US E&D operations focus more on gas, resource plays

This snapshot of exploration and development highlights in the US reflects more focus on gas than oil and onshore a shift to unconventional resource plays.

Many operators now limit the exploration component of their capital spending to 10-20%, leaving most dollars for exploitation.

As one explorationist recently pointed out, this cannot go on forever without a new crop of discoveries. However, unconventional plays represent vast resource potential and do not necessarily require "new field discoveries" in the historic sense.

A resource play is a low permeability zone with large areal extent that can be economically exploited using modern technology by companies that hold enough acreage to drill hundreds or thousands of wells, Mark Papa, EOG Resources Inc., Houston, said recently.

Technologies important to resource plays include horizontal drilling, innovative completions, and the wellbore manufacturing culture to drive down costs.

North American hydrocarbon basins are neither dead nor dying; rather they are evolving toward massive, low permeability plays to turn resources into reserves, Papa said.

More companies are investigating the resource potential of unconventional formations. For example, Vintage Petroleum Inc., Tulsa, earmarked 15% of its $38 million US exploration budget to assess the potential of unconventional resource projects in various basins.

What follows is a sample of 2003-04 E&D action in the US.

Alaska

Gov. Frank Murkowski launched a drive on Mar. 31 to lease state offshore acreage opposite the Arctic National Wildlife Refuge and the National Petroleum Reserve-Alaska on the eastern North Slope.

Murkowski proposed to offer 350,000 acres off ANWR and 670,000 acres off NPR-A as early as late 2004.

Alpine field on the western North Slope produced its 100 millionth bbl of oil earlier than expected in early November 2003, after going on production in late November 2000. Field owners have at least more than three times that volume left to recover.

Operator ConocoPhillips, now the state's busiest driller, was proceeding with a project to boost production capacity to 140,000 b/d later this year from 105,000 b/d (OGJ Online, Mar. 4, 2004). Alpine is the largest onshore oil field discovered in the US in more than 10 years.

Environmental review continued for development of Fiord, Nanuq, Lookout, Spark, and West Alpine fields, all to be produced through Alpine production facilities.

Total, Paris, planned to drill the first of several wildcats 50 miles southwest of Alpine field in NPR-A.

Kerr-McGee Corp. is drilling the Nikaitchuq prospect as operator with 70% working interest. The company holds 12,000 acres on 8 leases and options on another 50,000 acres in the Milne Point extension area. The target is the Sag River formation, and a first well established the presence of hydrocarbons 5 miles from previous production.

Pioneer Natural Resources Co., Dallas, and the Alaska unit of Armstrong Oil & Gas Co., Denver, are evaluating the commerciality of a Jurassic oil discovery, Ooguruk. The firms drilled 3 wells in 2003 in an area where they have a 63,000 acre position, including lands farmed out from ConocoPhillips. Ooguruk, in 2-3 ft of water northwest of Kuparuk River field.

Evergreen Resources Corp., Denver, is pursuing a coalbed methane play with 300,000 acres in the Cook Inlet basin north of Anchorage. Next up is a pilot project in the area where the company perceives a possible resource of 200 tcf.

California

Plains Exploration & Production Co., Houston, was looking forward to multiwell development of deeper formations in its Inglewood field near downtown Los Angeles, where shallow oil production dates to a 1924 discovery.

The field's shallow Pliocene Vickers and Rindge sands produce 7,000 b/d of 23° gravity oil. Plains began sales Mar. 10 from an 8,000-ft hole that stabilized at 300 b/d of 43° gravity oil and 3 MMcfd of gas at 1,100 psi from the Bradna and Sentous formations (Fig. 1). Two other formations are prospective in the well.

Productivity, porosity, and sand thickness are better than were expected before interpretation of 3D seismic data, the company said. The company hopes to encounter 300,000 to 700,000 bbl recoverable per well.

Plains plans to spud a well in May at Point Arguello Unit in the Santa Barbara Channel (OGJ, Nov. 17, 2003, p. 40). Goal is to drill 18,000-ft laterals at 8,000 ft TVD taking 90-120 drilling days, and tapping 50-75 million bbl of light oil reserves.

Plains, Point Arguello operator with 50% working interest, hopes to get approval to develop the adjacent Bonito and Sword Units.

