Special Report: Africa's reserves, production enter period of steady growth

The continent of Africa is progressing through an extended period of oil and gas production growth and reserves appreciation.

Discovery of huge oil reserves offshore and numerous deposits on land and the construction of pipelines from the interior to the coasts are transforming the continent into a major producing territory.

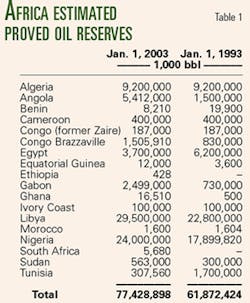

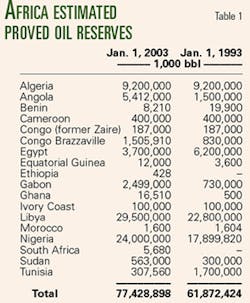

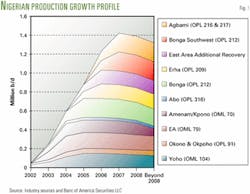

By OGJ estimates, Africa's estimated proved oil reserves have grown the past 10 years until they are nearly equal to those of Russia and the eastern FSU and double those of the Asia-Pacific region (Tables 1 and 2).

Oil reserves are up 25% on the decade, conservatively. Gas reserves are up about half that percentage and are being monetized as operators meet gas utilization requirements in Nigeria and other countries.

Several large oil fields and megaprojects have started up or are to go on production from 2002 through 2004, lifting continental output from the 6.8 million b/d OGJ estimated in calendar 2002.

Vast areas of Africa remain unexplored or underexplored. Supermajors and large independents tend to control areas such as Algeria, Egypt, Angola, and Nigeria, but dozens of medium and small independents have flocked to these and other countries and even dominate the scene in some of them.

The following is a partial account of how this activity is shaping Africa's ascent.

Central-West Africa

Nigeria and Angola dominate statistics in this region, but significant exploration successes have buoyed the outlook for countries along the margin as far north as Mauritania.

Nigeria deepwater

OGJ reported Nigeria's proved reserves at 24 billion bbl of oil and 124 tcf of gas as of Jan. 1, 2003 (OGJ, Dec. 23, 2002, pp. 114-115).

The government in 2002 promulgated a "conservative" reserve estimate of 30 billion bbl of oil and 159 tcf of gas and set a goal of reaching 40 billion bbl by 2010, noted Phil Magor, senior petroleum geologist with IHS Energy, Tetbury, UK.

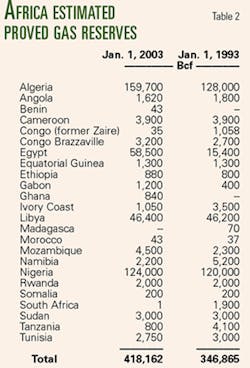

OGJ estimated that Nigeria's oil production averaged just under 2 million b/d in 2002. Magor said IHS Energy studies indicate that Nigerian deepwater production could exceed 500,000 b/d by 2005 and 1 million b/d by 2010.

Nigeria awarded the first deepwater licenses in 1992-93, and the first well was drilled in 1995. As of late 2002, 30,000 sq km of deepwater acreage was under license with few relinquishments.

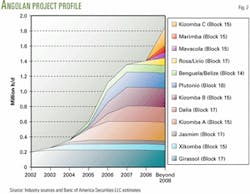

The results: 37 exploratory and 13 appraisal wells completed as of late 2002 with a 66% finding rate that included five giant oil fields, at least two giant gas fields, and a number of smaller discoveries. The 24 discoveries identified recoverable volumes of more than 5 billion bbl of oil and 19 tcf of gas, Magor noted (Table 3).

EA and Okono fields have started up. Abo start-up is imminent, and Amenam should come on in June 2003. Bonga could launch as early as 2004. Erha and East Area Additional Recovery should begin in 2005 and Agbami and Bonga Southwest in 2006 (Fig. 1).

Angola's outlook

OGJ reports Angola's proved reserves at 5.4 billion bbl, 80% more than the volume listed 10 years earlier.

ExxonMobil Corp. and Ocean Energy Inc. completed installation of the $560 million Jade platform in Zafiro field off Equatorial Guinea in 2000. Jade is the largest fixed production drilling platform off West Africa. A nearby floating production, storage, and offloading vessel stores all production from the platform until tankers export it through a single-point mooring buoy. Work is also proceeding on a new FPSO scheduled for installation the second half of 2003 that will serve the new southern area of the field that is under development. Photo courtesy of Ocean Energy.

The outlook is for large increases in oil reserves and production as the major fields discovered since the 1990s are developed, deepwater discoveries are added, and investments accelerate in the primary shelf block.

