Petrochemical capacity additions to slow 2002-12

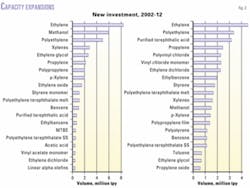

Petrochemical production capacity additions will slow 2002-12. From 1992 to 2002, worldwide capacity for the top 97 petrochemical products increased by almost 400 million tonnes/year (tpy). Announced planned expansions for 2002-12 total only about 150 million tpy.

The result of one of the longest chemical industry downturns in history (1997-2003) is that companies are reluctant to expand capacity even with apparent tight market prospects.

Substantial new capacity will be needed 2007-12 for most of the products that SRI Consulting covers. Some products are already showing a need for further expansions such as methyl methacrylate, styrene, and the polyester chain.

Petrochemical companies with long-term higher profitability objectives should consider investments with the highest possible economic performance. Investing in China, particularly in non-pure ethylene derivatives, is one option. Investing in low-cost feedstock regions with stranded natural gas reserves or refinery product availability is another major alternative. In either case, a strong technology and market position is necessary for meeting higher profit objectives.

An option for non-oil companies with no relationships in major oil producing countries like Saudi Arabia is to consider one of the smaller Persian Gulf countries with large natural resource bases for investment or by partnering in China.

Experience

The petrochemical industry has prepared itself for recovery in the past few years by rationalizing capacity and reducing fixed costs.

Poised for demand growth in early 2001, the industry experienced the beginning of a recovery in the second half of that year. It was a false start, however; demand showed only weak growth based on poor performance of the global economy, mainly due to anxiety building up to the Iraq conflict.

A lesson learned from the 1997-2002 chemical industry recession is that companies only invest in areas with the highest possible returns on investment for the long term.

The confluence of high natural gas prices in North America, high oil prices, political and economic problems in Latin America, and mediocre demand growth in late 2002 and at least first-half 2003, forced companies to scrupulously narrow investment plans to areas with supreme advantage in terms of products and regions.

Regional factors

Markets in Western Europe and North America have a relatively higher cost of production than other regions. Producers there focus on niche and specialty petrochemical investments, or on the products for which they have a raw-material advantage—such as butylenes and propylene—based on large FCC capacities at indigenous refineries.

Investment interest in Latin America has declined due to the rise of political parties with unfavorable commercial policies in many countries. The notable exception is Mexico, which is taking steps to encourage investment and potentially offers favorable feedstock costs.

In Asia, investment interest has shifted to China, as it maintains low labor costs vs. rising labor costs in other Asian countries. China with a population of 1.3 billion has a more attractive investment position than India with a population of 900 million. Although the two countries have similar economic potential, India poses political hurdles for investors.

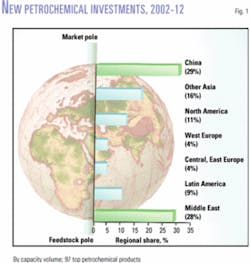

Downstream manufacturing industries have moved from other countries, including those in Asia, and into China. This makes China the largest growing petrochemical market in the world and, as such, an attraction pole for petrochemical investment (Fig. 1).

The other investment pole is the Middle East, due to its basic trade environment and abundant, low-cost hydrocarbon resources. Companies searching for an advantage are looking beyond interim Middle East hostilities and planning to build capacity there (Fig. 2).

A political change in Iraq could attract oil companies (mainly from the US) to invest in oil and gas exploration, production, and refining. With increasing oil and gas production, Iraq will have enough raw materials to feed a new world scale gas-liquid cracker, which would be most likely in Basra or Fao, in the southern part of Iraq, between 2005 and 2012.

Profit outlook

The settlement of the Iraq conflict should boost consumer confidence and spending, which will, in turn, increase petrochemical demand. Petrochemical margins are set to improve by yearend 2003.

Our forecasting methodology hinges on the fact that product price movements are basically related to a combination of feedstock cost and market condition changes.

Price variability typically depends on cost swings; however, the increment of price movement most important to producers (margin) depends more on market conditions, specifically supply and demand conditions.

Operating rates are an inadequate guide to profitability because, for instance, producers can run plants at higher rates to divert product to the export market at lower prices when demand is low. Alternatively, when rates are in the high 90%s, the market can import more material at even higher prices. We call this the "trade effect."

