational minimum support high prices and add to volatility.

"One needs no other explanation for high prices, and in particular one need not rely on any arguments based on speculative interest," said Paul Horsnell, head of energy research, Barclays Capital Inc., London.

"At this precise instant, the degree of supply flexibility in the world oil system as a whole appears fairly limited. Commercial inventories are low, and there currently appears to be extremely limited spare production capacity anywhere outside Saudi Arabia," he said.

Meanwhile, US distillate fuel stocks rose by 2.8 million bbl to 138.3 million bbl during the week ended Jan. 9, with increases in both diesel fuel and heating oil.

Gasoline inventories increased by 2.1 million bbl to 208.4 million bbl, EIA said.

US refinery inputs averaged less than 15.1 million b/d during the week ended Jan. 9, down by 330,000 b/d from the previous week. "The vast majority of the decline was seen on the Gulf Coast, where crude oil inputs averaged about 7.1 million b/d, the lowest weekly average since the week ended Mar. 21, 2003," said EIA.

US crude imports averaged 9.2 million b/d during the latest week, down by 454,000 b/d from the previous week, "with an increase in the Gulf Coast more than offset by declines in every other region, particularly the West Coast," EIA officials said.

"One might argue over precisely how low crude oil inventories have fallen, but the main point is simply that they are very low indeed," Horsnell said.

"We should expect some upwards drift in crude oil inventories from this point, but it might prove to be a long process before any degree of comfort is reestablished."

Industry Scoreboard

Industry Trends

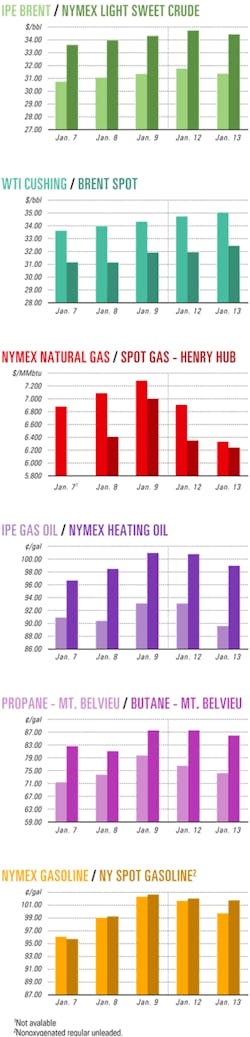

null

null

US OIL FIELD chemicals demand is expected to grow 6.1%/year through 2007 to a value of $4.2 billion.

A recent study from Cleveland-based Freedonia Group Inc. analyzed the current US oil field chemical industry, valued at $3.1 billion in 2002.

The study presents historical demand data for 1992, 1997, and 2002.

It also makes forecasts for 2007 and 2012.

Freedonia said, "Deeper and more-complex wells and a continued move towards drilling in harsher offshore and deepwater environments will boost demand."

"Drilling fluids will provide the best growth opportunities," the study said. Clay and barite are forecast to do well among commodity chemicals, and surfactants and polymers are expected to pace "higher-value products."

However, Freedonia added, despite these positive developments, trends exist that could stifle future market growth.

"Although natural gas production has risen in recent years, oil production continues to fall as US fields reach maturity. Drilling and development moratoria and strong opposition to oil and gas drilling in environmentally sensitive areas—such as the Arctic National Wildlife Refuge and the southern portion of the California coast—will continue to limit drilling," the analyst said.

Products analyzed in the study included drilling fluids, cementing chemicals, biocides, enhanced oil recovery products, stimulation chemicals, and completion and workover fluids.

The largest segment of the formulated products market, drilling fluids, will see "above-average gains and provide the best opportunities for growth through 2007," the analyst said.

Freedonia estimated that growth in drilling fluid demand will average 8.4%/year though 2007.

Freedonia added that commodity chemicals such as clay and barite, which are the most commonly used raw materials in making drilling fluid, also will see rapid growth as drilling activity rises through the time period studied.

Demand for stimulation chemicals is expected to rise to an average of 6.6%/year through 2007.

"Declining oil reserves and maturing US oil fields are expected to require greater amounts of chemicals to improve or maintain production levels," Freedonia said. "In addition, the US government's interest in limiting the nation's dependence on foreign oil will fuel demand for EOR and stimulation chemicals to increase domestic output."

The study also examined the market environment, reviewed oil field technology, detailed industry structure and market share, and profiled 35 oil field service companies.

WORLD CHLOR-ALKALI capacity is on the increase, with one consultant expecting more capacity to be built by 2008 than has been announced so far and that additional capacity is apt to be primarily in northeastern Asia and the Middle East.

