OGJ Newsletter

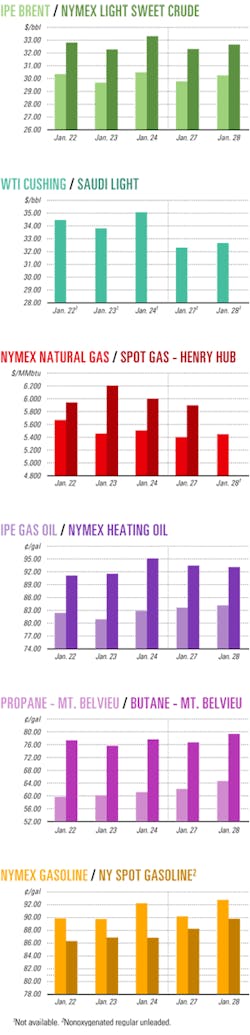

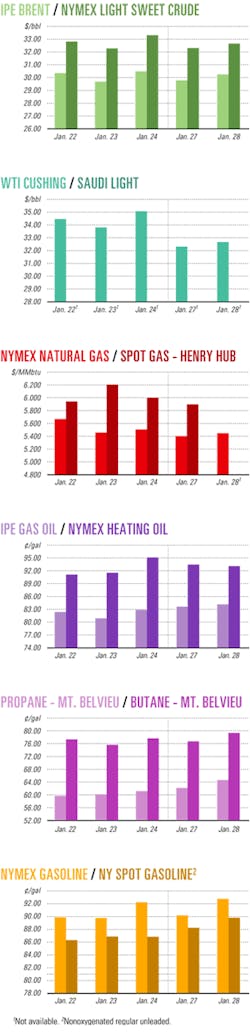

Spot natural gas prices surge amid cold

Frigid temperatures across much of the US triggered some surprisingly high spot natural gas prices for late February delivery, and traders also reported concern about anticipated dwindling gas inventory numbers heading into spring.

Spot natural gas prices surged for the week ended Jan. 24 as major US heating regions experienced some of the coldest conditions in more than 6 years.

"Few should have been surprised to see spot prices eclipse the $5/MMbtu mark," said UBS Warburg LLC analyst Ronald Barone in a Jan. 23 research note. He received multiple reports of intraday Northeast spot deliveries selling for $15-22/MMbtu.

Although frigid temperatures pushed some US furnaces into overdrive, recently released forecasts suggest milder days ahead.

The US National Weather Service's midterm outlook calls for temperatures throughout much of the US to average normal or above normal, while readings in the Southeast are expected to average below normal, Barone said.

But traders still expect near-term price pressure, noting that natural gas stocks are dropping fast because of a cold winter. Energy Information Administration figures showed a 247 bcf stock draw for the week ended Jan. 24.

February natural gas futures prices on the New York Mercantile Exchange jumped by 21.6¢, or 4%, to settle at $5.66/MMbtu as that month's contract expired.

Oil prices a gas market factor

Strong NYMEX crude oil prices also are helping to support gas prices, traders said.

The March contract for benchmark US light, sweet crude jumped by 96¢ to $33.63/bbl on Jan. 29, while the April position gained 89¢ to $32.71/bbl on Jan. 29. Oil traders were reacting to the weekly inventory reports by the American Petroleum Institute and the EIA.

EIA said the nation's crude oil stocks declined by 500,000 bbl for the week ended Jan. 24, while gasoline inventories were lower by 3.3 million bbl. Distillate stocks pulled back by 6.8 million bbl.

API said crude stocks rose by 232,000 bbl, while gasoline and distillate inventories fell by 3.31 million and 7.45 million bbl, respectively.

Meanwhile, Barone called his first quarter natural gas forecast of $4.10/MMbtu conservative, adding that odds are increasing that Apr. 1 storage levels will fall below 1 tcf. Other revised forecasts are calling for steeper declines in North American deliverability.