Montana foothills

Canadian and US companies may pursue deep hydrocarbons in the Montana foothills west of Great Falls.

PYR Energy Corp., Denver, which holds 100% working interest in 230,000 net acres, said extensive geologic and seismic analysis identified numerous structural culminations of similar size, geometry, and kinematic history as prolific Canadian foothills fields such as Waterton and Turner Valley.

Suncor Energy Inc.'s Suncor Energy Natural Gas America Inc. (Sengai) unit signed an option agreement with PYR in March that could result in the drilling of 1 or 2 wells on PYR's acreage, known as the Rogers Pass exploration project.

Only one well has been drilled on the acreage. That well, the Unocal 1-B30, in 30-14n-5w, Lewis and Clark County, was drilled in 1989 to 17,818 feet, and was plugged and abandoned after testing (see map, OGJ, Aug. 3, 1992, p. 67). It remains the state's deepest hole.

PYR said, "Recent improvements in seismic imaging and prestack processing have resulted in our belief that this test well was drilled based upon a misleading seismic image and was located significantly off-structure."

Williston basin

St. Mary Land & Exploration Co., Denver, has been a participant in the Williston basin since 1991.

The company has had a 92% drilling success rate, due in large part to its ability to map structure and porosity development in Ordovician Red River in Montana and North Dakota.

St. Mary Land also participates with 22,000 acres in the horizontal Devonian Bakken dolomite play. Completions range from 250 to 650 b/d of oil and reserves from 350,000 to 750,000 bbl/well. The dolomite lies 20-30 ft below the densely drilled Bakken shale.

The company will drill 9 single and dual lateral wells this year and at least 9 in 2005.

Petrosearch Corp., Houston, and affiliates reignited the Lodgepole reef play on 45,000 acres of holdings in Slope and Stark counties, ND.

Powder River coals

The Powder River basin coalbed methane play produces 950 MMcfd from more than 12,000 wells, state records show.

Production averages more than 800 MMcfd from Wyodak coals on the east side of the basin and 125 MMcfd from more recently exploited Big George coals on the west side.

The overall play covers 100 miles north-south and 60 miles east-west, and Wyoming regulators estimate 25 tcf recoverable. Cumulative production exceeds 1.2 tcf.

Western Gas Resources Corp., Denver, and partner Williams Cos., Tulsa, averaged 122 MMcfd of Powder River CBM production in the fourth quarter of 2003. They plan to drill 800 wells in 2004, compared with 600 in 2003.

The companies have 3,900 wells either producing or waiting on completion and hold more than 1 million gross acres. Western has drilled less than 35% of the 529,000 net acres it holds and recovered less than 10% of its acreage's potential producible volume.

In the Big George coals, WGR is the largest acreage holder. Among the other Big George players are Anadarko Petroleum Corp. and Marathon Oil Corp., both of Houston, Devon Energy Corp., Oklahoma City, and Yates Petroleum Corp., Artesia, NM.

Cumulative production from Big George coals stands at 57 bcf.

Green River basin

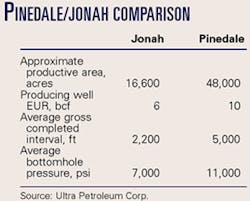

Pinedale anticline and Jonah field, in the northern Green River basin southwest of the Wind River mountains, are producing a combined 1.1 bcfd of gas. Estimated ultimate recovery (EUR) is pegged at 14-16 tcf, and the estimate has risen markedly in recent years as operators applied new fracturing technology and increased well density.

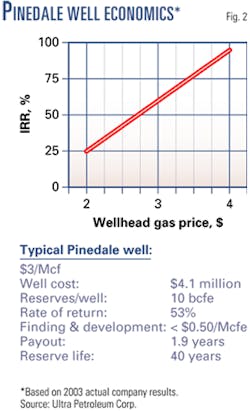

Ultra Petroleum Corp., Houston, was to spend $160 million this year, up 45% from 2003, to participate in 80 gross wells (Fig. 2).

Ultra holds 101,000 net acres in Pinedale Anticline and Jonah fields and operates over 60% of its acreage. The company has 3,200 net producing acres in the two fields and is the largest working interest owner in Pinedale Anticline field, which it believes will have EUR exceeding 20 tcf of gas.