Houston-based Chemical Market Associates Inc. recently completed the 2004 World Chlor-Alkali Analysis, which evaluated the market through 2008.

Investment in chlor-alkali capacity slumped in the last 3 years along with a dip in the global economy, but sustainable economics appear to be on the rebound, CMAI said.

Government Developments

EXPORT CONTROL REGULATIONS pose legal and financial liabilities for oil and gas companies operating internationally. It is incumbent upon companies to understand their responsibilities to avoid US and UK export control violations.

In a recent report, Stacey Lax of Ernst & Young LLP used new UK export controls as an example. Policy changes, partially prompted by concerns of terrorism, were not well communicated to the industry, Lax said.

The shipment of certain goods and technology from the mainland UK to the UK Continental Shelf poses liability exposure, Lax said. Industry frequently uses dual-use items, such as optical sensor and laser equipment, that might require licenses under the export controls. These items are considered dual use because they also could be used for military purposes or terrorism.

In order to meet their obligations, oil and gas companies must determine which products require a license under new UK rules, Lax said.

"If an item is allocated under the regulations with a control number, it requires a license to be exported to the UKCS. Upon receipt of the license, holders must have appropriate compliance procedures in place to meet the conditions of the license. Holders may be reviewed every 18 months to ensure compliance with license conditions and if errors are found, the license may be revoked," the analyst added.

Additionally, numerous UK-based companies are subject to US reexport controls when exporting from the UK. That is because the US imposes export control jurisdiction over people, technology, and products from the US wherever those people or items might be located. "These rules potentially limit the activities of companies employing US persons or reexporting US products," Lax said. "The US generally imposes tighter restrictions than the UK on exports to countries where the oil industry is active," including Libya and Iran.

The US government can impose fines and also can deny a company's export privileges, Lax said. "Any noncompliance is therefore a direct threat to a company's business, reputation, and ability to compete effectively."

PUBLIC POLICY GROUPS have urged the US Department of Energy against adopting a proposal to revise the voluntary greenhouse gases (GHG) reporting program by establishing emissions credits.

Washington, DC-based Competitive Enterprise Institute (CEI) and 10 other groups have said that neither the legislation that created the voluntary reporting program nor any other provision of law authorizes the government to establish emissions credits.

The creation of a crediting program for emissions reduction "would create the institutional framework and lobbying incentives for energy rationing," the groups said. "Since credits attain full market value only under a mandatory emissions reductions target, or 'cap,' every credit holder would have a financial incentive to lobby to make 'voluntary' reductions mandatory," the groups said in a Jan. 12 statement to the DOE. Marlo Lewis Jr., CEI senior fellow, said that transforming the voluntary reporting program into an emission reductions credit program "would be both illegal and unwise."

PHASE 6 OF SOUTH PARS field development in the Persian Gulf off Iran kicked off Jan. 5 with the delivery of a 1,500 tonne jacket to the field, the first of three required in this phase, reports Phases 6-8 operator Statoil AS (OGJ Online, Nov. 6, 2002).

The platforms are expected to recover some 650 billion cu m of gas and 700 million bbl of condensate from the field. Drilling of the first wells will begin in February.

The two other jackets are nearing completion at Bandar Abbas, with one due for deployment in late January or early February. Iran's Sadra is fabricating topsides at Busher, Iran, and the first production platform is scheduled to be ready for production in early 2005.

South Pars, the world's largest offshore gas field, extends from the Iranian sector into Qatari waters, where it is known as North field. In North field development off Qatar, Dolphin Energy Ltd. of the UAE awarded a $190 million contract to J. Ray McDermott, Houston, for engineering, procurement, construction, and installation of two integrated drilling and production platforms—DP1 and DP2. They represent part of Dolphin's $3.5 billion project to supply the UAE with as much as 3.2 bcfd of natural gas from North field (OGJ Online, Feb. 6, 2003). Santos Ltd. has awarded a contract to Oceaneering Multiflex, a division of Oceaneering International Inc., Houston, to supply 34 km of umbilicals for Exeter and Mutineer fields off Western Australia. Mutineer-Exeter lies within Exploration Permit WA 191-P in the Carnarvon basin, 150 km north of Dampier (OGJ Online, Oct. 28, 2003). Project partners are Kufpec Australia Pty. Ltd., Nippon Oil Exploration, and Woodside Petroleum Ltd. Woodside Energy Ltd. has selected FMC Technologies Inc., Houston, to supply subsea systems and related services for Woodside's Enfield project, 25 miles northwest of North West Cape off Western Australia. FMC will provide 13 subsea trees, production controls, and associated systems and will furnish technical services related to installation and start-up.

