Market Movement

Profit takers roll back energy futures prices

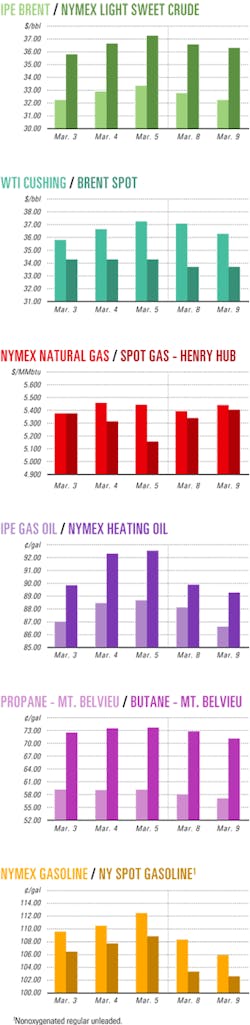

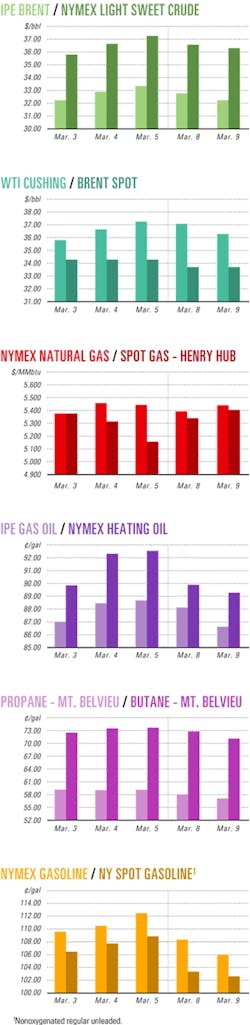

Energy futures prices declined Mar. 8-10 on New York and London markets, as profit takers rolled back the price increases of the previous week. Energy prices continued to fall after the US Energy Information Administration reported commercial US crude inventories jumped by 3.7 million bbl to 279.5 million bbl during the week ended Mar. 5. However, crude stocks were still 22.1 million bbl below the 5-year average for that time of year, EIA officials said.

US distillate stocks rose by 1.4 million bbl to 112.7 million bbl during the same period, with a drop in diesel fuel more than offset by a rise in heating oil, EIA officials reported. However, they said US gasoline inventories fell by 1.6 million bbl and were down by 10.4 million bbl below the 5-year average for that period.

The American Petroleum Institute subsequently reported that US crude inventories increased by 2.7 million bbl to 281.3 million bbl during the week ended Mar. 5. However, it said distillate stocks dipped by 488,000 bbl to 113.4 million bbl during the same period, while gasoline stocks fell by 1.7 million bbl to 199.1 million bbl.

EIA's weekly data were "very soft for heating oil and crude, while gasoline conditions remain strong. Gasoline demand is riding far above last year, and production is starting to turn down," said Paul Horsnell, head of energy research, Barclays Capital Inc., London.

In an unusual move, Horsnell predicted Mar. 10 that petroleum prices are about to weaken, while at the same time Barclays raised its 2004 price forecasts by $1.90 to an average $32/bbl for US benchmark crudes and by $1.70 to an average $29.30/bbl for North Sea Brent oil. Evidence of a pending price break "does not come from crude oil prices, which have not yet fallen off their perch or made any decisive break downwards," said Horsnell. The April contract for benchmark US light, sweet crudes was still above $36/bbl Mar. 10 on the New York Mercantile Exchange.

Gasoline crack spreads weaken

"However, in the oil product markets, there is more convincing evidence of a weakening. Over the past week, gasoline crack spreads [simultaneous purchase of crude futures and sale of petroleum product futures to establish a refining margin] have fallen sharply. All of the upward progress made by the April crack over the past 5 months has been unwound in just a week," said Horsnell.

Still, he said, "Increasingly, we are becoming convinced that the move down will be less sharp than we had first imagined." Horsnell said, "Part of the reason why we do not expect prices to get much traction downward in coming months is that the gasoline situation has not improved."

Inputs into US refineries increased by 80,000 b/d, averaging more than 14.7 million b/d in the week ended Mar. 5. Decreases on the US East Coast and in the Midwest were offset by increases elsewhere, with the largest increase occurring in the isolated West Coast market, EIA reported.

Crude imports into the US declined by 49,000 b/d to nearly 9.8 million b/d during the same week. "A large decrease into the West Coast was nearly offset by a large increase into the Gulf Coast," said EIA officials. Imports from Saudi Arabia apparently "were down significantly last week while imports from Venezuela increased substantially," they said.

