Market Movement

Traders expect $40/bbl crude

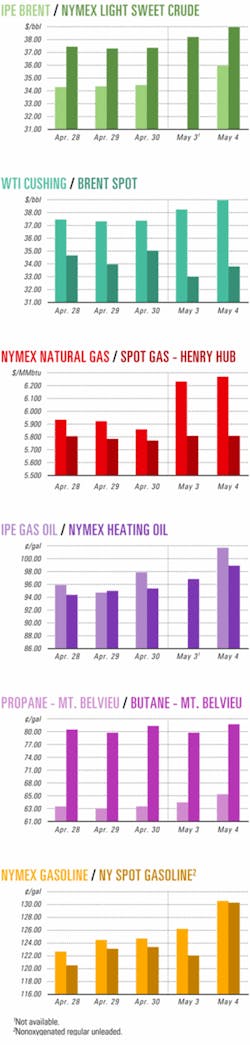

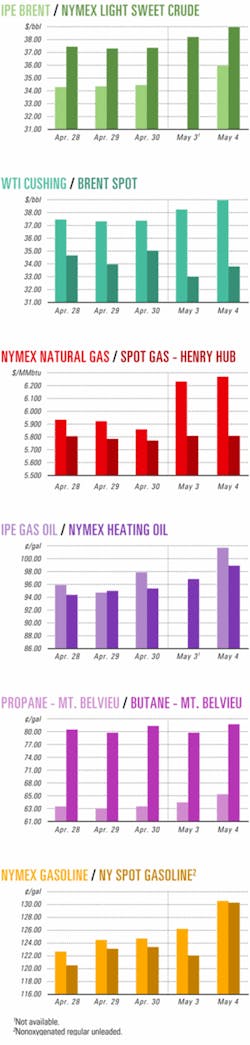

Traders last week were predicting that crude futures prices would soon push past $40/bbl because of continued political instability and escalating violence in the Middle East. Widespread anti-US sentiment in the Middle East in the wake of reported abuse of Iraqi prisoners by US-led coalition forces fanned fears that escalating violence could threaten crude supplies from that area and helped push energy futures prices to new highs last week, analysts said.

On May 3, the June contract for benchmark US sweet, light crudes jumped by 83¢ to $38.21/bbl, the highest crude settlement price on the New York Mercantile Exchange since Oct. 16, 1990. The price of that contract continued climbing over the next two sessions to $39.57/bbl on May 5.

The International Petroleum Exchange in London was closed May 3 for a public holiday. But when trading resumed, its June contract for North Sea Brent crude escalated by $2.24/bbl over the next two sessions to a May 5 closing price of $36.72/bbl, its highest level since the 1990 Gulf War.

Traders worried that US crude prices could "shoot through the roof" in anticipation of supply shortages if terrorist attacks on Middle East oil facilities continue, analysts said. Crude prices are likely to remain at historically high levels because of political unrest in Iraq and Saudi Arabia, they said.

"Even though the consensus outlook is still that West Texas Intermediate spot prices will drop below $30/bbl in the second half of 2004, we believe that full-year projections have to continue to rise, especially given the persistent strength in the second quarter," said Robert S. Morris, analyst with Banc of America Securities LLC, New York. "In fact, similar to last year, the surprise may still be that oil prices don't pull back as much as the consensus is expecting."

The biggest risk to current crude price levels, he said, "is a sharp slowdown in the Chinese economy, which accounts for roughly one third of our 2.6% projected increase in global crude oil demand this year."

Some analysts contend that the resulting harm to the economies of major consumer countries from rapidly escalating crude prices eventually will force the Organization of Petroleum Exporting Countries to increase production. However, OPEC members so far have resisted such pressures, blaming rising prices on speculators and political forces beyond their control.

Obaid bin Saif Al-Nasseri, UAE's energy minister, said OPEC members may decide to increase their production quotas in the third quarter to calm market fears and replenish stocks in industrialized countries. He acknowledged that some members have proposed hiking OPEC's price band above the $22-28/bbl set in 2000. "However, they didn't officially float these proposals and they may be raised at the next OPEC meeting on June 3 in Beirut," he said.

Gasoline, natural gas prices climb

Near-month gasoline contracts also set new records for high prices in 9 out of 10 NYMEX trading sessions from Apr. 22 through May 5, as US gasoline inventories remained at critically low levels ahead of the traditional start of summer demand on Memorial Day, May 31. With refinery bottlenecks contributing to that shortage, US consumers this summer likely will pay the highest gasoline prices seen in years, analysts said.