ABU DHABI GAS INDUSTRIES LTD. (Gasco), which plans to increase the gas processing and reinjection capacity of its Habshan gas complex in Abu Dhabi by September, has awarded a $10 million contract to Fluor Corp. for front-end engineering and design services.

Gasco will add a new 350 MMcfd train and install a low-pressure booster compressor, an acid-gas removal unit, and a natural gas liquids unit.

In addition, it will construct a gas pipeline from Bab field to Habshan and an NGL pipeline and high-pressure gas pipeline to Habshan from Abu Dhabi Co. for Onshore Oil Operations's (ADCO) oil field at Bu Hasa.

A reinjection compressor unit at Habshan will supply ADCO with gas for reinjection to Bab field.

Saudi Aramco said it has completed its complex at Haradh, 280 km southwest of Dhahran, Saudi Arabia. The complex consists of a 1.5 bcfd gas processing plant, a 300,000 b/d gas-oil separation plant, and a 130 MMscfd associated gas gathering facility.

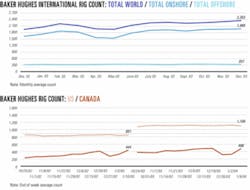

AUSTRIA'S OMV AG and Slovakian state pipeline company Transpetrol—now 49% owned by Russia's OAO Yukos—have agreed to construct and operate jointly a 60 km crude oil pipeline from the 115,000-b/d Bratislava refinery in Slovakia to OMV's 180,000-b/d Schwechat refinery near Vienna. The Schwechat refinery currently is supplied with Russian crude via pipeline from Trieste, Italy. The proposed pipeline will enable OMV to supply its refinery with Russian oil directly.

The proposed $30 million pipeline will have an initial capacity of 72,000 b/d, expandable to 100,000 b/d with installation of additional pumping stations. Pipeline construction is slated to begin by yearend.

In a related contract, Yukos pledged to supply OMV's refinery with as much as 100,000 b/d of Urals crude initially for 10 years, starting with 40,000 b/d in January 2006 (OGJ, Oct. 6, 2003, p. 62).

Petroleos de Venezuela SA (PDVSA) plans to receive bids Jan. 19 for construction of the first section its ICO east-west natural gas pipeline, according to a report in Business News Americas. BNAmericas quoted project coordinator Richard Tahan as saying the contract will be awarded in February, with construction to begin in March or April. The $67 million pipeline will transport 40-100 MMcfd of gas 70 km from Falcon state gas fields to the Paraguana refining complex, starting in January 2005, BNAmericas reported. PDVSA will call for bids in the second half for the $400 million second phase, in which 230 km of pipeline will be added to link Falcon state with PDVSA's eastern transport system. Three compressor stations also will be added to boost total capacity in the east by 520 MMcfd, according to the report. Phase II construction is planned for 2005-06, with operations to begin in December 2006-February 2007.

EL PASO CORP.'s affiliate El Paso Energy Bridge Gulf of Mexico LLC signed agreements Dec. 17 transferring the assets and technology of its Energy Bridge deepwater natural gas port project to Excelerate Energy LP, the operating unit of Excelerate Energy LLC, The Woodlands, Tex.

Under the agreements, El Paso will provide construction, maintenance, and operational support for the first Energy Bridge deepwater natural gas port 116 miles off Louisiana (OGJ Online, May 8, 2002).

Excelerate also inked other agreements pertinent to the port and vessel operations, including a 20 year charter of two Energy Bridge LNG vessels currently under construction at the Daewoo Shipbuilding & Marine Engineering shipyard in South Korea. The vessels, which will contain regasification facilities, will deliver LNG to the proposed moored offshore port, regasify it, and move the gas through 8 miles of proposed high-pressure pipeline to existing subsea gas pipelines to shore (OGJ Online, Dec. 26, 2002).

Advanced Production & Loading AS of Norway will manufacture and install the submerged buoy system, which will be an integral component of the Gulf of Mexico Energy Bridge LNG receiving terminal.

Excelerate said it expects that the US Department of Transportation will issue a license in the first quarter authorizing port construction and operation.

Upon completion, the port would be the first offshore LNG regasification terminal in the world and capable of delivering more than 500 MMcfd of gas. LNG deliveries are scheduled to begin late this year or in early 2005.

BP PLC and partners BHP Billiton Ltd. and Unocal Corp. reported an oil discovery on Green Canyon Block 823 in the deepwater Gulf of Mexico. The Puma-1 exploration well, spudded Aug. 14, 2003, by the BP-operated Ocean Confidence drillship 140 miles off Louisiana, found about 500 ft of net oil pay in Miocene sandstones. The well was drilled to 19,034 ft TMD in 4,130 ft of water 8 miles west of the BP-operated Mad Dog development on Green Canyon Blocks 825 and 826.