Bullish long-term gas price outlook

Deliverability concerns are part of the tight supply-demand fundamentals anticipated through 2004, said analysts who outlined bullish long-term outlooks for natural gas prices.

Arlington, Va.-based Friedman, Billings, Ramsey & Co. Inc. outlined its 3-year outlook for natural gas prices, saying, "A new natural gas pricing regime is sustainable.

"Based on our assessment of tight natural gas supply-demand fundamentals through 2005, we are raising our 2003 price forecast to $4.40/Mcf and establishing 2004 and 2005 price forecasts of $4/Mcf and $3.70/Mcf, respectively. Our price forecast assumes moderate economic growth, a decline in crude oil prices to $22/bbl, and normal weather," FBR analysts said in a Jan. 28 research note.

Sustained strength of natural gas prices stems from what FBR analysts see as a "current overwhelming supply-demand imbalance."

"We expect total deliverability, or the supply of natural gas to the US consuming markets, to continue to decline through 2004 before flattening out in 2005. We estimate that base domestic natural gas production will continue to decline 1-2% annually, and that it will decrease an incremental 1.3 bcfd by 2004, or 2%, of 2001 North American natural gas supply levels," FBR analysts said.

They also expect "a modest decline in Canadian imports and increasing exports to Mexico to further exacerbate deliverability declines, leading to a (net) incremental decrease in deliverability of 1.2 bcfd."

Deliverability declines of 2.7-2.8 bcfd will be partly offset by 1.5 bcfd of increased LNG imports and continued ethane rejection, they said.

Regarding demand, FBR studied the impact of high natural gas prices and a weak economic growth scenario on industrial demand.

"The results of our analysis indicate that the US will lose an additional 2.8 bcfd of industrial gas demand (cumulative) through 2005. Furthermore, we expect moderating crude oil prices through 2005 to induce a fuel switching-driven natural gas demand loss of 1.1 bcfd," analysts said.

Natural gas is expected to capture a greater share of the US power market, with a 2.4 bcfd increase in consumption. New environmental rules will add another 1.5 bcfd.

Industry Scoreboard

null

null

null

Industry Trends

WIND POWER is moving to the forefront of the renewable energy industry.

Norwalk, Conn.-based Business Communications Co. Inc. (BCC) concludes that is because of increasingly favorable regulatory regimes, government support, environmental pressures, and rapidly evolving technology.

Large wind turbines are the first industrialized renewable energy technology to be priced competitively with coal and natural gas-fueled turbines for utility-scale power generation, BCC said.

"The kicker is that the resource, wind, has no price volatility. Perhaps the most important feature in a new era of economic uncertainty is a quick turnaround for investors. Large wind projects begin delivering returns within a year of financing," BCC said in a recent report, "Renewable Bulk Power Sources: World Markets for Large Wind Turbines."

Worldwide in 2001, $5.5 billion was invested in new large wind turbines. That amount held steady through 2002 as the large wind industry continued apace everywhere but in the US (see table).

"A frantic pace of development will resume in 2003 in the US as backlogged and new projects are brought to completion ahead of the expiration date of the federal production tax credit," BCC said. Meanwhile, large markets are opening in France, the UK, and Australia.

EQUITY MARKETS worldwide were lower in 2002, but the oil industry saw more of its stock rise than fall, consulting company John S. Herold Inc., Norwalk, Conn., said in a recent report.

The Herold Energy Investment Outlook—Year End Review 2002, showed the median total return from Herold's survey of 304 integrated oil and oil service companies was 4%, which compared with declines in the Dow Jones Industrial Average (down 16.8%), the S&P 500 (down 23.4%), and the NASDAQ (down 31.5%).

Herold said that all 15 oil industry peer groups it follows outperformed the broad market.

Although oil shares in general provided a relatively safe haven from the bear market, the large integrated oils fell for the third straight year, a 9.2% drop that translated into a $110 billion loss in market value in 2002 and a $200 billion decline over the last 2 years, Herold said.