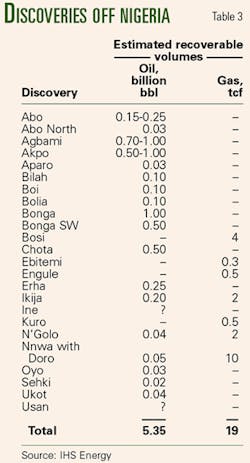

Angola's oil production, which averaged 900,000 b/d in 2002, could almost double as early as 2006 from four blocks alone (blocks 14, 15, 1, and 18), Centre for Global Energy Studies suggested last year. CGES already considers that at least 21 discoveries since 1996 have vaulted Angola's reserves to more than 10 billion bbl, and most of those finds will go on production in 2004-07 (OGJ, Apr. 1, 2002, p. 28).

Another analyst forecast production growth of 14%/year from 2002 through 2008 (Fig. 2)

The top two investors are TotalFinaElf and ExxonMobil Corp. Each plans to spend more than $800 million in Angola this year, and ExxonMobil's spending might eclipse that in 2004, estimates Wood Mackenzie, Edinburgh analyst. Most of the funds will go toward deepwater developments.

Block 0 off Cabinda is an important producing area at an estimated 450,000 b/d in 2002 and reserves of 1.9 billion bbl at Jan. 1, 2003.

Angola extended the Block 0 concession to 2030 from 2010, and the operating group plans significant additional investments there. The group consists of Angola's state Sonangol, ChevronTexaco Corp., ENI-Agip, and TotalFinaElf.

Greater West Africa

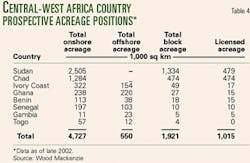

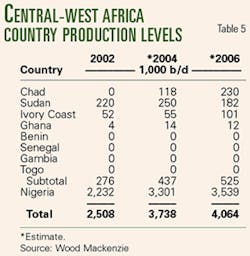

Tantalizing, possibly commercial discoveries, new plays, vast acreage availability, and licensing rounds imply that the multicountry areas between Angola and Mauritania will pick up steam in coming years (Tables 4 and 5).

The 19 countries control 710,578 sq miles offshore to the 4,000 m contour, an area three times that of Texas, said Jane Whaley, senior principal technical advisor, IHS Energy, Tetbury, UK.

Countries have made progress towards resolving some territorial disputes, and peace finally came to Angola, but project approval in the region can still be painfully slow, she noted.

The US is to import 25% of West Africa's crude by 2015, up from 15% at present, Whaley predicted.

Of the 19 countries, 13 have oil or gas reserves, and 86% of the total 80.5 billion bbl of reserves at end-2001 was in Nigeria and Angola.

Most of the smaller, nonproducing countries are licensing blocks or improving fiscal terms in anticipation of licensing. A majority of the acreage is not under license, many countries are willing to negotiate licenses out of round, and numerous companies that hold acreage are seeking partners.

Farther south, Congo (Brazzaville) averaged 250,000 b/d in 2002 from 1.5 billion bbl in reserves. Both figures are up sharply from 1993, and production is expected to begin growing after a stretch of decline in 2001-04.

To the north, interest is heightened off Morocco and the Canary Islands in light of geographic similarities with the productive Scotian shelf off eastern Canada. One well could be drilled on each of the Safi Haute Mer and Ras Tafelney blocks off Morocco in 2003-2004.

Developments, discoveries

Development of the Doba basin oil project in Chad and the associated Chad-Cameroon oil pipeline, Baobab deepwater oil field off Ivory Coast, and two discoveries off Ghana are the only developments in view by 2004.

Completion of the Chad-Cameroon pipeline should stimulate drilling in Central African Republic, Chad, Cameroon, and possibly Niger.

Recent wells have identified working petroleum systems off nonproducing Mauritania and Guinea Bissau, Wood Mackenzie noted.

Woodside Petroleum (Pty.) Ltd. plans to submit a commerciality declaration in mid-2003 from its 2001 Chinguetti discovery off Mauritania and targets first oil there in first quarter 2006. It also gauged oil at the Banda discovery last year on the same block in the Atlantic Ocean off Nouakchott.

These discoveries are more than 1,500 coastal miles northwest from the nearest oil production off Ivory Coast. The area is also 700 miles south of exploration in the Atlantic between Morocco and the Canary Islands.

Activity should also pick up in less-evaluated waters east and west of Ivory Coast, said Wood Mackenzie.

"Evidence of a ripple effect emanating from the Nigerian successes to the other countries in the central Africa region can be seen from the increased levels of exploration forecast for the coming years," the analyst said.

