The third quarter financial results of integrated and independent oil companies, as well as of service and supply companies, showed healthy gains from year-earlier results. Revenues and net income for each group of companies moved up for both the quarter and the first 9 months of the year.

Click here to view Third Quarter Revenues, Earnings.

Much-improved performance in both the upstream and downstream sectors boosted the third quarter earnings of the integrated oil companies, while the independent operators benefited from higher production volumes and prices.

Collectively, the companies in the sample of US oil and gas operators reported a more than sevenfold increase in earnings for the third quarter as compared with the same period a year ago on revenues that rose 17%. Leading this sharp jump in earnings were ConocoPhillips and ChevronTexaco Corp., each turning around year-ago losses for profits exceeding $1 billion in the recent quarter.

A sampling of Canadian companies also posted stronger results as compared with a year earlier (see related story, p. 22).

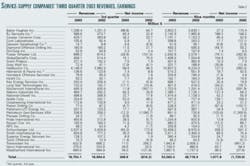

The group of service and supply companies in the sample recorded earnings of $309 million vs. a loss of $810 million in third quarter 2002. This negative year-ago figure was weighted by a loss by a single company, Petroleum Geo-Services ASA. Revenues for the group improved to $18.8 billion from $16.1 billion a year earlier.

Majors

ExxonMobil Corp. reported strong third quarter results. Net income was $3.7 billion, up $1 billion from third quarter 2002. Excluding merger effects, discontinued operations, and special items, ExxonMobil's earnings increased $721 million from third quarter 2002.

Revenue for third quarter 2003 totaled $59.8 billion compared with $54.1 billion in the same period of 2002. Capital and exploration expenditures of $3.8 billion in third quarter 2003 were up $275 million compared with a year earlier.

ExxonMobil's Chairman Lee R. Raymond commented, "Third quarter earnings were the second highest ever for this quarter and increased by 38% vs. last year due to significant improvement in the downstream. [Capital spending] continued to grow consistent with our long-term investment plans."

ExxonMobil's upstream earnings were $2.7 billion, an increase of $210 million from third quarter 2002 results excluding special items. This increase reflects higher average crude and natural gas prices.

Liquids volumes increased by 1% due to production from new projects in West Africa. On an oil-equivalent basis, actual production in the third quarter was down 3% as lower European gas demand and natural field decline of both oil and gas more than offset contributions from new projects.

As a result of improved industry-wide conditions, ExxonMobil's downstream earnings were $911 million, an increase of $786 million from last year's third quarter. Chemicals earnings of $230 million were down $123 million from last year's strong third quarter due to higher worldwide feedstock costs.

ConocoPhillips posted third quarter net income of $1.3 billion compared with a net loss of $116 million for the same quarter in 2002, which included only one month of the combined company. Total revenues were $26.5 billion vs. $14.7 billion a year ago.

"Our performance in the third quarter was solid," said Jim Mulva, ConocoPhillips president and CEO. "We operated as expected and benefited from market conditions in both upstream and downstream. Upstream production was 1.56 million boe/d during the quarter. The downstream business generated a significant portion of our total earnings by maintaining high utilization rates, allowing us to realize the benefit of strong refining margins.

"ConocoPhillips was able to fund $4.4 billion in capital expenditures, reduce debt by $3.7 billion, and improve its debt-to-capital ratio to 36% during the first 9 months of this year.

"We have completed asset sales of $2.2 billion since the merger, and we expect to complete another estimated $1.3 billion by the end of the year. This will meet our announced divestiture program target of $3 billion to $4 billion by the end of 2004. During the third quarter, we made significant progress with the announced agreement to sell the Circle K Corp. and the completion of the sale of our New York and New England retail marketing assets," Mulva said.

Analyst JJ Traynor of Deutsche Bank, commenting on ConocoPhillips's downstream bonanza said, "After some mixed signals in the results season to date, ConocoPhillips has finally delivered what the margin environment had been suggesting over the quarter.

"Downstream earnings of $416 million for the quarter were up 83% from [second quarter 2002] reflecting the strong refining margins on both the East and Gulf Coast. Utilization rates were also high at 95%, especially considering the down time at the group's Ponca City facility, while turnaround costs were low for the quarter, at just $13 million. Looking ahead such a result is unlikely to be repeated in the fourth quarter; margins have come off [third quarter 2003] peaks, while the company has flagged a higher level of turnarounds for the fourth quarter.

Independent E&P firms

Strong oil and gas prices coupled with increased output fueled the results of many independent producers, including Anadarko Petroleum Corp., Apache Corp., and Cabot Oil & Gas Corp.

Burlington Resources Inc. reported estimated net income of $267 million for third quarter 2003 compared with net income of $79 million during the same quarter of 2002.

