OGJ Newsletter

Market Movement

OPEC said to raise oil price band

Although not officially stated, the Organization of Petroleum Exporting Countries reportedly plans to administer a new oil price band of $24-30/bbl, up from its avowed $22-28/bbl band, said Michael Rothman and Steven A. Pfeifer, first vice-presidents and senior analysts at Merrill Lynch Global Securities Research & Economics Group, New York, in an Apr. 14 report.

"The driving force behind this paradigm shift was (and is) budget requirements of the producing country governments," they said. "Since 1999, OPEC has very effectively managed the oil balance to ensure oil prices high enough to meet the members' domestic budget requirements. In the aftermath of the [1998-99] Asian contagion [currency and financial crisis], OPEC throttled back production to respond to weakening demand. As the global economy rebounded with strong growth in 2000, OPEC aggressively increased production to meet accelerating demand. While in the 2001-02 downturn, OPEC effectively navigated the storm by curbing output."

Government budgets of OPEC members "offer a good insight into the cartel's motivation in setting price policy," said the Merrill Lynch executives.

For example, Saudi Arabian government expenditures "routinely exceed budgeted levels," they said. "In 2003, expenditures of $66.7 billion were 20% above the original budget. The 2004 budget calls for a decline in spending to $61.3 billion. However, based on actual 2003 spending and the rising trend since the oil price collapse in 1998-99, we believe that expenditures will likely be at least as high as [in] 2003."

Merrill Lynch reported, "At flat government spending and 7.9 million b/d of average oil production, we calculate that the Saudi government budget balances at a West Texas Intermediate equivalent oil price of approximately $27/bbl."

The Merrill Lynch executives claimed the New York Mercantile Exchange apparently has accepted the concept of higher sustainable crude prices "as futures contracts are above $28/bbl through 2010."

The "disappointing" inability of oil producers outside of OPEC to boost production by a meaningful amount ensures that OPEC will maintain control of the market despite higher prices for crude. "The consensus view as oil prices rose in 1999-2000 was that higher prices would spark a surge in non-OPEC supply. In reality, production has disappointed, with only the former Soviet Union providing incremental supply," Merrill Lynch reported. "Our analysis of recently released company finding and development costs and unit operating costs indicate that the marginal cost of non-OPEC supply has continued to move higher."

In the mid-1990s, oil companies added reserves at an average cost of $4/boe. "High capital efficiency meant that the capital investment required to bring an average oil project on stream was much less," the analysts said. A market price equivalent to $18/bbl for WTI was sufficient "to generate an adequate return" on investment in that period. However, in 2001-03, F&D costs escalated to $7/boe, and a price of $28/bbl for WTI was required to provide the same rate of return, they said.

Meanwhile, the analysts concluded, "We've seen a higher contraction in OPEC's spare production capacity related to geopolitical disturbances, including the difficult reconstruction of Iraq's oil industry in the postwar period." That further tightens supply during a period of growing demand.

Record futures market prices

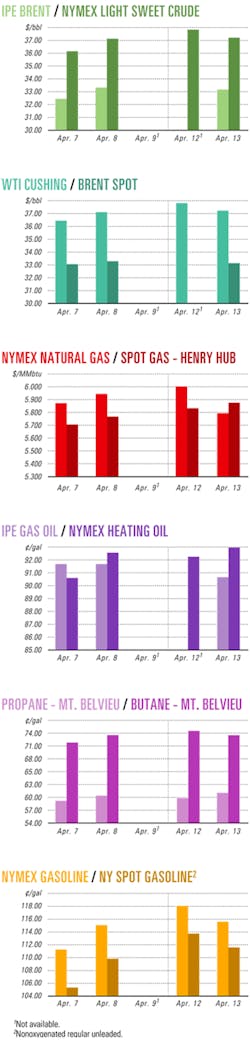

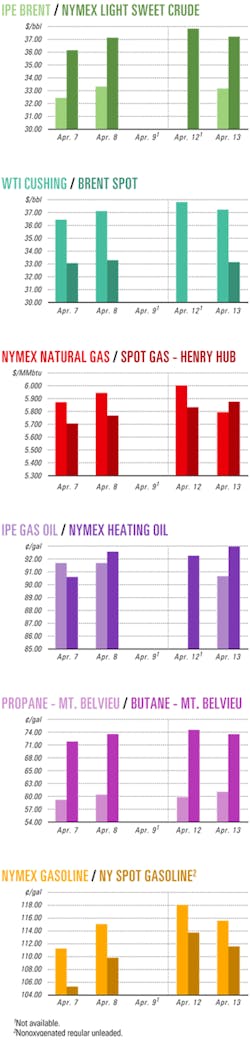

May contracts for gasoline and natural gas hit new highs Apr. 12 during trading on NYMEX. Gasoline closed at $1.1803/gal, up by 2.95¢ on that date, after hitting a 10-year high of $1.183/gal. Natural gas finished at $6.009/Mcf, up 6.8¢ for the day, after hitting a contract high of $6.03/Mcf on the strength of a strong rally in the crude futures market.