"Further encouragement is drawn from virgin exploration drilling in Gambia, Togo, and the AGC region between Senegal and Guinea Bissau (jointly administered area). Consideration of the deepwater plays, so long the focus of attention in West Africa, is under way and drilling in Ghana, Benin, and Togo is expected in the coming years."

It is also uncertain how far south Niger Delta prospectivity extends.

The gas business

LNG projects and pipelines are beginning to sprout to tap the region's considerable gas potential, and gas-to-liquids technology is sure to play a role.

Construction costs and gas prices are major issues in solving the region's almost complete lack of natural gas infrastructure.

Seven countries from Ivory Coast to Angola hold implied gas reserves of 223 tcf. Nigeria, with 84% of that, said Whaley of IHS Energy, ranks among the world's 10 top gas endowments.

Regional production averaged 5.3 bcfd in 2001, with 68% of that coming from Nigeria. Angola was the next largest West African gas producer with 11% of the total, and no other country had more than Congo (Brazzaville)'s 6%.

Considering new discoveries, Angola could recover 9.5 tcf of gas and possibly as much as 25 tcf, said the US Energy Information Administration.

Significant gas volumes in deepwater discoveries off Nigeria point to potential in the rest of the region's little drilled deepwater frontiers.

A GTL project in Nigeria and gas liquefaction terminals in Nigeria and Angola will help dispense onshore volumes.

An LNG facility in Luanda, Angola, would receive gas from eight offshore blocks as early as 2007. Some 85% of Angola's gas is flared, and the rest is processed for liquids and-or reinjected for pressure maintenance. Three oil-producing fields off Cabinda have zero-flare systems.

Also on tap are the $400 million West African Gas Pipeline from Nigeria to Benin, Togo, and Ghana, and possibly in 10-15 years a gas pipeline from Nigeria to Algeria that would cost $2 billion to $5 billion.

At least two multimillion dollar pipelines are proposed to transport gas from coastal Nigeria to the country's northern and eastern interior.

Sudan's fortunes

Sudan is becoming a major production and exploration center in central Africa on the heels of startup of the Greater Nile Oil Project in the Muglad basin.

GNOP averages 230,000 b/d from fields in southern Sudan which is shipped almost 900 miles northeast to Port Sudan on the Red Sea for export. A small portion of the crude is refined locally.

OGJ reported Sudan's proved reserves at 563 million bbl, and there is scope for much growth here. Others have estimated that recovery from GNOP's Heglig and Unity fields alone will reach 1.2 billion bbl, and Sudanese officials have stated that countrywide recoverable volumes already stand at 700 million bbl.

Several other areas of southern Sudan already have discoveries in various stages of development readiness.

Both Sudan and neighboring Chad have nearly 500,000 sq km of acreage licensed. Exploration maturity is low in Sudan and practically nonexistent in Chad except for the Doba basin. Inactivity and interruptions in operations in Sudan have occurred due to civil unrest.

ONGC Videsh Ltd. of India was near closing the $758 million purchase of Talisman Energy Inc.'s 25% stake in GNOP at this writing in mid-February.

The government wants to step up licensing and exploration in the Melut, Blue Nile, and Sudan's other basins.

North Africa

Algeria, Egypt, and Libya remain the powerhouses of North Africa in terms of reserves and production, with growth apparent in all three countries.

Algeria's expansion

OGJ reports Algeria with 9.2 billion bbl of oil reserves, and increases are probable in coming years as recent discoveries are booked, numerous development programs mature, and enhanced oil recovery takes hold.

Algeria's production capacity reached 1.1 million b/d last fall and was to climb to 1.5 million b/d shortly, Chakib Khelil, minister of energy and mining resources, told OGJ. He presumably referred to the startup of giant Ourhoud oil field with completion of surface facilities in early 2003.

The country's crude oil production averaged 839,000 b/d in the first 10 months of 2002, EIA reported, so this was already above Algeria's OPEC quota of 780,000 b/d as of Feb. 1, 2003. Full production at Ourhoud was to have attained 230,000 b/d by the end of February 2003.

Algeria puts its gas reserves at 160 tcf. The country had the capacity to export 2 tcf/year last year and aims at export capacity of 3 tcf/year or more by 2010, EIA reported. More pipelines to Europe and LNG projects are on the books.

Natural gas developments have caused condensate production to reach 430,000 b/d, and the country has output of another 190,000 b/d of gas plant liquids.

Libya's situation

OGJ puts Libya's oil reserves at 29.5 billion bbl, up from 22.8 billion bbl in the last 10 years.