Venezuela

Venezuelan President Hugo Chávez reiterated Venezuela's desire to continue commercial relations with the US and other countries "since we want peace, respect, and integration." Chávez's remarks came during a ceremony granting a license to ChevronTexaco Corp. to explore and exploit natural gas reserves in Block 3 off the country's northeastern coast. Chávez earlier had indicated that Venezuela would take action if the US intervened in the political turmoil that recently surfaced in that country after a government election committee reported too few legal signatures on petitions for an election to recall Chávez from office.

Meanwhile, state oil firm Petróleos de Venezuela SA and the state news agency Venpres announced Aires Barreto resigned as vice-president of PDVSA for "personal reasons." To offset what was described as "distortions" about Barreto's resignation, Venpres published a letter that he sent Mar. 6 to PDVSA's board. The government will soon pick his replacement on the PDVSA board, Venpres reported. PDVSA Pres. Alí Rodríguez Araque subsequently issued a statement denying reports that he, too, had resigned his post. Rodriguez said a destabilization campaign is being waged against PDVSA "to hide the nonconcealable, which is the total recovery of the company." He said Venezuela is now producing nearly 3.2 million b/d of oil, including 1.9 million b/d from the eastern region and 1.3 million b/d from the western region.

Industry Scoreboard

null

null

null

Industry Trends

null

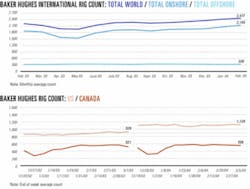

A record number of drilling rigs—currently a total of 12—are drilling for oil and gas in the ultradeep waters (5,000 ft or deeper) of the Gulf of Mexico, according to US Minerals Management Service Director Johnnie Burton.

"This is a very important milestone which demonstrates how industry continues to focus on new frontiers," Burton noted.

Deepwater oil and gas development in the gulf continues to be the workhorse of US domestic oil and gas production, Burton said. "The US is now in its 9th year of sustained expansion of domestic oil and gas development in the deepwater area of the Gulf of Mexico, and it shows no sign of diminishment. The resource potential for the nation continues to grow with each new discovery in ultradeep water."

Oil production from the deepwater gulf rose 535% during 1995-2002, MMS reported. Gas production, meanwhile, also rose by 620% over those same years. "Production of oil from the gulf now accounts for more than 30% of all US production; for gas it is 23%," MMS said.

MMS pointed out that over the last 3 years, there have been several significant oil and gas discoveries in the gulf.

Most notably, MMS said, there were five discoveries in 5,000 ft of water or deeper in 2001, three in 2002, and six in 2003.

The median acquisition price for Canadian oil and natural gas reserves reached a record high for the fourth consecutive year, increasing 12% to $9.33 (Can.)/boe in 2003 from $8.31/boe in 2002.

According to Sayer Securities Ltd., this peak price was the highest recorded since the Calgary-based finance and research firm began publishing merger and acquisition data in 1988.

Over the last 5 years, Sayer reported, the median price for established reserves—proven plus one-half probable reserves, before royalties—rose to $9.33/boe in 2003 from $4.83/boe in 1999. Sayer noted that high commodity prices, especially for natural gas, were the most "obvious influence" on acquisition prices over this time period.

Another factor contributing to the high-priced acquisitions in 2003, Sayer said, was "the low level of assets and companies for sale as measured by the small amount of activity."

The firm noted that, in 2003, the total enterprise value of M&A deals was $9.1 billion—the lowest value since the $7.1 billion total in 1994.

"This low activity was not due to lack of demand," Sayer observed. "In 2003 there were 135 large transactions (over $5 million in size) compared to 143 in 2002. This suggests demand was still strong in the M&A market in 2003."

Also contributing to the "lower dollar numbers" for M&A activity last year was the scarcity of multibillion dollar deals, Sayer continued.

In 2002, for example, deals such as the $15.9 billion merger of PanCanadian Energy Corp. and Alberta Energy Co. Ltd. highlighted M&A activity.

If this deal were removed from that year's statistics, the total M&A value was $9.5 billion, or just 4% higher than the value in 2003.

Government Developments

US Senate Finance Committee Chairman Chuck Grassley (R-Iowa) Mar. 4 sought to renew an expired marginal oil and gas production credit now included in a stalled energy bill.

Grassley is trying to amend a pending "jobs" bill so it will extend the oil provision and three other energy-related tax relief plans that either already expired or are due to expire this year.

Senate Energy and Natural Resources Chairman Pete Domenici (R-NM) said Mar. 4 he supported Grassley's action, saying that the inclusion of the four provisions would have no impact on his own energy bill, now pending before the Senate.

