E&C contractors face tight margins, more risk

Engineering and construction companies are facing tighter margins, riskier contracts, and intense competition as the industry's client base further consolidates.

The shrinking client base is reflected in the reduced number of operating companies listed in this year's Worldwide Construction Update (Oil & Gas Journal's exclusive construction survey is available at www.ogjonline.com).

An outlook for tougher E&C market conditions emerged at the recent 6th Annual Rice Global Forum for Engineering and Construction held in Houston at Rice University on Sept. 8.

Sponsored by the George R. Brown School of Engineering, Fluor Corp., Jacobs Engineering Group Inc., JGC Corp., KBR, Snamprogetti SPA, Technip, and Toyo Engineering Corp., the forum brought together industry experts from all over the world to discuss the trends and challenging business environment profoundly affecting E&C contracting companies.

A major theme among the speakers was that engineering services are increasingly seen as a commodity and that margins are becoming razor thin. On the one hand, advances in information technology, enhanced bandwidth, and stronger national companies have resulted in improved efficiencies and productivity across the board. However, the downside effect is that E&C contractors can no longer count on personal relationships with clients and suppliers nor can they count on their reputations for reliability and core competencies in order to win contracts. Instead, contractors are asked to participate in reverse auctions in which almost any international engineering firm can prevail based on its low bid.

Over the last decade, E&C contractors have faced falling operating margins, falling profit margins, falling returns on capital, difficulty in recruiting young technical talent, and growing bankruptcies, according to JP Chevriere, president of Transmar Consulting, Houston. He recommends that E&C firms adapt to a world of smaller staffs and different selection techniques. Firms must develop competencies with SAP, Oracle, or Ariba—the petroleum companies' preferred software systems.

He also states that an E&C contracting firm's senior management must become less reactive and more imaginative in order to deal with more complex operator-contractor relationships.

E&C companies are entering the "age of accountants," said Don Cruver, managing partner at Cruver & Associates LLP, Houston. In this period profitability continues to decline, cash-negative payment terms are commonplace, and the trend towards lump sum, turnkey engineering, procurement, and construction contracts continues to accelerate.

"The supermajors have overwhelming market power," said Cruver. "As the E&C industry continues to shrink, the weakest participants drive prices down and risks up in their effort to survive."

Cruver admonished contractors to stop thinking and acting like a commodity and to stop blaming Far Eastern contractors for low price bids. Instead, contractors can influence the outcome of negotiations by contesting unreasonable contracts, challenging "worst practices" in open forums, and refusing to sign an owner's standard contract when the risk outweighs the reward.

"The community of interest is in serious trouble," he said. E&C contractors must find a common ground of risk- sharing with operating firms or else insist that greater risk result in greater reward. His advice included a focus on rebuilding relationships, bidding responsibly, and engaging owners in meaningful dialogue at every level.

In his keynote address, Randy Harl, president and CEO of KBR, pointed out that within the last 15 years at least 75 E&C firms have been acquired, have merged, or have gone out of business. He agrees that a disproportionate amount of risk is being shoved across the table to the contractor. Harl also said that although KBR used to refuse to participate in reverse auctions, they will now participate, but only after careful risk-reward evaluation and after a delivered profit can be reliably assured. He advised that E&C firms must walk away from projects, particularly epic offshore projects, if the risk relationship is out of proportion.

Harl also noted that due to increased globalization, host countries have come to expect that provisions for local jobs, training, and sustainable development be included in contracts, but not at the expense of their culture or environment. "These shareholders," Harl warned, "are ignored at our peril."

M&A activity

As Harl stated, E&C firms continue to merge. In June, Chicago Bridge & Iron Co. (CB&I), The Woodlands, Tex., acquired John Brown Hydrocarbons Ltd., London, a subsidiary of Russia's OAO Yukos. The acquisition adds an additional 600 employees and offices in Canada, London, Moscow, and the Caspian region. John Brown Hydrocarbons holds a strategic alliance agreement with Yukos to provide technical and project services to support production operations throughout Russia.

CB&I also announced a new brand identity and logo to better represent its successful integration of Howe-Baker International LLC and Petrofac Inc., both of Tyler, Tex., and other acquisitions. Some of CB&I's 2003 EPC contracts include work at the LNG expansion projects at Bonny Island in Nigeria and at Lake Charles, La.; a maintenance contract at Syncrude Canada Ltd.'s oil sands facility in Mildred Lake, Alta.; a liquid butane storage facility at the Shanghai Chemical Industrial Park in Caojing, Shanghai; two LNG storage tanks at Aniva Bay, Sakhalin Island; and two double-walled LPG storage tanks at the Al Khaleej gas project in Qatar—the largest such tanks in the Middle East.