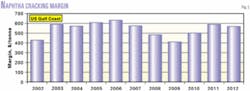

The ethylene naphtha-cracking margin along the US Gulf Coast is an adequate surrogate indicator for the general state of the world petrochemical industry. This margin will peak in 2006, at which time another down cycle will occur (Fig. 3).

Ethylene

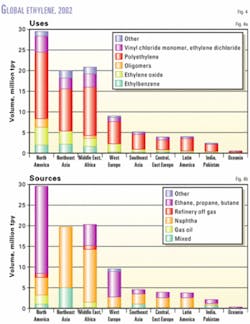

The worldwide ethylene business will start to recover in conjunction with the global economic recovery expected. Most ethylene demand is based on worldwide polyethylene growth, with regional ethylene demand shares varying with cracker feedstock slates and the development of end-use markets.

Regions with naphtha cracking capacity may have a broader ethylene market, based on petrochemicals requiring a combination of by-products—such as ethylene, benzene, and butadiene for acrylonitrile butadiene styrene resins—or special niche markets such as specialty ethylene oxide markets in developed regions (Fig. 4).

The Middle East has planned mainly ethane cracker projects; the region will likely have further "pure" ethylene derivative-type projects associated with these plans.

We expect more naphtha cracking in China. Regional and domestic refineries will supply more of this naphtha as they expand to meet growing fuels demand in China and Asia.

Asian producers will have an advantage in the major ethylene cracker by-product derivatives, as the Middle East focuses on lighter feed cracker expansions, which have less by-products.

Propylene

Worldwide propylene demand will grow 4.1%/year during the next 10 years. This is about the same amount of growth as ethylene demand.

Whereas ethylene is almost exclusively manufactured via steam cracking, about 40% of the world propylene production base consists of other sources, particularly refineries and, to a lesser degree, on-purpose manufacture. A large share of new cracker expansions are based on ethane or lighter feeds; therefore, there is a concern that not enough propylene would be available to meet consumption needs.

There will not be a shortage of propylene during the next 10 years. There are also other sources besides naphtha crackers to fill this gap, such as refineries, metathesis plants, or propane dehydrogenation units. An often-underestimated trend is the growth of refinery propylene production and its potential as chemical feedstock.

About 12 million tpy of additional refinery propylene will be available worldwide during the next 10 years. Refinery propylene production will increase to 45 million tonnes in 2012 from 33 million tonnes in 2002. This huge additional volume is equal to the output of approximately 30-40 world-scale steam crackers.

About 97% of refinery propylene comes from catalytic cracking. The remaining 3% comes from coker units. About 75% of the additional 12 million tonnes of refinery propylene will be produced in North America and Asia. This will make North America a key area for propylene derivatives expansion.

Nearly half of the world catalytic cracking capacity (340 million tpy out of 715 million tpy) is in North America. Western Europe has 19% of the world FCC capacity and Asia has 18%. The Middle East does not currently have significant FCC capacity, with only 18 million tpy, or 2.5% of world capacity.

New catalysts or deep catalytic cracking are the primary sources of increased propylene output. Asia will add about 35 million tpy of new FCC capacity. Asia is the only region likely to see significant FCC capacity increases. North America and Asia will each increase refinery propylene output by 4.5 million tpy by 2012.

New FCC units will be built mainly in Asia because gasoline demand is still growing there, unlike in Western Europe and North America, where gasoline demand is declining or stagnating.

Recent catalyst improvements can increase propylene yield in FCC production to 10% or higher from the current average of 4.5%. These developments give North America (mainly the US, with its large FCC capacity) an advantage over other regions of the world.

The potential methyl tertiary butyl ether (MTBE) ban in the US will increase the need for high-octane gasoline components. Because FCC products have a high octane number, they will help fill this need, but only after ethanol (for oxygenate requirements) and butanes.

Some building of on-purpose propylene capacity will also occur. Propane dehydrogenation units must be supplied with low-cost propane; therefore, potential new units will be built in the Middle East, North Africa, or Russia.

New already announced metathesis plants will be built in Port Arthur, Tex., Osaka, and Antwerp.

Thermoplastics

Our projections are based on relatively conservative demand projections in consumption regions such as China. Even by this measure, China will continue importing significant amounts of thermoplastics such as polyvinyl chloride, polyethylene, polystyrene, and polypropylene during the next 10 years.

Profitability will improve steadily from 2003 to the anticipated peak period of 2005-06. Total world polyethylene demand will grow 5.2%/year, similar to its 1998-2001 rate.