Grassley's proposal, if approved by the Senate, would give producers an additional year to use the taxable income limit on percentage depletion for oil and gas produced from marginal properties.

The amendment extends the deduction for the depletion of oil and gas wells, currently limited to 100% of the net income from the property in any year.

Under Domenici's pending legislation, the provision to extend the suspension also is included, but for longer periods.

New Mexico Gov. Bill Richardson Mar. 8 urged US officials to consider a less-aggressive oil and gas drilling plan that shields more federal grassland from development in the Otero Mesa region.

State officials have joined environmental groups in opposing a pending US Department of the Interior proposal that would be administered by DOI's Bureau of Land Management (BLM). New Mexico officials say BLM's latest plan was never made available for public comment.

"BLM did a bait-and-switch. Their alternative is very different than their original draft. So, the earlier comments have become irrelevant because the latest version is so different," said New Mexico Energy, Minerals and Natural Resources Sec. Joanna Prukop.

BLM is reviewing the proposal but is not under any legal obligation to revise its plan, or offer more public hearings, as Richardson and Prukop are suggesting. The agency could finalize the leasing by spring; environmentalists have threatened to take the agency to court to stop the pending leasing plan from going forward.

Richardson has proposed his own alternative that he says will increase grassland and habitat protections.

The state proposal limits oil and gas exploration and development by designating more than 600,000 acres closed to leasing and no surface occupancy. Another 900,000 acres are open to leasing with stipulations, allowing for 700,000 acres open to leasing with no restrictions.

State officials argued that the BLM plan does not adequately protect fragile ecosystems in the mesa's Chihuahuan Desert, which is considered by New Mexico officials to be a unique "eco-region."

If the BLM proposal moves forward, an estimated 140 new wells could be drilled in the region (OGJ, Jan. 26, 2004, p. 28). But if the New Mexico plan were to be adopted instead, only about half those wells might be drilled, according to producers.

Quick Takes

ARGENTINA AND BOLIVIA expect to sign a final natural gas sales agreement Apr. 13, solidifying plans for construction of the proposed $2 billion Gasoducto del Noreste Argentino (GNA) gas production and pipeline project.

The 1,500 km pipeline would transport gas from Bolivia's Tarija department to Argentina's Santa Fe province. It will have a capacity of 10 million cu m/day (MMcmd), expandable to 30 MMcmd, and will require 11 compressor stations and an additional 1,000 km of smaller-diameter laterals. Construction is scheduled to start in July and complete in mid-2006.

Argentine firm Techint SA de CV along with project partners Transportadora de Gas de Norte SA and Transportadora de Gas del Sur will finance $750 million for the project; Argentina will provide the remaining $250 million.

The second aspect of the GNA project is a $700 million investment in Bolivia's upstream gas production. Techint is seeking to partner with international gas producers in Tarija department to supply gas for the pipeline.

CONOCOPHILLIPS ALASKA, operator of Alpine field on Alaska's North Slope, plans to in- crease the field's oil production capacity to 140,000 b/d later this year.

The $58 million Alpine Capacity Expansion, Phase 2 (ACX2), is scheduled for completion by mid-2005. ACX2 will expand the oil handling and seawater injection capacities of field facilities and will increase water and gas handling capacities at a field processing plant.

null

In addition, Conoco-Phillips and 22% partner Anadarko Petroleum Corp. are studying additional expansion opportunities.

The 40,000 acre field, the largest onshore oil field discovered in the US in more than 10 years, is in the Colville River area, 34 miles west of Kuparuk River field.

Syncrude Canada Ltd. reported a delay in the Stage 3 expansion of its Syncrude oil sands mining operation in Fort McMurray, Alta., along with a significant cost increase. Canadian Oil Sands Ltd., the largest stakeholder in the project, said, "The best current estimate from Syncrude is that the project will reach mechanical completion in early 2006, rather than mid-2005, and be in service by mid-2006." The extended completion date is expected to increase total capital costs to about $7.8 billion (Can.) compared with the $5.7 billion estimate made in September 2002. Syncrude noted that the largest capital cost increases stem from "the protracted engineering phase at the beginning of the project and the underestimation of revamping existing facilities and tie-insU." To date, Stage 3 expenditures total about $4.7 billion. Syncrude's Stage 3 expansion includes the development of the Aurora 2 mine and the addition of a third 100,000 b/d fluid coker. Syncrude's total site production will be increased to about 350,000 b/d. Syncrude project partners are Syncrude Canada Ltd., Imperial Oil Resources, Canadian Oil Sands LP, Canadian Oil Sands Ltd., ConocoPhillips Oilsands Partnership II, Mocal Energy Ltd., Murphy Oil Company Ltd., Nexen Inc., and Petro-Canada Oil & Gas. Unocal Corp. unit Unocal Indonesia Co., Balikpapan, Indonesia, resumed oil and gas production Mar. 1 from its Attaka field off Indonesia. The field, 19 km east of Tanjung Santan, East Kalimantan, had been shut in following a flash fire Feb. 21 on one of the company's platforms. The fire, which injured nine persons, was immediately extinguished, the company said, and the field shut in pending an investigation of the incident and assurance that operations could be conducted safely. ENI SPA's Tunisian unit Agip Tunisia BV, Tunis, started oil production from the Hawa-1 exploration well on the Borj el Khadra production concession in southern Tunisia, achieving 9,000 b/d (OGJ Online, Dec. 16, 2003).