Recent escalation of energy prices "has been heavily centered on dislocations in the US gasoline market. Over the past week, June gasoline futures have risen by $4.37/bbl, three times the pace of the rise in crude oil prices. As a result, gasoline crack spreads are manifesting a severe spike," said Paul Horsnell, Barclays Capital Inc., London, in a May 5 report.

The June natural gas contract also registered record highs in three consecutive NYMEX trading sessions starting May 3 and closing at $6.31/Mcf on May 5. That market was "overbought," said analysts at Enerfax Daily. However, they noted, "Talk about hot summer forecasts, a busy hurricane season, and tight coal supplies continued to keep the bulls running, particularly with crude oil [prices] still strong. But with storage inventories fairly high, many expect mild spring weather early this month to limit further cash gains, despite longer-term concerns about sagging production and dwindling imports from Canada."

"Based on normal temperatures and no production interruptions due to hurricanes in the Gulf of Mexico, our models reveal that minimal [300 MMcfd] industrial demand will need to be 'backed out' this summer in order to refill storage by the start of next winter," said BAS's Morris. "A warmer-than-normal summer is now widely forecast, along with another active hurricane season, which could then push natural gas prices to a level necessary to back out additional industrial demand or prompt switching to distillate fuel oil."

Industry Scoreboard

null

null

null

Industry Trends

SAUDI ARAMCO could rely on "intelligent" well technology for 30% of its wells within 10 years.

A senior executive made that suggestion last week during an Offshore Technology Conference news briefing in Houston. He was announcing the first well completion in Saudi Arabia using technology from the Halliburton Co.-Royal Dutch/Shell Group joint venture WellDynamics.

The WellDynamics system was installed in a trilateral maximum reservoir contact well, Shaybah 119, in southern Saudi Arabia's Empty Quarter.

Nansen Salieri, manager of reservoir management for Aramco, said the state-owned company plans to evaluate four or five intelligent wells using technology from WellDynamics and its competitors before yearend.

"Advanced well completion is one of our technology focus areas, and we firmly believe that smart-well technology will contribute to our goals of improved reservoir management with maximum recovery while reducing well count," he said.

At an average cost of $1 million/well, Salieri said intelligent completion technology is too expensive to be widely applied. But within 10 years, it could become an industry standard.

Aramco executives said the company might expand the technology to other fields during the next 5 years, but they do not anticipate applying the technology to all fields.

"Generalities do not apply," Salieri said, adding that the technology is emerging. "Six months from now, we'll know 10 times more than what we do now."

But if those results are not as promising as the company hopes, then Aramco has other options to consider, Salieri said.

WORLD OIL investment hinges upon uncertainties associated with future oil demand levels, policy developments, and technological advances.

That consensus was reached by participants of a joint workshop in Paris last month organized by the International Energy Agency and the Organization of Petroleum Exporting Countries. It was the second annual workshop examining IEA's World Energy Investment Outlook and OPEC's oil outlook.

"A pivotal area in shaping the flow of investment to oil development is the Middle East," said IEA Executive Director Claude Mandil. "Although the costs of developing the region's vast resources are lower than anywhere else in the world, financing this investment will be determined partially by perceptions of security risk, but even more so by national decisions establishing the pace of resource exploitation." The amount of net earnings that national oil companies can retain for investment depends upon broader national budget needs, he said.

"Financing new projects could become a problem where the national debt is already high, and national considerations discourage or preclude private or foreign investment," he said. "If the projected amount of investment in the Middle East is not forthcoming and production does not, therefore, increase as rapidly as expected, more capital would need to be spent in other, more costly regions." Regarding Russia, Mandil said "Maintaining the momentum of the rebound in Russian production and exports will be difficult." That momentum requires that new production be brought on stream, that oil export pipelines be expanded, and that the government stabilizes legal and tax regimes for investors, he added.

Government Developments

LOUISIANA GOV. KATHLEEN BLANCO (D) urged the US Federal Energy Regulatory Commission to approve a proposed LNG receiving terminal in southwestern Louisiana.

During the Offshore Technology Conference in Houston last week, Blanco met with various industry executives as part of the Louisiana state government's efforts to woo oil and gas investment back into the state.

"We're on the verge of developing new industry," she told reporters.

Houston-based Cheniere Energy Inc. has spent 4 years planning a 2.6 bcfd onshore facility at Sabine Pass, La., and state and company officials are hopeful that construction could start early next year (OGJ Online, Dec. 23, 2003). If that timetable is realized, gas could be available for the 2007-08 heating season, Cheniere executives said. The company expects that natural gas prices will remain robust enough 3 years from now to justify the plant without the need for tax incentives from the state—despite a growing number of LNG project proposals across the US.