Discoveries in the Murzuk and Sirte basins have contributed to the gains. Production averaged an estimated 1.3 million b/d in 2002, with state-owned National Oil Corp. operating about half that.

Only about 25% of the country is under license, which EIA said is "due largely to lack of investment mainly as a result of stringent fiscal terms imposed by Libya on foreign oil companies." However, the economic potential of Libyan blocks is generally considered attractive.

"European companies reportedly are growing frustrated over the slow pace of progress in awarding Libyan oil concessions," EIA said. "including the 130 exploration blocks offered since UN sanctions were lifted in 1999." Libya had awarded only a half dozen blocks by mid-2002.

Libya wants to raise that to 2 million b/d within 5 years, and it wants to develop its gas reserves for domestic use to free more oil for export. Gas is expected to flow to Europe starting in 2004 from the Western Libyan Gas Project sponsored by ENI SPA and NOC.

Egypt's gas tilt

Egypt has promulgated gas reserves of 58.5 tcf, up from a reported 35 tcf at the beginning of 2002.

Gas projects have started up and are being developed in the Nile Delta offshore and onshore and in the western desert as an adjunct to oil production. Countrywide gas output is to rise to 5 bcfd by 2007 from a reported 3 bcfd at the end of 2002.

Two LNG projects are under construction and due to begin shipping gas in 2004 and 2005 to European purchasers. Scarab and Saffron fields, to start up this quarter on the West Delta Deep Marine concession, will first supply the domestic market (OGJ, Feb. 10, 2003, p. 45).

Meanwhile, Shell and Petronas and others are exploring for oil in the offshore part of the delta. Shell, which will conduct more drilling, said that so far one well was noncommercial and another was a disappointment on the Northeast Mediterranean concession.

Egypt's oil production has declined 632,000 b/d in 2002 from 748,000 b/d in 2000, EIA reported.

Gulf of Suez Petroleum Co., a combined of BP PLC and Egyptian General Petroleum Corp., and the Agip-EGPC combine Petrobel was completing programs to extend the lives of fields in the gulf.

BP was awarded two new exploration blocks in the gulf in January 2003 and said it is looking for more opportunities there.

Tunisia

OGJ shows Tunisia's oil reserves at 308 million bbl, up from 187 million bbl in 1993 on a number of small but important discoveries.

Tunisia's oil production averaged 71,000 b/d in 2002, almost 75% of which comes from three fields: El Borma, Ashtart, and Sidi El Kilani, all in decline.

Eleven wildcats drilled in 2002 resulted in three new field discoveries: Hasdrubal Southwest-1 in the Gulf of Gabes, Baraka Southeast 1 in the Gulf of Hammamet, and Adam-1 in southern Tunisia.

The country has 2.8 tcf of proved gas reserves and produced about 75 bcf of gas in 2002, up more than 4% from 2001. Production at BG PLC's Miskar gas-condensate field in the Gulf of Gabes is building in phases toward a peak of 230 MMcfd before starting to decline in 2009.

The country is in the midst of an exploration licensing round, hoping to attract more independent operators. Entreprise Tunisienne d'Activites Petrolieres said 25 onshore and 10 offshore permits were in force during 2002. Four permits were granted, one was renewed, and three were relinquished.

Exploration is picking up in southernmost Tunisia in the extension of the Ghadames basin that has been Algeria's biggest success story in many years. Adam-1 flowed 5,240 b/d of 40-41° gravity oil and 16 MMcfd of gas and 1,320 b/d of 59° condensate from four Silurian Acacus zones at 3,333 m. First oil is expected in May 2003.

South and East Africa

South Africa is slowly building its oil and gas production and reserves, and Mozambique and Tanzania are launching first gas production projects.

South Africa had reserves of 16 million bbl at Jan. 1, 2003, and averaged 21,500 b/d in 2002 from Oribi and Oryx fields off the southern coast. Start-up of Sable field in the second quarter of 2003 is expected to add 30,000-40,000 b/d of oil from 6 wells.

Sable's reserves are 25 million bbl of oil, and the operating companies plan to drill 2-3 exploration wells this year and were negotiating to sell Sable gas to a synfuels plant.

The country hopes to step up gas utilization when supplies become available from discoveries off its west coast and from Mozambique.

Timing of the west coast offshore development is uncertain, but gas probably will not flow before 2005. On the east coast, gas is to begin flowing to South Africa from Mozambique next year when a 536-mile pipeline is completed from Pande and Temane gas fields to Secunda.

In Tanzania, start-up of the long-awaited Songas pipeline to transport gas from Songa Songa field to Dar es Salaam is expected in 2003-04.