The primary location of new investment will be in China, the Middle East, and North America. Western Europe and Japan roles will be limited to scrap-and-rebuild strategies to sustain domestic demand and declining net trade.

Demand for polyethylene will improve from 2003, with increased utilization rates and the need for speculative capacity commencing as early as 2007. Some adjustments will be required in high-density polyethylene (HDPE) and linear, low-density polyethylene (LLDPE): Supply is too centered on HDPE and not enough on LLDPE.

On the demand side, LLDPE could grow faster than low-density polyethylene (LDPE), particularly if the world economy improves at a high rate of recovery.

Among the three polyethylenes, HDPE shows the least attractive supply-demand balance in the short term due to the considerable recent capacity additions in Western Europe and North America and the announcements of planned capacity in the Middle East.

We expect that operators will produce more LLDPE from existing swing capacity. After 2006, operators may reconsider more HDPE projects in favor of alternative polyethylene types.

The overall product supply-demand balance for polypropylene looks attractive due to the growing gap between demand and capacity growth. This gap will require more speculative capacity to reach a level of 11 million tpy by 2012.

New capacity will occur mainly in market regions that have available feedstocks, particularly from refineries.

Some alternate possibilities involve interpolymer substitution. The tightening of the polypropylene supply-demand balance and rising propylene costs could boost the growth of HDPE in overlapping end-use segments. Another interpolymer substitution possibility is that the current slow economic cycle could continue to sustain LDPE against the possible faster penetration of LLDPE in some emerging economies. We did not consider this possibility in our forecast.

Aromatics

The growth of polyethylene terephthalate (PET) melt capacity in China will drive the global polyester market.

PET melt capacity will grow to more than 14.5 million tpy by 2012 from 7.6 million tpy in 2002, to produce more polyester fibers, films, and PET solid-state resins.

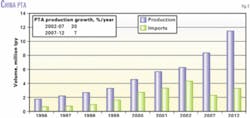

Purified terephthalic acid (PTA) imports in China reached 4.3 million tonnes in 2002 because growth in domestic PTA capacity lags demand growth.

Even with more than six new world-scale PTA plants to be commissioned in China by 2007, PTA imports will still average more than 2.7 million tpy (Fig. 5).

Methanol

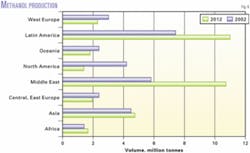

Areas with low-cost natural gas, such as the Middle East, Chile, and the Caribbean like to produce methanol. This trend will continue during the next 10 years (Fig. 6).

Worldwide methanol production will increase to 35.6 million tpy in 2012 from 31.2 million tpy in 2002. The Middle East's share of total methanol production 2002-12 will increase to 30.3% from 18.7%.

The North American share of worldwide methanol production in the same period will drop sharply, to 3.8% from 13.5%. Latin America will increase its share to 31.1% from 23.9%. This is based in part on a significant reduction in MTBE use in the US.

These estimates could change, depending on how low other countries choose to set natural gas prices.

Refining, energy

The worldwide refined products market will grow 2.2%/year, to 3.8 billion tonnes by 2012 from 3.1 billion tonnes in 2002. Based on this demand growth and steadily growing crude oil supply, crude oil prices will average around $25/bbl during the next 10 years.

The highest refined product consumption growth will occur in aviation fuel, which will rise as airline passenger traffic rebounds and continues strong growth during the next 10 years. Gas oil-diesel use is the second fastest growing fuels segment due to more truck and marine transportation.

On a regional basis, most refined product consumption growth will occur in Asia, at about 3.2%/year during the next 10 years. Mature regions, such as Western Europe and the US, will grow at 1%/year or less during this time frame, based on fuel efficiency trends.

More refining capacity will be built in Asia; therefore, more production capacity for petrochemicals that depend on refineries for feedstock will be built in Asia during the next 10 years.

Acknowledgment

Andrea Borruso, Ed Gartner, Ed Sporcic, and Michael Walther at SRI.Consulting contributed to this article. F

The author

Paul Bjacek is the world petrochemical director at SRI Consulting, Houston. He has also served as a business research leader for Chevron Chemical Co. and in consulting positions with Ernst & Young LLP, Chem Systems, and The WEFA Group. Bjacek holds an MS in sea law, economics, and policy from the London School of Economics and a BS in chemistry and business from the University of Scranton, Pa. He is also a past president of the Commercial Development & Marketing Association.