Oil sands drive Canada's oil production growth

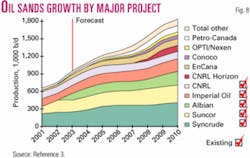

Forecasts show that bitumen production from Canada's oil sands may exceed 1.8 million b/d by 2010 up from an average 920,000 million b/d in 2003. This additional production will come from both surface-mined bitumen and bitumen recovered with such thermal processes as cyclic steam stimulation and steam-assisted gravity drainage (SAGD).

Other technologies under test, such as a solvent-aided process (SAP) and vapor extraction (VAPEX), may further help increase the recovery from this immense resource base that the Alberta Energy and Utilities Board (EUB) estimates has 1.6 trillion bbl of bitumen in place.1

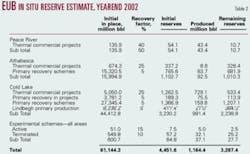

At yearend 2002, EUB estimated Western Canada's remaining established bitumen reserves at 174.4 billion bbl, of which 11.6 billion bbl were in areas under active development (Table 1). Because of the ongoing expansion in the active area, EUB's scheduled mid-2004 reserves update may alter significantly the reserves in the active areas.

Athabasca (near Fort McMurray), Cold Lake (near Lloydminster), and Peace River are the three main areas of Western Canada that contain bitumen resources (Fig. 1). Oil sand deposits are commonly found near surface and are a mixture of sand saturated with water and an almost solid hydrocarbon called bitumen.

To develop these resources requires companies to create a manufacturing process that integrates production, upgrading, transportation, and marketing. Typically the projects are developed in stages to maintain a long production plateau of 20-30 years, instead of the short production peak rates of conventional oil production projects.

In its March 2004 oil sands update, Alberta Economic Development (AED), an Alberta government ministry, listed more than 40 major oil sands projects either under way or planned.2 These include both new projects and planned expansion of existing projects.

Reserves estimates

EUB based its reserves estimate on drilled holes and well logs. For Cretaceous sand bitumen, it used a minimum saturation cutoff of 3% by mass of bitumen and a minimum 1.5-m saturated zone thickness for in situ and primary areas, and 6% by mass and a minimum 3-m saturated zone thickness for surface-mineable areas.

For bitumen in carbonate deposits, EUB used a minimum bitumen saturation of 30% of pore volume and a minimum 5% porosity cutoff.

Within these cutoffs for nonactive areas, EUB selected a recovery factor of 20% for thermal developments and 5% for primary development, factors which are lower than in active projects to account for uncertainty in the recovery processes and for areas with poorer-quality resources.

For the active projects in Peace River and Athabasca, EUB used recovery factors of 40 and 50%, respectively.

EUB identified potential mining areas using economic strip ratio criteria, a minimum saturation cutoff of 7% by mass of bitumen, and a minimum 3-m saturated zone thickness cutoff to obtain an initial volume in-place of 59.1 billion bbl. After applying reduction factors for inaccessible areas, isolated ore bodies, and extraction losses, it estimated an initial mineable bitumen resource of 35.2 billion bbl of which about 25% were under active development.

The mineable bitumen is all in the Wabiskaw-McMurray sands of the Athabasca area and lies at a depth shallower than 250 ft.

EUB estimates that at yearend 2002, remaining established in situ reserves were 141.9 billion bbl of which 3.3 billion bbl were in active development areas (Table 2).

Mines

The current technique for oil sands mining is first to remove the overburden and then to mine the mixture of bitumen, water, and sand from just below the surface using shovels and trucks. This material is mixed with warm water in an extraction plant to separate the crude from the sand.

From there, the extracted crude enters an upgrader for processing into a synthetic crude (SCO) that refineries use as a feedstock. SCO has a density and viscosity similar to conventional light-medium crude oil.

EUB forecasts that SCO production will increase to 1.48 million b/d in 2012 from the 0.44 million b/d in 2002.

Upgraders chemically add hydrogen to bitumen, subtract carbon from it, or both.