Two sidetrack bores also encountered oil in reservoir intervals of a similar age, BHP said.

The partners plan further seismic reprocessing and appraisal drilling to more thoroughly evaluate the size and significance of the discovery, BHP said.

Operator BP holds 51.66% interest in the well, while BHP holds 33.34%, and Unocal 15%.

Apache Corp. has doubled to 800 bcf its estimate of total gross natural gas reserves in John Brookes field in the Carnarvon basin off Western Australia. The Houston independent said the revision was the result of a second appraisal well drilled in early December. The field's discovery well John Brookes-1, drilled in late 1998, found a 311 gross ft gas column at 9,115-9,426 ft in the Cretaceous-age Barrow sandstone group. Flow tests performed on two zones yielded a combined 54 MMcfd of gas and 274 b/d of condensate. The appraisal wells, Thomas Bright-1 and Thomas Bright-2, are in the same reservoir, with consistent gas-water contacts. Over the last 2 years, Apache increased its ownership in the field to 55% from 20% and became the operator. Santos (BOL) Pty. Ltd. holds the remaining interest. On Block 7 in the Atlantic off Mauritania, Dana Petroleum E&P Ltd., operator for Hardman Resources NL and Sydney-based Roc Oil Co. Ltd., said wireline logging at Pelican-1, the first well drilled on the 3.3 million acre license, indicated a gross hydrocarbon column of more than 300 m in the well's primary, Tertiary (Paleocene) target horizon. Several good-quality reservoir sands have been identified in the logged interval, Dana said. It drilled Pelican-1 to 3,825 m TD in 1,700 m of water 150 km north of the Chinguetti discovery. The well encountered oil and gas shows from 3,400 m to TD, and preliminary log and pressure data analysis indicates natural gas to be the primary hydrocarbon. "It is too early to conclude whether Pelican-1 has discovered an independent gas field or a gas cap overlying an oil field," Dana said. The well will be suspended while Dana analyzes all data to determine Pelican's significance and the potential for oil downdip of the drill site. Kerr-McGee Corp., Oklahoma City, spudded an exploration well Dec. 12 on the Dawson Deep prospect on Garden Banks Block 625 about 150 miles off Texas. The 5,760 acre prospect is adjacent the recently commissioned Gunnison spar facility (OGJ Online, Dec. 12, 2003). The well, in 2,900 ft of water, will be drilled to 22,000 ft TVD (23,700 ft TMD). Operator Kerr-McGee holds a 25% interest in the venture. Partners are McMoRan Exploration Co. 30%, an unnamed private company 20%, Nexen Petroleum Offshore USA Inc. 15%, and Cal Dive International Inc 10%.

DRILCORP ENERGY LTD., Calgary, reported its Kakwa 06-31-62-03W6 well was placed on production Jan. 4 and during the first week of production averaged 1 MMcfd of sweet natural gas and 32 b/d of natural gas liquids. Kakwa field, immediately west of Jayar field in western Alberta, is about 100 km south of Grand Prairie.

At Bulwark, near Alliance in central Alberta, operator Drilcorp has contracted a service rig to recomplete two wells—01-29 and 16-20 in 38-12W4—for the production of Viking oil and gas. These wells offset the Bulwark Viking oil pool that Drilcorp placed on production in November and December 2003. Bulwark currently is producing 425 Mcfd of natural gas and 28 b/d of sweet, light crude oil.

China's CNOOC Ltd. said reservoir characteristics and the geological structure of some CNOOC producing fields—including heavy crude discoveries QHD 32-6 and PL 19-3 in Bohai Bay off China—have proven complex, impacting next year's production and costs.

In addition, CNOOC's PY5-1/4-2 field in the eastern South China Sea is slower in ramping up production than budgeted.

"These difficultiesUare expected to remove 5-6 million boe of production from planned 2004 targets," said Zhou Shouwei, president of CNOOC Ltd.

However, "costs are projected to come down again in 2005," noted Fu Chengyu, chairman and CEO.

A CONTRACT has been awarded to Parker Instrumentation, a division of Parker Hannifin Corp., Barnstaple, UK, to supply valves and compression tube fittings worth more than $250,000 for upgrading the 140,000 b/d Basra refinery in southern Iraq. South Refining Co. operates the facility.

Parker expects to provide the components during the first quarter, including more than 1,000 new ball valves to be used as isolation mechanisms for the refinery's instrumentation and control network.

The project is part of the upgrading of Iraq's three main refineries in Basra, Baiji, and Daura (OGJ Online, Sept. 9, 2003).