However, energy futures prices fell Apr. 13 amid market expectations of an increase in commercial US inventories of crude. Sure enough, the US Energy Information Administration reported Apr. 14 that US crude stocks jumped by 3.2 million bbl to 295.4 million bbl during the week ended Apr. 9, far more than traders had expected.

US gasoline inventories rose by 1 million bbl to 201.1 million bbl during the same period, while distillate stocks fell by 2 million bbl to 103.2 million bbl, with heating oil accounting for nearly all of that loss.

As a result, energy futures prices continued to decline. Losses on near-month contracts in trading Apr. 13-14 on NYMEXfor benchmark US light, sweet crudes totaled $1.12, down to $36.72/bbl. Other 2-day total declines includednatural gas, down 26.5¢ to $5.74/Mcf; gasoline, down 2.5¢ to $1.1553/gal; and heating oil, down 0.57¢ to 93.67¢/gal.

On the US spot market, WTI at Cushing, Okla., lost $1.10 to $36.73/bbl in the same period.

Industry Scoreboard

null

null

null

Industry Trends

GLOBAL PROPYLENE OXIDE (PO) and propylene glycol (PG) supplies are expected to remain tight with "moderately strong" demand throughout 2004.

Meanwhile, the cost of energy and feedstocks will continue exerting upward pressure on pricing, Dow Chemical Co.'s Earl Shipp said in a written statement released from the company's headquarters in Midland, Mich. Shipp is Dow's new business director for PO and PG business.

"Propylene monomer supply is extremely tight," he said, noting that propylene prices have risen more than 20% in the past 6 months and are expected to continue to climb. "This drastically affects our price point for PO and PG," he said.

Natural gas prices also are likely to remain high this year, significantly impacting costs. Last month, Dow was among companies asking President George W. Bush and congressional leaders to lower royalties on some gas production, to allow more drilling in the US, and to reduce the incentives that promote the use of natural gas for electricity generation.

"However, the good news is that PO markets are growing at a healthy 5-6%/year," Shipp said. "The current global industry demand for PO isU12 billion lb/year."

Growth for PG also is expected—at 2-3%/year through 2004. In 2003, global demand for all PGs was 3.1 billion lb, Shipp said. "Overall, global demand for PG is strong, and Dow forecasts overall growth for 2004 will be around 3%/year for the industry, which we view as the long-term growth rate."

Although PO pricing has remained stable this year, Shipp said, Dow increased its products price for PGs in North America, Europe, and Latin America. "Further price increases in Europe are possible," he added.

UK OFFICALS believe that wind power will play an important role in the expansion of renewable energy.

Alastair Newton, British Consultate-General deputy consul-general of investment, New York, told an American Wind Energy Association meeting in Chicago late last month that the UK takes climate change seriously.

"Within a few years, the UK will no longer be self-sufficient in energy... Renewables, with wind in the lead, offer the best opportunity for the new capacity we need," said Newton. Renewables development opportunities will be open to US firms, he added.

The UK Renewables Obligation calls on all licensed electricity suppliers in England and Wales to supply a specified and growing proportion of their electricity sales from a choice of eligible renewable sources. Scotland also has a Renewables Obligation.

The aim is that 10% of the UK's electricity should be supplied from renewable energy sources by 2010, rising to 15.4% by 2015-16. The obligation is effective until 2027, with a review slated for 2005-06, Newton said.

In a recent second round of offshore wind licensing, the UK government offered options for 15 development sites to 12 consortiums. The round involved potential total capacity of up to 7.2 Gw, or 7% of UK electricity generation, he said.

The licenses range from 64 Mw proposals to developments of 1.2 Gw or more, he added.

Government Developments

UK OFFICIALS URGE North Sea oil producers to implement a plan for capturing and sequestering carbon dioxide for use in enhanced oil recovery. The goal is to reduce greenhouse emissions while improving production.

The Department of Trade and Industry released a white paper Apr. 8 specifying interim actions that include EOR as a factor in developing an overall strategy for carbon capture and storage (CCS), which DTI said is central to the development of zero to near-zero emissions from fossil fuel combustion.