Low permeability Cretaceous Lance sand is productive from 500 wells on 25 sq miles making more than 750 MMcfd in Jonah field. EnCana Corp., Calgary, Jonah's largest operator, believes Jonah recovery will total 8.5 tcf of the 10 tcf of original gas in place.

Lance at Pinedale Anticline field produces from 210 wells on 75 sq miles making more than 400 MMcfd. Neither gas in place nor recovery factor has been estimated, said Michael Watford, Ultra chairman, president, and CEO (see table, p. 36).

"Given the simple amount of data we have currently, it's hard for us to imagine the anticline not being minimally two times Jonah, which if you use EnCana's number would be 17 tcf," Watford said.

Ultra picks up additional reserves by drilling numerous wells 800-1,000 ft deeper into Cretaceous Mesaverde at a cost of $500,000-750,000 drilling cost below the Lance. Those 70 completions have averaged 2 bcf/well in the Mesaverde.

Utah

The Utah Geological Survey obtained federal funds for a 3-year study of the Mississippian Leadville limestone exploration play in Utah and Colorado.

Leadville has produced more than 53 million bbl of oil from 6 fields in the northern Paradox basin of both states. However, only 100 exploratory wells have penetrated the formation in 7,500 sq miles.

The study will address exploration methods and costs, geologic setting, and production methods.

Houston Exploration acquired its first acreage in the Rocky Mountains in 2003 and now holds more than 200,000 acres in Utah, Wyoming, Montana, and the Dakotas.

Its initial focus area is 60,000 acres around Natural Buttes gas field in the Uinta basin, where it plans to drill 15 more wells this year.

Colorado

Patina Oil & Gas Corp., Denver, operates about 95% of the 3,200 wells in which it holds interest in giant Wattenberg gas and oil field in the Denver-Julesburg basin. The company spends about $100 million/year in Wattenberg and accounts for nearly one third of the field's production.

After several years without activity, Lexam Explorations Inc., Toronto, signed an agreement in February 2004 with a private Dallas independent to explore the San Luis basin in Saguache and Alamosa counties (OGJ, Sept. 1, 1997, p. 78).

EnCana with 18 rigs and Williams with 10-12 rigs dominate activity in the Piceance basin. Tom Brown Inc., Denver, which participated in 36 Piceance wells in 2003, plans to run as many as 3 rigs in the South Parachute area in 2004. At 300,000 acres it has the basin's second largest net acreage position. Much of the activity is in tight gas sands south and west of Rifle in Rulison, Parachute, South Parachute, Plateau, and Grand Valley fields.

Only 2-3 companies are exploring in the Paradox basin, says Tom Brown. Its net production averaged 53 MMcfed in 2003, and proved reserves were 125 bcfe at yearend.

Key property is Andy's Mesa field, where the company boosted gross field EUR fivefold to 128 bcfe since acquiring it from Unocal in 1999. The field is expanding to the south and has significant potential, the company said.

Evergreen Resources Corp., Denver, is building CBM production in the Raton basin, where company reserves were 1.4 tcf and production 127 MMcfd at yearend 2003.

Evergreen's 2004 budget is $110 million for the drilling of 200 wells.

With deeper Vermejo coals all but drilled up, Evergreen is concentrating on the shallower Raton seams. The coals are interbedded with tight sands.

New Mexico

Burlington Resources Inc. averaged a net 546 MMcfd of gas, 31,300 b/d of NGLs, and 1,200 b/d of oil from the San Juan basin in 2003. Of that, 347 MMcfd and all of the NGLs came from the tight Mesaverde formation, which consists of the Lewis shale, Cliffhouse, Menefee, and Point Lookout sands.

BR's total also included a net 199 MMcfd from more than 1,700 completions in the Fruitland Coal, where the state approved infill drilling on 160-acre units in the high-productivity part of the coals.

Oklahoma

Chesapeake Energy Corp., Oklahoma City, was operating 48 rigs in late March as the second most active US driller. The company has 80% of its operations in the Midcontinent.

The basin's largest acreage holder is Apache, and its planned 88 wells in the Anadarko exceeds the company's drilling pace of 10 years ago. The company's drilling outlook is for 220 wells in 2004 in the Permian, Anadarko, and East Texas basins.