The process also removes most sulfur either in elemental form or as a constituent of oil sands coke.

Most companies stockpile oil sands coke, with some burned to generate electricity.

Companies either stockpile elemental sulfur or ship it to facilities that convert it to sulfuric acid, used mainly in the manufacturing of fertilizers.

AED indicated that production from the three active bitumen-mining operations was about 560,000 b/d in 2003.

Suncor Energy Inc., from its mining project, averaged 217,000 b/d in 2003 up from about 206,000 b/d in 2002. The company expects to produce 225,000-230,000 b/d in 2004. The production from this mine started in 1964, and cumulative production in 2004 reached 1 billion bbl.

EUB estimates that the overall liquid yield factor for the current Suncor delayed coking operation is about 0.81.

Suncor currently has finished 45% of the construction of the Millennium vacuum unit, which it says is on schedule and on budget. With completion of the Voyageur project it expects production, including that from its in situ Firebag project, to reach 330,000 b/d in late 2007.

Syncrude Canada Ltd. production averaged about 212,000 b/d in 2003, down from about 230,000 b/d in 2002 as a result of an unscheduled coker turnaround and extended maintenance.

Production in December 2003 was 264,000 b/d.

AED says Syncrude has completed Train 2 at the Aurora Mine and more than 35% of the first Upgrader Expansion 1 (UE1) at Mildred Lake. Both projects are part of Stage 3 of the Syncrude 21 expansion program, which may increase the company's oil sands production by 100,000 b/d.

The completion date for Stage 3 of the Syncrude 21 expansion is now mid-2006 and estimated costs for Stage 3 have increased to $7.8 billion (Can.) from $5.7 billion previously.

Syncrude plans to complete Stage 4, which includes Aurora Train 3, and further upgrader expansion in 2009.

EUB estimates that the current yield for Syncrude fluid coking/hydrocracking upgrader is 0.85.

In the newest producing mining project, Albian Sands Energy Inc.'s Muskeg River mine, about 75 km north of Fort McMurray, averaged 130,000 b/d in the last quarter of 2003, up from 115,000 in the previous quarter.

Production operations began Dec. 29, 2002, from the 155,000 b/d design capacity project.

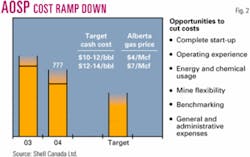

The Muskeg mine is part of the integrated Athabasca Oil Sands Project (AOSP) that also includes the Scotford Upgrader, near Edmonton, and the Corridor pipeline.

AOSP is a joint venture between Shell Canada Ltd., 60%, Chevron Canada, 20%, and Western Oil Sands LP, 20%.

EUB expects the overall liquid yield factor for the Shell upgrader using a hydrocracking process to be at or more than 0.90.

Shell Canada indicates that the unit costs in 2004 will average more than $22/bbl (Can.), although its target is a $12-14/bbl unit costs at recent natural gas prices (Fig. 2).

Shell says the project contains 1.6 billion bbl of bitumen resources, but that all its leases in the area contain about 9 billion bbl and will support additional projects.

Its plans include an expansion of the existing mine that will increase production by about 70,000 b/d and a second mine called Jackpine that will provide an additional 300,000 b/d in two phases, to be completed in 2010-15.

The Jackpot mine Phase 1 recently received regulatory approval.

Canadian Natural Resources Ltd.'s (CNRL) received regulatory approval for the Horizon project, an $8 billion (Can.) mine and upgrader development with a 270,000 b/d design capacity. CNRL expects construction to commence in 2005 with initial production in 2008 and full production in 2011.

EUB expects the CNRL upgrader with delayed coking will have about a 0.86 liquid yield factor.

Imperial Oil Ltd. announced plans for the Kearl oil sands project, a mine and upgrader project with a 100,000 b/d initial and 200,000 b/d final design capacity.

AED expects Imperial to receive regulatory approval in 2005 with first production starting in 2010.