In other M&A news, Candover Partners Ltd. and the UK's 3I Group, along with JP Morgan Partners LLC, New York, formed a private equity consortium in November to acquire the oil, gas, and petrochemical business of ABB Ltd., Zurich, for $975 million. Final acquisition is expected to be completed sometime early next year.

Also of note, Lukoil-Neftegazstroy and Technip's office in Germany have signed an agreement to create a joint venture for the development of projects related to oil and gas processing and refining in Russia and other countries. Technip also signed the same kind of agreement with China's Sinopec Group for E&C services in the Middle East, India, China, Africa, and the Asia-Pacific region.

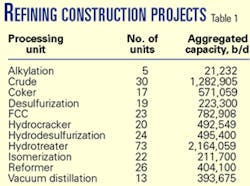

Refining

The exclusive OGJ survey of worldwide downstream construction projects shows that, despite slim profit margins for constructors, few refining unit projects have been delayed or canceled. Overall, more than 1.2 million b/d of capacity will be added to crude units worldwide in the near term.

One of the largest of these crude projects is the monster 190,000 b/d crude distillation unit at Petrolera Ameriven SA's upgrader facility in Jose, Anzoategui, Venezuela.

The $3.8 billion project will employ a contract work force of 6,000 during peak construction and will process heavy crude from the Orinoco Belt. Petrolera Ameriven, a JV of ChevronTexaco Corp., Petroleos de Venezuela SA, and ConocoPhillips, expects to be onstream in fourth quarter 2004.

In September, Bosicor Refinery Ltd. announced the completion of its 30,000 b/d Karachi refinery in Pakistan. The company entered into a 10-year contract with Pakistan State Oil Co. Ltd. for the sale of most of its products within Pakistan but plans to export naphtha.

Work at the InterOil Corp., Toronto, refinery in Papua New Guinea continued as the main crude column, reactors, and other major equipment arrived on site in September. Mechanical completion is expected in March 2004. This hydroskimming, 32,500 b/d refinery will process light, sweet crudes like Kutubu and is sized to meet the predicted demand of Papua New Guinea. The configuration consists of an atmospheric distillation unit plus a catalytic reformer for production of gasoline blendstock. The excess naphtha will be exported as petrochemical feedstock for ethylene production. Other products include propane, butane, gasoline, jet kerosine, diesel, and low-sulfur fuel oil.

In September, Imperial Oil Resources Ltd., Dartmouth, NS, completed its $80 million refinery upgrade. The upgrade, targeted to produce 30 ppm low-sulfur gasoline, utilized ExxonMobil Corp.'s Scanfining technology. Imperial plans to have all its facilities producing low-sulfur fuels by yearend.

Oman Refining Co. awarded EPC contracts to JGC and partner Yokohama-based Chiyoda Corp. for major engineering and construction on a new 116,400 b/d refinery at Sohar. The complex configuration will include four hydroprocessors, a resid fluid catalytic cracker unit, and an alkylation unit, plus hydrogen production. Commercial start-up of the $875 million refinery should be in early 2006.

null

On the other hand, worldwide refining will lose some crude processing capacity as Caltex (Philippines) Inc., a subsidiary of ChevronTexaco, converts its Batangas refinery into a finished product import terminal. The decision was motivated by market overcapacity in the Middle East and Asia Pacific and the resultant depressed refining margins. The terminal will have a storage capacity of 2.7 million bbl and is expected to be operational by yearend.

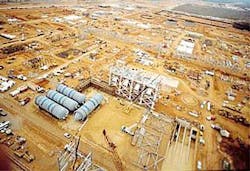

Petrochemicals

Worldwide petrochemical plans under way include 45 new or expanded ethylene projects. The largest of these projects are located in Qatar, Saudi Arabia, Iran, and Venezuela.

In the US, a major ethylene project is BP PLC's Chocolate Bayou, Tex., olefins complex. KBR won the EPC contract for the expansion. The project will include new SCORE furnaces for added capacity and a reduction of NOx emissions. The project is scheduled for a 2005 completion date.