The main option for storing CO2 is through geosequestration in oil reservoirs, depleted gas fields, and saline aquifers.

Although CO2-based EOR is used widely in North America, North Sea oil producers currently have little interest in it; therefore a full implementation plan has not yet been developed.

The report, "Implementing a demonstration of enhanced oil recovery using carbon dioxide," indicates that CO2 for EOR could play a significant role in future demonstrations of CCS and that it should be considered as part of an integrated strategy for developing CCS technologies.

US SENATE Energy and Natural Resources Committee Chairman Pete V. Domenici (R-NM) said he has attached the tax portions of the stalled energy bill to a bill that, if passed, would repeal export tax breaks.

Sen. Majority Leader Frist (R-Tenn.) sponsored the bill to repeal export taxes. The World Trade Organization has called the export tax breaks illegal, and that prompted retaliatory tariffs to make it harder for US companies to sell products abroad.

Domenici called the attachment his "new strategy for getting the energy bill through the Senate..."

The energy tax package includes tax breaks for renewable energy, alternate fuel vehicles, conservation, and clean coal incentives. Its oil and natural gas provisions include:

- Incentives for development of the Alaska gas pipeline through an enhanced oil recovery credit, accelerated depreciation, and a floor price provision.

- A new production credit for marginal wells. The credit is not available if the market prices for oil and gas exceed certain levels.

- Accelerated depreciation for gas gathering lines.

- An allowance for small refiners to claim an immediate deduction for up to 75% of the qualified capital costs to comply with the highway diesel fuel sulfur requirements.

- A 5¢/gal credit for low-sulfur diesel fuel produced by a small refiner.

- An increased production limit for special tax rules governing independents.

US CITIZENS can access a new government database that includes chemical analysis of crude oil, natural gas, and rock samples from thousands of locations worldwide.

US Geological Survey officials last month said they expect its database, which contains 65,000 records, to help government officials, academics, and the public assess domestic and world energy resources.

The agency predicted the information "will be a useful reference for federal, state, and local agencies involved in land and resource planning, oil and gas production, oil and gas assessments, public safety, and environmental concerns.

Quick Takes

LIBYA'S NATIONAL OIL CO. on Apr. 7 granted Paris-based Cie. Generale de Geophysique (CGG), in cooperation with North African Geophysical Co., exclusive rights to perform a speculative, multiclient geodata acquisition program over all Offshore Libya acreage. In the second quarter, CGG will begin gathering 2D seismic, gravimetric, and magnetic data in a 12-month program covering 38,000 line km. Subject to that program's outcome, CGG will investigate the potential for extensive 3D nonexclusive coverage. CGG said little new data have been secured on Libya's offshore in 20 years. The new dataset will extend information on shelf areas and will examine deepwater basin prospectivity.

CNOOC Ltd. said its parent China National Offshore Oil Corp. is offering 10 exploration blocks off China to international oil and gas companies for production sharing contracts (PSCs), effective immediately. The 10 blocks cover 35,158 sq km and already have seen some exploration activity. One block each is in Bohai Bay, South Yellow Sea basin, and the East China Sea. Four blocks are in the eastern South China Sea, and three are in the western South China Sea. Hong Kong-based CNOOC Ltd. is a 70.6% subsidiary of CNOOC. Marathon Petroleum Norge AS, a subsidiary of Marathon Oil Corp., Houston, struck oil and natural gas with the Hamsun 24/9-7 well on production license (PL) 150 in 124 m of water on the Norwegian continental shelf. The vertical well was drilled to 2,250 m below sea level and encountered 37 m of net gas pay and 12 m of net oil pay, mainly in two reservoirs. The company is evaluating a reservoir management strategy for the Hamsun accumulation, including a possible tie-back to the Alvheim development. Marathon operates PL150 and holds a 65% working interest. Swedish Lundin Petroleum AB is in the process of acquiring the other 35% from Norway's Det Norske Oljeselskap AS, pending governmental approval. Egypt has awarded BP Egypt exploration rights on the East Warda Block in the Gulf of Suez and on Blocks 12 and 13 in the northern Red Sea. In the Red Sea, BP Egypt will spend a total of $59 million on a high-resolution aeromagnetic survey, a 3D seismic survey over the entire 12,500 sq km concession area, and other exploration activities. The 545 sq km East Warda Block is north of giant October field and near existing infrastructure. BP Egypt will spend $17 million to conduct a 3D seismic survey and drill from one to three wells.