TrueNorth LP continues to defer construction of the regulatory approved Fort Hills oil sands mine and extraction plant project, 90 km north of Fort McMurray. AED indicates that TrueNorth is investigating options to reduce the initial phase of the project to support a production of 50,000 b/d with an on site upgrader. The original application called for $3.5 billion (Can.) that would support a minimum 190,000 b/d and recover 2.8 billion bbl during a 40-year life.

AED says Synenco Energy Ltd.'s formal disclosure document for its Northern Lights project remains on file.

The project includes an integrated mine, extraction plant, and upgrading facility with a design capacity of 100,000 b/d and an estimated construction cost of $4-5 billion (Can.).

It says that if Synenco receives regulatory approval, the project may start in 2007 with peak production in 2010.

Another project AED noted involves the Fort McKay First Nation that has discussed plans for a 35,000 b/d oil sands mining project near Fort McKay that does not include an upgrader. Two stand-alone upgraders in the oil sands region are the Husky Energy Ltd. Lloydminster and New Grade Energy Ltd. Regina upgraders.

AED says Husky Energy is proceeding with engineering for debottlenecking and increasing on-stream reliability to increase the Lloydminster capacity to handle 82,000 b/d by yearend 2004 from the current 77,000 b/d.

BA Energy Ltd. also plans to construct a standalone upgrader with a bitumen-processing capacity of 50,000 b/d and design capacity of 150,000 b/d in Strathcona County, Alta.

AED expects BA Energy, subject to regulatory approval, to begin operations in the last half of 2006.

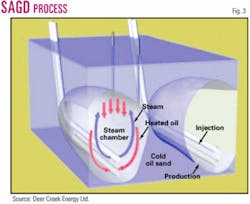

SAGD producing projects

After many years of pilot testing, companies have concluded that steam-assisted gravity (SAGD) is commercial. SAGD requires a pair of horizontal wells, one above the other with the laterals spaced about 15 ft apart (Fig. 3).

The process continuously injects steam into the top lateral, forming a steam chamber that grows and heats the surrounding bitumen to allow it to drain by gravity into the lower horizontal lateral.

Steam quality, oil-in-water emulsions, limits on steam-oil-ratio, and effect of the high temperature on artificial lift and tubulars are some of the technological challenges that concern operators in SAGD operations.

Most projects add a diluent such as propane plus (natural gas condensate) to the produced bitumen before transporting it in a pipeline. Other diluent options include naptha, light crude oil, and synthetic oil.

EnCana Corp. says its Foster Creek project was Canada's first large-scale commercial SAGD project, starting up in 1997.

After adding six new well pairs, production from the project has increased to 28,000 b/d.

As in many SAGD projects, cogeneration is an integral part of the project that adds steam-generation capacity and provides electricity sales to the Alberta power grid.

The company has applied for regulatory approval for Phase 2 of the project, which would increase bitumen production by 50,000 b/d. AED expects construction to start in 2004 with bitumen production starting in 2006.

EnCana's other SAGD project is at Christina Lake in northeast Alberta, which produces about 5,300 b/d from four well pairs and has a 10,000 b/d design capacity. At Christina Lake, EnCana also has a solvent-aided process (SAP) under test.

The process adds small amounts of solvent to the injected steam to decrease bitumen viscosity.

EnCana says its SAGD projects have the lowest steam-oil ratio in the industry of 2.5 bbl of water/1 bbl of oil produced and its long-term objective is to reduce this ratio further.

In 2004, it expects a 38,000 b/d production from its SAGD projects, compared to the 27,000 b/d average in 2003.

In September 2002, Petro-Canada started injecting steam in its 100% working interest MacKay River steam-assisted gravity drainage (SAGD) project. The company expects the $290-million (Can.) project to recover bitumen from oil sands lying at about a 300-ft depth (OGJ, Nov. 11, 2002, p. 55).

It estimates that the 11.5 sections in the current development contain 230-300 million bbl of recoverable bitumen reserves, providing enough resources to produce for at least 25 years.