Burlington attributes the earnings increase to higher average commodity prices and rising production of gas, natural gas liquids, and oil. Burlington also reported progress in its cost containment efforts.

Burlington's gas production averaged 1.9 bcfd, up 3% from the prior year's quarterly average of 1.8 bcfd. NGL production increased 6% to 63,000 b/d, and oil production increased to 47,300 b/d from 44,700 b/d a year earlier.

The company achieved increases in gas and NGL volumes in Canada and larger oil volumes from international operations due to the addition of production from Burlington-operated MLN field in Algeria. Subsequent to the quarter, oil production began from Panyu field off China—operated by Devon Energy China Ltd., a unit of Devon Energy Corp.—and gas volumes were rising in Madden field in Wyoming as a result of progress on the gathering line repairs.

Gas price realizations averaged $4.68/Mcf during the quarter, compared to $2.77/Mcf during the prior year's quarter. The company said that increased pipeline capacity in the Rocky Mountains has reduced basis differentials and increased prices realized for its gas production there.

NGL price realizations of $20.42/bbl were up from $15.22/bbl realized during the prior year's quarter. Oil price realizations of $27.16/bbl were up from $25.90/bbl. Exploration expenses were $55 million during the third quarter compared with $53 million during the prior year's quarter.

Service, supply firms

Financial results of the service and supply firms were mixed during the third quarter.

Weatherford International Ltd. posted third quarter earnings of $34 million compared with a net loss of $122 million a year earlier.

Revenue for the period moved up to $660 million vs. $585 million for the same 2002 period. Weatherford attributes the revenue gain to improvements in nearly all geographic regions.

Weatherford's drilling services segment recorded revenue of $383 million during the quarter, up $36 million from a year earlier.

The company's productions systems segment posted revenue of $277 million, a $40 million gain from a year earlier. This was an 8% increase from the second quarter of this year, driven by strong performances in Canada and the Middle East. Weatherford's artificial lift and production optimization operations showed the biggest improvements from the previous quarter.

Patterson-UTI Energy Inc. reported net income of $17.1 million for the quarter, compared to earnings of $249,000 for the comparable 3 months last year. Revenues for the quarter were $207 million vs. $133.5 million for the same quarter ended a year earlier.

Net income for the 9 months ended Sept. 30, 2003, was $34.9 million compared with net income of $339,000 for the 9 months ended Sept. 30, 2002. Revenues for the 9 months totaled $567.9 million, compared with $387.1 million for the comparable period in 2002.

Cloyce A. Talbott, Patterson-UTI CEO, commented, "While demand for drilling rigs has remained relatively stable over the past several months, we have increased average revenues and margin per drilling day. Compared to the second quarter of 2003, our average revenue per drilling day increased by $340 to $9,580 and our average margin per drilling day increased by $370 to $2,600.

"During the third quarter of 2003, we had an average of 192 rigs operating, including 11 in Canada. While we are beginning to see an increase in the demand for drilling services, recent activity has been impacted by wet conditions in Texas, which have caused delays in preparing drilling locations and moving rigs. We estimate that our rig count will average 188 rigs operating for October, including 12 in Canada, and expect our rig count to increase as the negative effect of the wet conditions diminishes," Talbott added.

The company expects demand for drilling rigs to increase in the coming months as producers seek to overcome gas production declines and to profit from strong commodity prices.

Baker Hughes Inc. reported a third quarter 2003 net loss of $98.8 million compared to earnings of $64.7 million for third quarter 2002.

The company recorded after-tax charges totaling $105.9 million in the third quarter of 2003 related to its 30% minority interest in the WesternGeco seismic venture for the impairment of its multiclient seismic library and rationalization of its marine seismic fleet.

In addition, the company completed its evaluation of the carrying value of its investment in WesternGeco and has determined that the investment is impaired. Accordingly, the company recorded an after-tax charge of $45.3 million in the third quarter of 2003 that reduced the carrying value of the company's equity investment in affiliates.

The company also recorded an after- tax credit of $1.1 million related to the reversal of a restructuring charge recorded in 2000.

Third quarter results were impacted by the recent announcement that the company had entered into a definitive agreement with Andritz Group for the sale of Bird Machine, the remaining operating division of its process segment. The company has classified and is now reporting Bird Machine as a discontinued business for all current and prior periods.

Revenue for third quarter 2003 was up 7% compared to third quarter 2002, and up 1.8% compared to the second quarter of this year.

Michael E. Wiley, Baker Hughes' chairman, president, and CEO, said, "Our oil field divisions continued their strong performance in the third quarter with a consolidated operating profit margin in excess of 15% despite disappointing customer spending in the Gulf of Mexico. All other geographic regions met or exceeded our expectations. For the current quarter we expect continued modest improvements in the international markets and flat US activity."