The well has been tied in via 13 km of 8-in. ipe line to existing facilities at Oued Zar field, which Agip also operates. Participants in the concession are operator Agip 17.5%, ENI Tunisia BEK 17.5%, Tunisa's state oil company ETP (L'Enterprise Tunisienne d'Activites Petrolieres) 30%, Pioneer Natural Resources Co. 28%, and Paladin Expro Ltd. 7%. The companies plan further drilling this year, said partner Paladin Expro. F Total SA has begun production from Skirne natural gas and condensate field on Block 25/5 (PL 102) in the Norwegian sector of the North Sea, about 140 km northwest of Stavanger. The field, discovered in 1990, consists of two subsea wells, Skirne and Byggve, which are tied back to the Heimdal platform. Total expects production to plateau at 150 MMcfd of gas and 6,900 b/d of condensate. Skirne and Bygge reserves are 300 bcf of gas and 10 million bbl of condensate (OGJ, Dec. 6, 1999, p. 25). Total is operator and holds 40% interest in the field. Its partners are Petoro AS 30%, Marathon Petroleum Norge AS 20%, and Norsk Hydro AS 10%.

TransCanada Corp. and ConocoPhillips said they would suspend further work on the Fairwinds LNG regasification terminal in Harpswell, Me., following a Mar. 9 vote by residents against leasing the former US Navy Fuel Depot site for the project (OGJ Online, Sept. 22, 2003).

Both companies said they remain committed to pursuing opportunities to deliver LNG to the US Northeast.

Fairwinds is the second North American LNG project cancelled this month because of site problems. Marathon Oil Co. earlier abandoned plans to construct an LNG terminal in Baja California when state officials expropriated a site near Tijuana deemed critical to that project (OGJ Online, Mar. 2, 2004).

Algeria's state-owned oil and gas company Sonatrach reported that its two undamaged LNG processing trains at Skikda, Algeria, are expected to be back in operation by April. A third train, which was connected to three trains destroyed in an explosion Jan. 20 (OGJ Online, Feb. 18, 2004), is scheduled to be back on line this summer. The three trains will have a total capacity of about 3.5 billion cu m (bcm)/year. Meanwhile, Sonatrach has increased the capacity of its Maghreb-Europe gas pipeline to Spain and Portugal by about 3 bcm/year to replace lost LNG deliveries to customers in Europe.

ROYAL DUTCH/SHELL GROUP subsidiary Shell Malaysia Exploration & Production has reported what it calls "an important oil discovery" on deepwater Block J northwest of Sabah, Malaysia.

Shell said the recently drilled Gumusut-1 exploration well encountered "a long gross oil column in excellent reservoir-quality rock." While saying it was too early to give quantitative estimates for the find, Shell said, "Initial indications are that the Gumusut crude oil is light and of high quality."

The vertical discovery well, drilled in water 1 km deep, was completed in December 2003. Shell then drilled two sidetracks.

Shell Malaysia, operator with 40% equity, is partners on the block with ConocoPhillips 40% and Petronas Carigali Sdn. Bhd., the exploration and production arm of Malaysia state oil firm Petronas, 20%.

Cairn Energy PLC, London, said its N-A-1 exploration well in southwestern Rajasthan, India, is an oil discovery with preliminary recoverable volumes estimated at 20-80 million bbl. The well, on northern Block RJ-ON-90/1 some 5 miles southeast of the company's larger N-B-1 (Mangala) discovery, cut a 120 m gross oil column with 15 m of net pay in "excellent quality sands of the (Paleocene) Fatehgarh formation."