Amerada Hess Ltd., operator of Pangkah PSC area off Indonesia, has begun a two-well appraisal-drilling program to determine the western extension of Ujung Pangkah natural gas field. Current reserves are 478 bcf, and production is expected to plateau at 100-150 MMscfd. Initial development calls for six production wells tied to an offshore platform connected via a 16-in. pipeline to an onshore gas processing facility at Gresik, Sumatra. Two satellite platforms could be added. Oil reserves are estimated at 450 million bbl. Partners are Amerada Hess, 66%, ConocoPhillips 22%, and Dana Petroleum PLC, Aberdeen, 12%. F

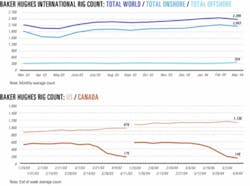

US DRILLING ACTIVITY slipped from a 31-month high, down by 22 active rotary rigs to 1,138 working the week ended Apr. 9, compared with 979 during the same period a year ago. The biggest decline was in land drilling, down by 24 rigs to 1,031, Baker Hughes Inc. reported Apr. 8. Drilling in inland waters increased by 2 units to 16, while offshore drilling was unchanged at 89 rigs in the Gulf of Mexico and 91 in US waters as a whole. In Canada, drilling activity dropped by 46 rigs to 148 still working during the seasonal thaw, down from 175 the same time last year. Among US rigs, the number drilling for natural gas declined by 12 to 988 the week ended Apr. 9, while drilling for oil was down by 9 rigs to 148. There were 2 rigs unclassified.

PEMEX EXPLORATION & PRODUCTION CO. has signed a letter of intent to award Global Offshore Mexico SRL de CV a $100 million contract to install three 20-in. pipelines and nine 12-in. pipelines as part of the EPC-77 development project in the Cantarell complex of fields in the Bay of Campeche. EPC-77 lies about 80 km off the Yucatan Peninsula (see maps, OGJ, Aug. 27, 2001, p. 54). The project is slated for completion by first quarter 2005. Global Chairman and CEO William J. Doré, said that the project will utilize the company's Hercules, Shawnee, and Pioneer pipelay vessels. The contractor is a subsidiary of Carlyss, La.-based Global Industries Ltd. Husky Energy Inc., Calgary, has received the 940,000 bbl SeaRose floating production, storage, and offloading vessel for White Rose oil field off Newfoundland and Labrador. Husky expects first oil from White Rose field in late 2005 or early 2006, with peak oil production expected to reach 92,000 b/d. Samsung Heavy Industries constructed the FPSO in South Korea, and during the next 18 months Aker Maritime Kiewit Contractors will install topsides facilities. Single Buoy Mooring in Abu Dhabi fabricated the FPSO's 1,000 tonne riser buoy, which has arrived at Bay Bulls, Newf. Technip Offshore Canada Ltd. will install the buoy in White Rose field this summer. The completed FPSO is scheduled to sail to White Rose field in fourth quarter 2005. White Rose field owners are operator Husky 72.5% and Petro-Canada 27.5%.

ALASKA GOV. FRANK H. MURKOWSKI recently signed a law that appropriated $1.65 million in state funds to help defray some of the costs of bringing North Slope natural gas to market. The Alaska Natural Gas Development Authority will receive about $650,000 to study an LNG export project and continue efforts to identify and develop markets on the US West Coast and in Asia, officials said. The funds also will permit ANGDA to evaluate pipeline gas needs in the Kenai and Anchorage areas and to develop a petrochemical industry within Alaska. About $1 million was authorized for issues common to all pending North Slope pipeline proposals, including legal opinions on the use of tax-exempt bonds to finance a pipeline, market evaluations, permitting issues, intrastate gas consumption, and studies of a pipeline's impact on communities along the proposed state-favored route. Enbridge Inc., Calgary, intends to file a Stranded Gas Development Act (SGDA) application with Alaska allowing Enbridge to negotiate fiscal, taxation, royalty, and other terms related to the construction of a natural gas pipeline from Prudhoe Bay to the Yukon border. The state currently is negotiating a draft contract under SGDA with Alaskan North Slope producers BP PLC, ConocoPhillips, and ExxonMobil Corp. and has a second application under review from the Port Authority group, comprising the city of Valdez and the Fairbanks North Star Borough. A third applicant, MidAmerican Energy Holding Co., Des Moines, last month withdrew its application for a $6.3 billion gas pipeline after the state declined to give MidAmerican a 5-year exclusive right to build, own, and operate the pipeline (OGJ Online, Mar. 25, 2004). Alyeska Pipeline Service Co. awarded a $28 million contract to SNC-Lavalin Inc., Montreal, for engineering, procurement, and construction management services to upgrade pump stations along the Trans Alaska Pipeline System.