Mergers, and the resultant cost-cutting and size-based economies of scale, have not paid off in the last 3 years, as evidenced by the subpar returns of ConocoPhillips (down 19.7%) and ChevronTexaco Corp. (down 25.8%), the survey said.

Government Developments

ENERGY CHARTER Conference (ECC) Sec. Gen. Ria Kemper has said her organization would like to offer the Organization of Petroleum Exporting Countries observer status as outlined by the Energy Charter Treaty.

Kemper said the ECC welcomed OPEC member countries as well as OPEC as an organization.

Seven of the 11 OPEC member countries already have individual observer status in ECC, with Iran most recently granted observer status (OGJ Online, Dec. 23, 2002). Non-OPEC member South Korea also was granted observer status at the same time.

The ECC is the governing body of an intergovernmental organization devoted to promoting East-West energy cooperation among its 51 European and Asian member states.

Kemper recently visited Vienna where she attended a workshop on OPEC and the ECC. She later spoke with OPEC News Agency.

Kemper said oil and natural gas exporting countries gain advantages by joining the ECC.

"As we see it, the treaty embodies a balanced approach to the creation of attractive investment conditions in producer states, promoting the interests of both foreign investors and host governments," she told OPECNA.

Kemper said the charter was not intended for adoption exclusively within Europe, adding, "Our geopolitical scope as an organization is by now truly 'Eurasian' in nature. We believe that a targeted further expansion of the charter's membership would be in the interest of global energy security."

IRAQI OIL EXPORTS dipped around 25% to 11.34 million bbl during the week ended Jan. 24, after rising to 15.1 million bbl the previous week under the United Nations' oil-for-aid program.

Year-on-year figures, however, suggest that Iraqi exports for the first 4 weeks of January are running slightly higher than for the comparable weeks of January 2002, while earnings are nearly double.

In January 2003, there were 33 loadings totaling 46.26 million bbl as opposed to 27 loadings totaling 43.3 million bbl in January 2002. On average, the Iraqis loaded 1.4 million bbl/shipment last month, compared with 1.6 million bbl/shipment in January 2002.

Owing to the rise in oil prices, however, Iraq's income of $1.291 billion for this January is nearly twice the $709 million brought in during the same period in 2002.

UN officials told OGJ there was "no particular reason" for the fall-off during Jan. 18-24, but reports emerged last week that water contamination in the pipeline that pumps Iraqi oil to the Turkish port of Ceyhan would delay oil tanker loadings.

As a result, oil flow was reduced during Jan. 18-19 while port officials attempted to drain water from the system, oil buyers said.

UN officials said that Iraq exported an average 1.6 million b/d during Jan. 18-24, down 500,000 b/d from an average of 2.1 million b/d during the week ended Jan. 17. The UN estimated that, at an average price of $27.80/bbl, Iraq's most recent exports generated $324 million for the aid program.

Phase 13 of the UN's oil-for-aid program extends from Dec. 5, 2002, through June 3, 2003. The UN said estimated revenue generated from the beginning of this most recent phase stands at $2.2 billion.

Quick Takes

GREKA ENERGY CORP.'s wholly owned subsidiary Greka Energy (International) BV, New York City, has signed four, 30-year production-sharing contracts (PSCs) with China United Coalbed Methane Corp. Ltd. (CUCBM) for the exploitation of coalbed methane resources in China's Shanxi and Anhui provinces. Greka previously had secured a PSC for Fengcheng Block in Jiangxi Province.

Greka will serve as operator of the five blocks with a 60% working interest in all PSCs except Fengcheng Block, in which it has a 49% working interest. CUCBM will own the remaining interest.

The combined total contract area is 1.7 million acres, with average coalbed thickness of 16.5 ft and potential reserves of 34.5 tcf, Greka said. Three of the blocks are near the West-East natural gas pipeline that is expected to provide immediate access to CBM markets.