To move the Cheniere project proposal forward, FERC representatives met with Sabine Pass area residents in March.

"A very loud chorus of support was the message FERC took home to Washington, DC," a spokesman for the governor said.

Blanco told reporters that she has written FERC, urging commissioners to shorten the approval process so that permits could be ready by yearend. She indicated her desire to ensure that any proposed LNG terminal "gets done properly" regardless of whether or not the approval process is streamlined.

Currently, Louisiana has one LNG facility, which is at Lake Charles. Blanco expressed no specific preference for the location of future facilities, predicting that both onshore and offshore plants might be built in the state.

A RECENT POLL shows that 71% of Ontarians surveyed said they believe the Canadian government should keep its 19% interest in Petro-Canada.

Ipsos-Reid Corp., Toronto, conducted the poll on behalf of the Communications, Energy, & Paperworkers Union of Canada and the Council of Canadians. The majority of Ontarians polled said they want the Canadian government to keep its interest in Petro-Canada in order to maintain Canadian influence and to ensure that country's future energy security.

In late March, the Canadian government announced its intention to sell its remaining 49 million Petro-Canada shares during fiscal 2004-05. Timing and details of the anticipated share sale is to be at the government's discretion.

Petro-Canada's interest in repurchasing any of those shares will be determined at the time of the sale, based upon market conditions and competing priorities, company executives said.

"We will work with the government to ensure an effective placement of the shares in the market," said Harry Roberts, Petro-Canada's chief financial officer. "The government has been a supportive shareholder all along, so this change will not affect Petro-Canada business strategies or daily operations."

Ipsos-Reid conducted the telephone poll Mar. 30-Apr. 1 by interviewing a randomly selected sample of 1,000 adult Canadians.

Quick Takes

Repsol-YPF SA signed a 30-year production-sharing contract with Staatsolie, the state oil company of Suriname, for oil exploration and production on Block 30, which lies 100 km off Suriname in the Guyana-Suriname basin, where oil currently is produced from Tambaredjo and Calcutta fields. The PSC includes a 6-year exploration period, Repsol-YP said. Suriname has both land and marine border disputes with Guyana. A joint border commission is looking into an incident in which Suriname sent a gunboat to expel employees of CGX Energy Inc., Toronto, from a drilling site on Corentyne Block (OGJ Online, July 26, 2000). The commission also is working to facilitate resumption of field activity in the disputed area.

Statoil ASA spudded its first oil exploration well on its Linerle prospect in the Norwegian Sea. The prospect, which lies about 20 km northeast of Norne field, is on Block 6608/11 in Production License 128. The well is being drilled by Stavanger-based Smedvig ASA's dynamically positioned West Navigator deepwater drillship through a $13 million contract (OGJ Online, Feb. 2, 2004). The Linerle prospect, which is thought to potentially contain oil, belongs to a sequence that also includes the Svale and Falk structures, where recoverable oil deposits have already been proven, Statoil reported. The well, which was spudded Apr. 30, is expected to be drilled in 20 days.

Foreign oil companies, especially independents, still will have plenty of bidding choices later this summer even though Brazil is slightly paring back its sixth exploration and production licensing round this August, government officials said at the Offshore Technology Conference in Houston last week. Brazilian officials with the country's National Petroleum Agency (ANP) said a recent move to pull 61 tracts from consideration in order to collect more data for environmental reviews will not change the round's appeal with industry. "It won't impact things at all because there are plenty of remaining blocks," said John Forman, ANP director of exporaion. Sixteen foreign companies have shown interest in Round 6. Industry participation is expected to be robust because of encouraging seismic information collected for state-owned oil company Petroleo Brasileiro SA. Forman expects the round to be held on or about Aug. 17 in Rio de Janeiro. ANP said there now would be 914 blocks offered for bid: 295 onshore, 454 in shallow water, and 165 in deep water. The excluded tracts lie in Barreirinhas and Santos deepwater areas but should be available next year when a new round takes place.

Unocal Corp. said its Tobago prospect well found oil on Alaminos Canyon Block 859 in the deepwater Gulf of Mexico. The well, drilled to 18,510 ft, discovered 50 ft of net pay i high-quality sandstone. A sidetrack drilled to 18,425 ft further delineated the well. Together, the well and sidetrack cost $25 million. The Tobago well, which was temporarily plugged, confirmed that Tobago could be part of a future Alaminos Canyon area development, said Unocal, which operates Tobago with 40.01% interest. Partners are Shell Oil Co. 30%, ChevronTexaco Corp. 16.66%, and Calgary-based Nexen Inc. 13.33%.

