What Newfield Exploration Co., Houston, said is likely to become the deepest well on the Gulf of Mexico shelf might spud before the end of 2004.

The well will face high geological and mechanical risks as it tests objectives from 27,000 ft to more than 30,000 ft subsea. These risks are more than offset with recovery potential amounting to potential fields that could contain several trillion cubic feet of recoverable gas, said David A. Trice, Newfield president and CEO.

Newfield has been working 3 years on the play, which it acquired with the assets of EEX Corp. in 2002. With the signing of recent agreements, Newfield has tapped into the knowledge and experience of the world's largest two companies, Trice said.

Well planning for the first well was under way in April and May.

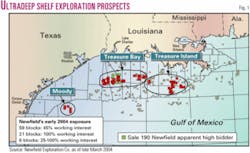

Newfield holds interests in 83 gulf blocks associated with the Treasure Project (Fig. 1, red and green blocks). The aim is to evaluate the prospectivity of South Louisiana sediments (Eocene Wilcox) where they occur on the gulf shelf in shallow water at undrilled depths.

Newfield described the shelf ultradeep play as a 2-5 year play. The company continues to market its interests in other prospects and expects to find more partners in the next 1-3 years to carry its interests. Newfield has 12-15 prospects in the Treasure Bay area.

Treasure Island

ExxonMobil Corp. in late April signed letters of intent with Newfield, BP Exploration & Production Inc., and Petrobras America Inc. to drill the Blackbeard West Prospect in Newfield's Treasure Island play.

ExxonMobil will operate the well, which is contracted to spud by Jan. 31, 2005. The prospect covers four blocks in South Timbalier and two in Ship Shoal.

Newfield will be carried for a 23% working interest in the prospect "to the objective depth, subject to certain limitations," Newfield said.

The Blackbeard prospect is subject to a 1.25% overriding royalty interest held by the Treasure Island Royalty Trust, which was established in connection with Newfield's acquisition of EEX (OGJ Online, June 4, 2002).

"The sole purpose of the trust is to hold nonexpense bearing overriding royalty interests in future production from the ultradeep zones of the Treasure Island area," Newfield said.

Treasure Bay

Petrobras America made a firm commitment to drill one exploration well and has the option to drill a second exploration well to earn an interest in all of Newfield's Treasure Bay leases.

A letter of intent signed in late April calls for Petrobras America to acquire a 30% working interest in the Treasure Bay Project area off western Louisiana.

BHP Billiton Petroleum (Deepwater) Inc. is operator of Treasure Bay with a 44% working interest, and Newfield retains a 26% working interest.

Substantially all of Newfield's interest in the initial well, and the option well if drilled, will be noncost bearing. Initial drilling to test prospects in the Treasure Bay area is expected in 2005.

Newfield and BHP Billiton jointly own 60 lease blocks associated with the Treasure Bay project. The Treasure Island Royalty Trust does not hold any interests in the Treasure Bay area.

Moody (see map), with ownership similar to Treasure Bay, is a 10,000-acre ultradeep prospect in 1,200 ft of water in East Breaks.

Newfield in the gulf

Newfield has been increasing its exploration spending on absolute and percentage bases the last few years to 35% of its 2004 capital budget.

Half of the company's production and 40% of its reserves are in the gulf, and it also participates in deepwater exploration.

The company holds interests in 1.7 million gross lease acres, including 249 blocks in shallow water and 85 blocks in deep water.

Newfield has more than 150 production platforms on the shelf and operates nearly 530 MMcfed of gross production.

"This infrastructure is an advantage both in the traditional shelf play and in the underlying deep trends," Newfield said in its 2003 annual report.

For instance, it brought the 2003 West Cameron 73 deep shelf discovery on line in the fourth quarter by buying an existing platform from another operator. The discovery well found more than 250 ft of net gas pay, and Newfield may drill a second well this year. It is operator with 70% working interest.

The majority of the company's new leases are related to deep shelf prospects below 15,000 ft and ultradeep shelf trends below 20,000 ft.

Newfield was successful at 12 of 17 deep shelf wells in the last three years, including four successes in six attempts in 2003.

"Deep shelf prospects typically have little or no supporting seismic amplitude anomalies and are located in geopressured environments," Newfield said.