The project consists of well pads and facilities, a central processing plant, and a short lateral pipeline connecting to export facilities.

MacKay River began producing in the fall of 2002 and produced an average 16,000 b/d in 2003. For 2004, Petro-Canada expects to produce an average 25,000 b/d in the facility designed for handling 30,000 b/d.

Steaming in Suncor's Firebag SAGD project (Fig. 4) commence on Sept. 14, 2003, with first oil delivered to the oil sands upgrader on Jan 12, 2004. Firebag is adjacent to Suncor's bitumen mining operation. Suncor says Stage 1 of the project consist of two wells with 10 well pairs on each pad that drain 781 acres.

The company currently is developing Stage 2 of the project that will include an additional two well pads with 10 wells on each, draining 831 acres.

Suncor plans to complete enough wells to maintain a bitumen fill rate to its plant with a design capacity of 35,000 b/d.

It expects the wells to produce for about 10 years, and its plans call for drilling another 40 well pairs during the 30-year life of the plant.

Firebag wells are completed at a depth of about 1,050 ft. The Stage 1 wells have horizontal laterals of about 3,300 ft that run in a north-south orientation, while the horizontal laterals in Stage 2 wells will have lengths of 3,300-3,950 ft. Suncor also has oriented Stage 2 wells in a north-south direction except for 1 pair that has an east-west orientation.

Japan Canada Oil Sands (JACOS) operates a SAGD pilot on the Hangingstone lease and has plans for a commercial SAGD project with a design capacity of 30,000 b/d.

In April 2004, Deer Creek Energy began steam injection in Phase 1 of its SAGD Joslyn oil sands project, designed to produce about 600 b/d. The company expects construction of the $270 million Phase 2 of the project to begin later in 2004. This phase would increase production to 10,000 b/d by 2007.

Deer Creek also is evaluating a third phase that would increase production to 30,000 b/d.

SAGD planned projects

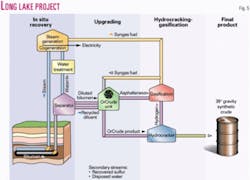

The OPTI Canada Inc. and Nexen Inc. Long Lake project, about 40 km southeast of Fort McMurray, will be the first project to combine SAGD with a field upgrading facility.

The companies plan to commence Phase 1 in 2006 with an upgrader designed to produce 60,000 b/d of 39° gravity synthetic crude from a 72,000 b/d of bitumen inlet stream.

The plans for the project include a second phase that will double production by 2010.

The companies expect to commence SAGD production in 2006 with the upgrader starting in 2007.

OPTI/Nexen says Long Lake Lease 27 covers 20,000 hectares and contains more than 4 billion bbl of bitumen in place.

Phase 1, which covers 6,700 hectares, has more than 1 billion bbl of recoverable bitumen that can sustain a 60,000 b/d production of synthetic crude for more than 40 years, according to the companies.

The project includes the use of partially upgraded bitumen with OPTI's proprietary OrCrude process, followed by conventional hydrocracking and gasification (Fig. 5).

Phase 1 plans include completing 60-70 horizontal well pairs, each 1,000 m long with expected production of 1,000-1,500 b/d of bitumen from each pair. The company plans to drill the wells from centralized well pads with slant rigs and expects to need about 350 additional well pairs during the life of the project to sustain production rates.

OPTI/Nexen notes that a main advantage of the upgrading technology is that the process eliminates the need from purchasing natural gas, a volatile cost component of SAGD operations.

The companies estimate that this gives the project a $5-10/bbl (Can.) cost advantage over other SAGD operations.

Instead of gas, the process uses asphaltene residue to produce most of the fuel gas and hydrogen required for the operation, cogeneration facility, and upgrading components.

The companies explain that the OrCrude process forms a continuous loop that completely processes the bitumen, leaving only source synthetic crude oil and liquid asphaltenes, and does not generate solid coke by-products that require disposal

Another project, ConocoPhillips' Surmont Project, a $1 billion (Can.) SAGD in situ facility with a design production capacity of 100,000 b/d, received regulatory approval in May 2003.