Although China's CBM reserves are among the top five largest in the world, China has not yet sold commercial production, Greka said, because traditional development requires extensive vertical wells and high capital expenditures in surface facilities. Greka will use horizontal drilling technology, which requires fewer surface facilities. Contracted areas include:

- Fengcheng Block in Jiangxi Province, considered one of the better potential CBM exploitation areas in China. Greka plans to drill and evaluate a pilot well this year.

- Shizhuang Block South in Shanxi Province, China's most advanced CBM reserve and where CUCBM has invested most of its development capital over the last 5 years. Current production from 15 wells support Greka's plans to begin production sales this year.

- The adjacent Shizhuang Block North in Shanxi Province, which has geology, topography, and reservoir behavior similar to that of Shizhuang South.

- Qinyuan Block in Shanxi Province, which contains a well-developed infrastructure.

- Panxie Block in Anhui Province.

Six international oil majors will cooperate with National Iranian Oil Co. (NIOC) in implementing research projects to enhance production from Iran's oil and gas fields, OPEC News Agency reported. Mohammadali Emadi, NIOC research director, said BP PLC, TotalFinaElf SA, Statoil ASA, Norsk Hydro ASA, Malaysia's state owned Petronas Carigali Overseas Sdn. Bhd., and Tatarstan state oil company OAO Tatneft each agreed to pay as much as $300,000/year in the cooperative effort with NIOC. The consortium, which has agreed to a 5-year first stage, intends to transfer its expertise to help boost Iran's oil and natural gas production. If successful, the cooperation is expected to continue. Emadi said NIOC and Statoil already have cooperated for 8 months.

In other production news, Statoil said normal production has resumed at Glitne field in the North Sea following the offloading of oil Jan. 17 from the Petrojarl 1 production and storage vessel. Bad weather in the area and the floating production, storage, and offloading vessel's limited storage capacity were blamed for a production reduction of 10,000 b/d Jan. 15-16. The field has produced 36,000 b/d since Jan. 16, Statoil said.

OIL & GAS DEVELOPMENT CO. LTD. (OGDCL), Islamabad, said its Chak 7A No. 1 well found condensate and natural gas, marking its ninth discovery since March 2001 in the southern Indus basin of Pakistan.

Each discovery is in a different pay zone. Chak 7A, drilled to 3,050 m, is 22 km northwest of Sanghar in Sindh Province.

OGDCL operates and owns 76% of the Sinjhoro exploration license. Partners are Orient Petroleum International 9% and state-owned Government Holdings 5%. During initial tests, the well flowed 800 b/d of condensate and 5 MMcfd of gas through a 1/2-in. choke at 1,200 psi.

OGDCL estimates that the nine Sinjhoro discoveries will produce a total of 10,000 b/d of oil and 71 MMcfd of gas.

US-financed PetroTech Peruana SA is holding two hearings for environmental impact studies in March before beginning a seismic survey of Block Z-6's Sechura basin off northern Peru. Hearings will be held in Piura Mar. 5 and in Chiclayo Mar. 6. PetroTech signed an exploration and development license for the block on Mar. 20, 2002. Block Z-6 is south of Block Z-2B, which the company also operates off northern Peru (OGJ Online, Jan. 28, 2002). Last year, Block Z-2B produced an average 12,401 b/d of oil and 7.6 MMcfd of natural gas.

THE CURRENT CONTRACTOR for the Strategic Petroleum Reserve (SPR), DynMcDermott Petroleum Operations Co. of New Orleans, will be granted a new 5-year contract, effective Apr. 1, said US Sec. of Energy Spencer Abraham.

DynMcDermott will receive $120 million/year to maintain the readiness of the SPR's four crude oil storage facilities in Louisiana and Texas. The new contract includes a provision for a 5-year extension.