ENI Petroleum Co. Inc. contracted Intec Engineering Partnership Ltd., Houston, to provide technical support for subsea production facilities in deepwater K2 field on Green Canyon Block 562 in the Gulf of Mexico. K2, in 3,900-4,300 ft of water, includes a two-to-three well cluster in the North Fault Block area and one or two wells in the South Fault Block area, all to be tied back 8 miles to a host tension leg platform. Production, designed for a capacity of 60,000 b/d of oil, is slated to start up in March 2005. Contracts for dual insulated 7-in. pipeline within 12-in. pipe flowlines and umbilical installations are scheduled for this spring. Norwegian authorities approved Statoil's development plan to install a third template for the Åsgard Q project in the Norwegian Sea. Statoil, operator of the Norwegian Sea Åsgard license—once called "the most daring and complex subsea project ever launched"—plans to increase oil recovery by 26 million bbl from Smørbukk, one of three Åsgard fields (see map, OGJ, Aug. 17, 1998, p. 66). The field's Smørbukk South deposit is tied back to the Åsgard A production ship. Last year, Statoil launched efforts to improve oil recovery because Smørbukk South drainage was not optimal. The template was recently stabilized on the seabed, and the first well to be drilled through this structure was spudded, with production expected to come on stream Jan. 1.

BP West Java awarded a $65 million engineering, procurement, and construction contract to a joint venture of the offshore division of Perth-based Clough Ltd. and Indonesian-owned PT Petrosea for BP's APN natural gas field development in the West Java Sea off Java. APN field lies about 100 km northeast of Jakarta in 15-45 m of water. The engineering JV will install three monopod platforms that are linked by 28 km of 24-in. infield pipeline. The new facilities will be tied into an existing facility 50 km away via a 24-in. trunk line. Also, modifications to the existing facilities are reuired to allow the integration of the gas into the system, JV partner Clough said. The JV expects to complete work on the field by first quarter 2005. The field will supply gas to meet the needs of West Java.

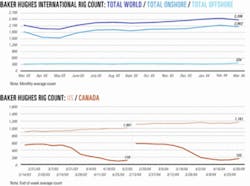

US drilling activity rebounded the week ended Apr. 30 with 1,161 rotary rigs working, up by 15 from the previous week and the largest number since the week ended Sept. 28, 2001, when the count was at 1,168 and falling. Land operations led the rebound, up by 12 units to 1,040 rigs. Offshore operations increased by 3 rigs to 96 in the Gulf of Mexico and 98 for the US as a whole. Inland waters activity was unchanged with 23 rigs working. That compares with a total 1,001 active rigs during the same period last year. Canada's rig count increased by 3 to 96, down from 106 a year ago. Calgary-based Antrim Energy Inc. signed a drilling contract for an undisclosed sum with Transocean Sedco Forex Inc. unit Sedco Forex International Inc. for Antrim's first offshore exploration well on its South Galapagos prospect on Australia's North West Shelf. The well will be drilled using Transocean's Sedco 703 semisubmersible drilling rig, which is currently operating in the area and might be available to start drilling operations as early as September, Antrim reported.

ConocoPhillips awarded Halliburton Co. unit Sperry-Sun Drilling Services a 3-year contract to provide North Sea integrated drilling services with two additional options for up to 3 years each. The contract is estimated to be worth $130 million for the first 3-year duration, and if all extensions are granted, it could be worth $300 million, a Halliburton spokeswoman said. Sperry-Sun will provide directional drilling, measurement-while-drilling, logging-while-drilling, mud logging, and surveying services. Fundamental to this contract is Sperry-Sun's second-generation, point-the-bit rotary steerable service. Other technologies involved in the contract will provide ConocoPhillips with wireline-quality formation evaluation services.

Devils Tower field on Mississippi Canyon Block 773 in the Gulf of Mexico was brought on stream May 5, said operator Dominion Exploration & Production Inc., New Orleans. The field is expected to produce 60 bcf of natural gas within a year. Mississippi Canyon 773 A-1 is the first of eight completions expected to be brought on stream in sequence through the first quarter of 2005. Devils Tower production flows through a spar floating production facility in 5,610 ft of water. Williams Cos. Inc. owns the spar. Dominion E&P Pres. and CEO Duane Radtke said Devils Tower is the fourth producing property in the company's deepwater portfolio. BP Trinidad & Tobago LLC awarded Fluor Corp. additional contract work worth about $20 million toward the engineering and construction of BP's new offshore gas processing platform and other facilities in Trinidad and Tobago. Aliso Viejo, Calif.-based Fluor will team with two Trinidadian firms to provide front-end engineering and design, project engineering, procurement, and construction management services for BP's project. The project consists of an unmanned offshore platform designed to process 1 bcfd of natural gas, a subsea pipeline to a nearby platform, and a land-based facility to collect and meter nearly 3 bcfd of gas. The project is scheduled for completion in June 2005.