In Qatar, Qatar Petrochemical Co. Ltd. recently completed a feasibility study to increase production at the Mesaieed ethylene plant to 720,000 tonnes/year (tpy) from the existing 525,000 tpy. The project is expected to be completed by the end of 2004.

In Taiwan, Chinese Petroleum Corp. (CPC) has canceled a plan to build an eighth naphtha cracker at an industrial site at Putai. Although CPC signed a letter of intent with the Chaiayi County government to build the cracker, the project has since come under fire from conservationist and aquaculture groups. Also, CPC determined that a project-driven deepwater port would not be economically viable.

One of the largest ammonia projects currently under construction listed in the survey is the $385-million, 800,000 tpy Burrup fertilizer plant on the Burrup peninsula in Australia. SNC-Lavalin Inc. of Montreal is the EPC contractor with KBR as technical advisor. The production will go to Norsk Hydro ASA.

Chevron Phillips Chemical Co. LP (CPChem), The Woodlands, Tex., plans to shut down the cumene unit and benzene extraction unit at its Port Arthur, Tex., facility by yearend. According to CPChem the benzene extraction unit was not economical and poor market conditions for the cumene unit made shutdown necessary. CPChem will continue to operate the olefins complex and the cyclohexane unit at the facility. Construction of the 266,000 tpy cyclohexane unit will continue as planned and should start up early next year.

Gas-to-liquids

Although many GTL projects have been proposed worldwide, most operators are taking a wait-and-see stance before actually breaking ground. The construction survey shows a current projected capacity of less than 300,000 b/d to come on line by 2007 and some of those projects might be canceled.

However, some projects are proceeding with confidence. Foster Wheeler Ltd. reported two projects with completed front-end engineering and design completion. The first project, to be operated by Chevron Nigeria Ltd. at Escravos, Nigeria, is anticipated to produce 24,000 b/d of syncrude, 9,000 b/d of naphtha, and 1,000 b/d of LPG. The plant will be designed to process 330 MMscfd of lean natural gas using the Fischer-Tropsch method. FW did the prefeasibility and FEED in preparation for EPC bidders and expects to assist with the EPC evaluation and award.

null

Foster Wheeler's other project is the Oryx GTL Ltd. plant, to be operated by a JV of Sasol Petroleum International (Pty.) Ltd. and Qatar Petroleum at Ras Laffan, Qatar. That plant should produce 34,000 b/d of premium-quality GTL fuels and naphtha products based on the slurry phase distillate process developed and commercialized in South Africa by Sasol. Foster Wheeler completed the FEED and preparation work and expects to be an integral part of the owner's project management team for the execution of EPC work for the project. Technip announced its EPC award, valued at $675 million, and expects completion by late 2005. According to Technip, this will be the most technologically advanced GTL plant in the world, and the first such complex for the Middle East.

One GTL project has been completed and commissioned. BP Exploration Alaska completed the GTL demonstration facility in Nikiski, Alas. The $86 million plant was completed in May, started up July 27, and began producing about 100 b/d.

Gas processing

LNG continues to be the important news in gas processing projects. According to the survey, more than 75 million tpy in new and expanded LNG export capacity will be brought online outside the US in the next few years. By all accounts the US will be a net importer, and several import and regasification terminals are under consideration on the East and West Coasts and in the Gulf of Mexico.

In addition to the planned onshore LNG capacity increases listed in the survey, BHP Billiton Ltd. has filed an application to construct and operate Cabrillo Port, a $550 million floating LNG regasification unit to be located off southern California. If favorable, and if all other permitting is approved and the project is still considered economically feasible, the 800 MMcfd sendout capacity facility could be onstream as early as 2008.

Tractebel NA, a wholly owned subsidiary of Tractebel SA, has submitted permit requests to the authorities to build a new LNG receiving terminal in the Bahamas. If environmental issues can be resolved, the plan would be to then build a pipeline to export gas to electric power plants in Florida.

Elsewhere, a consortium comprised of ChevronTexaco, Sonangol, BP, Total SA, ExxonMobil, and Norsk Hydro formed joint venture company Angola LNG Ltd. in Angola. Angola LNG plans a $2 billion, 4 million tpy, single train LNG facility to monetize associated gas because Angola is a no-flare zone. Although under consideration for years, the project is still in very early planning stages.

In Spain, BP successfully delivered the first shipment of LNG to the new terminal at Bilbao.