MST Odin assists in oil recovery off Spain

Sonsub Inc., Houston, chartered Statoil ASA's multipurpose shuttle tanker MST Odin to recover oil from the damaged Prestige oil tanker that broke in two off the Spanish coast in late 2002 (OGJ Online, Nov. 27, 2002). The wreck, lying in two pieces in 3,500 m of water, requires the use of Sonsub's remotely operated vehicle in the recovery process. Sonsub is subcontractor to Spanish oil company Repsol-YPF SA, which was commissioned by Spanish authorities to implement the oil recovery. For this assignment, Statoil also has provided advisory services and specialized equipment. Photo courtesy of Statoil.

TAPS operator Alyeska previously received approval from the pipeline's owners to invest more than $250 million in that upgrade. SNC-Lavalin will install electrical pumps at four critical pump stations, increase automation, and upgrade control systems. Florida's Gov. Jeb Bush has approved Tractebel Calypso Pipeline LLC's proposed 42 mile pipeline in Florida and federal waters and 6 miles onshore in Broward County, Fla. (OGJ Online, Jan. 29, 2004). Tractebel now has all major US approvals. The proposed 165 mile, 24-in. pipeline will transport 832 MMcfd of natural gas from a planned Tractebel Bahamas LNG Ltd. LNG storage and regasification facility in Freeport, Grand Bahama, to Port Everglades, Fla. beginning in 2007.

GIANT INDUSTRIES INC., Scottsdale, Ariz., has temporarily shut down its 20,800 b/d Ciniza refinery near Gallup, NM, following a fire Apr. 8 at an alkylation unit. Investigations are under way to determine the cause of the fire and the extent of damage. Giant said the fire was contained to one unit, with some damage to ancillary equipment of two adjacent units. Turnaround maintenance work, previously scheduled to begin Apr. 17, is being accelerated to minimize disruption to refinery operations and is expected to complete by mid-May. Giant also expects to be completed the $2.5-4 million fire-related repairs by mid-June. Before the fire, the Ciniza plant yielded 18,000 b/d of products. During the turnaround and repair shutdowns, Giant will increase output from its 16,000 b/d Bloomfield, NM, refinery by about 6,000 b/d. Saudi Aramco Mobil Refinery Co. Ltd. awarded Foster Wheeler Energy Ltd., Clinton, NJ, a contract for detailed engineering, procurement, and construction planning for a low-sulfur automotive diesel project at Yanbu, Saudi Arabia. The total investment value of the project is $18 million. Terms of the Foster Wheeler contract were not disclosed. The work follows the October 2003 completion by Foster Wheeler of the front-end engineering design for the project, which upgrades refinery facilities to produce low-sulfur diesel. The project is scheduled for completion during the refinery turnaround early in 2006.

LNG GEMINI—a joint venture of Praxair Inc.'s Brazilian subsidiary SA White Martins and Brazil's state-owned Petroleo Brasileiro SA—is planning a $38 million LNG liquefaction plant in Paulinia, São Paulo state, Brazil. White Martins will build and operate the 380,000 cu m/day plant, Brazil's first, with the motor vehicle market in mind. Brazil, with the second largest fleet of compressed natural gas-fueled vehicles in the world, will be ripe for five LNG plants within the next 7 years, White Martins said. The LNG will be transported, via truck and rail, to sites as far as 900 miles away. Construction is slated to begin in July, and the plant is expected to come on stream at yearend 2005. Statoil ASA has received two giant natural gas compressors for use in the gas liquefaction unit in the Arctic Ocean- sited Snohvit gas field north of Hammerfest, Norway. A unit of Siemens AG, Duisburg, Germany, supplied the compressors. The units were made to operate in temperatures as cold as –22º C. The two compressors are part of a 30 million euro order that includes a total of six compressors. Statoil plans to ship about 5.67 billion cu m/year of LNG from Snohvit field during 2005-35.

PETROCHEMICAL INDUSTRIES DEVELOPMENT MANAGEMENT CO., an affiliate of Iran's National Petrochemical Corp., awarded a 25 billion yen contract to a Japanese-led international consortium for engineering, procurement, and technical assistance in the construction of an ammonia-urea complex in Iran's Bandar Assaluyeh region. The complex, scheduled for completion in 2006, will include a 2,050 tonne/day ammonia plant and a 3,250 tonne/day urea plant. Consortium members include Toyo Engineering Corp., Chiba, Japan; Chiyoda Corp., Yokohama; and Petrochemical Industries Design & Engineering Co., Shiraz, Iran. Mitsui & Co. Ltd. is working in cooperation with the consortium. The complex will use natural gas from South Pars field as feedstock, said officials.