The contractor was responsible for increasing the SPR to 599 million bbl, a record level, Abraham said. DynMcDermott became the operating contractor in 1993.

DynMcDermott is owned by DynCorp, Reston, Va.; Jacobs Engineering, Pasadena, Calif.; and McDermott International Inc. and International-Matex Tank Terminals, both of New Orleans.

OMAN GAS CO. (OGC) has awarded a contract valued at 2 million Oman rials ($18.7 million) to Dodsal & Co. of India to construct a 48 km, bidirectional natural gas pipeline spur that will connect with the Fahud-Sohar pipeline at Mahdha and terminate at Buraimi on the border with the UAE.

Gas from the new 24-in. line initially will be exported to the UAE as feedstock for a 620 Mw power plant and 100 million gal/day desalination plant planned for Qidfa in Fujairah.

Omani officials said the new pipeline is a key element in a plan to export surplus Omani gas prior to the start-up of heavy industrial and petrochemical plants projected for an industrial complex at Sohar.

Omani officials said the new pipeline also will link the sultanate's gas network with a regional gas grid planned by Abu Dhabi's Dolphin Energy Ltd., allowing for future imports of gas.

Engineering consultants ILF & Partner, which earlier handled OGC's $300 million Sohar and Salalah lines, also will undertake project management for the Mahdha-Buraimi pipeline project. OGC is 80% owned by the Oman government and 20% by Oman Oil Co.

Chicap Pipe Line Co., a joint venture company based in Lisle, Ill., has named BP Pipelines (North America) Inc. new operator of its Chicap pipeline, formerly operated by Unocal Corp. Chicap is owned by Unocal 48.1%, BP 29.2%, and Calgary-based Enbridge Inc. 22.7%. The 200 mile, 26-in. pipeline originates near Patoka, Ill., and transports crude oil to refineries in the Midwest from the Gulf of Mexico and outside the US. It has connections at Manhattan, Ill., to lines operated by Enbridge Pipeline Inc. and BP Pipelines, and spurs to refineries at Lemont and Joliet. On other pipeline fronts, Crosstex Energy LP, Dallas, has completed connections to 70 miles of pipeline the company acquired from Florida Gas Transmission Co. last June and is now selling natural gas to Florida. The acquired pipeline provides Crosstex with access to those markets from the Corpus Christi Natural Gas Co. LP and Gulf Coast systems, including connections to a new supply point at the ConocoPhillips Lobo Pipeline at Agua Dulce field in South Texas. Gas last week flowed at 50 MMcfd. With the new pipeline's capacity of 100 MMcfd, Crosstex is working to access additional Florida markets.

Meanwhile, a search is being conducted in Pakistan for parties responsible for sabotaging Sui Northern Gas Pipelines Ltd. mainlines in separate incidents last week that cut off gas supply to some areas of Sindh and Balochistan provinces. On Jan. 21 warring Mazari and Bugti tribesmen firing rockets at each other blew up two main 24-in. and 30-in gas pipelines and a valve assembly 18 miles downstream of Sui field. The system had been transporting 500 MMcfd of gas. The following day, unidentified individuals set off explosives under a pipeline in Balochistan province, according to local witnesses. At least seven active gas wells in Sui fields were shut down to avoid further damage. Sui Northern said that repair work proceeded "on a war footing" so that supply could be resumed as a top priority. The incidents represent the fourth time that the main gas pipeline from Sui to Punjab has been damaged.

BOLLINGER SHIPYARDS of Lockport, La., has delivered the first of four double-hulled, ocean-going oil tank barges to K-Sea Transportation Corp. of Staten Island, NY. The unmanned barge, designated DBL 101, measures 400 ft by 74 ft by 25 ft, with a total cargo capacity of 100,000 bbl.