The number of Fatehgarh sands encountered is sharply less than at Mangala, Cairn said. TD is 1,634 m. The first two Fatehgarh zones flowed 1,226 b/d of 31° gravity oil through a 1-in. choke on an open-hole test. Preliminary estimates of OOIP at N-A-1 is 130-470 million bbl, Cairn said. N-A-1 also encountered a log-evaluated oil-bearing column of 60-150 m in an apparent tight, silty Paleocene Barmer Hill formation. Phase 1 crude delivery from the Barmer basin will be via truck or rail, starting in first quarter 2005 from Saraswati, Raageshwari, Guda, GR-F, and N-Q-1 (see map, OGJ, Feb. 2, 2004, p. 44). Phase 2 development likely would require a new 150 mile crude oil pipeline from northern fields Mangala and N-A-1, tying in the central and southern fields, and connecting with India's main oil pipeline system in mid-to-late 2007. Occidental Exploradora del Peru Ltda., a unit of Occidental Petroleum Corp., is preparing to begin exploration on Block 64 in Peru's Marañon basin after reaching an agreement with a sector of Ashuar Osham communities in the area. Occidental is the operator with a 50% interest in Block 64. Partners Burlington Resources Inc. and Spain's Repsol-YPF SA jointly hold the remaining interest. The Block 64 project includes drilling an exploration well and a confirmation well and completing a seismic study on the area bordering Ecuador. Block 64 work has been on hold for 6 years until Ashuar Osham communities agreed that Oxy could explore there. The cost of the Block 64 project is expected to reach $15-20 million/well. State oil concern Perupetro is awaiting final approval, xpetednext month, for Oxy to acquire an exploration and development license on Block 101, adjacent to Block 64.

Air Products Canada Ltd. subsidiary Air Products & Chemicals Inc., Allentown, Pa., plans to construct a 71 MMscfd hydrogen production plant adjacent Petro-Canada's 135,000 b/d refinery in Edmonton.

The facility, a natural gas-based steam methane reformer, will help Petro-Canada's refinery produce cleaner transportation fuels and other petroleum products from heavy, sour crude feedstocks. The hydrogen and steam generating facility, to be owned and operated by Air Products under a long-term agreement, is expected to be on stream in April 2006.

Valero Energy Corp. has awarded a $60 million turnkey engineering, procurement, and construction contract to Chicago Bridge & Iron unit CB&I Matrix, The Woodlands, Tex., for a 60,000 b/d gasoline desulfurization unit at Valero's 185,000 b/d refinery at St. Charles, La. The contract includes the design, fabrication, and installation of the process unit, which will reduce the sulfur content of naphtha feedstock, using catalytic distillation technology licensed from Catalytic Distillation Technologies. Mechanical completion is expected in summer 2005. Flint Hills Resources LP, Wichita, Kan., has selected Jacobs Engineering Group Inc., Houston, to provide front-end and detailed design engineering, procurement, and construction services for an ultralow-sulfur diesel fuel project at its refinery in Pine Bend, Minn. Officials estimate the overall project, which includes a grassroots hydrocracker, will cost $325-400 million. Completion is scheduled for second quarter 2006.

SANTOS LTD. has awarded a contract to Australia's Worley Ltd. for front-end engineering and design (FEED) associated with the $200 million development of Casino gas field off western Victoria. Santos expects the FEED studies to be complete and regulatory approvals to be in hand by yearend.

Casino, discovered in September 2002 about 29 km southwest of Port Campbell and 250 km southwest of Melbourne, is estimated to have reserves of 200-270 bcf of gas, Santos said.

Santos expects to drill two development wells and install subsea infrastructure and a pipeline from the field to TXU Australia Corp.'s Iona gas processing plant near Port Campbell.

Vic/P44 participants are operator Santos 50.0%, Peedamullah Petroleum Ltd. (AWE) 25.0%, and Mittwell Energy Resources Pty. Ltd. (Mitsui) 25.0%.

The JV has secured a 12 year gas sales agreement with TXU Australia to supply as much as 293 PJ of gas from the field, with an option to increase it by an additional 200 PJ. Santos said first gas sales could be delivered in the March 2006 quarter.

THE WRECKED TASMAN SPIRIT tanker has been removed from the Port of Karachi shipping channel, making port navigation safer.

The tanker, owned by Assimina Maritime Ltd. of Malta and carrying 67,000 tonnes of oil, ran aground in the channel July 27, 2003, during a storm, foundered, and later broke in two, polluting 16 km of coastline with at least 12,000 tonnes of crude (OGJ Online, Aug. 25, 2003).

Pakistan arrested seven rescued crewmen and a Greek salvage master, who remain in Pakistani custody. Efforts to free the men have been unsuccessful to date, and the vessel's liability insurer, the American Club, refuses to pay compensation until their release.