AED expects construction of the first phase to commence in 2004 with initial production in 2006.

Devon Energy Corp. $400 million (Can.) Jackfish SAGD project, near Conklin, Alta., is awaiting regulatory approval and has a design capacity of 35,000 b/d. AED expects production to start in 2007.

Husky Energy Ltd. is also awaiting regulatory approval on its Tucker 30,000 b/d SAGD Tucker thermal project application. The company expects production to start in 2006.

Husky also has a second planed SAGD project, the Sunrise Thermal project.

Phase 1 is designed to produce 50,000 b/d, and the company says expansions will increase production to more than 200,000 b/d during the 40-year life of the project.

It plans for production to commence in 2008.

BlackRock Ventures Ltd. is advancing its application to develop the in situ Orion EOR Project at Hilda Lake. The company expects regulatory approval in 2004 or 2005.

The project may support a production of 20,000 b/d.

BlackRock produces about 8,000 b/d of bitumen from its Seal project that is a cold production facility.

The company expects to increase production to 16,000 b/d by yearend 2004.

Other processes

Shell Canada's Peace River leases currently produce about 9,000 b/d through cyclic thermal in situ recovery processes from wells, some of which have multilateral completions.

The company estimates that its Peace River lease contains about 7 billion bbl of bitumen in place.

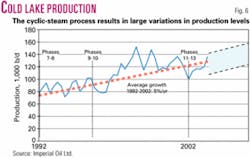

By far the largest cyclic steam project is Imperial Oil Ltd.'s Cold Lake project that in 2003 produced an average 129,000 b/d up from 112,000 b/d in 2002.

Production from the pilot projects in the field started in 1964. Imperial notes that production from the area can result in large variations (Fig. 6).

null

The company has filed an application to construct and operate two additional phases to the Cold Lake Project, the Nabiye and Mahihkan North projects (Phases 14-16), which it expects will add 30,000 b/d by 2007.

Another project in the Cold Lake area, is CNRL's Primrose-Wolf Lake-Burnt Lake oil sands project that includes both cyclic steam injection and SAGD.

Currently the project produces 35,000 b/d, but CNRL has regulatory approval to increase the output to more than 120,000 b/d.

Besides thermal projects, Devon Canada operates the Dover VAPEX pilot project.

The process has a pair of horizontal lateral similar to SAGD but uses solvents instead of steam.

Projections

Onno DeVries, general manager, oil sands and oil markets, Canadian Association of Petroleum Producers, Calgary, presented CAAP's estimates for the growth in Canada's crude oil production and supply at a recent NPRA meeting.3

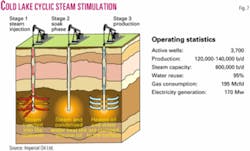

CAAP says that by 2010 oil sands production will exceed 1.8 million b/d while operating costs will remain in the $8-12 (Can.)/bbl range (Fig. 7).

CAAP estimates the 1996-2002 period saw a $24 billion (Can.) investment in oil sands, with a further $7 billion currently under construction for 2002-2006, and an additional $25 billion in announced project at various stages.

CAAP also believes the bitumen blend sold into the North American market will change as availability of gas condensate for use as a diluent (Dilbit blend) becomes more scarce. It expects synthetic oil (Synbit blend) to replace condensate. From a refining perspective it says the Dilbit blends are predominantly heavy, whereas the Synbit blends result in similar products to medium type, sour crude.

References

1. Alberta's Reserves 2002 and Supply/Demand Outlook 2003-2012, Statistical Series 2003-98, Alberta Energy Utility Board, June 2003.

2. Oil Sands Industry Update, Alberta Economic Development, March 2004.

3. DeVries, O., "Western Canadian Crude Oil Supply and Markets, 2002-2010," NPRA Annual Meeting, Mar. 21-23, 2004.