The barge was built to a new design provided by Guarino & Cox LLC, Slidell, La., that meets requirements of the Oil Pollution Act of 1990, officials said. A second barge, designated DBL 81, is under construction at Bollinger Marine Fabricators (BMF), Amelia, La., and is scheduled for delivery this month.

A $5 MILLION LOAN to the Peruvian government signed by Inter-American Development Bank (IDB) Jan. 20 will help fund a $7.2 million project to strengthen state companies monitoring the Camisea natural gas project on the eastern slopes of the Andes, 500 km east of Lima. Peru is to pay the remaining $2.2 million for that project from state funds.

Camisea partners, who have invested $650 million on field development and pipelines already, need an equivalent amount to complete the project, officials said. Camisea expects to obtain financing by the third quarter.

The IDB loan is part of $275 million Camisea participants hope to obtain from development banks, including $75 million from IDB, $50 million from Andean Development Fund, and $150 million from Export-Import Bank of the US. Additional financing is expected through private banks.

Pluspetrol SA's Peru unit heads the consortium operating the upstream concession, while another Argentine company, Techint SA, heads the group operating the transportation concession, and Belgium's Tractebel SA subsidiary Gas Natural de Lima y Callao leads a third consortium for distribution of the gas in Lima (OGJ, Nov. 25, 2002, p. 22).

Partners expect the project to be completed on schedule, before August 2004.

Meanwhile, Parker Drilling Co. completed drilling a second development gas well in San Martin field and will move the rig to neighboring Cashiriari field to drill two more development wells.

China Oilfield Services Ltd. (COSL), the drilling service arm of China National Offshore Oil Corp., has signed contracts for the construction of eight ships valued at $80.96 million, with delivery scheduled by May 2004. Seven are multifunctional oil field support vessels, and one is an integrated seismic-geohazard survey vessel with dynamic positioning capabilities. Four Chinese shipyards will construct the vessels: Dalian New Shipbuilding Heavy Industry, Guangzhou Whampoa Shipbuilding Plant, Wuchang Shipyard, and Shandong Huanghai Shipbuilding.

NIGERIA LIQUEFIED NATURAL GAS LTD. (NLNG) has secured a loan of $460 million to fund eight new LNG carriers for its shipping subsidiary, Bonny Gas Transport Ltd. (BGT). "We anticipateUloan execution in March," NLNG Managing Director Andrew Jamieson told OGJ.

BGT currently owns eight carriers transporting LNG from NLNG's three existing trains, with a ninth ship due for delivery this month from Hyundai Heavy Industries of South Korea.

NLNG also has a 10th ship under long-term charter from Shell Bermuda Overseas Ltd., with an option to purchase after Jan. 1, 2006. Purchase of the new carriers is aimed at increasing the company's fleet to 18 vessels to handle 8 million tonnes of additional LNG output following construction of Trains 4 and 5, Jamieson said.

Jamieson said NLNG last month signed loan agreements for $1.06 billion to finance Trains 4 and 5, which are expected to start up in second half 2005 at a cost of $2.1 billion, excluding the cost of the new LNG carriers.

BGT will own four of the new carriers, and the other four new vessels will be chartered from Bergesen of Norway, which plans to contract Daewoo Shipbuilding & Marine Engineering Co. Ltd., of South Korea, to build them at a cost of $710 million. Delivery is to take place in first, third, and fourth quarters 2005 and first quarter 2006.

NLNG has an option to buy each of the four Bergesen vessels at agreed stages during the contract period, the first 5 years after delivery.

Production from NLNG's third train began last November, and the first shipment departed in December for Gas Natural SDG SA of Spain under a 22.5-year contract for 2.7 billion cu m/year. Transgas of Portugal will purchase the remaining 1 billion cu m/year from Train 3, also under a 22.5-year contract.

NLNG is a Nigerian joint venture of Nigerian National Petroleum Corp. 49%, Royal Dutch/Shell Group 25.6%, TotalFinaElf SA 15%, and Agip SPA 10.4%.