The 800-Mw combined-cycle electric power station and LNG complex is the first fully integrated facility of its kind in Europe and is owned by BP and other partners.

Plans by Repsol-YPF SA and BG Group to export to Mexico some of Bolivia's natural gas, in the form of LNG, met with uproar, civil unrest, and rioting. Plans for the $5 billion Pacific LNG gas export project and an accompanying facility for production of petrochemical feedstocks are on hold.

Shell India Private's $600 million LNG receiving terminal at Hazira in Gujarat is the country's first private sector facility of its kind. Construction is under way and, when completed in 2004, it will have a capacity of 2.5 million tpy with additional capacity expansion room if needed.

Sulfur

According to the survey, 60 projects totaling 23,300 tonne/day (tpd) of new or expanded sulfur recovery capacity are planned. The largest projects are to be built in Belarus, Kazakhstan, Kuwait, and Qatar.

In Qatar, Aramco Overseas Co. plans new and expanded sulfur recovery units at Berri. To support new gas-oil separation plants at Qatif north and south, which are currently producing 800,000 b/d of crude oil, Aramco will upgrade the Berri plant to process 370 MMcfd of gas and will revamp three sulfur recovery facilities and add two new trains. Total production there will reach 3,300 tpd after completion in 2004.

Currently, Canada is the world's largest producer of recovered sulfur, and new units are planned to support expanding oil sands projects.

Suncor Energy Inc. plans a new 250 tpd Claus sulfur recovery at the Northern Alberta oil sands facility at Fort McMurray, Alta. Included in the process will be a hydrogenation and amine tail gas unit, an amine treating unit, and a sour water stripper. The project will be completed in 2008.

Also in Fort McMurray, Opti Canada Inc. plans a Long Lake oil sands project that will include a 600 tpd Claus sulfur recovery system. Completion of the project is slated for 2007.

China has historically been the largest importer of sulfur. However, a recent focus on refinery reorganizations, driven by an exploding demand for transportation fuels and cleaner energy, may cause China's demand of imported sulfur to slow or decrease as its own refineries produce more sulfur.

According the The Sulphur Institute (TSI), Washington, DC, other markets must be encouraged to exploit increased sulfur production to avoid a worldwide glut.

TSI believes the market with the greatest potential for expansion is plant nutrient sulfur. TSI instituted agricultural programs designed to develop a global market and expand awareness and commercialization of sulfur as a plant nutrient. TSI also is involved in developing other markets for sulfur such as sulfur polymer cement concrete and sulfur asphalt.

Pipelines

This year's report shows a slight decrease in proposed miles of new pipeline construction; 40,113 miles compared with last year's 40,752 miles.

Major projects include the 287 mile natural gas pipeline from In Salah to Hassi R'Mel, Algeria, by BP and Sonatrach. Project engineer Bechtel reports that construction should be completed by second quarter 2004.

In China, Sinopec awarded a preliminary engineering and design contract to Gulf Interstate Engineering Co., Houston, for the 716 mile gas pipeline and the 975 mile products pipeline to run from Guangdong to the Yunan Province in China.

In the Philippines, Philippine National Oil Co. (PNOC) is seeking private investing partners to develop its proposed $100 million Batman I pipeline. The natural gas pipeline would extend from Batangas to Manila. PNOC also plans a Batman II gas pipeline from Bataan to Manila, and the eventual Batcave pipeline from Batangas to Cavite.

In the US, Dominion Transmission Inc., Richmond, Va., halted work on the Greenbrier Pipeline project. The 280 mile natural gas line was to extend from West Virginia to North Carolina. Dominion suspended work to review the budget for the pipeline and for its expansion plans at the Cove Point, Md., LNG terminal. However, Dominion stressed that a suspension indicates a matter of pipeline timing but not pipeline need. Dominion will work with regulators and interested stakeholders to resume work on the project at the appropriate time.

In Canada, Enbridge Inc. of Calgary plans to build a 635 mile pipeline called Southern Access. The pipeline would be a 24-30-in. pipeline connecting the Enbridge system at Superior, Wis., to refiners and other pipeline facilities at Wood River, Ill. Initial capacity is planned to be 250,000 b/d of oil from oil sands production in the Athabasca basin. Enbridge plans to have the pipeline in service by early 2007.

More pipeline updates will be available in the upcoming Worldwide Pipe- line Construction special report to be published in OGJ on Feb. 2, 2004.