St. Mary Land said it has produced from 18 Morrow pay intervals and identified 5-7 more potential Morrow pay zones at Northeast Mayfield field, Beckham County, Anadarko basin.

So many wells have been drilled through the Morrow section that the company has been able to map the irregular shaped sand bodies, reducing the risk of their exploitation. Some of the sands lie below 19,000 ft.

St. Mary Land's net production from the field was 9.6 bcfe in 2003, up from 3.7 bcfe in 2002. It budgeted 23 wells there this year versus 16 in 2003.

Kansas

Evergreen Resources acquired a combined 667,500 acres in eastern Kansas.

In the Forest City basin the company plans to drill more than 60 wells this year and have 100 wells on production or testing by the end of the year. The lands, mostly in Jackson, Atchison, Doniphan, and Brown counties, have prospective pay zones in more than 12 coal seams, more than 6 shales, and 3-6 sands in the Labette, Cabaniss, and Krebs formations of Middle Pennsylvanian age.

Anadarko completed a 5-well CBM exploration program in the Forest City basin in Kansas last year. The project is in the initial exploration phase pending evaluation of core data.

Arkansas

Southwestern Energy Corp., Houston, said two wells 6 miles west of production on the Ranger anticline in Yell and Logan counties may indicate that gas-filled Pennsylvanian Borum sands could extend over a much larger area than originally thought.

Smith 1-10 tested at 2.7 MMcfd, and 1 mile south the Doggle 2-15 logged more than 350 ft of pay. Southwestern is operator with 100% interest in both wells.

Houston Exploration plans to spend $23 million to drill as many as 70 wells in 2004 in the Arkoma basin, where it drills mostly in eastern Sebastian and western Logan counties, Ark. It has 3 rigs running on wells that seek gas in Pennsylvanian Atoka, which the company downspaced last year to 80 acres/well. The wells average 500 MMcf to 1 bcf of reserves, and drilling costs are $450,000-650,000/well to an average 5,500 ft. The company produced 23 MMcfed in the Arkoma in 2003.

Louisiana

Anadarko's 2004 plan called for drilling 205 wells in the Bossier play in East Texas and North Louisiana, including 6 exploration wells.

It planned to run 13 rigs in East Texas, two more than in 2003, and continue with 9 in Louisiana.

Bossier contributed 122 bcf of gas or 19% of the company's gas production, making it Anadarko's largest onshore gas area. Exploration leasing continued last year, bringing the leasehold to 478,000 net acres.

Vernon field in Jackson Parish was producing 141 MMcfd of gas net to Anadarko from 123 wells at the end of 2003, about double the yearend 2002 rate (Fig. 3). Anadarko drilled 49 wells, all successful, at Vernon last year and had 124,000 net acres at yearend.

St. Mary Land completed the first horizontal James lime well in Spider field, southwestern DeSoto Parish, across the Toledo Bend reservoir from Huxley field, where 5 horizontal completions at 6,200 ft TVD averaged 2.3 MMcfd of gas.

St. Mary plans 7 Spider wells in 2004. The first potentialed at 3 MMcfd. Drilling time has declined to 17 days from 24 and with it the cost to $1 million from $1.4 million.

Shelf operator Energy Partners Ltd., New Orleans, is drilling its first "onshore" well, an 18,500-ft test at West White Lake field in Vermilion Parish. Interests are EPL and Samson Resources Co., Tulsa, each 50%. Potential is more than 100 bcfe at the $7 million swamp wildcat.

Alabama

Energen Resources Corp., Birmingham, Ala., was to spend $10 million in the Black Warrior basin to drill 45 infill wells and on other projects.

Palmer Petroleum Inc., Shreveport, completed its 7th producing well in North Monroeville field in Monroe County.

The 1 Williams, in 1-6n-7e, flowed 627 b/d of oil with 110 Mcfd of gas from perforations at 11,174-178 ft in the Frisco City sand of Jurassic Haynesville.

Mississippi

Clayton Williams Energy Inc., Midland, Tex., is drilling the Weyerhaeuser-1, in 11-21n-10e, a 15,500-ft exploratory well in Webster County, Miss.