PAKISTAN's Federal Minister for Petroleum and Natural Resources Nouraiz Shakoor invited foreign investors to participate in a $1 billion refinery proposed for Pakistan, in exploration blocks, and in gas storage facilities at Gwadar for Balochistan Province and in storage facilities for the hilly areas of the country. Saying at a press conference that there was a need for both upstream and downstream investment in Pakistan's oil and gas sector, Nouraiz said he hoped in fiscal year 2004-05 to surpass the record $800 million provided by foreign investors in all sectors of oil and gas in Pakistan during fiscal year 2003-04. He said the feasibility study for the $3 billion Turkmenistan-Afghanistan-Pakistan oil pipeline would be completed by June, and project construction could begin by yearend 2005. Nouraiz said that a consortium of companies would be formed later this year to fund the pipeline.

Shell Canada Ltd. selected Fluor for a $300 million project to help Shell meet Canadian government regulations for ultralow-sulfur diesel. Under terms of the contract, Fluor will design and construct new diesel hydrotreater units at two Shell refineries: Scotford refinery near Edmonton and Montreal East refinery in Quebec. Scotford has a 97,900 b/d capacity and Montreal East has a 129,900 b/d capacity. Fluor has completed the front-end engineering and design work and is moving forward with engineering, construction, procurement, and construction management. The project is scheduled for completion in early 2006, ahead of the government's June 1, 2006, requirement. PetroChina Co. Ltd. (PetroChina) has selected UOP LLC's Unicracking technology for a new hydrocracking unit to be built at Dalian Petrochemical Co. in Dalian, China. The project will expand PetroChina's total refinery capacity to 400,000 b/d. Basic engineering design of the unit is under way. Commissioning is slated for third quarter 2006. Des Plaines, Ill.-based UOP's technology was chosen to produce high-quality diesel and jet fuel products from 71,000 b/d o vauum gas oil feedstock. The new unit will be configured as a single-stage recycle unit with parallel reactors to process several alternate feedstocks over a wide conversion range, UOP said. MOL PLC awarded Honeywell International Inc., Morristown, NJ, a $5.8 million contract to oversee installation of automation equipment and services at a new gasoline desulfurization unit at MOL's 161,000 b/d Szazhalom- batta refinery in Hungary. Honeywell Hungary is the automation contractor, providing third-party instrumentation and engineering services. The contract work is expected to reach completion by June 2005.

Kinder Morgan Inc., Houston, awarded a multimillion-dollar contract to Dresser-Rand Co., Olean, NY, for three heavy-duty reciprocating compressors for use in carbon dioxide applications at a Snyder, Tex., gas plant. No other details were given in that deal. The equipment is scheduled for delivery at midyear from Dresser Rand's facility in Painted Post, NY. F

EURONAV SA, the Belgium tanker subsidiary of Cie. Maritime Belge, and partners reached an agreement to acquire four double-hull ultralarge, 442,500 dwt crude carriers: Hellespont Alhambra, Hellespont Tara, Hellespont Fairfax, and Hellespont Metrop- olis. The ships, to be delivered in May and June, will be renamed TI Asia, TI Europe, TI America, and TI Africa. The vessels will trade through the Tankers International pool, a fleet pool of 46 very large crude carriers. The vessels were built at Daewoo Shipbuilding & Marine Engineering in South Korea during 2002-03.

SUNCOR ENERGY INC. subsidiary Suncor Energy Products Inc., Sarnia, Ont., is investigating St. Clair Township, in the Sarnia-Lambton region, as a site for its proposed world-class ethanol plant (OGJ Online, Feb. 16, 2004). The $120 million plant is designed to produce more than 200 million l./year of ethanol beginning in 2005. It would utilize 18-20 million bushels/year of mostly Ontario-grown corn to make ethanol that would be blended into gasoline, which also would be sold through other wholesale and retail channels. Suncor said it plans to use thermal oxidizer technology, which scrubs emissions and reduces odors, at its proposed ethanol plant.

CORRECTION

In a report prepared for its Group Audit committee (GAC), Royal Dutch/Shell Group outlined how its former top executives knew and argued about a reserves reporting problem for 11/2 years before informing the public. Due to a typographical error, that timespan was incorrectly reported as 101/2 years (OGJ, Apr. 26, 2004, p. 20).