The well targets the Ordovician age Deep Knox Trend. This is the first well on the company's 47,000-acre lease block in the Black Warrior basin. Drilling operations should be completed in the second quarter of 2004.

null

The drill site is 15 miles northwest of Maben field in Oktibbeha County, where Total E&P USA Inc. produces gas mostly from Knox.

With 10 Maben wells on line, Total recently plugged back one well for the field's first Pennsylvanian completion. It averaged 8.5 MMcfd of gas from perforations at 9,160-70 ft.

Texas

Panhandle

Brigham Exploration Corp., Austin, was drilling a deep test to Hunton and Arbuckle in Mills Ranch field and planned to drill two others later this year. Projected total depths are 24,500 ft.

West

Tom Brown is involved in a horizontal fractured Devonian play in the Deep Valley area of eastern Reeves County. The reservoir at 13,500-16,500 ft TVD is giving up reserves that average 7 bcf/well to as high as 16 bcfe on 320 acre spacing. Each well has a 3,000-4,000 ft lateral. IP was 15 MMcfd at the last well.

The company said Devonian has more than 100 bcfe of net unbooked potential, and underlying Ellenburger has infill potential.

Anadarko said its 100% owned Haley 41-1 and 18-1 wells in Loving County in an emerging tight gas play in the deep Delaware basin were economic successes. The company was drilling the Black Tip State 1 outside the Haley area.

Gulf Coast

Brigham Exploration Co., Austin, said Vicksburg development opportunities centered on Brooks County on the Lower Gulf Coast represent 37% of its 2004 drilling budget. The company is building on its Home Run, Triple Crown, Floyd, and Floyd South field discoveries.

Noble Energy Corp. plans to drill 6-10 more wells this year in a 3D amplitude play in Duval County.

Five successful of 6 exploratory wells drilled since July 2003 led to December 2003 net production of 11 MMcfed. Well costs are $1 million for a dry hole, $1.5 million completed. Reserves are 3-6 bcf/well, and Noble has 85-100% working interest.

Noble will drill 6-10 more wells in the play in 2004.

Vintage plans more horizontal drilling this year in Darst Creek and Luling fields east of San Antonio. The company completed 5 infill horizontal wells there as operator with 100% working interest in 2003 producing a gross combined 837 b/d of oil.

The company is also pursuing company generated Oligocene and Miocene prospects based on 3D seismic and geochemical surveys.

South

Houston Exploration is running 6 rigs and adding more acreage in South Texas. Its holdings are mainly in Webb and Zapata counties, and it has 1,200 sq miles of 3D seismic data in the area.

It drills mainly to the Wilcox-Lobo sands at 8,000-12,500 ft at $1.1-2.5 million/well and on average adds 1-2 bcf/well. It operates 476 wells on 65,000 net acres in the area and averaged 140 MMcfed in 2003. Houston plans to spend $113 million in South Texas this year.

Pogo Producing Co., Houston, had 79 prospective well locations remaining in Los Mogotes field, Zapata County, of which it budgeted to drill 34 this year. It drilled 29 wells there in 2003.

East

Gas recovery from the East Texas Bossier play reached 2.1 tcf at the end of 2003, Anadarko said (OGJ Online, Jan. 30, 2004).

Tom Brown said its 2 Crossman well, location unspecified, will open a new area of Bossier production. The well targets the overpressured Cotton Valley expanded section with more than 600 bcfe of gross potential. The company said it hopes to be able soon to reveal results of the well, in which its working interest is 86.25%.

Comstock Resources Inc. has a $20 million 2004 budget to drill 6 wells in the Double A Wells deep Woodbine field area of Polk County.

It spent $8 million in 2003 to drill 3 delineation wells on the Ross prospect just south of Double A Wells. The company has 3D seismic data over the 2,000 acre Ross prospect and the 4,000 acre Robin prospect farther south.

Davis Petroleum planned two development wells in Polk County near the Davis PDB-1 well at the Seven Oaks area. It flowed 926 b/d of oil and 1.3 MMcfd of gas from Cretaceous Woodbine. Pogo has a 70% interest.

Anadarko was participating in a 197 sq mile 3D spec seismic survey in the Dallardsville area of the deep Woodbine play, with data being acquired by Seismic Associates in Polk County.

North

Burlington Resources, which entered the Fort Worth basin Barnett play with a 2002 acquisition in Denton County, employed as many as 9 rigs and drilled 163 wells during 2003. This hiked its Barnett production to 34 MMcfd of gas, 4,100 b/d of NGLs, and 1,100 b/d of oil at yearend 2003.

Quicksilver Resources Inc. has accumulated about 100,000 acres in the Barnett shale play area (OGJ, Jan. 19, 2004, p. 45).

Gulf of Mexico

Mobile offshore drilling units in the gulf were at 66.9% utilization the week of Mar. 19, said ODS-Petrodata Consulting & Research, Houston (OGJ Online, Mar. 19, 2004).

Gulf rig demand was at a 59-month low with 109 units on the job out of 163 available.

BP operates the Mad Dog spar development in 4,400 ft of water at Green Canyon 826. The Mad Dog hull arrived in the gulf in January 2004 and is to deliver first oil by March 2005. Risked at 200-450 MMboe, Mad Dog is to peak at 80,000 b/d of oil and 50 MMcfd of gas.

Agip's K2 field, discovered in October 1999 in around 4,000 ft of water on Green Canyon 562, is a subsea development to be tied back to Anadarko's Marco Polo field TLP on Green Canyon Block 608, installed in January 2004.

Development drilling is under way. K2, at an unrisked 55-125 million boe, is to start up in the second quarter of 2005 and peak at 50-65 boed.

BP is drilling Mad Dog Deep, a St. Malo-type Lower Tertiary trend play deeper than Mad Dog's Miocene reservoir. Another Lower Tertiary wildcat between Trident and St. Malo, the Sardinia prospect in the Keathley Canyon area, is spudding. St. Malo is in the Walker Ridge area.

Devon, with 22.5% interest in St. Malo, is drilling the Jack prospect on Walker Ridge 759, west of St. Malo. The company drilled more than 100 seabed core holes to define the prospect.

Kerr-McGee said Gunnison field in Garden Banks 668, which started up in December 2003, should reach 30,000 b/d of oil by yearend 2004 as wells are completed. Facilities capacity is 40,000 b/d and 200 MMcfd.

Kerr-McGee has 40 blocks in proximity to Gunnison and plans to drill 3-4 satellite prospects this year.

Murphy Oil Corp. has a 37.5% interest in the Thunderhawk prospect, on Mississippi Canyon 734, is syncline separated from the gulf's massive Thunder Horse oil and gas field. Projected total depth is 27,146 ft MD in 6,100 ft of water on the prospect, rated at 200-400 million boe of potential.

Murphy Oil plans to drill the 200-400 bcf rated South Dachshund prospect in the eastern gulf's southern Sale 181 area in the fourth quarter of 2004.

Michigan

Michigan operators have drilled around 500 horizontal wells in the state since the first one in 1982. Half those have been for redevelopment in known oil and gas fields, and exploration and gas storage accounted for another 20% each, said speakers affiliated with the Petroleum Technology Transfer Council.

Quicksilver Resources Inc., Fort Worth, became the largest natural gas producer in Michigan and the Devonian Antrim shale trend with a late 2002 acquisition. The company had 620 bcfe of reserves in the state at the end of 2003.

Appalachian

Talisman drilled 5 wells with initial potentials of a combined 72 MMcfd of gas in the Ordovician Trenton-Black River play in the southern Finger Lakes region of western New York.

Of 3 more wells drilling at end March, two are looking good, said Jim Buckee, president and chief executive officer. They are Wonderview in Schuyler County and Hammond in Chemung County.

The company has identified more than 50 drilling locations on its 406,000 net acres in the area. Its 2004 capital spending program is $50 million and 11 wells. Talisman believes it is exposed to 500 bcf of recoverable potential.

Consol Energy Inc., Pittsburgh, averaged 135 MMcfd of gas in 2003 from Oakwood coalbed methane field in Buchanan County, Va.

Cabot Oil & Gas Corp., Houston, plans capex of $58 million this year to drill 174 development and 5 exploratory wells in West Virginia. It will operate 99% of the wells with an average 95% working interest.

Range Resources Corp., Fort Worth, will spend $31 million this year in the Appalachian basin through its 50% interest in Great Lakes Energy Partners Inc., the basin's third largest operator. GLEP holds more than 1.3 million net acres in the basin.